FY20 Interim Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2015 Annual Results 19 August 2015 Agenda

2015 Annual Results 19 August 2015 Agenda • Merger update and strategic focus Angus McNaughton • Financial results Richard Jamieson Angus McNaughton Richard Jamieson • Portfolio performance Chief Executive Officer CFO and EGM Investments Stuart Macrae • Development update Jonathan Timms • FY16 focus and guidance Stuart Macrae Jonathan Timms Angus McNaughton EGM Leasing EGM Development 2 Merger update and strategic focus Angus McNaughton Cranbourne Park, VIC Merger benefits on track with a strong platform for growth • Strategic focus remains unchanged • Operational cost synergies on track • Over 60% of operational cost savings1 already locked in • Merger financing savings achieved1 with over $100m lower cost • Weighted average cost of debt reduced to 4.2% • Integration is on program • Key operational teams finalised and team co-locations underway • Solid FY15 performance • Statutory net profit of $675.1m • Underlying earnings up 6.2%2 • Development pipeline increased to $3.1b and current projects on or ahead of plan The Myer Centre Brisbane, QLD 1. On a run-rate or annualised basis. 2. On an aggregate basis. 4 Strategic focus remains unchanged Retail real estate • We will own, manage and develop Australian retail assets across the spectrum • Portfolio composition will evolve as developments occur and asset recycling continues Operational excellence • High performance intensive asset management approach • Continuous improvement of systems and processes • Strongly committed to responsible investment and sustainability • Development of a fully -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

SWP Melbourne Three Page Capability Statement

BUILDING CODE CONSULTANTS BUILDING SURVEYORS & CERTIFIERS SYDNEY • MELBOURNE • BRISBANE Experts in Performance and Prescriptive Approaches to BCA Compliance MELBOURNE Steve Watson & Partners Building Approvals Services Steve Watson & Partners provide professional building code consulting and approvals services, adding value through our timely pro-active approach to the auditing of concept and design details, and by minimising construction and defect risks via a rigorous inspection and review process. Our Team Building Regulations Consultants - Accredited Certifiers Bringing a wealth of experience to any compliance issue, our team includes over 35 staff in Qld, NSW and Victoria with expertise in Building Approvals, the Building Code of Australia, Fire-safety Engineering, Energy Efficiency and Access consulting. As integral members of the construction team, we measure our success in terms of your project’s success. Our Key Strengths › Special expertise in both performance and prescriptive approaches to BCA compliance › Motivated, professional staff who understand client requirements and can communicate options and outcomes effectively › Rigorous Quality Assurance procedures, affording the maximum possible protection against the risk of design and construction errors › A reputation for integrity with Councils and the Fire Brigade, facilitating efficient and clear communications with these authorities What Sets Us Apart › Early involvement in projects means that our skills and knowledge can guide your key project decisions, saving time and -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

Melbourne Retail Guide

MELBOURNE Cushman & Wakefield Global Cities Retail Guide Cushman & Wakefield | Melbourne | 2018 0 Melbourne is Victoria's capital city and the business, administrative, cultural and recreational hub of the state. With a combination of world-class dining, art galleries, homegrown fashion and a packed sports calendar, Melbourne is regarded as one of the world’s most liveable city. Melbourne’s retail and hospitality sectors are booming, creating jobs, economic growth and a buzzing international city. Melbourne’s CBD is home to more than 19,000 businesses and caters for 854,000 people on a typical weekday. Melbourne is the centre of the Australian retail industry – an exciting mix of international designer brands, flagship stores, local fashion retailers and world class department stores including Australia’s first Debenhams department store. The city has a reputation for style and elegance while at the same time being fashion forward. Melbourne offers a range of retail locations to suit a variety of stores – with flourishing inner city shopping strips and larger suburban shopping complexes, accounting for 16% of all major shopping centres in Australia. Melbourne's CBD has evolved as the pre- eminent shopping area in Australia and a destination for global brands. The city centre has a wide variety of modern retail complexes housing local and international retailers, historic arcades, bustling laneways, a luxury MELBOURNE precinct and heritage-listed markets. The City of Melbourne municipality covers 37.7 sqkm. It is OVERVIEW made up of the city centre and a number of inner suburbs, each with its own distinctive character and with different businesses, dwellings and communities living and working there. -

