Media(4)-02-11 : Paper 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

House of Commons Welsh Affairs Committee

House of Commons Welsh Affairs Committee S4C Written evidence - web List of written evidence 1 URDD 3 2 Hugh Evans 5 3 Ron Jones 6 4 Dr Simon Brooks 14 5 The Writers Guild of Great Britain 18 6 Mabon ap Gwynfor 23 7 Welsh Language Board 28 8 Ofcom 34 9 Professor Thomas P O’Malley, Aberystwth University 60 10 Tinopolis 64 11 Institute of Welsh Affairs 69 12 NUJ Parliamentary Group 76 13 Plaim Cymru 77 14 Welsh Language Society 85 15 NUJ and Bectu 94 16 DCMS 98 17 PACT 103 18 TAC 113 19 BBC 126 20 Mercator Institute for Media, Languages and Culture 132 21 Mr S.G. Jones 138 22 Alun Ffred Jones AM, Welsh Assembly Government 139 23 Celebrating Our Language 144 24 Peter Edwards and Huw Walters 146 2 Written evidence submitted by Urdd Gobaith Cymru In the opinion of Urdd Gobaith Cymru, Wales’ largest children and young people’s organisation with 50,000 members under the age of 25: • The provision of good-quality Welsh language programmes is fundamental to establishing a linguistic context for those who speak Welsh and who wish to learn it. • It is vital that this is funded to the necessary level. • A good partnership already exists between S4C and the Urdd, but the Urdd would be happy to co-operate and work with S4C to identify further opportunities for collaboration to offer opportunities for children and young people, thus developing new audiences. • We believe that decisions about the development of S4C should be made in Wales. -

Scotland's Digital Media Company

Annual Report and Accounts 2010 Annual Report and Accounts Scotland’s digital media company 2010 STV Group plc STV Group plc In producing this report we have chosen production Pacific Quay methods which aim to minimise the impact on our Glasgow G51 1PQ environment. The papers chosen – Revive 50:50 Gloss and Revive 100 Uncoated contain 50% and 100% recycled Tel: 0141 300 3000 fibre respectively and are certified in accordance with the www.stv.tv FSC (Forest stewardship Council). Both the paper mill and printer involved in this production are environmentally Company Registration Number SC203873 accredited with ISO 14001. Directors’ Report Business Review 02 Highlights of 2010 04 Chairman’s Statement 06 A conversation with Rob Woodward by journalist and media commentator Ray Snoddy 09 Chief Executive’s Review – Scotland’s Digital Media Company 10 – Broadcasting 14 – Content 18 – Ventures 22 KPIs 2010-2012 24 Performance Review 27 Principal Risks and Uncertainties 29 Corporate Social Responsibility Corporate Governance 34 Board of Directors 36 Corporate Governance Report 44 Remuneration Committee Report Accounts 56 STV Group plc Consolidated Financial Statements – Independent Auditors’ Report 58 Consolidated Income Statement 58 Consolidated Statement of Comprehensive Income 59 Consolidated Balance Sheet 60 Consolidated Statement of Changes in Equity 61 Consolidated Statement of Cash Flows 62 Notes to the Financial Statements 90 STV Group plc Company Financial Statements – Independent Auditors’ Report 92 Company Balance Sheet 93 Statement -

ITV Plc Corporate Responsibility Report 04 ITV Plc Corporate Responsibility Report 04 Corporate Responsibility and ITV

