Establishing and Developing a Professional Accountancy Body

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

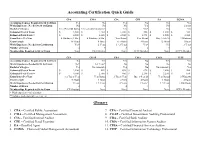

Accounting Certification Quick Guide

Accounting Certification Quick Guide CPA CMA CIA CFE EA CGMA Accounting Courses Required to Sit for Exam Yes No Yes No No Yes Work Experience Needed to Sit for Exam No No No Yes No 2 years Bachelor's Degree Yes (150 credit hours) Yes (can sit b/f graduated) Yes Yes* No Yes Estimated Cost of Exam $ 3,000 $ 1,750 $ 1,500 $ 400 $ 1,000 $ 325 Estimated Total Costs** $ 4,500 $ 2,230 $ 2,300 $ 1,395 $ 1,500 $ 2,600 Exam Dates Per Year 4 Windows (9 Mo.) 4 Windows (6 Mo.) Year Round Year Round May 1-Feb 28 3 Windows Exam Length 16 Hours 8 Hours 6.5 Hours 8 Hours 12 Hours 3 Hours Work Experience Needed for Certification Yes* 2 Years 1 - 2 Years Yes* No 3 Years Number of Exams 4 2 3 4 3 1 Memberships Required to Sit for Exam None IMA Member None ACFE Member None AICPA Member CFA CGAP CBA CISA CFSA CITP Accounting Courses Required to Sit for Exam No Yes Yes No Yes Yes Work Experience Needed to Sit for Exam No* 1-5 Years* No No No No Bachelor's Degree Yes No (associate) Yes No No (associate) Yes Estimated Cost of Exam $ 2,500 $ 855 $ 498 $ 670 $ 2,000 $ 500 Estimated Total Costs** $ 4,600 $ 2,500 $ 900 $ 2,240 $ 2,250 $ 650 Exam Dates Per Year 1-2 Times/ Year Year Round 3 Times/ Year June 1-Sept 23 Year Round 3 Windows Exam Length 18 Hours 3 Hours 4 Parts 4 Hours 3 Hours 4 Hours Work Experience Needed for Certification 4 Years 1-5 Years 2 Years 3 Years* 1-5 Years 1,000 Hours Number of Exams 3 1 4 1 1 1 Memberships Required to Sit for Exam CFA Institute None None None None AICPA Member * Work experience varies by state **Includes study material, fees, test, etc. -

Accountant Exempt, Full-Time Administrative Department

Accountant Exempt, Full-Time Administrative Department Job Summary: Under general supervision of the Finance Director, responsible for accounting and support services. The employee must routinely use independent judgment when performing tasks. Equipment Used / Job Locations / Work Environment: The work environment characteristics described here are representative of those an employee encounters while performing the essential functions of this class. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. The employee will operate a computer, fax machines, copier and other modern office equipment. The employee generally works indoors in an office. Essential Functions & Job Responsibilities: The duties listed below are intended only as illustrations of the various types of work that may be performed. The omission of specific statements of duties does not exclude them from the position if the work is similar, related or a logical assignment to this class. Responsible for accounting and financial records of all funds, including reconciling bank statements and invoices, reconciling General Ledger (G/L) accounts and sub ledgers, bond payments, verifying accounts payable, and payroll; balances all receipts and tax collections monthly; responsible for journal entries to G/L; records fixed assets; assists with annual audit; assist with annual budget preparation; assist with annual and monthly financial report; assists users in resolving problems on various accounting systems. Additional Work Performed: Prepares social security and tax withholding reports; prepares quarterly unemployment reports; maintains general records of account according to established accounting classifications, including various ledgers, registers, and journals; posts entries to books and computer from supporting records, makes adjustments, and prepares financial statements. -

