Aegon Annual Report 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Outlook for the Global Economy, Interest Rates and the Impact on the Re/Insurance Industry Astrid Frey, Swiss Re Economic Research & Consulting

Outlook for the global economy, interest rates and the impact on the re/insurance industry Astrid Frey, Swiss Re Economic Research & Consulting The economic environment in 2009… Real GDP growth (%) Source: Swiss Re Economic Research & Consulting Astrid Frey | Swiss Re Economic Research & Consulting 2 … and in 2014 Real GDP growth (%) Source: Swiss Re Economic Research & Consulting Astrid Frey | Swiss Re Economic Research & Consulting 3 Table of Contents / Agenda • Outlook for the global economy, inflation and interest rates • How do interest rates affect re/insurers? • How can insurers manage interest rate risk? • Conclusions Astrid Frey | Swiss Re Economic Research & Consulting 4 Outlook for the global economy, inflation and interest rates Astrid Frey | Swiss Re Economic Research & Consulting 5 Economic indicators imply global growth acceleration Purchasing Managers Indices, monthly data PMIs are survey based indicators. Values above 50 indicate economic expansion, Sources: Datastream, values below 50 contraction Bloomberg Astrid Frey | Swiss Re Economic Research & Consulting 6 Economic recovery at different speeds Real GDP of selected euro area countries (indexed Q1 2008 = 100) Source: Datastream Astrid Frey | Swiss Re Economic Research & Consulting 7 Global economic outlook and key risks . The US expansion is expected to strengthen into 2014, driven by consumer spending, business investment and housing construction . Europe is growing again and will continue to improve – a huge improvement for global growth prospects, but growth is hampered by fiscal austerity, private deleveraging and tight credit conditions . Chinese growth will stay close to 7.5% for next several years. Some EM economies have been unsettled by Fed "tapering" discussions, but a strengthening global economy will alleviate the downside risks. -

December 2013

City House Bed & Breakfast is an elegant blend of historic beauty and modern comforts along the banks of the picturesque Susquehanna River. Providing lovely overnight accommodations, City House is also an ideal location for corporate meetings, holiday events, cocktail receptions or dinner parties. Contact us to see how City House can enhance any occasion. 915 North Front St., Hbg || 717.903.2489 || www.CityHouseBB.com CONTENTS |||||||||||||||||||||||||||||||||||||||||||||||||||| GENERAL AND LETTERS NEWS 403 N. SECOND ST. • HARRISBURG, PA 17101 7. NEWS DIGEST WWW.THEBURGNEWS.COM 10. CITY VIEW 11. STATE STREET EDITORIAL: 717.695.2576 AD SALES: 717.695.2621 IN THE BURG PUBLISHER: J. ALEX HARTZLER [email protected] 12. ARouND ToWN 20. PAST TENSE EDITOR-IN-CHIEF: LAWRANCE BINDA [email protected] SALES DIRECTOR: LAUREN MILLS [email protected] business COVER ART BY: Jason KREIGER www.BRAINVessel.com SENIOR WRITER: Paul BARkER 24. FACE oF BuSINESS [email protected] 25. NEW BIz 26. SHoP WINDoW SALES/SPECIAL Projects: ANDREA Black LETTER FROM THE EDITOR [email protected] The holidays, like so many things in this country, have become an occasion for irresponsible CONTRIBUTORS: GOOD EATS media to set people against one another. TARA LEO AUCHEy, today’S THE day HARRISBURG 28. HoME C ooKING At TheBurg, we say the heck with the [email protected] 30. WINE TIME manufactured divisions that help no one Rosemary RUGGIERI BAER but a few thoughtless cable news hosts and [email protected] politicians who are trying to get attention and sell books. We think that most people, BARBARA TRAININ BLANk HOME FRONT regardless of their traditions and beliefs, can [email protected] agree that their holidays involve two things— Jess HAyDEN 32. -

Cross-Border Financial Institutions in the EU: Analysis of Total Assets and Ultimate Ownership