One ITV ITV plc Corporate responsibility report 04 ITV plc Corporate responsibility report 04 Corporate responsibility and ITV ITV’s role in society is defined ITV is a commercial public service by the programmes we make broadcaster. That means we and broadcast. The highest produce programmes appealing ethical standards are essential to to a mass audience alongside maintaining the trust and approval programmes that fulfil a public of our audience. Detailed rules service function. ITV has three core apply to the editorial decisions public service priorities: national we take every day in making and international news, regional programmes and news bulletins news and an investment in and in this report we outline the high-quality UK-originated rules and the procedures in place programming. for delivering them. In 2004, we strengthened our longstanding commitment to ITV News by a major investment in the presentation style. Known as a Theatre of News the new format has won many plaudits and helped us to increase our audience. Researched and presented by some of the finest journalists in the world, the role of ITV News in providing accurate, impartial news to a mass audience is an important social function and one of which I am proud. Our regional news programmes apply the same editorial standards to regional news stories, helping communities to engage with local issues and reinforcing their sense of identity. Contents 02 Corporate responsibility management 04 On air – responsible programming – independent reporting – reflecting society – supporting communities – responsible advertising 14 Behind the scenes – encouraging creativity – our people – protecting the environment 24 About ITV – contacts and feedback Cover Image: 2004 saw the colourful celebration of a Hindu Wedding on Coronation Street, as Dev and Sunita got married. -

Researching Digital on Screen Graphics Executive Sum M Ary

Researching Digital On Screen Graphics Executive Sum m ary Background In Spring 2010, the BBC commissioned independent market research company, Ipsos MediaCT to conduct research into what the general public, across the UK thought of Digital On Screen Graphics (DOGs) – the channel logos that are often in the corner of the TV screen. The research was conducted between 5th and 11th March, with a representative sample of 1,031 adults aged 15+. The research was conducted by interviewers in-home, using the Ipsos MORI Omnibus. The key findings from the research can be found below. Key Findings Do viewers notice DOGs? As one of our first questions we split our sample into random halves and showed both halves a typical image that they would see on TV. One was a very busy image, with a DOG present in the top left corner, the other image had much less going on, again with the DOG in the top left corner. We asked respondents what the first thing they noticed was, and then we asked what they second thing they noticed was. It was clear from the results that the DOGs did not tend to stand out on screen, with only 12% of those presented with the ‘less busy’ screen picking out the DOG (and even fewer, 7%, amongst those who saw the busy screen). Even when we had pointed out DOGs and talked to respondents specifically about them, 59% agreed that they ‘tend not to notice the logos’, with females and viewers over 55, the least likely to notice them according to our survey. -

FTSE Factsheet

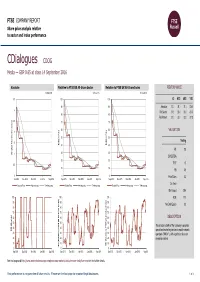

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 14 September 2016 CDialogues CDOG Media — GBP 0.65 at close 14 September 2016 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-Sep-2016 14-Sep-2016 14-Sep-2016 3.5 100 100 1D WTD MTD YTD 90 90 Absolute 31.3 31.3 31.3 -23.5 3 Rel.Sector 31.5 33.0 33.2 -24.0 80 80 Rel.Market 31.2 33.3 33.2 -27.8 2.5 70 70 60 60 VALUATION 2 (local currency) (local 50 50 Trailing 1.5 Relative Price 40 Relative Price 40 PE 2.8 30 30 Absolute Price Price Absolute 1 EV/EBITDA - 20 20 0.5 PCF 1.0 10 10 PB 0.5 0 0 0 Price/Sales 0.3 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Div Yield - Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout 29.4 100 100 100 ROE 17.7 90 90 90 Net Debt/Equity 0.0 80 80 80 70 70 70 60 60 60 DESCRIPTION 50 50 50 The principal activity of the Company is provides 40 40 40 RSI (Absolute) RSI specialised marketing services to mobile network 30 30 30 operators ("MNOs" ), with a particular focus on 20 20 20 emerging markets. -