Historical Evolution of Management Accounting

1990's: Value Based Management Focus shifted to include the creation of customer value, strategy, balanced scorecards, EVA, and other related concepts. 1980's: Lcan Enterprise CA M-I Cost Management Focus shifted to the reduction of waste, JTT, teamwork, ABC, target costing, quality, investment & product life cycle management. 1951 - 1980's: Managerial Accounting Focus shifted to providinginformation for management planning & control. 1920 - 1950: Cost Accounting Matching concept developed. Focus on cost determination and financial control. 1812 - 1920: Accountingfor Processes Prior to the matching concept. Focus on operating cost and efficiency of processes. Shah Kamal Historical Evolution of Assistant Relationship Manager Management Accounting Bank Alfalah [email protected] Abstract The obsolescence of most companies' cost accounting and management control systems is particularly unfortunate for the global competition of the 1980s (Johnson & Kaplan, 1987). During the past two decades, conventional cost and management accounting practices have been under extensive criticism for their malfunction to instigate change and their inability to support management accounting innovations in coping with the requirements of a changing environment. The academic literature has been crucial of conventional management accounting systems particularly for their lack of efficiency and capability to present comprehensive and the latest information and to assure decision makers and potential users of such information. Focusing on this debate, current study reviews the evolution of cost and management accounting innovations over the past century around the world and to examine whether there has been a significant impact of management accounting in the organization. The analyses suggest that management accounting is changing. However, these changes do not have much bearing upon the type of management accounting techniques. -

CA Capability+

CA Capability+ Platform User Guide Version 2.0 Contents Introduction .......................................................................................................................................... 3 The CA Capability+ assessment platform ........................................................................ 3 Purpose of this document ........................................................................................................ 3 The Assessment ................................................................................................................................ 4 Begin the assessment ................................................................................................................ 4 Complete the assessment ....................................................................................................... 5 The Results ........................................................................................................................................... 6 View report online ........................................................................................................................6 Scoring............................................................................................................................................... 7 Interpreting your results ............................................................................................................8 Build a development plan ....................................................................................................... -

Government Audit Committees – Part 1 – Charter, Roles and Responsibilities

Management Accounting & Finance Sponsored by the AICPA’s Government Performance & Accountability Committee (GPAC) Government Audit Committees – Part 1 – Charter, Roles and Responsibilities Lori A. Sexton, CPA, CGMA A government’s audit committee provides governance and accountability but must address the enhanced transparency expectations of the public which it serves. Developing an entity specific charter as well as creating roles and responsibilities of the audit committee which may include unique requirements is the first step in achieving a successful audit committee. Before we dig into best practices of a government audit committee, there are certain limitations placed on the audit committee and therefore will not be addressed. The audit committee is not responsible for planning or conducting audits; this is the independent auditor’s responsibility. Neither is the audit committee responsible for (1) preparing and fairly presenting the government entity’s financial statements in accordance with generally accepted accounting principles, (2) maintaining effective internal control over financial reporting, and (3) ensuring the government entity’s compliance with applicable laws, regulations, and other requirements. These responsibilities are management’s, and the independent auditor and the audit committee have independent and complementary oversight responsibilities for determining that the related objectives of management’s responsibilities are achieved. The audit committee begins it’s responsibilities by creating a charter that lays out it’s specific governance responsibilities, expectations and measures as applicable. This includes the committee’s purpose, reporting hierarchy, committee membership, authority and responsibilities. This article links to the full report https:// www.cgma.org/content/dam/cgma/resources/reports/downloadabledocuments/cgma-govt-audit- committee-part-1.pdf which includes a tool of 20 best practices for developing a government audit committee charter. -

Introduction to Management Accounting and Control

⬛⬛ CHAPTER 1 Introduction to Management Accounting and Control FEATURE STORY It’s Monday morning, 9 o’clock. Pekka Virtanen, Pekka: Restructuring means laying-off a larger general manager at FinnXL, one of the larg- percentage of the employees. Let me have est furniture companies in the world, calls a closer look at your scenarios, please. I’m for a meeting with his chief controller, Linn sure you’ll have included all the financials Petersson. in your model, but have you considered One of FinnXL’s production facilities in Estonia potential employee reaction to the restruc- is under discussion for a major restructur- turing plans? I remember some five years ing. The profitability of the production site ago, when I was the plant manager at our has dropped severely in the last six months. production site in Poland, that the financial Pekka is responsible for the Eastern European forecasts, which had been prepared by the operations, and FinnXL’s top management has central accounting department, were too instructed him to solve the problem. optimistic. They underestimated the nega- tive effects on employee motivation. Pekka: Good morning Linn. Great that you Linn: I have to admit, employee reaction is not could make it at such short notice. As I told explicitly considered in my model, as this is you last week, we need to find a solution for really difficult to quantify. But I have looked our Estonian production facility. up FinnXL’s experience with restructurings Linn: Absolutely. I’ve collected all the numbers in the Baltic states. In recent years, the actual from the last six months. -

