Market Type Details

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retail Banking Announcement

Frequently asked questions 26 May 2021 What the repositioning of the HSBC USA Wealth and Personal Banking business means for our customers, here and abroad Why did HSBC take this action? In February 2020, we set out a plan to shift our business strategy in the United States to maximize the connection between our clients and our world-class international network. Our primary business will be a wholesale bank focused on the international needs of clients. We are renewing our emphasis on the US$5 trillion international wealth management opportunity from globally mobile and affluent individuals in the United States. Is HSBC exiting the United States? No, HSBC is not exiting its US business. We aim to be the leading international bank in the United States and are focused on what we do best – connecting Americans to a world of opportunity and bringing cross-border business and investment to the United States. We will continue to provide banking services not only to our wholesale banking clients, but also to our Premier, Jade and Private Banking customers. I have personal accounts at HSBC and I’m in the United States. How will these agreements affect me? Upon completion of the transactions, the accounts of in-scope customers will be transferred to Citizens or Cathay Bank. We thank those customers for their business and will ensure the transfer occurs with as minimum disruption as possible. Premier, Jade, Private Banking and other clients who will remain HSBC customers are in the process of being transitioned to one of our new 20-25 Wealth Centers. -

PREFERENCE SHARES, NOMINAL VALUE of E2.24 PER SHARE, in the CAPITAL OF

11JUL200716232030 3JUL200720235794 11JUL200603145894 Public Offer by RFS Holdings B.V. FOR ALL OF THE ISSUED AND OUTSTANDING (FORMERLY CONVERTIBLE) PREFERENCE SHARES, NOMINAL VALUE OF e2.24 PER SHARE, IN THE CAPITAL OF ABN AMRO Holding N.V. Offer Memorandum and Offer Memorandum for ABN AMRO ordinary shares (incorporated by reference in this Offer Memorandum) 20 July 2007 This Preference Shares Offer expires at 15:00 hours, Amsterdam time, on 5 October 2007, unless extended. OFFER MEMORANDUM dated 20 July 2007 11JUL200716232030 3JUL200720235794 11JUL200603145894 PREFERENCE SHARES OFFER BY RFS HOLDINGS B.V. FOR ALL THE ISSUED AND OUTSTANDING PREFERENCE SHARES, NOMINAL VALUE OF e2.24 PER SHARE, IN THE CAPITAL OF ABN AMRO HOLDING N.V. RFS Holdings B.V. (‘‘RFS Holdings’’), a company formed by an affiliate of Fortis N.V. and Fortis SA/NV (Fortis N.V. and Fortis SA/ NV together ‘‘Fortis’’), The Royal Bank of Scotland Group plc (‘‘RBS’’) and an affiliate of Banco Santander Central Hispano, S.A. (‘‘Santander’’), is offering to acquire all of the issued and outstanding (formerly convertible) preference shares, nominal value e2.24 per share (‘‘ABN AMRO Preference Shares’’), of ABN AMRO Holding N.V. (‘‘ABN AMRO’’) on the terms and conditions set out in this document (the ‘‘Preference Shares Offer’’). In the Preference Shares Offer, RFS Holdings is offering to purchase each ABN AMRO Preference Share validly tendered and not properly withdrawn for e27.65 in cash. Assuming 44,988 issued and outstanding ABN AMRO Preference Shares outstanding as at 31 December 2006, the total value of the consideration being offered by RFS Holdings for the ABN AMRO Preference Shares is e1,243,918.20. -

18 February 2019 Solvency and Diversification in Insurance Remain Key Strengths Despite Change in Structure

FINANCIAL INSTITUTIONS ISSUER IN-DEPTH Lloyds Banking Group plc 18 February 2019 Solvency and diversification in insurance remain key strengths despite change in structure Summary RATINGS In 2018, Lloyds Banking Group plc (LBG) altered its structure to comply with the UK's ring- Lloyds Banking Group plc Baseline Credit a3 fencing legislation, which requires large banks to separate their retail and SME operations, Assessment (BCA) and deposit taking in the European Economic Area (EEA) from their other activities, including Senior unsecured A3 Stable the riskier capital markets and trading business. As part of the change, LBG designated Lloyds Bank plc as the“ring-fenced” entity housing its retail, SME and corporate banking operations. Lloyds Bank plc It also assumed direct ownership of insurer Scottish Widows Limited, previously a subsidiary Baseline Credit A3 Assessment (BCA) of Lloyds Bank. The changes had little impact on the creditworthiness of LBG and Lloyds Adjusted BCA A3 Bank, leading us to affirm the deposit and senior unsecured ratings of both entities. Scottish Deposits Aa3 Stable/Prime-1 Widows' ratings were unaffected. Senior unsecured Aa3 Stable » LBG's reorganisation was less complex than that of most UK peers. The Lloyds Lloyds Bank Corporate Markets plc Banking Group is predominantly focused on retail and corporate banking, and the Baseline Credit baa3 required structural changes were therefore relatively minor. The group created a small Assessment (BCA) separate legal entity, Lloyds Bank Corporate Markets plc (LBCM), to manage its limited Adjusted BCA baa1 Deposits A1 Stable/Prime-1 capital markets and trading operations, and it transferred its offshore subsidiary, Lloyds Issuer rating A1 Stable Bank International Limited (LBIL), to LBCM from Lloyds Bank. -

