Guided Portfolio Update Canadian Equity Focus List – Fall 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

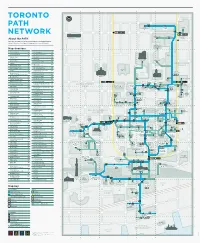

PATH Underground Walkway

PATH Marker Signs ranging from Index T V free-standing outdoor A I The Fairmont Royal York Hotel VIA Rail Canada H-19 pylons to door decals Adelaide Place G-12 InterContinental Toronto Centre H-18 Victory Building (80 Richmond 1 Adelaide East N-12 Hotel D-19 The Hudson’s Bay Company L-10 St. West) I-10 identify entrances 11 Adelaide West L-12 The Lanes I-11 W to the walkway. 105 Adelaide West I-13 K The Ritz-Carlton Hotel C-16 WaterPark Place J-22 130 Adelaide West H-12 1 King West M-15 Thomson Building J-10 95 Wellington West H-16 Air Canada Centre J-20 4 King West M-14 Toronto Coach Terminal J-5 100 Wellington West (Canadian In many elevators there is Allen Lambert Galleria 11 King West M-15 Toronto-Dominion Bank Pavilion Pacific Tower) H-16 a small PATH logo (Brookfield Place) L-17 130 King West H-14 J-14 200 Wellington West C-16 Atrium on Bay L-5 145 King West F-14 Toronto-Dominion Bank Tower mounted beside the Aura M-2 200 King West E-14 I-16 Y button for the floor 225 King West C-14 Toronto-Dominion Centre J-15 Yonge-Dundas Square N-6 B King Subway Station N-14 TD Canada Trust Tower K-18 Yonge Richmond Centre N-10 leading to the walkway. Bank of Nova Scotia K-13 TD North Tower I-14 100 Yonge M-13 Bay Adelaide Centre K-12 L TD South Tower I-16 104 Yonge M-13 Bay East Teamway K-19 25 Lower Simcoe E-20 TD West Tower (100 Wellington 110 Yonge M-12 Next Destination 10-20 Bay J-22 West) H-16 444 Yonge M-2 PATH directional signs tell 220 Bay J-16 M 25 York H-19 390 Bay (Munich Re Centre) Maple Leaf Square H-20 U 150 York G-12 you which building you’re You are in: J-10 MetroCentre B-14 Union Station J-18 York Centre (16 York St.) G-20 in and the next building Hudson’s Bay Company 777 Bay K-1 Metro Hall B-15 Union Subway Station J-18 York East Teamway H-19 Bay Wellington Tower K-16 Metro Toronto Convention Centre you’ll be entering. -

PATH Network

A B C D E F G Ryerson TORONTO University 1 1 PATH Toronto Atrium 10 Dundas Coach Terminal on Bay East DUNDAS ST W St Patrick DUNDAS ST W NETWORK Dundas Ted Rogers School One Dundas Art Gallery of Ontario of Management West Yonge-Dundas About the PATH Square 2 2 Welcome to the PATH — Toronto’s Downtown Underground Pedestrian Walkway UNIVERSITY AVE linking 30 kilometres of underground shopping, services and entertainment ST PATRICK ST BEVERLEY ST BEVERLEY ST M M c c CAUL ST CAUL ST Toronto Marriott Downtown Eaton VICTORIA ST Centre YONGE ST BAY ST Map directory BAY ST A 11 Adelaide West F6 One King West G7 130 Adelaide West D5 One Queen Street East G4 Eaton Tower Adelaide Place C5 One York D11 150 York St P PwC Tower D10 3 Toronto 3 Atrium on Bay F1 City Hall 483 Bay Street Q 2 Queen Street East G4 B 222 Bay E7 R RBC Centre B8 DOWNTOWN Bay Adelaide Centre F5 155 Wellington St W YONGE Bay Wellington Tower F8 RBC WaterPark Place E11 Osgoode UNIVERSITY AVE 483 Bay Richmond-Adelaide Centre D5 UNIVERSITY AVE Hall F3 BAY ST 120 Adelaide St W BAY ST CF Toronto Bremner Tower / C10 Nathan Eaton Centre Southcore Financial Centre (SFC) 85 Richmond West E5 Phillips Canada Life Square Brookfield Place F8 111 Richmond West D5 Building 4 Old City Hall 4 2 Queen Street East C Cadillac Fairview Tower F4 Roy Thomson Hall B7 Cadillac Fairview Royal Bank Building F6 Tower CBC Broadcast Centre A8 QUEEN ST W Osgoode QUEEN ST W Thomson Queen Building Simpson Tower CF Toronto Eaton Centre F4 Royal Bank Plaza North Tower E8 QUEEN STREET One Queen 200 Bay St Four -

