$8.15 Million Public Offering of Common Stock

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Initial Public Offerings

November 2017 Initial Public Offerings An Issuer’s Guide (US Edition) Contents INTRODUCTION 1 What Are the Potential Benefits of Conducting an IPO? 1 What Are the Potential Costs and Other Potential Downsides of Conducting an IPO? 1 Is Your Company Ready for an IPO? 2 GETTING READY 3 Are Changes Needed in the Company’s Capital Structure or Relationships with Its Key Stockholders or Other Related Parties? 3 What Is the Right Corporate Governance Structure for the Company Post-IPO? 5 Are the Company’s Existing Financial Statements Suitable? 6 Are the Company’s Pre-IPO Equity Awards Problematic? 6 How Should Investor Relations Be Handled? 7 Which Securities Exchange to List On? 8 OFFER STRUCTURE 9 Offer Size 9 Primary vs. Secondary Shares 9 Allocation—Institutional vs. Retail 9 KEY DOCUMENTS 11 Registration Statement 11 Form 8-A – Exchange Act Registration Statement 19 Underwriting Agreement 20 Lock-Up Agreements 21 Legal Opinions and Negative Assurance Letters 22 Comfort Letters 22 Engagement Letter with the Underwriters 23 KEY PARTIES 24 Issuer 24 Selling Stockholders 24 Management of the Issuer 24 Auditors 24 Underwriters 24 Legal Advisers 25 Other Parties 25 i Initial Public Offerings THE IPO PROCESS 26 Organizational or “Kick-Off” Meeting 26 The Due Diligence Review 26 Drafting Responsibility and Drafting Sessions 27 Filing with the SEC, FINRA, a Securities Exchange and the State Securities Commissions 27 SEC Review 29 Book-Building and Roadshow 30 Price Determination 30 Allocation and Settlement or Closing 31 Publicity Considerations -

U.S. Century Bank Announces Pricing of Initial Public Offering of Class a Common Stock

U.S. CENTURY BANK ANNOUNCES PRICING OF INITIAL PUBLIC OFFERING OF CLASS A COMMON STOCK MIAMI—July 22, 2021—U.S. Century Bank (USCB) announced today the pricing of the initial public offering of 4,000,000 shares of its Class A common stock, at a public offering price of $10.00 per share for expected net proceeds to U.S. Century Bank, after deducting the underwriting discount and estimated offering expenses, of approximately $34.0 million. The shares are expected to begin trading on Friday, July 23, 2021 on The Nasdaq Global Market under the symbol "USCB." The offering is expected to close on or about July 27, 2021, subject to the satisfaction of customary closing conditions. U.S. Century Bank has granted the underwriters a 30-day option to purchase up to an additional 600,000 shares of its Class A common stock, at the initial public offering price of $10.00 per share, minus the underwriting discount. If the underwriters' option is exercised in full, it is expected to result in additional net proceeds to U.S. Century Bank of approximately $5.6 million after deducting the underwriting discount and estimated offering expenses. U.S. Century Bank intends to use the net proceeds from this offering to support continued growth, including organic growth and potential future acquisitions, as well as for the redemption of any remaining outstanding shares of U.S. Century Bank preferred stock following the completion of the voluntary exchange offer being separately conducted, pursuant to which U.S. Century Bank has offered all holders of outstanding Class C preferred stock and Class D preferred stock the ability to exchange such shares for shares of its Class A common stock at the initial offering price. -

