KOLKATA Retail Q1 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Durga Pujas of Contemporary Kolkata∗

Modern Asian Studies: page 1 of 39 C Cambridge University Press 2017 doi:10.1017/S0026749X16000913 REVIEW ARTICLE Goddess in the City: Durga pujas of contemporary Kolkata∗ MANAS RAY Centre for Studies in Social Sciences, Calcutta, India Email: [email protected] Tapati Guha-Thakurta, In the Name of the Goddess: The Durga Pujas of Contemporary Kolkata (Primus Books, Delhi, 2015). The goddess can be recognized by her step. Virgil, The Aeneid,I,405. Introduction Durga puja, or the worship of goddess Durga, is the single most important festival in Bengal’s rich and diverse religious calendar. It is not just that her temples are strewn all over this part of the world. In fact, goddess Kali, with whom she shares a complementary history, is easily more popular in this regard. But as a one-off festivity, Durga puja outstrips anything that happens in Bengali life in terms of pomp, glamour, and popularity. And with huge diasporic populations spread across the world, she is now also a squarely international phenomenon, with her puja being celebrated wherever there are even a score or so of Hindu Bengali families in one place. This is one Bengali festival that has people participating across religions and languages. In that ∗ Acknowledgements: Apart from the two anonymous reviewers who made meticulous suggestions, I would like to thank the following: Sandhya Devesan Nambiar, Richa Gupta, Piya Srinivasan, Kamalika Mukherjee, Ian Hunter, John Frow, Peter Fitzpatrick, Sumanta Banjerjee, Uday Kumar, Regina Ganter, and Sharmila Ray. Thanks are also due to Friso Maecker, director, and Sharmistha Sarkar, programme officer, of the Goethe Institute/Max Mueller Bhavan, Kolkata, for arranging a conversation on the book between Tapati Guha-Thakurta and myself in September 2015. -

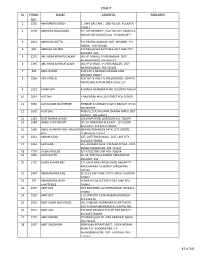

Sl Form No. Name Address Remarks

STARLIT SL FORM NAME ADDRESS REMARKS NO. 1 2235 ABHIMANYU SINGH 2, UMA DAS LANE , 2ND FLOOR , KOLKATA- 700013 2 1998 ABHISHEK MAJUMDER R.P. APPARTMENT , FLAT NO-303 PRAFULLA KANAN (W) KOLKATA-101 P.S-BAGUIATI 3 1922 ABHRANIL DUTTA P.O-PRAFULLANAGAR DIST-24PGS(N) , P.S- HABRA , PIN-743268 4 860 ABINASH HALDER 139 BELGACHIA EAST HB-6 SALT LAKE CITY KOLKATA -106 5 2271 ABU HENA MONIRUL ALAM VILL+P.O-MILKI, P.S-REJINAGAR DIST- MURSHIDABAD, PIN-742163 6 1395 ABU HENA SAHINUR ALAM VILL+P.O-MILKI , P.S-REGINAGAR , DIST- MURSHIDABAD, PIN-742163 7 446 ABUL HASAN B 32 1AH 3 MIAJAN OSTAGAR LANE KOLKATA 700017 8 3286 ADA AFREEN FLAT NO 9I PINES IV GREENWOOD SONATA NEWTOWN ACTION AREA II KOL 157 9 1623 ADHIR GIRI 8 DURGA CHANDRA ROAD KOLKATA 700014 10 2807 AJIT DAS 6 RAJENDRA MULLICK STREET KOL-700007 11 3650 AJIT KUMAR MUKHERJEE SHIBBARI K,S ROAD P.O &P.S NAIHATI DT 24 PGS NORTH 12 1602 AJOY DAS PO&VILL SOUTH GARIA CHARAK MATH DIST 24 PGS S PIN 743613 13 1261 AJOY KUMAR GHOSH 326 JAWPUR RD. DUMDUM KOL-700074 14 1584 AKASH CHOUDHURY DD-19, NARAYANTALA EAST , 1ST FLOOR BAGUIATI , KOLKATA-700059 15 2460 AKHIL CHANDRA ROY MNJUSRI 68 RANI RASHMONI PATH CITY CENTRE ROY DURGAPUR 713216 16 2311 AKRAM AZAD 227, DUTTABAD ROAD, SALT LAKE CITY , KOLKATA-700064 17 1441 ALIP JANA VILL-KHAMAR CHAK P.O-NILKUNTHIA , DIST- PURBA MIDNAPORE PIN-721627 18 2797 ALISHA BEGUM 5/2 B DOCTOR LANE KOL-700014 19 1956 ALOK DUTTA AC-64, PRAFULLA KANAN KRISHNAPUR KOLKATA -101 20 1719 ALOKE KUMAR DEY 271 SASHI BABU ROAD SAHID NAGAR PO KANCHAPARA PS BIZPUR 24PGSN PIN 743145 21 3447 -

