An Opportunity for Economic Growth Australia's Healthcare System

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

Stoxx® Australia 150 Index

STOXX® AUSTRALIA 150 INDEX Components1 Company Supersector Country Weight (%) Commonwealth Bank of Australia Banks Australia 8.37 CSL Ltd. Health Care Australia 7.46 BHP GROUP LTD. Basic Resources Australia 7.23 National Australia Bank Ltd. Banks Australia 4.37 Westpac Banking Corp. Banks Australia 4.09 Australia & New Zealand Bankin Banks Australia 3.75 Wesfarmers Ltd. Retail Australia 3.30 WOOLWORTHS GROUP Personal Care, Drug & Grocery Australia 2.87 Macquarie Group Ltd. Financial Services Australia 2.84 Rio Tinto Ltd. Basic Resources Australia 2.48 Fortescue Metals Group Ltd. Basic Resources Australia 2.27 Transurban Group Industrial Goods & Services Australia 2.20 Telstra Corp. Ltd. Telecommunications Australia 2.05 Goodman Group Real Estate Australia 1.77 AFTERPAY Industrial Goods & Services Australia 1.54 Coles Group Personal Care, Drug & Grocery Australia 1.39 Woodside Petroleum Ltd. Energy Australia 1.28 Newcrest Mining Ltd. Basic Resources Australia 1.27 Aristocrat Leisure Ltd. Travel & Leisure Australia 1.11 XERO Technology Australia 1.00 SYDNEY AIRPORT Industrial Goods & Services Australia 0.93 Brambles Ltd. Industrial Goods & Services Australia 0.91 Sonic Healthcare Ltd. Health Care Australia 0.90 ASX Ltd. Financial Services Australia 0.82 SCENTRE GROUP Real Estate Australia 0.80 Cochlear Ltd. Health Care Australia 0.74 QBE Insurance Group Ltd. Insurance Australia 0.73 SUNCORP GROUP LTD. Insurance Australia 0.71 South32 Australia Basic Resources Australia 0.71 Santos Ltd. Energy Australia 0.68 Ramsay Health Care Ltd. Health Care Australia 0.66 Insurance Australia Group Ltd. Insurance Australia 0.65 Mirvac Group Real Estate Australia 0.60 DEXUS Real Estate Australia 0.59 SEEK Ltd. -

ASX50 Financial Reporting Insights 30 June 2015 Reporting Season October 2015

ASX50 financial reporting insights 30 June 2015 reporting season October 2015 Introduction: KPMG has analysed the financial reports of the ASX50 through the latest reporting season (1 January 2015 to 30 June 2015) with a focus on: • considering the financial performance of the ASX50 group of companies as an indicator of the economy in general • analysing trends by industry sector, with specific focus on the contribution of mining companies and the ‘Big 4’ banks • comparing and analysing profits reported under statutory and non-statutory (underlying/non- conforming) measures. All amounts are in Australian dollars, unless otherwise stated. PRINT Executive summary Key findings Annual reported financial results – ASX50 ► Annual revenue has reduced by $13 billion (2 percent) despite 68 percent of the companies reporting an improvement in annual revenue. This is the first time in the survey period that annual revenue has reduced. This is due to the impact of the continued decline in commodity 160 700 prices on the mining sector and the energy and utilities sector which has more than offset 140 the growth stories in the remainder of the ASX50 group. Five companies from these sectors 600 reported a combined $30 billion reduction in revenue and an $18 billion reduction in statutory 120 profit before tax (BHP Billiton and South 32, Rio Tinto, Caltex and Origin Energy). 500 100 ► Annual statutory profit before tax has reduced $8.5 billion (8 percent) to $102 billion. 400 Thirty of the ASX50 companies reported a growth in statutory profits and there is generally a 80 positive trend across most industry sectors. -

(Ramsay) Is Pleased to Announce the Appointment of Mr Martyn Roberts As Group Chief Financial Officer

