Onair Coverage

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kuwait Passenger Airline Industry

July 2010 Industry Research Kuwait Passenger Airline Industry Summary Report Contents Middle East is emerging as a major aviation force driven by the regions Summary strong economic growth, ambitious expansion plans, and favorable Middle East Aviation Industry demographics. The majority population in the Middle East, particularly in the Gulf region is non-nationals, which form a sizeable travelling Kuwait Airline Industry population, primarily to their countries of origin. This is further supported Kuwait airways privatization by a rising younger population with high disposable income. The financial Airline Operators in Kuwait crisis has negatively affected the economies of the GCC region, despite Kuwait Airways that the aviation sector maintained a healthy growth. The GCC countries Wataniya Airways are highly reliant on the oil sector and hence face major challenges in Jazeera Airways diversifying the economy. The governments are focusing on real estate, Conclusion trade, tourism etc to diversify. List of related research The lack of railway network in the GCC region, a vibrant young population, liberalization of aviation sector, and rising disposable income Appendix has contributed to the robust growth in air traffic leading to the development of airports, expansion of fleet capacity and entrance of new operators. The region’s aviation sector has also been greatly helped by Analyst the global market liberalization, which were previously limited by Jyoti Prakash Singh restrictive controls. The major airlines in the region benefits from Associate Manager geographical location, young aircraft fleet, and low operating cost. Most j.singh @capstandards.com of the airlines focus is on high quality and timeliness at reasonable prices. -

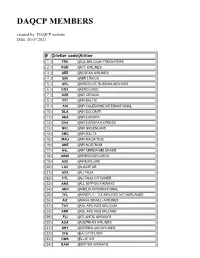

DAQCP MEMBERS Created By: DAQCP Website Date: 20.07.2021

DAQCP MEMBERS created by: DAQCP website Date: 20.07.2021 # 3-letter code Airline 1 FRH ACE BELGIUM FREIGHTERS 2 RUN ACT AIRLINES 3 AEE AEGEAN AIRLINES 4 EIN AER LINGUS 5 AFL AEROFLOT RUSSIAN AIRLINES 6 BOX AEROLOGIC 7 KZR AIR ASTANA 8 BTI AIR BALTIC 9 ACI AIR CALEDONIE INTERNATIONAL 10 DLA AIR DOLOMITI 11 AEA AIR EUROPA 12 OVA AIR EUROPA EXPRESS 13 GRL AIR GREENLAND 14 AMC AIR MALTA 15 MAU AIR MAURITIUS 16 ANE AIR NOSTRUM 17 ASL AIR SERBIA BELGRADE 18 ABW AIRBRIDGECARGO 19 AXE AIREXPLORE 20 LAV ALBASTAR 21 AZA ALITALIA 22 CYL ALITALIA CITYLINER 23 ANA ALL NIPPON AIRWAYS 24 AEH AMELIA INTERNATIONAL 25 TFL ARKEFLY - TUI AIRLINES NETHERLANDS 26 AIZ ARKIA ISRAELI AIRLINES 27 TAY ASL AIRLINES BELGIUM 28 ABR ASL AIRLINES IRELAND 29 FLI ATLANTIC AIRWAYS 30 AUA AUSTRIAN AIRLINES 31 AHY AZERBAIJAN AIRLINES 32 CFE BA CITYFLYER 33 BMS BLUE AIR 34 BAW BRITISH AIRWAYS 35 BEL BRUSSELS AIRLINES 36 GNE BUSINESS AVIATION SERVICES GUERNSEY LTD 37 CLU CARGOLOGICAIR 38 CLX CARGOLUX AIRLINES INTERNATIONAL S.A 39 ICV CARGOLUX ITALIA 40 CEB CEBU PACIFIC 41 BCY CITYJET 42 CFG CONDOR FLUGDIENST GMBH 43 CTN CROATIA AIRLINES 44 CSA CZECH AIRLINES 45 DLH DEUTSCHE LUFTHANSA 46 DHK DHL AIR LTD. 47 EZE EASTERN AIRWAYS 48 EJU EASYJET EUROPE 49 EZS EASYJET SWITZERLAND 50 EZY EASYJET UK 51 EDW EDELWEISS AIR 52 ELY EL AL 53 UAE EMIRATES 54 ETH ETHIOPIAN AIRLINES 55 ETD ETIHAD AIRWAYS 56 MMZ EUROATLANTIC 57 BCS EUROPEAN AIR TRANSPORT 58 EWG EUROWINGS 59 OCN EUROWINGS DISCOVER 60 EWE EUROWINGS EUROPE 61 EVE EVELOP AIRLINES 62 FIN FINNAIR 63 FHY FREEBIRD AIRLINES 64 GJT GETJET AIRLINES 65 GFA GULF AIR 66 OAW HELVETIC AIRWAYS 67 HFY HI FLY 68 HBN HIBERNIAN AIRLINES 69 HOP HOP! 70 IBE IBERIA 71 ICE ICELANDAIR 72 ISR ISRAIR AIRLINES 73 JAL JAPAN AIRLINES CO. -