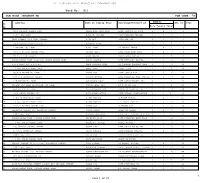

BUS ROUTE-18-19 Updated Time.Xls LIST of DROP ROUTES & STOPPAGES TIMINGS LIST of DROP ROUTES & STOPPAGES TIMINGS

LIST OF DROP ROUTES & STOPPAGES TIMINGS LIST OF DROP ROUTES & STOPPAGES TIMINGS FOR THE SESSION 2018-19 FOR THE SESSION 2018-19 ESTIMATED TIMING MAY CHANGE SUBJECT ESTIMATED TIMING MAY CHANGE SUBJECT TO TO CONDITION OF THE ROAD CONDITION OF THE ROAD ROUTE NO - 1 ROUTE NO - 2 SL NO. LIST OF DROP STOPPAGES TIMINGS SL NO. LIST OF DROP STOPPAGES TIMINGS 1 DUMDUM CENTRAL JAIL 13.00 1 IDEAL RESIDENCY 13.05 2 CLIVE HOUSE, MALL ROAD 13.03 2 KANKURGACHI MORE 13.07 3 KAJI PARA 13.05 3 MANICKTALA RAIL BRIDGE 13.08 4 MOTI JEEL 13.07 4 BAGMARI BAZAR 13.10 5 PRIVATE ROAD 13.09 5 MANICKTALA P.S. 13.12 6 CHATAKAL DUMDUM ROAD 13.11 6 MANICKTALA DINENDRA STREET XING 13.14 7 HANUMAN MANDIR 13.13 7 MANICKTALA BLOOD BANK 13.15 8 DUMDUM PHARI 01:15 8 GIRISH PARK METRO STATION 13.20 9 DUMDUM STATION 01:17 9 SOVABAZAR METRO STATION 13.23 10 7 TANK, DUMDUM RD 01:20 10 B.K.PAUL AVENUE 13.25 11 AHIRITALA SITALA MANDIR 13.27 12 JORABAGAN PARK 13.28 13 MALAPARA 13.30 14 GANESH TALKIES 13.32 15 RAM MANDIR 13.34 16 MAHAJATI SADAN 13.37 17 CENTRAL AVENUE RABINDRA BHARATI 13.38 18 M.G.ROAD - C.R.AVENUE XING 13.40 19 MOHD.ALI PARK 13.42 20 MEDICAL COLLEGE 13.44 21 BOWBAZAR XING 13.46 22 INDIAN AIRLINES 13.48 23 HIND CINEMA XING 13.50 24 LEE MEMORIAL SCHOOL - LENIN SR. 13.51 ROUTE NO - 3 ROUTE NO - 04 SL NO. -

