Equity Income Guided Portfolio

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

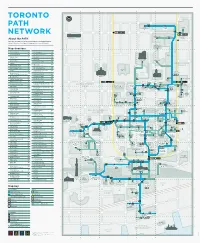

PATH Underground Walkway

PATH Marker Signs ranging from Index T V free-standing outdoor A I The Fairmont Royal York Hotel VIA Rail Canada H-19 pylons to door decals Adelaide Place G-12 InterContinental Toronto Centre H-18 Victory Building (80 Richmond 1 Adelaide East N-12 Hotel D-19 The Hudson’s Bay Company L-10 St. West) I-10 identify entrances 11 Adelaide West L-12 The Lanes I-11 W to the walkway. 105 Adelaide West I-13 K The Ritz-Carlton Hotel C-16 WaterPark Place J-22 130 Adelaide West H-12 1 King West M-15 Thomson Building J-10 95 Wellington West H-16 Air Canada Centre J-20 4 King West M-14 Toronto Coach Terminal J-5 100 Wellington West (Canadian In many elevators there is Allen Lambert Galleria 11 King West M-15 Toronto-Dominion Bank Pavilion Pacific Tower) H-16 a small PATH logo (Brookfield Place) L-17 130 King West H-14 J-14 200 Wellington West C-16 Atrium on Bay L-5 145 King West F-14 Toronto-Dominion Bank Tower mounted beside the Aura M-2 200 King West E-14 I-16 Y button for the floor 225 King West C-14 Toronto-Dominion Centre J-15 Yonge-Dundas Square N-6 B King Subway Station N-14 TD Canada Trust Tower K-18 Yonge Richmond Centre N-10 leading to the walkway. Bank of Nova Scotia K-13 TD North Tower I-14 100 Yonge M-13 Bay Adelaide Centre K-12 L TD South Tower I-16 104 Yonge M-13 Bay East Teamway K-19 25 Lower Simcoe E-20 TD West Tower (100 Wellington 110 Yonge M-12 Next Destination 10-20 Bay J-22 West) H-16 444 Yonge M-2 PATH directional signs tell 220 Bay J-16 M 25 York H-19 390 Bay (Munich Re Centre) Maple Leaf Square H-20 U 150 York G-12 you which building you’re You are in: J-10 MetroCentre B-14 Union Station J-18 York Centre (16 York St.) G-20 in and the next building Hudson’s Bay Company 777 Bay K-1 Metro Hall B-15 Union Subway Station J-18 York East Teamway H-19 Bay Wellington Tower K-16 Metro Toronto Convention Centre you’ll be entering. -

PATH Network

A B C D E F G Ryerson TORONTO University 1 1 PATH Toronto Atrium 10 Dundas Coach Terminal on Bay East DUNDAS ST W St Patrick DUNDAS ST W NETWORK Dundas Ted Rogers School One Dundas Art Gallery of Ontario of Management West Yonge-Dundas About the PATH Square 2 2 Welcome to the PATH — Toronto’s Downtown Underground Pedestrian Walkway UNIVERSITY AVE linking 30 kilometres of underground shopping, services and entertainment ST PATRICK ST BEVERLEY ST BEVERLEY ST M M c c CAUL ST CAUL ST Toronto Marriott Downtown Eaton VICTORIA ST Centre YONGE ST BAY ST Map directory BAY ST A 11 Adelaide West F6 One King West G7 130 Adelaide West D5 One Queen Street East G4 Eaton Tower Adelaide Place C5 One York D11 150 York St P PwC Tower D10 3 Toronto 3 Atrium on Bay F1 City Hall 483 Bay Street Q 2 Queen Street East G4 B 222 Bay E7 R RBC Centre B8 DOWNTOWN Bay Adelaide Centre F5 155 Wellington St W YONGE Bay Wellington Tower F8 RBC WaterPark Place E11 Osgoode UNIVERSITY AVE 483 Bay Richmond-Adelaide Centre D5 UNIVERSITY AVE Hall F3 BAY ST 120 Adelaide St W BAY ST CF Toronto Bremner Tower / C10 Nathan Eaton Centre Southcore Financial Centre (SFC) 85 Richmond West E5 Phillips Canada Life Square Brookfield Place F8 111 Richmond West D5 Building 4 Old City Hall 4 2 Queen Street East C Cadillac Fairview Tower F4 Roy Thomson Hall B7 Cadillac Fairview Royal Bank Building F6 Tower CBC Broadcast Centre A8 QUEEN ST W Osgoode QUEEN ST W Thomson Queen Building Simpson Tower CF Toronto Eaton Centre F4 Royal Bank Plaza North Tower E8 QUEEN STREET One Queen 200 Bay St Four -

