Morgan Stanley Financials Conference

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

18 February 2019 Solvency and Diversification in Insurance Remain Key Strengths Despite Change in Structure

FINANCIAL INSTITUTIONS ISSUER IN-DEPTH Lloyds Banking Group plc 18 February 2019 Solvency and diversification in insurance remain key strengths despite change in structure Summary RATINGS In 2018, Lloyds Banking Group plc (LBG) altered its structure to comply with the UK's ring- Lloyds Banking Group plc Baseline Credit a3 fencing legislation, which requires large banks to separate their retail and SME operations, Assessment (BCA) and deposit taking in the European Economic Area (EEA) from their other activities, including Senior unsecured A3 Stable the riskier capital markets and trading business. As part of the change, LBG designated Lloyds Bank plc as the“ring-fenced” entity housing its retail, SME and corporate banking operations. Lloyds Bank plc It also assumed direct ownership of insurer Scottish Widows Limited, previously a subsidiary Baseline Credit A3 Assessment (BCA) of Lloyds Bank. The changes had little impact on the creditworthiness of LBG and Lloyds Adjusted BCA A3 Bank, leading us to affirm the deposit and senior unsecured ratings of both entities. Scottish Deposits Aa3 Stable/Prime-1 Widows' ratings were unaffected. Senior unsecured Aa3 Stable » LBG's reorganisation was less complex than that of most UK peers. The Lloyds Lloyds Bank Corporate Markets plc Banking Group is predominantly focused on retail and corporate banking, and the Baseline Credit baa3 required structural changes were therefore relatively minor. The group created a small Assessment (BCA) separate legal entity, Lloyds Bank Corporate Markets plc (LBCM), to manage its limited Adjusted BCA baa1 Deposits A1 Stable/Prime-1 capital markets and trading operations, and it transferred its offshore subsidiary, Lloyds Issuer rating A1 Stable Bank International Limited (LBIL), to LBCM from Lloyds Bank. -

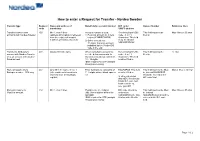

How to Enter a Request for Transfer - Nordea Sweden

How to enter a Request for Transfer - Nordea Sweden Transfer type Request Name and address of Beneficiary’s account number BIC code / Name of banker Reference lines code beneficiary SWIFT address Transfer between own 400 Min 1, max 4 lines Account number is used: Receiving bank’s BIC This field must not be Max 4 lines x 35 char accounts with Nordea Sweden (address information is retrieved 1) Personal account no = pers code - 8 or 11 filled in from the register of account reg no (YYMMDDXXXX) characters. This field numbers of Nordea, Sweden) 2) Other account nos = must be filled in 11 digits. Currency account NDEASESSXXX indicated by the 3-letter ISO code in the end Transfer to third party’s 401 Always fill in the name When using bank account no., Receiving bank’s BIC This field must not be 12 char account with Nordea Sweden see the below comments. In code - 8 or 11 filled in or to an account with another Sweden account nos consist of characters. This field Swedish bank 10 - 15 digits. must be filled in IBAN required for STP (straight through processing) Domestic payments to 402 Only fill in the name in line 1 Enter bankgiro no consisting of BGABSESS. This field This field must not be filled Max 4 lines x 35 char Bankgiro number - SEK only (other address information is 7 - 8 digits without blank spaces must be filled in. in. Instead BGABSESS retrieved from the Bankgiro etc should be entered in the register) In other currencies BIC code field than SEK: Receivning banks BIC code and bank account no. -