Ward No: 011 ULB Name :KOLKATA MC ULB CODE: 79

BPL LIST-KOLKATA MUNICIPAL CORPORATION Ward No: 011 ULB Name :KOLKATA MC ULB CODE: 79 Member Sl Address Name of Family Head Son/Daughter/Wife of BPL ID Year No Male Female Total 1 82/1 BIDHAN SARANI ROAD ABANINDRA NATH BOUR LATE SANTOSH KU BOUR 1 2 3 2 2 156/2 APC ROAD AJAY KR JAISWAL LAKHINARAYAN JAISWAL 1 2 3 5 3 GRAY STREET 72/1 GRAY STREET AJOY DAS JAGADISH DAS 2 3 5 6 4 28/C NALIN SARKAR ST,KOL-4 SADHANA KUNDU 3 2 5 7 5 1 MADHAB DAS LANE AJOY PATRA LT KARTIK PATRA 2 4 6 8 6 82/1/1 BIDHAN SARANI ROAD AKSHAY GIRI LATE PANCHANAN GIRI 1 2 3 9 7 77/1 BIDHAN SARANI ALOK MONDAL LAXMIKANTA MONDAL 4 2 6 11 8 MOHAN BAGAN LANE 3A/H/16/1 MOHAN BAGAN LANE AMALA NASKAR LATE EKADASHI NASKAR 1 2 3 13 9 A P C ROAD 156 A P C RD AMAR CHANDRA SAHA LT SANATAN CHANDRA SAHA 1 3 4 14 10 3 NO, MOHAN BAGAN LANE AMAR SHAW BIMAL SHAW 2 3 5 18 11 4C/H/4 MADHABDAS LANE AMIYA ROY LATE SATISH ROY 4 2 6 20 12 157/H/1 AROBINDA SARANI ANANTA MONDAL LATE NARENDRA NATH MONDAL 2 2 4 22 13 1/E MADHABDAS LANE ANGURBALA DASI LATE RABINDRANATH DAS 0 1 1 23 14 MADHAB DAS LANE 1E MADHAB DAS LANE ANGURI BALA DAS LT AJIT KR DAS 0 1 1 24 15 8/A MADHABDAS LANE ANIL CHANDRA DAS RABINDRA CHANDRA DAS 2 2 4 25 16 36/C NALIN SARKAR ST ANIL KUMAR MITRA LATE NIRMAL KUMAR MITRA 8 7 10+ 26 17 1/B/H/2 MADHABDAS LANE ANIMA MANDAL SUKUMAR MONDAL 4 2 6 27 18 3 NO, MOHAN BAGAN LANE ANIMA MONDAL LT SAMBHU MONDAL 2 2 4 28 19 82/1/1 BIDHAN SARANI ROAD ANIMA ROY SRIKANTA ROY 1 2 3 29 20 ARABINDA SARANI 110 ARABINDA SARANI ANITA PATRA PARITOSH PATRA 2 2 4 30 21 156/5 APC ROAD APARNA SADHUKHA LATE -

32. West Bengal

Indian Economic Association Life Membership Profiles - WEST BENGAL WEST BENGAL Acharya, Dr. Rajat - WB-001 Deptt.of Economics,Jadavpur University,Kolkata-700032 (W.B.) Adhikari, Mr. Swapan Kumar - WB-002 Vill & P.O., Pusurah,Hooghly-712408 (W.B.) Agrawal, Mr. Dhanpat Ram - WB-003 AE-758, Salt Lake City,Kolkata-700 064 (W.B.) Agrawal, Ms. Sadhna - WB-004 AE-758, Salt Lake City,Sector-1, Kolkata-700 064, (W.B.) Ahmad, Dr. Fakruddin - WB-005 3, Nawab Sarajul Islam Lane, Kolkata-700016 (W.B.) Anand, Mr. Abhishek - WB-332 Director, Accede Technologies Pvt. Ltd., Second Floor, 110 Lake Town Block-A Kolkata- 700089 (W.B) Bagchi, Mr. Dhurjati Prasad - WB-006 79/1/1, N.N. Roy Street,P.O. Srirampur,Hooglhly-712201, (W.B.) Bagchi, Mr. Sayantani - WB-358 Paschim Das Para, Vidyasagar Sarani, P.O- Sonarpur, Kolkatta – 700150 (WB) Bagchi, Prof. (Dr.) Kanak Kanti - WB-007 Meghamathar Suryasen Pally, P.O. Kadamtala-734 011, Dist. Darjeeling (W.B.) Bandyopadhyay, Dr. D. Kumar - WB-008 A-2/8 Baitalik CooperativeHousing Society, Baga-Jatin, KMDA Complex (E.M. Bypass), Kolkata-700094 (W.B.) Bandyopadhyay, Ruby - WB-009 242/3B APC Road,Nandan Apartment, Maharaja Srischandra College, Kolkata-700004 (W.B.) IEA - Life Members - WEST BENGAL 1 Indian Economic Association Life Membership Profiles - WEST BENGAL Bandyopadhyay Dr. Subir - WB-010 3/6, Netajinagar,Post Office :-Regent Park,Kolkata-700040, (W.B.) Banerjee Mr. Basudeb - WB-012 RA-63, Sector 2B, S. S. Banerjee Sarani, Bidhan Nagar,Durgapur-713212 (W.B.) Banerjee, Dr. Dibyendu - WB-333 Assistant Professir in Economics, Amulya Kanan Housing Complex, (Phase 2), Flat No. -

