Environmental, Social and Governance Report Notes on the Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

All-New Electric SUV AIRTREK Teased at Auto Shanghai 2021

4/19/2021 No.1325 All-New Electric SUV AIRTREK Teased at Auto Shanghai 2021 Tokyo, April 19, 2021 – MITSUBISHI MOTORS CORPORATION (MMC) announced that GAC Mitsubishi Motors Co., Ltd. (GMMC)1, MMC’s vehicle production and sales joint venture in China, today teased the all-new electric SUV AIRTREK at Auto Shanghai 20212. 1. A joint venture between Guangzhou Automobile Group Co., Ltd. (GAC), Mitsubishi Corporation and MMC. 2. Officially called The 19th Shanghai International Automobile Industry Exhibition. April 19 and 20 are Press Days, and April 21 to 23 are Trade Days. The show is open to the public from April 24 to 28. The exhibition is held at the National Exhibition and Convention Center (Shanghai). The all-new AIRTREK is based on the concept of an “e-cruising SUV” founded on three keywords: “Electric (electric vehicle),” “Expanding (expanding life’s pleasures with a car)” and “Expressive (expressing the uniqueness of MITSUBISHI MOTORS).” It generates an image of advanced sophistication fit for an EV while incorporating MMC’s consistent design identity, represented by its Dynamic Shield front design concept, and is styled to express the powerful performance expected of a Mitsubishi vehicle. “We have developed the AIRTREK as an SUV that enables customers to enjoy limitless adventures,” said John Signoriello, executive officer, responsible for global marketing and sales, MMC. “Designed exclusively for the Chinese market, the all-new AIRTREK will be launched by the end of this year as the fourth model of MITSUBISHI MOTORS’ lineup in China. With the addition of this electric vehicle, we aim to contribute to creating a sustainable mobility society.” # # # -1- . -

GAC Motor Unveils Concept Car ENTRANZE at NAIAS 2019

GAC Motor Unveils Concept Car ENTRANZE at NAIAS 2019 Detroit, U.S., January 14, 2019 Automaker GAC Motor impressed audiences at the 2019 North American International Auto Show (NAIAS) on January 14 with the world premiere of its ENTRANZE concept car, emphasizing the automaker's human-centric approach to family vehicles. The ceremony was attended by distinguished guests, including media, global suppliers and partners. Developed by the GAC Motor’s Advanced Design Center in Los Angeles, the bullet- inspired ENTRANZE concept is designed to meet the needs of American consumers. It offers a revolutionary vision of future mobility, showcasing new energy breakthroughs, an upgraded user experience (UI), unique interior and exterior design concepts, and technology features including: Replacement of traditional control panel with an advanced voice-controlled UI and dynamic buttons on the steering wheel New 3+2+2 seating arrangement and aircraft-inspired aisle Two-side mounted displays for functional feature control, plus curved displays for passenger entertainment Integrated cargo system with a central movable storage unit in the second row, removable backpacks doubling as in-vehicle storage and folding rocker panel for leisure seating. “Ultimately, automotive products are a means for people to connect during life’s great journey. The ENTRANZE concept embodies our vision to provide mobility solutions that enrich lives,” said Yu Jun, president of GAC Motor. GAC Motor has also displayed its portfolio of star vehicles of SUVs, sedans, minivans and NEVs, including GS3, GS4, GS5, GS7, GS8, GA4, GM6, GM8, and GE3 530 at NAIAS 2019. California Headquarters Announced At the show, GAC Motor officially announced that it has registered its North American Sales Company in Irvine, Calif., near Los Angeles. -

