Unibail-Rodamco-Westfield Nv

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Central Link Initial Segment and Airport Link Before & After Study

Central Link Initial Segment and Airport Link Before & After Study Final Report February 2014 (this page left blank intentionally) Initial Segment and Airport Link Before and After Study – Final Report (Feb 2014) Table of Contents Introduction ........................................................................................................................................................... 1 Before and After Study Requirement and Purposes ................................................................................................... 1 Project Characteristics ............................................................................................................................................... 1 Milestones .................................................................................................................................................................. 1 Data Collection in the Fall .......................................................................................................................................... 2 Organization of the Report ........................................................................................................................................ 2 History of Project Planning and Development ....................................................................................................... 2 Characteristic 1 - Project Scope .............................................................................................................................. 6 Characteristic -

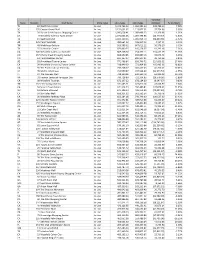

State Storeno Mall Name Store Type 2015 Sales 2014 Sales Variance

Variance State StoreNo Mall Name Store Type 2015 Sales 2014 Sales Inc/(Dec) % Inc/(Dec) TX 83 NorthPark Center In-Line 1,472,766.00 1,363,984.00 108,782.00 7.98% SC 135 Coastal Grand Mall In-Line 1,151,631.67 1,113,877.31 37,754.36 3.39% TX 20 Barton Creek Square Shopping Center In-Line 1,096,658.41 1,083,499.33 13,159.08 1.21% CA 8 Westfield Valencia Town Center In-Line 1,071,022.26 1,087,795.83 (16,773.57) -1.54% TX 19 Baybrook Mall In-Line 1,025,120.43 1,055,953.79 (30,833.36) -2.92% AZ 125 Park Place Mall In-Line 950,664.23 946,527.12 4,137.11 0.44% TN 48 Wolfchase Galleria In-Line 923,588.32 867,012.22 56,576.10 6.53% TX 55 Stonebriar Centre In-Line 876,800.55 815,558.37 61,242.18 7.51% CA 126 Westfield Galleria at Roseville In-Line 869,168.30 754,757.11 114,411.19 15.16% CO 167 Cherry Creek Shopping Center In-Line 868,959.85 835,887.13 33,072.72 3.96% CO 61 Park Meadows Center In-Line 831,157.07 800,397.91 30,759.16 3.84% AZ 28 Arrowhead Towne Center In-Line 771,406.64 656,746.72 114,659.92 17.46% CA 39 Westfield University Towne Center In-Line 738,949.33 573,464.00 165,485.33 28.86% CA 35 The Promenade at Temecula In-Line 733,268.27 666,557.65 66,710.62 10.01% KY 78 Mall St. -

REGIONAL PARK-AND-RIDE STRATEGIC IMPLEMENTATION PLAN for the Sarasota/Manatee Metropolitan Planning Organization

AL FIN REGIONAL PARK-AND-RIDE STRATEGIC IMPLEMENTATION PLAN for the Sarasota/Manatee Metropolitan Planning Organization December 2013 Submitted by: REGIONAL PARK - AND - RIDE STRATEGIC IMPLE MENTATION PLAN TABLE OF CONTENTS Introduction and Overview ............................................................................................................................. 1 Data Inventory and Background Analysis .................................................................................................. 11 Park-and-Ride Locations ............................................................................................................................... 25 Park-and-Ride General Area Locations ..................................................................................................... 27 Evaluation of Park-and-Ride General Area Locations ............................................................................ 37 Park-and-Ride Specific Site Locations ........................................................................................................ 45 Pursuing the Recommended Sites ................................................................................................................. 61 Potential Funding Opportunities .................................................................................................................. 68 Summary and Conclusions ............................................................................................................................. 71 Appendix A: Park-and-Ride -

