Stocks List U Ethical Australian Equities Portfolio

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

U Ethical Australian Equities Trust

Quarterly u ethical Australian Equities Performance Trust - Retail Review Quarterly highlights June 2021 • The Australian equity market performed Fund information strongly over the quarter buoyed by solid economic data and positive earnings revisions Inception date 7 July 2003 • The total return for the Trust over the quarter Fund size $91.35 million was 8.0 per cent, slightly below the benchmark Over the last 12 months the Trust has delivered Benchmark S&P/ASX 300 a strong total return of 25.9 per cent Accumulation Index • Sector allocation was a small drag, although Buy/sell spread1 0.25%/0.25%1 security selection was positive with top Management costs Estimated up to 1.315% p.a. performing stocks including ResMed, See Product Disclosure Statement Cleanaway Waste Management and REA Group • Recent lockdowns highlight the ongoing Portfolio manager Jon Fernie Covid-19 risks. Rising inflation and elevated Number of stocks 20-40 valuations relative to historic levels also remain concerns Growth of $1,000 invested† Investment objective The U Ethical Australian Equities Trust has been 3,000 U Ethical AET Benchmark developed for the long-term investor and aims to 2,500 outperform the benchmark after fees over rolling 5-year periods. It invests primarily in Australian 2,000 shares as well as up to 10 per cent in fixed interest and cash. 1,500 1,000 500 0 2006 2008 2010 2012 2014 2016 2018 2020 2022 Performance 3 months 6 months 1 year 3 years 5 years 10 years Since inception % % % p.a. % % p.a. % p.a. % p.a. -

Goodman Plus Trust Annual Report 2011 Cover: 82,015 Sqm Distribution Centre Under Development for Metcash at Bungarribee Industrial Estate

Goodman Plus Trust Annual Report 2011 Cover: 82,015 sqm distribution centre under development for Metcash at Bungarribee Industrial Estate. Goodman Annual 1 PLUS Trust Report 2011 Goodman PLUS Trust Annual Report 2011 Contents Corporate governance 2 Summary of terms of redemption and exchange of Goodman PLUS 12 Financial report 15 Independent auditor’s report 32 Securities information 33 Definitions 35 Corporate directory 39 2 Corporate governance Corporate governance is the framework of rules, systems and processes by which authority is exercised within Goodman and accountability placed. It influences how the objectives of Goodman PLUS Trust (Trust) are set and achieved, how risk is monitored and assessed and how performance is optimised. The Trust recognises that an effective corporate governance culture is critical to success. We have designed and implemented a substantial range of governance initiatives, described in detail below, and we believe that our corporate governance systems are robust and effective. We recognise corporate governance is not static and systems will need to evolve over time to meet the demands of a changing market and corporate circumstances. At all times, we strive to achieve governance outcomes which balance the needs or requirements of the Trust, its stakeholders, regulators and the market. The corporate governance statement below outlines the ways in which the Trust has met the Australian Securities Exchange (ASX) Corporate Governance Council’s Corporate Governance Principles and Recommendations (2nd Edition). Any departures to implementation of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations are described in the corporate governance statement below. As a result of the Trust not having employees of its own, and as a result of the limited business activities of the Trust, some of the ASX Corporate Governance Council’s recommendations are undertaken by Goodman Group (Goodman) rather than the Trust, as set out below. -

Invocare Limited and Controlled Entities

InvoCare Limited and Controlled Entities ABN: 42 096 437 393 Interim financial report For the half-year ended 30 June 2019 InvoCare Limited and Controlled Entities Directors’ report Your directors present their report on the consolidated entity consisting of InvoCare Limited and the entities it controlled at the end of, or during, the half-year ended 30 June 2019. Directors The persons who were directors of InvoCare Limited during the entire half-year period and until the date of this report are as below: Bart Vogel (Chairman) Martin Earp (Chief Executive Officer) Richard Davis Robyn Stubbs Keith Skinner Jackie McArthur Megan Quinn Dividends The directors have determined a fully franked interim dividend of 17.5 cents per share (2018: 17.5 cents per share fully franked) which will be paid on 4 October 2019. For the 2019 interim dividend, it is intended that the required shares will be issued at a discount of 2% to the market price. Any shortfall in DRP take-up will not be underwritten. The market price will be calculated as the weighted average market price of trading in shares in the Company during the first ten (10) trading days after (but not including) the DRP Election date, 7 September 2019. Page 2 of 37 InvoCare Limited and Controlled Entities Directors’ report continued Operating and Financial Review 2019 2018 Change Result highlights: Half-Year $'000 $'000 $'000 Operating Sales Revenue (i) 241,493 225,675 15,818 7.0% Other revenue (i) 1,836 977 859 87.9% Operating expenses (i) (180,497) (172,923) (7,574) (4.4%) Operating EBITDA -

