Leading Suppliers of Oracle Saas Implementation and Integration Services Positioning of Accenture

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Microsoft Partner of the Year Award Winners and Finalists

2021 Microsoft Partner of the Year Award Winners and Finalists The Microsoft Partner of the Year Awards acknowledge outstanding achievements and innovations from across our global partner ecosystem. This impressive group of partners and their solutions demonstrates amazing agility and creativity in building new technologies across the intelligent cloud to edge, all with the goal of exceeding customer expectations by bringing technology to life in meaningful ways. This year’s group of winners and finalists is an inspiring reflection of the impact our partner ecosystem enables through the innovative technologies they continue to build for our mutual customers. Across categories including Azure, Modern Work & Security, and Social Impact, our partners are dedicated to helping customers solve challenges and truly work to support our mission to empower every person and every organization on the planet to achieve more. Congratulations to this year’s winners and finalists, which have shown exceptional expertise, dedication to our customers, and care for our world through a year of change. Table of contents Partner of the Year Awards: Category Winners • Azure • Business Applications • Modern Work & Security • Industry • Social Impact • Business Excellence Category Finalists Country/Region Winners 2021 Microsoft Partner of the Year Award Winners – Category Azure 2021 Microsoft Partner of the Year Award Winners – Category 2021 Microsoft Partner of the Year Award Winners – Category Azure AI Icertis United States www.icertis.com Icertis’ strategic bet with Microsoft on Azure AI is delivering strong customer success and leadership positioning in the contract lifecycle management market. Hundreds of customers have been empowered through over 10 million contracts valued at more than $1 trillion, and in 40+ languages across 90+ countries. -

Artemis Met Le Big Data Au Service Des Armées

Artemis met le big data au service des armées Enjeu vital pour la défense du futur, le big data exige de réunir données, infrastructures numériques et compétences de pointe. Avec Artemis, la DGA bâtit une solution qui sera tout à la fois une plateforme technique, un environnement de développement et un écosystème d’innovation. Le consortium mené par Atos, avec Capgemini et le CEA, relèvent déjà le défi. «En fédérant l’innovation du monde civil et de la défense, Artemis devient la plateforme souveraine de big data au service des usagers du Ministère des Armées. Cet écosystème fera émerger des usages qui seront déployés dans des cycles courts, pour toujours garder l’avantage opérationnel» Le contexte Le challenge La solution La donnée, un enjeu critique Robustesse, agilité et sécurité Une approche en trois phases pour la défense Lancé par la DGA en novembre 2017, le La DGA s’est entourée de partenaires, dont Aide à la décision et au commandement, partenariat d’innovation Artemis s’inscrit Atos, afin de mener cet ambitieux projet cybersécurité, maintenance prédictive, santé dans cette stratégie générale. Il vise à doter en trois phases. La première a consisté à des militaires, combat collaboratif, drones, le ministère des Armées d’une infostructure réaliser un démonstrateur technologique, guerre électronique, … la donnée et ses de stockage et de traitement des données qui devait comporter toutes les briques de usages s’apprêtent à révolutionner le monde de masse, adaptée aux besoins de la défense la future plateforme : matériel (souverain de la défense, au point d’être considérée et capable de capter les innovations issues dans le cas d’Atos), forge logicielle à base de comme une évolution critique pour la du monde civil, avec des cycles courts de composants open source, expertises (data supériorité stratégique et opérationnelle développement. -