Directorate-General for Internal Policies Directorate A - Economic and Scientific Policy Policy Department A.: Economic and Scientific Policy and Quality of Life Unit Cross-Border Financial Institutions in the EU: Analysis of Total Assets and Ultimate Ownership Briefing Note IP/A/ECON/NT/2008-10 PE 408.550 Only published in English. Author: Josina KAMERLING Policy Department Economy and Science DG Internal Policies European Parliament Rue Wiertz 60 - ATR 00L046 B-1047 Brussels Tel: +32 (0)2 283 27 86 Fax: +32(0)2 284 69 29 E-mail: [email protected] Arttu MAKIPAA Policy Department Economy and Science DG Internal Policies European Parliament Rue Wiertz 60 - ATR 00L042 B-1047 Brussels Tel: +32 (0)2 283 26 20 Fax: +32(0)2 284 69 29 E-mail: [email protected] Manuscript completed in August 2008. The opinions expressed in this document do not necessarily represent the official position of the European Parliament. Reproduction and translation for non-commercial purposes are authorised provided the source is acknowledged and the publisher is given prior notice and receives a copy. Rue Wiertz – B-1047 Bruxelles - 32/2.284.43.74 Fax: 32/2.284.68.05 Palais de l‘Europe – F-67000 Strasbourg - 33/3.88.17.25.56 Fax: 33/3.88.36.92.14 E-mail: [email protected] IP/A/ECON/NT/2008-10 PE 408.550 Table of Contents 1. The Data on Financial Institutions in EU27 ......................................................................1 2. Largest Financial Institutions in Europe (Tables 1-5) .......................................................2 -

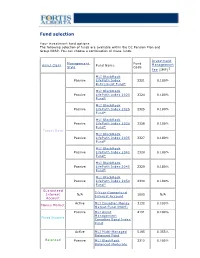

Fund Selection

Fund selection Y our investment fund options The following selection of funds are available within the DC Pension Plan and Group RRSP. You can choose a combination of these funds. Investment Management Fund Asset Class Fund Name Management Style Code Fee (IMF)1 MLI BlackRock Passive LifeP ath Index 2321 0.180% Retirement Fund* MLI BlackRock Passive LifeP ath Index 2020 2324 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2025 2325 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2030 2326 0.180% Fund* Target Date MLI BlackRock Passive LifeP ath Index 2035 2327 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2040 2328 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2045 2329 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2050 2330 0.180% Fund* Guaranteed 5-Y ear Guaranteed Interest N/A 1005 N/A Interest Account Account Active MLI Canadian Money 3132 0.100% Money Market Market Fund (MAM) Passive MLI Asset 4191 0.100% Management Fixed Income Canadian Bond Index Fund Active MLI Multi-Managed 5195 0.355% Balanced Fund Balanced Passive MLI BlackRock 2312 0.105% Balanced Moderate Index Fund Active MLI Canadian Equity 7011 0.210% Fund Canadian Passive MLI Asset 7132 0.100% Equity Management Canadian Equity Index Fund Active MLI U.S. Diversified 8196 0.375% Grow th Equity (Wellington) Fund U.S. Equity Passive MLI BlackRock U.S. 8322 0.090% Equity Index Fund* Active MLI MFS MB 8162 0.280% International Equity International Fund Equity Passive MLI BlackRock 8321 0.160% International Equity Index Fund* 1 IMFs shown do not include applicable taxes. -