Hsbc to Acquire Lloyds Banking Group Onshore Assets in the Uae

Ab c 29 March 2012 HSBC TO ACQUIRE LLOYDS BANKING GROUP ONSHORE ASSETS IN THE UAE HSBC Bank Middle East Ltd (‘HSBC’), an indirect wholly-owned subsidiary of HSBC Holdings plc, has entered into an agreement to acquire the onshore retail and commercial banking business of Lloyds Banking Group (‘Lloyds’) in the United Arab Emirates (‘UAE’). The value of the gross assets being acquired is US$769m as at 31 December 2011. The transaction, which is subject to regulatory approvals, is expected to complete in 2012. HSBC’s largest operations in the MENA region are based in the UAE where HSBC enjoys a market-leading trade and commercial banking presence, in addition to the largest international retail banking and wealth management business. The business being acquired from Lloyds has approximately 8,800 personal and commercial customers and a loan book of approximately US$573m as at 31 December 2011. Commenting on the acquisition, Simon Cooper, Deputy Chairman and Chief Executive Officer of HSBC in MENA, said: “HSBC is the leading international bank in the UAE and the addition of Lloyds’ strong presence in retail and commercial banking is highly complementary to our business. The acquisition underscores the strategic importance of the UAE, and of the MENA region as a whole, to HSBC.” Media enquiries to: Tim Harrison + 971 4 4235632 [email protected] Brendan McNamara +44 (0) 20 7991 0655 [email protected] ends/more Registered Office and Group Head Office: This news release is issued by 8 Canada Square, London E14 5HQ, United Kingdom Web: www.hsbc.com HSBC Holdings plc Incorporated in England with limited liability. -

Natwest, Lloyds Bank and Barclays Pilot UK's First Business Banking Hubs

NatWest, Lloyds Bank and Barclays pilot UK’s first business banking hubs NatWest, Lloyds Bank and Barclays have announced that they will pilot the UK’s first shared business banking hubs. The first hub will open its door in Perry Barr, Birmingham today. The pilot will also see five other shared hubs open across the UK in the coming weeks The hubs have been specifically designed to enable businesses that manage cash and cheque transactions to pay in large volumes of coins, notes and cheques and complete cash exchange transactions. They will be available on a trial basis to pre-selected business clients in each local area and will offer extended opening times (8am to 8pm) 7 days a week, providing business and corporate customers more flexibility to manage their day-to-day finances. The hubs will be branded Business Banking Hub and they have been designed to enable business customers from Natwest, Lloyds Bank and Barclays to conduct transactions through a shared facility. Commenting on the launch of the pilot, Deputy CEO of NatWest Holdings and CEO of NatWest Commercial and Private Banking Alison Rose said: “We have listened to what our business customers really want from our cash services. It is now more important than ever that we continue to offer innovative services, and we are creating an infrastructure that allows small business owners and entrepreneurs to do what they do best - run their business. I look forward to continued working with fellow banks to ensure the UK's businesses are getting the support they deserve." Commenting on the support this will provide businesses, Paul Gordon, Managing Director of SME and Mid Corporates at Lloyds Bank Commercial Banking said: “SMEs are the lifeblood of the UK economy. -

Meet the Exco

Meet the Exco 18th March 2021 Alison Rose Chief Executive Officer 2 Strategic priorities will drive sustainable returns NatWest Group is a relationship bank for a digital world. Simplifying our business to improve customer experience, increase efficiency and reduce costs Supporting Powering our strategy through customers at Powered by Simple to Sharpened every stage partnerships deal with capital innovation, partnership and of their lives & innovation allocation digital transformation. Our Targets Lending c.4% Cost Deploying our capital effectively growth Reduction above market rate per annum through to 20231 through to 20232 CET1 ratio ROTE Building Financial of 13-14% of 9-10% capability by 2023 by 2023 1. Comprises customer loans in our UK and RBS International retail and commercial businesses 2. Total expenses excluding litigation and conduct costs, strategic costs, operating lease depreciation and the impact of the phased 3 withdrawal from the Republic of Ireland Strategic priorities will drive sustainable returns Strengthened Exco team in place Alison Rose k ‘ k’ CEO to deliver for our stakeholders Today, introducing members of the Executive team who will be hosting a deep dive later in the year: David Lindberg 20th May: Commercial Banking Katie Murray Peter Flavel Paul Thwaite CFO CEO, Retail Banking NatWest Markets CEO, Private Banking CEO, Commercial Banking 29th June: Retail Banking Private Banking Robert Begbie Simon McNamara Jen Tippin CEO, NatWest Markets CAO CTO 4 Meet the Exco 5 Retail Banking Strategic Priorities David -