2017 Passenger Vehicles Actual and Reported Fuel Consumption: a Gap Analysis

2017 Passenger Vehicles Actual and Reported Fuel Consumption: A Gap Analysis Innovation Center for Energy and Transportation December 2017 1 Acknowledgements We wish to thank the Energy Foundation for providing us with the financial support required for the execution of this report and subsequent research work. We would also like to express our sincere thanks for the valuable advice and recommendations provided by distinguished industry experts and colleagues—Jin Yuefu, Li Mengliang, Guo Qianli,. Meng Qingkuo, Ma Dong, Yang Zifei, Xin Yan and Gong Huiming. Authors Lanzhi Qin, Maya Ben Dror, Hongbo Sun, Liping Kang, Feng An Disclosure The report does not represent the views of its funders nor supporters. The Innovation Center for Energy and Transportation (iCET) Beijing Fortune Plaza Tower A Suite 27H No.7 DongSanHuan Middle Rd., Chaoyang District, Beijing 10020 Phone: 0086.10.6585.7324 Email: [email protected] Website: www.icet.org.cn 2 Glossary of Terms LDV Light Duty Vehicles; Vehicles of M1, M2 and N1 category not exceeding 3,500kg curb-weight. Category M1 Vehicles designed and constructed for the carriage of passengers comprising no more than eight seats in addition to the driver's seat. Category M2 Vehicles designed and constructed for the carriage of passengers, comprising more than eight seats in addition to the driver's seat, and having a maximum mass not exceeding 5 tons. Category N1 Vehicles designed and constructed for the carriage of goods and having a maximum mass not exceeding 3.5 tons. Real-world FC FC values calculated based on BearOil app user data input. -

CHINA FIELD TRIP May 10Th –12Th, 2011

CHINA FIELD TRIP May 10th –12th, 2011 This presentation may contain forward-looking statements. Such forward-looking statements do not constitute forecasts regarding the Company’s results or any other performance indicator, but rather trends or targets, as the case may be. These statements are by their nature subject to risks and uncertainties as described in the Company’s annual report available on its Internet website (www.psa-peugeot-citroen.com). These statements do not reflect future performance of the Company, which may materially differ. The Company does not undertake to provide updates of these statements. More comprehensive information about PSA PEUGEOT CITROËN may be obtained on its Internet website (www.psa-peugeot-citroen.com), under Regulated Information. th th China Field Trip - May 10 –12 , 2011 2 PSA in Asia – Market Forecast, PSA in China: ongoing successes and upsides Frédéric Saint-Geours Executive VP, Finance and Strategic Development Grégoire Olivier, Executive VP, Asia Table of contents Introduction China: the new auto superpower China: a global economic power The world’s largest automotive market The growth story is set to continue PSA in China China: a second home market for PSA 2 complementary JVs Key challenges in China and PSA differentiation factors A sustainable profitable growth Extending the Chinese Success ASEAN strategy Capturing the Indian opportunity th th China Field Trip - May 10 –12 , 2011 4 PSA – a global automotive player (1/2) > 39% of PSA’s 2010 sales are realized outside of Europe, of -

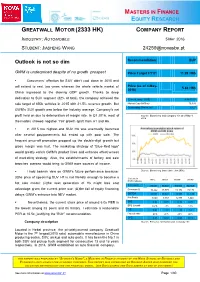

Outlook Is Not So Dim Recommendation: BUY

MASTERS IN FINANCE QUITY ESEARCH E R GREATWALL MOTOR (2333 HK) COMPANY REPORT INDUSTRY : AUTOMOBILE 5 MAY 2016 STUDENT: JIASHENG WANG [email protected] Outlook is not so dim Recommendation: BUY GWM is underpriced despite of no growth prospect Price Target FY17: 11.29 HK$ . Consumers’ affection for SUV didn’t cool down in 2015 and Price (as of 4-May- will extend to next two years whereas the whole vehicle market of 5.88 HK$ 2016) China regressed to the slowing GDP growth. Thanks to deep dedication to SUV segment (82% of total), the company achieved the 52-week range (HK$) 4.96-18.57 sale target of 850k vehicles in 2015 with 21.5% revenue growth. But Market Cap (HK$ m) 79,399 Outstanding Shares (m) 9,127 GWM’s SUV growth was below the industry average. Company’s net profit held on due to deterioration of margin rate. In Q1 2016, most of Source: Bloomberg and company f ile as of May 4, 2016 the models showed negative YoY growth apart from H1 and H6. In 2015 the highest-end SUV H8 was eventually launched after several postponements but ended up with poor sale. The frequent price-off promotion propped up the double-digit growth but gross margin was hurt. The marketing strategy of “Blue-Red logo” would greatly enrich GWM’s product lines and enhance effectiveness of marketing strategy. Also, the establishments of factory and sale branches oversea would bring to GWM more sources of income. I hold bearish view on GWM’s future performance because: Source: Bloomberg (base date: Jan 2005) (i)the price of upcoming SUV H7 is not friendly enough to become a (Values in 2015 2016E 2017E 2018E RMB millions) hot sale model; (ii)the next generation of H6 might loss cost Rev enues 76,033 80,943 89,560 94,568 advantage given the current price war; (iii)the fail of equity financing Gross prof it 16,222 17,979 18,174 19,176 delays GWM’s entrance into NEV market. -