Chapter 11 ) LAKELAND TOURS, LLC, Et Al.,1 ) Case No

20-11647-jlg Doc 205 Filed 09/30/20 Entered 09/30/20 13:16:46 Main Document Pg 1 of 105 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ) In re: ) Chapter 11 ) LAKELAND TOURS, LLC, et al.,1 ) Case No. 20-11647 (JLG) ) Debtors. ) Jointly Administered ) AFFIDAVIT OF SERVICE I, Julian A. Del Toro, depose and say that I am employed by Stretto, the claims and noticing agent for the Debtors in the above-captioned case. On September 25, 2020, at my direction and under my supervision, employees of Stretto caused the following document to be served via first-class mail on the service list attached hereto as Exhibit A, via electronic mail on the service list attached hereto as Exhibit B, and on three (3) confidential parties not listed herein: Notice of Filing Third Amended Plan Supplement (Docket No. 200) Notice of (I) Entry of Order (I) Approving the Disclosure Statement for and Confirming the Joint Prepackaged Chapter 11 Plan of Reorganization of Lakeland Tours, LLC and Its Debtor Affiliates and (II) Occurrence of the Effective Date to All (Docket No. 201) [THIS SPACE INTENTIONALLY LEFT BLANK] ________________________________________ 1 A complete list of each of the Debtors in these chapter 11 cases may be obtained on the website of the Debtors’ proposed claims and noticing agent at https://cases.stretto.com/WorldStrides. The location of the Debtors’ service address in these chapter 11 cases is: 49 West 45th Street, New York, NY 10036. 20-11647-jlg Doc 205 Filed 09/30/20 Entered 09/30/20 13:16:46 Main Document Pg 2 of 105 20-11647-jlg Doc 205 Filed 09/30/20 Entered 09/30/20 13:16:46 Main Document Pg 3 of 105 Exhibit A 20-11647-jlg Doc 205 Filed 09/30/20 Entered 09/30/20 13:16:46 Main Document Pg 4 of 105 Exhibit A Served via First-Class Mail Name Attention Address 1 Address 2 Address 3 City State Zip Country Aaron Joseph Borenstein Trust Address Redacted Attn: Benjamin Mintz & Peta Gordon & Lucas B. -

Linde Equity Research TSX Performance Review

Linde Equity Research TSX Performance Review 2008 Q2: TSX has strong second quarter thanks to Energy, Materials Canadian market among best performers in the world in Q2 2008 Q2 Sector Returns Energy 24.21% Materials 17 . 16 % S&P/TSX Composite 8.37% Utilities 4.59% Industrials 3.42% Information Technology 2.04% Telecommunications Services 1. 3 1% Consumer Staples 0.17% -5.20% Financials -7.63% Health Care - 11. 4 5 % Consumer Discretionary -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% • TSX 60 (large cap) stocks continued to 2008 Index Returns Q2 YTD outperform the broader market, a trend which S&P/TSX Composite 8.37% 4.58% began in Q2 2007. • The Canadian market again outperformed the US S&P/TSX 60 (Large Cap) 10.18% 6.76% market (S&P 500) in Q2. The S&P/TSX S&P/TSX Mid Cap 2.53% -2.32% Composite returned 8.4% versus -3.2% for the S&P/TSX Small Cap 2.85% -2.22% S&P 500 (-3.9% in Canadian dollar terms). • The dramatic spike in oil prices to around $140 per barrel by quarter-end drove strong Q2 Biggest Contributors Q2 Biggest Detractors performance in energy stocks throughout the Potash Corporation Manulife Financial world. The large weighting of Energy stocks in the Canadian market was the primary reason for Cdn Natural Resources CIBC Canada’s strong relative performance. EnCana Sun Life Financial • Materials stocks were also a strong driver of Suncor Energy Centerra Gold performance. The Canadian Materials sector performed better than comparable sectors in Husky Energy Royal Bank of Canada other countries due its higher exposure to Agrium Magna International fertilizer and gold stocks. -

