安裝兒童安全座椅前,請確認肩帶高低已調整至適當位置。 ! 安裝和調整汽車安全帶時,須注意汽車安全帶肩帶和腰帶都不可以扭曲或 妨礙汽車安全帶的正常功能。 B Air Ag 2 1.拉出汽車安全帶,將汽車腰帶穿過座椅卡槽,再將插扣片插到插扣座內 11 12 3 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Guangzhou Auto Components Forecast Change

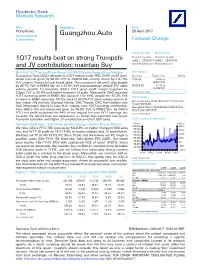

Deutsche Bank Markets Research Asia Industry Date Hong Kong 28 April 2017 Automobiles & Guangzhou Auto Components Forecast Change Vincent Ha, CFA Fei Sun, CFA Research Analyst Research Analyst 1Q17 results beat on strong Trumpchi (+852 ) 2203 6247 (+852 ) 2203 6130 and JV contribution; maintain Buy [email protected] [email protected] 99% YoY 1Q17 net profit rise thanks to GS8 SUV and strong JV contribution Key Changes Guangzhou Auto (GAC) released its 1Q17 results under PRC GAAP on 28 April. Company Target Price Rating Gross revenue grew by 66.4% YoY to RMB16.9bn, mainly driven by a 67.3% 2238.HK 14.85 to - 16.20(HKD) YoY jump in Trumpchi local brand sales. The company’s net profit also surged by 98.7% YoY to RMB3.8bn on a 37.9% YoY total passenger vehicle (PV) sales 601238.SS 14.10 to - 15.35(CNY) volume growth. To elaborate, GAC’s 1Q17 gross profit margin improved by Source: Deutsche Bank 3.3ppt YoY to 23.8% with better economy of scale. Meanwhile, GAC recorded 1Q17 operating profit of RMB1.9bn (jumped 1.6x YoY), despite the 57.2% YoY Focus stocks increase in SG&A expenses. On the back of 30.2% YoY sales volume growth at Guangzhou Auto (2238.HK),HKD12.10 Buy Price four major JVs (namely Guangqi Honda, GAC Toyota, GAC Fiat-Chrysler and Target HKD16.20 GAC Mitsubishi) thanks to new SUV models, total 1Q17 earnings contribution Guangzhou Auto-A (601238.SS),CNY25.50 Sell from GAC's JVs and associates grew by 76.3% YoY to RMB2.3bn. -

2020 Annual Results Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. GUANGZHOU AUTOMOBILE GROUP CO., LTD. 廣 州 汽 車 集 團 股 份 有 限 公 司 (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2238) 2020 ANNUAL RESULTS ANNOUNCEMENT The Board is pleased to announce the audited consolidated results of the Group for the year ended 31 December 2020 together with the comparative figures of the corresponding period ended 31 December 2019. The result has been reviewed by the Audit Committee and the Board of the Company. - 1 - CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME Year ended 31 December Note 2020 2019 RMB’000 RMB’000 Revenue 3 63,156,985 59,704,322 Cost of sales (60,860,992) (57,181,363) Gross profit 2,295,993 2,522,959 Selling and distribution costs (3,641,480) (4,553,402) Administrative expenses (3,850,327) (3,589,516) Net impairment losses on financial assets (55,110) (53,831) Interest income 304,233 290,694 Other gains – net 4 1,379,690 2,620,340 Operating loss (3,567,001) (2,762,756) Interest income 127,551 171,565 Finance costs 5 (439,567) (516,481) Share of profit of joint ventures and associates 6 9,570,978 9,399,343 Profit before income tax 5,691,961 6,291,671 Income tax credit 7 355,990 -