2014 Registration Document Annual Financial Report Contents

2014 REGISTRATION DOCUMENT ANNUAL FINANCIAL REPORT CONTENTS 1 4 Presentation of the Company Financial Information 129 and its activities 5 4.1 Analysis on Capgemini 2014 Group consolidated 1.1 Milestones in the Group’s history and its values 6 results AFR 130 1.2 The Group’s activities 8 4.2 Consolidated accounts AFR 136 1.3 Main Group subsidiaries and simplified 4.3 Comments on the Cap Gemini S.A. Financial organization chart 13 Statements AFR 195 1.4 The market and the competitive environment 15 4.4 Cap Gemini S.A. financial statements AFR 197 1.5 2014, a year of strong growth 17 4.5 Other financial and accounting information AFR 221 1.6 The Group’s investment policy, financing policy and market risks AFR 25 1.7 Risk analysis AFR 26 5 CAP GEMINI and its shareholders 223 2 5.1 Cap Gemini S.A. Share Capital AFR 224 5.2 Cap Gemini S.A. and the stock market 229 Corporate governance 5.3 Current ownership structure 233 and Internal control 33 5.4 Share buyback program AFR 235 2.1 Organization and activities of the Board of Directors AFR 35 6 2.2 General organization of the Group AFR 54 2.3 Compensation of executive corporate officers AFR 58 2.4 Internal control and risk management Report of the Board of Directors procedures AFR 70 and draft resolutions 2.5 Statutory Auditors’ report prepared in accordance with Article L.225-235 of the French Commercial of the Combined Shareholders’ Code on the report prepared by the Chairman Meeting of May 6, 2015 237 of the Board of Directors AFR 79 6.1 Resolutions presented at the Ordinary Shareholders’ -

Leading Multiple Generations Navigating Driving Innovation

SUMMER MEETING EDITION WWW.MYCALIBR.COM SUMMER 2020 ISSUE REINVENT: HOW YOU WORK | HOW YOU LEAD | YOUR LEGACY Leading Navigating Multiple Driving Generations VUCA Innovation Volatility Uncertainty Complexity Ambiguity TABLE OF CONTENTS SUMMER 2020 EDITION PROGRAM MANAGEMENT PARTNER AND COMMUNICATIONS COMMITTEE Message From The President ............................................................................. 3 URBANOMICS CONSULTING GROUP DAVID GREENE Training Generation Z ......................................................................................... 5 Chief Program Officer ERIC WINGO Program Manager 5 Qualities of Great Leadership ........................................................................... 7 OFFICERS PRESIDENT What Today’s Most Influential Businesses Recommend for Timothy Foy Managing Through COVID-19 ............................................................................. 8 Chief Strategy Officer Official Talent Sports Marketing VICE PRESIDENT 2020 CALIBR New Members ............................................................................12 Shavonne Gordon VP, Diversity Recruiting and US Card Talent Acquisition Capital One The Superpowers We Hold: Architects of the New Normal for TREASURER Black Business ..................................................................................................14 Gresford Gray Director of Finance ACA Compliance Group Re-Imagining the Future ................................................................................... 16 SECRETARY Franklin Reynolds -

Cloud Transformation/ Operation Services & Xaas

Cloud Transformation/ A research report Operation Services & XaaS comparing provider strengths, challenges U.S. 2019 and competitive differentiators Quadrant Report Customized report courtesy of: November 2018 ISG Provider Lens™ Quadrant Report | November 2018 Section Name About this Report Information Services Group, Inc. is solely responsible for the content of this report. ISG Provider Lens™ delivers leading-edge and actionable research studies, reports and consulting services focused on technology and service providers’ strength and Unless otherwise cited, all content, including illustrations, research, conclusions, weaknesses and how they are positioned relative to their peers in the market. These assertions and positions contained in this report were developed by and are the sole reports provide influential insights accessed by our large pool of advisors who are property of Information Services Group, Inc. actively advising outsourcing deals as well as large numbers of ISG enterprise clients who are potential outsourcers. The research and analysis presented in this report includes research from the ISG Provider Lens™ program, ongoing ISG Research programs, interviews with ISG advisors, For more information about our studies, please email [email protected], briefings with services providers and analysis of publicly available market information call +49 (0) 561-50697537, or visit ISG Provider Lens™ under ISG Provider Lens™. from multiple sources. The data collected for this report represents information that ISG believes to be current as of September 2018, for providers who actively participated as well as for providers who did not. ISG recognizes that many mergers and acquisitions have taken place since that time but those changes are not reflected in this report. -

