Press Release 0700 Hours, 1 September 2020 STV Group Plc Half

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Scotland's Digital Media Company

Annual Report and Accounts 2010 Annual Report and Accounts Scotland’s digital media company 2010 STV Group plc STV Group plc In producing this report we have chosen production Pacific Quay methods which aim to minimise the impact on our Glasgow G51 1PQ environment. The papers chosen – Revive 50:50 Gloss and Revive 100 Uncoated contain 50% and 100% recycled Tel: 0141 300 3000 fibre respectively and are certified in accordance with the www.stv.tv FSC (Forest stewardship Council). Both the paper mill and printer involved in this production are environmentally Company Registration Number SC203873 accredited with ISO 14001. Directors’ Report Business Review 02 Highlights of 2010 04 Chairman’s Statement 06 A conversation with Rob Woodward by journalist and media commentator Ray Snoddy 09 Chief Executive’s Review – Scotland’s Digital Media Company 10 – Broadcasting 14 – Content 18 – Ventures 22 KPIs 2010-2012 24 Performance Review 27 Principal Risks and Uncertainties 29 Corporate Social Responsibility Corporate Governance 34 Board of Directors 36 Corporate Governance Report 44 Remuneration Committee Report Accounts 56 STV Group plc Consolidated Financial Statements – Independent Auditors’ Report 58 Consolidated Income Statement 58 Consolidated Statement of Comprehensive Income 59 Consolidated Balance Sheet 60 Consolidated Statement of Changes in Equity 61 Consolidated Statement of Cash Flows 62 Notes to the Financial Statements 90 STV Group plc Company Financial Statements – Independent Auditors’ Report 92 Company Balance Sheet 93 Statement -

FTSE Factsheet

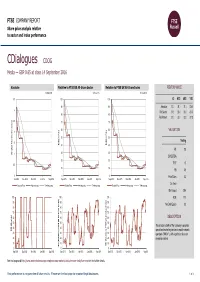

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 14 September 2016 CDialogues CDOG Media — GBP 0.65 at close 14 September 2016 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-Sep-2016 14-Sep-2016 14-Sep-2016 3.5 100 100 1D WTD MTD YTD 90 90 Absolute 31.3 31.3 31.3 -23.5 3 Rel.Sector 31.5 33.0 33.2 -24.0 80 80 Rel.Market 31.2 33.3 33.2 -27.8 2.5 70 70 60 60 VALUATION 2 (local currency) (local 50 50 Trailing 1.5 Relative Price 40 Relative Price 40 PE 2.8 30 30 Absolute Price Price Absolute 1 EV/EBITDA - 20 20 0.5 PCF 1.0 10 10 PB 0.5 0 0 0 Price/Sales 0.3 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Div Yield - Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout 29.4 100 100 100 ROE 17.7 90 90 90 Net Debt/Equity 0.0 80 80 80 70 70 70 60 60 60 DESCRIPTION 50 50 50 The principal activity of the Company is provides 40 40 40 RSI (Absolute) RSI specialised marketing services to mobile network 30 30 30 operators ("MNOs" ), with a particular focus on 20 20 20 emerging markets. -

ITV Plc (ITV:LN)