Government Gazette of the STATE of NEW SOUTH WALES Number 160 Wednesday, 24 December 2008 Published Under Authority by Government Advertising LEGISLATION Orders

12957 Government Gazette OF THE STATE OF NEW SOUTH WALES Number 160 Wednesday, 24 December 2008 Published under authority by Government Advertising LEGISLATION Orders New South Wales Transport Administration (Sydney Ferries—Fares) Amendment Order 2008 under the Transport Administration Act 1988 I, Rear Admiral Geoff Smith AO, Chief Executive Officer of Sydney Ferries, in pursuance of the Transport Administration Act 1988, make the following Order on behalf of Sydney Ferries. Dated, this 19th day of Decemberday of December 2008. 2008. Chief Executive Officer Sydney Ferries Explanatory note The object of this Order is to amend the Transport Administration (Sydney Ferries—Fares) Order 2004 (the Principal Order) to increase, from 4 January 2009, certain multi-trip and weekly periodical fares for Sydney Ferries services in the Sydney Suburban Area. The fares include fares for services that are provided in conjunction with bus services provided by the State Transit Authority and rail services provided by RailCorp in the Sydney Suburban Area. The increases are in accordance with recent determinations of the Independent Pricing and Regulatory Tribunal. This Order also makes amendments to the Principal Order relating to the JetCat service consequential on the withdrawal from service of the JetCat fleet after 31 December 2008. This Order is made under the Transport Administration Act 1988, including section 85 (Orders fixing charges). s2008-553-09.d05 Page 1 12958 LEGISLATION 24 December 2008 Clause 1 Transport Administration (Sydney Ferries—Fares) Amendment Order 2008 Transport Administration (Sydney Ferries—Fares) Amendment Order 2008 under the Transport Administration Act 1988 1 Name of Order This Order is the Transport Administration (Sydney Ferries—Fares) Amendment Order 2008. -

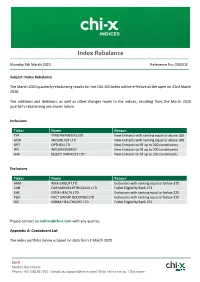

Index Rebalance

Index Rebalance Monday 9th March 2020 Reference No: 0002/20 Subject: Index Rebalance The March 2020 quarterly rebalancing results for the CXA 200 Index will be effective at the open on 23rd March 2020. The additions and deletions, as well as other changes made to the indices, resulting from the March 2020 quarterly rebalancing are shown below. Inclusions Ticker Name Reason TYR TYRO PAYMENTS LTD New Entrants with ranking equal or above 180 MSB MESOBLAST LTD New Entrants with ranking equal or above 180 OPT OPTHEA LTD New Entrants to fill up to 200 constituents IFN INFIGEN ENERGY New Entrants to fill up to 200 constituents SHV SELECT HARVESTS LTD New Entrants to fill up to 200 constituents Exclusions Ticker Name Reason AMA AMA GROUP LTD Exclusions with ranking equal or below 220 CVN CARNARVON PETROLEUM LTD Failed Eligibility Rank 273 EHE ESTIA HEALTH LTD Exclusions with ranking equal or below 220 PGH PACT GROUP HOLDINGS LTD Exclusions with ranking equal or below 220 SIG SIGMA HEALTHCARE LTD Failed Eligibility Rank 252 Please contact [email protected] with any queries. Appendix A: Constituent List The index portfolio below is based on data from 2 March 2020. Chi-X Market Operations Phone: +61 2 8078 1701 | Email: [email protected]| Web: chi-x.com.au | Disclaimer Newly added constituents are in BOLD. Chi-X indices (CXA 200 Index) Ticker Name CBA COMMONWEALTH BANK OF AUSTRAL CSL CSL LTD BHP BHP GROUP LTD WBC WESTPAC BANKING CORP NAB NATIONAL AUSTRALIA BANK LTD ANZ AUST AND NZ BANKING GROUP WOW WOOLWORTHS GROUP LTD MQG MACQUARIE GROUP -

OUTLOOK Australia’S Most Liveable City, Melbourne’S Population Is Growing at a Faster Rate Than Any Other Australian City

