Seattle Children's Research Institute Building

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

3Rd Quarter Holdings

Calvert VP Russell 2000® Small Cap Index Portfolio September 30, 2020 Schedule of Investments (Unaudited) Common Stocks — 95.2% Security Shares Value Auto Components (continued) Security Shares Value Aerospace & Defense — 0.8% LCI Industries 2,130 $ 226,398 Modine Manufacturing Co.(1) 4,047 25,294 AAR Corp. 2,929 $ 55,065 Motorcar Parts of America, Inc.(1) 1,400 21,784 Aerojet Rocketdyne Holdings, Inc.(1) 6,371 254,139 Standard Motor Products, Inc. 1,855 82,826 AeroVironment, Inc.(1) 1,860 111,619 Stoneridge, Inc.(1) 2,174 39,936 Astronics Corp.(1) 2,153 16,621 Tenneco, Inc., Class A(1)(2) 4,240 29,426 Cubic Corp. 2,731 158,862 Visteon Corp.(1) 2,454 169,866 Ducommun, Inc.(1) 914 30,089 VOXX International Corp.(1) 1,752 13,473 Kaman Corp. 2,432 94,775 Workhorse Group, Inc.(1)(2) 8,033 203,074 Kratos Defense & Security Solutions, Inc.(1) 10,345 199,452 XPEL, Inc.(1) 1,474 38,442 (1) Maxar Technologies, Inc. 5,309 132,406 $2,100,455 Moog, Inc., Class A 2,535 161,049 Automobiles — 0.1% National Presto Industries, Inc. 420 34,381 PAE, Inc.(1) 5,218 44,353 Winnebago Industries, Inc. 2,733 $ 141,214 Park Aerospace Corp. 1,804 19,700 $ 141,214 Parsons Corp.(1) 1,992 66,812 Banks — 6.8% Triumph Group, Inc. 4,259 27,726 (1) Vectrus, Inc. 987 37,506 1st Constitution Bancorp 623 $ 7,414 $ 1,444,555 1st Source Corp. 1,262 38,920 Air Freight & Logistics — 0.4% ACNB Corp. -

Shigeru Ban, on Structural Design

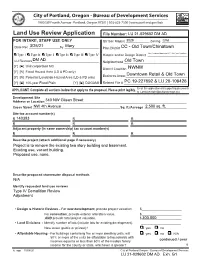

Land Use Review Application File Number: FOR INTAKE, STAFF USE ONLY Qtr Sec Map(s) _____________ Zoning ______________ Date Rec _________________by ___________________ Plan District _____________________________________ Type I Type Ix Type II Type IIx Type III Type IV Historic and/or Design District ______________________ LU Reviews _____________________________________ Neighborhood ___________________________________ [Y] [N] Unincorporated MC District Coalition _________________________________ [Y] [N] Flood Hazard Area (LD & PD only) [Y] [N] Potential Landslide Hazard Area (LD & PD only) Business Assoc __________________________________ [Y] [N] 100-year Flood Plain [Y] [N] DOGAMI Related File # ___________________________________ Email this application and supporting documents APPLICANT: Complete all sections below that apply to the proposal. Please print legibly. to: [email protected] Development Site Address or Location ______________________________________________________________________________ Cross Street ________________________________________________Sq. ft./Acreage _______________________ Site tax account number(s) R R R R R R Adjacent property (in same ownership) tax account number(s) R R R Describe project (attach additional page if necessary) Describe proposed stormwater disposal methods Identify requested land use reviews • Design & Historic Reviews - For new development, provide project valuation. $______________________ For renovation, provide exterior alteration value. $______________________ AND -