Annual Report 2 0 Annual Report 1 8 年度報告

Annual Report 2018 年度報告 2238 股份代號: (於中華人民共和國註冊成立的股份有限公司) Important Notice 1. The Board, supervisory committee and the directors, supervisors and senior management of the Company warrant the authenticity, accuracy and completeness of the information contained in the annual report and there are no misrepresentations, misleading statements contained in or material omissions from the annual report for which they shall assume joint and several responsibilities. 2. All directors of the Company have attended meeting of the Board. 3. PricewaterhouseCoopers issued an unqualified auditors’ report for the Company. 4. Zeng Qinghong, the person in charge of the Company, Feng Xingya, the general manager, Wang Dan, the person in charge of accounting function and Zheng Chao, the manager of the accounting department (Accounting Chief), represent that they warrant the truthfulness and completeness of the financial statements contained in this annual report. 5. The proposal for profit distribution or conversion of capital reserve into shares for the reporting period as considered by the Board The Board proposed payment of final cash dividend of RMB2.8 per 10 shares (tax inclusive). Together with the cash dividend of RMB1.0 per 10 shares (including tax) paid during the interim period, the ratio of total cash dividend payment for the year to net profit attributable to the shareholders’ equity of listed company for the year would be approximately 35.66%. 6. Risks relating to forward-looking statements The forward-looking statements contained in this annual report regarding the Company’s future plans and development strategies do not constitute any substantive commitment to investors and investors are reminded of investment risks. -

QYT AUTO PARTS CO., LTD Email: [email protected] ; [email protected] Whatsapp: +86 13634216230 QYT No

QYT AUTO PARTS CO., LTD Email: [email protected] ; [email protected] WhatsApp: +86 13634216230 QYT no. Description Corss Ref. Application TOYOTA;LEXUS (SO0001‐SO0300) TOYOTA CAMRY ACV40 06‐12; SO0001 Steering Tie rod ends 45470‐09090 LEXUS LEXUS ES350/ES240 07‐ TOYOTA CAMRY ACV40 06‐12; SO0002 Steering Tie rod ends 45460‐09140 LEXUS LEXUS ES350/ES240 07‐ TOYOTA CAMRY SO0003 Steering Tie rod ends 45460‐09160 ACV50(2012‐) TOYOTA CAMRY SO0004 Steering Tie rod ends 45460‐09250 ACV50(2012‐) GEELY PANDA,HAIJING,GEELY YUANJING, YUANJING 18‐, SO0005 Steering Tie rod ends 45047‐49045 YUANJINGX3,GEELY EMGRAND EC7,GEELY ENGLON ,BINRUI;BYD F0,BYD F3/F3R/G3/G3R/L3;TOYOTA COROLLA;LIFAN LIFAN 620;JAC YUEYUE GEELY PANDA,HAIJING,GEELY YUANJING, YUANJING 18‐, SO0006 Steering Tie rod ends 45046‐49115 YUANJINGX3,GEELY EMGRAND EC7,GEELY ENGLON ,BINRUI;BYD F0,BYD F3/F3R/G3/G3R/L3;TOYOTA COROLLA;LIFAN LIFAN 620;JAC YUEYUE CHANGAN RAETON;TOYOTA CAMRY2.4/3.0 (03),PREVIA ACR30 (34M); SO0007 Steering Tie rod ends 45460‐39615 LEXUS ES300/MCV30 01‐06 CHANGAN RAETON;TOYOTA CAMRY2.4/3.0 (03),PREVIA ACR30 (34M); SO0008 Steering Tie rod ends 45470‐39215 LEXUS ES300/MCV30 01‐06 BYD SURUI,SONG MAX;ZOTYE Z300; SO0009 Steering Tie rod ends 45046‐09590 TOYOTA COROLLA 07‐/VERSO 11‐/LEVIN 14‐ BYD SURUI ,SONG MAX;ZOTYE Z300; SO0010 Steering Tie rod ends 45047‐09590 TOYOTA COROLLA 07‐/VERSO 11‐/LEVIN 14‐ SO0011 Steering Tie rod ends 45464‐30060 TOYOTA REIZ/CROWN;LEXUS LEXUS IS250/300 06‐,GS300/350/430 05‐ SO0012 Steering Tie rod ends 45463‐30130 TOYOTA REIZ/CROWN;LEXUS LEXUS -

Deals on Wheels Great Wall’S Haval H2 Has Been Met with Strong Demand Domestic Brands Attempt Turnaround One Trend We Didn’T Forecast

