Breaking up with Bad Banks

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Brief History of Occupy Wall Street ROSA LUXEMBURG STIFTUNG NEW YORK OFFICE by Ethan Earle Table of Contents

A Brief History of Occupy Wall Street ROSA LUXEMBURG STIFTUNG NEW YORK OFFICE By Ethan Earle Table of Contents Spontaneity and Organization. By the Editors................................................................................1 A Brief History of Occupy Wall Street....................................................2 By Ethan Earle The Beginnings..............................................................................................................................2 Occupy Wall Street Goes Viral.....................................................................................................4 Inside the Occupation..................................................................................................................7 Police Evictions and a Winter of Discontent..............................................................................9 How to Occupy Without an Occupation...................................................................................10 How and Why It Happened........................................................................................................12 The Impact of Occupy.................................................................................................................15 The Future of OWS.....................................................................................................................16 Published by the Rosa Luxemburg Stiftung, New York Office, November 2012 Editors: Stefanie Ehmsen and Albert Scharenberg Address: 275 Madison Avenue, Suite 2114, -

Automated Clearing House (ACH) Agreement

Automated Clearing House (ACH) Agreement P.O. Box 189, Middlebury, Vermont 05753-0189 www.nbmvt.com Phone: 1-802-388-4982 THIS AGREEMENT is made this _______ day of ___________________, 20_____, by and between _____________________________________________________________ (“Company”) and National Bank of Middlebury of Middlebury, Vermont, (“Bank”). This agreement is governed by the laws of the State of Vermont. The Company has requested that the Bank permit it to initiate electronic signals for paperless entries through the Bank to accounts maintained at the Bank and in other banks and financial institutions, by means of the Automated Clearing House (“ACH”). NOW, THEREFORE, in consideration of the mutual promises contained herein, it is agreed as follows— 1. The Bank will transmit the credit and/or debit entries initiated by the Company to the ACH as provided in the ACH Rules (“Rules”), as in effect from time to time and this Agreement. An ACH Rule Book is available upon request from the Bank. Please contact the Bank with any questions about compliance with the ACH Rules. The Bank reserves the right to audit the Company to ensure compliance with the ACH Rules. 2. The Company will comply with the Rules insofar as applicable. The specific duties of the Company provided in the following paragraphs of this Agreement in no way limit the foregoing undertaking. The Company (Originator) will not initiate entries that violate the laws of the United States, which includes Office of Foreign Asset Control sanctions (OFAC). Website: www.treas.gov/ofac/ 3. The Company will obtain written authorization for consumer entries, shall provide a copy to the consumer, and shall retain the original for two (2) years after termination or revocation of such authorization. -

Geopolitics, Oil Law Reform, and Commodity Market Expectations

OKLAHOMA LAW REVIEW VOLUME 63 WINTER 2011 NUMBER 2 GEOPOLITICS, OIL LAW REFORM, AND COMMODITY MARKET EXPECTATIONS ROBERT BEJESKY * Table of Contents I. Introduction .................................... ........... 193 II. Geopolitics and Market Equilibrium . .............. 197 III. Historical U.S. Foreign Policy in the Middle East ................ 202 IV. Enter OPEC ..................................... ......... 210 V. Oil Industry Reform Planning for Iraq . ............... 215 VI. Occupation Announcements and Economics . ........... 228 VII. Iraq’s 2007 Oil and Gas Bill . .............. 237 VIII. Oil Price Surges . ............ 249 IX. Strategic Interests in Afghanistan . ................ 265 X. Conclusion ...................................... ......... 273 I. Introduction The 1973 oil supply shock elevated OPEC to world attention and ensconced it in the general consciousness as a confederacy that is potentially * M.A. Political Science (Michigan), M.A. Applied Economics (Michigan), LL.M. International Law (Georgetown). The author has taught international law courses for Cooley Law School and the Department of Political Science at the University of Michigan, American Government and Constitutional Law courses for Alma College, and business law courses at Central Michigan University and the University of Miami. 193 194 OKLAHOMA LAW REVIEW [Vol. 63:193 antithetical to global energy needs. From 1986 until mid-1999, prices generally fluctuated within a $10 to $20 per barrel band, but alarms sounded when market prices started hovering above $30. 1 In July 2001, Senator Arlen Specter addressed the Senate regarding the need to confront OPEC and urged President Bush to file an International Court of Justice case against the organization, on the basis that perceived antitrust violations were a breach of “general principles of law.” 2 Prices dipped initially, but began a precipitous rise in mid-March 2002. -