Anticipated Acquisition by ITV Plc of SDN Limited

Anticipated acquisition by ITV plc of SDN Limited The OFT’s decision on reference under section 22(1) given on 15 August 2005. Full text of decision published 24 August 2005. PARTIES 1. ITV plc (ITV) is a vertically integrated broadcaster active in the acquisition and production of broadcasting content, the packaging of that content into channels (ITV1, ITV2, ITV3, ITV News, and Men and Motors) and the distribution of those channels on analogue and the Digital Terrestrial Television (DTT) platform. It has 48.5 per cent share ownership on Digital 3and4 limited, which holds the licence for Multiplex 2.1 2. SDN Limited (SDN) holds the licence for and operates Multiplex A, part of the DTT transmission system. It was jointly controlled by S4C, United Business Media and NTL. In the year ending 31 December 2003 it had a turnover of £7.76 million in the UK. TRANSACTION 3. On 27 April ITV acquired the entire shareholding in SDN, following the shareholders’ triggering of a buy out option. 4. The statutory deadline is 26 August. The administrative deadline has expired. JURISDICTION 5. As a result of this transaction ITV and SDN have ceased to be distinct. The parties overlap in the ownership of DTT multiplex licences and in the supply of multiplex capacity for pay-TV and commercial TV. The share of supply test in section 23 of the Enterprise Act 2002 (the Act) is met as they have 33 per cent of multiplex licences and at least 25 per cent of capacity available for both pay-TV and commercial TV in the UK. -

S4C's Response to the Future Pricing of Spectrum Used for Terrestrial Broadcasting Consultation Introduction S4C Is a Statutor

S4C’s Response to the Future pricing of spectrum used for terrestrial broadcasting Consultation Introduction S4C is a statutory corporation originally established under the Broadcasting Act 1981 and now regulated by the Communications Act 2003 and the Broadcasting Act s1990 and 1996. S4C (Sianel Pedwar Cymru – the Welsh Fourth Channel, www.s4c.co.uk) was established to provide a broad range of high quality and diverse programming in which a substantial proportion of the programmes shown are in Welsh. S4C currently broadcasts S4C on analogue, S4C Digidol and S4C2 on the digital platforms and the best of its content on broadband. On S4C analogue S4C broadcasts the best of Channel 4. S4C has a crucial role to play in providing entertainment and news through the Welsh language throughout Wales and beyond via its services. S4C is uniquely funded through a mixture of grant in aid and advertising and commercial revenue. It has an annual turnover of just over £95 million, and receives some programming from the BBC. During 2005 £8m was spent on carriage costs. Like the other established public service broadcasters, S4C is having to manage the technological challenges of switchover and the rise of other new platforms and other technological development that will become the norm over the next 10 years. S4C Digidol (the Welsh language only service) and S4C2 are currently carried on capacity reserved for S4C on Mux A (50% of the capacity in Wales is reserved for use by S4C Companies). S4C has always operated in a manner that ensures that it utilises that which it requires and frees up the capacity to ensure most efficient use. -

ITV Plc (ITV:LN)

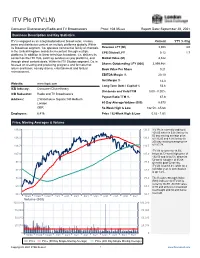

ITV Plc (ITV:LN) Consumer Discretionary/Radio and TV Broadcasters Price: 108.05 GBX Report Date: September 28, 2021 Business Description and Key Statistics ITV is engaged as an integrated producer broadcaster, creates, Current YTY % Chg owns and distributes content on multiple platforms globally. Within its Broadcast segment, Co. operates commercial family of channels Revenue LFY (M) 3,308 3.0 in the United Kingdom and delivers content through multiple EPS Diluted LFY 0.12 1.7 platforms. In addition to linear television broadcast, Co. delivers its content on the ITV Hub, catch up services on pay platforms, and Market Value (M) 4,322 through direct content deals. Within its ITV Studios segment, Co. is focused on creating and producing programs and formats that Shares Outstanding LFY (000) 3,999,984 return and travel, namely drama, entertainment and factual Book Value Per Share 0.21 entertainment. EBITDA Margin % 20.10 Net Margin % 14.3 Website: www.itvplc.com Long-Term Debt / Capital % 53.6 ICB Industry: Consumer Discretionary Dividends and Yield TTM 0.00 - 0.00% ICB Subsector: Radio and TV Broadcasters Payout Ratio TTM % 67.8 Address: 2 Waterhouse Square;140 Holborn London 60-Day Average Volume (000) 8,573 GBR 52-Week High & Low 132.50 - 65.68 Employees: 6,416 Price / 52-Week High & Low 0.82 - 1.65 Price, Moving Averages & Volume 136.0 136.0 ITV Plc is currently trading at 108.05 which is 6.0% below its 50 day moving average price 126.3 126.3 of 115.00 and 8.3% below its 200 day moving average price 116.7 116.7 of 117.78. -