Equity Capital Markets Credentials

Equity Capital Markets credentials February 2020 Strictly private and confidential Nordea Markets – Investment Banking Selected Equity Capital Markets credentials February 2020 January 2020 January 2020 Accelerated Accelerated Accelerated Bookbuilding Bookbuilding Bookbuilding CreateCreate CreateCreate CreateCreate tombstoneDeal valuetombstone tombstoneDeal valuetombstone tombstoneDeal valuetombstone hereNOK 518mhere hereNOK 850mhere hereSEK 1.3bnhere Joint Bookrunner Joint Lead Manager & Joint Bookrunner Joint Bookrunner 1 Equity Capital Markets credentials Confidential Nordea Markets – Investment Banking Selected Equity Capital Markets credentials January 2020 December 2019 December 2019 November 2019 November 2019 November 2019 Accelerated Accelerated Rights issue Accelerated Accelerated Accelerated bookbuilding bookbuilding bookbuilding bookbuilding bookbuilding CreateCreate on behalf of CreateCreate CreateCreate CreateCreate CreateCreate CreateCreate tombstoneDeal valuetombstone tombstoneDeal valuetombstone tombstoneDeal valuetombstone tombstoneDeal valuetombstone tombstoneDeal valuetombstone tombstoneDeal valuetombstone hereDKK 6.1bnhere hereSEK 312mhere hereSEK 1,500mhere hereSEK 290mhere hereEUR 161mhere hereSEK 840mhere Joint Global Coordinator Joint Global Coordinator Co-manager Joint Bookrunner Joint Bookrunner Joint Bookrunner and Joint Bookrunner and Joint Bookrunner November 2019 November 2019 October 2019 October 2019 September 2019 September 2019 IPO Accelerated Accelerated Listing Accelerated Accelerated bookbuilding bookbuilding -

Bank of China Debt Capital Markets Capabilities Market Outlook 2020

PRIVATE & CONFIDENTIAL Bank of China Debt Capital Markets Capabilities Market Outlook 2020 Bank of China Limited January 2020 0 Content BOC Capabilities 2 Market Developments and Outlook 9 Case Studies 20 DCM Team 54 Green Bond Developments 56 1 Experience and Capabilities - Top Asian Debt Capital Market Franchise EM Bonds 2019 League Table (bln USD) Bookrunner Rank Vol Issues Global coverage with DCM Centre established across key financial centers – Beijing, Hong Kong, Singapore and London. Bank of China 1 89.4 646 Citics 2 69.2 575 Global footprint with diversified investor base and solid relationship with major global investors who could provide supportive anchor orders, especially in Asia. ICBC 3 66.1 482 China Securities 4 64.7 577 Global Global Strong support from in-house investment book with a potential credit line for corporate names. Citi 5 62.2 451 Coverage HSBC 6 61.7 581 Strategy partner in RMB transactions. Guotai Junan 7 54.5 525 Asian top underwriter for G3 issuance, and the only leading underwriter in both China Onshore and Offshore market. JP Morgan 8 51.6 346 CICC 9 48.3 350 Standard Chartered 10 43.5 440 2019 2019 2019 2019 2018 2018 2018 2017 Logicor Financing CPI Property SA PPF Arena 1 CEZ Group EP Infrastructure Agricultural Development EUR Ministry of Finance of the EUR 500 million due 2022 Bank of China Luxembourg People’s Republic of China EUR 1,850 million EUR 550 million EUR 550 million Senior Unsecured Bond EUR750 million Transactions Senior Unsecured Bond Subordinated Bond Senior Unsecured Bond Co-Manager -

Select Recent Financial Sponsor Transactions

Select Recent Financial Sponsor Transactions July 2016 June 2016 June 2016 June 2016 May 2016 May 2016 May 2016 has merged with a portfolio company of a portfolio company of a portfolio company of a portfolio company of a portfolio company of a portfolio company of portfolio companies of has been acquired by $60,000,000 Incremental Term Loan $70,000,000 $885,000,000 $349,393,000 For an Aggregate of $650,000,000 $2,025,000,000 Incremental Term Loan B Senior Secured Credit Facilities Follow-On Offering $208,050,000 Senior Secured Notes Senior Secured Credit Facilities Senior Secured Credit Facilities Left Lead Arranger, Joint Bookrunner Co-Manager Joint Lead Arranger & Joint Bookrunner Joint Lead Arranger & Joint Bookrunner Sell-Side Advisor Joint Lead Arranger & Joint Bookrunner Joint Bookrunner & Administrative Agent April 2016 April 2016 February 2016 February 2016 February 2016 February 2016 February 2016 a portfolio company of a portfolio company of a portfolio company of a portfolio company of has sold a portfolio company of has acquired a portfolio company of has been acquired by has acquired to a portfolio company of $56,000,000 $550,000,000 $178,816,935 $145,000,000 Senior Secured Credit Facilities Senior Secured Credit Facilities Follow-On Offering Senior Secured Credit Facilities Joint Lead Arranger, Sole Bookrunner Joint Lead Arranger & Joint Bookrunner Buy-Side Advisor Joint Bookrunner Joint Lead Arranger & Joint Bookrunner Sell-Side Advisor & Administrative Agent Sell-Side Advisor February 2016 January 2016 January 2016 January -