4. Role of Multilateral Banks and Export Credit Agencies in Trade Finance 34 5

Revitalising Trade Finance: Development Banks and Export Credit Agencies at the Vanguard EXPORT-IMPORT BANK OF INDIA WORKING PAPER NO. 71 REVitaLISING TRADE FINANCE: DEVELOPMENT BANKS AND Export CREDIT AGENCIES at THE VangUARD EXIM Bank’s Working Paper Series is an attempt to disseminate the findings of research studies carried out in the Bank. The results of research studies can interest exporters, policy makers, industrialists, export promotion agencies as well as researchers. However, views expressed do not necessarily reflect those of the Bank. While reasonable care has been taken to ensure authenticity of information and data, EXIM Bank accepts no responsibility for authenticity, accuracy or completeness of such items. © Export-Import Bank of India February 2018 1 Export-Import Bank of India Revitalising Trade Finance: Development Banks and Export Credit Agencies at the Vanguard 2 Export-Import Bank of India Revitalising Trade Finance: Development Banks and Export Credit Agencies at the Vanguard CONTENTS Page No. List of Figures 5 List of Tables 7 List of Boxes 7 Executive Summary 9 1. Introduction 16 2. Review of Trade Finance Market 19 3. Challenges to Trade Finance 26 4. Role of Multilateral Banks and Export Credit Agencies in Trade Finance 34 5. Way Ahead 44 Project Team: Mr. Ashish Kumar, Deputy General Manager, Research and Analysis Group Ms. Jahanwi, Manager, Research and Analysis Group 3 Export-Import Bank of India Revitalising Trade Finance: Development Banks and Export Credit Agencies at the Vanguard 4 Export-Import Bank of India Revitalising Trade Finance: Development Banks and Export Credit Agencies at the Vanguard LIST OF FIGURES Figure No. -

United National Bank

BUSINESS eBANKING SYSTEM SERVICES AGREEMENT This Business eBanking System Services Agreement (“Agreement”), together with the applicable Terms and Conditions of Your Account for any account that is or will be linked (“Account”) to the Business eBanking System (“System”), governs the use of the System. You understand and acknowledge that that all such Accounts are to be used primarily for commercial or business purposes, and that this Agreement will control if there is any conflict between it and any agreement applicable to Your linked Account(s). In this Agreement, ‘You,’ ‘Your,’ or ‘Customer’ refers to each owner of the Account(s) accessed through the System and each person authorized to access the Account(s) using the System. A ‘Writing’ refers to a communication conveyed on paper and signed by a person with sufficient authority to bind Customer or Bank, as applicable, or an electronic message from a person with sufficient authority to bind Bank or Customer, as applicable, and conforming to the requirements of the Uniform Electronic Transactions Act as incorporated into the laws of the state governing this Agreement. By signing the Agreement or using the System and the services described herein available to Customer (collectively, “Services”). You agree to the terms and conditions set forth below. A. SERVICES 1) Generally. As requested by Customer, Bank will enter into the System balance information and/or itemized debit and credit information for Accounts on a daily basis. Bank shall provide System instructions to Customer. The System is for Customer’s internal use to enable Customer to obtain balance and other Account information and to direct payments from Account(s) to third-parties (collectively, “Payees”, and each individually, a “Payee” when using the bill payment module; collectively “Beneficiaries”, and each individually a “Beneficiary” when accessing Wire Transfers; and collectively “Receivers”, and each individually a “Receiver” when using the Automated Clearing House (ACH) network). -

Divest Invest February 2018 (Compressed)

Divest from the past, invest in the future. www.divestinvest.org Disclaimer: Divest Invest assumes no legal or financial responsibility for the practices, products, or services of any businesses listed. The funds listed are examples, not recommendations. Please read all materials carefully prior to investing. This presentation will cover: • What the Paris Agreement means for investors 3 • What is Divest Invest 7 • Divest Invest is the prudent financial choice 12 • Divest Invest fulfills fiduciary duty 21 • Fossil free investing: from niche to mainstream 27 • Divest Invest options for every asset class 31 2 What the Paris Agreement means for investors WHAT THE PARIS AGREEMENT MEANS FOR INVESTORS Under the Paris Agreement, world governments commit to keep global temperature rise to well below 2°C and to pursue efforts to limit it to 1.5°C. To achieve this, up to 80% of fossil fuel reserves can’t be burned. They are stranded assets whose economic value won’t be realized. Investors are sitting on a carbon bubble. Climate risks, including stranded assets, pose a material threat to investor portfolios now, say a growing chorus of financial regulators, asset managers, analysts, policymakers and … oil companies: 4 WHAT THE PARIS AGREEMENT MEANS FOR INVESTORS The Paris Agreement Mark Carney Warns Investors Face signals to markets that ‘Huge’ Climate Change Losses (9/29/15) the global clean energy transition is underway and accelerating. Shell CEO Ben Van Beurden Has Seen Prudent investors are The Future—And It’s Several Shades heeding the call. -

