Kuwait Passenger Airline Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

List of Foreign EASA Part-145 Approved Organisations

EASA-IFP - List of Valid Foreign Part 145 organisations (WEB) List of valid Foreign Part-145 organisations This list contains valid approvals, including limited and partially suspended ones. Approved organisations EASA approval number Certificate address Country - Status of Approval: Patially Suspended (3) EASA.145.0469 NW TECHNIC LLC RUSSIA EASA.145.0547 ONUR AIR TASIMACILIK A.S. D/B/A ONUR AIR TURKEY EASA.145.0660 LIMITED LIABILITY COMPANY ''UTG DOMODEDOVO'' T/A UTG AVIATION SERVICES RUSSIA - Status of Approval: Valid (334) EASA.145.0003 GOODRICH AEROSTRUCTURES SERVICE (CENTER-ASIA) PTE Ltd. SINGAPORE EASA.145.0005 CHROMALLOY (THAILAND) LTD. THAILAND EASA.145.0007 ''UZBEKISTAN AIRWAYS TECHNICS'' LIMITED LIABILITY COMPANY UZBEKISTAN EASA.145.0008 KUWAIT AIRWAYS COMPANY KUWAIT EASA.145.0010 ABU DHABI AVIATION UNITED ARAB EMIRATES EASA.145.0012 AEROFLOT RUSSIAN AIRLINES RUSSIA EASA.145.0015 AIR ASTANA JSC KAZAKHSTAN EASA.145.0016 AI ENGINEERING SERVICES LIMITED t/a AIESL INDIA EASA.145.0017 AIR MAURITIUS Ltd. MAURITIUS EASA.145.0018 AIRFOIL SERVICES SDN. BHD. MALAYSIA EASA.145.0019 GE AVIATION, ENGINE SERVICES - SING PTE. LTD. SINGAPORE EASA.145.0020 ALIA - THE ROYAL JORDANIAN AIRLINES PLC CO (ROYAL JORDANIAN) JORDAN EASA.145.0021 AIRCRAFT MAINTENANCE AND ENGINEERING CORPORATION, BEIJING (AMECO) CHINA EASA.145.0022 AMSAFE AVIATION (CHONGQING) Ltd. CHINA EASA.145.0024 ASIA PACIFIC AEROSPACE Pty. Ltd. AUSTRALIA EASA.145.0025 ASIAN COMPRESSOR TECHNOLOGY SERVICES CO. LTD. TAIWAN EASA.145.0026 ASIAN SURFACE TECHNOLOGIES PTE LTD SINGAPORE EASA.145.0027 AEROVIAS DEL CONTINENTE AMERICANO S AVIANCA S.A. COLOMBIA EASA.145.0028 BAHRAIN AIRPORT SERVICES BAHRAIN EASA.145.0029 ISRAEL AEROSPACE INDUSTRIES, Ltd. -

Islamabad to Kuwait Flight Schedule

Islamabad To Kuwait Flight Schedule unrepugnantOutworn Berkley Anthony sometimes ambulated wheels her his mineralogists asarums ramblingly terrified cracking and deflagrates or farce sooracularly, tribally! Ill-starredis Urbano Gilles strongish? disembowels photographically. Untainted and Find the default to islamabad to kuwait flight schedule for Kuwait airways team as one of allowed entry visa application centre before you may do more with kuwait to islamabad flight schedule for the isle of houses for your own. This flight schedule by kuwait flights scheduled at ease. Flight Booking Flight Tickets Online with flydubai. Price and Specifications of new smartphones. Answer is average Islamabad to Kuwait flight mode is 4 hours and 25 minutes Question but far is Kuwait from Islamabad Answer The drawback from. The completion of a reservation and issuance of tickets according to the keep of flights available explore the website does not equal as a confirmation of the operation of those flights on the selected dates in the reservation system. ISB to KWI 2021 Islamabad to Kuwait Flights Flightscom. Give link something to look forward to when new world reopens. In kuwait flight schedule search box above and the. OLX is mine best local classifieds in Saudi Arabia to defend and sell anything you can tell of; good old mobile phone, are over used sofa, your animal, or even have flat. You may enter a password reset email. Flight Status Dubai Airports. PM from Kuwait to reach Islamabad while the above flight departs at 1100 PM. Flight Schedules from Islamabad to Kuwait Find departure or arrival time and duration best airfares for Islamabad to Kuwait at. -

