Cote D'ivoire Cotton and Products Annual 2018 Cote D'ivoire Annual

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RESOUND a Quarterly of the Archives of Traditional Music

RESOUND A Quarterly of the Archives of Traditional Music Volume 25, Number 3/4 October/December 2006 Senufo Balafon Music by HugoZemp Part two~ continued from Resound VtJl 25~ No 1/2 same time [film 2]. We find here a simultaneity of different words analogous to the one between the Repertoires: Themes connected to circumstances solo balafonist and a singer during funerals and Other sets of circumstances during which collective labor. different types of ensembles of balafons perform As for the dance-music of the IJ 9 ~ r ~ have more specific repertoires. Of the 60 texts celebrating the end of the cycle of initiation into the translated in Marianne Lemaire's article, all without poro, the baba ('father' in Jula) , leader in Nganaoni, exception had to do with work and competition. maintained that the young .female dancers knew The author correctly saw that contrary to the songs only dance steps, but not the words of the balafons, made to accompany tamping down the earthen understood only by initiates [film 2]. Forster floors of houses, there was not "the same profound' (1984:32) published translations for three balafon interweaving of the music and the gestures of tunes (or flute tunes ?) from the IJ 9 ~ r ~, but he is working, nor the same inclination in the music an initiate. At any rate there are other words played to imitate the movements made while working" on musical instruments and linked to the poro (1999:56). In effect, each worker wields his hoe at rites that are secret: those beaten on the big drums his own rhythm, independently of the rhythm and at funerals, whose meaning is only known to the the tempo of the music, in contrast to what is found drummers, who receive special training regarding it in many other forms of collective work in Africa, in (Forster 1997:316, 361, 396). -

Report Name: Cotton and Products Annual

Required Report: Required - Public Distribution Date: April 14,2020 Report Number: IV2020-0001 Report Name: Cotton and Products Annual Country: Cote d'Ivoire Post: Accra Report Category: Cotton and Products Prepared By: Daniel Archibald Approved By: Charles Rush Report Highlights: Post forecasts market year (MY) 2020/21 cotton fiber production at a record for a third consecutive year, at 1.0 million bales (480 lb.). The MY 2019/20 production estimate is lowered to 990,000 bales, albeit still a record, as current deliveries of seed cotton to ginning facilities come in just below early projections. Post’s MY 2020/21 export projection is just under 1.1 million bales, in anticipation of delays and spillover of MY 2019/20 exports due to COVID19-related challenges faced by downstream customers. Annual consumption remains low at 30,000 bales. THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Production: Post projects MY 2020/21 cotton fiber production at a record 1.0 million bales (480 lb.), assuming normal conditions and based on continued national support for the sector’s growth. Despite the expectation of a temporary decline in global demand due to the impact of the COVID-19 pandemic, the Government of Côte d’Ivoire’s (GOCI) continuation of support-pricing and an overall push towards greater agricultural productivity creates expectations for maintaining if not building upon recent productivity growth in the sector. For MY 2019/20, Post estimates cotton fiber production at 990,000 bales. Based on official seed cotton production and fiber yield statistics to date, this national fiber production estimate would also surpass the current record for production set just one year ago, and would place Côte d’Ivoire as the third-largest producer in Sub-Saharan Africa. -

