Social Impact Insight Report December 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2015 Annual Results 19 August 2015 Agenda

2015 Annual Results 19 August 2015 Agenda • Merger update and strategic focus Angus McNaughton • Financial results Richard Jamieson Angus McNaughton Richard Jamieson • Portfolio performance Chief Executive Officer CFO and EGM Investments Stuart Macrae • Development update Jonathan Timms • FY16 focus and guidance Stuart Macrae Jonathan Timms Angus McNaughton EGM Leasing EGM Development 2 Merger update and strategic focus Angus McNaughton Cranbourne Park, VIC Merger benefits on track with a strong platform for growth • Strategic focus remains unchanged • Operational cost synergies on track • Over 60% of operational cost savings1 already locked in • Merger financing savings achieved1 with over $100m lower cost • Weighted average cost of debt reduced to 4.2% • Integration is on program • Key operational teams finalised and team co-locations underway • Solid FY15 performance • Statutory net profit of $675.1m • Underlying earnings up 6.2%2 • Development pipeline increased to $3.1b and current projects on or ahead of plan The Myer Centre Brisbane, QLD 1. On a run-rate or annualised basis. 2. On an aggregate basis. 4 Strategic focus remains unchanged Retail real estate • We will own, manage and develop Australian retail assets across the spectrum • Portfolio composition will evolve as developments occur and asset recycling continues Operational excellence • High performance intensive asset management approach • Continuous improvement of systems and processes • Strongly committed to responsible investment and sustainability • Development of a fully -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

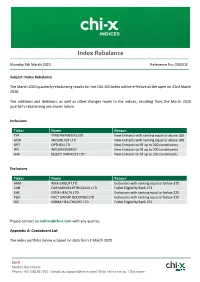

Index Rebalance

Index Rebalance Monday 9th March 2020 Reference No: 0002/20 Subject: Index Rebalance The March 2020 quarterly rebalancing results for the CXA 200 Index will be effective at the open on 23rd March 2020. The additions and deletions, as well as other changes made to the indices, resulting from the March 2020 quarterly rebalancing are shown below. Inclusions Ticker Name Reason TYR TYRO PAYMENTS LTD New Entrants with ranking equal or above 180 MSB MESOBLAST LTD New Entrants with ranking equal or above 180 OPT OPTHEA LTD New Entrants to fill up to 200 constituents IFN INFIGEN ENERGY New Entrants to fill up to 200 constituents SHV SELECT HARVESTS LTD New Entrants to fill up to 200 constituents Exclusions Ticker Name Reason AMA AMA GROUP LTD Exclusions with ranking equal or below 220 CVN CARNARVON PETROLEUM LTD Failed Eligibility Rank 273 EHE ESTIA HEALTH LTD Exclusions with ranking equal or below 220 PGH PACT GROUP HOLDINGS LTD Exclusions with ranking equal or below 220 SIG SIGMA HEALTHCARE LTD Failed Eligibility Rank 252 Please contact [email protected] with any queries. Appendix A: Constituent List The index portfolio below is based on data from 2 March 2020. Chi-X Market Operations Phone: +61 2 8078 1701 | Email: [email protected]| Web: chi-x.com.au | Disclaimer Newly added constituents are in BOLD. Chi-X indices (CXA 200 Index) Ticker Name CBA COMMONWEALTH BANK OF AUSTRAL CSL CSL LTD BHP BHP GROUP LTD WBC WESTPAC BANKING CORP NAB NATIONAL AUSTRALIA BANK LTD ANZ AUST AND NZ BANKING GROUP WOW WOOLWORTHS GROUP LTD MQG MACQUARIE GROUP -

