Two Banks, One Crisis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

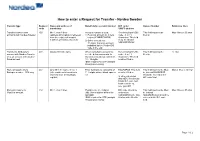

How to Enter a Request for Transfer - Nordea Sweden

How to enter a Request for Transfer - Nordea Sweden Transfer type Request Name and address of Beneficiary’s account number BIC code / Name of banker Reference lines code beneficiary SWIFT address Transfer between own 400 Min 1, max 4 lines Account number is used: Receiving bank’s BIC This field must not be Max 4 lines x 35 char accounts with Nordea Sweden (address information is retrieved 1) Personal account no = pers code - 8 or 11 filled in from the register of account reg no (YYMMDDXXXX) characters. This field numbers of Nordea, Sweden) 2) Other account nos = must be filled in 11 digits. Currency account NDEASESSXXX indicated by the 3-letter ISO code in the end Transfer to third party’s 401 Always fill in the name When using bank account no., Receiving bank’s BIC This field must not be 12 char account with Nordea Sweden see the below comments. In code - 8 or 11 filled in or to an account with another Sweden account nos consist of characters. This field Swedish bank 10 - 15 digits. must be filled in IBAN required for STP (straight through processing) Domestic payments to 402 Only fill in the name in line 1 Enter bankgiro no consisting of BGABSESS. This field This field must not be filled Max 4 lines x 35 char Bankgiro number - SEK only (other address information is 7 - 8 digits without blank spaces must be filled in. in. Instead BGABSESS retrieved from the Bankgiro etc should be entered in the register) In other currencies BIC code field than SEK: Receivning banks BIC code and bank account no. -

2019 Annual and Sustainability Report

2019 Annual and Sustainability Report Contents Swedbank in brief 2 Income, balance sheet and notes, Group The year in brief 4 Income statement 54 CEO statement 6 Statement of comprehensive income 55 Goals and results 8 Balance sheet 56 Value creation 10 Statement of changes in equity 57 Business model 12 Statement of cash flow 58 Sustainability 14 Notes 59 The share and owners 24 Income, balance sheet and notes, Parent company Board of Directors’ report Income statement 154 Financial analysis 26 Statement of comprehensive income 154 Swedish Banking 30 Balance sheet 155 Baltic Banking 31 Statement of changes in equity 156 Large Corporates & Institutions 32 Statement of cash flow 157 Group Functions & Other 33 Notes 158 Corporate governance report 34 Alternative performance measures 192 Board of Directors 46 Group Executive Committee 50 Sustainability Disposition of earnings 52 Sustainability report 194 Materiality analysis 195 Sustainability management 197 Notes 199 GRI Standards Index 212 Signatures of the Board of Directors and the CEO 217 Auditors’ report 218 Sustainability report – assurance report 222 Annual General Meeting 223 Market shares 224 Five-year summary – Group 225 Three-year summary – Business segments 228 Definitions 231 Contacts 233 Financial information 2020 Annual General Meeting 2020 Q1 Interim report 23 April The Annual General Meeting will be held on Thursday, 26 March at 11 am (CET) at Cirkus, Djurgårdsslätten Q2 Interim report 17 July 43–45, Stockholm, Sweden. The proposed record day for the dividend is 30 March 2020. The last day for Q3 Interim report 20 October trading in Swedbank’s shares including the right to the dividend is 26 March 2020. -

Swedbank Economic Outlook Is Available At

Completed: January 20, 2021, 06:30 Distributed: January 20, 2021, 07:00 Mattias Persson Global Head of Macro Research and Group Chief Economist [email protected] +46 8 5859 59 74 Andreas Wallström Axel Zetherström Liis Elmik Head of Forecasting Assistant Senior Economist Deputy Head of Macro Research Sweden [email protected] [email protected] andreas.wallströ[email protected] +46 8 5859 57 75 +372 888 72 06 +46 8 700 93 07 Marianna Rõbinskaja Robin Ahlén Øystein Børsum Economist Economist Chief Economist Norway [email protected] [email protected] +372 888 79 25 +46 8 700 93 08 Chief Credit Strategist [email protected] Cathrine Danin +47 91 18 56 35 Senior Economist Līva Zorgenfreija [email protected] Jon Espen Riiser Chief Economist Latvia +46 8 700 92 97 Analyst [email protected] [email protected] +371 6744 58 44 Jana Eklund +47 90 98 17 49 Senior Econometrician Agnese Buceniece [email protected] Marlene Skjellet Granerud Senior Economist +46 8 5859 46 04 Economist [email protected] [email protected] +371 6744 58 75 Knut Hallberg +47 94 30 53 32 Senior Economist Laura Orleāne [email protected] Economist +46 8 700 93 17 [email protected] Heidi Schauman +371 6744 42 13 Pernilla Johansson Chief Economist Finland Senior Economist [email protected] [email protected] +358 503 281 229 +46 40 24 23 31 Nerijus Mačiulis Sonja Liukkonen Deputy Group Chief Economist Maija Kaartinen Junior Economist Chief -