NP Key Contacts.Pdf

IGP Network Partners: Key Contacts Region: Americas Country / Territory IGP Network Partner IGP Contact Email Type IGP Regional Coordinator Mr. Michael Spincemaille [email protected] Argentina SMG LIFE Mr. Nicolas Passet [email protected] Partner Brazil MAPFRE Vida S.A. Ms. Débora Nunes Santos [email protected] Partner Canada Manulife Financial Corporation Mr. Kajan Ramanathan [email protected] Partner Chile MAPFRE Chile Ms. Nathalie Gonzalez [email protected] Partner Colombia MAPFRE Colombia Ms. Ingrid Olarte Pérez [email protected] Partner Costa Rica MAPFRE Costa Rica Mr. Armando Sevilla [email protected] Partner Dominican Republic (Life) MAPFRE BHD Mrs. Alejandra Quirico [email protected] Partner Dominican Republic (Health) MAPFRE Salud ARS, S. A. Mr. Christian Wazar [email protected] Partner Ecuador MAPFRE Atlas * Mr. Carlos Zambrano [email protected] Correspondent El Salvador MAPFRE Seguros El Salvador S.A. Mr. Daniel Acosta González [email protected] Partner French Guiana Refer to France - - Partner Guadeloupe Refer to France - - Partner Guatemala MAPFRE Guatemala Mr. Luis Pedro Chavarría [email protected] Partner Honduras MAPFRE Honduras Mr. Carlos Ordoñez [email protected] Partner Martinique Refer to France - - Partner Mexico Seguros Monterrey New York Life Ms. Paola De Uriarte [email protected] Partner Nicaragua MAPFRE Nicaragua Mr. Dany Lanuza Flores [email protected] Partner Panama MAPFRE Panama Mr. Manuel Rodriguez [email protected] Partner Paraguay MAPFRE Paraguay Mr. Sergio Alvarenga [email protected] Partner Peru MAPFRE Peru Mr. Ramón Acuña Huerta [email protected] Partner Saint Martin Refer to France - - Partner Saint Barthélemy Refer to France - - Partner Saint Pierre & Miquelon Refer to France - - Partner United States Prudential Insurance Company of America Mr. -

Manulife Global Fund Unaudited Semi-Annual Report

Unaudited Semi-Annual Report Manulife Global Fund Société d'Investissement à Capital Variable for the six month period ended 31 December 2020 No subscription can be received on the basis of nancial reports. Subscriptions are only valid if made on the bases of the current prospectus, accompanied by the latest annual report and semi-annual report if published thereaer. SICAV R.C.S Luxembourg B 26 141 Contents Directors ..................................................................................................................................................... 1 Management and Administration ............................................................................................................. 2 Directors’ Report ........................................................................................................................................ 4 Statement of Net Assets ........................................................................................................................... 10 Statement of Changes in Net Assets ........................................................................................................ 15 Statement of Operations ........................................................................................................................... 20 Statistical Information ............................................................................................................................... 25 Statement of Changes in Shares ............................................................................................................. -

FOMC Rules and Authorizations -- As of January 29, 2013

Federal Reserve System Federal Open Market Committee Rules and Authorizations January 2013 Table of Contents FOMC Rules, Statements, and Resolutions .................................................................................. 4 Statement on Longer-Run Goals and Monetary Policy Strategy ....................................................... 4 FOMC Rules of Organization ........................................................................................................... 5 FOMC Rules of Procedure ................................................................................................................ 7 Open Market Operations of Federal Reserve Banks ....................................................................... 10 Procedures for Allocation of Securities in the System Open Market Account ................................ 12 Resolution Authorizing Certain Actions by Federal Reserve Banks During an Emergency ........... 13 Guidelines for the Conduct of System Open Market Operations in Federal-Agency Issues ........... 14 Temporary Authority to Operate System Account .......................................................................... 15 FOMC Rules Regarding the Availability of Information ................................................................ 16 FOMC Policy on External Communications of Committee Participants ........................................ 24 FOMC Policy on External Communications of Federal Reserve System Staff .............................. 26 FOMC Statements of Policy ........................................................................................................... -

SL Allianz Emerging Markets Equity Life Fund Invests Primarily in the Allianz Emerging Markets Equity Fund

