Post-Communist Countries of the Eu and the Euro: Dynamic Linkages Between Exchange Rates*

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

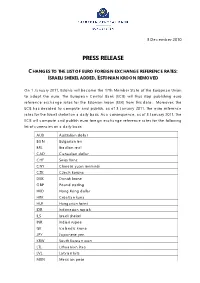

Press Release Changes to the List of Euro Foreign Exchange Reference

3 December 2010 PRESS RELEASE CHANGES TO THE LIST OF EURO FOREIGN EXCHANGE REFERENCE RATES: ISRAELI SHEKEL ADDED, ESTONIAN KROON REMOVED On 1 January 2011, Estonia will become the 17th Member State of the European Union to adopt the euro. The European Central Bank (ECB) will thus stop publishing euro reference exchange rates for the Estonian kroon (EEK) from this date. Moreover, the ECB has decided to compute and publish, as of 3 January 2011, the euro reference rates for the Israeli shekel on a daily basis. As a consequence, as of 3 January 2011, the ECB will compute and publish euro foreign exchange reference rates for the following list of currencies on a daily basis: AUD Australian dollar BGN Bulgarian lev BRL Brazilian real CAD Canadian dollar CHF Swiss franc CNY Chinese yuan renminbi CZK Czech koruna DKK Danish krone GBP Pound sterling HKD Hong Kong dollar HRK Croatian kuna HUF Hungarian forint IDR Indonesian rupiah ILS Israeli shekel INR Indian rupee ISK Icelandic krona JPY Japanese yen KRW South Korean won LTL Lithuanian litas LVL Latvian lats MXN Mexican peso 2 MYR Malaysian ringgit NOK Norwegian krone NZD New Zealand dollar PHP Philippine peso PLN Polish zloty RON New Romanian leu RUB Russian rouble SEK Swedish krona SGD Singapore dollar THB Thai baht TRY New Turkish lira USD US dollar ZAR South African rand The current procedure for the computation and publication of the foreign exchange reference rates will also apply to the currency that is to be added to the list: The reference rates are based on the daily concertation procedure between central banks within and outside the European System of Central Banks, which normally takes place at 2.15 p.m. -

Exchange Market Pressure on the Croatian Kuna

EXCHANGE MARKET PRESSURE ON THE CROATIAN KUNA Srđan Tatomir* Professional article** Institute of Public Finance, Zagreb and UDC 336.748(497.5) University of Amsterdam JEL F31 Abstract Currency crises exert strong pressure on currencies often causing costly economic adjustment. A measure of exchange market pressure (EMP) gauges the severity of such tensions. Measuring EMP is important for monetary authorities that manage exchange rates. It is also relevant in academic research that studies currency crises. A precise EMP measure is therefore important and this paper re-examines the measurement of EMP on the Croatian kuna. It improves it by considering intervention data and thresholds that ac- count for the EMP distribution. It also tests the robustness of weights. A discussion of the results demonstrates a modest improvement over the previous measure and concludes that the new EMP on the Croatian kuna should be used in future research. Key words: exchange market pressure, currency crisis, Croatia 1 Introduction In an era of increasing globalization and economic interdependence, fixed and pegged exchange rate regimes are ever more exposed to the danger of currency crises. Integrated financial markets have enabled speculators to execute attacks more swiftly and deliver devastating blows to individual economies. They occur when there is an abnormally large international excess supply of a currency which forces monetary authorities to take strong counter-measures (Weymark, 1998). The EMS crisis of 1992/93 and the Asian crisis of 1997/98 are prominent historical examples. Recently, though, the financial crisis has led to severe pressure on the Hungarian forint and the Icelandic kronor, demonstrating how pressure in the foreign exchange market may cause costly economic adjustment. -

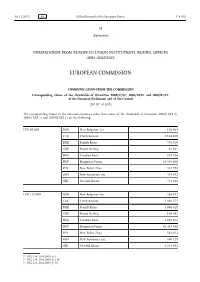

Corresponding Values of the Thresholds of Directives 2004/17/EC, 2004/18/EC and 2009/81/EC, of the European Parliament and of the Council (2015/C 418/01)