ASX ANNOUNCEMENT 18 December 2019 GROUP CHIEF FINANCIAL OFFICER APPOINTMENT Ramsay Health Care Limited (Ramsay) is pleased to announce the appointment of Mr Martyn Roberts as Group Chief Financial Officer. Mr Roberts is currently the Group Chief Financial Officer at Coca-Cola Amatil, a role he has held since July 2015. Before Amatil, Mr Roberts worked for seven years at Woolworths Ltd in various senior executive roles including Finance Director Supermarkets, General Manager of Woolworths Petrol and General Manager Corporate Strategy and Business Development. Prior to Woolworths, he was in various senior finance roles in the fashion and luxury goods sector in Sydney, London, Hong Kong and Paris including nine years with Louis Vuitton. Mr Roberts has a Bachelor of Science in Mathematics from the University of York and commenced his career with Coopers and Lybrand in the UK where he was a member of the Institute of Chartered Accountants of England and Wales. Ramsay Managing Director Craig McNally said: “I am delighted to have Martyn join our Company. He is a highly credentialed executive with broad experience in general management and in leading finance and corporate strategy, both in Australia and offshore. He is an accomplished CFO with 20 years’ experience and has a strong track record of success in driving performance improvement. We look forward to welcoming him to our executive team.” Mr Roberts will commence in the role in the first half of 2020. He succeeds Mr Bruce Soden who will step down at the end of this year. Contacts: Craig McNally Carmel Monaghan Managing Director Chief of Staff Ramsay Health Care Ramsay Health Care + 61 2 9220 1000 + 61 438 646 273 The release of this announcement was authorised by Henrietta Rowe, Group Company Secretary. -

Stocks List U Ethical Australian Equities Portfolio

All stocks list U Ethical Australian Equities Portfolio Below is a list of all holdings within the portfolio as at 31 March 2019. Stock holdings The A2 Milk Company G8 Education Reliance Worldwide Amcor Goodman Group ResMed Australia and New Zealand Banking GUD Holdings Seek Group Bingo Industries Invocare Sonic Healthcare Bluescope Steel JB Hi-Fi Suncorp Group Boral Lendlease Group Transurban Group Carsales.com Macquarie Group Telstra Challenger Monash IVF Group Wesfarmers Coles Oil Search Westpac Banking Corporation Commonwealth Bank of Australia QBE Insurance Group Woodside Petroleum CSL Ramsay Health Care Fortescue Metals Group REA Group This document dated 31 March 2019 is issued by UCA Growth Fund Limited (UCA Growth) for the U Ethical Australian Equities Portfolio (the Portfolio). U Ethical (a registered business name of Uniting Ethical Investors Limited ABN 46 102 469 821 AFSL 294147) is the Manager and Administrator of the Portfolio. The information provided is general information only. It does not constitute financial, tax or legal advice or an offer or solicitation to subscribe for units in any fund of which U Ethical is the Manager, Administrator, Issuer, Trustee or Responsible Entity. This information has been prepared without taking account of your objectives, financial situation or needs. Before acting on the information or deciding whether to acquire or hold a product, you should consider the appropriateness of the information based on your own objectives, financial situation or needs or consult a professional adviser. You should also consider the relevant Product Disclosure Statement (PDS) or Offer Document which can be found on our website www.uethical.com or by calling us on 1800 996 888. -

Ramsay Health Care Limited and Controlled Entities Abn 57 001 288

RAMSAY HEALTH CARE LIMITED AND CONTROLLED ENTITIES A.B.N. 57 001 288 768 FINANCIAL REPORT FOR THE YEAR ENDED 30 JUNE 2014 RAMSAY HEALTH CARE LIMITED AND CONTROLLED ENTITIES A.B.N. 57 001 288 768 FINANCIAL REPORT FOR THE YEAR ENDED 30 JUNE 2014 CONTENTS PAGE Directors’ Report 3 Independent Audit Report 44 Directors’ Declaration 46 Consolidated Income Statement 47 Consolidated Statement of Comprehensive Income 48 Consolidated Statement of Financial Position 49 Consolidated Statement of Changes in Equity 50 Consolidated Statement of Cash Flows 52 Notes to the Consolidated Financial Statements 53 Attachment 1 – Ramsay Health Care Limited Directors & Company Secretary 122 2 RAMSAY HEALTH CARE LIMITED DIRECTORS’ REPORT Your Directors submit their report for the year ended 30 June 2014. DIRECTORS The names of the Directors of the Company in office during the financial year and until the date of this report, unless otherwise stated, are: Names P.J. Ramsay AO - Non-Executive Chairman (deceased 1 May 2014) M.S. Siddle - Non-Executive Chairman (from 28 May 2014. Prior to this date, was the Deputy Chairman) P.J. Evans - Non-Executive Deputy Chairman (from 28 May 2014. Prior to this date, was a Non-Executive Director) C.P. Rex - Managing Director B.R. Soden - Group Finance Director A.J. Clark AM - Non-Executive Director I.P.S. Grier AM - Non-Executive Director R.H. McGeoch AO - Non-Executive Director K.C.D. Roxburgh - Non-Executive Director Particulars of each Director’s experience and qualifications are set out in Attachment 1. Interests in the shares and options of the Company and related bodies corporate The beneficial interest of each Director in the share capital of the Company as at the date of this report was as follows: Ramsay Health Care Limited Director Ordinary Shares Convertible Adjustable Rights over Rate Equity Securities Ordinary Shares (CARES) M.S. -

