Le Groupe La Poste 2021 Half-Year Financial Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PIP – Market Environment PIP – Pressure

Bernhard BukovcBernhard Bukovc The New Postal Ecosystem PIP – market environment PIP – pressure Mail volumes Costs Political expectations Organization ICT developments Market expectations Competition PIP – mail volumes > 5 % < 5 % + Post Danmark Deutsche Post DHL China Post Poste Italiane Australia Post Luxembourg Post Correos Swiss Post Itella Le Groupe La Poste Austria Post Hongkong Post PTT Turkish Post Correios Brasil Pos Indonesia Posten Norge NZ Post Thailand Post India Post Singapore Post PostNL Japan Post PIP – parcel volumes - + Mainly due to domestic Average growth rates per year economic problems (e.g. a between 4 – 6 % general decline or lower growth levels of eCommerce) PIP – eCommerce growth 20 - 30 China, Belgium, Turkey, Russia, India, Indonesia 15 – 20 % 10 - 20 Australia, Italy, Canada, Germany, Thailand, France, US online retail sales 0 - 10 Japan, Netherlands, annual growth until 2020 Switzerland, UK PIP – opportunities PIP – some basic questions What is the role of a postal operator in society ? What is its core business ? PIP – some basic questions What is the postal DNA ? PIP – bringing things from A to B PIP – intermediary physical financial information B 2 B 2 C 2 C 2 G PIP – challenges PIP – main challenges • Remaining strong & even growing the core business • Diversification into areas where revenue growth is possible • Expansion along the value chain(s) of postal customers • Being a business partner to consumers, businesses & government • Embracing technology PIP – diversification Mail Parcel & Financial Retail IT services Logistics & Telecom Express services freight PIP – value chain Sender Post Receiver PIP – value chain mail Sender Post Receiver Add value upstream Add value downstream • Mail management services • CRM • Printing and preparation • Choice • Marketing • Response handling • Data etc. -

Conditions Specifiques De La Boutique (Particuliers) Chapitre I

CONDITIONS SPECIFIQUES DE LA BOUTIQUE (PARTICULIERS) CHAPITRE I - DISPOSITIONS COMMUNES ARTICLE 1. DEFINITIONS « Abonnement Mobilité (AM) » : désigne le SeL qui permet au Client de faire garder son courrier par La Poste ou de le faire suivre vers une adresse provisoire. « Adresse de courrier électronique » : désigne l’adresse de courrier électronique renseignée par l’Utilisateur lors de la phase de création d’un Compte sur la Boutique et sur laquelle lui sera transmis, notamment, le courrier électronique de confirmation d’Inscription et toute notification ultérieure (alerte, avis de réception, …). « Articles » : pour les besoins du Contrat, désigne les SeL et les Produits. « Avis de réception » : désigne le document généré par La Poste, en charge de l’acheminement de la (LReLN). Lors de l’envoi d’une LReLN le Client opte de recourir, ou non à l’Avis de réception. « Boutique » : désigne la boutique web de la Poste accessible via le Site et qui regroupe l’offre de Produits et de Services en Ligne. « Client » : désigne toute personne physique disposant de la pleine capacité juridique ayant ouvert un Compte sur la Boutique. « Compte » : désigne le compte individuel d’un Client ouvert sur la Boutique, dont la création est une étape obligatoire, gratuite et préalable à l’utilisation de la Boutique en vue d’un achat. Ce compte regroupe les données personnelles du Client et les données relatives à la consommation de ses Articles. Il permet au Client de s’identifier (en saisissant son Adresse de courrier électronique et son Mot de passe) et d’accéder à un espace réservé lui permettant d’utiliser et de gérer ses commandes. -

Alessandra Fratini [email protected]