Enwave's District Cooling Service

ENWAVE’S DISTRICT COOLING SERVICE Enwave has been in the outsourced air conditioning business since 1997. District cooling was a natural extension of the company’s core steam distribution business as the same customers that required heating, also required air conditioning. While Enwave’s foray into the air conditioning business had always been premised on using natural cooling from the depths of Lake Ontario, the early stages of the business made use of conventional technology. With two 1,500-ton absorption chillers at its newly constructed Chilled Water Plant, Enwave began supplying the expanded Metro Toronto Convention Center (MTCC) with 2600 tons of cooling in 1997. In 1999, plant capacity was expanded to 7700 tons with the addition of a 4,700-ton steam-driven centrifugal chiller as the customer base expanded to include the Air Canada Centre, the Steam Whistle Brewery and the telecommunications centre at 151 Front Street West, which was signed in 2000. With the commissioning of the company’s signature Deep Lake Water Cooling project (DLWC), the chillers were retained for emergency backup and peak shaving on the hottest days of the year. However, the primary source of cooling would now be the cold water of Lake Ontario. To date, over $110 million has been expended to bring in colder, cleaner drinking water for the City of Toronto and environmentally friendly cooling for downtown buildings. An additional $80 million will be spent by the time the system is fully built-out. The Deep Lake Water Cooling (DLWC) system is a sustainable energy project, which replaces conventional air conditioning. -

Sun Life Guaranteed Investment Funds (Gifs)

Sun Life Guaranteed Investment Funds (GIFs) ANNUAL FINANCIAL STATEMENTS SUN LIFE ASSURANCE COMPANY OF CANADA December 31, 2015 Life’s brighter under the sun Sun Life Assurance Company of Canada is a member of the Sun Life Financial group of companies. © Sun Life Assurance Company of Canada, 2016. 36D-0092-02-16 Table of Contents Independent Auditors' Report 3 Sun MFS Dividend Income 196 Sun Beutel Goodman Canadian Bond 5 Sun MFS Global Growth 200 Sun BlackRock Canadian Balanced 10 Sun MFS Global Total Return 204 Sun BlackRock Canadian Composite Equity 15 Sun MFS Global Value 209 Sun BlackRock Canadian Equity 20 Sun MFS Global Value Bundle 214 Sun BlackRock Canadian Equity Bundle 25 Sun MFS International Growth 218 Sun BlackRock Cdn Composite Eq Bundle 29 Sun MFS International Growth Bundle 222 Sun BlackRock Cdn Universe Bond 33 Sun MFS International Value 226 Sun Canadian Balanced Bundle 38 Sun MFS International Value Bundle 230 Sun CI Cambridge Canadian Equity 42 Sun MFS Monthly Income 234 Sun CI Cambridge Cdn Asset Allocation 46 Sun MFS US Equity 238 Sun CI Cambridge Global Equity 50 Sun MFS US Equity Bundle 242 Sun CI Cambridge/MFS Canadian Bundle 54 Sun MFS US Growth 246 Sun CI Cambridge/MFS Global Bundle 58 Sun MFS US Value 250 Sun CI Signature Diversified Yield II 62 Sun MFS US Value Bundle 255 Sun CI Signature High Income 66 Sun Money Market 259 Sun CI Signature Income & Growth 70 Sun NWQ Flexible Income 264 Sun Daily Interest 74 Sun PH&N Short Term Bond and Mortgage 268 Sun Dollar Cost Average Daily Interest 78 Sun RBC Global High -

Magna Steyr India (Pvt)

CANADA SPECIAL COMPANY PROFILE Company: Company: MAGNA STEYR India (Pvt) Ltd OpenText Areas of Operation: Areas of Operation: Full vehicle development, Enterprise content manage- from sports cars to off-road ment, from document creation vehicles, flexible assembly to presentation to publishing. of vehicles, fuel tank compo- SOURCE: WWW.OPENTEXT.COM 5 nents, modules and complete 6 fuel systems, among others. SOURCE: WWW.MAGNASTEYR.COM hether you n these times of information explosion, it is said that drive a Porsche, content is king. In the world of enterprise content manage- WMercedes, Audi, Iment (ECM), OpenText is no less than king. or any other vehicle, In this age of all-digital and increasingly all-online content, you can be sure that everything must be sorted, grouped, tagged and stored for Magna Styer has online access, sharing, integration and broadcast—all these played an important are what OpenText does, and so much more. part in ensuring Set up in 1991 in Waterloo in southern Ontario, Canada, your drive is smooth. OpenText has become a global leader in ECM, helping organ- There isn’t an auto- isations in 114 countries manage their business content. Last mobile company, year, it earned a little less than a billion dollars in revenue. anywhere in the Through nearly 4450 employees, the company captures and world, that doesn’t preserves corporate memory, increases brand equity, auto- use parts, systems and mates processes, mitigates risk, manages compliance and assemblies designed, improves competitiveness. manufactured and inte- Its flagship product OpenText ECM has committed users grated by Magna Steyr. Its list across the globe, from car manufacturers to banks to the of customers is the virtual who’s media to real estate giants to law firms. -