16.12.2015 EN Official Journal of the European Union C 418/1 II (Information) INFORMATION FROM EUROPEAN UNION INSTITUTIONS, BODIES, OFFICES AND AGENCIES EUROPEAN COMMISSION COMMUNICATION FROM THE COMMISSION Corresponding values of the thresholds of Directives 2004/17/EC, 2004/18/EC and 2009/81/EC, of the European Parliament and of the Council (2015/C 418/01) The corresponding values in the national currencies other than euros of the thresholds of Directives 2004/17/EC (1), 2004/18/EC (2) and 2009/81/EC (3) are the following: EUR 80 000 BGN New Bulgarian Lev 156 464 CZK Czech Koruna 2 184 400 DKK Danish Krone 596 520 GBP Pound Sterling 62 842 HRK Croatian Kuna 610 024 HUF Hungarian Forint 24 549 600 PLN New Polish Zloty 333 992 RON New Romanian Leu 355 632 SEK Swedish Krona 731 224 EUR 135 000 BGN New Bulgarian Lev 264 033 CZK Czech Koruna 3 686 175 DKK Danish Krone 1 006 628 GBP Pound Sterling 106 047 HRK Croatian Kuna 1 029 416 HUF Hungarian Forint 41 427 450 PLN New Polish Zloty 563 612 RON New Romanian Leu 600 129 SEK Swedish Krona 1 233 941 (1) OJ L 134, 30.4.2004, p. 1. (2) OJ L 134, 30.4.2004, p. 114. (3) OJ L 216, 20.8.2009, p. 76. C 418/2 EN Official Journal of the European Union 16.12.2015 EUR 209 000 BGN New Bulgarian Lev 408 762 CZK Czech Koruna 5 706 745 DKK Danish Krone 1 558 409 GBP Pound Sterling 164 176 HRK Croatian Kuna 1 593 688 HUF Hungarian Forint 64 135 830 PLN New Polish Zloty 872 554 RON New Romanian Leu 929 089 SEK Swedish Krona 1 910 323 EUR 418 000 BGN New Bulgarian Lev 817 524 CZK Czech Koruna 11 413 790 DKK -

Should Poland Join the Euro? an Economic and Political Analysis

Should Poland Join the Euro? An Economic and Political Analysis Should Poland Join the Euro? An Economic and Political Analysis Graduate Policy Workshop February 2016 Michael Carlson Conor Carroll Iris Chan Geoff Cooper Vanessa Lehner Kelsey Montgomery Duc Tran Table of Contents Acknowledgements ................................................................................................................................ i About the WWS Graduate Policy Workshop ........................................................................................ ii Executive Summary .............................................................................................................................. 1 1 Introduction ................................................................................................................................. 2 2 The Evolution of Polish Thought on Euro Adoption ................................................................. 5 2.1 Pre-EU membership reforms ...................................................................................................................... 5 2.2 After EU Accession ....................................................................................................................................... 5 2.3 Crisis years ...................................................................................................................................................... 6 2.4 Post-crisis assessment .................................................................................................................................. -

A Report on the Costs and Benefits of Poland’S Adoption of the Euro

A Report on the Costs and Benefits of Poland’s Adoption of the Euro Warsaw, March 2004 Edited by: Jakub Borowski Authors: Jakub Borowski Micha∏ Brzoza-Brzezina Anna Czoga∏a Tatiana Fic Adam Kot Tomasz J´drzejowicz Wojciech Mroczek Zbigniew Polaƒski Marek Rozkrut Micha∏ Rubaszek Andrzej S∏awiƒski Robert Woreta Zbigniew ˚ó∏kiewski The authors thank Andrzej Bratkowski, Adam B. Czy˝ewski, Ma∏gorzata Golik, Witold Grostal, Andrzej Rzoƒca, El˝bieta Skrzeszewska-Paczek, Iwona Stefaniak, Piotr Szpunar and Lucyna Sztaba for their numerous and insightful remarks on earlier drafts of this Report. The authors thank professor Michael J. Artis for his excellent assistance with the English language version of the Report. The Report was submitted for publishing in March 2004. Design: Oliwka s.c. Printed by: Drukarnia NBP Published by: National Bank of Poland 00-919 Warszawa, ul. Âwi´tokrzyska 11/21, Poland Phone (+48 22) 653 23 35 Fax (+48 22) 653 13 21 © Copyright Narodowy Bank Polski, 2004 2 National Bank of Poland Table of contents Table of contents Executive Summary . .5 Introduction . .9 1. Conditions for accession to the euro area . .13 2. Risks and costs of introducing the euro . .15 2.1. Loss of monetary policy independence . .15 2.1.1. The effectiveness of the exchange rate adjustment mechanism . .18 2.1.2. Labour market adjustment mechanism . .25 2.1.3. The fiscal adjustment mechanism . .27 2.1.4. Convergence of business cycles . .30 2.1.5. Endogeneity of Optimum Currency Area criteria . .36 2.2. Short-term cost of meeting the inflation convergence criterion . .37 2.3. -