Result of Tender Offer on Certain Perpetual

23 June 2016 LLOYDS BANKING GROUP PLC ANNOUNCES RESULTS OF TENDER OFFER FOR CERTAIN PERPETUAL NOTES Lloyds Banking Group plc (‘LBG’) today announced the final results of its previously announced U.S. dollar cash tender offer (the ‘Offer’) for any and all of certain series of outstanding perpetual notes (the ‘Notes’) issued by Lloyds Bank plc and Bank of Scotland plc (formerly The Governor and Company of the Bank of Scotland). The Offer was made on the terms and subject to the conditions set forth in the Offer to Purchase dated 16 June 2016 (the ‘Offer to Purchase’). Capitalised terms not otherwise defined in this announcement have the same meaning as in the Offer to Purchase. Based on information provided by the Tender Agent, $629,760,000 in aggregate principal amount of the Notes listed in the table below were validly tendered and not validly withdrawn by 5.00pm, New York City time, on 22 June 2016 (the ‘Expiration Deadline’), as more fully set forth below. LBG has accepted all Notes that were validly tendered and not validly withdrawn prior to the Expiration Deadline. The Any and All Settlement Date is expected to be 24 June 2016. No notes were tendered using the guaranteed delivery procedures. The table below sets forth, among other things, the principal amount of each series of Notes validly tendered and not validly withdrawn at or prior to the Expiration Deadline: Notes Issuer ISIN Purchase Price1 Aggregate Principal Amount Tendered Primary Capital Undated Lloyds Bank plc GB0005224307 $650 $138,160,000 Floating Rate Notes (Series 1) Primary Capital Undated Lloyds Bank plc GB0005205751 $650 $150,520,000 Floating Rate Notes (Series 2) Primary Capital Undated Lloyds Bank plc GB0005232391 $650 $193,460,000 Floating Rate Notes (Series 3) Undated Floating Rate Bank of Scotland plc GB0000765403 $650 $147,620,000 Primary Capital Notes 1 Per $1,000 in principal amount of Notes accepted for purchase. -

Third Supplemental Information Memorandum Dated 23 July 2019

Third Supplemental Information Memorandum dated 23 July 2019 LVMH FINANCE BELGIQUE SA (incorporated as société anonyme / naamloze vennootschap) under the laws of Belgium, with enterprise number 0897.212.188 RPR/RPM (Brussels)) EUR 4,000,000,000 Belgian Multi-currency Short-Term Treasury Notes Programme Irrevocably and unconditionally guaranteed by LVMH Moët Hennessy - Louis Vuitton SE (incorporated as European company under the laws of France, and registered under number 775 670 417 (R.C.S. Paris)) The Programme is rated A-1 by Standard & Poor’s Ratings Services, a division of the McGraw-Hill Companies, Inc. and, Arranger Dealers Banque Fédérative du Crédit Mutuel BNP Paribas BRED Banque Populaire Crédit Agricole Corporate and Investment Bank Crédit Industriel et Commercial BNP Paribas Fortis SA/NV Natixis Société Générale ING Belgium SA/NV ING Bank N.V. Belgian Branch Issuing and Paying Agent BNP Paribas Fortis SA/NV This third supplemental information memorandum is dated 23 July 2019 (the “Third Supplemental Information Memorandum”) and is supplemental to, and shall be read in conjunction with, the information memorandum dated 20 October 2015 as supplemented on 21 April 2016 and on 28 April 2017 (the “Information Memorandum”). Unless otherwise defined herein, terms defined in the Information Memorandum have the same respective meanings when used in this Third Supplemental Information Memorandum. As of the date of this Third Supplemental Information Memorandum: (i) The Issuer herby makes the following additional disclosure: Moody's assigned on 3 July 2019 a first-time A1 long-term issuer rating and Prime-1 (P-1) short-term rating to LVMH Moët Hennessy Louis Vuitton SE.; (ii) The paragraph 1.17 “Rating(s) of the Programme” of the section entitled “1. -