How to Make a Complaint 2 How to Make a Complaint

How to make a complaint 2 How to make a complaint Contents We value your opinion 3 RBC business groups 4 If you have a complaint or encounter a problem 5 Step 1: Start at the source 5 Step 2: Escalate the complaint 6 Step 3: Write to the RBC Office of the Ombudsman 7 Regulatory bodies and other resources 11 Financial Consumer Agency of Canada 11 Voluntary codes and public commitments 12 Autorité des marchés financiers 12 Investment Industry Regulatory 13 Organization of Canada Mutual Fund Dealers Association of Canada 14 How to make a complaint 3 We value your opinion We all stand to gain from open communication. Whether it’s used to answer a question, solve a problem or share a success, communication is the key. While we welcome all positive comments you may have, it is equally important for us to know when you have a problem so that we can resolve it and retain your confidence. At the same time, we use your feedback to continually improve the quality of products and services we provide to you and other clients. There are a variety of ways you can express your concerns or provide positive feedback about your experiences with RBC® companies. We encourage you to get in touch with us, either in person or by telephone, email, mail or fax. 4 How to make a complaint RBC business groups ¡ RBC Royal Bank® and RBC Global Private Banking® are trademarks of Royal Bank of Canada. RBC Royal Bank includes all branches and our Business Banking Centres. -

International Corporate Investment in Ohio Operations June 2020

Research Office A State Affiliate of the U.S. Census Bureau International Corporate Investment in Ohio Operations 20 September 2007 June 20 June 2020 Table of Contents Introduction and Explanations Section 1: Maps Section 2: Alphabetical Listing by Company Name Section 3: Companies Listed by Country of Ultimate Parent Section 4: Companies Listed by County Location International Corporate Investment in Ohio Operations June 2020 THE DIRECTORY OF INTERNATIONAL CORPORATE INVESTMENT IN OHIO OPERATIONS is a listing of international enterprises that have an investment or managerial interest within the State of Ohio. The report contains graphical summaries of international firms in Ohio and alphabetical company listings sorted into three categories: company name, country of ultimate parent, and county location. The enterprises listed in this directory have 5 or more employees at individual locations. This directory was created based on information obtained from Dun & Bradstreet. This information was crosschecked against company Websites and online corporate directories such as ReferenceUSA®. There is no mandatory state filing of international status. When using this directory, it is important to recognize that global trade and commerce are dynamic and in constant flux. The ownership and location of the companies listed is subject to change. Employment counts may differ from totals published by other sources due to aggregation, definition, and time periods. Research Office Ohio Development Services Agency P.O. Box 1001, Columbus, Ohio 43266-1001 Telephone: (614) 466-2116 http://development.ohio.gov/reports/reports_research.htm International Investment in Ohio - This survey identifies 4,303 international establishments employing 269,488 people. - Companies from 50 countries were identified as having investments in Ohio. -

UPDATE REPORT As of December 31, 2013

UPDATE REPORT As of December 31, 2013 Portfolio vs. Benchmark Returns* 18.00% 14.00% 10.00% 6.00% Portfolio 2.00% TSX(TRI) -2.00% Sep Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 -6.00% 2010 2011 2012 2013 -10.00% -14.00% * Performance is shown gross of all fees. Performance data is historical and is not indicative of future performance. Returns are annualized for periods > 1 year. This document is for information purposes only. Top 10 Holdings % Portfolio Performance* 1 Methanex Corp. 4.55% Since 2 Valeant Pharmaceuticals 4.34% 1 Month 3 Month 2013 2 Year Inception 3 Magna International Inc. 3.88% Portfolio 1.6% 8.6% 29.0% 18.3% 13.9% 4 Transcontinental Inc. 3.26% TSX(TRI) 2.0% 7.3% 13.0% 10.1% 7.2% 5 Constellation Software 3.21% Over/Under Performance -0.4% 1.3% 16.0% 8.2% 6.7% 6 Linamar Corp. 3.13% 7 Stantec Inc. 3.06% 8 Element Financial Corp 2.96% # of Stocks in Portfolio 75 9 Air Canada 2.86% 10 Sierra Wireless, Inc. 2.63% Market Capitalization % Portfolio Total: 33.87% Large Cap (>2 Billion) 68.62% Style Models - Last Quarter's Performance Mid Cap (>= 1 Billion and <= 2 Billion) 16.20% Small Cap (<1 Billion) 14.94% Style Weight Style Model Performance Rank Selected (Out of 6) Portfolio Characteristics Portfolio SP/TSX AGGCON 11.51% 7 1 Price / Earnings on Trailing EPS 16.79 16.59 AGGCON100 12.09% 6 Current Price / Book Ratio 2.39 1.94 INCOME 5.53% 10 Price / Latest Cash Flow 8.20 8.21 GROWTH 15.56% 2 1 Reinvestment Rate on Current Year Median 13.67 7.37 GIV 6.62% 8 1 1 Year Price Alpha vs. -