SIMS GROUP LIMITED Annual REPORT 2008 SIM S G R O U P L IM IT E D a N N U a L RE P O R T 2 0

SIMS GROUP LIMITED GROUP SIMS ANN U a L REPORT2008 L ThE average motor vEhIcle SIMS GROUP LIMITED Lasts 13.5 yEars anD comprises annUaL report 2008 approximately 15,000 IndividuaL Parts, Of whIch 80% are potentially recOverable. Approximately 68% Of a vEhIcle’S Parts by weighT aRE steel, followed by plastic (9%) anD nOn ferrous metals (8%), with ThE remaInder rubber, glass anD other materials. www.simsMM.cOM finanCiaL Summary Corporate DireCtory For the year ended 30 June 2008 SeCuritieS exChange LiSting Shareholder enquirieS The Company’s ordinary shares are quoted Enquiries from investors regarding their $7.67 b 38% $433m 81% 306¢ 60% 130¢ 8% on the Australian Securities Exchange under share holdings should be directed to: the ASX Code ‘SGM’. Computershare Investor Services Pty Limited TotaL REvEnue Profit after Tax EaRnIngs per ShaRE DIvidends per Share The Company’s American Depositary Shares Level 3 (ADSs) are quoted on the New York Stock 60 Carrington Street Exchange under the symbol ‘SMS’. The Company Sydney NSW 2000 has a Level II ADS program, and the Depositary Postal Address: is the Bank of New York Mellon Corporation. GPO Box 7045 ADSs trade under cusip number 829160100 Sydney NSW 2001 with each ADS representing one (1) ordinary Telephone: 1300 855 080 share. Further information and investor Facsimile: (02) 8235 8150 enquiries on ADSs may be directed to: Company SeCretarieS $181m 42% 14.6% 22% 10.9% 43% $8.02 72% The Bank of New York Mellon Corporation Frank Moratti Depositary Receipts Division Scott Miller Net caSh flowS Return -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

Stoxx® Australia 150 Index

STOXX® AUSTRALIA 150 INDEX Components1 Company Supersector Country Weight (%) Commonwealth Bank of Australia Banks Australia 8.37 CSL Ltd. Health Care Australia 7.46 BHP GROUP LTD. Basic Resources Australia 7.23 National Australia Bank Ltd. Banks Australia 4.37 Westpac Banking Corp. Banks Australia 4.09 Australia & New Zealand Bankin Banks Australia 3.75 Wesfarmers Ltd. Retail Australia 3.30 WOOLWORTHS GROUP Personal Care, Drug & Grocery Australia 2.87 Macquarie Group Ltd. Financial Services Australia 2.84 Rio Tinto Ltd. Basic Resources Australia 2.48 Fortescue Metals Group Ltd. Basic Resources Australia 2.27 Transurban Group Industrial Goods & Services Australia 2.20 Telstra Corp. Ltd. Telecommunications Australia 2.05 Goodman Group Real Estate Australia 1.77 AFTERPAY Industrial Goods & Services Australia 1.54 Coles Group Personal Care, Drug & Grocery Australia 1.39 Woodside Petroleum Ltd. Energy Australia 1.28 Newcrest Mining Ltd. Basic Resources Australia 1.27 Aristocrat Leisure Ltd. Travel & Leisure Australia 1.11 XERO Technology Australia 1.00 SYDNEY AIRPORT Industrial Goods & Services Australia 0.93 Brambles Ltd. Industrial Goods & Services Australia 0.91 Sonic Healthcare Ltd. Health Care Australia 0.90 ASX Ltd. Financial Services Australia 0.82 SCENTRE GROUP Real Estate Australia 0.80 Cochlear Ltd. Health Care Australia 0.74 QBE Insurance Group Ltd. Insurance Australia 0.73 SUNCORP GROUP LTD. Insurance Australia 0.71 South32 Australia Basic Resources Australia 0.71 Santos Ltd. Energy Australia 0.68 Ramsay Health Care Ltd. Health Care Australia 0.66 Insurance Australia Group Ltd. Insurance Australia 0.65 Mirvac Group Real Estate Australia 0.60 DEXUS Real Estate Australia 0.59 SEEK Ltd. -

