Scope Insights1 As a Means to Offer Investors a Positive Yield Experience

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

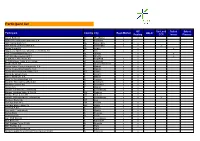

Participant List

Participant list GC SecLend Select Select Participant Country City Repo Market HQLAx Pooling CCP Invest Finance Aareal Bank AG D Wiesbaden x x ABANCA Corporaction Bancaria S.A E Betanzos x ABN AMRO Bank N.V. NL Amsterdam x x ABN AMRO Clearing Bank N.V. NL Amsterdam x x x Airbus Group SE NL Leiden x x Allgemeine Sparkasse Oberösterreich Bank AG A Linz x x ASR Levensverzekering N.V. NL Utrecht x x ASR Schadeverzekering N.V. NL Utrecht x x Augsburger Aktienbank AG D Augsburg x x B. Metzler seel. Sohn & Co. KGaA D Frankfurt x x Baader Bank AG D Unterschleissheim x x Banco Bilbao Vizcaya Argentaria, S.A. E Madrid x x Banco Cooperativo Español, S.A. E Madrid x x Banco de Investimento Global, S.A. PT Lisbon x x Banco de Sabadell S.A. E Alicante x x Banco Santander S.A. E Madrid x x Bank für Sozialwirtschaft AG D Cologne x x Bank für Tirol und Vorarlberg AG A Innsbruck x x Bankhaus Lampe KG D Dusseldorf x x Bankia S.A. E Madrid x x Banque Centrale du Luxembourg L Luxembourg x x Banque Lombard Odier & Cie SA CH Geneva x x Banque Pictet & Cie AG CH Geneva x x Banque Internationale à Luxembourg L Luxembourg x x x Bantleon Bank AG CH Zug x Barclays Bank PLC GB London x x Barclays Bank Ireland Plc IRL Dublin x x BAWAG P.S.K. A Vienna x x Bayerische Landesbank D Munich x x Belfius Bank B Brussels x x Berlin Hyp AG D Berlin x x BGL BNP Paribas L Luxembourg x x BKS Bank AG A Klagenfurt x x BNP Paribas Fortis SA/NV B Brussels x x BNP Paribas S.A. -

Succès De L'émission De L'obligation « Senior

COMMUNIQUE DE PRESSE Paris, le 15 juin 2020 La Banque Postale : succès de l’émission de l’obligation « Senior Non Préférée » de 750 M€ Dans le contexte de crise sanitaire et économique, La Banque Postale a émis avec succès une obligation « Senior Non Préférée » pour un montant de 750 M€. La maturité de 6 ans est assortie d’un coupon fixe de 0,50 % sur 5 ans, puis d'un coupon variable en cas de non exercice de l'option de rappel à l'année 5. Cette émission est conforme à la stratégie de La Banque Postale de renforcer ses ressources éligibles au MREL 1. Le carnet d’ordres final de la transaction atteint 2,5 Md€ (soit un taux de souscription de 3,3 fois par plus de 137 investisseurs différents), grâce à une forte demande des gestionnaires d’actifs. La répartition géographique du carnet d’ordres est bien diversifiée pour cette émission : France 40 %, Allemagne, Suisse & Autriche 22 %, Benelux 12 %, Angleterre & Irlande 10 %, Europe du Sud 9 %, Europe du Nord 6 %. La transaction, notée BBB+ par Fitch et BBB par S&P présente un spread final resserré à MS + 88 bp. La Banque Postale, BNP Paribas, Commerzbank, Citigroup, UBS Europe et UniCredit ont été mandatés par La Banque Postale en tant que co-chefs de file sur cette opération. 1 Minimum Requirement for own funds and eligible liabilities A propos de La Banque Postale La Banque Postale, forme avec ses filiales dont CNP Assurances, un grand groupe de bancassurance, filiale du Groupe La Poste, présent sur les marchés de la banque de détail, de l’assurance, de la banque de financement et de la gestion d’actifs. -