Prospectus-24-November-2020.Pdf

National Express Group PLC (incorporated and registered in England and Wales under the Companies Act 1985 with registered number 2590560) £500,000,000 Perpetual Subordinated Non-Call 5.25 Fixed Rate Reset Notes Issue Price: 100 per cent. The £500,000,000 Perpetual Subordinated Non-Call 5.25 Fixed Rate Reset Notes (the "Notes") are issued by National Express Group PLC (the "Issuer"). Each Note entitles the holder thereof (each a "Noteholder") to receive cumulative interest in accordance with the terms and conditions of the Notes (the "Conditions" and references herein to a numbered Condition shall be construed accordingly). Interest on the Notes will accrue: (i) from, and including, 26 November 2020 (the "Issue Date") to, but excluding, 26 February 2026 (the "First Reset Date") at an interest rate of 4.250 per cent. per annum, and (ii) from, and including, the First Reset Date at an interest rate per annum equal to the relevant Reset Interest Rate (as defined in the Conditions). Interest in respect of the Notes will be payable (subject to deferral as described herein) annually in arrear on 26 February in each year (short first interest period). Interest payments in respect of the Notes may be deferred in certain circumstances. See Condition 4 for further details. If the Issuer does not elect to redeem the Notes following a Change of Control Event (as defined in the Conditions), the then prevailing rate of interest (and all subsequent rates of interest (if any)) in respect of the Notes shall be increased by 5 per cent. per annum with effect from, and including, the date on which the Change of Control Event occurs (see Condition 4 for further details). -

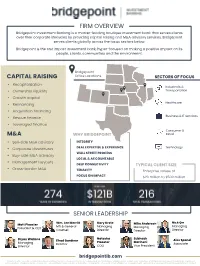

Firm Overview Capital Raising M&A Senior Leadership

FIRM OVERVIEW Bridgepoint Investment Banking is a market-leading boutique investment bank that serves clients over their corporate lifecycles by providing capital raising and M&A advisory services. Bridgepoint serves clients globally across the focus sectors below. Bridgepoint is the first impact investment bank, hyper-focused on making a positive impact on its people, clients, communities and the environment. Bridgepoint CAPITAL RAISING Office Locations SECTORS OF FOCUS • Recapitalization Industrials & • Ownership liquidity Transportation • Growth capital Healthcare • Refinancing • Acquisition financing Business & IT Services • Rescue finance • Leveraged finance Consumer & M&A WHY BRIDGEPOINT Retail • Sell-side M&A advisory INTEGRITY • Corporate divestitures DEAL EXPERTISE & EXPERIENCE Technology WALL STREET PROCESS • Buy-side M&A advisory LOCAL & ACCOUNTABLE • Management buyouts DEEP CONNECTIVITY TYPICAL CLIENT SIZE • Cross-border M&A TENACITY Enterprise values of FOCUS ON IMPACT $20 million to $500 million SENIOR LEADERSHIP Wm. Lee Merritt Gary Grote Nick Orr Matt Plooster Mike Anderson MD & General Managing Managing President & CEO Managing Counsel Director Director Director Natasha Subhash Bryan Wallace Chad Gardiner Alex Spanel Plooster Marineni Managing Director Associate Director COO Vice President bridgepointib.com In order to offer securities-related Investment Banking Services discussed herein, to include M&A and institutional capital raising, certain representatives of Bridgepoint Investment Banking are registered representatives -