The Bay Area-Silicon Valley and Australia an Expanding Trans-Pacific Partnership

The Bay Area-Silicon Valley and Australia An Expanding Trans-Pacific Partnership December 2020 Acknowledgments This report was developed in partnership with the Odette Hampton, Trade and Investment Commissioner American Chamber of Commerce in Australia, with and Deputy Consul General, Australian Trade and support from Cisco, Google, Lendlease, Salesforce, Investment Commission (Austrade) Telstra, University of Technology Sydney, and Wipro. Joe Hockey, Founding Partner and President, Bondi Development of the project was led by Sean Randolph, Partners, Australian Ambassador to the US, 2016–2020 Senior Director at the Bay Area Council Economic Institute. Neils Erich, a consultant to the Institute, Vikas Jain, Asia-Pacific Business Head for Engineering, was co-author. The Institute wishes to thank April Construction and Mining, Wipro Palmerlee, Chief Executive Officer of the American Claire Johnston, Managing Director, Google Chamber of Commerce in Australia, for her support Development Ventures, Lendlease throughout this effort and the following individuals for Joe Kaesshaefer, Trade and Investment Commissioner– their valuable input: USA, Department of Industry, New South Wales Jeff Bleich, Chief Legal Officer, Cruise, US Ambassador Michael Kapel, Trade and Investment Commissioner to to Australia 2009–2013 the Americas in San Francisco, Government of Victoria Michael Blumenstein, Associate Dean, Research Damian Kassabgi, Executive Vice President, Public Strategy and Management, Faculty of Engineering Policy and Communications, Afterpay and -

LATHAM & WATKINS LLP Michael G. Romey (Bar No. 137993)

Case 2:20-cv-08896 Document 1 Filed 09/28/20 Page 1 of 46 Page ID #:1 1 LATHAM & WATKINS LLP Michael G. Romey (Bar No. 137993) 2 [email protected] Sarah F. Mitchell (Bar No. 308467) 3 [email protected] 355 South Grand Avenue, Suite 100 4 Los Angeles, California 90071-1560 Telephone: +1.213.485.1234 5 Facsimile: +1.213.891.8763 6 Richard P. Bress (pro hac vice forthcoming) [email protected] 7 Andrew D. Prins (pro hac vice forthcoming) [email protected] 8 Eric J. Konopka (pro hac vice forthcoming) [email protected] 9 555 Eleventh Street, NW, Suite 1000 Washington, D.C. 20004-1304 10 Telephone: +1.202.637.2200 Facsimile: +1.202.637.2201 11 Attorneys for Plaintiffs and the Proposed Class 12 UNITED STATES DISTRICT COURT 13 CENTRAL DISTRICT OF CALIFORNIA 14 15 MY DREAM BOUTIQUE, a CASE NO. 2:20-cv-8896 16 California corporation, on behalf of itself and all others similarly situated; CLASS ACTION COMPLAINT 17 ANAHIT KHACHATRYAN, an individual; NELLI VIRABYAN, an 18 individual; DI ORO SALON, INC., a California corporation, on behalf of 19 itself and all others similarly situated; VARDGES AVETISYAN, an 20 individual; AL-AZIM INC., a California corporation, on behalf of 21 itself and all others similarly situated; RIAZ MOHAMMED, an individual; 22 WESTFIELD PROPERTY MANAGEMENT LLC, a Delaware 23 limited liability company; WESTFIELD TOPANGA OWNER 24 LLC, a Delaware limited liability company; SHERMAN OAKS 25 FASHION ASSOCIATES, LP, a Delaware limited liability partnership; 26 CULVER CITY MALL LLC, a Delaware limited liability company; 27 SANTA ANITA SHOPPINGTOWN 28 LP, a Delaware limited liability ATTORNEYS AT L AW CLASS ACTION COMPLAINT LOS ANGELES Case 2:20-cv-08896 Document 1 Filed 09/28/20 Page 2 of 46 Page ID #:2 1 partnership; and VALENCIA TOWN CENTER VENTURE, L.P., a Delaware 2 limited liability partnership, 3 Plaintiffs, 4 v. -