Deep Thoughts

Paul Gottsegen SPOTLIGHT Chief Marketing and Strategy Officer Mindtree's Digital Practice Forecast: Clear Vision in a Cloudy Market A new report, "Mindtree's Digital Practice Brings Clarity to a Cloudy Market," from Horses for Sources (HfS), a leading global services analyst firm, spotlights Mindtree's growing digital At Mindtree, we like to say we were "born digital" since practice. This Q&A with Mindtree's Digital Business leader, Radha digital transformation has been at the core of our business R., shares insights into how clients can harness a digital from Day 1. We know that digital is more than transformation for long-term competitive advantage. technologies and tools. Like the Internet of Things, it's a Read the report to learn why HfS Managing Director for Digital game changer that offers a world of new opportunities for Ned May says Mindtree's Digital vision is "one of the clearest in our customers. This month's Spotlight features an the market today-one that can serve to help frame the interview that takes a close look at our digital practice and conversation for any enterprise buyer." why Mindtree's unique, collaborative approach delivers real business results. Download the report >> CLIENT SPEAK MINDTREE MATTERS CIO Report: Leading Industrial Supplier Discovers flydubai Selects Mindtree as a Strategic Digital Success Technology Partner The move from paper catalog-based sales to a robust ecommerce Mindtree announced a strategic partnership with Dubai- system delivered $1 million in savings and $1 billion in annual based flydubai to shape the full digital experience of the revenue for MSC Industrial Supply Co. -

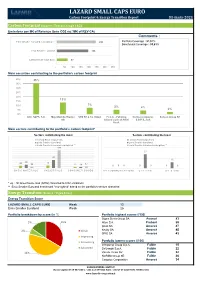

Carbon Footprint & Energy Transition Report

LAZARD SMALL CAPS EURO Carbon Footprint & Energy Transition Report 31-mars-2021 Carbon Footprint (Source : Trucost, scope 1&2) Emissions per M€ of Revenue (tons CO2 éq.*/M€ of REV CA) Comments : Emix Smaller Euroland reweighted ** 242 Portfolio Coverage : 97,51% Benchmark Coverage : 93,61% Emix Smaller Euroland 196 Lazard Small Caps Euro 67 - 50 100 150 200 250 300 350 Main securities contributing to the portfolio's carbon footprint 40% 35% 35% 30% 25% 20% 13% 15% 10% 7% 5% 4% 5% 2% 0% Altri, SGPS, S.A. Mayr-Melnhof Karton STO SE & Co. KGaA F.I.L.A. - Fabbrica Corticeira Amorim, Surteco Group SE AG Italiana Lapis ed Affini S.G.P.S., S.A. S.p.A. Main sectors contributing to the portfolio's carbon footprint* Sectors contributing the most Sectors contributing the least Lazard Small Caps Euro Lazard Small Caps Euro Emix Smaller Euroland Emix Smaller Euroland Emix Smaller Euroland reweighted ** Emix Smaller Euroland reweighted ** 193 27 87 12 35 28 24 13 17 12 11 00 0 0 0 0 0 BASIC MATERIALS INDUSTRIALS CONSUMER GOODS TELECOMMUNICATIONS UTILITIES OIL & GAS * eq. : All Greenhouse Gas (GHG) converted to CO2 emissions ** Emix Smaller Euroland benchmark "reweighted" based on the portfolio's sectors allocation Energy Transition (Source : Vigeo Eiris) Energy Transition Score LAZARD SMALL CAPS EURO Weak 13 Emix Smaller Euroland Weak 25 Portfolio breakdown by score (in %) Portfolio highest scores (/100) Sopra Steria Group SA Avancé 83 5% 10% Alten S.A. Probant 59 Ipsos SA Amorcé 47 2% Weak Nexity SA Amorcé 45 SPIE SA Amorcé 43 Improving Portfolio lowest scores (/100) Convincing Interpump Group S.p.A. -

