Comparison of a Financial Audit and Financial Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

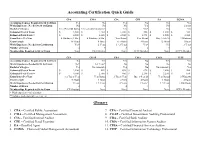

Accounting Certification Quick Guide

Accounting Certification Quick Guide CPA CMA CIA CFE EA CGMA Accounting Courses Required to Sit for Exam Yes No Yes No No Yes Work Experience Needed to Sit for Exam No No No Yes No 2 years Bachelor's Degree Yes (150 credit hours) Yes (can sit b/f graduated) Yes Yes* No Yes Estimated Cost of Exam $ 3,000 $ 1,750 $ 1,500 $ 400 $ 1,000 $ 325 Estimated Total Costs** $ 4,500 $ 2,230 $ 2,300 $ 1,395 $ 1,500 $ 2,600 Exam Dates Per Year 4 Windows (9 Mo.) 4 Windows (6 Mo.) Year Round Year Round May 1-Feb 28 3 Windows Exam Length 16 Hours 8 Hours 6.5 Hours 8 Hours 12 Hours 3 Hours Work Experience Needed for Certification Yes* 2 Years 1 - 2 Years Yes* No 3 Years Number of Exams 4 2 3 4 3 1 Memberships Required to Sit for Exam None IMA Member None ACFE Member None AICPA Member CFA CGAP CBA CISA CFSA CITP Accounting Courses Required to Sit for Exam No Yes Yes No Yes Yes Work Experience Needed to Sit for Exam No* 1-5 Years* No No No No Bachelor's Degree Yes No (associate) Yes No No (associate) Yes Estimated Cost of Exam $ 2,500 $ 855 $ 498 $ 670 $ 2,000 $ 500 Estimated Total Costs** $ 4,600 $ 2,500 $ 900 $ 2,240 $ 2,250 $ 650 Exam Dates Per Year 1-2 Times/ Year Year Round 3 Times/ Year June 1-Sept 23 Year Round 3 Windows Exam Length 18 Hours 3 Hours 4 Parts 4 Hours 3 Hours 4 Hours Work Experience Needed for Certification 4 Years 1-5 Years 2 Years 3 Years* 1-5 Years 1,000 Hours Number of Exams 3 1 4 1 1 1 Memberships Required to Sit for Exam CFA Institute None None None None AICPA Member * Work experience varies by state **Includes study material, fees, test, etc. -

Accountant Exempt, Full-Time Administrative Department

Accountant Exempt, Full-Time Administrative Department Job Summary: Under general supervision of the Finance Director, responsible for accounting and support services. The employee must routinely use independent judgment when performing tasks. Equipment Used / Job Locations / Work Environment: The work environment characteristics described here are representative of those an employee encounters while performing the essential functions of this class. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. The employee will operate a computer, fax machines, copier and other modern office equipment. The employee generally works indoors in an office. Essential Functions & Job Responsibilities: The duties listed below are intended only as illustrations of the various types of work that may be performed. The omission of specific statements of duties does not exclude them from the position if the work is similar, related or a logical assignment to this class. Responsible for accounting and financial records of all funds, including reconciling bank statements and invoices, reconciling General Ledger (G/L) accounts and sub ledgers, bond payments, verifying accounts payable, and payroll; balances all receipts and tax collections monthly; responsible for journal entries to G/L; records fixed assets; assists with annual audit; assist with annual budget preparation; assist with annual and monthly financial report; assists users in resolving problems on various accounting systems. Additional Work Performed: Prepares social security and tax withholding reports; prepares quarterly unemployment reports; maintains general records of account according to established accounting classifications, including various ledgers, registers, and journals; posts entries to books and computer from supporting records, makes adjustments, and prepares financial statements. -