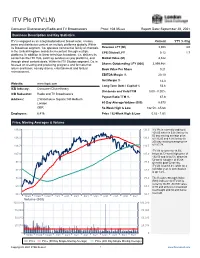

ITV Plc (ITV:LN) Consumer Discretionary/Radio and TV Broadcasters Price: 108.05 GBX Report Date: September 28, 2021 Business Description and Key Statistics ITV is engaged as an integrated producer broadcaster, creates, Current YTY % Chg owns and distributes content on multiple platforms globally. Within its Broadcast segment, Co. operates commercial family of channels Revenue LFY (M) 3,308 3.0 in the United Kingdom and delivers content through multiple EPS Diluted LFY 0.12 1.7 platforms. In addition to linear television broadcast, Co. delivers its content on the ITV Hub, catch up services on pay platforms, and Market Value (M) 4,322 through direct content deals. Within its ITV Studios segment, Co. is focused on creating and producing programs and formats that Shares Outstanding LFY (000) 3,999,984 return and travel, namely drama, entertainment and factual Book Value Per Share 0.21 entertainment. EBITDA Margin % 20.10 Net Margin % 14.3 Website: www.itvplc.com Long-Term Debt / Capital % 53.6 ICB Industry: Consumer Discretionary Dividends and Yield TTM 0.00 - 0.00% ICB Subsector: Radio and TV Broadcasters Payout Ratio TTM % 67.8 Address: 2 Waterhouse Square;140 Holborn London 60-Day Average Volume (000) 8,573 GBR 52-Week High & Low 132.50 - 65.68 Employees: 6,416 Price / 52-Week High & Low 0.82 - 1.65 Price, Moving Averages & Volume 136.0 136.0 ITV Plc is currently trading at 108.05 which is 6.0% below its 50 day moving average price 126.3 126.3 of 115.00 and 8.3% below its 200 day moving average price 116.7 116.7 of 117.78. -

Sci-Fi Sisters with Attitude Television September 2013 1 LOVE TV? SO DO WE!

April 2021 Sky’s Intergalactic: Sci-fi sisters with attitude Television www.rts.org.uk September 2013 1 LOVE TV? SO DO WE! R o y a l T e l e v i s i o n S o c i e t y b u r s a r i e s o f f e r f i n a n c i a l s u p p o r t a n d m e n t o r i n g t o p e o p l e s t u d y i n g : TTEELLEEVVIISSIIOONN PPRROODDUUCCTTIIOONN JJOOUURRNNAALLIISSMM EENNGGIINNEEEERRIINNGG CCOOMMPPUUTTEERR SSCCIIEENNCCEE PPHHYYSSIICCSS MMAATTHHSS F i r s t y e a r a n d s o o n - t o - b e s t u d e n t s s t u d y i n g r e l e v a n t u n d e r g r a d u a t e a n d H N D c o u r s e s a t L e v e l 5 o r 6 a r e e n c o u r a g e d t o a p p l y . F i n d o u t m o r e a t r t s . o r g . u k / b u r s a r i e s # R T S B u r s a r i e s Journal of The Royal Television Society April 2021 l Volume 58/4 From the CEO It’s been all systems winners were “an incredibly diverse” Finally, I am delighted to announce go this past month selection. -

![Statement 2011 [FINAL]](https://docslib.b-cdn.net/cover/9394/statement-2011-final-1129394.webp)

Statement 2011 [FINAL]

Statement 2011 Overall strategy / major themes for the year STV continues to thrive as Scotland’s most popular peak time TV station and holds the broadcast licences for central and north Scotland, attracting more than 4 million viewers each month. With a strong, recognisable brand and a flourishing production arm we enter 2011 in the best position possible to create and deliver and unique, rich and relevant schedule for our viewers. 2011 will see Scotland complete its digital switchover process which has already been achieved successfully in the STV north region. This brings increased choice to all viewers including a DTT HD version of STV, the result of new investment in order to offer Scotland’s most popular peaktime service at the highest resolution. The digital business has been a huge success for STV over the past 12 months and we are looking forward to bolstering this throughout 2011 and further cementing STV’s reputation as Scotland’s digital media company. Remaining at the core of STV’s strategy is our ongoing commitment to our quality content and making that content available to our audiences whenever, wherever and however they want it through our STV Anywhere program. We offer Scottish viewers a service that is both relevant and unique to Scotland and increasingly available on multi platforms including DTT, DSAT & DCAB and HD. To complement our on air transmissions, we are developing new access for viewers via online websites such as the STV Player and YouTube and serving content to mobile and connected devices starting with iPhone apps and PS3 consoles. -