Cagbc 2018AR WEB.Pdf

2 0 1 8 LA GÉODE LEED Platinum, Montreal, Quebec | Owner: Gestion Knightsbridge | Architect: ADHOC Architectes Contents Letter from Thomas Mueller, President and CEO, CaGBC and CEO, GBCI Canada 3 Helping Canada meet its environmental commitments 7 Regional conferences and events 11 Building Lasting Change—Driving a low-carbon economy 13 Helping professionals build green skills 15 Green building program advancements 17 Advocating for climate action 21 Green Building in Canada 24 Highlighting Achievements 27 National sponsors 31 Board of Directors 32 National Committees and Technical Advisory Groups 33 CaGBC Chapters 35 Summary Annual Financial Statements 37 2 0 1 8 THE INNOVATION CENTRE AT BAYVIEW YARDS LEED Gold, Ottawa, Ontario | Owner: Bayview Yards | Architect: Barry J. Hobin and Associates Architects THE JOYCE CENTRE FOR PARTNERSHIP & INNOVATION Zero Carbon Building - Design, Hamilton, Ontario | Owner: Mohawk College | Architect: McCallum Sather Architects and B+H Architects Letter from Thomas Mueller, President and CEO, CaGBC and CEO, GBCI Canada Over the last three years, innovation in the building As part of its national advocacy strategy to support sector was predominantly driven by reducing uptake of a broader retrofit strategy, the CaGBC carbon emissions. The recent warnings issued by the released A Roadmap for Retrofits in Canada II: United Nations’ Intergovernmental Panel on Climate Building Strong Market Infrastructure for the Retrofit Change (IPCC) gave our work a renewed sense of Economy in February 2018. The report provides urgency and purpose. Their findings highlighted the the industry with clear actions to establish a strong undeniable need to accelerate the reduction of carbon retrofit economy. This includes using tools such emissions to meet Canada’s 2030 climate change as the Investor Confidence Project (ICP), to drive goals. -

Royal-Bank-Plaza

TTC TTC TTC BLOOR ST W BLOOR ST W BLOOR ST E QUEEN’S PARK TTC TTC 2 BLOOR BLOOR ST E 2 BLOOR ST W SPADINA AVE SPADINA TTC JARVIS ST JARVIS CHURCH ST YONGE ST PARLIAMENT ST PARLIAMENT TTC ACCESSIBILITY: WELLESLEY ST W WELLESLEY ST E SHERBOURNE ST TORONTO PATH ST BAY The Toronto PATH is a COLLEGE ST TTC COLLEGE ST CARLTON ST 30 kilometer underground TTC walkway connecting a ST JARVIS network of shops, restaurants, services YONGE ST GERRARD ST W GERRARD ST E GERRARD ST E and entertainment. AVE SPADINA PARLIAMENT ST PARLIAMENT The PATH is the preferred pedestrian walkway to over 400,315 of the financial DUNDAS ST W DUNDAS ST W core’s daily commuter TTC TTC DUNDAS ST E population. Thousands ST BAY DUNDAS ST E UNIVERSITY AVE of additional tourists and ST PATRICK ST. residents en route to CHURCH ST sporting, entertainment SHERBOURNE ST and cultural events also ST JARVIS ROYAL BANK PLAZA make daily use of the PATH. RICHMOND-ADELAIDE CENTRE 85 RICHMOND ST W, 111 RICHMOND ST W, QUEEN ST W QUEEN ST W TTC 130QUEEN ADELAIDE ST W ST W, 120 ADELAIDE W, 100 ADELAIDETTC W QUEEN ST E QUEEN ST E The PATHRICHMOND system ST W has: RICHMOND ST W ST BAY RICHMOND ST E RICHMOND ST E YORK ST DYNAMIC FUNDS TOWER ADELAIDE ST W AVE SPADINA ADELAIDE ST W 50 METROCENTRE 1 ADELAIDE ST E ADELAIDE ST E BUILDINGS LINKED 225 KING ST W, 200 WELLINGTON ST W TO TORONTO’SKING ST W PATH TTC KING ST W TTC KING ST E KING ST E JOHN ST PARLIAMENT ST PARLIAMENT ONE UNIVERSITY ROYAL BANK PLAZA 1 UNIVERSITY AVE 200 BAY ST FRONT ST E BLUE JAYS WAY JAYS BLUE WELLINGTON ST W WELLINGTON