CHINA Deals on Wheels Great Wall’s Haval H2 has been met with strong demand Domestic brands attempt turnaround One trend we didn’t forecast . Two trends we forecast at the outset of 2013 – strong demand for premium cars and SUVs – have played out as expected. One we did not identify has been the implosion in market share of the domestic brands. This month we take a closer look at who has been winning and losing market share among the domestic brands and by model and the impact on discounting. Our proprietary dealer survey shows that while the domestic OEMs have selectively cut prices on some models, discounting has not escalated. Hopeful of new models reversing the trend Source: Macquarie Research, August 2014 . All four domestic brands in our survey – Great Wall, Geely, BYD and Chery – have lost share this year, with Geely and BYD suffering the biggest losses. Great Wall and Geely are both looking for better performance in 2H helped by Inside new models. We see Great Wall as the best positioned as its new models are focused on the popular SUV segment, which is likely to continue to out-pace Domestic brands attempt turnaround 2 the market. There is no evidence of any discounting on the Haval H2 across JV brands – discounts jump 9 the 14 cities in our survey, with a waiting list of up to 4 months. The Haval H6 Premium brands –intensifying continues to sell well with an average discount of just 0.1%. competition 17 Discounts expand for JV brands Model types – SUV premiums fading 21 . -

GUANGZHOU AUTOMOBILE GROUP CO., LTD. 廣州汽車集團股份有限公司 (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 2238)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. GUANGZHOU AUTOMOBILE GROUP CO., LTD. 廣州汽車集團股份有限公司 (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2238) 2012 ANNUAL RESULTS ANNOUNCEMENT The Board is pleased to announce the audited consolidated results of the Group for the year ended 31 December 2012 together with the comparative figures of the corresponding period ended 31 December 2011. The result has been reviewed by the Audit Committee. 1 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME Year ended 31 December Note 2012 2011 RMB’000 RMB’000 Revenue 12,963,860 10,984,273 Cost of sales 4 (12,273,586) (10,559,896) Gross profit 690,274 424,377 Selling and distribution costs 4 (814,760) (589,242) Administrative expenses 4 (1,332,539) (1,216,442) Interest income 279,795 316,222 Other gains – net 5 12,865 840,288 Operating loss (1,164,365) (224,797) Finance costs 6 (528,644) (414,744) Interest income 55,891 57,879 Share of profit of jointly-controlled entities and associates 7 2,637,092 4,638,648 Profit before income tax 999,974 4,056,986 Income tax credit 8 64,786 109,914 Profit for the year 1,064,760 4,166,900 Other comprehensive income for the year, net of tax 1,211 (1,145) -

Environmental, Social and Governance Report 02 Guangzhou Automobile Group Co., Ltd

2017 Environmental, Social and Governance Report 02 Guangzhou Automobile Group Co., Ltd. Notes on the Report This is the sixth annual social responsibility report released by Guangzhou Automobile Group Co., Ltd. The board and all the directors of GAC undertake that the Report contains no false records, misleading representations or major omis- sions and will assume joint and several liabilities for its authenticity, accuracy and completeness. Scope of the Report: This report covers Guangzhou Automobile Group Co., Ltd., hereinafter referred to as “GAC Group”, “Group” or “we” as appropriate for ease of expression. The Report covers the time span from January 1, 2017 to December 31, 2017, though part of the content exceeds the time span. Basis for Compilation: The report has been compiled in accordance with the national standards on social responsibility, including the Social Responsibility Guidelines (GB/T36000-2015), Social Responsibility Reporting Guidelines (GB/T36001-2015) and So- cial Responsibility Performance Classification Guidelines (GB/T36002-2015), as well as other relevant regulations, including the Notice of Shanghai Stock Exchange on Strengthening the Assumption of Social Responsibility by List- ed Companies and Issuing the Guidelines on the Disclosure of Environmental Information by Listed Companies, the Guidelines of Shanghai Stock Exchange for Compilation of Reports on the Performance of Social Responsibility by Companies and SEHK Environmental, Social and Governance Reporting Guide. The compilation of the report is also based on ISO Guidance on Social Responsibility (ISO26000), the Sustainable Development Reporting Guidelines of the Global Reporting Initiative (GRI 4.0) and AA1000 Assurance Standard (2008) as reference. Notes on Data: All the data used in this Report are from the statistical reports and other official documents of the Group. -