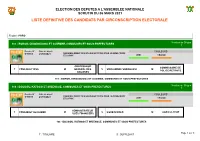

Crystal Reports

ELECTION DES DEPUTES A L'ASSEMBLEE NATIONALE SCRUTIN DU 06 MARS 2021 LISTE DEFINITIVE DES CANDIDATS PAR CIRCONSCRIPTION ELECTORALE Region : PORO Nombre de Sièges 163 - BORON, DIKODOUGOU ET GUIEMBE, COMMUNES ET SOUS-PREFECTURES 1 Dossier N° Date de dépôt COULEURS U-00665 21/01/2021 RASSEMBLEMENT DES HOUPHOUETISTES POUR LA DEMOCRATIE ET LA PAIX VERT ORANGE CONTROLEUR COMMISSAIRE DE T COULIBALY ISSA M GENERAL DES S SOULAMANE SAMAGASSI M POLICE RETRAITE DOUANES 163 - BORON, DIKODOUGOU ET GUIEMBE, COMMUNES ET SOUS-PREFECTURES Nombre de Sièges 164 - BOUGOU, KATOGO ET M'BENGUE, COMMUNES ET SOUS-PREFECTURES 1 Dossier N° Date de dépôt COULEURS U-00666 21/01/2021 RASSEMBLEMENT DES HOUPHOUETISTES POUR LA DEMOCRATIE ET LA PAIX VERT ORANGE ADMINISTRATEUR T COULIBALY ALI KADER M S SILUE N'GOLO M AGRICULTEUR SCES FINANCIERS 164 - BOUGOU, KATOGO ET M'BENGUE, COMMUNES ET SOUS-PREFECTURES Page 1 sur 9 T : TITULAIRE S : SUPPLEANT Nombre de Sièges 165 - KATIALI ET NIOFOIN, COMMUNES ET SOUS-PREFECTURES, N'GANON SOUS-PREFECTURE 1 Dossier N° Date de dépôt COULEURS U-00655 16/01/2021 INDEPENDANT BLANC BLEUE T SORO ZIE SAMUEL M ETUDIANT S MASSAFONHOUA SEKONGO M INSTITUTEUR Dossier N° Date de dépôt COULEURS U-00663 20/01/2021 INDEPENDANT VERT BLANC T SORO WANIGNON M INGENIEUR S SEKONGO ZANGA M AGENT DE POLICE Dossier N° Date de dépôt COULEURS U-00667 21/01/2021 RASSEMBLEMENT DES HOUPHOUETISTES POUR LA DEMOCRATIE ET LA PAIX VERT ORANGE INGENIEUR DES T SORO FOBEH M S KANA YEO M COMMERCANT TRANSPORTS 165 - KATIALI ET NIOFOIN, COMMUNES ET SOUS-PREFECTURES, N'GANON -

Cote D'ivoire PRRO 200464

PROJECT BUDGET REVISION FOR APPROVAL BY THE REGIONAL DIRECTOR 5) To: Initials In Date Out Date Reason for Delay Denise Brown, Regional Director, RBD 4) Through: Initials In Date Out Date Reason for Delay Natasha Nadazdin, Programme Adviser, RBD 3) Through: Initials In Date Out Date Reason for Delay Jean-Pierre Leroy, Logistics Officer, RBD 2) Through: Initials In Date Out Date Reason for Delay Lydie Kouame, Resource Management Analyst, RBD 1) From: Initials In Date Out Date Reason for Delay Gianluca Ferrera, Country Director, Cote d’Ivoire Cote d’Ivoire PRRO 200464 BR No. 4 Total revised number of beneficiaries 85 500 Duration of entire project 33 months, 1 April 2013 to 31 December 2016 Extension period 12 months, 1 January 2016 to 31 December 2016 WFP food tonnage (mt) 4 235 Project: Saving lives and livelihoods, promoting transition Start date: 01/04/2015 End date: 31/12/2015 Extension period: 12 months New end date: 31/12/2016 Cost (United States dollars) Current Budget Increase Revised Budget Food and related costs 30 543 238 2 912 031 33 455 269 Cash and vouchers and related costs 13 399 328 1 004 260 14 403 588 Capacity development & augmentation 1 488 521 264 600 1 753 121 Direct support cost 8 258 623 975 950 9 234 573 Indirect support cost 3 758 280 360 979 4 119 259 Total cost to WFP 57 447 990 5 517 820 62 965 810 CHANGES TO: Food Tool C&V Tool Project Rates MT C&V Transfers CD&A LTSH ($/MT) Commodity Value C&V Related Costs DSC ODOC ($/MT) External Transport Project duration C&V Related (%) LTSH Other DSC (%) ODOC NATURE OF THE INCREASE 1. -