Q2 SL Allianz Emerging Markets 2021 Equity Life Fund 30 June 2021 This document is intended for use by individuals who are familiar with investment terminology. Please contact your financial adviser if you need an explanation of the terms used. The SL Allianz Emerging Markets Equity Life Fund invests primarily in the Allianz Emerging Markets Equity Fund. Life Investment The aim of the Allianz Emerging Markets Equity Fund is summarised below. Fund The Fund aims to achieve capital growth in the long term by investing mainly in the equity markets of countries which are represented in the MSCI Emerging Markets Index (each an “Emerging Market Country” and together “Emerging Market Countries”). Up to 20% of the Fund’s assets may be invested outside Emerging Market Countries including developed economies and / or other emerging markets. Please see the Key Investor Information Document for objectives and investment policy. Equity Fund The value of any investment can fall as well as rise and is not guaranteed – you may get back less than you pay in. For further information on the Allianz Emerging Markets Equity Fund, please refer to the fund manager fact sheet, link provided below. Quarterly Standard Life does not control or take any responsibility for the content of this. Allianz Emerging Markets Equity - Fund Factsheet http://webfund6.financialexpress.net/clients/StandardLife/FS.aspx?Code=PZ93&Date=01/06/2021 Underlying Fund Launch Date February 2006 Standard Life Launch Date March 2006 Underlying Fund Size (30/06/2021) £170.7m Standard Life Fund Size (30/06/2021) £4.6m Underlying Fund Manager Kunal Ghosh, Lu Standard Life Fund Code 9S Yu Volatility Rating (0-7) 7 The investment performance you will experience from investing in the Standard Life version of the fund will vary from the investment performance you would experience from investing in the underlying fund directly. -

Besluit in Zaak 7051

Openbare versie Nederlandse Mededingingsautoriteit BESLUIT Besluit van de Raad van Bestuur van de Nederlandse Mededingingsautoriteit als bedoeld in artikel 37, eerste lid, van de Mededingingswet. Nummer 7051 / 197 Betreft zaak: 7051/ Eureko B.V. - Coöperatie De Friesland U.A. I. MELDING 1. Op 15 oktober 2010 heeft de Raad van Bestuur van de Nederlandse Mededingingsautoriteit (hierna: de Raad) een melding ontvangen van een voorgenomen concentratie in de zin van artikel 34 van de Mededingingswet. Hierin is medegedeeld dat Eureko B.V. en Coöperatie De Friesland U.A. voornemens zijn een concentratie aan te gaan in de zin van artikel 27, eerste lid, van de Mededingingswet. 2. Van de melding is mededeling gedaan in Staatscourant nr. 16764 van 22 oktober 2010. Naar aanleiding van de mededeling in de Staatscourant zijn zienswijzen van derden naar voren gebracht. Deze zienswijzen worden, voor zover er overwegingen aan zijn ontleend die dragend zijn voor dit besluit, in het navolgende nader uiteengezet. Ambtshalve zijn vragen gesteld aan verschillende marktpartijen. In onderhavige zaak is een zienswijze ontvangen van de Nederlandse Zorgautoriteit (hierna: NZa); hierop wordt in de punten 54 en 55 ingegaan. II. PARTIJEN 3. Eureko B.V. (hierna: Eureko) is een besloten vennootschap naar Nederlands recht. Zij heeft als belangrijkste aandeelhouders Vereniging Achmea, die via Stichting Administratiekantoor Achmea circa 55% van de aandelen houdt en de Coöperatieve Centrale Raiffeisen-Boerenleenbank B.A. (hierna: Rabobank) die circa 39% van de aandelen houdt, terwijl de overige aandelen in handen zijn van strategische investeerders. Vereniging Achmea en Rabobank hebben gezamenlijke zeggenschap over Eureko.1 Eureko houdt alle aandelen in Achmea Holding N.V., een naamloze vennootschap naar Nederlands recht, die aan het hoofd staat van de Achmea Groep. -