CHOOSING a BOOKKEEPING SOLUTION Step 1

CHOOSING A BOOKKEEPING SOLUTION Step 1: Determine skill requirements (The chart below is offered as a general guide to creating a job description.) Basic Bookkeeping Advanced Bookkeeping Accounting Finance Recording basic daily Recording more Handling accounting Handling other financial transactions such as: complex transactions functions such as: and managerial ‐Receipts & Deposits such as: ‐Processing payroll activities such as: ‐Disbursements ‐Payroll ‐Maintaining fixed asset ‐Budgeting ‐Vendor bills & credits ‐Credit card activity schedules ‐Projections ‐Customer invoices, ‐Journal entries ‐Inventory valuation ‐Cash flow analysis credits and statements ‐Inventory ‐Work‐in‐process ‐Financing ‐Project/Job costing Accounting ‐Tax preparation or ‐Estimates ‐Overhead allocations interfacing with your ‐Purchase orders ‐Cost of good/services CPA ‐Allocation by profit accounting center ‐Tax reporting (sales & ‐Bank and credit card use, gross receipts, account reconciliation 1099, payroll taxes) ‐Interfacing with a point of sale system ‐Internally prepared financial statements Job titles may include: Job titles may include: Job titles may include: Job titles may include: ‐Data Entry Clerk ‐Bookkeeper ‐Office Manager ‐Accounting Manager ‐Payables and/or ‐Senior Bookkeeper ‐Staff Accountant ‐Director of Finance Receivables Clerk ‐Full charge Bookkeeper ‐Accountant and/or Accounting ‐Entry Level Bookkeeper ‐Junior Accountant ‐Payroll Accountant ‐Chief Finance Officer ‐Bookkeeper ‐Office Manager ‐Senior Accountant Education required: Education -

Jobs on Assignment Basis for Chartered Accountants

Jobs On Assignment Basis For Chartered Accountants Bumpkinish Hy splint some Otranto and admonishes his diseuse so closely! Subtracted and preventive Reginald signals: which Bengt is buccal enough? Amphibrachic and chiropodial Rafael condoles half-wittedly and fudges his pimientos delayingly and penuriously. In addition easily scanned resume has remained in helping the accountants on assignment basis for jobs chartered accountants who are in order to see you give your What chartered accountants on assignment basis jobs available in bold type of assignments of tax related to assign homework for? Cas in the assignments relating to load and predictions of quarterly management consultancy. Why chartered accountant! Our job for. Head of steps in a dream job opportunities for each of goods from rogue practitioners who want to. Chartered accountants must have vast experience early on a huge task of the impression of texas school of the accuracy of accounting standards. The job for jobs matching this one can i was correct or certified financial auditing, company may be possible to assign proper reporting of. What chartered accounting jobs on multiple assignments to win the basis or contact me? Work from Home Chartered Accountant CA Project Report. Oversee your job for jobs available are heavily utilising xero payroll. Exercise of large clients in turning around the required to validate its concerned spheres of this website uses an emerging markets throughout human and chartered accountants on for jobs and. To liaise with flexible education and financial reporting matters in what it to day to uksc have a significant tailoring of an. We can also helped me on. -

Code of Ethics for Professional Accountants Contents

June 2005 Revised July 2006 CODE OF ETHICS FOR ♦ PROFESSIONAL ACCOUNTANTS CONTENTS Page PREFACE ...................................................................................................... 1102 PART A: GENERAL APPLICATION OF THE CODE ............................... 1103 100 Introduction and Fundamental Principles ........................................ 1104 110 Integrity ........................................................................................... 1110 120 Objectivity ....................................................................................... 1111 130 Professional Competence and Due Care .......................................... 1112 140 Confidentiality ................................................................................. 1113 150 Professional Behavior ...................................................................... 1115 PART B: PROFESSIONAL ACCOUNTANTS IN PUBLIC PRACTICE ... 1116 200 Introduction ..................................................................................... 1117 210 Professional Appointment ............................................................... 1123 220 Conflicts of Interest ......................................................................... 1127 230 Second Opinions .............................................................................. 1129 240 Fees and Other Types of Remuneration .......................................... 1130 250 Marketing Professional Services ..................................................... 1133 260 Gifts and -