Íslandsbanki Hf

Proposal summary Swedbank in cooperation with Kepler Cheuvreux are proud to present our offer to act as an Underwriter in a potential IPO of Íslandsbanki Swedbank offers a full suite of Investment Banking services, including advisory, M&A, IPO, IPO financing, project financing, equity and bond issuance, equity and credit trading etc. ABOUT SWEDBANK Applicable Read and understood Consent regarding operating provisions of Act no. publication of ✓ licenses of party ✓ 155/2012 and ✓ advisor’s expression Íslandsbanki’s policy on of interest sustainability SWEDBANK & Swedbank has partnered with Kepler Cheuvreux, a leading European Financial Service Long lasting relationship through KEPLER CHEUVREUX Company with emphasis on equity research and ECM execution, to broaden our extensive advisory service within COOPERATION product offering and international distribution in Europe bond issuance The team is supported by Swedbank CEO Jens Henriksson and is Experienced lead by highly qualified individuals with vast deal experience Cooperation within ESG at the team over the years, including Icelandic deals and government sell highest level – both our CEOs are downs part of ‘Nordic CEOs for a Sustainable Future’ Global Reach The partnership with Kepler Cheuvreux enables us to reach all with Multi- relevant pockets of demand throughout Europe and North Local presence America OUR OFFER – Contact person Kepler Cheuvreux has extensive coverage of all the major banks Best-in-class in Europe, which will include Íslandsbanki and research report Sanna Tunsbrunn research will be distributed on every continent Director, FIG Origination Phone: +46 8 700 93 14 Mobile: +46 72 566 33 78 After- We work in close collaboration with our customers to support Email: [email protected] transaction the companies after they entered a public environment through Address: SE-105 34, Stockholm, Sweden support non-deal roadshows, trading support etc. -

View Annual Report

Swedbank AB Annual Report 2009 Annual Report 2009 Anna Sundblad Johannes Rudbeck CONTACTS 52210011 Group Press Manager Head of Investor Relations Telephone: +46 8 585 921 07 Telephone: +46 8 585 933 22 E-mail: [email protected] E-mail: [email protected] Contents 1 Financial summary and important events 2009 2 This is Swedbank 4 President’s statement 8 Fundamental values 9 Strategies and priorities 14 Financial analysis Business areas: 2 1 Swedish Banking 2 5 Baltic Banking 2 9 International Banking 33 Swedbank Markets 3 6 Asset Management 3 8 Ektornet Employees 40 BOARD OF DIRECTORS’ REPORT DIRECTORS’ OF BOARD 42 Salaries and incentives 43 Sustainable development 45 The share and owners 48 The Group’s risks and risk control Financial statements and notes: 58 Income statement 59 Statement of comprehensive income 60 Balance sheet 61 Statement of cash flow 62 Statement of changes in equity 63 Notes Financial information 2010 124 Signatures of the Board of Directors and the President Q1 interim report 27 April 125 Auditors’ report Q2 interim report 22 July 126 Board of Directors Q3 interim report 21 October 128 Group Executive Committee 129 Corporate governance report Annual General Meeting 136 Market shares The Annual General Meeting 2010 will be held at 138 Five-year summary - Group Berwaldhallen, Stockholm, on Friday, 26 March. 140 Two-year summary - Business areas 145 Annual General Meeting 146 Definitions 148 Addresses Swedbank’s annual report is offered to all new shareholders and distributed to those who have actively chosen to receive it. The interim reports are not printed, but are available at www.swedbank.se/ir, where the annual report can also be ordered. -