Broadcasters' Liaison Group (BLG) Meeting– 13 November 2018 Note

Broadcasters’ Liaison Group (BLG) Meeting– 13 November 2018 Note of conclusions and action points ___________________________________________________________________________ Present: Ric Bailey (BBC), Tabby Karamat (BBC), Alasdair MacLeod (BBC Scotland) ,Iestyn Morris (S4C), Chris Wissun (ITV), Heather Jackson (Channel 4), Simon O’Brien (Channel 5), Joan Darroch (STV), Steven Ladurantaye (STV), Chris Hagan (UTV), Jacqueline McIntyre (BBC NI), Alice Hickey (BBC), Martin Forward (BBC Wales) Nick Powell (ITV Wales), Tim Burke (BBC), Janet Maclay (Channel Five), Craig Westwood (the Electoral Commission- observer member). Apologies: Rosalind Innes (BBC Scotland), Bill Ridley(Talksport), Jimmy Buckland ( Wireless), Jo Verrill (This is Global) and Rhys Evans (BBC Wales). The Group was joined by Adam Baxter from Ofcom. ___________________________________________________________________________ 1 NOTES OF THE LAST MEETING Members did not have any comments on the notes from the last BLG annual meeting of 28 November 2017 which had been circulated prior to the meeting. These meeting notes do not purport to be a full record merely a note of the conclusions in action points. 2 RETROSPECTIVE FOR 2018 Local Elections The BLG noted that there had not been any particular issues in respect of the PEBs for the Local England Elections that took place on 3 May 2018. The BLG reflected on the PEB allocations where each broadcaster had come to their own decision in respect of allocation. PPBs The members discussed that in Northern Ireland two of the main parties (DUP and Sinn Fein) did not take up their PPB slots. This was not replicated in England. There was a discussion in respect of a complaint received by STV, and subsequently dismissed by Ofcom, where a MSP complained about another party’s PPB and the alleged resemblance to a living individual in that broadcast. -

Cteea/S5/20/C19/C015

CTEEA/S5/20/C19/C015 CULTURE, TOURISM, EUROPE AND EXTERNAL AFFAIRS COMMITTEE CALL FOR VIEWS ON THE IMPACT OF COVID-19 ON SCOTLAND’S CULTURE AND TOURISM SECTORS SUBMISSION FROM STV GROUP PLC STV Group plc (“STV”) is pleased to take this opportunity to respond to the Culture, Tourism, Europe And External Affairs Committee inquiry on the impact of Covid-19. STV holds the Channel 3 licences for central and north Scotland, broadcasting both the network schedule of drama, entertainment and events alongside regional content which is primarily news and current affairs. We reach over 85% of the population in our regions every month and our STV News at Six programme is Scotland’s most watched bulletin. STV is also Scotland’s largest commercial producer of television programmes in a range of genres including drama (The Victim and Elizabeth is Missing) - and entertainment (Catchphrase), working with all the major UK networks. In digital, the STV Player has enjoyed significant growth over the past year, with availability on more platforms and an increasing range of new content and channels in addition to our 30 day catchup service. STV is a proud commercial partner for Scottish business including many SMEs. Our Growth Fund initiative enables many businesses to access television advertising for the first time. We have committed £20m to the Growth Fund and worked with nearly 200 businesses already. We are pleased to attach below two documents for the Committee as they examine the impact of Covid-19. Both are forward looking as we consider the challenge of doing business post-lockdown. -