WebConference on postal, delivery and ecommerce economics and policy 19 May 2020 Summary I. Role of the State/State aid: overview of measures & legal bases 1. Non-aid 2. Compensation of USO 3. Compensation of other SGEIs provided by postal operators or via postal network 4. Pension relief 5. State guarantees 6. Other measures II. Role of the State/State aid in COVID-19 times 1. Temporary Framework: liquidity measures, recapitalisation? 2. FDI screening? 2 Measures&legal bases 1/6 1 Measures not constituting State aid Poste Italiane: remuneration of current account deposited with Treasury (2008, 2019: no advantage); remuneration for distribution of postal saving products (2006: MEIP; 2008: Altmark 4) Royal Mail: 3 loans measures (2009: MEIP) bpost: 2 capital injections (2003, 2012: MEIP) Correos: 3 capital injections (2018: MEIP) Post Danmark: capital injection by PostNord; VAT exemption under Article 132(1)(a) of VAT Directive (2018: not imputable to State) 3 Measures&legal bases 2/6 2 Compensation of USO - Article 106(2) TFUE 1. Poczta Polska: 2006, 2009, 2015 (compensation fund) 2. ELTA: 2003, 2012, 2014 (compensation fund withdrawn) 3. Poste Italiane: 2002, 2008, 2012, 2015 4. bpost: 2003, 2015 5. Correos: 2018, 2020 6. Czech Post: 2018 7. Post Danmark: 2018 4 Measures&legal bases 3/6 Compensation of other SGEIs - Article 106(2) TFUE 3 AnPost: 2002 (counter network) Posten AB: 2002 (basic cashier services) Post Office Ltd: 2007, 2010, 2012, 2015, 2018 (post offices network and over-the-counter access to a set of services) Poste -

Research for Tran Committee

STUDY Requested by the TRAN committee Postal services in the EU Policy Department for Structural and Cohesion Policies Directorate-General for Internal Policies PE 629.201 - November 2019 EN RESEARCH FOR TRAN COMMITTEE Postal services in the EU Abstract This study aims at providing the European Parliament’s TRAN Committee with an overview of the EU postal services sector, including recent developments, and recommendations for EU policy-makers on how to further stimulate growth and competitiveness of the sector. This document was requested by the European Parliament's Committee on Transport and Tourism. AUTHORS Copenhagen Economics: Henrik BALLEBYE OKHOLM, Martina FACINO, Mindaugas CERPICKIS, Martha LAHANN, Bruno BASALISCO Research manager: Esteban COITO GONZALEZ, Balázs MELLÁR Project and publication assistance: Adrienn BORKA Policy Department for Structural and Cohesion Policies, European Parliament LINGUISTIC VERSIONS Original: EN ABOUT THE PUBLISHER To contact the Policy Department or to subscribe to updates on our work for the TRAN Committee please write to: [email protected] Manuscript completed in November 2019 © European Union, 2019 This document is available on the internet in summary with option to download the full text at: http://bit.ly/2rupi0O This document is available on the internet at: http://www.europarl.europa.eu/thinktank/en/document.html?reference=IPOL_STU(2019)629201 Further information on research for TRAN by the Policy Department is available at: https://research4committees.blog/tran/ Follow us on Twitter: @PolicyTRAN Please use the following reference to cite this study: Copenhagen Economics 2019, Research for TRAN Committee – Postal Services in the EU, European Parliament, Policy Department for Structural and Cohesion Policies, Brussels Please use the following reference for in-text citations: Copenhagen Economics (2019) DISCLAIMER The opinions expressed in this document are the sole responsibility of the author and do not necessarily represent the official position of the European Parliament. -