Page 1 of 375 6/16/2021 File:///C:/Users/Rtroche

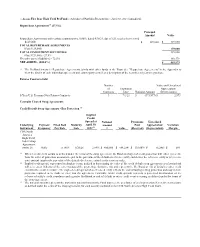

Page 1 of 375 :: Access Flex Bear High Yield ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited) Repurchase Agreements(a) (27.5%) Principal Amount Value Repurchase Agreements with various counterparties, 0.00%, dated 4/30/21, due 5/3/21, total to be received $129,000. $ 129,000 $ 129,000 TOTAL REPURCHASE AGREEMENTS (Cost $129,000) 129,000 TOTAL INVESTMENT SECURITIES 129,000 (Cost $129,000) - 27.5% Net other assets (liabilities) - 72.5% 340,579 NET ASSETS - (100.0%) $ 469,579 (a) The ProFund invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix to view the details of each individual agreement and counterparty as well as a description of the securities subject to repurchase. Futures Contracts Sold Number Value and Unrealized of Expiration Appreciation/ Contracts Date Notional Amount (Depreciation) 5-Year U.S. Treasury Note Futures Contracts 3 7/1/21 $ (371,977) $ 2,973 Centrally Cleared Swap Agreements Credit Default Swap Agreements - Buy Protection (1) Implied Credit Spread at Notional Premiums Unrealized Underlying Payment Fixed Deal Maturity April 30, Amount Paid Appreciation/ Variation Instrument Frequency Pay Rate Date 2021(2) (3) Value (Received) (Depreciation) Margin CDX North America High Yield Index Swap Agreement; Series 36 Daily 5 .00% 6/20/26 2.89% $ 450,000 $ (44,254) $ (38,009) $ (6,245) $ 689 (1) When a credit event occurs as defined under the terms of the swap agreement, the Fund as a buyer of credit protection will either (i) receive from the seller of protection an amount equal to the par value of the defaulted reference entity and deliver the reference entity or (ii) receive a net amount equal to the par value of the defaulted reference entity less its recovery value. -

The Regrade, Seattle, WA ABOUT MIDTOWN21

The Regrade, Seattle, WA ABOUT MIDTOWN21 Midtown 21 is a stunning new mixed-use retail and office building designed with beautiful retail space and set in a neighborhood designed for livability. The neighborhood is rapidly evolving and becoming Seattle’s densest and most livable area. With an emphasis on walkability and the ‘live, work, and play’ mindset, the Denny Triangle is a prime target for retailers and restaurants seeking an 18-hour per day customer base. Denny Triangle seamlessly integrates Seattle’s most vibrant neighborhoods as it is at the nexus of the Central Business District, Capitol Hill, South Lake Union and the retail core. Adjacent buildings provide foot traffic from Amazon, HBO, Seattle Children’s, and more. Future adjacent development will include the $1.6B expansion of the Washington State Convention Center, Seattle Children’s Building Cure, as well as Washington’s largest hotel with over 1,200 rooms at 8th and Howell. 5,720 SF of retail divisible 365,000+ SF Class A office Seattle City Light Electrical Substation Nexus 403 units (2019) 1200 Stewart Metropolitan Park 149,309 SF retail Pho Bac MINOR AVE 336,000 SF oce 876 units Market (2019) House Corned Beef Olive Mirabella Retirement Kinects Tower Tower Apartment 366 units (2018) Apt Tilt 49 1901 Minor 307,000 SF oce(2017) + 393 units 737 units (proposed) Convention Convention Center BOREN AVE Hilton Center Expansion Garden Inn Expansion Surface Parking Jars 564,000 sf oce Juice 222 rooms Hill7 (2020) 1800 Terry 270 units (2018) Midtown 21 Building Cure 365,000 SF -

The Over-Saturation Trend of High-End Apartment Development

Seattle Apartment Market Alignment Analysis (2011-2016) Adrien Renaud A thesis submitted in partial fulfillment of the requirements for the degree of Master of Urban Design and Planning University of Washington 2013 Committee: Chris Bitter George Rolfe Program Authorized to Offer Degrees: College of the Built Environments © Copyright 2013 Adrien Renaud University of Washington Abstract Seattle Apartment Market Alignment Analysis (2011-2016) Adrien Renaud Chair of the Supervisory Committee: Assistant Professor Christopher Bitter Department of Urban Design & Planning This thesis will explore the alignment between demand and the supply of apartment pipeline developed in the Seattle area through 2016. This topic specifically deals with the possibility of overdevelopment or a bubble in the apartment market, which could result in lower returns for investors. This threat to investor expectations necessitates the assessment of the alignment between supply and demand as a matter of due diligence for any investor. This thesis will use a Market Analysis method and Net Absorption Model technique to forecast through 2016. Tenure and apartment capture ratio will be the specific focus of the analysis. The primary findings of the research show that the boom portion of a possible bubble is already well underway. A bubble effect is almost unavoidable, due to the use of contemporary financial instruments. Tenure and Apartment Capture Ratios will need to be very elevated to avoid record high vacancy rates, which is unsustainable for this elongated duration. The resulting misalignment of the market will likely occur before 2016.Other factors will soften the impacts of overbuilding the apartment stock, like apartment conversion into condominiums, financial market changes to apartment investment volumes, and investors purchasing previously owned residential properties for rental purposes, tight individual mortgage market credit, and Amazon.com’s continued aggressive hiring in the center of Seattle. -