San Diego's Mid-Century Modern Marvels

SAVE OUR HERITAGE ORGANISATION PRESENTS SAN DIEGO’S MID-CENTURY MODERN MARVELS INTRODUCTION As we advance into the 2020s, 20th-century Modern architecture is having a renaissance. Not only is the style rising in popularity, but Mid-Century designs are reaching a level of maturity that qualifies many for historic designation and a higher level of recognition and importance. This self-guided driving tour will take you from North Park, Mission Valley, and Hillcrest to the coast with stops in Point Loma, Shelter Island, and La Jolla to see some of San Diego’s most marvelous Mid-Century Modern buildings. Built from the years 1949 to 1977, the movement’s end in the 1970s, these designs showcase the work of many of San Diego’s leading Modernist architects, including Lloyd Ruocco, Robert Mosher, and William Krisel. While this tour is limited to public buildings and represents only a dozen of the Mid-Century sites worthy of recognition and study, we hope it offers a taste of the diversity of Mid-Century Modern designs and their place in San Diego’s development. MAP Click below on this image to be redirected to an interactive Google Map that will help guide you to each of the 12 sites on the tour. 1. Rudford’s Restaurant, 1949 Photos by Sandé Lollis Photo by James Daigh 2900 El Cajon Boulevard A signature El Cajon Boulevard landmark, Rudford’s Restaurant has been in operation since 1949. The sleek modern design features oval porthole style windows and original neon signage. El Cajon Boulevard is historically significant as a commercial strip known for its neon, and Rudford’s is a key example of this mid-century neighborhood development. -

2020 Tax Return Guide

2020 Tax Return Guide Westfield Newmarket, NZ — Scentre Group Limited ABN 66 001 671 496 Scentre Management Limited ABN 41 001 670 579 AFS Licence 230329 as responsible entity of Scentre Group Trust 1 ABN 55 191 750 378 ARSN 090 849 746 RE1 Limited ABN 80 145 743 862 AFS Licence 380202 as responsible entity of Scentre Group Trust 2 ABN 66 744 282 872 ARSN 146 934 536 RE2 Limited ABN 41 145 744 065 AFS Licence 380203 as responsible entity of Scentre Group Trust 3 ABN 11 517 229 138 ARSN 146 934 652 This document does not constitute financial product or investment advice, and, in particular, it is not intended to influence you in making a decision in relation to financial products including Scentre Group Stapled Securities. You should obtain professional advice before taking any action in relation to this document, for example from your accountant, taxation or other professional adviser. About this Guide This 2020 Tax Return Guide (“Guide”) has been prepared to assist Australian resident individual securityholders to complete their 2020 Australian income tax return. This Guide provides general information Section 1 Important Information for only. Accordingly, this Guide should not be relied upon as taxation Australian Resident Individual advice. Each securityholder’s particular circumstances are different and we recommend you contact your accountant, taxation or other Securityholders Completing professional adviser for specific advice. a 2020 Tax Return This Tax Return Guide has two sections: General information - Scentre Group Scentre Group is a stapled group that comprises the following four Section 1 Provides information to assist entities: Australian resident individual - Scentre Group Limited (“SGL”) securityholders complete - Scentre Group Trust 1 (“SGT1”) their 2020 Australian income - Scentre Group Trust 2 (“SGT2”) tax return. -

Store # State City Mall/Shopping Center Name Address Date 2918

Store # State City Mall/Shopping Center Name Address Date 2918 AL ALABASTER COLONIAL PROMENADE 340 S COLONIAL DR Coming Soon in September 2016! 2218 AL HOOVER RIVERCHASE GALLERIA 2300 RIVERCHASE GALLERIA Coming Soon in September 2016! 2131 AL HUNTSVILLE MADISON SQUARE 5901 UNIVERSITY DR Coming Soon in September 2016! 219 AL MOBILE BEL AIR MALL MOBILE, AL 36606-3411 Coming Soon in September 2016! 2840 AL MONTGOMERY EASTDALE MALL MONTGOMERY, AL 36117-2154 Coming Soon in September 2016! 2956 AL PRATTVILLE HIGH POINT TOWN CENTER PRATTVILLE, AL 36066-6542 Coming Soon in September 2016! 2875 AL SPANISH FORT SPANISH FORT TOWN CENTER 22500 TOWN CENTER AVE Coming Soon in September 2016! 2869 AL TRUSSVILLE TUTWILER FARM 5060 PINNACLE SQ Coming Soon in September 2016! 2709 AR FAYETTEVILLE NW ARKANSAS MALL 4201 N SHILOH DR Coming Soon in September 2016! 1961 AR FORT SMITH CENTRAL MALL 5111 ROGERS AVE Coming Soon in September 2016! 2914 AR LITTLE ROCK SHACKLEFORD CROSSING 2600 S SHACKLEFORD RD Coming Soon in July 2016! 663 AR NORTH LITTLE ROCK MC CAIN SHOPPING CENTER 3929 MCCAIN BLVD STE 500 Coming Soon in July 2016! 2879 AR ROGERS PINNACLE HLLS PROMDE 2202 BELLVIEW RD Coming Soon in September 2016! 2936 AZ CASA GRANDE PROMNDE AT CASA GRANDE 1041 N PROMENADE PKWY Coming Soon in September 2016! 157 AZ CHANDLER MILL CROSSING 2180 S GILBERT RD Coming Soon in September 2016! 251 AZ GLENDALE ARROWHEAD TOWNE CENTER 7750 W ARROWHEAD TOWNE CENTER Coming Soon in September 2016! 2842 AZ GOODYEAR PALM VALLEY CORNERST 13333 W MCDOWELL RD Coming Soon in September -