247 – £Ukasz W

2 4 7 £ukasz W. Rawdanowicz Poland's Accession to EMU – Choosing the Exchange Rate Parity W a r s a w , 2 0 0 2 Materials published here have a working paper character. They can be subject to further publication. The views and opinions expressed here reflect Authors’ point of view and not necessarily those of the CASE. The publication was financed by AIG Pension Society. Key words: real exchange rates, equilibrium exchange rates, EMU enlargement. Acknowledgements: I am greatly indebted to Przemek Kowalski and Mateusz Szczurek for their valuable and inspiring comments, and their help with collecting data. © CASE – Center for Social and Economic Research, Warsaw 2002 Graphic Design: Agnieszka Natalia Bury DTP: CeDeWu Sp. z o.o. ISSN 1506-1701, ISBN 83-7178-298-5 Publisher: CASE – Center for Social and Economic Research ul. Sienkiewicza 12, 00-944 Warsaw, Poland tel.: (4822) 622 66 27, 828 61 33, fax (4822) 828 60 69 e-mail: [email protected] Contents Abstract 5 1. Introduction 6 2. Concepts of Equilibrium Exchange Rate 7 2.1. PPP 7 2.2. FEER 8 2.3. BEER 9 3. Empirical Estimations 10 3.1. FEER Calculations 11 3.2. BEER Estimations 18 4. What Should Be the Entry Exchange Rate? 20 5. Conclusions 25 References 27 Statistical Appendix 29 Studies & Analyses CASE No. 247 – £ukasz W. Rawdanowicz £ ukasz W. Rawdanowicz £ukasz Rawdanowicz graduated from Sussex University in 1998 (MA in International Economics) and Warsaw University - Department of Economics in 1999 (MA in quantitative methods). His main area of interest is macroeconomics and econometrics. -

Small and Medium-Sized Enterprises: U.S. and EU Export Activities, and Barriers and Opportunities Experienced by U.S

United States International Trade Commission Small and Medium- Sized Enterprises: U.S. and EU Export Activities, and Barriers and Opportunities Experienced by U.S. Firms Investigation No. 332-509 USITC Publication 4169 July 2010 U.S. International Trade Commission COMMISSIONERS Deanna Tanner Okun, Chairman Charlotte R. Lane Daniel R. Pearson Shara L. Aranoff Irving A. Williamson Dean A. Pinkert Robert B. Koopman Acting Director of Operations Arona Butcher Karen Laney Acting Director of Economics Director, Office of Industries Address all communications to Secretary to the Commission United States International Trade Commission Washington, DC 20436 U.S. International Trade Commission Washington, DC 20436 www.usitc.gov Small and Medium-Sized Enterprises: U.S. and EU Export Activities, and Barriers and Opportunities Experienced by U.S. Firms Investigation No. 332-509 Publication 4169 July 2010 Project Leadership Justino De La Cruz, Project Leader [email protected] James Stamps, Deputy Project Leader [email protected] Laura Bloodgood, Office of Industries Coordinator [email protected] Principal Authors Laura Bloodgood William Greene George Serletis Nannette Christ Katherine Linton James Stamps Daniel Cook Brendan Lynch Donald Sussman Justino De La Cruz Ruben Mata Mihir Torsekar Michael Ferrantino Elizabeth Nesbitt Ralph Watkins Dennis Fravel William Powers Isaac Wohl Primary Reviewers Joanne Guth and Joanna Bonarriva Special Assistance From Tamar Asadurian William Gearhart Andrew Martinez Richard Brown Alberto Goetzl Jesse Mora Eric Cardenas Alexander Hammer Andrew Rylyk Dylan Carlson Peg Hausman Patricia M. Thomas Judith Dean Aimee Larsen Alison Weingarden Robert Feinberg Linda Linkins Linda White Office of Publishing Interns Bethany Bengfort, Daniel Mason-D’Croz, Vincent Procacci, and Danielle Trachtenberg Under the Direction of Arona Butcher, Chief Country, Regional, and Analysis Division [email protected] ABSTRACT This report examines the extent and composition of U.S. -