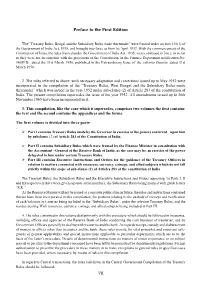

Preface to the First Edition

Preface to the First Edition The” Treasury Rules, Bengal and the Subsidiary Rules made thereunder” were framed under section 135(1) of the Government of India Act, 1935, and brought into force as from lst April 1937. With the commencement of the Constitution of India, the rules framed under the Government of India Act, 1935, were continued in force, in so far as they were not inconsistent with the provisions of the Constitution, in the Finance Department notification-No. 3468F.B., dated the 31st March 1950, published in the Extraordinary Issue of the calcutta Gazette, dated 31st March 1950. 2. The rules referred to above, with necessary adaptation and corrections issued up to May 1952 were incorporated in the compilation of the “Treasury Rules, West Bengal and the Subsidiary Rules made thereunder” which was issued in the year 1952 under sub-clause (2) of Article 283 of the constitution of India. The present compilation supersedes the issue of the year 1952. All amendments issued up to 30th November 1965 have been incorporated in it. 3. This compilation, like the cone which it supersedes, comprises two volumes the first contains the text and the second contains the appendices and the forms. The first volume is divided into three parts- , Ø Part I contains Treasury Rules made by the Governor in exercise of the powers conferred upon him by subclause (2) of Article 283 of the Constitution of India. Ø Part II contains Subsidiary Rules which were framed by the Finance Minister in consultation with the Accountant –General of the Reserve Bank of India, as the case may be, m exercise of the power delegated to him under certain Treasury Rules. -

16‐06‐20 13 5 Seals Garden Lane Cossipore 700002 1 1

Affected Zone DAYS SINCE Date of reporting of REPORTING Sl No. Address Ward Borough Local area the case 13 5 SEALS GARDEN LANE The premises itself 1 1 1 Cossipore 16‐06‐20 COSSIPORE 700002 14 The affected flat/the 59 Kalicharan Ghosh Rd standalone house 2 kolkata ‐ 700050 West 2 1 Sinthi Bengal India 16‐06‐20 14 The premises itself 21/123 RAJA MANINDRA 3 31 Paikpara ROAD BELGACHIA 700037 16‐06‐20 14 14A BIRPARA LANE The premises itself 4 kolkata ‐ 700030 West 31 Belgachia 16‐06 ‐20 BBlIdiengal India 14 The flat itself A4 6 R D B RD Kolkata ‐ 5 41 Paikpara 700002 West Bengal India 16‐06‐20 14 110/1A COSSIPORE Road The premises itself 6 Kolkata ‐ 700002 West 6 1 Chitpur 16‐06‐20 Bengal India 14 Adjacent common passage of affected hut 14 3 GALIFF STREET 7 7 1 Bagbazar including toilet and BAGHBAZAR 700003 water source of the 16‐06‐20 slum 14 Adjacent common passage of affected hut 14 3 GALIFF STREET 8 7 1 Bagbazar including toilet and BAGHBAZAR 700003 water source of the 16‐06‐20 slum 14 Affected Zone DAYS SINCE Date of reporting of REPORTING Sl No. Address Ward Borough Local area the case 1 RAMKRISHNA LANE The premises itself 9 Kolkata ‐ 700003 West 7 1 Girish Mancha 16‐06‐20 Bengal India 14 The premises itself 4/2/1B KRISHNA RAM BOSE 10 STREET SHYAMPUKUR 10 2 Shyampukur KOLKATA 700004 16‐06‐20 14 T/1D Guru Charan Lane The premises itself 11 Kolkata ‐ 700004 West 10 2 Hatibagan 16‐06‐20 Bengal India 14 Adjacent common 47 1 SHYAMBAZAR STREET passage of affected hut 12 Kolk at a ‐ 700004 W est 10 2 Shyampu kur iilditiltdncluding toilet and -