Victor Carlstrom VS SWEDBANK and Folksam and Other Swedish Officials

Case 1:19-cv-11569 Document 1 Filed 12/17/19 Page 1 of 74 LAWRENCE H. SCHOENBACH, ESQ. Law Offices of Lawrence H. Schoenbach 111 Broadway, Suite 901 New York, New York 10006 JOSHUA L. DRATEL, ESQ. Dratel & Lewis, P.C. 29 Broadway, Suite 1412 New York, New York 10006 Attorneys for Victor Carlström, Stephen Brune , Vinacossa Enterprises AB, SBS Resurs Direkt AB, Boflexibilitet Sverige AB, Vinacossa Enterprises Ltd, and Sparflex AB UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK __________________________________________ ) VICTOR CARLSTRÖM, STEPHEN BRUNE, ) VERIFIED COMPLAINT VINACOSSA ENTERPRISES AB, ) AND JURY DEMAND VINACOSSA ENTERPRISES LTD, ) RICO (18 U.S.C.§1962(c)) BOFLEXIBILITET SVERIGE AB, SBS ) RICO CONSPIRACY RESURS DIREKT AB and SPARFLEX AB. ) (18 U.S.C.§1962(d)) ) COMPUTER FRAUD AND Plaintiffs, ) ABUSE ACT ) (18 U.S.C.§1030(a)) - Against – ) BREACH OF CONTRACT ) (NEW YORK COMMON LAW) ) TORTIOUS INTERFERENCE FOLKSAM ÖMSESIDIG LIVFÖRSÄKRING, ) WITH CONTRACT SWEDBANK AB, SKATTEVERKET, ) (NEW YORK COMMON LAW) FINANSINSPEKTIONEN, JENS ) TORTIOUS INTERFERENCE HENRIKSSON, ERIK THEDÉEN, KATRIN ) WITH COMPETITIVE WESTLING PALM and others known and ) ADVANTAGE (NEW YORK unknown. ) COMMON LAW) ) INTENTIONAL INFLICTION OF Defendants. ) EMOTIONAL DISTRESS ) (NEW YORK COMMON LAW) __________________________________________) Plaintiffs VICTOR CARLSTRÖM, STEPHEN BRUNE, BO FLEXIBILITET SVERIGE AB, VINACOSSA ENTERPRISES AB, VINACOSSA ENTERPRISES LTD, SBS RESURS 1 Case 1:19-cv-11569 Document 1 Filed 12/17/19 Page 2 of 74 DIREKT AB and SPARFLEX AB, allege the following against defendants FOLKSAM ÖMSESIDIG LIVFÖRSÄKRING (“Folksam”), SWEDBANK AB, SKATTEVERKET, FINANSINSPEKTIONEN, JENS HENRIKSSON, ERIK THEDÉEN, KATRIN WESTLING PALM and others known and unknown. JURISDICTION Subject Matter Jurisdiction 1. This Court has federal question jurisdiction pursuant to 28 U.S.C. -

Popis Trećih Osoba S Kojima Su Sklopljeni Ugovori O Delegiranju Poslova Skrbništva (Podskrbnici)

OTP banka d.d. Domovinskog rata 6, 21000 Split, Croatia MB 3141721, OIB 52508873833 SWIFT: OTPVHR2X Popis trećih osoba s kojima su sklopljeni ugovori o delegiranju poslova skrbništva (podskrbnici) Tržište podskrbnik OTP banke d.d. Krajnji skrbnik SWIFT Clearstream Banking Luxembourg CAJA DE VALORES S.A. CAVLARBAXXX Argentina Societe Generale SA CITIBANK N.A. BUENOS AIRES CITIARBAXXXX The Bank of New York Mellon Brussels HSBC BANK AUSTRALIA LIMITED HKBAAU2SXXX Clearstream Banking Luxembourg JPMORGAN CHASE BANK, N.A. (SYDNEY BRANCH) CHASAU2XDCC Australija Clearstream Banking Luxembourg BNP Paribas Securities Services PARBAU2SXXX Societe Generale SA CITICORP NOMINEES PTY LIMITED CITIAU3XXXX The Bank of New York Mellon Brussels UNICREDIT BANK AUSTRIA AG BKAUATWWXXX Clearstream Banking Luxembourg ERSTE GROUP BANK AG GIBAATWGXXX Austrija Clearstream Banking Luxembourg CLEARSTREAM BANKING AG, FRANKFURT DAKVDEFFXXX Societe Generale SA UNICREDIT BANK AUSTRIA – VIENNA BKAUATWWXXX Societe Generale SA EUROCLEAR BANK SA/NV MGTCBEBEECL Bahrein Societe Generale SA HSBC BANK MIDDLE EAST LIMITED BBMEBHBXXXX The Bank of New York Mellon Brussels NATIONAL BANK OF BELGIUM IRVTBEBBDCP The Bank of New York Mellon Brussels EUROCLEAR BELGIUM IRVTBEBBDCP Clearstream Banking Luxembourg BNP PARIBAS SECURITIES SERVICES, PARIS PARBFRPPXXX Belgija Clearstream Banking Luxembourg CLEARSTREAM BANKING AG, FRANKFURT DAKVDEFFXXX Clearstream Banking Luxembourg KBC BANK NV KREDBEBBXXX Societe Generale SA SOCIETE GENERALE FRANCE SOGEFRPPINV Societe Generale SA EUROCLEAR BANK -