Insight February 2010

Airline Insurance INSIGHT FEBRUARY 2010 1ST QUARTER 2010 In marked contrast to the fourth With the fourth quarter generating in excess of 70% of quarter of 2009 which saw in excess the annual premium in 2009, many in the market believe of 100 risks renew generating more that the ‘2009 Cycle’ commences on October 1, below we illustrate the percentage premium movements generated than US$1,350 million in premium; since October 2009. The premium generated since the first quarter of 2010 is likely to October 2009 totals US$1,379 million, an increase of 20% see less than 20 risks renew. compared to the previous comparable period. As would be expected, December generates the largest volume of In 2009 the quarter generated US$40 million in premium premium in the past five months. which represents less than 2% of the year’s premium income. HuLL AND LIABILITY With Blue Wings (Germany) ceasing operations and other Q4 2009 AND 2010 NET % PREMIUM MOVEMENTS programmes being incorporated into larger programmes (Bahrain Air & Wataniya Airways), although this is offset by the Air Transat renewal having extended its previous policy AS AT FEBRUARY 2010 and now renewing in March for the first time, however it is 40% 34% likely that this share will decrease slightly in 2010. 35% 30% 28% The lack of renewal activity makes it difficult to draw any 25% 23% realistic conclusions, however it would appear that insurers +20% 20% 20% are still being successful in their attempts to increase 14% premium levels. For 2010 to date, premium is showing an 15% increase of 24%, although the level of premium generated 10% currently totals just US$13 million from six renewals. -

The History and Development of Aviation in the State of Kuwait

The International Journal of Engineering and Science (IJES) || Volume || 6 || Issue || 4 || Pages || PP 14-20 || 2017 || ISSN (e): 2319 – 1813 ISSN (p): 2319 – 1805 The History and Development of Aviation in the State of Kuwait Fadala Hassan Alfadala Higher Institute of Telecommunication and Navigation State of Kuwait I. INTRODUCTION The aviation industry today is a growing industry but is faced with many challenges that entail “rough decisions, forcing them to ground planes, pare fleets, consolidate routes, and cut staff” (“2011 Global Aerospace Outlook,” 2011). As a result, airline companies try to survive by having leaner organizations that aspire for efficiency; they aim for competitiveness and yet work on reducing costs in all possible ways. They are bombarded with issues such as increasing or fluctuating fuel prices which affect their profit margins; there are also companies that approach challenges with a “wait and see” attitude as they await what will happen and how they will perform as situations happen; but there also those that are confronted by emerging developments that challenge them to increase their fleets, number of routes and seat capacities; they are also pressed with the need to find other lucrative businesses to augment future profitability like charging fees for checked bags, food or in-flight entertainment; they may also offer operating leases as fleet financing opportunity for many airlines. Being part of the aviation industry also requires aviation companies to keep abreast of what is new in the global aviation market. Although it is a promising market having steady growth and development, there is a growing need to continually upgrade or innovate to make the industry lucrative in a global scale. -