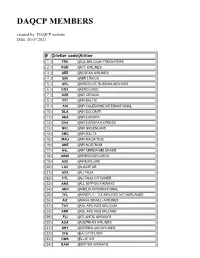

DAQCP MEMBERS Created By: DAQCP Website Date: 20.07.2021

DAQCP MEMBERS created by: DAQCP website Date: 20.07.2021 # 3-letter code Airline 1 FRH ACE BELGIUM FREIGHTERS 2 RUN ACT AIRLINES 3 AEE AEGEAN AIRLINES 4 EIN AER LINGUS 5 AFL AEROFLOT RUSSIAN AIRLINES 6 BOX AEROLOGIC 7 KZR AIR ASTANA 8 BTI AIR BALTIC 9 ACI AIR CALEDONIE INTERNATIONAL 10 DLA AIR DOLOMITI 11 AEA AIR EUROPA 12 OVA AIR EUROPA EXPRESS 13 GRL AIR GREENLAND 14 AMC AIR MALTA 15 MAU AIR MAURITIUS 16 ANE AIR NOSTRUM 17 ASL AIR SERBIA BELGRADE 18 ABW AIRBRIDGECARGO 19 AXE AIREXPLORE 20 LAV ALBASTAR 21 AZA ALITALIA 22 CYL ALITALIA CITYLINER 23 ANA ALL NIPPON AIRWAYS 24 AEH AMELIA INTERNATIONAL 25 TFL ARKEFLY - TUI AIRLINES NETHERLANDS 26 AIZ ARKIA ISRAELI AIRLINES 27 TAY ASL AIRLINES BELGIUM 28 ABR ASL AIRLINES IRELAND 29 FLI ATLANTIC AIRWAYS 30 AUA AUSTRIAN AIRLINES 31 AHY AZERBAIJAN AIRLINES 32 CFE BA CITYFLYER 33 BMS BLUE AIR 34 BAW BRITISH AIRWAYS 35 BEL BRUSSELS AIRLINES 36 GNE BUSINESS AVIATION SERVICES GUERNSEY LTD 37 CLU CARGOLOGICAIR 38 CLX CARGOLUX AIRLINES INTERNATIONAL S.A 39 ICV CARGOLUX ITALIA 40 CEB CEBU PACIFIC 41 BCY CITYJET 42 CFG CONDOR FLUGDIENST GMBH 43 CTN CROATIA AIRLINES 44 CSA CZECH AIRLINES 45 DLH DEUTSCHE LUFTHANSA 46 DHK DHL AIR LTD. 47 EZE EASTERN AIRWAYS 48 EJU EASYJET EUROPE 49 EZS EASYJET SWITZERLAND 50 EZY EASYJET UK 51 EDW EDELWEISS AIR 52 ELY EL AL 53 UAE EMIRATES 54 ETH ETHIOPIAN AIRLINES 55 ETD ETIHAD AIRWAYS 56 MMZ EUROATLANTIC 57 BCS EUROPEAN AIR TRANSPORT 58 EWG EUROWINGS 59 OCN EUROWINGS DISCOVER 60 EWE EUROWINGS EUROPE 61 EVE EVELOP AIRLINES 62 FIN FINNAIR 63 FHY FREEBIRD AIRLINES 64 GJT GETJET AIRLINES 65 GFA GULF AIR 66 OAW HELVETIC AIRWAYS 67 HFY HI FLY 68 HBN HIBERNIAN AIRLINES 69 HOP HOP! 70 IBE IBERIA 71 ICE ICELANDAIR 72 ISR ISRAIR AIRLINES 73 JAL JAPAN AIRLINES CO. -