Chapter 11 ) LAKELAND TOURS, LLC, Et Al.,1 ) Case No

20-11647-jlg Doc 205 Filed 09/30/20 Entered 09/30/20 13:16:46 Main Document Pg 1 of 105 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ) In re: ) Chapter 11 ) LAKELAND TOURS, LLC, et al.,1 ) Case No. 20-11647 (JLG) ) Debtors. ) Jointly Administered ) AFFIDAVIT OF SERVICE I, Julian A. Del Toro, depose and say that I am employed by Stretto, the claims and noticing agent for the Debtors in the above-captioned case. On September 25, 2020, at my direction and under my supervision, employees of Stretto caused the following document to be served via first-class mail on the service list attached hereto as Exhibit A, via electronic mail on the service list attached hereto as Exhibit B, and on three (3) confidential parties not listed herein: Notice of Filing Third Amended Plan Supplement (Docket No. 200) Notice of (I) Entry of Order (I) Approving the Disclosure Statement for and Confirming the Joint Prepackaged Chapter 11 Plan of Reorganization of Lakeland Tours, LLC and Its Debtor Affiliates and (II) Occurrence of the Effective Date to All (Docket No. 201) [THIS SPACE INTENTIONALLY LEFT BLANK] ________________________________________ 1 A complete list of each of the Debtors in these chapter 11 cases may be obtained on the website of the Debtors’ proposed claims and noticing agent at https://cases.stretto.com/WorldStrides. The location of the Debtors’ service address in these chapter 11 cases is: 49 West 45th Street, New York, NY 10036. 20-11647-jlg Doc 205 Filed 09/30/20 Entered 09/30/20 13:16:46 Main Document Pg 2 of 105 20-11647-jlg Doc 205 Filed 09/30/20 Entered 09/30/20 13:16:46 Main Document Pg 3 of 105 Exhibit A 20-11647-jlg Doc 205 Filed 09/30/20 Entered 09/30/20 13:16:46 Main Document Pg 4 of 105 Exhibit A Served via First-Class Mail Name Attention Address 1 Address 2 Address 3 City State Zip Country Aaron Joseph Borenstein Trust Address Redacted Attn: Benjamin Mintz & Peta Gordon & Lucas B. -

Enwave's District Cooling Service

ENWAVE’S DISTRICT COOLING SERVICE Enwave has been in the outsourced air conditioning business since 1997. District cooling was a natural extension of the company’s core steam distribution business as the same customers that required heating, also required air conditioning. While Enwave’s foray into the air conditioning business had always been premised on using natural cooling from the depths of Lake Ontario, the early stages of the business made use of conventional technology. With two 1,500-ton absorption chillers at its newly constructed Chilled Water Plant, Enwave began supplying the expanded Metro Toronto Convention Center (MTCC) with 2600 tons of cooling in 1997. In 1999, plant capacity was expanded to 7700 tons with the addition of a 4,700-ton steam-driven centrifugal chiller as the customer base expanded to include the Air Canada Centre, the Steam Whistle Brewery and the telecommunications centre at 151 Front Street West, which was signed in 2000. With the commissioning of the company’s signature Deep Lake Water Cooling project (DLWC), the chillers were retained for emergency backup and peak shaving on the hottest days of the year. However, the primary source of cooling would now be the cold water of Lake Ontario. To date, over $110 million has been expended to bring in colder, cleaner drinking water for the City of Toronto and environmentally friendly cooling for downtown buildings. An additional $80 million will be spent by the time the system is fully built-out. The Deep Lake Water Cooling (DLWC) system is a sustainable energy project, which replaces conventional air conditioning. -

How to Make a Complaint 2 How to Make a Complaint

How to make a complaint 2 How to make a complaint Contents We value your opinion 3 RBC business groups 4 If you have a complaint or encounter a problem 5 Step 1: Start at the source 5 Step 2: Escalate the complaint 6 Step 3: Write to the RBC Office of the Ombudsman 7 Regulatory bodies and other resources 11 Financial Consumer Agency of Canada 11 Voluntary codes and public commitments 12 Autorité des marchés financiers 12 Investment Industry Regulatory 13 Organization of Canada Mutual Fund Dealers Association of Canada 14 How to make a complaint 3 We value your opinion We all stand to gain from open communication. Whether it’s used to answer a question, solve a problem or share a success, communication is the key. While we welcome all positive comments you may have, it is equally important for us to know when you have a problem so that we can resolve it and retain your confidence. At the same time, we use your feedback to continually improve the quality of products and services we provide to you and other clients. There are a variety of ways you can express your concerns or provide positive feedback about your experiences with RBC® companies. We encourage you to get in touch with us, either in person or by telephone, email, mail or fax. 4 How to make a complaint RBC business groups ¡ RBC Royal Bank® and RBC Global Private Banking® are trademarks of Royal Bank of Canada. RBC Royal Bank includes all branches and our Business Banking Centres. -