Cteea/S5/20/C19/C015

CTEEA/S5/20/C19/C015 CULTURE, TOURISM, EUROPE AND EXTERNAL AFFAIRS COMMITTEE CALL FOR VIEWS ON THE IMPACT OF COVID-19 ON SCOTLAND’S CULTURE AND TOURISM SECTORS SUBMISSION FROM STV GROUP PLC STV Group plc (“STV”) is pleased to take this opportunity to respond to the Culture, Tourism, Europe And External Affairs Committee inquiry on the impact of Covid-19. STV holds the Channel 3 licences for central and north Scotland, broadcasting both the network schedule of drama, entertainment and events alongside regional content which is primarily news and current affairs. We reach over 85% of the population in our regions every month and our STV News at Six programme is Scotland’s most watched bulletin. STV is also Scotland’s largest commercial producer of television programmes in a range of genres including drama (The Victim and Elizabeth is Missing) - and entertainment (Catchphrase), working with all the major UK networks. In digital, the STV Player has enjoyed significant growth over the past year, with availability on more platforms and an increasing range of new content and channels in addition to our 30 day catchup service. STV is a proud commercial partner for Scottish business including many SMEs. Our Growth Fund initiative enables many businesses to access television advertising for the first time. We have committed £20m to the Growth Fund and worked with nearly 200 businesses already. We are pleased to attach below two documents for the Committee as they examine the impact of Covid-19. Both are forward looking as we consider the challenge of doing business post-lockdown. -

Katherine Ryan Writer / Performer

Katherine Ryan Writer / Performer Originally from Canada, now UK based, and star of Netflix’s KATHERINE RYAN: IN TROUBLE and Comedy Central’s ROAST BATTLE and YOUR FACE OR MINE, Katherine is a writer, performer and stand-up comedian who is dominating the television and live comedy scenes – both in the UK and abroad. Britain and Canada’s first and only woman to have a worldwide Netflix special, Katherine Ryan will bring her acclaimed, total sell-out 2017/18 nation-wide tour show GLITTER ROOM to the Garrick Theatre in London’s West End. Buy tickets here. Katherine recently became the first woman to host Channel Four's 8 OUT OF CATS DOES COUNTDOWN, taking the host chair for a special episode to commemorate women’s suffrage in the UK that will air later this year. She was only the second British-based comedian (after Jimmy Carr) to have a Netflix Original Comedy Special released globally and remains the only woman from both Britain and Canada. KATHERINE RYAN: IN TROUBLE was filmed at the Hammersmith Eventim Apollo and was released to 190 countries in February 2017. Watch it here. Katherine performed a set on TBS’ THE CONAN O’BRIEN SHOW in the US to publicize the special. In July 2018, Katherine will return to her native Canada to host the 8-part series THE STAND-UP SHOW WITH KATHERINE RYAN for Canada’s The Comedy Network / Bell Media. Performances will be taped over six records at the prestigious Just For Laughs Festival Comedy Festival in Montreal, a festival of which Katherine is a veteran. -

Transforming ITV ITV Plc Report and Accounts 2010 117

ITV plc ITV 2010 accounts and Report ITV plc The London Television Centre Upper Ground London SE1 9LT www.itv.com investors: www.itvplc.com Transforming ITV ITV plc Report and accounts 2010 117 Financial record 2010 2009 2008 2007 2006 ITV today Broadcasting & Online ITV Studios £m £m £m £m £m ITV is the largest commercial ITV content is funded by advertising and ITV Studios comprises ITV’s UK production Results Revenue 2,064 1,879 2,029 2,082 2,181 television network in the UK. sponsorship revenues as well as viewer operations, ITV’s international production competitions and voting. ITV1 is the largest companies and ITV Studios Global Earnings before interest, tax and amortisation (EBITA) before exceptional items 408 202 211 311 375 It operates a family of channels commercial channel in the UK. It attracts Entertainment. Amortisation of intangible assets (63) (59) (66) (56) (56) including ITV1, and delivers the largest audience of any UK commercial ITV Studios produces programming for Impairment of intangible assets – – (2,695) (28) (20) broadcaster and has the greatest share of content across multiple platforms ITV’s own channels and for other UK and Share of profits or (losses) of joint ventures and associated undertakings (3) (7) (15) 2 8 the UK television advertising market at via itv.com and ITV Player. international broadcasters. 45.1%. ITV’s digital channels continue to Investment income – – 1 1 3 ITV Studios produces and sells grow their audiences and most recently A wide range of programme genres are Exceptional items 19 (20) (108) (9) 4 programmes and formats in saw the launch of high definition (HD) produced, including: drama, soaps, Profit/(loss) before interest and tax 361 116 (2,672) 221 314 the UK and worldwide. -