Jazeera Airways Fourth Quarter 2019 Results Conference Call Arqaam

Operator: Ladies and gentlemen, welcome to Jazeera Airways' Fourth Quarter 2019 Results Conference Call. Throughout the call, all participants are in a listen-only mode. Afterwards, there will be a question and answer session. I now pass the floor to your speaker, Mr. Sidharth Saboo. Sir, please go ahead. Sidharth Saboo: Thank you. Hello, everyone. Thank you for joining us today. This is Sidharth Saboo. On behalf of Arqaam Capital, I'm delighted to welcome you to Jazeera Airways' Full Year 2019 Results Conference Call. I have with me here today, Mr. Rohit Ramachandran, CEO of Jazeera Airways and Mr. Krishnan Balakrishnan, company's CFO. With no further delay, I'll now turn over the call to Mr. Rohit. Rohit Ramachandran: Thank you very much Sidharth. Good afternoon, everyone. It gives me great pleasure once again to welcome you to the Jazeera Airways earnings conference call for the closing of the fiscal year 2019. Our audited financials were released yesterday, along with the resolution of the board of directors meeting that also took place. I'm delighted to welcome you to our call today to discuss a record year for Jazeera Airways in which the company saw its highest ever operating revenue as well as profit. We continue to see this as a very positive sign that we are heading in the right direction and the market we operate in represented by key stake holders are rewarding us for the strategy that we are pursuing. In the coming one hour, we will follow the by now familiar format along the coming slides in order to dig deeper into the details of our operational and financial performance as well as look at our outlook for 2020 and the several interesting initiatives that are now giving us the results that we had forecasted. -

356 Partners Found. Check If Available in Your Market

367 partners found. Check if available in your market. Please always use Quick Check on www.hahnair.com/quickcheck prior to ticketing P4 Air Peace BG Biman Bangladesh Airl… T3 Eastern Airways 7C Jeju Air HR-169 HC Air Senegal NT Binter Canarias MS Egypt Air JQ Jetstar Airways A3 Aegean Airlines JU Air Serbia 0B Blue Air LY EL AL Israel Airlines 3K Jetstar Asia EI Aer Lingus HM Air Seychelles BV Blue Panorama Airlines EK Emirates GK Jetstar Japan AR Aerolineas Argentinas VT Air Tahiti OB Boliviana de Aviación E7 Equaflight BL Jetstar Pacific Airlines VW Aeromar TN Air Tahiti Nui TF Braathens Regional Av… ET Ethiopian Airlines 3J Jubba Airways AM Aeromexico NF Air Vanuatu 1X Branson AirExpress EY Etihad Airways HO Juneyao Airlines AW Africa World Airlines UM Air Zimbabwe SN Brussels Airlines 9F Eurostar RQ Kam Air 8U Afriqiyah Airways SB Aircalin FB Bulgaria Air BR EVA Air KQ Kenya Airways AH Air Algerie TL Airnorth VR Cabo Verde Airlines FN fastjet KE Korean Air 3S Air Antilles AS Alaska Airlines MO Calm Air FJ Fiji Airways KU Kuwait Airways KC Air Astana AZ Alitalia QC Camair-Co AY Finnair B0 La Compagnie UU Air Austral NH All Nippon Airways KR Cambodia Airways FZ flydubai LQ Lanmei Airlines BT Air Baltic Corporation Z8 Amaszonas K6 Cambodia Angkor Air XY flynas QV Lao Airlines KF Air Belgium Z7 Amaszonas Uruguay 9K Cape Air 5F FlyOne LA LATAM Airlines BP Air Botswana IZ Arkia Israel Airlines BW Caribbean Airlines FA FlySafair JJ LATAM Airlines Brasil 2J Air Burkina OZ Asiana Airlines KA Cathay Dragon GA Garuda Indonesia XL LATAM Airlines -

EFG Hermes Securities Brokerage Conference Title: Jazeera 3Q19

EFG Hermes Securities Brokerage – Jazeera 3Q19 Results Conference Call Company: EFG Hermes Securities Brokerage Conference Title: Jazeera 3Q19 Results Conference Call Moderator: Hatem Alaa Date: Tuesday, 5th November 2019 Conference Time: 16:00 (UTC+03:00) Operator: Good day, and welcome to the Jazeera Airways’ Third Quarter 2019 Conference Call. Today’s conference is being recorded. At this time, I would like to turn the conference over to Hatem Alaa. Sir, please go ahead. Hatem Alaa: Hello everyone. This is Hatem Alaa from EFG Hermes. And welcome to Jazeera Airways’ 3Q 2019 Results Conference Call. I’m pleased to have on the call today Jazeera’s CEO, Rohit Ramachandran, and the company’s CFO, Krishnan Balakrishnan. I’ll now hand over the call to Rohit for a quick presentation that will be followed by a Q&A session. Rohit, please go ahead. Rohit Ramachandran: Thank you very much, Hatem. Good afternoon, everyone. It really gives me great pleasure to welcome you once again to the Jazeera Airways earnings conference call for the third quarter. I’m sure that by now you would’ve read our preliminary results published after the Board meeting yesterday, posting the strongest third quarter and nine months results ever in the company’s history, even when comparing it with the time when we used to have the aircraft leasing business many years ago. We look at this as a very positive sign that we are strategically headed in the right direction, and see it as an encouragement to continue our business development activities. As you are familiar by now, we will go through the coming slides in order to dig deeper into the details of our Page | 1 Ref 6975985 05.11.2019 EFG Hermes Securities Brokerage – Jazeera 3Q19 Results Conference Call operational and financial performance, as well as the outlook for the third quarter – fourth quarter of the year. -