Cagbc 2018AR WEB.Pdf

2 0 1 8 LA GÉODE LEED Platinum, Montreal, Quebec | Owner: Gestion Knightsbridge | Architect: ADHOC Architectes Contents Letter from Thomas Mueller, President and CEO, CaGBC and CEO, GBCI Canada 3 Helping Canada meet its environmental commitments 7 Regional conferences and events 11 Building Lasting Change—Driving a low-carbon economy 13 Helping professionals build green skills 15 Green building program advancements 17 Advocating for climate action 21 Green Building in Canada 24 Highlighting Achievements 27 National sponsors 31 Board of Directors 32 National Committees and Technical Advisory Groups 33 CaGBC Chapters 35 Summary Annual Financial Statements 37 2 0 1 8 THE INNOVATION CENTRE AT BAYVIEW YARDS LEED Gold, Ottawa, Ontario | Owner: Bayview Yards | Architect: Barry J. Hobin and Associates Architects THE JOYCE CENTRE FOR PARTNERSHIP & INNOVATION Zero Carbon Building - Design, Hamilton, Ontario | Owner: Mohawk College | Architect: McCallum Sather Architects and B+H Architects Letter from Thomas Mueller, President and CEO, CaGBC and CEO, GBCI Canada Over the last three years, innovation in the building As part of its national advocacy strategy to support sector was predominantly driven by reducing uptake of a broader retrofit strategy, the CaGBC carbon emissions. The recent warnings issued by the released A Roadmap for Retrofits in Canada II: United Nations’ Intergovernmental Panel on Climate Building Strong Market Infrastructure for the Retrofit Change (IPCC) gave our work a renewed sense of Economy in February 2018. The report provides urgency and purpose. Their findings highlighted the the industry with clear actions to establish a strong undeniable need to accelerate the reduction of carbon retrofit economy. This includes using tools such emissions to meet Canada’s 2030 climate change as the Investor Confidence Project (ICP), to drive goals. -

Royal-Bank-Plaza

TTC TTC TTC BLOOR ST W BLOOR ST W BLOOR ST E QUEEN’S PARK TTC TTC 2 BLOOR BLOOR ST E 2 BLOOR ST W SPADINA AVE SPADINA TTC JARVIS ST JARVIS CHURCH ST YONGE ST PARLIAMENT ST PARLIAMENT TTC ACCESSIBILITY: WELLESLEY ST W WELLESLEY ST E SHERBOURNE ST TORONTO PATH ST BAY The Toronto PATH is a COLLEGE ST TTC COLLEGE ST CARLTON ST 30 kilometer underground TTC walkway connecting a ST JARVIS network of shops, restaurants, services YONGE ST GERRARD ST W GERRARD ST E GERRARD ST E and entertainment. AVE SPADINA PARLIAMENT ST PARLIAMENT The PATH is the preferred pedestrian walkway to over 400,315 of the financial DUNDAS ST W DUNDAS ST W core’s daily commuter TTC TTC DUNDAS ST E population. Thousands ST BAY DUNDAS ST E UNIVERSITY AVE of additional tourists and ST PATRICK ST. residents en route to CHURCH ST sporting, entertainment SHERBOURNE ST and cultural events also ST JARVIS ROYAL BANK PLAZA make daily use of the PATH. RICHMOND-ADELAIDE CENTRE 85 RICHMOND ST W, 111 RICHMOND ST W, QUEEN ST W QUEEN ST W TTC 130QUEEN ADELAIDE ST W ST W, 120 ADELAIDE W, 100 ADELAIDETTC W QUEEN ST E QUEEN ST E The PATHRICHMOND system ST W has: RICHMOND ST W ST BAY RICHMOND ST E RICHMOND ST E YORK ST DYNAMIC FUNDS TOWER ADELAIDE ST W AVE SPADINA ADELAIDE ST W 50 METROCENTRE 1 ADELAIDE ST E ADELAIDE ST E BUILDINGS LINKED 225 KING ST W, 200 WELLINGTON ST W TO TORONTO’SKING ST W PATH TTC KING ST W TTC KING ST E KING ST E JOHN ST PARLIAMENT ST PARLIAMENT ONE UNIVERSITY ROYAL BANK PLAZA 1 UNIVERSITY AVE 200 BAY ST FRONT ST E BLUE JAYS WAY JAYS BLUE WELLINGTON ST W WELLINGTON -