AUGUST 2015 WHY MELBOURNE? OUTLOOK Australia’s most liveable city, Melbourne’s population is growing at a faster rate than any other Australian city. CARNEGIE MELBOURNE: Apartment Market & Economic Growth Compared to Brisbane and Sydney, apartment Prices A CONTEXT ON BUSINESS, CULTURE, LIFESTYLE AND RESIDENTIAL across Greater Melbourne saw the strongest annual growth in the 10 years to April. ACCESSIBILITY & AMENITY Carnegie is well connected to transport, with direct access to road, rail and tram infrastructure. INFRASTRUCTURE & INVESTMENT The Cranbourne- Pakenham Railway corridor is being upgraded at a cost of $2.5 billion. EMPLOYMENT & EDUCATION The Monash Employment Cluster is 8km from Carnegie and employs 58,500 people. Access to the Carnegie’s apartment market CBD is 18 minutes via train. DEMOGRAPHICS A high proportion of tertiary students and people aged comfortably outperformed the 20 to 39, as well as above average per capita incomes. RESIDENTIAL MARKET average for Greater Melbourne Median apartment prices in Carnegie increased by 17% in the past three years, compared to Greater Melbourne which has seen 4.5% growth. over the past decade, with strong RENTAL MARKET Carnegie contains a high proportion of renters, which growth in median apartment prices. comprise 42% of residents. RESIDENTS OF CARNEGIE CARNEGIE’S RESIDENTS HAVE DIRECT ACCESS TO HAVE ACCESS TO MAJOR MONASH UNIVERSITY’S ARTERIAL ROADS, CAULFIELD AND ALONG WITH DIRECT CLAYTON PUBLIC TRANSPORT CAMPUSES LINKS TO THE MELBOURNE CBD CHADSTONE SHOPPING CENTRE IS 3KM FROM 1 POP 2 INF 3 EMP CARNEGIE AND IS CURRENTLY BEING REDEVELOPED Carnegie accommodates all three of the Urbis fundamentals that make a sustainable suburb - Population, Infrastructure and Employment. -

Oriental & Continental Foods Mini Market 43 Carlotta

Customer Name Type Address Suburb Postcode ORIENTAL & CONTINENTAL FOODS MINI MARKET 43 CARLOTTA STREET ARTARMON 2064 NATURES BEST BELFIELD PRODUCE MARKET 29 BURWOOD RD BELFIELD 2191 IGA BERRY SUPERMARKET 123 QUEEN ST BERRY 2535 KEMENY'S FOOD & LIQUOR BOTTLE SHOP AND LIQUOR STORE 137/147 BONDI RD BONDI 2026 GLENAYR CONVENIENCE CONVENIENCE STORE 133/137 GLENAYR AVE, BONDI BEACH BONDI 2026 FRIENDLY GROCER 7 WAYS SUPERMARKET 85 GLENAYR AVE BONDI 2026 CAFÉ BRAZIL CAFÉ & RESTAURANT 195, BONDI RD BONDI BEACH 2026 DOCTOR EARTH MINI MARKET 444 OXFORD ST BONDI JUNCTION2022 IGA BOTANY SUPERMARKET 1128, BOTANY RD BOTANY 2019 TOPPING MAD PIZZA PIZZARIA & RESTAURANT 65, MACPHERSON ST BRONTE 2024 QUATTRO FORMAGGI DELI BROOKVALE GOURMET GROCERY STORE WESTFIELD WARRINGAH MALL, SHOP X6-X8 CROSS ST WARRINGAH MALL SHOPPING CENTRE BROOKVALE 2100 BULLI FRUIT & VEG PRODUCE MARKET 161 PRINCES HWY BULLI 2516 CANBERRA CHOICE SUPERMARKETS PTY LTD SUPERMARKET 2 BARKER ST, GRIFFITH CANBERRA 2614 FRIENDLY GROCER COOK SUPERMARKET SUPERMARKET 27 COOK PL CANBERRA 2614 DIJON FOODS PTY LTD WHOLESALER 5-7 RESOLUTION DRIVE CARINGBAH 2229 IGA CASTLECRAIG SUPERMARKET CNR EASTERN VALLEY WAY & EDINBURGH RD CASTLECRAG 2068 FRUIT EZY MKT CHATSWOOD CHASE SUPERMARKET CHATSWOOD CHASE SYDNEY, WESTFIELD CHATSWOOD, B001/345 VICTORIA AVE CHATSWOOD 2067 FRIENDLY GROCER CROYDON GROCERY STORE 11 THE STRAND CROYDON 2132 BEL FRESCO - BIRKENHEAD POINT OUTLET CENTRE GROCERY SHOP 113, BIRKENHEAD POINT SHOPPING CENTRE DRUMMOYNE 2047 BEL FRESCO - BIRKENHEAD POINT OUTLET CENTRE SHOPPING MALL 19 -