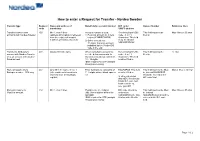

How to Enter a Request for Transfer - Nordea Sweden

How to enter a Request for Transfer - Nordea Sweden Transfer type Request Name and address of Beneficiary’s account number BIC code / Name of banker Reference lines code beneficiary SWIFT address Transfer between own 400 Min 1, max 4 lines Account number is used: Receiving bank’s BIC This field must not be Max 4 lines x 35 char accounts with Nordea Sweden (address information is retrieved 1) Personal account no = pers code - 8 or 11 filled in from the register of account reg no (YYMMDDXXXX) characters. This field numbers of Nordea, Sweden) 2) Other account nos = must be filled in 11 digits. Currency account NDEASESSXXX indicated by the 3-letter ISO code in the end Transfer to third party’s 401 Always fill in the name When using bank account no., Receiving bank’s BIC This field must not be 12 char account with Nordea Sweden see the below comments. In code - 8 or 11 filled in or to an account with another Sweden account nos consist of characters. This field Swedish bank 10 - 15 digits. must be filled in IBAN required for STP (straight through processing) Domestic payments to 402 Only fill in the name in line 1 Enter bankgiro no consisting of BGABSESS. This field This field must not be filled Max 4 lines x 35 char Bankgiro number - SEK only (other address information is 7 - 8 digits without blank spaces must be filled in. in. Instead BGABSESS retrieved from the Bankgiro etc should be entered in the register) In other currencies BIC code field than SEK: Receivning banks BIC code and bank account no. -

Hsbc to Acquire Lloyds Banking Group Onshore Assets in the Uae

Ab c 29 March 2012 HSBC TO ACQUIRE LLOYDS BANKING GROUP ONSHORE ASSETS IN THE UAE HSBC Bank Middle East Ltd (‘HSBC’), an indirect wholly-owned subsidiary of HSBC Holdings plc, has entered into an agreement to acquire the onshore retail and commercial banking business of Lloyds Banking Group (‘Lloyds’) in the United Arab Emirates (‘UAE’). The value of the gross assets being acquired is US$769m as at 31 December 2011. The transaction, which is subject to regulatory approvals, is expected to complete in 2012. HSBC’s largest operations in the MENA region are based in the UAE where HSBC enjoys a market-leading trade and commercial banking presence, in addition to the largest international retail banking and wealth management business. The business being acquired from Lloyds has approximately 8,800 personal and commercial customers and a loan book of approximately US$573m as at 31 December 2011. Commenting on the acquisition, Simon Cooper, Deputy Chairman and Chief Executive Officer of HSBC in MENA, said: “HSBC is the leading international bank in the UAE and the addition of Lloyds’ strong presence in retail and commercial banking is highly complementary to our business. The acquisition underscores the strategic importance of the UAE, and of the MENA region as a whole, to HSBC.” Media enquiries to: Tim Harrison + 971 4 4235632 [email protected] Brendan McNamara +44 (0) 20 7991 0655 [email protected] ends/more Registered Office and Group Head Office: This news release is issued by 8 Canada Square, London E14 5HQ, United Kingdom Web: www.hsbc.com HSBC Holdings plc Incorporated in England with limited liability. -