Initial Public Offerings in Canada

INITIAL PUBLIC OFFERINGS IN CANADA From kick-off to closing, Torys provides comprehensive guidance on every step essential to successfully completing an IPO in Canada. A Business Law Guide i INITIAL PUBLIC OFFERINGS IN CANADA A Business Law Guide This guide is a general discussion of certain legal matters and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the matters in this guide with you, in the context of your particular circumstances. ii Initial Public Offerings in Canada © 2017 Torys LLP. All rights reserved. CONTENTS 1 INTRODUCTION ...................................................................................... 3 Going Public .......................................................................................................... 3 Benefits and Costs of Going Public ...................................................................... 3 Going Public in Canada ........................................................................................ 4 Importance of Legal Advisers ............................................................................... 5 2 OVERVIEW OF SECURITIES REGULATION AND STOCK EXCHANGES IN CANADA ............................ 8 Securities Regulation in Canada .......................................................................... 8 Where to File a Prospectus and Why .................................................................... 8 Filing a Prospectus in Quebec ............................................................................ -

Financing Alternative Energy Power Projects in the Current Economic Climate

Financing Alternative Energy Power Projects in the Current Economic Climate Investment Banking Division Alternative Energy Banking March 2009 Amy Corinne Smith Confidential Presentation Table of Contents Agenda I. Barclays Capital II. Financing Alternative Energy Projects A. Current Environment / Market Update B. Bank, Loan and Tax Equity Markets Barclays Capital Barclays Capital’s Alternative Energy Strategy Barclays Capital To be the Leading Advisory, Financing and Risk Management Team Mission in the Alternative Energy Sector Power Development Financing Advisory Hedging Equity / Cvt Approach Materials Construction Suite of Private Plcmnt hedging Loan Financially M&A to Client Project Back Settled FX, Commodities Structure levering Products Project Finance Business Advisory Advisory Credit sleeves Tax Equity Integrated Advisory, Risk Management and Financing Solutions 9 In-depth sub-sector coverage model covers all facets of alternative energy 9 Stand alone Alternative Energy Banking and Energy Structured Finance efforts 9 Creative structuring capabilities within our Energy Structured Finance franchise Competitive 9 Industry leading commodity hedging platform Advantage 9 Excellent relationships across the spectrum of pure play alternative energy companies, utilities, conglomerates private equity, venture capital, hedge funds, etc. 9 Provides highest level of access to key decision makers in the power sector 9 Leading advisory business within equity, convertible, private placement, debt, syndicated loan and M&A markets 1 Unparalleled, -

NYSE IPO Guide Third Edition

NYSE IPO Guide NYSE IPO Guide Third Edition www.nyse.com/ipo Publisher Timothy Dempsey Project Manager Chloe Tuck NYSE Editorial William Kantrowitz and Zachary Harvey Printing and Binding AGS NYSE IPO Guide, Third Edition, is published by Caxton Business & Legal, Inc. 27 North Wacker Drive, Suite 601 Chicago, IL 60606 Phone: +1 312 361 0821 Email: [email protected] Web: www.caxtoninc.com ISBN: 978-0-9964982-5-8 Copyright in individual sections rests with the co- publishers. No photocopying: copyright licenses do not apply. DISCLAIMER The NYSE IPO Guide, Third Edition (the “Guide”), contains summary information about legal and regulatory aspects of the IPO process and is current as of the date of its initial publication (April 2021). The Guide should not be relied upon as a substitute for specific legal or financial advice from a professional. Although efforts have been made to ensure that the information herein is correct, the Guide may contain errors or omissions, and the NYSE, the publishers, and the contributing authors disclaim any responsibility for, or duty to update or correct, any such errors or omissions. The views expressed in the Guide are those of the authors alone. Published by NYSE IPO Guide Third Edition www.nyse.com/ipo Preface 5 2.8 Anti-takeover protections 18 6.6 Market perception feedback 62 Simpson Thacher & Bartlett IHS Markit Stacey Cunningham President, NYSE Group 2.9 Incentive compensation 6.7 Investment community arrangements 19 database and CRM 62 Simpson Thacher & Bartlett IHS Markit Introduction: Advantages of listing on the NYSE 7 2.10 Managing third-party risk 22 6.8 ESG and the newly public IHS Markit company 64 IHS Markit NYSE 3. -