WM/Refinitiv Closing Spot Rates

The WM/Refinitiv Closing Spot Rates The WM/Refinitiv Closing Exchange Rates are available on Eikon via monitor pages or RICs. To access the index page, type WMRSPOT01 and <Return> For access to the RICs, please use the following generic codes :- USDxxxFIXz=WM Use M for mid rate or omit for bid / ask rates Use USD, EUR, GBP or CHF xxx can be any of the following currencies :- Albania Lek ALL Austrian Schilling ATS Belarus Ruble BYN Belgian Franc BEF Bosnia Herzegovina Mark BAM Bulgarian Lev BGN Croatian Kuna HRK Cyprus Pound CYP Czech Koruna CZK Danish Krone DKK Estonian Kroon EEK Ecu XEU Euro EUR Finnish Markka FIM French Franc FRF Deutsche Mark DEM Greek Drachma GRD Hungarian Forint HUF Iceland Krona ISK Irish Punt IEP Italian Lira ITL Latvian Lat LVL Lithuanian Litas LTL Luxembourg Franc LUF Macedonia Denar MKD Maltese Lira MTL Moldova Leu MDL Dutch Guilder NLG Norwegian Krone NOK Polish Zloty PLN Portugese Escudo PTE Romanian Leu RON Russian Rouble RUB Slovakian Koruna SKK Slovenian Tolar SIT Spanish Peseta ESP Sterling GBP Swedish Krona SEK Swiss Franc CHF New Turkish Lira TRY Ukraine Hryvnia UAH Serbian Dinar RSD Special Drawing Rights XDR Algerian Dinar DZD Angola Kwanza AOA Bahrain Dinar BHD Botswana Pula BWP Burundi Franc BIF Central African Franc XAF Comoros Franc KMF Congo Democratic Rep. Franc CDF Cote D’Ivorie Franc XOF Egyptian Pound EGP Ethiopia Birr ETB Gambian Dalasi GMD Ghana Cedi GHS Guinea Franc GNF Israeli Shekel ILS Jordanian Dinar JOD Kenyan Schilling KES Kuwaiti Dinar KWD Lebanese Pound LBP Lesotho Loti LSL Malagasy -

A Place at the Top Table? Poland and the Euro Crisis

Reinvention of Europe Project A place at the top table? Poland and the euro crisis By Konstanty Gebert If you want to dine at the European Union’s top table it is important to be able to count on powerful friends who can help you pull up a chair. With an economy only one quarter that of Germany’s, and a population half its size, Poland cannot and does not aspire to have a permanent chair at that top table. But neither can it – with a population accounting for half of all the 2004 enlargement states and an economy among the best-performing in a crisis-ridden EU – content itself with merely a seat at the lower table. This is the challenge facing Poland, as it seeks to follow its developing interests and make its voice heard at a time when the most powerful countries in the EU are pulling in very different directions. Poland’s position within the EU is further complicated by its straddling of several dividing lines. For instance, its future is fundamentally tied to the Eurozone club that it does not belong to but very deeply desires to participate in. It managed to assume the rotating EU presidency for the first time just as the deepest crisis to affect the Union was deepening even further. Following on from the Lisbon Treaty, however, the presidency’s influence is now much reduced, and so Poland was relegated to being a mere observer of decisions made by others, mostly over the future of the Eurozone. Poland also straddles the demographic and economic boundaries between the EU’s major players and its smaller ones (the sixth largest in both categories). -