Harlow Klimple Crown Hill

SEATTLE CBD BALLARD 17 TH AVE NW 18 TH AVE NW NW 80TH ST 16 TH AVE NW MARY AVE NW NW 83RD ST 15TH AVE NW HARLOW KLIMPLE CROWN HILL NE 80TH ST HARLOW KLIMPLE CROWN HILL MULTIFAMILY DEVELOPMENT SITE KIDDER.COM OFFERING MEMORANDUM | 8323-8327 15TH AVE NW & 8322-8326 16TH AVE NW | CROWNHILLOFFERING.COM 01 TABLE OF INVESTMENT SUMMARY 02 CONTENTS PROPERTY DESCRIPTION 03 MASSING STUDIES 04 MARKET SURVEY EXCLUSIVELY LISTED BY DAVE SPEERS KEN HIRATA JEFF LOFTUS 05 Senior Vice President, Partner Senior Vice President, Partner Senior Vice President, Partner MARKET OVERVIEW 206.296.9626 206.296.9625 206.248.7326 [email protected] [email protected] [email protected] KIDDER.COM The information contained in the following Marketing Brochure is proprietary and strictly confidential. It is intended to be reviewed only by the party receiving it from Kidder Mathews and should not be made available to any other person or entity without the written consent of Kidder Mathews. This Marketing Brochure has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. Kidder Mathews has not made any investigation, and makes no warranty or representation, with respect to the income or expenses for the subject property, the future projected financial performance of the property, the size and square footage of the property and improvements, the presence or absence of contaminating substances, PCB’s or asbestos, the compliance with State and Federal regulations, the physical condition of the improvements thereon, or the financial condition or business prospects of any tenant, or any tenant’s plans or intentions to continue its occupancy of the subject property. -

Lake Union Marine Industrial Offering Lake Union

SEATTLE CENTRAL BUSINESS DISTRICT SOUTH LAKE UNION LAKE UNION MARINE INDUSTRIAL OFFERING LAKE UNION FAIRVIEW AVE E N LAKE UNION MARINE INDUSTRIAL OFFERING KIDDER.COM OFFERING MEMORANDUM | 1801 FAIRVIEW AVE E, SEATTLE | SEATTLEMARINEOFFERING.COM CONTACT JASON ROSAUER 206.296.9608 [email protected] DAVE SPEERS 206.296.9626 [email protected] ROB ANDERSON 206.296.9644 [email protected] KIDDER.COM The information contained in the following Marketing Brochure is proprietary and strictly confidential. It is intended to be reviewed only by the party receiving it from Kidder Mathews and should not be made available to any other person or entity without the written consent of Kidder Mathews. This Marketing Brochure has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. Kidder Mathews has not made any investigation, and makes no warranty or representation, with respect to the income or expenses for the subject property, the future projected financial performance of the property, the size and square footage of the property and improvements, the presence or absence of contaminating substances, PCB’s or asbestos, the compliance with State and Federal regulations, the physical condition of the improvements thereon, or the financial condition or business prospects of any tenant, or any tenant’s plans or intentions to continue its occupancy of the subject property. The information contained in this Marketing Brochure has been obtained from sources we believe to be reliable; however, Kidder Mathews has not verified, and will not verify, any of the information contained herein, nor has Kidder Mathews conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. -