AIRLINES Monthly

AIRLINES monthly OTP APRIL 2018 Contents GLOBAL AIRLINES GLOBAL RANKING Top and bottom Regional airlines Latin American EMEA ASPAC North America and Caribbean Notes: % On-Time is percentage of flights that depart or Update: Status coverage as of April 2018 will only be based arrive within 15 minutes of schedule. on actual gate times rather than estimated times. This may Source: OAG flightview. Any reuse, publication or distribution of result in some airlines/airports being excluded from this report data must be attributed to OAG flightview. report. Global OTP rankings are assigned to all airlines/ Global OTP rankings are assigned to all Airports airports where OAG has status coverage for at least 80% where OAG has status coverage for at least 80% of the of scheduled flights. If you would like to review your flight scheduled flights. status feed with OAG please [email protected] AIRLINE MONTHLY OTP – APRIL 2018 Global airlines – top and bottom BOTTOM AIRLINE ON-TIME TOP AIRLINE ON-TIME FLIGHTS On-time performance On-time performance FLIGHTS Airline Arrivals Rank Flights Rank Airline Arrivals Rank Flights Rank TW T'way Air 99.5% 1 3,419 138 3H Air Inuit 39.2% 153 1,460 212 HX Hong Kong Airlines 95.8% 2 3,144 141 SF Tassili Airlines 41.9% 152 424 291 SATA International-Azores JH Fuji Dream Airlines 95.1% 3 2,122 173 S4 47.0% 151 625 268 Airlines S.A. PM Canaryfly 94.0% 4 1,072 232 EE Regional Jet 52.2% 150 70 367 BT Air Baltic Corporation 92.9% 5 4,624 117 VC ViaAir 53.4% 149 297 319 RC Atlantic Airways Faroe Islands 92.1% 6 221 333 TP TAP Air Portugal 53.8% 148 11,263 59 HR Hahn Air 91.7% 7 14 377 Z2 Philippines AirAsia Inc. -

Western-Built Jet and Turboprop Airliners

WORLD AIRLINER CENSUS Data compiled from Flightglobal ACAS database flightglobal.com/acas EXPLANATORY NOTES The data in this census covers all commercial jet- and requirements, put into storage, and so on, and when airliners that have been temporarily removed from an turboprop-powered transport aircraft in service or on flying hours for three consecutive months are reported airline’s fleet and returned to the state may not be firm order with the world’s airlines, excluding aircraft as zero. shown as being with the airline for which they operate. that carry fewer than 14 passengers, or the equivalent The exception is where the aircraft is undergoing Russian aircraft tend to spend a long time parked in cargo. maintenance, where it will remain classified as active. before being permanently retired – much longer than The tables are in two sections, both of which have Aircraft awaiting a conversion will be shown as parked. equivalent Western aircraft – so it can be difficult to been compiled by Flightglobal ACAS research officer The region is dictated by operator base and does not establish the exact status of the “available fleet” John Wilding using Flightglobal’s ACAS database. necessarily indicate the area of operation. Options and (parked aircraft that could be returned to operation). Section one records the fleets of the Western-built letters of intent (where a firm contract has not been For more information on airliner types see our two- airliners, and the second section records the fleets of signed) are not included. Orders by, and aircraft with, part World Airliners Directory (Flight International, 27 Russian/CIS-built types. -

Weekly Aviation Headline News

ISSN 1718-7966 JULy 23, 2018/ VOL. 650 www.avitrader.com Weekly Aviation Headline News WORLD NEWS Silk Way West teams up with JAL Cargo Silk Way West Airlines and JAL CAR- GO have agreed to start a co-opera- tion regarding cargo services, which does include the use of Silk Way West Airlines’ capacities by JAL CARGO. As JAL CARGO has stopped their own full freighter operations, the use of Silk Way West Airlines’ capacities on scheduled routes out of Europe via Baku into Japan and vice versa will create an interesting option for both carriers. At the same time, Silk Way West Airlines will boost its weekly op- eration between Baku and Europe to offer sequenced connections to and from Japan via Baku. FIA18 proved successful Air Nostrum and CityJet join for the forces OEMs. Air Nostrum and CityJet have an- Photo: Airbus nounced that they have signed a Heads of Terms with the aim to bring about closer co-operation between Farnborough Airshow review the two airlines under the umbrella Order bonanza grips the UK Airshow of a new holding company. Such a de- velopment will be subject to obtain- The 2018 edition of Farnborough finalised orders for up to 20 787s, tar Airways also went for five of the ing the requisite regulatory approvals took place over sunny skies in Hamp- Vietjet went for an additional 100 same type. These were just a hand- and the preparation of the relevant shire, England and with a backdrop 737 MAXs. The agreement, which ful of the total orders generated by filings has begun. -