Keybanc Capital Markets

Confidential Equity Capital Market Transactions KeyBanc Capital Markets is a trade name under which corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., Member NYSE/FINRA/SIPC, and KeyBank National Association ("KeyBank N.A."), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and its licensed securities representatives, who may also be employees of KeyBank N.A. Banking products and services are offered by KeyBank N.A. Selected Follow-on Equity Offerings September 2013 August 2013 July 2013 June 2013 May 2013 $158,700,000 $146,625,000 $104,937,500 $132,000,000 $95,400,000 Follow-On Follow-On Follow-On Follow-On Follow-On Offering Offering Offering Offering Offering Senior Co-Manager Co-Bookrunner Co-Bookrunner Senior Co-Manager Co-Bookrunner May 2013 May 2013 May 2013 May 2013 May 2013 $109,882,500 $738,990,000 $1,690,500,000 $179,112,500 $179,113,000 Follow-On Follow-On Follow-On Follow-On Follow-On Offering Offering Offering Offering Offering Co-Bookrunner Senior Co-Manager Senior Co-Manager Co-Bookrunner Co-Bookrunner KeyBanc Capital Markets is a trade name under which corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., Member NYSE/FINRA/SIPC, and KeyBank National Association ("KeyBank N.A."), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and its licensed securities representatives, who may also be employees of KeyBank N.A. Banking products and services are offered by KeyBank N.A. -

2014 Selected Transactions

Selected Financing Transaction Experience $12,230,000 $125,000,000 $2,000,000 $11,500,000 $50,850,000 Private Placement Senior Convertible Notes Private Placement Follow-On Offering U.S. IPO ADS Sole Placement Agent Sole Bookrunner Senior Co-Manager December 2014 December 2014 December 2014 November 2014 November 2014 $5,000,000 $3,356,973 $900,000 $10,500,000 $99,750,000 Registered Direct & PIPE Offering PIPE PIPE Preferred Offering Follow-On Offering Sole Manager Placement Agent Sole Placement Agent Joint Bookrunner October 2014 October 2014 October 2014 October 2014 September 2014 $129,375,000 $5,850,000 $18,375,000 $140,000,000 $33,773,670 Convertible Perpetual Follow-On Offering Follow-On Offering Preferred Offering Preferred Stock Offering Follow-On Offering Joint Bookrunner September 2014 September 2014 August 2014 August 2014 August 2014 DIVISION OF NORTHLAND SECURITIES, INC. - MEMBER FINRA AND SIPC 1 Selected Financing Transaction Experience $5,287,500 $2,150,000 $6,515,100 $11,500,000 $12,000,000 Follow-On Offering Follow-On Offering Follow-On Offering Follow-On Offering PIPE Sole Bookrunner Sole Bookrunner Sole Placement Agent August 2014 August 2014 August 2014 July 2014 July 2014 $435,000,000 $6,750,000 $8,250,000 $149,500,000 $7,240,000 Follow-On Offering Initial Public Offering U.S. IPO ADS Initial Public Offering U.S IPO Sole Bookrunner Joint Bookrunner July 2014 July 2014 June 2014 June 2014 June 2014 $15,179,978 $202,687,500 $28,749,955 $486,000,000 $34,514,375 Preferred Offering Follow-On Offering Follow-On Offering Follow-On Offering Follow-On Offering Sole Bookrunner June 2014 June 2014 June 2014 June 2014 May 2014 DIVISION OF NORTHLAND SECURITIES, INC.