SCLAA NEWSLETTER June 2017 June 2017

SCLAA NEWSLETTER June 2017 June 2017 p: 1300 364 160 e: [email protected] w: sclaa.com.au In this edition • 2017 ASCL Awards - Call for submissions • Divisional reports • Straight Talking • Product Lifecycle Management and the Cloud 2017 Australian Supply Chain & Logistics Awards Call for Submissions Now Open Join the SCLAA For more information on how to join the SCLAA go to www.sclaa.com.au or follow us: SCLAA National Chairwoman - Amanda O'Brien Amanda O'Brien is the National Chairwoman of the SCLAA. Amanda is a Transport & Logistics Professional and the CEO and Managing Director of Australian Worldwide Logistics Pty Ltd trading as Xtreme Freight with head office based in Melbourne. It has been another busy month for the provided advice to the Victorian Government to go West and Board and committees of the Supply Chain build Melbourne’s next port when Port of Melbourne reaches approximately 8 million TEU which is likely to be around 2055. & Logistics Association of Australia. Did you Bay West is the preferred location for a second major container know that approximately 63 events have port because it has strong transport, land use, environmental been held to date across Australia and we and amenity advantages, when compared to Hastings. Bay West are only just getting started! There is no lack is a good option for catering to container demand once capacity of enthusiasm or thirst for new content from at the Port of Melbourne has been exhausted and is also well suited to becoming Melbourne's future container port in the our members and partners with plenty more long term. -

The Right Place for Business Mayor’S Message

the right place for Business Mayor’s message The City of Whittlesea is Our vision is underpinned by the committed to supporting following five key directions, which makes up our broader economic MAYOR CR LAWRIE COX our existing businesses, development strategy: small and large whilst 1 Strive to build a healthy, prosperous encouraging new and resilient community businesses to start, grow 2 Foster an environment that and prosper in the region. encourages the development of a vibrant local economy 3 Capitalise on the city’s human, Attracting new jobs for our growing natural and built resources to population is critical to improve maximise local employment the prosperity and liveability of 4 Promote the municipality as an our community. attractive destination to invest To ensure the local economy and work in, visit and enjoy reaches its potential, we aspire to 5 Collaborate with community, attract investment to provide the businesses and government to best possible foundation for our deliver resources and opportunities community to thrive. In order to create a vibrant Our vision is clear – to attract economy and local employment 10,000 new jobs to the City of opportunities, we must match Whittlesea over the next five years. job growth with residential It is an ambitious goal and one that growth – today but also for future provides clarity of purpose for our generations. However we’re also Economic Development team. Our aware that to create employment team have a big opportunity to growth, we must support it make a big contribution to the scale with the right infrastructure and size of employment growth development. -

MCT) and Light Rail Plan

DRAFT 59 Rail Futures Inc THE MELBOURNE RAIL PLAN Moving People in a City of 8 Million 25 May 2019 This paper has been prepared by Rail Futures Incorporated in the public interest. Rail Futures Inc is an independent non-partisan group formed to advocate cost effective rail and intermodal solutions for public transport and freight problems based on sound commercial, economic and social reasoning. Rail Futures members include experienced rail professionals, engineers, planners and economists. Melbourne Rail Plan 2019-2050, May 2019 Version 59 - DRAFT FOR COMMENT Rail Futures Institute 1 Foreword Melbourne once had one of the world’s best public transport systems. The forethought and planning of Victorians more than a century ago, and their capacity to value the welfare of Victorians of the future -us - as highly as their own, helped make Melbourne one of the world’s economically most productive and liveable cities. For the past few generations, myopia, carelessness and excessive valuation of the present over the future have been squandering that wonderful legacy. The economic and social life of this city will be deeply impaired by barriers to movement of people around the city unless chronic underinvestment over recent generations is remedied. The Melbourne Rail Plan 2019-50 demonstrates the way to correct the mistakes of recent generations, and that some contemporary Victorians are up to the challenge. The Report is comprehensive, creative and authoritative. It is an excellent foundation for rebuilding Melbourne to secure its position as one of the world’s most successful cities. Melbourne is growing more rapidly than any other large city in the developed world.