Revenue and Profit Growth As ITV Strategy Begins to Deliver

Revenue and profit growth as ITV strategy begins to deliver External revenues up 4% at £2,140m (2010: £2,064m) driven by non-advertising revenues Total non-NAR revenues up £93m or 11% to £922m (2010: £829m), mainly due to revenue growth from UK and international studios businesses ITV Family NAR up 1% - outperforming the TV advertising market ITV Family SOV up 1% with strong performance by digital channels up 10% EBITA before exceptional items up 13% to £462m (2010: £408m) Adjusted PBT up 24% to £398m (2010: £321m) Adjusted EPS up 23% at 7.9p (2010: 6.4p) Cost savings of £20m delivered – funding investments aligned to the Transformation Plan – with a further £20m identified for 2012 Positive net cash position of £45m (2010: net debt of £188m), with profit to cash conversion again over 100% Continued improvement in the efficiency of the balance sheet with £339m of bonds bought back in 2011 The Board has proposed a final dividend of 1.2p to give a total dividend for 2011 of 1.6p We expect ITV Family NAR to be down 2% in Q1 and April broadly flat. While we remain cautious on the outlook for advertising, we expect to outperform the market over the full year. Adam Crozier, CEO of ITV, said: “We’re now almost two years into our five-year Transformation Plan and our continued growth in revenue and profit - at a time when the advertising market is broadly flat - demonstrates that we’re performing in line with our strategic priorities. The increase in non-advertising revenues of £93m, driven by our studios and online businesses, is clear evidence of progress in rebalancing the Company and our ability to grow new revenue streams. -

Media Nations 2020 UK Report

Media Nations 2020 UK report Published 5 August 2020 Contents Section Overview 3 1. Covid-19 media trends: consumer behaviour 6 2. Covid-19 media trends: industry impact and response 44 3. Production trends 78 4. Advertising trends 90 2 Media Nations 2020 Overview This is Ofcom’s third annual Media Nations, a research report for industry, policy makers, academics and consumers. It reviews key trends in the TV and online video sectors, as well as radio and other audio sectors. Accompanying this report is an interactive report that includes an extensive range of data. There are also separate reports for Northern Ireland, Scotland and Wales. This year’s publication comes during a particularly eventful and challenging period for the UK media industry. The Covid-19 pandemic and the ensuing lockdown period has changed consumer behaviour significantly and caused disruption across broadcasting, production, advertising and other related sectors. Our report focuses in large part on these recent developments and their implications for the future. It sets them against the backdrop of longer-term trends, as laid out in our five-year review of public service broadcasting (PSB) published in February, part of our Small Screen: Big Debate review of public service media. Media Nations provides further evidence to inform this, as well as assessing the broader industry landscape. We have therefore dedicated two chapters of this report to analysis of Covid-19 media trends, and two chapters to wider market dynamics in key areas that are shaping the industry: • The consumer behaviour chapter examines the impact of the Covid-19 pandemic on media consumption trends across television and online video, and radio and online audio. -