Swedbank´S Annual and Sustainability Report 2018

2018 Compiled Sustainability Information This document compiles all the sustainability information presented in Swedbank´s Annual and Sustainability Report 2018. The document is developed to facilitate for our stakeholders to find information about the bank´s sustain ability efforts, increase transparency and give us an oppor tunity to report on how we work with and implement sustaina bility in our business. The report conforms to the Global Reporting Initiative´s (GRI) guidelines, version Standards, Core level and has been reviewed by Deloitte AB. Swedbank Compiled Sustainability Information 2018 Content 14 Sustainability – part of Swedbank’s heritage and purpose 17 The work with TCFD 18 Swedbank and the UN’s Sustainable Development Goals 188 Sustainability report 189 Materiality analysis 190 Stakeholder engagement 191 Material impacts and strategic policy documents 191 Precautionary principle 192 Sustainability management 194 S1 – Pay 195 S2 – Save/Invest 197 S3 – Finance 198 S4 – Procure 198 S5 – Environmental impacts 200 S6 – Employees 202 S7 – IT security and crime prevention 202 S8 – Anti-corruption 203 S9 – Taxes 203 S10 – Human rights 204 S11 – Social engagement 205 GRI Standards Index 206 GRI Topic-specific disclosures 214 Assurance report 225 Contacts Swedbank Compiled Sustainability Information 2018 14 SUSTAINABILITY Sustainability – part of Swedbank’s heritage and purpose Strong social engagement and clear values distinguish Swedbank in Sweden and the Baltic countries. Back when the first Swedish savings bank was founded, in 1820, the objective was to give the public a way to build savings for the long term. This social commitment has also applied to the Baltic countries from the beginning, with Hansabank, which was founded in 1991 and later became part of Swedbank. -

Disciplinary Committee of Nasdaq Stockholm

May 5, 2021 Decision by the Disciplinary Committee of Nasdaq Stockholm The Disciplinary Committee at Nasdaq Stockholm today ordered Swedbank to pay a fine of twelve annual fees, equivalent of SEK 46.6 million. As Swedbank stated in its Q1- report on April 27, the issue concerns historical matters dating back to 2016-2019. The Disciplinary Committee states that Swedbank over a long period of time had shortcomings in its AML processes and routines and that the shortcomings were known to the bank’s former top management for a long period of time. During March, Nasdaq Stockholm AB (Nasdaq) informed the bank of the conclusions of its review as to whether the bank had breached the Nasdaq’s rules during the period December 2016 to February 2019. Later, the review was handed over to the Disciplinary Committee of Nasdaq Stockholm which has now decided the matter. Swedbank stated in the quarterly report on April 27 that the bank largely concurs with Nasdaq’s conclusions. ”During the last year, the bank has undertaken several measures to strengthen processes for the disclosure of information. Today’s decision means that yet another issue concerning the bank’s historical shortcomings, is closed,” says Jens Henriksson, President and CEO of Swedbank. As the bank communicated in the quarterly report on April 27, 2021, the bank expected that the Disciplinary Committee of Nasdaq Stockholm would decide on a fine and therefore allocated SEK 30 million for the purpose. Contact information: Annie Ho, Head of Investor Relations, +46 70 343 78 15 Unni Jerndal, Head of Group Press Office, +46 73 092 11 80 Swedbank AB (publ) is required to disclose this information pursuant to the Swedish Securities Markets Act (2007:528), the Swedish Financial Instruments Trading Act (1991:980) and the regulatory framework of Nasdaq Stockholm. -