Booz Allen Hamilton

BOOZ ALLEN HAMILTON MAY 2017 © 2017 Proprietary and confidential. Booz Allen Hamilton COMPETITIVE LANDSCAPE POWERED BY MAY 2017 BOOZ 1. BAH trails Deloitte and Accenture in terms of media mentions and social sharing ALLEN HAMILTON 2. Most topics in this competitive scan are covered quite positively by the media and most of the neutral to negative stories are found in stock performance and guidance news 3. Major consulting firms have consistent news coverage over time while technology and defense contractors like IBM and Lockheed have more volatile coverage focused around announcements EXECUTIVE SUMMARY Booz Allen trails deloitte and Accenture in terms of company mentions Clusters IBM Cloud Platform ● 14% Applications Booz Allen and ● 13% Students ● BAH Stock 10% Consulting Firm ● 9.9% Outlooks ● Deloitte Jobs 8.5% ● IBM Stock 7.0% Government ● 7.0% Contracts Deloitte and ● 5.8% Accenture Innovation Blockchain and ● 5.1% FinTech Accenture ● 4.8% Acquisitions ● AI Tech 4.6% Leidos Merger with ● 4.3% Lockheed Cybersecurity and ● 4.1% Consulting Firms Accenture and Deloitte also lead by social media presence. Comparison of companies by media coverage and social sharing Booz Allen’s events are viewed positively while stock discussions have more negativity. Overview of sentiment across different themes of conversation. Top 15 Themes in Space (by Count) Sentiment summary ● positive 74% ● neutral 21% ● negative 4.2% Major consulting firms remain in the media consciousness while other companies are mentioned only during events. IBM Discussion over -

Deloitte Digital 1

Deloitte Digital 1 Deloitte Digital We imagine, deliver, and run the future. September 2015 Deloitte Digital 2 Bring us your challenges, we’ll reimagine your future. Deloitte Digital is creating a new model for a new age—we’re an agency and a consultancy. We combine leading digital and creative capabilities with the deep industry knowledge and experience Deloitte is known for. That means clients can bring us their biggest challenges, knowing we have what it takes to bring a new business vision to life. Deloitte Digital 3 Part business, part creative, part technology. One hundred percent digital. From first contact to final delivery, Deloitte Digital combines cutting-edge creative with trusted business and technology acumen to define and develop tomorrow’s digital business, today. Deloitte Digital 4 We’re transforming today’s digital journey. We power the way our clients engage with their audience at every point of their journeys—in a way that no other agency or consultancy can. UNDERSTAND ENABLE ELEVATE BRAND TRANSFORM EXECUTE SCALE DIRECT INNOVATE VIA AND CUSTOMER AND DRIVE ORGANIZATION CAMPAIGNS MARKETING DIGITAL PREDICT ENGAGEMENT GROWTH AND PROCESSES CUSTOMERS Deloitte Digital 5 Global presence. Deloitte Digital 6 Our place within Deloitte. Consulting Tax Audit Risk Advisory Financial Advisory Technology Deloitte Digital Strategy & Innovation Human Capital • Technology Advisory • Digital Marketing & Content • Premier Strategy • Human Resources Transformation • Technology Strategy & • Ecommerce and Portals • Deloitte Innovation Architecture -

Marsh & Mclennan Companies 2009 Notice of Annual Meeting and Proxy

Marsh & McLennan Companies Notice of Annual Meeting 2009 and Proxy Statement Important Notice Regarding the Availability of Proxy Materials for the MMC Annual Meeting of Stockholders to be held on May 21, 2009: This proxy statement and MMC’s 2008 Annual Report are available at http://www.proxy09.mmc.com. Dear MMC Stockholder: You are cordially invited to attend the annual meeting of stockholders of Marsh & McLennan Companies, Inc. The meeting will be held at 10:00 a.m. on Thursday, May 21, 2009 in the second floor auditorium at 1221 Avenue of the Americas, New York, New York. In addition to voting on the matters described in this proxy statement, we will use the meeting as an opportunity to report on MMC’s recent activities. You will be able to ask questions, and to meet your company’s directors and senior executives. Whether or not you plantoattend the annual meeting, your vote is important and we urge you to participate in electing directors and deciding the other items on the agenda for the annual meeting. You will find information on how to vote in the first section of this proxy statement. Very truly yours, BRIAN DUPERREAULT President & Chief Executive Officer April 2, 2009 MARSH & McLENNAN COMPANIES, INC. 1166 Avenue of the Americas New York, New York 10036-2774 NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT Time: 10:00 a.m. Local Time Date: May 21, 2009 Place: Second Floor Auditorium 1221 Avenue of the Americas New York, New York 10020 Purpose: 1. To elect four persons named in the accompanying proxy statement to serve as directors for a one-year term; 2. -