INVITATION Governor of the Banque De France, President of the Federal

INVITATION March 3, 2015 Governor of the Banque de France, President of the Federal Reserve Bank of Cleveland and more to Discuss Monetary Policy, Growth and Investment What: New Policies for the Post Crisis Era This full-day, public conference will explore monetary policy, Euro growth and investment, capital markets, and central banking in Europe through a series of sessions featuring premier international leaders in the economic and finance industry. When: March 23, 2015, from 8:30 a.m. to 3:45 p.m. Who: This event will feature Christian Noyer, governor of the Banque de France, Loretta J. Mester, president and CEO of the Federal Reserve Bank of Cleveland, Catherine Mann, chief economist of the Organisation for Economic Co-operation and Development, and Katarzyna Zajdel-Kurowska, member of the Board of the National Bank of Poland, as well as the following leaders and policymakers in finance and academia: • Filippo di Mauro, senior advisor of the research department, European Central Bank; • Daniel Fermon, head of cross asset thematic research, Societe Generale; • Patrick Foley, chief economist, Lloyds Banking Group; • Herve Goulletquer, head of strategy, La Banque Postale Asset Management; • David Kotok, CIO of Cumberland Advisors; • Steve Malin, director, U.S. investment strategist, Allianz Global Investors; • Gilles Noblet, deputy director-general of European and international relations, European Central Bank; • Debora Revoltella, director of the economics department, European Investment Bank; • Steve Sexauer, advisor to Allianz Global -

European Banks: IFRS 9 Impact on Bankfocus Research 17 June 2019 Bank Financials Is Manageable Irakli Pipia Xian (Peter) Li

European banks: IFRS 9 impact on BankFocus Research 17 June 2019 bank financials is manageable Irakli Pipia Xian (Peter) Li Leading European banks1 absorbed anticipated negative impact from the adoption of IFRS 9 without significant impact on their financials. In fact, asset quality and total provisioning coverage ratios improved across the board, despite contrary expectations. The negative impact from the adoption of IFRS 9 on regulatory CET 1 capital was most prominent for Spanish and Italian banks, but manageable for other European entities. • European banks adopted IFRS 9 accounting standards on 1 Impaired loans / Gross customer January 2018 which requires earlier recognition of credit loans & advances, YE 2018 vs losses compared to the existing IAS 39 accounting standards. YE 2017 (%) • Impaired loan (Stage 3) ratios improved under IFRS 9 compared to the same category as per IAS 39 standards for Company Name 2018 2017 Change almost all surveyed European banks (see exhibit). UniCredit 8.1 11.1 -3.0 Bankia 6.3 8.8 -2.5 • Consequently, the total provisioning coverage of impaired Caixa 4.8 6.2 -1.4 loans improved, while specific provisioning (Stage 3 Expected Sabadell 4.4 5.4 -1.0 Credit Losses vs Stage 3 loans) at 45% remains adequate as KBC 4.4 6.3 -1.9 at end-2018. BNP 4.3 5.0 -0.7 • Contrary to the original expectations, Loan loss reserves as BBVA 4.2 5.0 -0.8 percentage of Gross loans declined under IFRS 9, with the Intesa Sanpaolo 4.2 12.9 -8.7 accounting impact absorbed by banks’ regulatory capital. -

Breaking up with Bad Banks

BREAKING UP WITH BAD BANKS How Wall Street Makes It Hard to Leave Them – and How We Say Goodbye May 2021 1 Contents Introduction ..................................................................................................................................................... 2 Ideas for Change ............................................................................................................................................. 4 The Move Your Money Movement .............................................................................................................. 5 Obstacles to Moving Your Money ................................................................................................................ 6 Individuals ............................................................................................................................................ 7 Municipalities ....................................................................................................................................... 9 Making the Switch – ..................................................................................................................................... 12 Alternatives to Big Banks ..................................................................................................................... 12 How to Move Your Money ................................................................................................................... 15 Policy Changes to Remove Barriers to Switching Financial Institutions ............................................. -