BUILDING CURE 1920 Terry Avenue Seattle, Washington BUILDING CURE

BUILDING CURE 1920 Terry Avenue Seattle, Washington BUILDING CURE Together, Seattle Children’s Hospital seizes this once-in-a-lifetime opportunity to build a place where childhood disease can be cured. Located at Stewart Street and Terry Avenue in downtown Seattle, Building SOUTH Cure will expand the Seattle Children’s SITE CAPITOL HILL Research Institute campus to help LAKE accomplish more life-changing research that transforms the lives of Expansion UNION Opening 2020 children and their families. Building Cure will be 13-stories and include research facilities, building operations, a museum and forum space, classrooms, parking for about 300 RETAIL CORE vehicles and ground-oor retail. CBD Pike Place Market PIONEER SQUARE HOTEL ROOMS RESIDENTS 10M 14M PIKE PLACE 22M+ SQ FT OF NEW MARKET VISITORS ANNUAL VISITORS OFFICE SPACE ANNUALLY (Developed or Planned) 613K IN PRIMARY NEW PROJECTS TRADE AREA 14K+ P CURRENT 34K+ 265K $459M NEW RESIDENT UNITS $1.46B DAYTIME 6K+ DOWNTOWN 98K ANNUAL BUSINESS (Developed or Planned) POPULATION NEW ROOMS SEATTLE RETAIL PARKING SPACES REVENUE FROM (Developed or Planned) SALES (2015) CRUISE INDUSTRY DOWNTOWN SEATTLE Seattle City Light Electrical Substation Nexus 403 units (2019) 1200 Stewart Metropolitan Park 149,309 SF retail Pho Bac MINOR AVE 336,000 SF oce 876 units Market (2019) House Corned Beef Olive Mirabella Retirement Kinects Tower Tower Apartment 366 units (2018) Apt Tilt 49 1901 Minor 307,000 SF oce(2017) + 393 units 737 units (proposed) Convention Convention Center BOREN AVE Hilton Center Expansion -

2014 Urban Apartment Market Study

2013 2014 2015 2016 2017 Future Total Ballard 586 616 441 82 211 1,350 Ballard 43% 46% 33% 6% 16% 100% Belltown Capitol Hill/Eastlake 769 828 862 161 618 2,469 2014 2015 2016 2017 Future Capitol Hill/Eastlake 31% 34% 35% 7% 25% 100% Green Lake/Wallingford Downtown CBD 903 709 380 418 307 1,814 2014 2015 2016 2017 Future Downtown CBD 50% 39% 0% 21% 23% 17% 100% 7% Belltown 337 486 653 902 150 3,331 5,522 7% 9% Belltown 6% 9% 12% 16% 3% 60% 100% South Lake Union 807 959 985 921 1,650 1,200 5,715 27% South Lake Union 14% 17% 17% 16% 29% 21% 100% 12% Green Lake/Wallingford 550 468 1042 125 119 1,754 59% Green Lake/Wallingford 31% 27% 59% 7% 0% 7% 100% University District 432 581 1024 744 466 2,815 University District 15% 21% 36% 0% 26% 17% 100% Queen Anne 88 379 265 103 114 861 Queen Anne 10% 44% 31% 12% 0% 13% 100% Downtown CBD 16% West Seattle 328 651 922 422 507 2,502 60% 2014 2015 2016 2017 Future West Seattle 13% 26% 37% 17% 0% 20% 100% West Bellevue 114 266 1487 124 285 1,629 3,791 West Bellevue 3% 7% 39% 3% 8% 43% 100% 3% 17% SODO 183 333 158 347 838 39% SODO 22% 40% 19% 0% 0% 41% 100% 23% First Hill 131 1248 876 2,255 21% First Hill 6% 55% 0% 0% 39% 100% 31,686 West Bellevue 2014 2015 2016 2017 Future Ballard 46% 33% 6% 16% Queen Anne SODO 2014 2015 2016 2017 Future 2014 2015 2016 Future 2014 2015 2016 2017 Future Capitol Hill/Eastlake 34% 35% 7% 25% 2014 2015 2016 2017 Future 2014 2015 2016 2017 Future 13% 7% Downtown CBD 39% 21% 23% 17% 2014 2015 2016 2017 Future 12% 44% 41% 40% Belltown 9% 12% 16% 3% 60% 43% 31% 2014 2015 2016 -

1200 Howell St

1200 HOWELL ST EARLY DESIGN GUIDANCE DOWNTOWN DESIGN REVIEW BOARD MEETING ON 12/1/2015 DPD #3021813 CONTENTS URBAN FRAMEWORK Project Information and Neighborhood ............................................................................... 4 Zoning Summary / Zoning Map .......................................................................................... 6 Project Vicinity Building Use and City Context .................................................................... 8 Transportation and Street Level Analysis Maps .................................................................. 10 Surrounding Projects ....................................................................................................... 12 Neighboring Projects ....................................................................................................... 16 Site Details / Survey ....................................................................................................... 19 Climate Analysis and Solar Orientation ............................................................................ 20 Street Elevations and Photos ............................................................................................ 22 MASSING OPTIONS Option 1 .......................................................................................................................... 28 Option 2 .......................................................................................................................... 32 Option 3 (Preferred) ....................................................................................................... -