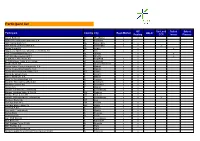

Participant List

Participant list GC SecLend Select Select Participant Country City Repo Market HQLAx Pooling CCP Invest Finance Aareal Bank AG D Wiesbaden x x ABANCA Corporaction Bancaria S.A E Betanzos x ABN AMRO Bank N.V. NL Amsterdam x x ABN AMRO Clearing Bank N.V. NL Amsterdam x x x Airbus Group SE NL Leiden x x Allgemeine Sparkasse Oberösterreich Bank AG A Linz x x ASR Levensverzekering N.V. NL Utrecht x x ASR Schadeverzekering N.V. NL Utrecht x x Augsburger Aktienbank AG D Augsburg x x B. Metzler seel. Sohn & Co. KGaA D Frankfurt x x Baader Bank AG D Unterschleissheim x x Banco Bilbao Vizcaya Argentaria, S.A. E Madrid x x Banco Cooperativo Español, S.A. E Madrid x x Banco de Investimento Global, S.A. PT Lisbon x x Banco de Sabadell S.A. E Alicante x x Banco Santander S.A. E Madrid x x Bank für Sozialwirtschaft AG D Cologne x x Bank für Tirol und Vorarlberg AG A Innsbruck x x Bankhaus Lampe KG D Dusseldorf x x Bankia S.A. E Madrid x x Banque Centrale du Luxembourg L Luxembourg x x Banque Lombard Odier & Cie SA CH Geneva x x Banque Pictet & Cie AG CH Geneva x x Banque Internationale à Luxembourg L Luxembourg x x x Bantleon Bank AG CH Zug x Barclays Bank PLC GB London x x Barclays Bank Ireland Plc IRL Dublin x x BAWAG P.S.K. A Vienna x x Bayerische Landesbank D Munich x x Belfius Bank B Brussels x x Berlin Hyp AG D Berlin x x BGL BNP Paribas L Luxembourg x x BKS Bank AG A Klagenfurt x x BNP Paribas Fortis SA/NV B Brussels x x BNP Paribas S.A. -

European Postal Services and Social Responsibilities

European Postal Services and Social Responsibilities How post offices enhance their economic, social and environmental role in society With the support of the European Social Fund, PIC Adapt With the support of European © Olivier Cahay in cooperation with with the support of www.csreurope.org This report was prepared byCSR Europe in cooperation with the Corporate Citizenship Company in the framework of a yearlong project initiated by La Poste and with the support of the EU ADAPT Programme 3 4 European Postal Services and Social Responsibilities 35 6 TABLE OF CONTENTS Acknowledgments Foreword 7 Executive summary 10 1. Introduction: background, methodology and aim of the report 12 2. Trends in Corporate Social Responsibility at European and international levels 2.1 A new paradigm in Europe 14 2.2 Corporate Social Responsibility – drivers of change 14 2.3 CSR – an evolving approach 16 2.4 Developments at European and international levels 17 3. Debate over developments in the European postal sector 3.1 Internal market for European postal services 19 3.2 Universal service safeguards 20 3.3 Pan-European co-ordination 20 3.4 Future trends 21 4. Social responsibility in action 4.1 Diversity and equal opportunity in the workforce 23 4.2 Training and career development 26 4.3 Health and safety 29 4.4 Social dialogue and employee consultation 31 4.5 Access to services for disadvantaged groups and local regeneration 32 4.6 Community involvement and charities 34 4.7 Environment 35 5. Going forwa r d: conclusions and rec o m m e n d a t i o n s 39 Appendix: The research process and roundtable discussions 41 Disclaimer: while every effort has been made to check that the contents of this report were correct at time of printing, the publishers retain sole responsibility for the contents. -

Succès De L'émission De L'obligation « Senior

COMMUNIQUE DE PRESSE Paris, le 15 juin 2020 La Banque Postale : succès de l’émission de l’obligation « Senior Non Préférée » de 750 M€ Dans le contexte de crise sanitaire et économique, La Banque Postale a émis avec succès une obligation « Senior Non Préférée » pour un montant de 750 M€. La maturité de 6 ans est assortie d’un coupon fixe de 0,50 % sur 5 ans, puis d'un coupon variable en cas de non exercice de l'option de rappel à l'année 5. Cette émission est conforme à la stratégie de La Banque Postale de renforcer ses ressources éligibles au MREL 1. Le carnet d’ordres final de la transaction atteint 2,5 Md€ (soit un taux de souscription de 3,3 fois par plus de 137 investisseurs différents), grâce à une forte demande des gestionnaires d’actifs. La répartition géographique du carnet d’ordres est bien diversifiée pour cette émission : France 40 %, Allemagne, Suisse & Autriche 22 %, Benelux 12 %, Angleterre & Irlande 10 %, Europe du Sud 9 %, Europe du Nord 6 %. La transaction, notée BBB+ par Fitch et BBB par S&P présente un spread final resserré à MS + 88 bp. La Banque Postale, BNP Paribas, Commerzbank, Citigroup, UBS Europe et UniCredit ont été mandatés par La Banque Postale en tant que co-chefs de file sur cette opération. 1 Minimum Requirement for own funds and eligible liabilities A propos de La Banque Postale La Banque Postale, forme avec ses filiales dont CNP Assurances, un grand groupe de bancassurance, filiale du Groupe La Poste, présent sur les marchés de la banque de détail, de l’assurance, de la banque de financement et de la gestion d’actifs. -