Fund Factsheet

31 August 2021 Russell Investments Managed Portfolio – Diversified 50 Asset allocation as at Portfolio objective 31 August 20212 To provide returns over the medium term, with moderate volatility, consistent with a diversified mix of defensive and growth oriented assets. Portfolio strategy The Portfolio typically invests in a diversified investment mix with exposure to growth investments of around 50% and defensive investments of around 50% over the long term, however the allocations will be actively managed within the allowable ranges depending on market conditions. Performance review Period ending 31/08/2021 1 3 1 2 3 5 Since month months year years years years inception % % % p.a. % p.a. % p.a. % p.a. % p.a. Total return 1.5 4.3 15.4 7.5 _ _ 7.8 Performance is net of fees and charges. Assumes reinvestments of income. Past performance is not a reliable indicator of future performance. Fund Facts Growth of $10,000 Inception date 19 June 2019 Portfolio manager Daniel Choo Recommended investment timeframe 4 years Fund Performance results are net of management fees for both the Managed Portfolio and the underlying managers’ fees and costs. These results do not take into account any third party platform fees charged to individual investors or transaction costs (which include buy/sell spread and brokerage fees). They assume income received is reinvested without any tax deduction. An individual investor’s actual performance will differ from this performance depending on a range of factors including the amount invested in the Managed Portfolio, transaction timing, transaction costs, actual underlying manager fees and costs, any exclusions selected by the investor, whether income is paid in cash and any divergence by the investor from Managed Portfolio weightings. -

Stocks List U Ethical Australian Equities Portfolio

All stocks list U Ethical Australian Equities Portfolio Below is a list of all holdings within the portfolio as at 31 March 2019. Stock holdings The A2 Milk Company G8 Education Reliance Worldwide Amcor Goodman Group ResMed Australia and New Zealand Banking GUD Holdings Seek Group Bingo Industries Invocare Sonic Healthcare Bluescope Steel JB Hi-Fi Suncorp Group Boral Lendlease Group Transurban Group Carsales.com Macquarie Group Telstra Challenger Monash IVF Group Wesfarmers Coles Oil Search Westpac Banking Corporation Commonwealth Bank of Australia QBE Insurance Group Woodside Petroleum CSL Ramsay Health Care Fortescue Metals Group REA Group This document dated 31 March 2019 is issued by UCA Growth Fund Limited (UCA Growth) for the U Ethical Australian Equities Portfolio (the Portfolio). U Ethical (a registered business name of Uniting Ethical Investors Limited ABN 46 102 469 821 AFSL 294147) is the Manager and Administrator of the Portfolio. The information provided is general information only. It does not constitute financial, tax or legal advice or an offer or solicitation to subscribe for units in any fund of which U Ethical is the Manager, Administrator, Issuer, Trustee or Responsible Entity. This information has been prepared without taking account of your objectives, financial situation or needs. Before acting on the information or deciding whether to acquire or hold a product, you should consider the appropriateness of the information based on your own objectives, financial situation or needs or consult a professional adviser. You should also consider the relevant Product Disclosure Statement (PDS) or Offer Document which can be found on our website www.uethical.com or by calling us on 1800 996 888. -