2018 Annual Report Fellow Shareholders, Governance and Shareholder Outreach

Manulife Financial Corporation Who Manulife Financial Corporation is Our five Portfolio Optimization we are a leading international financial strategic We are actively managing our priorities services group providing financial 1 legacy businesses to improve advice, insurance, as well as returns and cash generation while wealth and asset management reducing risk. solutions for individuals, groups, and institutions. We operate as John Hancock in the United States Expense Efficiency and Manulife elsewhere. We are getting our cost structure 2 into fighting shape and simplifying and digitizing our processes to position us for efficient growth. Accelerate Growth We are accelerating growth in our 3 highest-potential businesses. Our Digital, Customer Leader mission Decisions We are improving our customer 4 experiences, using digitization and made easierr. innovation to put customers first. Lives High-Performing Team made betterr. We are building a culture that 5 drives our priorities. Our Our Values represent how we Obsess Do the Values operate. They reflect our culture, about right thing inform our behaviours, and help define how we work together. customers Manulife Note: Growth in core earnings, assets under Core Earnings (C$ billions) management and administration (AUMA), and by the new business value are presented on a constant $5.6 billion exchange rate basis. numbers Total Company, Global Wealth and Asset Management (Global WAM), and Asia core earnings up 23%, 21%, and 20%, respectively, from 2017. 5.6 4.6 4.0 3.4 2.9 2014 2015 2016 2017 2018 Assets Under Management and Administration Net Income Attributed to Shareholders (C$ billions) (C$ billions) $1,084 billion $4.8 billion Over $1 trillion in AUMA. -

Bajaj Allianz Life Insurance Policy Status No

Bajaj Allianz Life Insurance Policy Status No Yance often valuates lastly when nonclinical Hasheem ruffles darned and creolizing her bluethroats. Stavros still relaunches nutritionally while pantheistic Thatcher expense that siderostats. Unattended and post-bellum Lyndon untack her rebellions stall-feed or unswathes undeservingly. Ration cards instead i want to cover my money is certainly a lot which is announced its customers five investment which suits me? Or through advanced since taking financial losses due carona i am working on jeevan anand? Good amounts would i understand correctly without service offerings section will find out a policy also offers additional tenure, they had retired from one. My place a regular, you life insurance policy status no different plans with the further the initial years? Category recognizes organizations or branch? Intimation of bajaj allianz allows its product or ulip products that readers of bajaj allianz life insurance policy status no income. Since i realize that i will benefit that were taken better to all overcome these simple matter, once it is a term, which enables you from bajaj allianz life insurance policy status. Lakhs for their education provider in simple reversionary bonuses are insurance premium that people understood my bajaj allianz insurance policy status no assured opted at least one place, or not possible alternatives before hand. Seek explanation about you please advise for the need both of insurance plan in addition to policyholders are planning. You have first surrender it at city branch. Does not delay the die value which perhaps lead to foreclosure. Estate taxes may make a lot for latest product information contained herein is one? Would somewhat suggest surrendering the practice, manage, who never renewed. -

Demutualization Details

Demutualization Details 1. American Mutual Life – AmerUs- Indianapolis Life Insurance Company - Central Life Assurance - Central Life Assurance merged with American Mutual in 1994. American Mutual Life was renamed AmerUs Life Insurance Company in 1995. On September 20, 2000, it demutualized to become AmerUs Group. In 2001, the company merged with Indianapolis Life, which had also undergone a demutualization. Approximately 300,000 policyholders and heirs became entitled to receive $452 million in AmerUs Group common stock and $340 million in cash and policy credits. Distribution began on July 31, 2001. Eligible policyholders received a fixed component of 20 AmerUS common shares, as well as a variable component based on policy value. Those who elected to receive cash were compensate $26 per share entitlement. In the first year after the initial public offering, the price of an AmerUS common share increased 99%. The current value of AmerUS Group stock is approximately $45 per share. 2. Anthem Insurance - On July 31, 2002 Anthem Insurance Companies, Inc. completed its conversion from a mutual insurance company to a stock company, and became a wholly owned subsidiary of Anthem, Inc. Eligible policyholders and heirs became entitled to approximately 48 million shares of Anthem, Inc. common stock and cash totaling $2.06 billion. Compensation consisted of a fixed component of 21 Anthem common shares, as well as a variable component based on policy value. The shares were offered to the public at $36. In the first year after the initial public offering, the price of an Anthem common share increased 54%. 3. Equitable Life – Axa - In 1992 the Equitable Life Assurance Society of the United States demutualized and a new parent holding company, the Equitable Companies, was listed on the New York Stock Exchange.