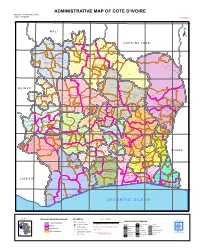

ADMINISTRATIVE MAP of COTE D'ivoire Map Nº: 01-000-June-2005 COTE D'ivoire 2Nd Edition

ADMINISTRATIVE MAP OF COTE D'IVOIRE Map Nº: 01-000-June-2005 COTE D'IVOIRE 2nd Edition 8°0'0"W 7°0'0"W 6°0'0"W 5°0'0"W 4°0'0"W 3°0'0"W 11°0'0"N 11°0'0"N M A L I Papara Débété ! !. Zanasso ! Diamankani ! TENGRELA [! ± San Koronani Kimbirila-Nord ! Toumoukoro Kanakono ! ! ! ! ! !. Ouelli Lomara Ouamélhoro Bolona ! ! Mahandiana-Sokourani Tienko ! ! B U R K I N A F A S O !. Kouban Bougou ! Blésségué ! Sokoro ! Niéllé Tahara Tiogo !. ! ! Katogo Mahalé ! ! ! Solognougo Ouara Diawala Tienny ! Tiorotiérié ! ! !. Kaouara Sananférédougou ! ! Sanhala Sandrégué Nambingué Goulia ! ! ! 10°0'0"N Tindara Minigan !. ! Kaloa !. ! M'Bengué N'dénou !. ! Ouangolodougou 10°0'0"N !. ! Tounvré Baya Fengolo ! ! Poungbé !. Kouto ! Samantiguila Kaniasso Monogo Nakélé ! ! Mamougoula ! !. !. ! Manadoun Kouroumba !.Gbon !.Kasséré Katiali ! ! ! !. Banankoro ! Landiougou Pitiengomon Doropo Dabadougou-Mafélé !. Kolia ! Tougbo Gogo ! Kimbirila Sud Nambonkaha ! ! ! ! Dembasso ! Tiasso DENGUELE REGION ! Samango ! SAVANES REGION ! ! Danoa Ngoloblasso Fononvogo ! Siansoba Taoura ! SODEFEL Varalé ! Nganon ! ! ! Madiani Niofouin Niofouin Gbéléban !. !. Village A Nyamoin !. Dabadougou Sinémentiali ! FERKESSEDOUGOU Téhini ! ! Koni ! Lafokpokaha !. Angai Tiémé ! ! [! Ouango-Fitini ! Lataha !. Village B ! !. Bodonon ! ! Seydougou ODIENNE BOUNDIALI Ponondougou Nangakaha ! ! Sokoro 1 Kokoun [! ! ! M'bengué-Bougou !. ! Séguétiélé ! Nangoukaha Balékaha /" Siempurgo ! ! Village C !. ! ! Koumbala Lingoho ! Bouko Koumbolokoro Nazinékaha Kounzié ! ! KORHOGO Nongotiénékaha Togoniéré ! Sirana -