12 December 2017 Cimic's Cpb Contractors to Construct

12 DECEMBER 2017 CIMIC’S CPB CONTRACTORS TO CONSTRUCT WEST GATE TUNNEL CIMIC Group company, CPB Contractors, has achieved contractual close on Victoria’s multi- billion dollar West Gate Tunnel. CPB Contractors was selected by Transurban and the State Government of Victoria as the preferred contractor for the project in April 2017, in a 50:50 joint venture with John Holland. The design and construct contract will generate revenue to CPB Contractors of approximately $2.49 billion. Major construction work is expected to start in early 2018 with the project scheduled to open to traffic in 2022. CIMIC Group Chief Executive Officer Michael Wright said: “Delivering complex roads and transport projects are core capabilities for CIMIC and CPB Contractors. We are the largest tunnelling contractor in Australia, with considerable experience in creating transforming infrastructure such as the West Gate Tunnel. “We are privileged to be working with Transurban and the Victorian Government to deliver this exciting project that is so integral to the State’s vision for sustainable roads systems, and so vitally important for its people and communities.” CPB Contractors Managing Director Juan Santamaria said: “With many decades of roads and tunnelling experience in Australia, our capabilities will ensure minimal disruption, a safe and effective works program, and certainty of delivery for our client. “We are focused on ensuring opportunities for local workers, and providing a value for money procurement program that includes Indigenous business and social enterprises to achieve broader community benefits.” The West Gate Tunnel project, one of Victoria’s largest ever urban road projects, will deliver a vital alternative to the West Gate Bridge, provide quicker and safer journeys, and remove thousands of trucks from residential streets. -

2019 Annual Report

Discover more Annual Report 2019 Join us as we discover Inside how Vicinity Centres creates market-leading 01 Highlights 42 Our Board 02 Our Value Chain 45 Our Executive Committee destinations. 04 Market-Leading Destinations 48 Tax Transparency 06 Chairman’s Review 52 Sustainability Assurance Destinations that 08 CEO and Managing Statement enhance communities Director’s Review 53 Financial Report 12 Our Operating and 54 Director’s Report and offer so much more Financial Review 58 Remuneration Report than an exceptional 29 Our Portfolio 80 Financial Statements 34 Integrated Energy Platform 122 Independent Auditor’s retail experience. 36 Our Communities Report 38 Our Data and Analytics 128 Summary of Securityholders 40 Our People 129 Corporate Directory About this report This annual report discloses Vicinity’s financial and non- environmentally responsible paper manufactured under This annual report is a summary of Vicinity Centres’ operations, financial performance for FY19 and has been prepared using IAO 14001 environmental standards. activities and financial position as at 30 June 2019. In this elements of the International Integrated Reporting Council The following symbols are used in this report to cross-refer report references to ‘Vicinity’, ‘Group’, ‘we’, ‘us’ and ‘our’ refer (IIRC) Integrated Reporting <IR> framework. More information, to more information on a topic: to Vicinity Centres unless otherwise stated. particularly latest company announcements and detailed sustainability reporting, can be found on Vicinity’s website. References in this report to a ‘year’ and ‘FY19’ refer to the References additional information within financial year ended 30 June 2019 unless otherwise stated. Vicinity is committed to reducing the environmental footprint this Annual Report All dollar figures are expressed in Australian dollars (AUD) associated with the production of the annual report and unless otherwise stated. -

STOXX Australia 150 Last Updated: 02.01.2017

STOXX Australia 150 Last Updated: 02.01.2017 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 97.5 1 1 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 74.9 2 2 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 61.1 3 3 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 55.9 4 5 AU000000BHP4 6144690 BHP.AX 614469 BHP Billiton Ltd. AU AUD Y 55.3 5 4 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 41.8 6 6 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 32.7 7 7 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 31.4 8 8 AU000000WOW2 6981239 WOW.AX 698123 Woolworths Ltd. AU AUD Y 21.3 9 9 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 19.1 10 10 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 17.4 11 11 AU000000SCG8 BLZH0Z7 SCG.AX AU01Z4 SCENTRE GROUP AU AUD Y 17.0 12 12 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd. AU AUD Y 15.6 13 13 AU000000TCL6 6200882 TCL.AX 689933 Transurban Group AU AUD Y 14.5 14 14 AU000000BXB1 B1FJ0C0 BXB.AX 612000 Brambles Ltd. AU AUD Y 13.5 15 16 AU000000WFD0 BMMVVX4 WFD.AX 605414 WESTFIELD CORP AU AUD Y 13.4 16 15 AU000000SUN6 6585084 SUN.AX 658508 SUNCORP GROUP LTD.