2021 Interim Results Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. GUANGZHOU AUTOMOBILE GROUP CO., LTD. 廣 州 汽 車 集 團 股 份 有 限 公 司 (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2238) 2021 INTERIM RESULTS ANNOUNCEMENT IMPORTANT NOTICE (I) The Board, the supervisory committee and the directors, supervisors and senior management of the Company warrant that the contents contained herein are true, accurate and complete. There are no false representations or misleading statements contained in or material omissions from this announcement, and they will jointly and severally accept responsibility. (II) All directors of the Company have attended the meeting of the Board. (III) The interim financial report of the Company is unaudited. The Audit Committee of the Company has reviewed the unaudited interim results of the Company for the six months ended 30 June 2021 and agreed to submit it to the Board for approval. (IV) Zeng Qinghong, the person in charge of the Company and Feng Xingya, the General Manager of the Company, Wang Dan, the person in charge of accounting function and Zheng Chao, the manager of the accounting department (Chief Accountant), warrant the truthfulness, accuracy and completeness of the financial statements contained in this announcement. -

Geely Automobile Holdings (175 HK)– BUY HKD12.00 Key Trends in China’S PV Market Over the Next Three Years: 1

Sector Initiation Hong Kong ! 5 May 2017 Consumer Cyclical | Automobiles & Components Neutral Automobiles & Components Stocks Covered: 3 Competition In The New Era Ratings (Buy/Neutral/Sell): 1 / 2 / 0 We expect growth in China’s PV market to slow to 5%/3% in 2017/2018 Top Pick Target Price respectively, due to diminishing effects of purchase tax cuts. We see three Geely Automobile Holdings (175 HK)– BUY HKD12.00 key trends in China’s PV market over the next three years: 1. Local brands to expand market share; 2. EV sales to grow at a higher pace vs fuel cars; 3. SUVs to continue to lead the market. China’s PV sales and growth rate on the uptrend Our sector Top Pick is Geely on its improved model portfolio and good synergy with Volvo. We also initiate coverage on BYD and GWM with NEUTRAL recommendations. Our sector call is NEUTRAL. We initiate coverage on China’s auto manufacturers with a NEUTRAL weighting. We expect passenger vehicles and minibus (collectively known as PV) sales in 2017/2018 to grow by 5%/3% respectively, slowing from 7%/15% registered in 2015/2016 respectively. This is as due to the diminishing effects of purchase tax discounts on cars with 1.6L displacement and below, to 25% starting 2017 from 50% in Oct 2015. Note that part of 2017’s PV sales were pre- sold in 2016, and part of PV sales in 2018 would be partially pre-sold in 2017. Solid growth expected in various segments, such as sport utility vehicles (SUVs), electric vehicles (EVs), smart vehicles, cars with displacements above 1.6L, premium brands, price-insensitive auto buyers, and in areas such as lower- Source: China Passenger Car Association (CPCA) tier cities. -