Assurance on XBRL Instance Document: a Conceptual Framework of Assertions

Assurance on XBRL Instance Document: A Conceptual Framework of Assertions Rajendra P. Srivastava Ernst & Young Professor and Director Ernst & Young Center for Auditing Research and Advanced Technology School of Business, The University of Kansas 1300 Sunnyside Avenue, Lawrence, Kansas 66045 Email: [email protected] and Alexander Kogan Department of Accounting and Information Systems Rutgers Business School – Newark and New Brunswick Rutgers University 180 University Avenue, Newark, NJ 07102-1895 Email: [email protected] 1 Assurance on XBRL Instance Document: A Conceptual Framework of Assertions ABSTRACT XBRL stands for extensible business reporting language. It is an XML based computer language for reporting business information. Starting December 2008, the United States Security and Exchange Commission (US SEC) has a proposal requiring top 500 public companies to file their financial statements with the SEC not only in the text format (i.e., in ASCII or HTML) but also in the XBRL format. The file created using XRBL language is called an XBRL instance document. Under this requirement, the filers are not required to obtain a third party assurance on the XBRL instance document. The main reason for not requiring a third party independent assurance of XBRL instance documents is to encourage filers to comply with the SEC requirement without incurring much added costs. In addition, to encourage the filers to comply with this requirement, the SEC is not holding filers legally liable of any errors in the filed XBRL instance documents so long as they look similar to the standard reports when viewed using the SEC viewer. Even though the SEC is not currently requiring a third party assurance of the XBRL instance documents of the SEC filings, it is in the best interest of the public that these documents be assured. -

OIG-18-031 Financial Management: Audit of the Bureau

Audit Report OIG-18-031 FINANCIAL MANAGEMENT Audit of the Bureau of Engraving and Printing’s Fiscal Years 2017 and 2016 Financial Statements December 19, 2017 Office of Inspector General Department of the Treasury This Page Intentionally Left Blank DEPARTMENT OF THE TREASURY WASHINGTON, D.C. 20220 OFFICE OF December 19, 2017 INSPECTOR GENERAL MEMORANDUM FOR LEONARD R. OLIJAR, DIRECTOR BUREAU OF ENGRAVING AND PRINTING FROM: James Hodge /s/ Director, Financial Audit SUBJECT: Audit of the Bureau of Engraving and Printing’s Fiscal Years 2017 and 2016 Financial Statements I am pleased to transmit the attached subject report. Under a contract monitored by our office, KPMG LLP (KPMG), an independent certified public accounting firm, audited the financial statements of the Bureau of Engraving and Printing (BEP) as of September 30, 2017 and 2016, and for the years then ended, and provided an opinion on the financial statements, an opinion on management’s assertion that BEP maintained effective internal control over financial reporting, and a report on compliance with laws, regulations, and contracts tested. The contract required that the audit be performed in accordance with U.S. generally accepted government auditing standards, Office of Management and Budget Bulletin No. 17-03, Audit Requirements for Federal Financial Statements, and the Government Accountability Office/President’s Council on Integrity and Efficiency, Financial Audit Manual. In its audit of BEP, KPMG found • the financial statements were fairly presented, in all material respects, in accordance with U.S. generally accepted accounting principles; • management’s assertion that BEP maintained effective internal control over financial reporting as of September 30, 2017, was fairly stated in all material respects; and • no instances of reportable noncompliance with laws, regulations, and contracts tested. -

Statutory Audit and Eligibility for Appointment As Internal Auditors in Public Companies Under Section 138 of the Companies Act, 2013