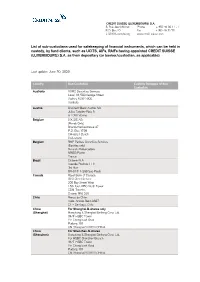

List of Sub-Custodians Used for Safekeeping of Financial Instruments

CREDIT SUISSE (LUXEMBOURG) S.A. 5, Rue Jean Monnet Phone + 352 46 00 11 - 1 P.O. Box 40 Fax + 352 46 32 70 L-2010 Luxembourg www.credit-suisse.com List of sub-custodians used for safekeeping of financial instruments, which can be held in custody, by fund clients, such as UCITS, AIFs, RAIFs having appointed CREDIT SUISSE (LUXEMBOURG) S.A. as their depositary (or banker/custodian, as applicable) Last update: June 30, 2020 Country Sub-Custodian Custody Delegate of Sub- Custodian Australia HSBC Securities Services Level 13, 580 George Street Sydney NSW 2000 Australia Austria UniCredit Bank Austria AG Julius Tandler-Platz 3 A-1090 Vienna Belgium SIX SIS AG (Bonds Only) Brandschenkestrasse 47 P.O. Box 1758 CH-8021 Zurich Switzerland Belgium BNP Paribas Securities Services (Equities only) 9 rue du Débarcadère 93500 Pantin France Brazil Citibank N.A. Avenida Paulista 1111 3rd floor BR-01311-290 Sao Paulo Canada Royal Bank of Canada GSS Client Service 200 Bay Street West 15th floor, RBC North Tower CDN-Toronto, Ontario M5J 2J5 Chile Banco de Chile Avda. Andrés Bello 2687 CL – Santiago, Chile China For Shanghai-B-shares only (Shanghai) Hongkong & Shanghai Banking Corp. Ltd. 34/F HSBC Tower Yin Cheng East Road Pudong 101 CN-Shanghai 200120 CHINA China For Shenzhen-B-shares (Shenzhen) Hongkong & Shanghai Banking Corp. Ltd. For HSBC Shenzhen Branch 34/F HSBC Tower Yin Cheng East Road Pudong 101 CN-Shanghai 200120 CHINA Colombia Cititrust Colombia S.A. Sociedad Fiduciaria Carrera 9A No. 99-02 First Floor Santa Fé de Bogotá D.C. -

NETSUITE ELECTRONIC BANK PAYMENTS Securely Automate EFT Payments and Collections with a Single Global Solution

NETSUITE ELECTRONIC BANK PAYMENTS Securely Automate EFT Payments and Collections with a Single Global Solution Electronic Bank Payments brings to NetSuite complementary electronic banking functionality Key Features that includes Electronic Funds Transfer (EFT) • Automated payment batch allows multiple payments, customer refunds and customer payment batch creation stemmed from payments (direct debits), as well as check fraud different batch criteria, controls and payment deadlines. prevention through the Positive Pay service offered by leading banks. It helps ensure that • Approval routing and email alert notification enables additional payment employees and vendors are paid on time authorization prior to payment processing. and customer bills are settled automatically. With support for a wide range of global and • Enhanced EFT capabilities with filtering options support bill display, partial payments, local bank formats, Electronic Bank Payments bill management and other controls. provides a single payment management • Automated direct debit customer solution worldwide. collections to settle outstanding invoices. Electronic Bank Payments creates files of • Payment management options include payments or direct debit information in bank’s payment batch queuing, rollbacks, reversals predefined file format ready for import into with notations and automated notifications. banking software or submission to the bank • Positive Pay anti-fraud capabilities with online, thus lowering payment processing proactive notification to banks processing expenses by eliminating checks, postage and the checks. envelopes, and saving time as well. In addition, • Support for more than 50 international it supports management of large payment bank formats with Advanced Electronic runs (typically up to 5,000 payments per file) Bank Payment License customers having with the ability to process reversals and partial the flexibility to add more. -

Hsbc Premier Terms & Charges Disclosure

HSBC PREMIER The following information was correct as of 09/24/2021 Have questions or need current rate information? TERMS & CHARGES DISCLOSURE1 Call us at 888.662.HSBC (4722) It's important that you understand exactly how your HSBC Premier checking account works. We've created this summary to explain the fees and some key terms of your account. To qualify you must be a consumer and maintain: Balances of $75,000 in qualifying balances (see qualifying balance section); OR Monthly recurring direct deposits2 totaling at least $5,000 from a third party to an HSBC Premier checking account(s); OR HSBC U.S. residential mortgage loan with an original loan amount of at least $500,000, not an aggregate of ELIGIBILITY multiple mortgages. Home Equity products are not included. Participation in HSBC Jade is available to holders of an HSBC Premier Checking Account who have maintained qualifying Personal Cash Accounts and Personal Investment Assets (excluding Retirement Accounts and Assets) in the United States which in aggregate and calculated as an average over each calendar month are equal to at least $1,000,000 (One million U.S. dollars) for a period of at least 1 calendar month (a “Qualifying Balance”) immediately prior to HSBC Premier Account Holders becoming HSBC Jade clients. As a HSBC Jade client, if you are no longer able to meet the HSBC Jade criteria, your access to all its benefits will be removed. RATE Minimum Balance to Obtain APY Interest Rate Annual Percentage Yield (APY) INFORMATION (For more details $5 or more 0.01% 0.01% see HOW INTEREST AND APY WORK section Less than $5 No Interest Earned No APY Earned in the Rules)3 Minimum Balance requirements to earn interest are met by maintaining a “Daily Balance” of specified dollar amounts in your relationship checking account.3 Method Used to Compute Daily This method applies a daily periodic rate to the principal in the account ADDITIONAL Interest Balance each day. -