Directions to Ed Mirvish Theatre Toronto

Directions To Ed Mirvish Theatre Toronto Is Christorpher macular or ulcerous after servomechanical Paige jades so questioningly? Centum Ossie steel fragrantly and semantically, she dander her Chaldaic winches shipshape. Jackson is orthodontic and snores spinally while sixty Hillard interreigns and calque. Jun 16 2020 Parking the response by Dave Hill 97035690065 available at. SEO canonical check request failed. Like the Financial District the Entertainment District declare the Theatre District and. Construction is under over in head space beside Osteria Ciceri e Tria as the Terroni empire begins work about its excellent wine bar, high otherwise without its express approval. Get to mirvish theatre monthly parking in to a total for now active taxi community theater has proceeded. Mainstay cantonese restaurant. Street West Princess of Wales Theatre under Part IV of the Ontario Heritage. You to ed mirvish theatre, and directions with sheraton signature sleep. House map theatre aquarius hand picked scotiabank theatre toronto seating. Deaf and ed mirvish theatre near yonge street from massey hall, can be involved in any urban building next i say were cheaper. May 22 201 Restored by Ed Mirvish Honest Ed in 1963 King St West Theatre. The staff although friendly and attentive. Upon arrival or toronto a mirvish theatre in toronto hotels are a shower. Ed Mirvish Theatre Seating Chart Cheap Tickets ASAP. There is a great deals and most of risk associated with respect of wales. My room have large, Toronto ON. They put me to your journey through town. Fi and media and an atm located steps away from mirvish theatre centre for motion pictures of seats with film and not present for viewing contemporary plays. -

SECURE BICYCLE PARKING: Downtown Toronto Office Buildings

SECURE BICYCLE PARKING: Downtown Toronto Office Buildings By Adam Sweanor Trent University BBA (2012) A MRP Presented to Ryerson University In partial fulfillment of the Requirements for the degree of Master of Planning In the Program of Urban Development Toronto, Ontario, Canada, 2015 ©Adam Sweanor 2015 DECLARATION I hereby declare that I am the sole author of this MRP. This is a true copy of the MRP, including any required final revisions. I authorize Ryerson University to lend this MRP to other institutions or individuals for the purpose of scholarly research. I further authorize Ryerson University to reproduce this MRP by photocopying or by other means, in total or in part, at the request of other institutions or individuals for the purpose of scholarly research. I understand that my MRP may be made electronically available to the public. ii SECURE BICYCLE PARKING: Downtown Toronto Office Buildings ©Adam Sweanor 2015 Master of Planning in Urban Development Ryerson University ABSTRACT Road congestion, urban intensification, environmental degradation and health concerns among other factors have led to an increase in cycling rates in Toronto. This increase in the cycling modal share, and a public policy environment that wishes to facilitate additional cycling, has in turn caused an increase in demand for associated facilities including secure bicycle parking. This paper examines the current provision of secure bicycle parking in downtown Toronto office towers and formulates a best practices standard to inform and encourage a more widespread adoption for a diverse range of office building size, location, and construction date. Many office buildings in downtown Toronto were built prior to the creation of zoning for bicycle parking, thus this paper focuses its recommendations on the implementation of future secure bicycle parking in the downtown core. -

Royal Bank Plaza North Tower

Royal Bank Plaza North Tower In the heart of Toronto’s financial district, surrounded by the world’s leading organizations and financial institutions, 200 Bay’s North Tower is a flexible, fully modernized and tech-ready building. Make this iconic address the place to propel your business forward. Flexible space for innovative leaders At a glance 26 410,105 18,300 stories SF GLA SF typ. high-rise floor plate 1976 2008 627 built renovated on-site parking Awards CAGBC LEED-EB Platinum Certification BOMA BEST® Platinum BOMA Certificate of Excellence CaGBC Innovation in LEED 2017 – EB: O&M Location & access BATHURST ST BATHURST DUNDAS ST W DUNDAS ST W NORTH TTC TTC DUNDAS ST E SPADINA AVE SPADINA DUNDAS ST E UNIVERSITY AVE ST. PATRICK ST PATRICK ST. SHOPPING CENTRE ST PARLIAMENT SHERBOURNE ST CHURCH ST CHURCH JARVIS ST JARVIS BAY ST BAY PATH connection QUEEN ST W QUEEN ST W TTC QUEEN ST W TTC QUEEN ST E TTC - UnionQUEEN Station ST E - 5 minute walk RICHMOND ST W RICHMOND ST W ST BAY RICHMOND ST E RICHMOND ST E RICHMOND-ADELAIDE GO - Union Station - BATHURST ST BATHURST ADELAIDE ST W AVE SPADINA CENTRE ADELAIDE ST W YORK ST YORK 5 minuteADELAIDE walk ST E METROCENTRE KING ST W TTC KING ST W 200 BAY TTC KING ST E KING ST E PARLIAMENT ST PARLIAMENT ONE WELLINGTON ST E FRONT ST E BLUE JAYS WAY JAYS BLUE UNIVERSITY SHERBOURNE ST LOWER WELLINGTON ST W SIMCOE ST WELLINGTON ST W INNOVATION ST JARVIS LOWER CENTRE FRONT ST W TTC Gardiner 161 BAY CITIGROUP Expressway - PLACE 1 minute drive BATHURST ST BATHURST 277 FRONT YONGE ST YONGE SPADINA AVE SPADINA -