Major Eurozone Banks Start the Implementation Phase of a New Unified Payment Scheme and Solution, the European Payment Initiative (EPI)

Internal EPI: The European Payments Initiative Press release Major Eurozone banks start the implementation phase of a new unified payment scheme and solution, the European Payment Initiative (EPI) Amsterdam, Berlin, Brussels, Frankfurt, Madrid, Munich, Paris, Valencia – 2 July 2020 Today, a group of 16 major European banks from five countries (Belgium, France, Germany, the Netherlands and Spain) paved the way for the future launch of the European Payments Initiative (EPI). The ambition of EPI is to create a unified pan-European payment solution leveraging Instant Payments/SEPA Instant Credit Transfer (SCT Inst), offering a card for consumers and merchants across Europe, a digital wallet and P2P payments. The solution aims to become a new standard means of payment for European consumers and merchants in all types of transactions including in-store, online, cash withdrawal and “peer-to-peer” in addition to existing international payment scheme solutions. A pan-European payment solution to bring concrete benefits to European merchants and consumers EPI’s objective is to offer a digital payment solution that can be used anywhere in Europe and to supersede the fragmented landscape that currently still exists. In doing so, EPI founders are responding to merchant and consumer communities that have been calling for payment initiatives to take a more pan-European approach. EPI will first and foremost benefit European citizens, possibly boosting innovation in the world of payments. More than 50% of retail payment transactions in Europe are still done by cash today. The EPI solution will also bring tangible benefits to European merchants, by offering them a seamless, competitive and unified payment solution for the whole of Europe that is also available to all European consumers. -

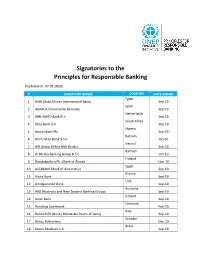

Signatories to the Principles for Responsible Banking

Signatories to the Principles for Responsible Banking (Updated on: 07.09.2020) # SIGNATORY BANKS COUNTRY DATE SIGNED Egypt 1 AAIB (Arab African International Bank) Sep-19 Spain 2 ABANCA Corporación Bancaria Sep-19 Netherlands 3 ABN AMRO Bank N.V. Sep-19 South Africa 4 Absa Bank Ltd. Sep-19 Nigeria 5 Access Bank Plc Sep-19 Bahrain 6 Ahli United Bank B.S.C Jan-20 Ireland 7 AIB Group (Allied Irish Banks) Sep-19 Bahrain 8 Al Baraka Banking Group B.S.C. Oct-19 Finland 9 Ålandsbanken Plc. (Bank of Åland) Nov-19 Egypt 10 ALEXBANK (Bank of Alexandria) Sep-19 Greece 11 Alpha Bank Sep-19 USA 12 Amalgamated Bank Sep-19 Australia 13 ANZ (Australia and New Zealand Banking Group) Sep-19 Iceland 14 Arion Bank Sep-19 Denmark 15 Aurskorg Sparebank Feb-20 Italy 16 Banca MPS (Banca Monte dei Paschi di Siena) Sep-19 Ecuador 17 Banco Bolivariano Dec-19 Brazil 18 Banco Bradesco S.A. Sep-19 Brazil 19 Banco da Amazônia Jan-20 Argentina 20 Banco de Galicia y Buenos Aires SA Sep-19 Ecuador 21 Banco de la Produccion S.A Produbanco Sep-19 Ecuador 22 Banco de Machala S.A. Sep-19 Mexico 23 Banco del Bajio, S.A. Aug-20 Ecuador 24 Banco Diners Club del Ecuador S.A. Nov-19 Nicaragua 25 Banco Grupo Promerica Nicaragua Sep-19 Ecuador 26 Banco Guayaquil Sep-19 El Salvador 27 Banco Hipotecario de El Salvador S.A. Sep-19 Ecuador 28 Banco Pichincha Sep-19 Dominican Republic 29 Banco Popular Dominicano Sep-19 Costa Rica 30 Banco Promerica Costa Rica Sep-19 Paraguay 31 Banco Regional Jul-20 Spain 32 Banco Sabadell Sep-19 Ecuador 33 Banco Solidario Nov-19 Colombia 34 Bancolombia -