Rating Action, Barclays Bank UK

Rating Action: Moody's takes rating actions on Barclays, Lloyds, Santander UK, Nationwide and Close Brothers, following update to banks methodology 13 Jul 2021 London, 13 July 2021 -- Moody's Investors Service (Moody's) has today taken rating actions on Barclays, Lloyds, Santander UK and Close Brothers banking groups and on Nationwide Building Society, including the upgrade of the long-term senior ratings of Lloyds Banking Group plc and Close Brothers Group plc. The rating actions were driven by revisions to Moody's Advanced Loss Given Failure (Advanced LGF) framework, which is applied to banks operating in jurisdictions with Operational Resolution Regimes, following the publication of Moody's updated Banks Methodology on 9 July 2021. This methodology is available at this link: https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1269625 . A full list of affected ratings and assessments can be found at the end of this Press Release. RATINGS RATIONALE Today's rating actions were driven by revisions to the Advanced Loss Given Failure framework within Moody's updated Banks Methodology: a revised notching guidance table, with thresholds at lower levels of subordination and volume in the liability structure have been applied to the UK banks and Additional Tier 1 (AT1) securities issued by banks domiciled in the UK have been included in the Advanced LGF framework, eliminating the previous analytical distinction between those high trigger instruments that were deemed to provide equity-like absorption of losses before the point of failure and other AT1 securities. Moody's removal of equity credit for high trigger Additional Tier 1 (AT1) instruments from banks' going concern capital means that affected banks have reduced capacity to absorb unexpected losses before the point of failure, everything else being equal. -

2019 Annual and Sustainability Report

2019 Annual and Sustainability Report Contents Swedbank in brief 2 Income, balance sheet and notes, Group The year in brief 4 Income statement 54 CEO statement 6 Statement of comprehensive income 55 Goals and results 8 Balance sheet 56 Value creation 10 Statement of changes in equity 57 Business model 12 Statement of cash flow 58 Sustainability 14 Notes 59 The share and owners 24 Income, balance sheet and notes, Parent company Board of Directors’ report Income statement 154 Financial analysis 26 Statement of comprehensive income 154 Swedish Banking 30 Balance sheet 155 Baltic Banking 31 Statement of changes in equity 156 Large Corporates & Institutions 32 Statement of cash flow 157 Group Functions & Other 33 Notes 158 Corporate governance report 34 Alternative performance measures 192 Board of Directors 46 Group Executive Committee 50 Sustainability Disposition of earnings 52 Sustainability report 194 Materiality analysis 195 Sustainability management 197 Notes 199 GRI Standards Index 212 Signatures of the Board of Directors and the CEO 217 Auditors’ report 218 Sustainability report – assurance report 222 Annual General Meeting 223 Market shares 224 Five-year summary – Group 225 Three-year summary – Business segments 228 Definitions 231 Contacts 233 Financial information 2020 Annual General Meeting 2020 Q1 Interim report 23 April The Annual General Meeting will be held on Thursday, 26 March at 11 am (CET) at Cirkus, Djurgårdsslätten Q2 Interim report 17 July 43–45, Stockholm, Sweden. The proposed record day for the dividend is 30 March 2020. The last day for Q3 Interim report 20 October trading in Swedbank’s shares including the right to the dividend is 26 March 2020. -