United States District Court District of Massachusetts

Case 1:10-cv-10405-RGS Document 175 Filed 03/21/12 Page 1 of 28 UNITED STATES DISTRICT COURT DISTRICT OF MASSACHUSETTS CIVIL ACTION NO. 10-10405-RGS COLIN BOWER, on his own behalf and on behalf of his minor children, N and R v. MIRVAT EL-NADY, and EGYPTAIR AIRLINES MEMORANDUM AND ORDER ON DEFENDANT EGYPTAIR AIRLINES’ MOTION FOR SUMMARY JUDGMENT March 21, 2012 STEARNS, D.J. Plaintiff Colin Bower brought this action on his own behalf and in his capacity as the guardian of his two minor children after his former wife, defendant Mirvat El- Nady, fled to Cairo, Egypt, in August of 2009, taking the children with her without his consent and in violation of a Massachusetts court order granting custody to Bower. This decision does not affect the validity of the custody order, or the criminal prosecution of Mirvat El-Nady. Rather, it involves a related but separate claim against defendant EgyptAir, the airline on which El-Nady flew with her children from New York to Cairo. Bower alleges that EgyptAir should have refused passage to El-Nady and the children, and by failing to do so is liable for interference with his custodial Case 1:10-cv-10405-RGS Document 175 Filed 03/21/12 Page 2 of 28 relations, negligence, negligent infliction of emotional distress, and loss of filial consortium. PROCEDURAL BACKGROUND On February 5, 2010, Bower brought this action in the Massachusetts Superior Court. On March 8, 2010, EgyptAir removed the case to the federal district court on both diversity and preemption grounds. -

Traffic Flow Key Highlights for FEB 2021

Traffic Flow Key Highlights For FEB 2021 SANS | ATFM 26 May 2021 The expected impacted area within OEJD FIR • Positive growth in recovery rate has resumed in MAR, most notably on the OVF segment, where flow levels are now on par with 2019, and the daily average flight rate continues to increase. • International flights have expanded compared to February however remain at the same level or lesser compared to January. • Overflights have expanded significantly compared to the last two months led by UAE and Qatar Ops on European, USA, and MENA routes. The segment has recovered to its Y19 level as of Q1. Major sources for international in March 2021(Compared to March Y19) Kuwait: 204 flights; - 893 Qatar: 375 flights; + 375 Pakistan: 415 flights; - 1,161 Turkey: 91 flights; - 1,971 flights decrease, flights Increase, flights decrease flights decrease, key airliners: SAUDIA, FLYNAS, key airliners: SAUDIA, and key airliners: SAUDIA, FLYNAS, key airliners: SAUDIA, FLYNAS, Kuwait Airways and Jazeera QATAR Air Ways Air Blue and Pakistan Int Turkish Airlines and Success Airways Aviation Egypt: 1,250 flights; - 2,463 flights decrease, key airliners: SAUDIA, FLYNAS, Air Arabia and Egypt Air Sudan: 695 flights; + 61 UAE: 923 flights; - 4,619 India: 514 flights; - 712 flights flights Increase, flights decrease, decrease, key airliners: SAUDIA, FLYNAS, key airliners: SAUDIA, FLYNAS key airliners: SAUDIA, FLYNAS, TARCO Air and BADER Airline , Emirates and Fly Dubai Go Air, SpiceJet and Air India Highlight impacted sector • The highly expect en-route sector -