Banques : Des Engagements Climats À Prendre Au 4 Degré

1 | Banques : des engagements climats à prendre au 4e degré Rédaction : Alexandre Poidatz (Oxfam France). Relecture : Cécile Duflot, Noélie Coudurier, Nicolas Vercken, Armelle Le Comte (Oxfam France), Louis Vidal, Léo Garnier (LITA), Lorette Phillipot (les Amis de la Terre France), Wojtek Kalinowski, Julien Hallak (Institut Veblen), des membres de l’équipe Carbon4 Finance. Les données unitaires sur l’empreinte carbone des banques françaises ont été fournies par la société Carbon4 Finance et font partie de leur offre Carbon Impact Analytics. Carbon4 Finance ne peut être tenu responsable des positions prises dans ce document. Conception graphique sur logiciels libres : Figures Libres Octobre 2020 – © Oxfam France | @oxfamfrance Les informations contenues dans ce document étaient correctes au moment de la mise sous presse. OXFAM FRANCE : 62 bis, avenue Parmentier, 75011 Paris Tél : 01 56 98 24 40 / [email protected] Oxfam France @oxfamfrance Banques : des engagements climats à prendre au 4e degré | 2 RÉSUMÉ EXÉCUTIF lors que s’ouvre les Climate Finance Days à Paris le 29 octobre 2020, Oxfam France lève le voile sur l'empreinte carbone colossale des banques françaises, qui repré- sente près de 8 fois les émissions de gaz à effet de serre de la France entière1. Les A émissions de gaz à effet de serre issues des activités de financement et d’investis- sement des six principales banques françaises – BNP Paribas, Crédit Agricole, Société Géné- rale, BPCE2, Crédit Mutuel et la Banque Postale – atteignent 3,3 milliards de tonnes équivalent CO2 par an. Chacune des deux premières banques françaises a, à elle seule, une empreinte car- bone deux fois supérieure à celle du territoire français. -

List of Private Placements Identified in Markit Iboxx EUR Benchmark

List of Private Placements identified in Markit iBoxx EUR Benchmark Currency ISIN BB Ticker Issuer Name Coupon Maturity Exclusion date EUR ES0370148001 AYTCED AyT Cedulas Cajas V Fondo de Titulizacion de Activos 4.500 12-Apr-2013 31-Dec-2003 EUR ES0347859003 IMCEDI IM Cedulas 2 4.500 11-Jun-2014 30-Nov-2006 EUR XS0315528850 ACAFP Credit Agricole SA/London 5.065 10-Aug-2022 31-Aug-2007 EUR XS0323922376 AXASA AXA SA 6.211 05-Oct-2017 31-Oct-2007 until 31-March-2008 ¹ EUR XS0338428302 ACAFP Credit Agricole SA/London 14.000 27-Dec-2017 31-Jan-2008 EUR FR0010564161 ACAFP Credit Agricole SA/London 7.625 27-Dec-2012 31-Jan-2008 EUR XS0353791345 MCD McDonald's Corp 5.000 26-Mar-2015 31-Mar-2008 EUR XS0348747865 GS Goldman Sachs Group Inc 4.050 31-Mar-2014 30-Apr-2008 EUR XS0372196062 SANTAN Santander International Debt SA 6.070 27-Jun-2011 30-Jun-2008 EUR XS0372196229 SANTAN Santander International Debt SA 6.010 30-Jun-2010 30-Jun-2008 EUR DE000BLB5KE1 BYLAN Bayerische Landesbank 5.000 10-Jun-2011 30-Jun-2008 EUR DE000BLB5KH4 BYLAN Bayerische Landesbank 5.750 11-Jun-2010 30-Jun-2008 EUR DE000LBW0YV2 LBBW Landesbank Baden-Wuerttemberg 5.750 10-Jun-2010 30-Jun-2008 EUR DE000HLB1MB6 HESLAN Landesbank Hessen-Thueringen Girozentrale 5.625 23-Jun-2011 30-Jun-2008 EUR DE000WLB8KX0 WESTLB WestLB AG 6.000 11-Mar-2010 30-Jun-2008 EUR DE000NLB4C30 NDB Norddeutsche Landesbank Girozentrale AG 5.750 11-Jun-2010 31-Jul-2008 EUR ES0316988007 CEDGBP Cedulas Grupo Banco Popular 4 5.750 25-Jun-2010 31-Jul-2008 EUR XS0364907641 CS Credit Suisse/London 4.000 30-Jun-2014 -