Financial System Development in Poland 2010

Financial System Development in Poland 2010 Warsaw, 2012 Editors: Paweł Sobolewski Dobiesław Tymoczko Authors: Katarzyna Bień Jolanta Fijałkowska Marzena Imielska Ewelina Jaskólska Piotr Kasprzak Paweł Kłosiewicz Michał Konopczak Sylwester Kozak Dariusz Lewandowski Krzysztof Maliszewski Rafał Nowak Dorota Okseniuk Aleksandra Paterek Aleksandra Pilecka Rafał Sieradzki Karol Siskind Paweł Sobolewski Andrzej Sowiński Mikołaj Stępniewski Michał Wiernicki Andrzej Wojciechowski Design, cover photo: Oliwka s.c. DTP: Print Office NBP Published by: National Bank of Poland Education and Publishing Department 00-919 Warsaw, Świętokrzyska 11/21, Poland Phone 48 22 653 23 35 Fax 48 22 653 13 21 www.nbp.pl © Copyright by National Bank of Poland, 2012 Introduction Table of contents Introduction . 5 1 . Financial system in Poland . 6 1.1. Evolution of the size and structure of the financial system in Poland . .6 1.2. Households and enterprises on the financial market in Poland .........................14 1.2.1. Financial assets of households ...............................................14 1.2.2. External sources of financing of Polish enterprises ................................18 2 . Regulations of the financial system . 21 2.1. Changes in financial system regulations in Poland ..................................21 2.1.1. Regulations affecting the entire financial services sector ...........................23 2.1.2. Regulations regarding the banking services sector ................................26 2.1.3. Regulations regarding non-bank financial institutions .............................32 2.1.4. Regulations regarding the capital market ......................................33 2.2. Measures of the European Union regarding the regulation of the financial services sector ....34 2.2.1. Regulations affecting the entire financial services sector ...........................34 2.2.2. Regulations regarding the banking services sector ................................39 2.2.3. -

Poland Without the Euro a Cost Benefit Analysis 2 Polityka Insight Poland Without the Euro Index

Poland without the euro A cost benefit analysis 2 Polityka Insight Poland without the euro Index EXECUTIVE SUMMARY 2 1. POLAND’S INTEGRATION WITHIN THE EURO AREA – THE CONTEXT 6 How to adopt the common currency? 8 Survey of social opinions and political positions on euro adoption 14 Analysis of probability of euro being introduced in Poland by 2030 15 2. COSTS OF DELAYING EURO ADOPTION 16 Measurable costs 17 Potential costs 21 Non-measurable costs 25 3. BENEFITS OF DELAYING EURO ADOPTION 28 Measurable benefits 29 Potential benefits 30 Non-measurable benefits 37 4. BALANCE OF COSTS AND BENEFITS OF DELAYING EURO ADOPTION 40 Balance of measurable effects 41 Balance of potential costs and benefits 42 Balance of non-measurable costs and benefits 45 SUMMARY 47 REFERENCES 49 A cost benefit analysis Polityka Insight 1 Executive summary This report deals with the question of adopting the euro in Poland. It differs from previous such works in two respects. First, our ques- tion is not “should Poland adopt the euro?” as the EU Treaties oblige all Member States who joined the EU after the Maastricht Treaty came into force to join the eurozone. Hence, we focus on the implications of Poland's decision to delay its adoption of the common currency. Second, in contrast to previous studies we distinguish between different types of costs and benefits – we identify those which are measurable, those which are po- tential and those which are non-measurable, i.e. are of socio-political nature. In our view such a distinction is required to assess the effects of adopting the euro on the Polish economy in a way which incorporates the possible differenc- es in the preferences of decision-makers and public opinion. -

Croatian Kuna: Money, Or Just a Currency? Evidence from the Interbank Market

Davor Mance, Bojana Olgic Drazenovic, and Stella Suljic Nikolaj. 2019. Croatian Kuna: Money, or just a Currency? Evidence from the Interbank Market. UTMS Journal of Economics 10 (2): 149–161. Original scientific paper (accepted November 6, 2019) CROATIAN KUNA: MONEY, OR JUST A CURRENCY? EVIDENCE FROM THE INTERBANK 1 MARKET Davor Mance2 Bojana Olgic Drazenovic Stella Suljic Nikolaj Abstract Modern sovereign money is accepted as an institution in virtue of the collective intentionality of the acceptance of the sovereign status function declaration it being the official currency of a country. A status function declaration may not create money it may only create a currency. How does one test the fact that an official currency also has all the properties of money? We propose a rather simple test based on the Granger causality of the acceptance of a currency in virtue of money if, and only if, the allocation function of its market interest rate is not rejected. This condition is fulfilled if the interest rate is its genuine allocator. This is the case if the changes in quantity cause the change in the interest rate as a price of money i.e. its true opportunity cost. We find that market interest rate changes are Granger caused by changes in quantities of traded euros on the overnight banking market but not by changes in the quantity of traded Croatian kuna. Thus, the Croatian kuna is only the domestic currency of Croatia, and the euro is its true money. Keywords: money functions, euroization, ZIBOR, Granger causality. Jel Classification: E31; E43; E47; E52; G17 INTRODUCTION The fact that we call something “money” is observer relative: it only exists relative to its users and relative to the users’ perspective considering something a money.