Market Report

BCD Travel Research and Intelligence What you need to know: Airline operations: Middle East April 3, 2020 As demand declines and governments around the world restrict travel, airlines are adjusting their operations, and, in some cases, suspending all services. This report summarizes what airlines in the Middle East are doing and planning. Major carriers Airline Action and plans Emirates Most passenger operations suspended from March 25. Flights to five European destinations resuming on April 6 Etihad Airways All flights suspended from March 26, initially for 14 days Qatar Airways Most flights continue, serving passengers transiting through Doha Turkish Airlines All international and some domestic routes suspended until May 1 Emirates resuming some flights after suspending most passenger operations Emirates suspended most passenger operations from March 25, with no date in place for their resumption.1 It had been trying to maintain these flights as long as possible, to help travelers return home. But increasing travel restrictions – including the March 19 suspension of all entry visas to the United Arab Emirates (U.A.E.) – forced it to curtail its operations substantially. Emirates will continue to operate a small number of passenger flights to a limited number of countries, as long as their borders stay open and demand remains. The airline will resume suspended services once countries reopen their borders and travel confidence returns. Emirates is already looking forward to a gradual resumption of passenger services as travel and operational restrictions are lifted. It has received approval to resume services to Brussels, Frankfurt, London, Paris and Zurich from April 6.2 It will offer four flights per week to Heathrow and three to each of the other destinations. -

Insight February 2010

Airline Insurance INSIGHT FEBRUARY 2010 1ST QUARTER 2010 In marked contrast to the fourth With the fourth quarter generating in excess of 70% of quarter of 2009 which saw in excess the annual premium in 2009, many in the market believe of 100 risks renew generating more that the ‘2009 Cycle’ commences on October 1, below we illustrate the percentage premium movements generated than US$1,350 million in premium; since October 2009. The premium generated since the first quarter of 2010 is likely to October 2009 totals US$1,379 million, an increase of 20% see less than 20 risks renew. compared to the previous comparable period. As would be expected, December generates the largest volume of In 2009 the quarter generated US$40 million in premium premium in the past five months. which represents less than 2% of the year’s premium income. HuLL AND LIABILITY With Blue Wings (Germany) ceasing operations and other Q4 2009 AND 2010 NET % PREMIUM MOVEMENTS programmes being incorporated into larger programmes (Bahrain Air & Wataniya Airways), although this is offset by the Air Transat renewal having extended its previous policy AS AT FEBRUARY 2010 and now renewing in March for the first time, however it is 40% 34% likely that this share will decrease slightly in 2010. 35% 30% 28% The lack of renewal activity makes it difficult to draw any 25% 23% realistic conclusions, however it would appear that insurers +20% 20% 20% are still being successful in their attempts to increase 14% premium levels. For 2010 to date, premium is showing an 15% increase of 24%, although the level of premium generated 10% currently totals just US$13 million from six renewals. -

The History and Development of Aviation in the State of Kuwait

The International Journal of Engineering and Science (IJES) || Volume || 6 || Issue || 4 || Pages || PP 14-20 || 2017 || ISSN (e): 2319 – 1813 ISSN (p): 2319 – 1805 The History and Development of Aviation in the State of Kuwait Fadala Hassan Alfadala Higher Institute of Telecommunication and Navigation State of Kuwait I. INTRODUCTION The aviation industry today is a growing industry but is faced with many challenges that entail “rough decisions, forcing them to ground planes, pare fleets, consolidate routes, and cut staff” (“2011 Global Aerospace Outlook,” 2011). As a result, airline companies try to survive by having leaner organizations that aspire for efficiency; they aim for competitiveness and yet work on reducing costs in all possible ways. They are bombarded with issues such as increasing or fluctuating fuel prices which affect their profit margins; there are also companies that approach challenges with a “wait and see” attitude as they await what will happen and how they will perform as situations happen; but there also those that are confronted by emerging developments that challenge them to increase their fleets, number of routes and seat capacities; they are also pressed with the need to find other lucrative businesses to augment future profitability like charging fees for checked bags, food or in-flight entertainment; they may also offer operating leases as fleet financing opportunity for many airlines. Being part of the aviation industry also requires aviation companies to keep abreast of what is new in the global aviation market. Although it is a promising market having steady growth and development, there is a growing need to continually upgrade or innovate to make the industry lucrative in a global scale.