Look Beyond Dividend Yields for Better Income and Total Returns

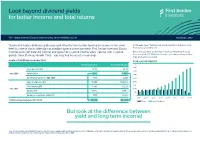

Look beyond dividend yields for better income and total returns First Sentier Investors Equity Income Strategy | Client reference guide September 2019 Stocks with higher dividend yields may look attractive to investors looking for income in the short In the early years, Telstra’s higher yield results in higher income term, but these stocks often do not provide higher income over time. First Sentier Investors’ Equity than Ramsay Health Care. Income team compare the income and growth of a typical income stock (Telstra), with a typical But in the long term, an investor in Ramsay Health Care would have received $15,709 more income, including franking credits, growth stock (Ramsay Health Care) – you may find the results surprising! than an investor in Telstra! Growth of $10,000 invested in June 2004 Income generated per year Telstra Corporation Ramsay Health Care $ 4000 Stock price in 2004 $5.03 $5.36 3500 June 2004 Yield in 2004 7.67% 4.86% 3000 Income generated over 2004-2005 $767 $486 2500 Value of holding in 2019 $7,654 $134,826 2000 1500 Stock price in 2019 $3.85 $72.24 June 2019 1000 Yield in 2019 6.82% 3.88% 500 Income generated over 2018-2019 $355 $3,906 0 2005 2007 2009 2011 2013 2015 2017 2019 Total income generated over 2004-2019 $11,559 $27,268 Telstra Ramsay Health Care But look at the difference between yield and long term income! Source: 67 stocks from the current S&P/ASX100 have the required 15 year price and dividend history. First Sentier Investors, Factset, IRESS. -

2017 Annual Report Year Ended 31 August 2017 Contents

2017 Annual Report Year ended 31 August 2017 Contents Chairman and Managing Director & CEO’s letter 5 Directors’ Report 7 Directors’ Details 8 Operating and Financial Review 12 Remuneration Report Introductory Message 47 Remuneration Report 49 Lead Auditor’s Independence Declaration 75 Financial Report Income Statements 78 Statements of Comprehensive Income 79 Balance Sheets 80 Statements of Changes In Equity 81 Statements of Cash Flows 85 Notes to the Financial Statements 86 Other Information Directors’ Declaration 143 Independent Auditor’s Report 144 Shareholding Details 148 Shareholder Information 151 5 Year Financial Summary 152 Glossary 153 Find out more: boq.com.au/annual_reports/2017 Continuing to deliver results for shareholders Cash Earnings Statutory Net Profit Profit Results after Tax after Tax ($ Millions) $378m $357m $360m $338m $352m $301m $318m $261m 2014 2015 2016 2017 CASH EARNINGS AFTER TAX STATUTORY NET PROFIT AFTER TAX 5% increase 4% increase in earnings from FY16 in earnings from FY16 $378m $352m Basic Cash Earnings Dividends Special Dividend Earnings & Dividends per ordinary share per ordinary share per ordinary share Net interest margin (Cents per ordinary share) 97.6 8 89.5 97.3 95.6 % 74 76 76 66 1.87 Down 7bps from FY16 2014 2015 2016 2017 BASIC CASH EARNINGS DIVIDENDS SPECIAL DIVIDEND Cash cost to PER ORDINARY SHARE PER ORDINARY SHARE PER ORDINARY SHARE (Cents per share) (Cents per share) (Cents per share) income ratio ¢ ¢ ¢ 97.6 76 8 % Up 2% from FY16 Unchanged from FY16 46.6 Down 20bps from FY16 Loan Impairment Expense ($ Millions) 86 Cash return on equity 74 67 48 10.4% Up 10bps from FY16 2014 2015 2016 2017 $48m Down 28% from FY16 Bank of Queensland Limited and its Controlled Entities 3 Delivering our strategy Our strategy is to focus on niche segments where customers value a more intimate banking relationship. -