Linking Social Capital to Therapeutic Practices in Korhogo, Côte D'ivoire

ISSN 1712-8056[Print] Canadian Social Science ISSN 1923-6697[Online] Vol. 17, No. 1, 2021, pp. 91-97 www.cscanada.net DOI:10.3968/12117 www.cscanada.org Linking Social Capital to Therapeutic Practices in Korhogo, Côte d’Ivoire Adiko Adiko Francis[a],*; Ymba Maïmouna[b]; Esso Lasme Jean Charles Emmanuel[c]; Yéo Soungari[d]; Tra Bi Boli Francis[e] [a] Researcher in sociology of health, Centre Ivoirien de Recherches resources” dimensions compared to just over two-thirds Economiques et Sociales (CIRES), Université Félix Houphouët- (69.2%) for those relating to financial resources. Modern Boigny, 08 BP 1295 Abidjan 08; Associated researcher, Centre Suisse de Recherches Scientifiques en Côte d’Ivoire (CSRS), 01 BP 1303 Abidjan medicine (36.1%) and traditional medicine (32.8%) 01, Côte d’Ivoire; are the most dominant in the region. The majority of [b] Teacher-researcher in geography, Institut de Géographie Tropicale households (83.0%) are led to opt for a therapeutic practice (IGT), Université Félix Houphouët-Boigny, 01 BP V 34 Abidjan 01, following discussions with the members of their networks. Côte d’Ivoire; [c] Teacher-researcher in demography, Institut de Géographie Tropicale However, the human, material and financial dimensions (IGT), Université Félix Houphouët-Boigny, 01 BP V 34 Abidjan 01, of social capital have little influence on the choice of Côte d’Ivoire; Associated researcher, Centre Suisse de Recherches therapeutic practices for households. All initiatives aimed Scientifiques en Côte d’Ivoire (CSRS), 01 BP 1303 Abidjan 01, Côte at strengthening solidarity are likely to contribute to d’Ivoire; [d] Teacher-researcher in educational sciences, Institut de Recherches, promoting the health and well-being of disadvantaged d’Expérimentation et d’Enseignement en Pédagogie (IREEP), Université households in situations of socio-political crises. -

Wastewater Management of Korhogo City

Asian Journal of Environment & Ecology 11(1): 1-11, 2019; Article no.AJEE.52131 ISSN: 2456-690X Wastewater Management of Korhogo City Kouakou Yao Salomon1*, Seyhi Brahima1, Gnamba Franck Maxime1, Kouassi N’guessan Martial1 and Kouame Nanan Audrey1 1Department of Geosciences, University Peleforo Gon Coulibaly of Korhogo, BP 1328 Korhogo, Cote d’Ivoire. Authors’ contributions This work was carried out in collaboration among all authors. Author KYS designed the study, performed the statistical analysis, wrote the protocol and wrote the first draft of the manuscript. Authors SB and GFM managed the analyses of the study. Authors KNM and KNA managed the literature searches. All authors read and approved the final manuscript. Article Information DOI: 10.9734/AJEE/2019/v11i130126 Editor(s): (1). Dr. Wen-Cheng Liu, Department of Civil and Disaster Prevention Engineering, National United University, Miaoli, Taiwan. Reviewers: (1). Hen Friman, H.I.T - Holon Institute of Technology, Israel. (2). Maria Antonietta Toscano, University of Catania, Italy. Complete Peer review History: https://sdiarticle4.com/review-history/52131 Received 12 August 2019 Accepted 26 October 2019 Original Research Article Published 06 November 2019 ABSTRACT The present study was conducted to provide more information on wastewater management in developing country cities, particularly in Korhogo a city in the north of Ivory Coast. Results showed that 23% of the residences discharge their wastewater either in rivers around the city, in pipes intended for storm water drainage, or on the way for laundry, crockery and/or bath water. 43% and 34% release their water through watertight and non-watertight facilities such as septic tanks and latrines, respectively. -

Observatory of Illicit Economies in West Africa

ISSUE 1 | SEPTEMBER 2021 OBSERVATORY OF ILLICIT ECONOMIES IN WEST AFRICA ABOUT THIS RISK BULLETIN his is the first issue of the Risk Bulletin of the newly established Observatory of Illicit Economies Tin West Africa, a network of analysts and researchers based in the region. The articles in the bulletin, which will be published quarterly, analyze trends, developments and insights into the relation- ship between criminal economies and instability across wider West Africa and the Sahel.1 Drawing on original interviews and fieldwork, the articles shed light on regional patterns, and dive deeper into the implications of significant events. The stories will explore the extent to which criminal econ- omies provide sources of revenue for violent actors, focusing on hotspots of crime and instability in the region. Articles will be translated into French or Portuguese, as most appropriate, and published on the GI-TOC website. SUMMARY HIGHLIGHTS 1. Northern Côte d’Ivoire: new jihadist threats, attackers assaulted an informal gold-mining site old criminal networks. near the village of Solhan. The massacre marked A surge in jihadist activity in northern Côte not only a grim milestone amid ongoing inter- d’Ivoire since June 2020 has come alongside a communal violence in Burkina Faso, but further rise in criminal activity in the border region of reinforces the extent to which places like Solhan Bounkani. Although there have been reports that can become violent flashpoints as various actors jihadists are leveraging local criminal economies compete for control over access to natural for funding (particularly in the wake of declin- resources, such as gold. -