Bankrolling the World

Since 2005, the UK’s high street banks have poured at least £12 billion into coal mining. Much of this is ordinary people’s money. Stop By nancing this dirty industry, banks are complicit in pushing people off their land and destroying communities around bankrolling the world. Coal is extracted and exported for use elsewhere, while many of the affected communities are among the 1.3 billion people who have no access to electricity. coal Join with WDM in calling for banks to get out of coal. The facts: UK banks and coal mining 2005-2012 £4.0bn £3.1bn £2.1bn £1.9bn £900m RBS and NatWest: Barclays: HSBC: Standard Chartered: Lloyds Banking Group: Glencore Xstrata*, South Africa Bumi Resources, Indonesia Drummond, Colombia Borneo Lumbung, Indonesia Cerrejón, Colombia The RBS Group (including NatWest), is the Barclays has long been a target of public HSBC is the UK’s biggest bank and one of Standard Chartered is descended from the A large part of Lloyds Banking Group (inlcuding biggest fi nancier of coal mining in the UK. anger for its lack of ethics, from links to the top three banks in the world. It was ‘Chartered Bank of India, Australia and China’ Halifax and Bank of Scotland) is owned by the After the fi nancial crisis of 2008, RBS was Apartheid South Africa in the 1980s to the established in 1865 as the Hong Kong and and the ‘Standard Bank of British South UK taxpayer. Despite being smaller than the 84 per cent nationalised as part of the bank recent rate fi xing scandal. -

Swedbank Economic Outlook Is Available At

Completed: January 20, 2021, 06:30 Distributed: January 20, 2021, 07:00 Mattias Persson Global Head of Macro Research and Group Chief Economist [email protected] +46 8 5859 59 74 Andreas Wallström Axel Zetherström Liis Elmik Head of Forecasting Assistant Senior Economist Deputy Head of Macro Research Sweden [email protected] [email protected] andreas.wallströ[email protected] +46 8 5859 57 75 +372 888 72 06 +46 8 700 93 07 Marianna Rõbinskaja Robin Ahlén Øystein Børsum Economist Economist Chief Economist Norway [email protected] [email protected] +372 888 79 25 +46 8 700 93 08 Chief Credit Strategist [email protected] Cathrine Danin +47 91 18 56 35 Senior Economist Līva Zorgenfreija [email protected] Jon Espen Riiser Chief Economist Latvia +46 8 700 92 97 Analyst [email protected] [email protected] +371 6744 58 44 Jana Eklund +47 90 98 17 49 Senior Econometrician Agnese Buceniece [email protected] Marlene Skjellet Granerud Senior Economist +46 8 5859 46 04 Economist [email protected] [email protected] +371 6744 58 75 Knut Hallberg +47 94 30 53 32 Senior Economist Laura Orleāne [email protected] Economist +46 8 700 93 17 [email protected] Heidi Schauman +371 6744 42 13 Pernilla Johansson Chief Economist Finland Senior Economist [email protected] [email protected] +358 503 281 229 +46 40 24 23 31 Nerijus Mačiulis Sonja Liukkonen Deputy Group Chief Economist Maija Kaartinen Junior Economist Chief -

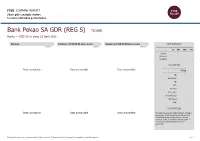

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Bank Pekao SA GDR (REG S) TICKER Banks — USD 28 at close 21 April 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 21-Apr-2015 1D WTD MTD YTD Absolute - - - - Rel.Sector - - - - Rel.Market - - - - VALUATION Data unavailable Trailing PE - EV/EBITDA - PB - PCF - Div Yield - Price/Sales - Net Debt/Equity - Div Payout - ROE - DESCRIPTION Data unavailable The Bank is a universal commercial bank, offering a broad range of banking services on domestic and foreign financial markets, provided to retail and corporate clients, in compliance with the scope of services, set forth in the Bank's Articles of Association. Past performance is no guarantee of future results. Please see the final page for important legal disclosures. 1 of 4 FTSE COMPANY REPORT: Bank Pekao SA GDR (REG S) 21 April 2021 Valuation Metrics Price to Earnings (PE) EV to EBITDA Price to Book (PB) Data unavailable Lloyds Banking Group 34.6 Standard Chartered 28.4 Bank of Georgia Group 1.0 Banks 30.3 Lloyds Banking Group 22.6 TBC Bank Group 0.8 HSBC Hldgs 28.6 HSBC Hldgs 22.0 HSBC Hldgs 0.7 Close Brothers Group 21.4 Banks 18.0 Lloyds Banking Group 0.6 Barclays 21.1 Close Brothers Group 15.8 Banks 0.6 Investec 2.1 Bank of Georgia Group 7.4 Natwest Group 0.5 Metro Bank -0.7 Barclays 6.4 Barclays 0.5 Virgin Money UK -12.4 Metro Bank 0.0 Standard Chartered 0.4 Natwest Group -31.5 Virgin Money UK 0.0 Metro Bank 0.2 Bank Pekao SA GDR (REG S) -120.0 Bank Pekao -