Environmental, Social and Governance Report Notes on the Report

Guangzhou Automobile Group Co., Ltd. Environmental, Social and Governance Report Notes on the Report This is the eighth annual social responsibility report released by Guangzhou Automobile Group Co., Ltd. The Board and all the directors of GAC undertake that the Report contains no false records, misleading representations or major omissions, and assume joint and several liabilities for the authenticity, accuracy and completeness. Scope of the Report: The Report covers Guangzhou Automobile Group Co., Ltd., hereinafter referred to as "GAC Group", "Group" or "we" as appropriate for ease of expression. The Report covers the period from January 1, 2019 to December 31, 2019, though part of the content exceeds this period. Basis for Compilation: The Report has been compiled in accordance with national standards on social responsibility, including the Guidance on Social Responsibility (GB/T 36000-2015), Guidance on Social Responsibility Reporting (GB/T 36001-2015) and Guidance on Classifying Social Responsibility Performance (GB/T 36002-2015), as well as other relevant regulations including the Notice on Strengthening the Assumption of Social Responsibility by Listed Companies and Issuing the Guidelines on the Disclosure of Environmental Information by Listed Companies and the Guidelines on Compilation of Reports on the Performance of Social Responsibility by Companies issued by Shanghai Stock Exchange and the Environmental, Social and Governance Reporting Guide issued by The Stock Exchange of Hong Kong Limited, and with reference to the Guidance on Social Responsibility (ISO 26000), the Sustainable Development Reporting Guidelines of the Global Reporting Initiative and AA 1000 Assurance Standard (2008). Notes on Data: All the data used in the Report are from the statistical reports and other official documents of the Group. -

GUANGZHOU AUTOMOBILE GROUP CO., LTD. 廣州汽車集團股份有限公司 (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 2238)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. GUANGZHOU AUTOMOBILE GROUP CO., LTD. 廣州汽車集團股份有限公司 (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2238) 2017 ANNUAL RESULTS ANNOUNCEMENT The Board is pleased to announce the audited consolidated results of the Group for the year ended 31 December 2017 together with the comparative figures of the corresponding period ended 31 December 2016. The result has been reviewed by the Audit Committee and the Board of the Company. 1 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME Year ended 31 December Note 2017 2016 RMB’000 RMB’000 Revenue 3 71,574,939 49,417,676 Cost of sales (58,716,478) (41,961,379) Gross profit 12,858,461 7,456,297 Selling and distribution costs (5,250,070) (3,396,393) Administrative expenses (4,021,804) (2,738,874) Interest income 342,643 488,696 Other gains – net 4 562,459 331,196 Operating profit 4,491,689 2,140,922 Interest income 52,676 97,240 Finance costs 5 (646,477) (962,927) Share of profit of joint ventures and associates 6 8,296,387 5,774,362 Profit before income tax 12,194,275 7,049,597 Income tax expense 7 (1,154,259) (754,342) Profit for the year 11,040,016 6,295,255 Profit attributable to: Owners -

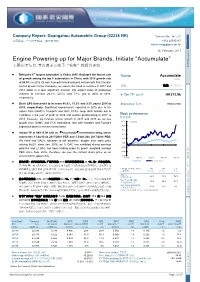

Engine Powering up for Major Brands, Initiate “Accumulate”