Fulbright-Hays Seminars Abroad Automobility in China Dr. Toni Marzotto

Fulbright-Hays Seminars Abroad Automobility in China Dr. Toni Marzotto “The mountains are high and the emperor is far away.” (Chinese Proverb)1 Title: The Rise of China's Auto Industry: Automobility with Chinese Characteristics Curriculum Project: The project is part of an interdisciplinary course taught in the Political Science Department entitled: The Machine that Changed the World: Automobility in an Age of Scarcity. This course looks at the effects of mass motorization in the United States and compares it with other countries. I am teaching the course this fall; my syllabus contains a section on Chinese Innovations and other global issues. This project will be used to expand this section. Grade Level: Undergraduate students in any major. This course is part of Towson University’s new Core Curriculum approved in 2011. My focus in this course is getting students to consider how automobiles foster the development of a built environment that comes to affect all aspects of life whether in the U.S., China or any country with a car culture. How much of our life is influenced by the automobile? We are what we drive! Objectives and Student Outcomes: My objective in teaching this interdisciplinary course is to provide students with an understanding of how the invention of the automobile in the 1890’s has come to dominate the world in which we live. Today an increasing number of individuals, across the globe, depend on the automobile for many activities. Although the United States was the first country to embrace mass motorization (there are more cars per 1000 inhabitants in the United States than in any other country in the world), other countries are catching up. -

Guangzhou Automobile Group

China / Hong Kong Company Guide Guangzhou Automobile Group Version 6 | Bloomberg: 2238 HK Equity | 601238 CH Equity | Reuters: 2238.HK | 601238.SS Refer to important disclosures at the end of this report DBS Group Research . Equity 7 May 2019 Japanese JCEs leading growth H: BUY Last Traded Price (H) ( 7 May 2019):HK$8.14(HSI : 29,363) More clarity on JVs future strategy. Guangzhou Auto (GAC) and its Price Target 12-mth (H):HK$9.60 (17.9% upside) (Prev HK$17.86) Japanese JCE partners have agreed on key priorities to grow the business. The medium-term plans include capacity expansion and new A: HOLD model development (both traditional and new energy vehicles). Last Traded Price (A) ( 7 May 2019):RMB11.61(CSI300 Index : 3,721) Price Target 12-mth (A):RMB11.30 (2.7% downside) (Prev RMB21.71) Another key factor is that both partners have agreed to maintain the current shareholding structure, hence removing uncertainties. The Analyst Rachel MIU+852 36684191 [email protected] Japanese auto brands have gained market share from 15.6% in December 2016 to 19% in February 2019 aided by their product What’s New range, pricing, and proactive business strategy. Despite the tough • More clarity on development of Japanese JCEs, key 1Q19 auto market, GAC’s Japanese JCEs managed to chalk up strong earnings driver in the future volume sales growth and decent profit contributions to the group. • Self-brand going through short-term adjustment and Where we differ? We expect normalisation of Trumpchi sales to have should start to normalise in 2H19 a meaningful impact on earnings, on anticipation of a recovery in • Maintain BUY, TP revised down slightly to HK$9.60 the PV market in 2H19. -

200218 EV Volumes Monthly Xev Sales Tracker

Global xEV This is a sample version of our ~ 90 page Global xEV Sales Tracker. Sales Tracker The price is 7 500€ / year and includes 12 updates. December and Full Year 2019 Data Center subscribers have 20 % lower price Contact [email protected] for info EVVOLUMES.COM Table of Contents Executive Summary 3 World 6 China 29 USA 36 Europe 43 Norway 51 UK 58 France 65 Germany 72 Japan 79 About EV-volumes 86 xEV Sales Tracker December & FY 2019 2 19-02-2020 EVVOLUMES.COM 2.2 million EVs were sold in 2019, growing by only 11% compared to last year and still representing less than 3% of PV sales. USA were down, China stable and Europe significantly up. Countries • China – 1.2 million EVs (5.2% penetration) - up 6% - 80% BEV – BJEV EU-Series = most solD EV • Europe – 565k EVs (3.1% penetration) - up 45% - 64% BEV – Tesla MoDel 3 = most solD EV • U.S.A. – 320k EVs (1.9% penetration) - down 12% - 73% BEV – Tesla MoDel 3 = most solD EV • Germany – 106k EVs (2.9% penetration) - up 60% - 64% BEV – Renault Zoé= most solD EV • Norway – 79k EVs (56% penetration) - up 9% - 76% BEV – Tesla MoDel 3 = most solD EV • UK – 75k EVs (3.2% penetration) – up 24% - 51% BEV – Tesla MoDel 3 = most solD EV • France – 62k EVs (2.8% penetration) - up 35% - 70% BEV – Renault Zoé = most solD EV • Japan – 44k EVs (1% penetration) - down 18% - 53% BEV – Nissan Leaf = most solD EV OEMs • Tesla won the OEM crown once again in front of BYD anD BAIC with more than 360k EVs solD • VW Group is finally serious about EVs and will overtake BMW Group in 2020 to become the 1st European OEM Models • Tesla MoDel 3 won the EV crown once again with more than 300k units solD • More than 50k Tesla MoDel 3 were solD in December while there wasn’t any European EV in Top 10 xEV Sales Tracker December & FY 2019 3 19-02-2020 EVVOLUMES.COM China represented 58% of global BEV market in December while Europe kept its lead on PHEVs with 46% market share and South Korea on FCEVs with 55% market share (300 units). -