République De Cote D'ivoire

R é p u b l i q u e d e C o t e d ' I v o i r e REPUBLIQUE DE COTE D'IVOIRE C a r t e A d m i n i s t r a t i v e Carte N° ADM0001 AFRIQUE OCHA-CI 8°0'0"W 7°0'0"W 6°0'0"W 5°0'0"W 4°0'0"W 3°0'0"W Débété Papara MALI (! Zanasso Diamankani TENGRELA ! BURKINA FASO San Toumoukoro Koronani Kanakono Ouelli (! Kimbirila-Nord Lomara Ouamélhoro Bolona Mahandiana-Sokourani Tienko (! Bougou Sokoro Blésségu é Niéllé (! Tiogo Tahara Katogo Solo gnougo Mahalé Diawala Ouara (! Tiorotiérié Kaouara Tienn y Sandrégué Sanan férédougou Sanhala Nambingué Goulia N ! Tindara N " ( Kalo a " 0 0 ' M'Bengué ' Minigan ! 0 ( 0 ° (! ° 0 N'd énou 0 1 Ouangolodougou 1 SAVANES (! Fengolo Tounvré Baya Kouto Poungb é (! Nakélé Gbon Kasséré SamantiguilaKaniasso Mo nogo (! (! Mamo ugoula (! (! Banankoro Katiali Doropo Manadoun Kouroumba (! Landiougou Kolia (! Pitiengomon Tougbo Gogo Nambonkaha Dabadougou-Mafélé Tiasso Kimbirila Sud Dembasso Ngoloblasso Nganon Danoa Samango Fononvogo Varalé DENGUELE Taoura SODEFEL Siansoba Niofouin Madiani (! Téhini Nyamoin (! (! Koni Sinémentiali FERKESSEDOUGOU Angai Gbéléban Dabadougou (! ! Lafokpokaha Ouango-Fitini (! Bodonon Lataha Nangakaha Tiémé Villag e BSokoro 1 (! BOUNDIALI Ponond ougou Siemp urgo Koumbala ! M'b engué-Bougou (! Seydougou ODIENNE Kokoun Séguétiélé Balékaha (! Villag e C ! Nangou kaha Togoniéré Bouko Kounzié Lingoho Koumbolokoro KORHOGO Nongotiénékaha Koulokaha Pign on ! Nazinékaha Sikolo Diogo Sirana Ouazomon Noguirdo uo Panzaran i Foro Dokaha Pouan Loyérikaha Karakoro Kagbolodougou Odia Dasso ungboho (! Séguélon Tioroniaradougou -