Presentation 6 Months Ended 31St December 2020

Ramsay Health Care 2021 International Year of Health & Care Workers FY21 Interim Result Presentation 6 months ended 31st December 2020 Managing Director & CEO, Craig McNally Group Chief Financial Officer, Martyn Roberts ramsayhealth.com Important information The information in this presentation is general background information about Ramsay Health Care Limited and its subsidiaries (Ramsay Group) and their activities and is current as at 25 February 2021. It is in summary form and is not necessarily complete. It should be read together with the company’s unaudited consolidated financial statements lodged with the ASX on 25 February 2021. The information in this presentation is general information only and is not intended to be relied upon as advice to investors or potential investors and does not take into account your objectives, financial situation or needs. Investors should consult with their own legal, tax, business and/or financial advisers in connection with any investment decision. The information in this presentation is believed to be accurate at the time of compilation. Any views expressed in this presentation are opinions of the author at the time of presenting and do not constitute a recommendation to act. No person, including any member of the Ramsay Group, has any responsibility to update any of the information provided in this presentation. This presentation contains forward looking statements. These forward looking statements should not be relied upon as a representation or warranty, express or implied, as to future matters. Prospective financial information has been based on current expectations about future events and is, however, subject to risks, uncertainties, contingencies and assumptions that could cause actual results to differ materially from the expectations described in such prospective financial information. -

Submission to the Productivity Commission Inquiry Into Mental Health

Submission to the Productivity Commission Inquiry into Mental Health June 2019 SUBMISSION BY RAMSAY HEALTH CARE 1.0 EXECUTIVE SUMMARY Ramsay Health Care (Ramsay) appreciates the opportunity to provide this submission to the Federal Government’s Productivity Commission Inquiry (Inquiry) into mental health. In developing this submission, Ramsay draws on its 55 years of experience in the delivery of mental health both in Australia and in France, and across both private and public settings. Ramsay is the largest provider of private acute mental health services in Australia and the leading independent provider of public acute mental health services in France. This Inquiry could not have come sooner. While Australia has made progress in caring for mental health patients, a number of challenges remain namely: The number of patients with a diagnosed mental health condition is growing. One in five Australians will experience a mental health condition this year. Approximately 11.5% will have at least one diagnosed mental health condition and 8.5% will have two mental health diagnoses. There were more than 3100 deaths from suicide in 2017. People with mental illness have a lower average life expectancy than the general population, with significant comorbidity issues. Specifically, eating disorders have one of the highest mortality rates of any psychiatric illness and the number of presentations is growing There are sizeable gaps in services and supports for specific demographics, including youth, elderly, Indigenous Australians, individuals from culturally diverse backgrounds and carers of people with a mental illness A lack of continuity of care exists across the mental health continuum and for those with episodic conditions, who may need access to services on an irregular, or non- continuous basis; Delayed access to existing services is growing rapidly. -

Managing Director and CEO Appointment

Managing Director and CEO Appointment • Olivier Chretien appointed MD and CEO from 1 January 2021 • Current CEO Martin Earp and Deputy CEO Damien MacRae to assist with orderly handover InvoCare Limited (ASX: IVC, “InvoCare” or “the Company”) is pleased to announce the appointment of former Wesfarmers and Ramsay Health Care senior executive, Olivier Chretien, as Managing Director and Chief Executive Officer, effective [1 January 2021.] Mr Chretien was most recently Group Chief Strategy Officer at Ramsay Health Care (ASX: RHC). Prior to joining Ramsay to take on that role in 2018, he served in a range of senior executive and managing director roles at Wesfarmers Ltd (ASX: WES) between 2006 and 2017. Mr Chretien’s appointment follows the announcement in June this year that current Managing Director and CEO Martin Earp would not be seeking re-appointment upon conclusion of his six-year contract on 31 March 2021. When Mr Earp advised of his intention, the Board commenced a two-step process to identify a successor. This included the elevation of the Company’s well regarded Chief Operating Officer, Damien MacRae, to the position of Deputy CEO to identify a clear internal succession plan. The second step was the initiation of a formal executive search process, which considered a range of external candidates, as well as Mr MacRae. Mr Chretien was selected because of his demonstrable experience in various senior leadership roles within large ASX-listed, consumer-facing companies. InvoCare Chair, Bart Vogel, said: “Olivier has a proven record with successful P&L management, value creation, strategy design and execution in those roles over many years.