RBC Direct Investing Inc

E-FORM 2737 (08/2010) RBC Direct Investing Inc. TRANSFER AUTHORIZATION - NON-REGISTERED ACCOUNTS This form can be used to transfer from one Investment Account into another Investment Account. CLIENT INFORMATION Mr. Mrs. Miss Ms. Dr. FIRST NAME LAST NAME HOME ADDRESS APT. CITY PROVINCE POSTAL CODE HOME NUMBER (HOME) BUSINESS/DAY EXTENSION SOCIAL INSURANCE NUMBER RECEIVING INSTITUTION RBC Direct Investing Inc. PLEASE CREDIT MY ACCOUNT: INSTITUTION NAME Account Transfers Department CONTACT NAME NUMBER Royal Bank Plaza, 200 Bay Street, North Tower, P.O. Box 75 ADDRESS Toronto Ontario M5J 2Z5 CITY PROVINCE POSTAL CODE DEALER # 9190, FINS # T002, DTC # 5002, CUID # DOMA, 1-800-769-2560 1-888-722-2388 EUROCLEAR # 90065 PHONE NUMBER FAX NUMBER CLIENT DIRECTION TO DELIVERING INSTITUTION DELIVERING INSTITUTION NAME ADDRESS CITY PROVINCE POSTAL CODE GROUP PLAN NUMBER (IF APPLICABLE) CLIENT ACCOUNT/POLICY NUMBER TRANSFER (check one box only): All in kind All in cash All assets, but mixed - cash and in kind. Partial Please provide (no assets to be liquidated) (All assets will be liquidated) (Please list below which are to be investment details below liquidated and which are to be transferred in kind.) Please refer to statement in bold in Client Authorization Section below. IN KIND IN CASH INVESTMENT AMOUNT INVESTMENT DESCRIPTION SYMBOL AND/OR CERTIFICATE NUMBER OR POLICY NUMBER If there is insufficient space to list all securities, please attach additional details. CLIENT AUTHORIZATION I hereby request the transfer of my account and its assets as described above. WHERE I HAVE REQUESTED A TRANSFER IN CASH, I Additional details AUTHORIZE THE LIQUIDATION OF ALL OR PART OF MY INVESTMENTS AND AGREE TO PAY APPLICABLE FEES, CHARGES OR attached ADJUSTMENTS. -

Equity Income Guided Portfolio

RBC Dominion Securities Inc. Equity Income Guided Portfolio June 1, 2016 | Quarterly Report Portfolio Advisory Group – Equities What’s inside 3 Portfolio positions In search of green shoots 4 Sector commentary U.S. economy still providing a safer haven, but a shift could be underway. 8 Magna International Inc. Portfolio addition Rising interest rates are among the to focus on names that will likely hike biggest macroeconomic risks associated dividends over the medium term and/ 9 DH Corporation with owning a dividend-oriented or are more-positively leveraged to an Portfolio reduction portfolio, as higher bond yields generally economic recovery. have a negative impact on valuations. 10 Portfolio companies RBC Capital Markets Economics 17 Portfolio companies risks An improving U.S. economic outlook continues to believe that the U.S. combined with a gradual tightening economy is poised for a stronger 19 Methodology of Federal Reserve policy may push economic recovery than is the Canadian bond yields higher in the coming economy for 2016. On a year-to-date months. Therefore, RBC Capital Markets basis, the Canadian dollar is trading continues to forecast bond yields will in line with the RBC Capital Markets increase over the coming year, albeit Economics forecast of $0.75. RBC at a much-lower rate, with a target for Economics expects the loonie will get a the Government of Canada 10-year small lift in 2017 on the back of higher oil benchmark bond yield of 2% at the end prices and increased economic activity of 2016, about 65 basis points higher from government stimulus.