2014 PRINT NAREIT Annual Report Layout 1

REITWay NAREIT’s Annual Report 2013 In Review & 2014 A Look Ahead National Association of Real Estate Investment Trusts® REITs: Building Dividends & Diversification® 2014 REITWay NAREIT’s Annual Report 2 To Our Members The past year was active for NAREIT as we Stock Exchange-Listed took the REIT story to all of our industry’s REIT Capital Offerings, 2013 audiences. This 2014 issue of REITWay: IPOs NAREIT’S Annual Report re-caps some of what Secured and we accomplished on the REIT industry’s behalf Unsecured Debt $5.71 billion during the year. $30.74 billion Policy & Politics Secondary Total: In the Policy and Politics area, we began the Equity year with a highly effective Washington $40.51 billion $76.96 billion Leadership Forum. Our industry’s leaders climbed Capitol Hill to provide legislators and their staffs with a better understanding of the REIT investment proposition, including its history, the REITs in today’s mortgage finance marketplace, to the impact of important functions REITs play in investment portfolios, their rising interest rates on REIT total returns. We also continued to channeling of capital to the real estate industry, and their role upgrade and expand our REIT.com online platform and our other creating jobs and economic growth. digital properties. Over the course of the year, our Policy & Politics team provided Additionally, we conducted a full schedule of successful constructive input to the ongoing discussion on tax reform, conference events for our members, including our major including input to the House Ways and Means Committee and investor conferences, REITWeek and REITWorld. -

Storeno State Mall Name FBC Store Type YTD Sales # Units Sold

Dec-19 StoreNo State Mall Name FBC Store Type YTD Sales # Units Sold # Receipts Units/Receipt Avg $ Receipt 1 CA The Shops at Mission Viejo Sam Guagliardo In-Line 579,475.02 12,413 10,379 1.20 $55.83 2 FL Dadeland Mall Chris Canada Kiosk 330,047.29 8,743 6,763 1.29 $48.80 4 FL Coconut Point Chris Canada In-Line 271,663.12 6,748 4,911 1.37 $55.32 5 PA Ross Park Mall Chris Canada In-Line 566,328.52 19,179 12,353 1.55 $45.85 6 CA South Bay Galleria Sam Guagliardo In-Line 216,941.59 5,432 4,355 1.25 $49.81 7 CT Westfield Trumbull Chris Canada Kiosk 279,730.18 16,039 11,910 1.35 $23.49 8 CA Westfield Valencia Town Center Sam Guagliardo In-Line 1,236,192.29 12,843 9,950 1.29 $124.24 9 PA Millcreek Mall Chris Canada In-Line 413,278.37 11,326 8,633 1.31 $47.87 10 CA The Mall of Victor Valley Sam Guagliardo Kiosk 396,509.02 11,596 8,639 1.34 $45.90 11 CA Antelope Valley Mall Sam Guagliardo In-Line 437,148.76 10,733 8,811 1.22 $49.61 12 FL Altamonte Mall Chris Canada In-Line 302,632.40 7,629 6,833 1.12 $44.29 13 NM Cottonwood Mall David Holland In-Line 139,928.50 5,898 4,006 1.47 $34.93 14 NM Coronado Center David Holland Kiosk 443,210.18 19,211 13,753 1.40 $32.23 15 FL The Falls Chris Canada In-Line 258,320.20 5,906 4,499 1.31 $57.42 16 FL Edison Mall Chris Canada Kiosk 354,239.65 12,014 9,353 1.28 $37.87 17 FL Boynton Beach Mall Chris Canada In-Line 18 FL Melbourne Square Mall Chris Canada Kiosk 315,866.19 7,161 5,834 1.23 $54.14 19 TX Baybrook Mall David Holland In-Line 980,316.56 18,848 14,975 1.26 $65.46 20 TX Barton Creek Square Shopping -