The Right to the Street

Right to the City as the Basis for Housing Rights Advocacy in Contemporary India The Right to the street Submitted by: Dr. Anushyama Mukherjee Dr. Ratoola Kundu Ford Foundation Sponsored Research (Year 2016 -18) Tata Institute of Social Sciences 1 Chapter 1: Introduction The Centre for Urban Policy and Governance at TISS has embarked upon a multifaceted research project “Right to the City” funded by Ford Foundation which aims to a) generate knowledge b) inform policy and practices c) build networks of solidarity on the various aspects of claiming and upholding the right to the city, particularly for marginalised and excluded communities and groups that inhabit the urban space. Within the broader rubric of the Right to the City project, this study attempts to re-conceptualise the Right to the Street as a democratic and socio-political right which is increasingly under threat from the dominant development planning paradigms of urban imagination that seek to reduce the street to a particular function - as merely a space for vehicles carrying goods and people. The street emblematizes the concrete everyday reality of cities in India and much of the Global South, and also offers an insight into the workings of larger scale political economic structures (Saskia Sassen 1988, 1990, 1994, 2000; Manuel Castells 1983, 1996; Parthasarathy 1996; Ramchandraiah 2003; and Annapurna Shaw 1999). It reveals and hides, simultaneously, the complex mesh of claims and forces that shapes its life, that of the city at large, as well as of larger geographies. One of the key stakeholders in this highly contested space and a co-producer of the space of the street as a space of production, accumulation and of livelihood is the hawker. -

Kolkata Train

Here is the complete history of Kolkata tram routes, from 1873 to 2020. HORSE TRAM ERA 1873 – Opening of horse tram as meter gauge, closure in the same year. 1880 – Final opening of horse tram as a permanent system. Calcutta Tramways Company was established. 1881 – Dalhousie Square – Lalbazar - Bowbazar – Lebutala - Sealdah Station. (Later route 14) Esplanade – Lalbazar – Pagyapatti – Companybagan - Shobhabazar - Kumortuli. (Later route 7 after extension) Dalhousie Square – Esplanade. (Later route 22, 24, 25 & 29) Esplanade – Planetarium - Hazra Park - Kalighat. (Later route 30) 1882 - Esplanade – Wellington Square – Bowbazar – Boipara - Hatibagan - Shyambazar Junction. (Later route 5) Wellington Square – Moula Ali - Sealdah Station. (Later route 12 after extension) Dalhousie Square – Metcalfe Hall - High Court. (Later route 14 extension) Metcalfe Hall – Howrah Bridge - Nimtala. (Later route 19). Steam tram service was thought. STEAM TRAM ERA 1883 - Esplanade – Racecourse - Wattganj - Khidirpur. (Later route 36) 1884 - Wellington Square – Park Street. (Later route 21 & 22 after extension) 1900 - Nimtala – Companybagan (non-revenue service only). Electrification & conversion to standard gauge was started. ELECTRIC TRAM ERA 1902 - Khidirpur & Kalighat routes were electrified. Shobhabazar – Hatibagan. (Later route 9 & 10) Nonapukur Workshop opened with Royd Street – Nonapukur (Later route 21 & 22 after re-extension). Royd Street – Park Street closed. 1903 – Shyambazar terminus opened with Shyambazar – Belgachhia. (Later route 1, 2, 3, 4 & 11) Kalighat – Tollyganj. (Later route 29 & 32) 1904 - Kumortuli – Bagbazar. Kumortuli terminus closed. (Later route 7 & 8) 1905 - Howrah Bridge – Pagyapatti – Boipara – Purabi Cinema - Sealdah Station (Later route 15). All remaining then-opened routes were electrified. 1907 - Moula Ali – Nonapukur. (Later route 20 & 26 after extension) Wattganj – Mominpur (via direct access through Ofphanganjbazar). -