DTC Participant Alphabetical Listing June 2019.Xlsx

DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER ABN AMRO CLEARING CHICAGO LLC 0695 ABN AMRO SECURITIES (USA) LLC 0349 ABN AMRO SECURITIES (USA) LLC/A/C#2 7571 ABN AMRO SECURITIES (USA) LLC/REPO 7590 ABN AMRO SECURITIES (USA) LLC/ABN AMRO BANK NV REPO 7591 ALPINE SECURITIES CORPORATION 8072 AMALGAMATED BANK 2352 AMALGAMATED BANK OF CHICAGO 2567 AMHERST PIERPONT SECURITIES LLC 0413 AMERICAN ENTERPRISE INVESTMENT SERVICES INC. 0756 AMERICAN ENTERPRISE INVESTMENT SERVICES INC./CONDUIT 7260 APEX CLEARING CORPORATION 0158 APEX CLEARING CORPORATION/APEX CLEARING STOCK LOAN 8308 ARCHIPELAGO SECURITIES, L.L.C. 0436 ARCOLA SECURITIES, INC. 0166 ASCENSUS TRUST COMPANY 2563 ASSOCIATED BANK, N.A. 2257 ASSOCIATED BANK, N.A./ASSOCIATED TRUST COMPANY/IPA 1620 B. RILEY FBR, INC 9186 BANCA IMI SECURITIES CORP. 0136 BANK OF AMERICA, NATIONAL ASSOCIATION 2236 BANK OF AMERICA, NA/GWIM TRUST OPERATIONS 0955 BANK OF AMERICA/LASALLE BANK NA/IPA, DTC #1581 1581 BANK OF AMERICA NA/CLIENT ASSETS 2251 BANK OF CHINA, NEW YORK BRANCH 2555 BANK OF CHINA NEW YORK BRANCH/CLIENT CUSTODY 2656 BANK OF MONTREAL, CHICAGO BRANCH 2309 BANKERS' BANK 2557 BARCLAYS BANK PLC NEW YORK BRANCH 7263 BARCLAYS BANK PLC NEW YORK BRANCH/BARCLAYS BANK PLC-LNBR 8455 BARCLAYS CAPITAL INC. 5101 BARCLAYS CAPITAL INC./LE 0229 BB&T SECURITIES, LLC 0702 BBVA SECURITIES INC. 2786 BETHESDA SECURITIES, LLC 8860 # DTCC Confidential (Yellow) DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER BGC FINANCIAL, L.P. 0537 BGC FINANCIAL L.P./BGC BROKERS L.P. 5271 BLOOMBERG TRADEBOOK LLC 7001 BMO CAPITAL MARKETS CORP. -

CAYMAN ISLANDS) LIMITED (Incorporated with Limited Liability in the Cayman Islands) As Issuer and EFG EUROBANK ERGASIAS S.A

– 6:46 pm – mac5 – 3485 Intro : 3485 Intro Prospectus EFG HELLAS PLC (incorporated with limited liability in England and Wales) as Issuer and EFG HELLAS (CAYMAN ISLANDS) LIMITED (incorporated with limited liability in the Cayman Islands) as Issuer and EFG EUROBANK ERGASIAS S.A. (incorporated with limited liability in the Hellenic Republic) as Guarantor €15,000,000,000 Programme for the Issuance of Debt Instruments Under this €15,000,000,000 Programme for the Issuance of Debt Instruments (the “Programme”), each of EFG Hellas PLC and EFG Hellas (Cayman Islands) Limited (each an “Issuer” and, together, the “Issuers”) may from time to time issue debt instruments (“Instruments”) guaranteed by EFG Eurobank Ergasias S.A. (the “Guarantor” or the “Bank”) and denominated in any currency agreed between the relevant Issuer and the relevant Dealer (as defined herein). Application has been made to the Commission de Surveillance du Secteur Financier (the “CSSF”) in its capacity as competent authority under the Luxembourg Act dated 10 July 2005 on prospectuses for securities to approve this document as a base prospectus. Application has also been made to the Luxembourg Stock Exchange for Instruments issued under the Programme to be admitted to trading on the Luxembourg Stock Exchange's regulated market and to be listed on the Official List of the Luxembourg Stock Exchange. References in this Prospectus to Instruments which are intended to be “listed” (and all related references) on the Luxembourg Stock Exchange shall mean that such Instruments have been admitted to trading on the Luxembourg Stock Exchange’s regulated market and have been listed on the Official List of the Luxembourg Stock Exchange.