Dexia – Rise & Fall of a Banking Giant ______

DEXIA – RISE & FALL OF A BANKING GIANT __________________________________________________ LES ETUDES DU CLUB N° 100 DECEMBRE 2013 DEXIA – RISE & FALL OF A BANKING GIANT __________________________________________________ LES ETUDES DU CLUB N° 100 DECEMBRE 2013 Etude réalisée par Monsieur Nicholas Whitbeck (HEC 2013) sous la direction de Monsieur Ulrich Hege Professeur à HEC Paris Introduction .................................................................................................................................................... 3 I. How Dexia conquered the world ............................................................................................................ 4 A. Marriage of convenience ............................................................................................................................................... 4 B. Consolidation .................................................................................................................................................................. 6 C. Expansion in all directions ........................................................................................................................................... 8 D. Kempen & Labouchère – Dexia’s first warnings ................................................................................................... 10 E. Short-term liabilities fuelled the expansion of Dexia’s balance sheet ................................................................. 11 F. Under the leadership of Axel Miller, Dexia continued -

As of 10/31/2020

Annual Report | October 31, 2020 Vanguard Total International Bond Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard. -

IIGCC’S Membership Includes a Broad Range of Asset Owners and Asset Managers

toggle menu Skip to content About us Our members Our board Our team Annual reports Vacancies Our work Policy programme Corporate programme Investor Practices programme Property programme Initiatives & collaborations Become a member Resources Events News Contact us Members login Our members Our board Our team Annual reports Vacancies Our members About Us Menu Our members Our board Our team Annual reports Vacancies 200+ Members 15 Countries represented €30tn in assets IIGCC’s membership includes a broad range of asset owners and asset managers. This includes many of the largest global and European institutional investors and asset managers. Reflecting the significance of climate change as an issue for the investor community and the impact of our work, our membership continues to grow. Click on the link below to find out more on the benefits of joining the IIGCC. Become a member Many of our members are based in Europe Investor members a. s. r. Asset Management Aberdeen Standard Investments ACTIAM NV Aegon NL Aeon Investments Limited AEW Allianz Global Investors Allianz Investment Management Amundi Asset Management AP Moller Capital AP Pension AP1 – Första AP-fonden AP2 – Andra AP-fonden AP3 – Tredje AP-fonden AP4 – Fjarde AP-fonden AP7 – Sjunde AP-fonden APG Asset Management Arisaig Partners (Asia) PTE Ltd Asper Investment Management Atlas Infrastructure ATP AustralianSuper Aviva Investors AXA Investment Managers Baillie Gifford & Co BBC Pension Trust Bedfordshire Pension Fund BlackRock BMO Global Asset Management (EMEA) BNP Paribas Asset