Containment Zones in West Bengal

We have two Containment Zones as on 04.05.20 for Darjeeling District: 1. Ward No 47, Siliguri Municipal Corporation. 2.Shantiniketan Housing Complex, Shusrat Nagar, Matigara Block. Containment Zones in Hooghly District ZONE CODE ZONE DETAILS 1 Sarai-tinna GP Purushortampur Pandua, PANDUA,SADAR 2 W-12 Champdani Muni-Chandannagar, CHAMPDANI MUNICIPALITY,CHANDANNAGAR 3 W-12 Konnagar Muni-Srerampore-U, KONNAGAR MUNICIPALITY,SRIRAMPORE 4 W-19 Serampore M-Srerampore-U, SERAMPORE MUNICIPALITY,SRIRAMPORE 5 W-11 Dankuni M-Srerampore-U, DANKUNI MUNICIPALITY,SRIRAMPORE 6 Rishra GP Sansad No-1 Malik Para, Mollaber SU Block Serampore-R, SRIRAMPORE-UTTARPARA,SRIRAMPORE 7 W-17 Srerampore M-Srerampore-U, SERAMPORE MUNICIPALITY,SRIRAMPORE 8 W-8 CMC Chandannagar, CHANDANNAGAR MUNICIPALITY,CHANDANNAGAR 9 W-18 srerampore M-Srerampre-U, SERAMPORE MUNICIPALITY,SRIRAMPORE 10 Sugandhaya GP Sansad 15 Gotu-Madhya-Sadar, POLBA-DADPUR,SADAR 11 Kanaipur GP-SU Block Srerampore, SRIRAMPORE-UTTARPARA,SRIRAMPORE 12 Barjhati GP Chanditala II Bl Srerampore, CHANDITALA-II,SRIRAMPORE 13 W- 1 Rishra M, Masjid Para, Srerampore, RISHRA MUNICIPALITY,SRIRAMPORE 14 W-2, Gokhanan, RISHRA MUNICIPALITY,SRIRAMPORE 15 Tirole GP, Arambagh, ARAMBAGH,ARAMBAG 16 W 11- CMC -Urdi Bazar, CHANDANNAGAR MUNICIPALITY,CHANDANNAGAR 17 W 12- CMC -Urdi Bazar , CHANDANNAGAR MUNICIPALITY,CHANDANNAGAR 18 W -29 Srerampore M Prabhasnagar, SERAMPORE MUNICIPALITY,SRIRAMPORE We have the following Containment Zones as on 04.05.20 for Jalpaiguri District: 1.Ward No 40, 41,.42 and 43 under Siliguri Municipal -

The Socio-Economic Study of Barabazar - a Traditional Market, Kolkata, West Bengal

International Journal of Research and Review Vol.8; Issue: 3; March 2021 Website: www.ijrrjournal.com Research Paper E-ISSN: 2349-9788; P-ISSN: 2454-2237 The Socio-Economic Study of Barabazar - A Traditional Market, Kolkata, West Bengal Sulagna Gupta Bhaya Dept. of Geography, Ranaghat College, Ranaghat, Nadia, West Bengal. Pin-741201 ABSTRACT started their business in Sutanuti hat. This bi-weekly hat grew into Barabazar, a Kolkata Metropolitan is one of the largest permanent residential wholesale cum retail agglomerations in India. The major and market. Kolkata being capital of British powerful wholesale trading activities are located India grew in importance and the invent of in the heart of Kolkata in Barabazar. Barabazar railways in the early 1860’s opened the expanded from a yarn and textile market into one of the largest wholesale markets in Asia. It flood gates of the journey of the up-country merchants particularly the Marwari, is a lively wholesale market with sections for [2] spices, textiles, electric and electronic goods, Gujarati and Khatri etc. to Kolkata . They ornaments and other kinds of goods. Here nested in Barabazar in a large number. The people can get customer for everything. People Marwaris and other North Indian from neighbouring countries like Nepal, Bhutan businessmen ousted the Sheths and Basaks as well as Bangladesh even come here for their and the other cloth merchants and business. On-street parking of good traffic, established their dominance over Barabazar loading and unloading operations severely market by the late 19th century [3]. affects operational efficiency of traffic and transportation. One fifth of the volume of good 2. -

City Disaster Management Plan of Kolkata

CITY DISASTER MANAGEMENT PLAN OF KOLKATA 2020 KOLKATA MUNICIPAL CORPORATION 5, S.N. BANERJEE ROAD, KOLKATA - 13 Foreword Cities are important centres of modern societies that will continue to gain in importance in the future. Today, more than half the world’s population lives in urban areas. The high density and interdependence of urban lifestyles and work, and the growing dependence on increasingly complex infrastructure systems and services, are making cities more vulnerable to a variety of hazards — natural and man-made. These can be the result of technological, natural or social causes. The populous City of Kolkata is situated in the multi-hazard prone southern part of the state of West Bengal which has considerable risk of damage/loss of lives and property due to natural hazards like Cyclone, Earthquake and Flood even if we keep aside the threats due to human induced hazards as Fire, Accidents, Industrial & Chemical hazards etc. To minimize the losses due to disasters and to have a disaster resilient society, we must have clear understanding in regard to the type and strength of each of the probable threats which may cause disasters of medium or large scale in the city. The perception about disaster and its management has undergone a change following the enactment of the Disaster Management Act, 2005. The definition of disaster is now all encompassing that includes not only the events emerging from natural and man-made causes, but even those events which are caused by accident or negligence. There was a long felt need to capture information about all such events occurring across the sectors and efforts made to mitigate them in the city and to collate them at one place in a global perspective.