WEBINAR on the Opinion of the Council of Institute of Cost Accountants of India on Statutory Audit and eligibility for appointment as Internal Auditors in Public Companies under section 138 of the Companies Act, 2013 CMA B. B. GOYAL Former Addl. Chief Adviser Cost Ministry of Finance, Government of India What is Internal Audit? • Internal audit is an independent, objective assurance and consulting activity designed to add value and improve an organization's operations. • It assists the organization to accomplish its objectives by bringing a systematic, & disciplined approach to evaluate and improve the effectiveness of • risk management, • control, and • governance processes. • IA provides an assurance relating to • Effectiveness of operations, • Reliability of financial management and reporting, and • Compliance with laws and regulations. August 15, 2020 B B GOYAL 2 Legal Provisions on Internal Audit • Section 138 of the Companies Act 2013 read with Rule 13 of the Companies (Accounts) Rules, 2014 - following class of companies shall be required to appoint an internal auditor • every listed company; • every unlisted public company having – • paid up share capital of Rs.50 crore or more during the preceding financial year; or • outstanding deposits of Rs.25 crore or more at any point of time during the preceding financial year; and • every unlisted public company or private company having – • turnover of Rs.200 crore or more during the preceding financial year; or • outstanding loans or borrowings from banks or public financial institutions exceeding Rs.100 crore or more at any point of time during the preceding financial year: Legal Provisions on Internal Auditor • Section 138 (1) Such class or classes of companies as may be prescribed shall be required to appoint an internal auditor, who shall either be a chartered accountant or a cost accountant, or such other professional as may be decided by the Board to conduct internal audit of the functions and activities of the company. -

Agenda Item 545 Fifth Avenue, 14Th Floor Tel: +1 (212) 286-9344 New York, New York 10017 Fax: +1 (212) 856-9420 Internet: 3-A

IFAC Education Committee Meeting Agenda 3-A Stockholm, August 2004 DRAFT IES INTERNATIONAL FEDERATION OF ACCOUNTANTS Agenda Item 545 Fifth Avenue, 14th Floor Tel: +1 (212) 286-9344 New York, New York 10017 Fax: +1 (212) 856-9420 Internet: http://www.ifac.org 3-A IES 8 EDUCATION REQUIREMENTS FOR AUDIT PROFESSIONALS CONTENTS Purpose and Scope of this Standard Introduction and Background Effective Date Knowledge Content for Audit Professionals Professional Skills Professional Values, Ethics and Attitudes Practical Experience Requirements Assessment of Professional Capabilities and Competence Continuing Professional Development Education Requirements for Audit Professionals Involved in Transnational Audits Page 1 of 18 IFAC Education Committee Meeting Agenda 3-A Stockholm, August 2004 DRAFT IES Purpose and Scope of this Standard 1. This Standard prescribes the specific education requirements IFAC member bodies should require their individual members to obtain before they may work as audit professionals. 2. The aim of this Standard is to ensure professional accountants have acquired the specific professional knowledge, professional skills and professional values, ethics and attitudes required to work as competent audit professionals. Audit professionals also need to maintain a level of competence which the public expects of those working in audit. Life-long learning will therefore be required to develop and maintain professional competence (see also International Education Standard for Professional Accountants 7, Continuing Professional Development: A Program of Lifelong Learning and Continuing Development of Professional Competence). 3. An audit professional is a professional accountant whose role is to undertake the general audit function and who has substantial involvement in an audit assignment. Substantial involvement in an audit assignment requires the professional accountant to make significant judgment decisions assisting in the formation of the audit opinion. -