Apt Vs Condo

Brian R. O’Connor, MAI, CRE Principal, O’Connor Consulting Group, LLC 1 Housing Cycle: New Owner Demand vs. Renter Demand (Units) 2014 Renter Demand at (King and Snohomish Counties 1980-2015, Forecast 2016-2018) 15,000 11,446 Units New Owner Housing Demand Renter Demand Peaked in 2004 Peaked at 13,000 Units in 1989. at 9,300 Units Sold 2010 Renter Demand at 9,849 Units 1980s Renter Housing Boom Dot-com Spike 10,000 Owner Housing Boom/ Bubble 5,000 Forecast 0 -5,000 2008 Recession 9/11 Dip -10,000 Source: NWMLS, OCG Net Apartment Demand New Construction SF & Condo Sales Poly. (Net Apartment Demand) 2 } Pine and 2nd ◦ Developed by Equity Residential. ◦ Located at 204 Pine St in the Downtown market area. ◦ 300,000 SF tower containing 40 stories that will have 398 units. ◦ Street level retail and four levels of above grade and four levels of below grade parking (250 parking stalls). ◦ Completion date of approximately June 2017. } Kinects Tower ◦ Developed by Security Properties. ◦ Located at 1823 Minor Ave in the Belltown market area. ◦ It is a 40 story tower containing 356 units. ◦ Street level retail including a restaurant with an outside dining area. ◦ One of the project amenities is a rooftop indoor pool. ◦ Completion date of approximately April 2017. 3 } Tower 12 ◦ Developed by Continental Properties. ◦ Located at 2001 2nd Ave in the Belltown market area. ◦ It is a 34 story tower containing 314 units. ◦ Full amenity package including rooftop deck, theater room, fitness center, sauna and hot tub, and a library. ◦ 69% of the units have a water view. -

Seattle New Construction & Proposed Multifamily Projects 3Q17

Seattle New Construction & Proposed Multifamily Projects 3Q17 ID PROPERTY UNITS 167 2218 1st Avenue 66 1 Stratus 430 168 2801 Elliott Avenue 61 2 AMLI Arc 393 169 3031 Western Avenue 100 5 Cora 75 137 232 170 307 Broad 149 9 Broadcast 74 171 408 Aurora Avenue North 78 11 Helios 398 172 427 9th Avenue North 242 12 Cascade 477 173 4th & Bell Tower 287 Total Lease-Up 1,847 174 5th & Lenora 470 15 John Street & Fairview Avenue North 1128 175 5th & Virginia 431 176 600 Wall Street 370 16 Esterra Park Blocks 5, 6A and 9 658 70 20 Alexan Central Park 193 177 601 Aurora Avenue North 123 21 Arrive 339 135 134 178 901 Harrison Street 292 25 AVA at Esterra Park 323 179 Altitude Residences 236 26 Danforth, The 265 180 Antioch University Site 1036 28 Bellevue Vuecrest 137 181 Block V 638 29 425 Fairview 430 182 Communita Atelier 98 30 Sitka 384 183 Emerald, The 266 141 31 Hugo House 80 139 140 184 F. X. McRory Building Redevelopment 55 32 Broadstone First Hill 350 136 233 185 Mercer Blocks, Block 25 West 83 34 Redmond 148 244 186 Mercer Blocks, Block 31 81 285 307 289 35 970 Denny 461 286 185 184 187 Rainier Square Redevelopment 200 36 McKenzie 450 142 176 188 Seattle Times Building 433 197 46 Anthology 400 284 59 189 Shilla Tower 286 47 2100 East Madison 50 304 190 St. Johns 430 48 2220 East Union 144 5 170 181 171 161 191 Third & Lenora 384 138 305 28 51 Valdok, The 177 192 722 East Pike Street 90 72 60 53 Metro 112 Phase II 57 177 193 800 Columbia Street 274 59 Westridge Phase II 50 283 29 194 Crosby Capitol Hill 50 195 Esker 70 60 624 Yale 206