Unibail-Rodamco-Westfield and the VOID Announce Global Partnership

Paris, Amsterdam, July 25, 2019 Press release Unibail-Rodamco-Westfield and The VOID announce global partnership that brings cutting edge virtual reality entertainment to URW’s portfolio in the United States and in Europe • The partnership will bring more than 25 state-of-the-art virtual reality destinations to Unibail- Rodamco-Westfield flagship centres in the US and Europe, making The VOID the world leader in immersive virtual reality experiences. • Pop-ups at Westfield centres in New York, San Francisco, Los Angeles and San Diego will open this summer and will later become permanent locations. • New permanent venues will be rolled out in US and European cities including Paris, London and Stockholm. Full roll-out will be completed by 2022. • The partnership, an industry first, is evidence of the power of URW’s portfolio of premier assets to attract international brands. Unibail-Rodamco-Westfield (URW), the premier global developer and operator of flagship shopping destinations, and The VOID, the industry-leader in immersive virtual reality experiences, today announced the formation of a partnership to bring more than 25 permanent, state-of-the-art immersive virtual reality destinations to URW centres in the United States and in Europe. The VOID, a Utah-based venture with experiential content deals spanning entertainment studios, including Disney and Sony, is recognised as the most immersive of virtual reality experiences and represents the future of entertainment. Titles include Star WarsTM: Secrets of the Empire, the award-winning experience by ILMxLAB and Lucasfilm; Ralph Breaks VR, by ILMxLAB created in collaboration with Walt Disney Animation Studios; Ghostbusters: Dimension, and original content Nicodemus: Demon of Evanishment, with several new experiences still to be released. -

Wesley Chapel, Florida

WESLEY CHAPEL, FLORIDA PROPERTY OVERVIEW TAMPA PREMIUM OUTLETS® WESLEY CHAPEL, FL TAMPA PREMIUM OUTLETS MAJOR METROPOLITAN AREAS SELECT TENANTS WESLEY CHAPEL, FL 75 Orlando Tampa: 16 miles Saks Fifth Avenue OFF 5TH, Ann Taylor Factory Store, Brooks Brothers Dade City Orlando: 85 miles Factory Store, Calvin Klein Company Store, Coach Factory Store, US Hwy 52 Ft. Myers: 150 miles Cole Haan, Columbia Sportswear Company, J.Crew Factory, Michael 19 US Hwy 56 Miami: 300 miles Kors Outlet, NikeFactoryStore, Polo Ralph Lauren Factory Store, Tommy 4 Hilfiger Company Store, Vera Bradley 75 RETAIL 275 TOURISM / TRAFFIC 4 GLA (sq. ft.) 441,000; 115 stores Tampa Tampa Bay, consisting of Hillsborough, Pinellas, Pasco and Hernando 19 75 OPENING DATE counties, is the most populous and affluent metropolitan statistical area (MSA) and the largest television market in the state. Tampa is Florida’s St. Petersburg Opened October 2015 third most populous city and Hillsborough is Florida’s fourth most populous county. Tampa’s economy is founded on a diverse base that includes tourism, agriculture, construction, finance, health care, PARKING RATIO government, technology and the Port of Tampa. 5.22:1 Tampa International Airport serves 16 million people annually. Furthermore, the Port of Tampa, the largest port in the southeast, offers RADIUS POPULATION many cruise destinations from the Garrison Channel Cruise Terminal. 15 miles: 732,724 30 miles: 2,551,607 ATTRACTIONS 45 miles: 3,515,905 Area attractions include beachside resorts along the Gulf of Mexico, Busch Gardens & Adventure Island, the Tampa Convention Center, Ybor AVERAGE HH INCOME City, the Florida Aquarium, and major sporting venues including home to 30 miles: $66,156 the Tampa Bay Buccaneers and the NY Yankees Spring Training facility.