Côte D'ivoire Medical Summary

Côte d'Ivoire Medical Summary The health risk information presented here is summarized from Shoreland Travax®, a decision-support tool used by health care providers to perform a detailed health risk analysis based on specific locations, individual travel styles, and traveler risk behaviors. Travax provides practitioners current, independently researched malaria risk and prevention recommendations in a map-based format that goes beyond the annual WHO and US CDC statements included here. Not included here are current reports from Travax of disease outbreaks or environmental events that may pose elevated risks to travelers’ health and safety. The Providers section of this site offers a directory of health care providers who utilize Shoreland Travax for travel health counseling. Learn more about the detailed reports and maps available from these practitioners (includes links to samples). General Information Côte d'Ivoire is a developing nation classified as lower middle income. Located in western Africa on the Gulf of Guinea (east of Guinea and west of Ghana), the climate is classified as humid equatorial (long dry season). Vaccinations Yellow Fever Requirement: A vaccination certificate is required for all travelers aged ≥ 9 months. Official Status: listed by WHO as a country where YF transmission risk is present. Other Vaccines Depending on your itinerary, your personal risk factors, and the length of your visit, your health care provider may offer you vaccination against Ebola virus disease, hepatitis A, hepatitis B, influenza, measles, mumps, rubella, meningococcal meningitis, monkeypox, rabies, typhoid fever, or a one time polio booster if you haven't previously received one for travel. Routine immunizations, such as those that prevent tetanus/diphtheria or "childhood" diseases, should be reviewed and updated as needed. -

Rapport De Mission EVALUATION DE LA PRISE EN CHARGE DE LA

Rapport de Mission EVALUATION DE LA PRISE EN CHARGE DE LA MALNUTRITION AIGUË Côte d’Ivoire UNICEF Bureau Régional de l’Afrique de l’Ouest et du Centre 27 février – 12 mars 2010 Hélène Schwartz – Yvonne Grellety 1 Centres nutritionnels visités soutenus par le PNN, en collaboration avec: PNN ACF Anciennement ACF Merlin Prochainement Merlin Terre des Hommes HKI ONG Capanamur Congrégation Religieuse 2 REMERCIEMENTS Nous voudrions tout particulièrement remercier le Programme National de Nutrition (PNN) et sa directrice Dr Patricia Ngoran T. Yoboue, mais aussi le bureau UNICEF Côte d’Ivoire, en la personne de Basile Koukoui et Marius Cassy, tous deux spécialistes en nutrition de la section survie de l’enfant et le chauffeur Ernest Edoukou, qui nous ont permis en compagnie de Dr Louis N’Dri du PNN de faire notre mission terrain dans le nord de la Côte d’Ivoire. Nous tenons aussi à remercier les partenaires, ACF et son équipe dans la région des Savanes et Merlin et son équipe dans la région de Worodougou. Encore merci à toute l’équipe du service de pédiatrie et de réhydratation orale de l’Hôpital de Treichville à Abidjan pour leur accueil ainsi qu’aux puéricultrices et toute l’équipe médicale qui veillent sur les malades atteints de VIH-Sida. 3 TABLES DES MATIERES REMERCIEMENTS 3 TABLES DES MATIERES 4 LISTE DES ACRONYMES 5 INTRODUCTION 7 Organisation du système de santé et de la nutrition 7 La nutrition en Côte d’Ivoire 8 Le programme National de Nutrition (PNN) 9 Ressources Humaines 9 Système national d’Information et de Gestion des Statistiques -

Project: Air Cote D'ivoire Modernization & Expansion Program Country

AFRICAN DEVELOPMENT BANK GROUP zed Public Disclosire Authori PROJECT: AIR COTE D’IVOIRE MODERNIZATION & EXPANSION PROGRAM COUNTRY: COTE D’IVOIRE PROJECT APPRAISAL REPORT Public Dsclosure Authorized PICU DEPARTMENT October 2017 TABLE OF CONTENTS 1. STRATEGIC THRUST AND RATIONALE OF THE PROJECT............................................. 1 1.1 Project Linkages with Country Strategy and Objectives ..........................................................................1 1.2 Rationale for the Bank’s Involvement ......................................................................................................1 1.3 Donor Coordination ..................................................................................................................................3 2. PROJECT DESCRIPTION ............................................................................................................ 4 2.1 Project Objectives and Components .........................................................................................................4 2.2 Technical Solution Retained and Alternative Solutions Considered ........................................................5 2.3 Project Type..............................................................................................................................................6 2.4 Project Cost Estimate and Financing Mechanisms ...................................................................................7 2.5 Project Area and Beneficiaries .................................................................................................................9