Market Overview Funds at a Glance

As of 31 August 2020 Market overview Global markets were positive again in August on vaccine hope and a very strong For more information on our Funds, tech sector. The US S&P500 was up 7.2% and the MSCI World index up 6.3%. All please contact: share markets were positive, including Australia up 2.8% and NZ up 1.8%. Global bonds were weak (yields rose), with the US 10-year up 0.17% to 0.70% and the David Boyle Australian 10-year up the same to 0.98%. NZ bonds bucked the offshore moves Head of Sales & Marketing and our 10-year bond fell 0.14% to 0.61%. Level 25, SAP Tower 151 Queen Street, Auckland It was reporting season in NZ and Australia in August. NZ was generally better than New Zealand expectations, or at least not as bad as it might have been. Revenue and earnings were slightly ahead of expectations in aggregate; however, dividends disappointed P 0800 646 833 a bit as boards took an understandably conservative approach to distributions. E [email protected] Only one third of companies gave guidance for the period ahead reflecting the www.mintasset.co.nz prevailing highly uncertain operating environment. EPS for companies reporting in Australia fell 20% for the year ending June, an outcome on a par with the GFC. However, this too was slightly better than expectations, with resilience in Consumer Staples, Building Materials and Discretionary Retail. The key upside factor this reporting season was better than expected cash flows, reflecting a fall in inventories and some delay in capex. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

Australian Equities Lending Margins Effective 21 April 2021

Australian Equities Lending Margins Effective 21 April 2021 Stock ASX Margin Stock ASX Margin Stock ASX Margin Code Rate Code Rate Code Rate A2B Australia A2B 40% AusNet Services AST 70% Costa Group Holdings CGC 60% The A2 Milk Company A2M 65% ASX ASX 75% Challenger Financial Australian Agricultural Company AAC 55% AUB Group AUB 50% Services Group CGF 70% Adelaide Brighton ABC 70% Australian United Challenger Capital Notes CGFPA 60% Abacus Property Group ABP 60% Investment Company AUI 70% Challenger Capital Notes 2 CGFPB 60% Audinate Group AD8 40% Aventus Retail Property Group AVN 50% Challenger Capital Notes 3 CGFPC 60% Adairs ADH 40% Alumina AWC 70% Charter Hall Group CHC 70% APN Industria REIT ADI 40% Accent Group AX1 40% Champion Iron CIA 50% Australian Ethical Amaysim Australia AYS 40% Cimic Group CIM 70% Investment Limited AEF 40% Aurizon Holdings AZJ 75% Carlton Investments CIN 50% Australian Foundation Bapcor BAP 60% Centuria Industrial REIT CIP 60% Investment Company AFI 75% Baby Bunting Group BBN 40% Collins Foods CKF 50% Ainsworth Game Technology AGI 40% Bendigo & Adelaide Bank BEN 70% Class CL1 40% AGL Energy AGL 75% Bendigo & Adelaide Bank BENHB 65% Clean Teq Holdings CLQ 40% AGL Energy USFDS AGLHA 75% Bendigo & Adelaide Bank CPS BENPE 65% Clover Corporation CLV 40% Automotive Holdings Group AHG 55% Bendigo & Adelaide Bank CPS BENPF 65% Charter Hall Long Wale REIT CLW 60% Asaleo Care AHY 50% Bendigo & Adelaide Bank CPS BENPG 65% Centuria Metropolitan REIT CMA 50% Auckland International Airport AIA 70% Bell Financial Group -