Position Paper

Page 1/5 POSITION PAPER The ECORYS Study on “Development of competition in the European postal sector” 22 March 2006 PostEurop, the Association of 43 Postal Operators, holders of the Universal Service Obligation at national as well as at international level, through its Postal Directive Working Group, has followed with attention the progress and the outcome of the Study performed by ECORYS for the European Commission (DG Markt) titled : “The development of competition in the European postal sector”1. The Study has been made public in mid-August 2005. The European Commission hosted a workshop on 10 October 2005 during which ECORYS described the main results of its study. PostEurop has already taken the opportunity to issue its opinions on the progress of the ECORYS study and refers therefore to its existing Opinion Paper of 15 June 20052. Following the invitation of the European Commission, PostEurop is pleased to have the opportunity to convey the following position observations in order to positively contribute to the further definition of Community postal policy. 1. GENERAL REMARKS At first sight the study provides a fresh view on current developments within the European postal sector as well as its (possible) future. The report’s uniqueness lies in the fact that it combines up-to- date knowledge of postal companies, their processes, the markets they serve, current and potential competitive forces, strategic options and the impact of liberalisation to draw a picture of the possible future of the European postal sector. ECORYS is considering the development of competition on the upstream markets as an indicator of the overall process of liberalisation. -

PROYECTO 7 RCI.Indd

PUBLIC EXPENDITURE EVALUATION 2018 PROJECT 7 (CORREOS) STUDY REPORT ON THE EVALUATION OF SOCIEDAD ESTATAL CORREOS Y TELÉGRAFOS, AND PROVISION OF THE UNIVERSAL POSTAL SERVICE The Independent Authority for Fiscal Responsibility (AIReF by its Spanish acronym) was created with the mission of ensuring strict compliance with the principles of budgetary stability and financial sustainability set out in article 135 of the Spanish Constitution. AIReF Contact C./ José Abascal, 2, 2.ª planta 28003 Madrid Tel. +34 910 100 599 Email: [email protected] Web: www.airef.es This document may be used and reproduced, in whole or in part, provided its source is acknowledged as AIReF. CONCLUSION OF THE EVALUATION In the context of the Spending Review carried out by AIReF in 2018, the provision of the Universal Postal Service –UPS UPS) by Sociedad Estatal Correos y Telégrafos, SA (hereinafter referred to as Correos) has been evaluated. The UPS is the set of postal services subject to public service obligations (PSO) and that must be provided permanently throughout the national territory and at an affordable price for all users. The State has entrusted Correos with the provision of this service for the period from 2011 to 2026. Correos receives compensation for the financial burden borne from providing this service. This study analyses the strategy and procedure for determining the public cost and conditions for the provision of the UPSUPS in the 2011-2020 period. In addition, the efficiency of the designated operator is also studied, as the amount of compensation depends on this. Currently, the service delivery plan implemented by the current Postal Law (2010) is pending approval and the UPS is compensated by instalment payments. -

INVITATION Governor of the Banque De France, President of the Federal

INVITATION March 3, 2015 Governor of the Banque de France, President of the Federal Reserve Bank of Cleveland and more to Discuss Monetary Policy, Growth and Investment What: New Policies for the Post Crisis Era This full-day, public conference will explore monetary policy, Euro growth and investment, capital markets, and central banking in Europe through a series of sessions featuring premier international leaders in the economic and finance industry. When: March 23, 2015, from 8:30 a.m. to 3:45 p.m. Who: This event will feature Christian Noyer, governor of the Banque de France, Loretta J. Mester, president and CEO of the Federal Reserve Bank of Cleveland, Catherine Mann, chief economist of the Organisation for Economic Co-operation and Development, and Katarzyna Zajdel-Kurowska, member of the Board of the National Bank of Poland, as well as the following leaders and policymakers in finance and academia: • Filippo di Mauro, senior advisor of the research department, European Central Bank; • Daniel Fermon, head of cross asset thematic research, Societe Generale; • Patrick Foley, chief economist, Lloyds Banking Group; • Herve Goulletquer, head of strategy, La Banque Postale Asset Management; • David Kotok, CIO of Cumberland Advisors; • Steve Malin, director, U.S. investment strategist, Allianz Global Investors; • Gilles Noblet, deputy director-general of European and international relations, European Central Bank; • Debora Revoltella, director of the economics department, European Investment Bank; • Steve Sexauer, advisor to Allianz Global -