CHOOSING a BOOKKEEPING SOLUTION Step 1

CHOOSING A BOOKKEEPING SOLUTION Step 1: Determine skill requirements (The chart below is offered as a general guide to creating a job description.) Basic Bookkeeping Advanced Bookkeeping Accounting Finance Recording basic daily Recording more Handling accounting Handling other financial transactions such as: complex transactions functions such as: and managerial ‐Receipts & Deposits such as: ‐Processing payroll activities such as: ‐Disbursements ‐Payroll ‐Maintaining fixed asset ‐Budgeting ‐Vendor bills & credits ‐Credit card activity schedules ‐Projections ‐Customer invoices, ‐Journal entries ‐Inventory valuation ‐Cash flow analysis credits and statements ‐Inventory ‐Work‐in‐process ‐Financing ‐Project/Job costing Accounting ‐Tax preparation or ‐Estimates ‐Overhead allocations interfacing with your ‐Purchase orders ‐Cost of good/services CPA ‐Allocation by profit accounting center ‐Tax reporting (sales & ‐Bank and credit card use, gross receipts, account reconciliation 1099, payroll taxes) ‐Interfacing with a point of sale system ‐Internally prepared financial statements Job titles may include: Job titles may include: Job titles may include: Job titles may include: ‐Data Entry Clerk ‐Bookkeeper ‐Office Manager ‐Accounting Manager ‐Payables and/or ‐Senior Bookkeeper ‐Staff Accountant ‐Director of Finance Receivables Clerk ‐Full charge Bookkeeper ‐Accountant and/or Accounting ‐Entry Level Bookkeeper ‐Junior Accountant ‐Payroll Accountant ‐Chief Finance Officer ‐Bookkeeper ‐Office Manager ‐Senior Accountant Education required: Education -

Code of Ethics for Professional Accountants Contents

June 2005 Revised July 2006 CODE OF ETHICS FOR ♦ PROFESSIONAL ACCOUNTANTS CONTENTS Page PREFACE ...................................................................................................... 1102 PART A: GENERAL APPLICATION OF THE CODE ............................... 1103 100 Introduction and Fundamental Principles ........................................ 1104 110 Integrity ........................................................................................... 1110 120 Objectivity ....................................................................................... 1111 130 Professional Competence and Due Care .......................................... 1112 140 Confidentiality ................................................................................. 1113 150 Professional Behavior ...................................................................... 1115 PART B: PROFESSIONAL ACCOUNTANTS IN PUBLIC PRACTICE ... 1116 200 Introduction ..................................................................................... 1117 210 Professional Appointment ............................................................... 1123 220 Conflicts of Interest ......................................................................... 1127 230 Second Opinions .............................................................................. 1129 240 Fees and Other Types of Remuneration .......................................... 1130 250 Marketing Professional Services ..................................................... 1133 260 Gifts and -

Guide for Financial Statement Audits and Compliance Attestation Engagements of Lender Servicers Administering the Federal Family Education Loan Program

Lender Servicer Audit Guide September 2020 GUIDE FOR FINANCIAL STATEMENT AUDITS AND COMPLIANCE ATTESTATION ENGAGEMENTS OF LENDER SERVICERS ADMINISTERING THE FEDERAL FAMILY EDUCATION LOAN PROGRAM U.S. DEPARTMENT OF EDUCATION OFFICE OF INSPECTOR GENERAL 2020 Lender Servicer Audit Guide September 2020 Table of Contents ABBREVIATIONS AND ACRONYMS ......................................................................................................................... 4 CHAPTER 1 – GENERAL REQUIREMENTS ................................................................................................................ 5 A. INTRODUCTION .......................................................................................................................... 5 A.1. PURPOSE AND APPLICABILITY ...................................................................................................5 A.2. BACKGROUND ..........................................................................................................................5 A.3. EFFECTIVE DATE AND IMPLEMENTATION ..................................................................................6 A.4. ENGAGEMENT PERIOD AND SCOPE...........................................................................................7 A.5. REPORT DUE DATES AND SUBMISSION .....................................................................................7 A.6. COORDINATING FINANCIAL STATEMENT AUDITS AND COMPLIANCE ATTESTATION ENGAGEMENTS 8 B. PROFESSIONAL STANDARDS ....................................................................................................... -