Bluescope Steel Limited Prospectus Abn 16 000 011 058

BLUESCOPE STEEL LIMITED PROSPECTUS ABN 16 000 011 058 PROSPECTUS FOR THE 1 FOR 1 NON-RENOUNCEABLE ENTITLEMENT OFFER OF UP TO APPROXIMATELY 911.7 MILLION NEW SHARES AT AN OFFER PRICE OF $1.55 PER NEW SHARE TO RAISE UP TO APPROXIMATELY $1,413 MILLION THIS PROSPECTUS IS AN IMPORTANT DOCUMENT AND REQUIRES YOUR IMMEDIATE ATTENTION. IF YOU ARE AN ELIGIBLE RETAIL SHAREHOLDER, YOU SHOULD READ THIS PROSPECTUS IN ITS ENTIRETY BEFORE DECIDING WHETHER TO ACCEPT THE OFFER OF NEW SHARES. YOUR ENTITLEMENT MAY HAVE VALUE AND YOU SHOULD THEREFORE CONSIDER WHETHER TO TAKE UP YOUR ENTITLEMENT RATHER THAN ALLOW IT TO LAPSE. IF YOU DO NOT UNDERSTAND ANY PART OF THIS PROSPECTUS, OR ARE IN DOUBT AS TO HOW TO DEAL WITH IT OR YOUR ENTITLEMENT, YOU SHOULD CONSULT YOUR STOCKBROKER, ACCOUNTANT, LAWYER OR OTHER PROFESSIONAL ADVISER. THIS DOCUMENT MAY NOT BE DISTRIBUTED INTO THE UNITED STATES OR TO ANY U.S. PERSON, AS DEFINED IN REGULATION S UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “U.S. SECURITIES ACT”), EXCEPT ACCOMPANIED BY THE INSTITUTIONAL OFFERING MEMORANDUM AND TO A LIMITED NUMBER OF QUALIFIED INSTITUTIONAL BUYERS, AS DEFINED IN RULE 144A UNDER THE U.S. AS PART OF THE INSTITUTIONAL OFFER (AS DEFINED HEREIN). For personal use only SOLE LEAD MANAGER, UNDERWRITER & BOOKRUNNER This Prospectus may not be distributed to, or relied upon by, persons in the U.S. or who are IMPORTANT NOTICE U.S. Persons unless accompanied by the institutional offering memorandum as part of the Institutional Offer. By returning a completed Entitlement and Acceptance Form, or making a This Prospectus relates to the 1 for 1 Offer of new shares (“New Shares”) by BlueScope payment of the Application Monies for New Shares by BPAY®, you will be taken to make the Steel. -

FNZ NTA & Allotment Notice

Friday, 1 March 2019 FNZ NTA & Allotment Notice Smartshares Limited would like to report details of the Units on Issue for the NZ Top 50 Fund (FNZ) as at 28 February 2019. Units on Issue: 194,951,179 Units Allotted/(Redeemed): - Net Tangible Assets (NTA): $2.63544 Tracking Difference: 0.35% The objective of the NZ Top 50 Fund (FNZ) is to provide a return that closely matches the return on the S&P/NZX 50 Portfolio Index. The S&P/NZX 50 Portfolio Index comprises 50 of the largest entities listed on the NZX Main Board. The following companies are currently held in the Fund: Code Security description AIA Auckland International Airport Ltd. AIR Air New Zealand Ltd. ANZ Australia and New Zealand Banking Group Ltd. ARG Argosy Property Ltd ARV Arvida Group Ltd. ATM The a2 Milk Company Ltd. CEN Contact Energy Ltd. CNU Chorus Ltd. EBO Ebos Group Ltd. FBU Fletcher Building Ltd. FPH Fisher & Paykel Healthcare Corporation Ltd. FRE Freightways Ltd. FSF Fonterra Shareholders' Fund Units GMT Goodman Property Trust GNE Genesis Energy Ltd. GTK Gentrack Group Ltd. HGH Heartland Group Holdings Ltd. IFT Infratil Ltd IPL Investore Property Ltd. KMD Kathmandu Holdings Ltd KPG Kiwi Property Group Ltd. MCY Mercury NZ Ltd. MEL Meridian Energy Ltd MET Metlifecare Ltd MFT Mainfreight Ltd. NZR The New Zealand Refining Company Ltd. NZX NZX Ltd. PCT Precinct Properties New Zealand Ltd. PFI Property for Industry Ltd. POT Port Of Tauranga Ltd. PPH Pushpay Ltd. RBD Restaurant Brands NZ Ltd. RYM Ryman Healthcare Ltd. www.smartshares.co.nz SAN Sanford Ltd. -