Company Report: Guangzhou Automobile Group (02238 HK) Toliver Ma 马守彰 公司报告:广州汽车集团 (02238 HK) +852 25095317 [email protected] 国泰君安研究 16 February 2017 Engine Powering up for Major Brands, Initiate “Accumulate” 主要品牌发力,首次覆盖并给予“收集”的投资评级 GTJA Research GTJA th Being the 6 largest automaker in China, GAC displayed the fastest rate Rating: Accumulate of growth among the top 6 automakers in China, with 2016 growth rate Initial at 26.9%. In 2016, its own Trumpchi brand and joint venture with Fiat Chrysler 评级: 收集 (首次研究) fuelled growth for the Company; we expect this trend to continue in 2017 and 2018 albeit in a less significant manner. We expect sales of passenger vehicles to increase 26.3%, 22.5% and 7.3% yoy in 2016 to 2018, 6-18m TP 目标价: HK$13.96 respectively. Basic EPS forecasted to increase 48.8%, 11.9% and 9.3% yoy in 2016 to Share price 股价: HK$12.900 2018, respectively. Significant improvement expected in 2016 due to the upturn from GAMC’s Trumpchi and GAC FCA’s Jeep. Both brands are to contribute a full year of profit in 2016 and sustain profit-making in 2017 to Stock performance 股价表现 2018. However, we forecast slower growth in 2017 and 2018 as we see 110.0 growth from GAMC and FCA normalized, and with Honda’s and Toyota’s % of return expansion plans to remain conservative. 90.0 70.0 Initiate TP at HK$13.96 with an “Accumulate”investment rating, which 50.0 represents 11.4x/10.4x 2017/2018 PER and 1.34x/1.29x 2017/2018 PBR. -

GUANGZHOU AUTOMOBILE GROUP CO., LTD. 廣州汽車集團股份有限公司 (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 2238)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. GUANGZHOU AUTOMOBILE GROUP CO., LTD. 廣州汽車集團股份有限公司 (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2238) 2018 INTERIM RESULTS ANNOUNCEMENT IMPORTANT NOTICE (I) The Board, the supervisory committee and the directors, supervisors and senior management of the Company warrant that the contents contained herein are true, accurate and complete. There are no false representations or misleading statements contained in or material omissions from this announcement, and they will jointly and severally accept responsibility. (II) All directors of the Company have attended the meeting of the Board. (III) The interim financial report of the Company is unaudited. The Audit Committee of the Company has reviewed the unaudited interim results of the Company for the six months ended 30 June 2018 and agreed to submit it to the Board for approval. (IV) Zeng Qinghong, the person in charge of the Company and Feng Xingya, the General Manager of the Company, Wang Dan, the person in charge of accounting function and Zheng Chao, the manager of the accounting department (Chief Accountant), warrant the truthfulness, accuracy and completeness of the financial statements contained in this announcement. (V) The Board proposed payment of interim dividend of RMB1 (tax inclusive) in cash for every 10 shares to all shareholders. -

China Vehicle Retention Value Report

China Vehicle Retention Value Report Updated in March 2020 China Vehicle Retention Value Report 01 05 Background Conclusions 02 04 Used Vehicle 03 Retention Rate Ranking Transaction Data Retention Value Findings Definition of Vehicle Retention Value It refers to the ratio of the transaction price* to a new vehicle‘s Manufacturer Suggested Retail Price* (MSRP) at purchase after a 1 period of use from the date of purchase 2 It is an important index to measure the value depreiaction speed of a vehicle It is affected by multiple factors: Single vehicle (e.g. age/ mileage/ condition/ purpose), product (e.g. quality/ design/ features/ 3 performance), brand (e.g. influence), new vehicle (e.g. price/ sales volume/ market share), used vehicle (e.g. market strategy/ supply-demand relationship), season, region, policy… Transaction Price* = X 100% Vehicle Retention Rate MSRP of New Vehicle* Vehicle transaction data within the most recent year (March 2019 to February 2020) * Vehicle Transaction Price: Retail price (B2C) is adopted, excluding purchase price and wholesale price; the transaction price is based on good vehicle condition and an average annual mileage of 15,000 km. * MSRP of New Vehicle: MSRP of New Vehicle shall be adopted uniformly, excluding discount of manufacturer or dealer. * Sampling Period: Stably reflect the retention rate level in a recent period, such as yearly/quarterly. 3 China Vehicle Retention Value Report Joint Production • J.D. Power is a global leader in consumer insights, data, analytics, • 58che.com and Uxin.com are the largest used vehicle and advisory services and conducts world-class industry transaction/listing data platforms in China.