Annual Report and Accounts 2014

ANNUAL REPORT AND ACCOUNTS 2014 COMMERCIALLY FOCUSED CREATIVELY LED Directors’ Report Strategic Report 01 2014 Financial Highlights 02 Meet the STV family 04 Chief Executive’s Review – Consumer 12 – Productions 14 Performance Review 17 Principal Risks 19 Corporate Responsibility Governance 26 Chairman’s Statement 28 Board of Directors 30 Corporate Governance Report 44 Remuneration Report Financial Statements 64 STV Group plc Consolidated Financial Statements – Independent Auditors’ Report 68 Consolidated Income Statement 68 Consolidated Statement of Comprehensive Income 69 Consolidated Balance Sheet 70 Consolidated Statement of Changes in Equity 71 Consolidated Statement of Cash Flows 72 Notes to the Financial Statements 94 STV Group plc Company Financial Statements – Independent Auditors’ Report 96 Company Balance Sheet 97 Notes to the Company Financial Statements 101 Five Year Summary Additional Information 102 Shareholder Information 104 Notice of Annual General Meeting 115 Appendix to the Notice of Annual General Meeting Directors’ Report Strategic Report 2014 FINANCIAL HIGHLIGHTS Revenue Operating Profit Pre-tax Profit (£ millions) (£ millions) (£ millions)* 102.0 102.7 112.1 120.4 15.0 17.1 18.0 19.5 12.7 13.1 15.2 17.3 2011 2012 2013 2014 2011 2012 2013 2014 2011 2012 2013 2014 +7% +8% +14% EPS Dividends Per Share Net Debt (pence)* (pence) (£ millions) 34.5 29.5 34.4 38.7 – – 2 8 54.5 45.3 35.7 29.4 2011 2012 2013 2014 2011 2012 2013 2014 2011 2012 2013 2014 +13% +300% -18% * pre-exceptionals and IAS 19 STV Annual Report and Accounts 2014 Directors’ Report Strategic Report CHIEF EXECUTIVE’S REVIEW MEET THE STV FAMILY CORE CHANNEL ON DEMAND ONLINE stv.tv Peaktime audience 3x 14m streams in 2014 3.6m monthly most watched commercial unique browsers channel in Scotland 03 The STV Family of consumer services showcases our commitment to ensure our consumers can access STV’s content free of charge anywhere, anytime. -

M&A Trends and Drivers

M&A trends and drivers 2017 Engineering and Construction Conference Session participants Eric Andreozzi Todd Wilson Bruce Gribens Managing Director Managing Director Tax Partner Deloitte Corporate Finance Deloitte & Touche LLP – Deloitte Tax LLP – MATS LLC MATS San Francisco, CA Charlotte, NC Chicago, IL +1 415 783 5959 +1 704 904 7030 +1 312 486 3892 [email protected] [email protected] [email protected] J. Mark Andrews Bryan Johnson Rob Strahle Managing Director Senior Manager Senior Manager Deloitte Consulting LLP Deloitte & Touche LLP – Deloitte & Touche LLP - Parsippany, NJ MATS Engineering & Capital Projects +1 973 602 6133 Boston, MA Jersey City, NJ [email protected] +1 617 437 3657 [email protected] +1 212 436 7439 [email protected] Copyright © 2017 Deloitte Development LLC. All rights reserved. 2 Agenda Module/Topic M&A Trends and Drivers • Macro perspective • Engineering & construction industry M&A workshop – Key takeaways • Financial due diligence • Tax due diligence • IT due diligence • Project due diligence Q&A Copyright © 2017 Deloitte Development LLC. All rights reserved. 3 M&A Trends and drivers Macro perspective Current M&A markets Global M&A Volume and Value (US$B) U.S. M&A Volume and Value (US$B) $Bil No. Deals $Bil No. Deals 4,500 50,000 2,000 12,000 3,750 40,000 1,600 9,000 3,000 30,000 1,200 2,250 6,000 20,000 800 1,500 3,000 10,000 400 750 0 0 0 0 2008 2009 2010 2011 2012 2013 2014 2015 2016 YTD YTD 2008 2009 2010 2011 2012 2013 2014 2015 2016 YTD YTD 2016 2017 2016 2017 Enterprise Value Number of Deals Enterprise Value Number of Deals Global M&A Activity – YTD Mar-17 U.S.