Annual Report 2010 66Th Annual General Meeting Berlin, June 2010

Giovanni Bisignani Director General & CEO International Air Transport Association Annual Report 2010 66th Annual General Meeting Berlin, June 2010 Promoting sustainable forest management. This paper is certified by the Forest Stewardship Council (FSC) and is cellulose based and recyclable. IATA Board of Governors 06 Simplifying the Business 30 Director General’s Message 08 Cost Efficiency 36 State of the Industry 10 Industry and Financial Services 40 Safety 16 Aviation Solutions 46 Security and Facilitation 20 IATA Membership 50 Regulatory and Public Policy 24 IATA Offices 52 Environment 26 Note: Unless specified otherwise, all dollar ($) figures in this annual report refer to US dollars (US$). Cautious optimism is returning. But challenges continue. We must rebuild the industry on a new and more resilient foundation. Safety, security, and environmental responsibility are the pillars of our industry, which we must constantly strengthen. Shocks and crises have exposed the weakness of the industry structure. The nearly $50 billion loss over the last decade is a blunt case for big change. Giovanni Bisignani 6 IATA Board of Governors as of 1 May 2010 Khalid Abdullah Almolhem Andrés Conesa Harry Hohmeister SAUDI ARABIAN AIRLINES AEROMEXICO SWISS Richard Anderson Enrique Cueto Mats Jansson DELTA AIR LINES LAN AIRLINES SAS Gerard Arpey Rob Fyfe Alan Joyce AMERICAN AIRLINES AIR NEW ZEALAND QANTAS David Bronczek Naresh Goyal Temel Kotil FEDEX EXPRESS JET AIRWAYS TURKISH AIRLINES Chew Choon Seng Peter Hartman Liu Shaoyong SINGAPORE AIRLINES KLM CHINA EASTERN AIRLINES Yang Ho Cho Pedro Heilbron Samer Majali KOREAN AIR COPA AIRLINES GULF AIR 7 Hussein Massoud Jean-Cyril Spinetta EGYPTAIR AIR FRANCE Wolfgang Mayrhuber Glenn Tilton LUFTHANSA UNITED AIRLINES Titus Naikuni Tony Tyler KENYA AIRWAYS CATHAY PACIFIC AIRWAYS Fernando Pinto José Viegas TAP PORTUGAL LAM-MOZAMBIQUE AIRLINES Calin Rovinescu Willie Walsh AIR CANADA BRITISH AIRWAYS Vitaly Saveliev AEROFLOT Tony Tyler Chairman IATA Board of Governors 8 Director General’s Message Airlines lost $9.9 billion in 2009. -

Washington Aviation Summary – February 2009

WASHINGTON AVIATION SUMMARY February 2009 EDITION CONTENTS I. REGULATORY NEWS................................................................................................ 1 II. AIRPORTS.................................................................................................................. 5 III. SECURITY AND DATA PRIVACY ……………………… ……………………….……...7 IV. E-COMMERCE AND TECHNOLOGY......................................................................... 9 V. ENERGY AND ENVIRONMENT............................................................................... 10 VI. U.S. CONGRESS...................................................................................................... 11 VII. BILATERAL AND STATE DEPARTMENT NEWS .................................................... 13 VIII. EUROPE/AFRICA..................................................................................................... 14 IX. ASIA/PACIFIC/MIDDLE EAST .................................................................................17 X. AMERICAS ............................................................................................................... 19 For further information, including documents referenced, contact: Joanne W. Young Kirstein & Young PLLC 1750 K Street NW Suite 200 Washington, D.C. 20006 Telephone: (202) 331-3348 Fax: (202) 331-3933 Email: [email protected] http://www.yklaw.com The Kirstein & Young law firm specializes in representing U.S. and foreign airlines, airports, leasing companies, financial institutions and aviation-related -