2020-Bos-Annual-Report.Pdf

Bank of Scotland plc Report and Accounts 2020 Member of Lloyds Banking Group Bank of Scotland plc Contents Strategic report 2 Directors’ report 10 Directors 14 Forward looking statements 15 Independent auditors’ report 16 Consolidated income statement 25 Statements of comprehensive income 26 Balance sheets 28 Statements of changes in equity 30 Cash flow statements 32 Notes to the accounts 33 Subsidiaries and related undertakings 122 Registered office: The Mound, Edinburgh EH1 1YZ. Registered in Scotland No. 327000 Bank of Scotland plc Strategic report Principal activities Bank of Scotland plc (the Bank) and its subsidiaries (together, the Group) provide a wide range of banking and financial services. The Group’s revenue is earned through interest and fees on a broad range of financial services products including current and savings accounts, personal loans, credit cards and mortgages within the retail market; loans and other products to commercial, corporate and asset finance customers; and private banking. Business review In the year to 31 December 2020, the Group recorded a profit before tax of £883 million compared to £1,278 million in the year to 31 December 2019. Total income decreased by £886 million, or 15 per cent, to £5,147 million in the year ended 31 December 2020 compared to £6,033 million in 2019 with a £220 million decrease in net interest income combined with a reduction of £666 million in other income. Net interest income was £5,208 million in the year ended 31 December 2020, a decrease of £220 million, or 4 per cent compared to £5,428 million in 2019 reflecting the lower rate environment, actions taken during the year to support customers and reduced levels of customer activity and demand during the coronavirus pandemic. -

Íslandsbanki Hf

Proposal summary Swedbank in cooperation with Kepler Cheuvreux are proud to present our offer to act as an Underwriter in a potential IPO of Íslandsbanki Swedbank offers a full suite of Investment Banking services, including advisory, M&A, IPO, IPO financing, project financing, equity and bond issuance, equity and credit trading etc. ABOUT SWEDBANK Applicable Read and understood Consent regarding operating provisions of Act no. publication of ✓ licenses of party ✓ 155/2012 and ✓ advisor’s expression Íslandsbanki’s policy on of interest sustainability SWEDBANK & Swedbank has partnered with Kepler Cheuvreux, a leading European Financial Service Long lasting relationship through KEPLER CHEUVREUX Company with emphasis on equity research and ECM execution, to broaden our extensive advisory service within COOPERATION product offering and international distribution in Europe bond issuance The team is supported by Swedbank CEO Jens Henriksson and is Experienced lead by highly qualified individuals with vast deal experience Cooperation within ESG at the team over the years, including Icelandic deals and government sell highest level – both our CEOs are downs part of ‘Nordic CEOs for a Sustainable Future’ Global Reach The partnership with Kepler Cheuvreux enables us to reach all with Multi- relevant pockets of demand throughout Europe and North Local presence America OUR OFFER – Contact person Kepler Cheuvreux has extensive coverage of all the major banks Best-in-class in Europe, which will include Íslandsbanki and research report Sanna Tunsbrunn research will be distributed on every continent Director, FIG Origination Phone: +46 8 700 93 14 Mobile: +46 72 566 33 78 After- We work in close collaboration with our customers to support Email: [email protected] transaction the companies after they entered a public environment through Address: SE-105 34, Stockholm, Sweden support non-deal roadshows, trading support etc.