Recent Press Coverage Contents

Recent Press Coverage Contents DOW JONES | New Firms Taking Financial Advice Online ................................................................................................................................ 3 THE WALL StREET JOURNAL | Searching for Financial Advice Online ............................................................................................. 5 NY DAILY NEWS | Tech Startups Give Wall St. Run For Its Money ........................................................................................................... 7 FAST COMPANY | The Financial Institutions Banking On Occupy Wall Street’s “Move Your Money Day” .................... 8 THE DAILY | Breaking up the Bank ................................................................................................................................................................................ 10 THE NEW YORK TIMES | Betterment Adds International Investments to Portfolio .................................................................... 12 THE NEW YORK TIMES | Investment Advice for Small Fry .......................................................................................................................... 13 AMERICAN BANKER | Mint Teams Up with Betterment to Boost Revenue .................................................................................... 17 THE NEW YORK TIMES | Betterment Raises $3M to Give Casual Investors a More Accessible Portfolio .................. 19 INC. | Congratulations! You’ve Closed Your First Round. Now What? ..................................................................................................... -

USDA Single Family Housing Guaranteed Loan Program

USDA Single Family Housing Guaranteed Loan Program No down payment loans for rural borrowers with incomes below 115 percent of area median income as defined by USDA BACKGROUND AND PURPOSE BORROWER CRITERIA The U.S. Department of Agriculture’s (USDA) Income limits: This program is limited to borrowers Single Family Housing Guaranteed Loan Program with incomes up to 115 percent of AMI (as defined by (Guaranteed Loan Program) is designed to serve eli- USDA). Approximately 30 percent of Guaranteed Loans gible rural residents with incomes below 115 percent are made to families with incomes below 80 percent of of area median income or AMI (see USDA definition in AMI. An applicant must have dependable income that overview) who are unable to obtain adequate hous- is adequate to support the mortgage. ing through conventional financing. Guaranteed Loans Credit: Borrowers must have reasonable credit his- are originated, underwritten, and closed by a USDA tories and an income that is dependable enough to approved private sector or commercial lender. The support the loans but be unable to obtain reasonable Rural Housing Service (RHS) guarantees the loan at credit from another source. 100 percent of the loss for the first 35 percent of the original loan and 85 percent of the loss on the remain- First-time homebuyers: If funding levels are limited ing 65 percent. The program is entirely supported by near the end of a fiscal year, applications are prioritized the upfront and annual guarantee fees collected at the to accommodate first-time homebuyers. time of loan origination. Occupancy and ownership of other properties: The dwelling purchased with a Guaranteed Loan must be PROGRAM NAME Single Family Housing Guaranteed Loan Program AGENCY U.S. -

How to Find the Best Credit Card for You

How to find the best credit card for you Why should you shop around? Comparing offers before applying for a credit card helps you find the right card for your needs, and helps make sure you’re not paying higher fees or interest rates than you have to. Consider two credit cards: One carries an 18 percent interest rate, the other 15 percent. If you owed $3,000 on each and could only afford to pay $100 per month, it would cost more and take longer 1. Decide how you plan to pay off the higher-rate card. to use the card The table below shows examples of what it might You may plan to pay off your take to pay off a $3,000 credit card balance, paying balance every month to avoid $100 per month, at two different interest rates. interest charges. But the reality is, many credit card holders don’t. If you already have a credit card, let APR Interest Months history be your guide. If you have carried balances in the past, or think 18% = $1,015 41 you are likely to do so, consider 15% = $783 38 credit cards that have the lowest interest rates. These cards typically do not offer rewards and do not The higher-rate card would cost you an extra charge an annual fee. $232. If you pay only the minimum payment every month, it would cost you even more. If you have consistently paid off your balance every month, then you So, not shopping around could be more expensive may want to focus more on fees and than you think. -