Running Head: SPORTS COVERAGE on BBC ALBA 1 Sports Coverage

Running head: SPORTS COVERAGE ON BBC ALBA 1 Sports Coverage on BBC ALBA: Content, Value and Position in the Scottish Broadcasting Landscape Xavier Ramon Vegas and Richard Haynes Published Online First: Communication and Sport 29 January 2018 Abstract Through a mixed-method approach, we examine the sports programming offered by BBC ALBA between 2008 and 2016 and identify the value that the channel creates in Scotland through its diverse sports portfolio. In an increasingly cluttered and complex scenario where pay TV giants Sky and BT hold a plethora of top-tier rights and BBC Scotland and STV cannot fit more sport into their schedules, BBC ALBA serves Gaelic-speaking and national audiences with a regular diet of quality sports programming. Beyond being instrumental to filling schedules, sports content has been a gateway for Gaelic, a key driver of BBC ALBA’s investment in the creative sector and a contributor to the development of grassroots sport in Scotland. However, the financial situation under which the channel operates makes it very difficult to sustain and improve its current position. This case study demonstrates that sport broadcasting offers genuine opportunities to maintain linguistic and cultural diversity in small nations, even in a context characterized by escalating competition, dwindling resources and the proliferation of multiple viewing portals. Keywords: BBC ALBA, Scotland, sport, Gaelic, diversity Xavier Ramon, Richard Haynes, Sports Coverage on BBC ALBA: Content, Value, and Position in the Scottish Broadcasting Landscape, Communication & Sport 7 (2), pp. 221-243. Copyright © The Authors 2018. Reprinted by permission of SAGE Publications. SPORTS COVERAGE ON BBC ALBA 3! Sports Coverage on BBC ALBA: Content, Value and Position in the Scottish Broadcasting Landscape Despite the cluttered and “increasingly complex digital media landscape” (Boyle & Haynes, 2014, p. -

Broadcasting in Wales

House of Commons Welsh Affairs Committee Broadcasting in Wales First Report of Session 2016–17 HC 14 House of Commons Welsh Affairs Committee Broadcasting in Wales First Report of Session 2016–17 Report, together with formal minutes relating to the report Ordered by the House of Commons to be printed 13 June 2016 HC 14 Published on 16 June 2016 by authority of the House of Commons Welsh Affairs Committee The Welsh Affairs Committee is appointed by the House of Commons to examine the expenditure, administration, and policy of the Office of the Secretary of State for Wales (including relations with the National assembly for Wales.) Current membership David T.C. Davies MP (Conservative, Monmouth) (Chair) Byron Davies MP (Conservative, Gower) Chris Davies MP (Labour, Brecon and Radnorshire) Glyn Davies MP (Conservative, Montgomeryshire) Dr James Davies MP (Conservative, Vale of Clwyd) Carolyn Harris MP (Labour, Swansea East) Gerald Jones MP (Labour, Merthyr Tydfil and Rhymney) Stephen Kinnock MP (Labour, Abervaon) Liz Saville Roberts MP (Plaid Cymru, Dwyfor Meirionnydd) Craig Williams MP (Conservative, Cardiff North) Mr Mark Williams MP (Liberal Democrat, Ceredigion) The following were also members of the Committee during this inquiry Christina Rees MP (Labour, Neath) and Antoinette Sandbach MP (Conservative, Eddisbury) Powers The committee is one of the departmental select committees, the powers of which are set out in House of Commons Standing Orders, principally in SO No 152. These are available on the internet via www. parliament.uk. Publication Committee reports are published on the Committee’s website at www.parliament.uk/welshcom and in print by Order of the House.