European Banks: IFRS 9 Impact on Bankfocus Research 17 June 2019 Bank Financials Is Manageable Irakli Pipia Xian (Peter) Li

European banks: IFRS 9 impact on BankFocus Research 17 June 2019 bank financials is manageable Irakli Pipia Xian (Peter) Li Leading European banks1 absorbed anticipated negative impact from the adoption of IFRS 9 without significant impact on their financials. In fact, asset quality and total provisioning coverage ratios improved across the board, despite contrary expectations. The negative impact from the adoption of IFRS 9 on regulatory CET 1 capital was most prominent for Spanish and Italian banks, but manageable for other European entities. • European banks adopted IFRS 9 accounting standards on 1 Impaired loans / Gross customer January 2018 which requires earlier recognition of credit loans & advances, YE 2018 vs losses compared to the existing IAS 39 accounting standards. YE 2017 (%) • Impaired loan (Stage 3) ratios improved under IFRS 9 compared to the same category as per IAS 39 standards for Company Name 2018 2017 Change almost all surveyed European banks (see exhibit). UniCredit 8.1 11.1 -3.0 Bankia 6.3 8.8 -2.5 • Consequently, the total provisioning coverage of impaired Caixa 4.8 6.2 -1.4 loans improved, while specific provisioning (Stage 3 Expected Sabadell 4.4 5.4 -1.0 Credit Losses vs Stage 3 loans) at 45% remains adequate as KBC 4.4 6.3 -1.9 at end-2018. BNP 4.3 5.0 -0.7 • Contrary to the original expectations, Loan loss reserves as BBVA 4.2 5.0 -0.8 percentage of Gross loans declined under IFRS 9, with the Intesa Sanpaolo 4.2 12.9 -8.7 accounting impact absorbed by banks’ regulatory capital. -

Delivering Letters and Parcels in Europe: Trends & Challenges In

Delivering letters and parcels in Europe: Trends & challenges in postal operations Antonia Niederprüm 10 December 2019 18th Königswinter Postal Seminar 0 Developments in postal operations before the e-commerce boom Outward Transpor- Inward Collection Delivery sorting tation sorting Sorting Sorting Delivery Depots centre centre office <<<<<<< <<< . Emphasis on cost savings / improvements in productivity and efficiency . Consolidation of letter volume in sorting centres and maximise automation . Sequence sorting of letters by machine . Optimize delivery organisation to reduce the number of postmen in the last mile . Parcel business much smaller than letter business at many postal operators 1 B2C e-commerce transforms postal operations Pattern of developments in postal operations Reducing the capacity in Expanding the capacity in letter operations parcel operations Step of Step of development development Optimise joint Optimise joint Letter delivery Parcel delivery delivery delivery Delivery: Increase Delivery: Increase flexibility flexibility Letter Modernise Parcel Modernise processing automation processing automation and and De-centralise transport Centralise sorting transport sorting Time Time Postal operators are slowly transforming from postal companies with parcel delivery to parcel companies with letter delivery 2 Sorting facilities Reducing capacity in letter operations Expanding capacity in parcel operations . Fewer letter sorting centres due to . More parcel sorting centres and further . Less letter post volume expansion planned . Declining share of priority letters delivered the . Trend to combined sorting centres & delivery next working day offices for parcels and to more direct transports . Reduced footprint of (modern) sorting machines . To accelerate delivery (D+1 as standard) . Fewer delivery offices . To more flexibly increase sorting capacities Outward Transpor- Inward . Indoor and outdoor delivery activities are separated Collection Delivery sorting tation sorting and assigned to different employees .