Gulf Airlines and the Changing Map of Global Aviation

GULF AIRLINES AND THE CHANGING MAP OF GLOBAL AVIATION KRISTIAN COATES ULRICHSEN, PH.D. FELLOW FOR THE MIDDLE EAST JUNE 24, 2015 © 2015 by the James A. Baker III Institute for Public Policy of Rice University This material may be quoted or reproduced without prior permission, provided appropriate credit is given to the author and the James A. Baker III Institute for Public Policy. Wherever feasible, papers are reviewed by outside experts before they are released. However, the research and views expressed in this paper are those of the individual researcher(s) and do not necessarily represent the views of the James A. Baker III Institute for Public Policy. Kristian Coates Ulrichsen, Ph.D. “Gulf Airlines and the Changing Map of Global Aviation” Gulf Airlines and the Changing Map of Global Aviation Introduction This report provides an empirical case study of one of the areas in which the Gulf States have been the most visible and dynamic generators of global change: the aviation sector. • The startling rise of Emirates, Etihad, and Qatar Airways has reshaped global aviation markets around the three hubs of Dubai, Abu Dhabi, and Doha as the Gulf airlines have developed into what the Economist magazine has labelled “global super-connectors” capable of connecting any two points in the world with one stopover in the Gulf.1 • This culminated in the January 2015 announcement that Dubai International Airport had overtaken London’s Heathrow Airport to become the world’s busiest airport for international passengers. Significantly, the 6 percent annual rise in Dubai’s international passengers (to almost 70 million in 2014) contrasted with the far smaller rate of increase caused by Heathrow operating at near-peak capacity owing to space and regulatory constraints. -

Aviation Maintenance News

Page 1 of 7 10 July 2009 No. 860 MRO Aviation Maintenance News Sabena Technics and Kuwait’s Al Wazzan Group have announced a joint venture to provide MRO operations in Kuwait City, starting autumn 2009. The objective of the partnership is to develop an MRO centre providing services to operators in the Middle East. This MRO centre will offer proximity services such as line, light and heavy aircraft maintenance, pool and logistics support, providing tailor-made solutions to customers in the region. The company’s first customer will be Wataniya Airways, an operator already supported by Sabena Technics, which provides passenger services from Kuwait to destinations within the Middle East. Christophe Bernardini, Chief Executive Officer of Sabena Technics, said: “I am very pleased and honoured to partner with a major Kuwait-based group, in line with our group’s worldwide development strategy and furthermore benefiting from an important and renowned name in the region, which will help us in our development.” Mr Al-Wazzan, Chaiman & CEO of Al-Wazzan group said that the two groups “can now develop synergies in the region, which will be the keys for the success of our Kuwaiti-based MRO centre.” #860.MRO1 * Sabena Technics has signed a seven-year full-support contract with new Romanian carrier Medallion Air for its fleet of MD82-83 aircraft. Under this agreement, Sabena Technics will perform component repair and overhaul services, including pool access with advanced standard exchange, component and engineering services for Medallion Air. The services will be carried out through Sabena Technics’ integrated services division. -

The Region's Leading Mro Exhibition for Commercial Aviation Maintenance

THE REGION’S LEADING MRO EXHIBITION FOR COMMERCIAL AVIATION MAINTENANCE 10 February 2019 11-12 February 2019 MRO Middle East Summit MRO Middle East & AIME Exhibition Post Show Report Conrad Hotel, Dubai Dubai World Trade Centre, UAE THE MIDDLE EAST’S ONLY AIRCRAFT INTERIORS EVENT It’s what’s inside that counts MROMIDDLEEAST.AVIATIONWEEK.COM | WWW.AIME.AERO SUMMARY MRO Middle East and Aircraft Interiors Middle East (AIME) took place on February 10-12, 2019 in Dubai, UAE. The three-day event is the largest of its kind in the region, gathering the entire airline supply chain. Fast Facts: 5,004 330 83 542 Total Exhibitors Countries Airline Attendees Represented Attendees Top industries represented include: Attendees by Job Role Airframe Manufacturers VP, Director, Head 35% Airline Operator Avionics/Instruments Manager 35% Cabin Interiors/Flight Ops/Infl ight Entertainment & Connectivity Components/Rotables Consulting Services Distributor/Supplier Engineering Logistics/Freight Forwarding C-Level 17% Supply Chain Other 13% This is the best platform “for us to showcase our capabilities and our high quality and standards. This year’s show has been very successful, we have already signed two collaborations, one with a customer and one with a potential customer. We have already booked to return in 2020 with a bigger presence than today. Abdul Khaliq Saeed” CEO, Etihad Airways Engineering ABOUT THE EXHIBITION Two co-located exhibitions serving the entire airline industry. Aviation Week Network and Tarsus F&E LCC Middle East hosted the two-day international exhibition which combines MRO Middle East with Aircraft Interiors Middle East (AIME) at the Dubai World Trade Center, UAE on February 11-12, 2019.