An Opportunity for Economic Growth Australia's Healthcare System

Australia’s healthcare system An opportunity for economic growth Contacts Brisbane Sydney Chris Rogan Chris Bartlett Partner, PwC Australia Partner, PwC Australia +61-7-3257-5152 +61-2-8266-4721 [email protected] [email protected] Sarah Butler Partner, PwC Australia +61-2-8266-5001 [email protected] 2 Strategy& About the authors Chris Bartlett is a recognised innovator in healthcare and digital strategy practices for Strategy&, PwC’s strategy consulting group. He is a partner with PwC Australia. Based in Sydney, he has worked on a range of projects with a particular focus on the intersection of the healthcare, telecommunications, and IT industries. A lead advisor on Australia’s National E-Health Strategy, he worked with government agencies in Australia and Singapore on implementing e-health strategies. Sarah Butler is a thought leader in the Australia health consulting practice at Strategy&. Based in Sydney, she is a partner with PwC Australia. Previously she was chairman and managing director for Strategy& in Greater China. She has worked with federal and state health departments, insurers, and private-sector players, advising clients on strategy, transformation, digital and analytics, and partnerships. Chris Rogan is a partner with PwC Australia in Brisbane. He has guided many large organisations through transformational change programmes and industry reform, and has led major programmes in areas including health information technology, governance, performance alignment, and hospital performance for the Australian Department of Health, many local health networks, and Medicare locals. Previously he worked in banking and financial services. The authors would like to thank the various industry leaders and senior experts who participated in our “Let’s Talk about Health” forums and shared their perspectives, and helped to shape the ideas presented in this report. -

Balanced Style Investing — Winning by Not Losing September 2020

Insights Active Quantitative Equity (AQE) Balanced Style Investing — Winning by Not Losing September 2020 Bruce Apted Head of Portfolio Management Australia Active Quantitative Equity Human emotions and biases affect all investors. Left unchecked, these emotions can sabotage financial decisions and generate suboptimal investment outcomes. However, by understanding how human emotions and behaviour impacts our decision making we can unlock opportunities for investors. The key to unlocking these opportunities is: • understanding how financial markets interact with human behaviour; and • finding an investment style to exploit these biases. Emotions are the Financial markets have the ability to generate and destroy wealth. They are complex and Enemy for Investors volatile and evoke significant emotions. Figure 1 depicts an all too common emotional roller coaster for investors. The worst case scenario is letting your emotions drive your investment decisions — buying a security near the high or capitulating and selling near the low. How can investors avoid the mistakes of mass psychology and turn emotional short comings into opportunity? Be risk averse when the market is overly optimistic (Euphoria) and risk seeking when the market is overly pessimistic (Panic and Capitulation). 10 Figure 1 Euphoria Market Becomes Expensive — Greatest Financial Risk The Emotional Roller Coaster of Investing 8 Thrill Anxiety Denial Excitment 6 Fear Optimism Optimism 4 Panic Relief 2 Hope Market Becomes Cheap — Greatest Financial Opportunity Capitulation Depression 0 1 2 3 4 5 6 7 8 9 10 11 12 13 Source: State Street Global Advisors. The information contained above is for illustrative purposes only. Over the last 20 years, there are many examples of Euphoria followed by Fear and Capitulation (see Figure 2). -

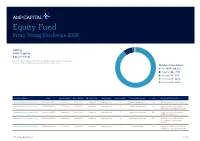

Equity Fund Proxy Voting Disclosure 2020

Equity Fund Proxy Voting Disclosure 2020 Voting AMP Capital Equity Fund Note: The below disclosures refer to Australian listed securities only and do not include foreign listed securities held in the portfolio. Number of resolutions: n For 1077 - 90.2% n Against 88 - 7.3% n Abstain 18 - 1.5% n Unvoted 8 – 0.7% n Unvoted 3 – 0.3% Company Name ISIN Meeting Date Record Date Meeting Type Proponent Proposal No. Type of Proposal Vote Proposal Description Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 1 Capital Management For Ratify Placement of Securities Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 2 Capital Management For Approve Issue of Securities (Executive chair Bill Beament) Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 3 Capital Management For Approve Issue of Securities (NED Mary Hackett) Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 4 Capital Management For Approve Issue of Securities (Former NED Christopher Rowe) Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 5 Board Related For Approve Financial Assistance (Kalgoorlie Lake View Pty Ltd) AMP Capital Equity Fund 1 of 58 Company Name ISIN Meeting Date Record Date Meeting Type Proponent Proposal No. Type of Proposal Vote Proposal Description Virgin Money UK Plc. AU0000064966 1/29/2020 1/24/2020 Annual Management 1 Audit/Financials For Accounts and Reports Virgin Money UK Plc. AU0000064966 1/29/2020 1/24/2020 Annual Management 2 Compensation For Remuneration Policy (Binding) Virgin Money UK Plc.