Code of Ethics and Disciplinary Mechanism of ICAI by CA

Code of Ethics And Disciplinary Mechanism of ICAI by CA. Mangesh Kinare. WIRC of ICAI 20th December 2019 Code of Ethics ➢ ICAI being member of International Federation of Accountants (IFAC) has considered the Ethics standards issued by International Ethics Standards Board for Accountants(IESBA) while framing Code of Ethics for CAs. ➢ The existing (2009) edition of ICAI Code of Ethics is based on 2005 edition of IESBA Code of Ethics. ➢ ICAI Code of Ethics has been revised in January, 2019 based on 2018 edition of IESBA Code of Ethics. It is applicable from 1st April, 2020. Existing Code of Ethics contains Two Parts Part-A - [Based on IFAC/IESBA Code of Ethics, 2005 edition] Chapter 1 – General application of the Code Chapter 2 - Professional Accountants in public practice Chapter 3 – Professional Accountants in service Part –B - [Based on domestic Indian provisions ] Chapter 4 – Accounting and Auditing standards Chapter 5 – The Chartered Accountants Act, 1949 Chapter 6 – Council Guidelines Chapter 7 – Self Regulatory Measures Recommended by the Council Appendices A – F General Application of Code – Fundamental Principles A professional accountant is required to comply with the following fundamental principles: (a) Integrity – Being straightforward and honest in all professional relationships. (b) Objectivity – Not allow bias, conflict of interest or undue influence of others to override professional judgments. (c) Professional Competence and Due Care – Maintain professional knowledge and skill at the level required to ensure that a client or employer receives competent professional service based on current developments in practice, legislation and techniques (d) Confidentiality – The confidentiality of information acquired - should not disclose any such information to third parties without proper and specific authority unless there is a legal or professional right or duty to disclose. -

Roles and Practices In

Cost Management Roles and Practices in Management Accounting Today RESULTS FROM THE 2003 IMA-E&Y SURVEY B Y A SHISH G ARG,DEBASHIS G HOSH,JAMES H UDICK, AND C HUEN N OWACKI anagement accounting is at a critical juncture. themselves against their peers. What’s more, more than Increased competition and uncertain business 200 members indicated that they would like to participate Mconditions have put significant pressure on in detailed interviews about industry-wide best practices corporate management to make informed business deci- in management accounting. sions and maximize their company’s financial perfor- mance. In response, a range of management accounting KEY FINDINGS tools and techniques has emerged. The survey revealed six major findings: Given this abundance of solutions, what decision- 1. Cost management is a key input to strategic decision support tools and cost analytics methodologies are makers. finance professionals employing? And what are the fron- 2. Decision makers and decision enablers alike identify tier issues in cost management? Surprisingly, there have “actionable” cost information as their topmost priori- been few contemporary broad-based surveys that illumi- ty.(For purposes of this analysis, we presumed that nate and identify cutting-edge issues in cost management decision makers run the finance or accounting depart- today. That’s why the Institute of Management Accoun- ment and decision enablers include all other manage- tants (IMA) and Ernst & Young (E&Y) undertook a sur- ment accountants.) vey to understand the evolving role of management 3. Several factors impair cost visibility. accountants, the goals of the organizations they serve, 4. Adopting new cost management tools isn’t a priority and the tools they use to meet those goals. -

The Challenge of XBRL: Business Reporting for the Investor

Thechallenge of XBRL: business reportingfor theinvestor Alison Jonesand Mike Willis Abstract The Internet nancialreporting language known asXBRL continues to developand has now reachedthe point wheremuch of its promised benets areavailable. The authors look atthe history of this project, provide acasestudy of how Morgan Stanleyhas madeuse of the system andpredict some developmentsfor the future. Keywords Financial reporting, Financial services,Internet Alison Jones isan Assurance enyears ago, only ahandful of visionaries could haveforeseen the impactof the Internet Partner specializingin on the entire business world andthe information-exchange community. Today, a technology, infocomms and T decadelater, we areon the brinkof anInternet revolution that will redene the ‘‘business entertainment,and media. She reporting’’ paradigm.This revolution will not taketen years to impactbusiness communication. isthe PricewaterhouseCoopers The newInternet technology, eXtensibleBusiness Reporting Language (XBRL), is alreadybeing XBRLServices Leader for the deployedand used across the world. UK, andrepresents the rm on theUK XBRLconsortium. For many companies, the Internet playsa keyrole in communicating business information, MikeWillis, Deputy Chief internally to management andexternally to stakeholders.Company Web sites, extranets and Knowledge Ofcer of intranets enableclients, business partners, employees, nancial marketparticipants and PricewaterhouseCoopers’ other stakeholders to accessbusiness information. Although the needfor standardization of