Roles and Practices In

Cost Management Roles and Practices in Management Accounting Today RESULTS FROM THE 2003 IMA-E&Y SURVEY B Y A SHISH G ARG,DEBASHIS G HOSH,JAMES H UDICK, AND C HUEN N OWACKI anagement accounting is at a critical juncture. themselves against their peers. What’s more, more than Increased competition and uncertain business 200 members indicated that they would like to participate Mconditions have put significant pressure on in detailed interviews about industry-wide best practices corporate management to make informed business deci- in management accounting. sions and maximize their company’s financial perfor- mance. In response, a range of management accounting KEY FINDINGS tools and techniques has emerged. The survey revealed six major findings: Given this abundance of solutions, what decision- 1. Cost management is a key input to strategic decision support tools and cost analytics methodologies are makers. finance professionals employing? And what are the fron- 2. Decision makers and decision enablers alike identify tier issues in cost management? Surprisingly, there have “actionable” cost information as their topmost priori- been few contemporary broad-based surveys that illumi- ty.(For purposes of this analysis, we presumed that nate and identify cutting-edge issues in cost management decision makers run the finance or accounting depart- today. That’s why the Institute of Management Accoun- ment and decision enablers include all other manage- tants (IMA) and Ernst & Young (E&Y) undertook a sur- ment accountants.) vey to understand the evolving role of management 3. Several factors impair cost visibility. accountants, the goals of the organizations they serve, 4. Adopting new cost management tools isn’t a priority and the tools they use to meet those goals. -

The Challenge of XBRL: Business Reporting for the Investor

Thechallenge of XBRL: business reportingfor theinvestor Alison Jonesand Mike Willis Abstract The Internet nancialreporting language known asXBRL continues to developand has now reachedthe point wheremuch of its promised benets areavailable. The authors look atthe history of this project, provide acasestudy of how Morgan Stanleyhas madeuse of the system andpredict some developmentsfor the future. Keywords Financial reporting, Financial services,Internet Alison Jones isan Assurance enyears ago, only ahandful of visionaries could haveforeseen the impactof the Internet Partner specializingin on the entire business world andthe information-exchange community. Today, a technology, infocomms and T decadelater, we areon the brinkof anInternet revolution that will redene the ‘‘business entertainment,and media. She reporting’’ paradigm.This revolution will not taketen years to impactbusiness communication. isthe PricewaterhouseCoopers The newInternet technology, eXtensibleBusiness Reporting Language (XBRL), is alreadybeing XBRLServices Leader for the deployedand used across the world. UK, andrepresents the rm on theUK XBRLconsortium. For many companies, the Internet playsa keyrole in communicating business information, MikeWillis, Deputy Chief internally to management andexternally to stakeholders.Company Web sites, extranets and Knowledge Ofcer of intranets enableclients, business partners, employees, nancial marketparticipants and PricewaterhouseCoopers’ other stakeholders to accessbusiness information. Although the needfor standardization of -

The Roles and Domain of the Professional Accountant in Business

Information Paper The Roles and Domain of the Professional Accountant in Business Published by the Professional Accountants in Business Committee Professional Accountants in Business Committee International Federation of Accountants 545 Fifth Avenue, 14th Floor New York, New York 10017 USA The mission of the International Federation of Accountants (IFAC) is to serve the public interest, strengthen the worldwide accountancy profession and contribute to the development of strong international economies by establishing and promoting adherence to high-quality professional standards, furthering the international convergence of such standards and speaking out on public interest issues where the profession’s expertise is most relevant. This publication was prepared by IFAC’s Professional Accountants in Business (PAIB) Committee. The PAIB Committee serves IFAC member bodies and the more than one million professional accountants worldwide who work in commerce, industry, the public sector, education, and the not-for-profit sector. Its aim is to enhance the role of professional accountants in business by encouraging and facilitating the global development and exchange of knowledge and best practices. This publication may be downloaded free-of-charge from the IFAC website http://www.ifac.org. The approved text is published in the English language. Copyright © November 2005 by the International Federation of Accountants (IFAC). All rights reserved. Permission is granted to make copies of this work provided that such copies are for use in academic classrooms or for personal use and are not sold or disseminated and provided further that each copy bears the following credit line: “Copyright © by the International Federation of Accountants. All rights reserved. Used by permission.” Otherwise, written permission from IFAC is required to reproduce, store or transmit this document, except as permitted by law.