Re:Imagining Change

WHERE IMAGINATION BUILDS POWER RE:IMAGINING CHANGE How to use story-based strategy to win campaigns, build movements, and change the world by Patrick Reinsborough & Doyle Canning 1ST EDITION Advance Praise for Re:Imagining Change “Re:Imagining Change is a one-of-a-kind essential resource for everyone who is thinking big, challenging the powers-that-be and working hard to make a better world from the ground up. is innovative book provides the tools, analysis, and inspiration to help activists everywhere be more effective, creative and strategic. is handbook is like rocket fuel for your social change imagination.” ~Antonia Juhasz, author of e Tyranny of Oil: e World’s Most Powerful Industry and What We Must Do To Stop It and e Bush Agenda: Invading the World, One Economy at a Time “We are surrounded and shaped by stories every day—sometimes for bet- ter, sometimes for worse. But what Doyle Canning and Patrick Reinsbor- ough point out is a beautiful and powerful truth: that we are all storytellers too. Armed with the right narrative tools, activists can not only open the world’s eyes to injustice, but feed the desire for a better world. Re:Imagining Change is a powerful weapon for a more democratic, creative and hopeful future.” ~Raj Patel, author of Stuffed & Starved and e Value of Nothing: How to Reshape Market Society and Redefine Democracy “Yo Organizers! Stop what you are doing for a couple hours and soak up this book! We know the importance of smart “issue framing.” But Re:Imagining Change will move our organizing further as we connect to the powerful narrative stories and memes of our culture.” ~ Chuck Collins, Institute for Policy Studies, author of e Economic Meltdown Funnies and other books on economic inequality “Politics is as much about who controls meanings as it is about who holds public office and sits in office suites. -

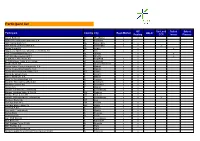

Participant List

Participant list GC SecLend Select Select Participant Country City Repo Market HQLAx Pooling CCP Invest Finance Aareal Bank AG D Wiesbaden x x ABANCA Corporaction Bancaria S.A E Betanzos x ABN AMRO Bank N.V. NL Amsterdam x x ABN AMRO Clearing Bank N.V. NL Amsterdam x x x Airbus Group SE NL Leiden x x Allgemeine Sparkasse Oberösterreich Bank AG A Linz x x ASR Levensverzekering N.V. NL Utrecht x x ASR Schadeverzekering N.V. NL Utrecht x x Augsburger Aktienbank AG D Augsburg x x B. Metzler seel. Sohn & Co. KGaA D Frankfurt x x Baader Bank AG D Unterschleissheim x x Banco Bilbao Vizcaya Argentaria, S.A. E Madrid x x Banco Cooperativo Español, S.A. E Madrid x x Banco de Investimento Global, S.A. PT Lisbon x x Banco de Sabadell S.A. E Alicante x x Banco Santander S.A. E Madrid x x Bank für Sozialwirtschaft AG D Cologne x x Bank für Tirol und Vorarlberg AG A Innsbruck x x Bankhaus Lampe KG D Dusseldorf x x Bankia S.A. E Madrid x x Banque Centrale du Luxembourg L Luxembourg x x Banque Lombard Odier & Cie SA CH Geneva x x Banque Pictet & Cie AG CH Geneva x x Banque Internationale à Luxembourg L Luxembourg x x x Bantleon Bank AG CH Zug x Barclays Bank PLC GB London x x Barclays Bank Ireland Plc IRL Dublin x x BAWAG P.S.K. A Vienna x x Bayerische Landesbank D Munich x x Belfius Bank B Brussels x x Berlin Hyp AG D Berlin x x BGL BNP Paribas L Luxembourg x x BKS Bank AG A Klagenfurt x x BNP Paribas Fortis SA/NV B Brussels x x BNP Paribas S.A. -

Single Family Home Loan Guarantees

Together, America Prospers Single Family Home Loan Guarantees What does this Who may apply for this program? What are applicant qualifications? Applicants must: • Income. Non-Self-Employed: program do? One-year history required. • Have a household income that does not exceed 115% of median Self-Employed and Seasonal: This no downpayment, household income.* Two-year history required. 100% financing program assists • Agree to occupy the dwelling as • Assets. No downpayment or approved lenders in providing their primary residence. reserves required. low- and moderate-income • Be a U.S. citizen, U.S. non-citizen • Credit. Must demonstrate a households the opportunity to national, or Qualified Alien. willingness and ability to repay debts. No set score requirement. • Be unable to obtain conventional own adequate, modest, decent, Alternative credit allowable for those financing with no private mortgage safe and sanitary dwellings as with no traditional credit. insurance (PMI). their primary residence in eligible • Monthly housing payment. Total • Not be suspended or debarred from payment (principal, interest, taxes, rural areas. participation in federal programs. insurance, HOA dues, RD annual fee) typically should not exceed Eligible applicants may purchase What properties are eligible? 29% of gross monthly income. existing homes (which may • Must be located within an eligible • All monthly debt payments. All rural area.* include costs to rehabilitate, payments included on credit report, • Must be a single-family dwelling including proposed new mortgage improve or relocate the dwelling) (may include detached, attached, payment, typically should not exceed or build new. PUD, condo, modular, and 41% of gross monthly income. manufactured). Student loan payments. Fixed USDA provides a loan note • Must meet HUD 4000.1 payment: use actual payment or 1% of loan balance.