CHINA CORP. 2015 AUTO INDUSTRY on the Wan Li Road

CHINA CORP. 2015 AUTO INDUSTRY On the Wan Li Road Cars – Commercial Vehicles – Electric Vehicles Market Evolution - Regional Overview - Main Chinese Firms DCA Chine-Analyse China’s half-way auto industry CHINA CORP. 2015 Wan Li (ten thousand Li) is the Chinese traditional phrase for is a publication by DCA Chine-Analyse evoking a long way. When considering China’s automotive Tél. : (33) 663 527 781 sector in 2015, one may think that the main part of its Wan Li Email : [email protected] road has been covered. Web : www.chine-analyse.com From a marginal and closed market in 2000, the country has Editor : Jean-François Dufour become the World’s first auto market since 2009, absorbing Contributors : Jeffrey De Lairg, over one quarter of today’s global vehicles output. It is not Du Shangfu only much bigger, but also much more complex and No part of this publication may be sophisticated, with its high-end segment rising fast. reproduced without prior written permission Nevertheless, a closer look reveals China’s auto industry to be of the publisher. © DCA Chine-Analyse only half-way of its long road. Its success today, is mainly that of foreign brands behind joint- ventures. And at the same time, it remains much too fragmented between too many builders. China’s ultimate goal, of having an independant auto industry able to compete on the global market, still has to be reached, through own brands development and restructuring. China’s auto industry is only half-way also because a main technological evolution that may play a decisive role in its future still has to take off. -

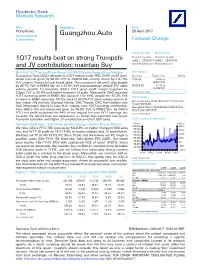

Guangzhou Auto Components Forecast Change

Deutsche Bank Markets Research Asia Industry Date Hong Kong 28 April 2017 Automobiles & Guangzhou Auto Components Forecast Change Vincent Ha, CFA Fei Sun, CFA Research Analyst Research Analyst 1Q17 results beat on strong Trumpchi (+852 ) 2203 6247 (+852 ) 2203 6130 and JV contribution; maintain Buy [email protected] [email protected] 99% YoY 1Q17 net profit rise thanks to GS8 SUV and strong JV contribution Key Changes Guangzhou Auto (GAC) released its 1Q17 results under PRC GAAP on 28 April. Company Target Price Rating Gross revenue grew by 66.4% YoY to RMB16.9bn, mainly driven by a 67.3% 2238.HK 14.85 to - 16.20(HKD) YoY jump in Trumpchi local brand sales. The company’s net profit also surged by 98.7% YoY to RMB3.8bn on a 37.9% YoY total passenger vehicle (PV) sales 601238.SS 14.10 to - 15.35(CNY) volume growth. To elaborate, GAC’s 1Q17 gross profit margin improved by Source: Deutsche Bank 3.3ppt YoY to 23.8% with better economy of scale. Meanwhile, GAC recorded 1Q17 operating profit of RMB1.9bn (jumped 1.6x YoY), despite the 57.2% YoY Focus stocks increase in SG&A expenses. On the back of 30.2% YoY sales volume growth at Guangzhou Auto (2238.HK),HKD12.10 Buy Price four major JVs (namely Guangqi Honda, GAC Toyota, GAC Fiat-Chrysler and Target HKD16.20 GAC Mitsubishi) thanks to new SUV models, total 1Q17 earnings contribution Guangzhou Auto-A (601238.SS),CNY25.50 Sell from GAC's JVs and associates grew by 76.3% YoY to RMB2.3bn.