Citibank Europe Plc, Luxembourg Branch: List of Sub-Custodians

Citibank Europe plc, Luxembourg Branch: List of Sub-Custodians Country Sub-Custodian Argentina The Branch of Citibank, N.A. in the Republic of Argentina Australia Citigroup Pty. Limited Austria Citibank Europe plc, Dublin Bahrain Citibank, N.A., Bahrain Bangladesh Citibank, N.A., Bangaldesh Belgium Citibank Europe plc, UK Branch Benin Standard Chartered Bank Cote d'Ivoire Bermuda The Hong Kong & Shanghai Banking Corporation Limited acting through its agent, HSBC Bank Bermuda Limited Bosnia-Herzegovina (Sarajevo) UniCredit Bank d.d. Bosnia-Herzegovina: Srpska (Banja Luka) UniCredit Bank d.d. Botswana Standard Chartered Bank of Botswana Limited Brazil Citibank, N.A., Brazilian Branch Bulgaria Citibank Europe plc, Bulgaria Branch Burkina Faso Standard Chartered Bank Cote D'ivoire Canada Citibank Canada Chile Banco de Chile China B Shanghai Citibank, N.A., Hong Kong Branch (For China B shares) China B Shenzhen Citibank, N.A., Hong Kong Branch (For China B shares) China A Shares Citibank China Co ltd ( China A shares) China Hong Kong Stock Connect Citibank, N.A., Hong Kong Branch Clearstream ICSD ICSD Colombia Cititrust Colombia S.A. Sociedad Fiduciaria Costa Rica Banco Nacioanal de Costa Rica Croatia Privedna banka Zagreb d.d. Cyprus Citibank Europe plc, Greece Branch Czech Republic Citibank Europe plc, organizacni slozka Denmark Citibank Europe plc, Dublin Egypt Citibank, N.A., Cairo Branch Estonia Swedbank AS Euroclear ICSD 1 Citibank Europe plc, Luxembourg Branch: List of Sub-Custodians Country Sub-Custodian Finland Nordea Bank AB (publ), Finish Branch France Citibank Europe plc, UK Branch Georgia JSC Bank of Georgia Germany Citibank Europe plc, Dublin Ghana Standard Chartered Bank of Ghana Limited Greece Citibank Europe plc, Greece Branch Guinea Bissau Standard Chartered Bank Cote D'ivoire Hong Kong Citibank NA Hong Kong Hungary Citibank Europe plc Hungarian Branch Office Iceland Citibank is a direct member of Clearstream Banking, which is an ICSD. -

Equipping Swedbank with the Tools to Carry out Faster, More Complex Investigations

CASE STUDY EQUIPPING SWEDBANK WITH THE TOOLS TO CARRY OUT FASTER, MORE COMPLEX INVESTIGATIONS EXPANDING VISIBILITY INTO INCREASINGLY DISPERSED SYSTEMS AND PREPARING FOR MORE MATURE ADVERSARIES. One of the world’s 100 largest banks, Swedbank is a Nordic-Baltic banking group with subsidiaries “We were impressed by how we were able to in Luxembourg, Estonia, Latvia and Lithuania and leverage Exabeam to help identify the real user a presence throughout Scandinavia as well as the within an environment where that user might United States, South Africa and China. Swedbank have multiple identities, and how easily the offers retail banking, asset management, financial, people who have to use the solution on a daily and other services to more than 7.3 million private basis were able to do so.” and 546 000 corporate customers globally. JAN WILLEKENS, APO CYBER DEFENSE CENTER & CYBER SECURITY INCIDENT MANAGER, SWEDBANK SECURING A GLOBAL FINANCIAL NETWORK SAFELY, AND EFFICIENTLY INDUSTRY Finance Operating in an environment that relies heavily on trust, compliance and speed, the Swedbank team EXABEAM PRODUCTS understood that, as adversaries and their tactics • Data Lake become more mature, so too should the technology • Cloud Connectors used to defend against them. • Advanced Analytics • Threat Hunter “What prompted us to lifecycle our existing tool Exabeam ultimately won out based on the above was the increased maturity of the adversaries out requirements, as well as having a predictable there, as well as their ability to hide within different pricing model that meant more consistent technologies,” said Jan Willekens, APO Cyber Defense budgeting going forward. Center & Cyber Security Incident Manager, Swedbank. -

Wholesale Banking Capital Markets Day

Wholesale Banking Capital Markets Day Martin A Persson, Head of Wholesale Banking 25 October 2019 Disclaimer ▪ This presentation contains forward-looking statements that reflect management’s current views with respect to certain future events and potential financial performance. Although Nordea believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of various factors. ▪ Important factors that may cause such a difference for Nordea include, but are not limited to: (i) the macroeconomic development, (ii) change in the competitive climate, (iii) change in the regulatory environment and other government actions and (iv) change in interest rate and foreign exchange rate levels. ▪ This presentation does not imply that Nordea has undertaken to revise these forward-looking statements, beyond what is required by applicable law or applicable stock exchange regulations if and when circumstances arise that will lead to changes compared to the date when these statements were provided. 2 Wholesale Banking KEY MESSAGES All-time-high customer satisfaction Reduce capital consumption New strategic direction 3 Introduction to Wholesale Banking Wholesale Banking overview Large corporate and institutional customer segments 10Y EUR interest rate Complex Daily banking 1,2 0,8 WB CBB CBB 0,4 LC&I BB BBD 0 Oct 14 Oct 15 Oct 16 Oct 17 Oct