COVID-19: How Will Consumers Change Cpgs? | Accenture

How will COVID-19 change the consumer? Data-driven insights into consumer behavior Accenture COVID-19 Consumer Pulse Research: Wave 7 August 2020 OUTMANEUVER UNCERTAINTY NOW NEXT COVID-19 has changed everything While still in the midst of the COVID-19 crisis, we can reflect on all that has occurred in recent months. The ways in which people live and work are different. How and what people buy is different. Consumers themselves have dramatically evolved, and the change is lasting. We see new archetypes emerging that consumer packaged goods (CPG) companies must take notice of and respond to—fast. Accenture has been continually investigating the impact and implications of the pandemic globally. Our seven waves of consumer research reveal that COVID-19 has had a profound impact on the consumer goods industry, and the effects may be everlasting. As companies move forward, they must have the capabilities to understand and deliver on consumers’ wants and needs and strive to outmaneuver uncertainty in this new era. 3 Copyright © 2020 Accenture. All rights reserved. WHAT AND HOW CONSUMERS BUY IS VERY DIFFERENT 4 Get to know your consumers Consumers have been through an emotional life-changing journey during the pandemic. Prior consumer segments—and the insights they’re built on—will need to be redefined to reflect new behaviors and preferences. CPG companies should get reacquainted with new and evolving consumer segments to understand the changes people have undergone and the values they now hold. On the Edge Stubbornly Seeking Normal Tentative Returner Me. Reinvented 19% 29% 36% 16% Extremely worried about health, Looking forward to balance and eager to Cautious about re-entering society Seizing the opportunity to finances and going out in public return to some level of normality and returning to normal routines transform themselves for the better Most worried about health, 45% are shopping more cost- Cutting back or moderating 82% are making more sustainable the economy and job consciously, making them least future spending. -

Accenture • Deloitte & Touche • KPMG • Pwc

Professional Services: Pharmaceuticals: Financial Services: Consumer Goods: Food & Drink: Accenture Abbott Allianz UK 3M Bacardi Deloitte & Touche AbbVie Arab African International AkzoNobel Britvic KPMG Astra Zeneca Bank Clarks Coca-Cola Enterprises PwC GlaxoSmithKline Aviva/Friends Life General Mills Coca-Cola Hellenic AXA Japan Tobacco Diageo Travel & Hospitality: Industrial & Energy: Barclays JTI SA Heineken First Group AngloGoldAshanti Capital One JTI UK Kellogg's Go Ahead BAE Systems Citi L'Occitane Mondelez Manchester Airport Jaguar Land Rover Deutsche Bank Philip Morris International Media: Group Johnson Matthey HSBC Management S.A. Michelin ING Ricoh UK Aegis Retail: Rolls-Royce Intesa San Paolo BSkyB Utilities & Services: Home Retail Group Siemens Investec Plc Experian Jeronimo-Martins Skanksa IPF (International Anglian Water Liberty Global Europe John Lewis Partnership Wood Group Personal Finance) Centrica Pearson Marks & Spencer Nationwide Deutsche Post DHGL Reed Elsevier Property, Construction, Southern Co-operatives Provident Financial Group Housing & Facilities: Legal: The Boots Group Prudential DP World The Co-operative Group BAM Construct UK Rothschild EDP Freshfields Bruckhaus British Land Santander UK Galp Energia Deringer Technology & Telecoms: Hammerson Schroders National Grid Linklaters Alcatel Lucent Intu Properties plc St James's Place Port of Tyne Olswang ARM ISS UK Standard Chartered Royal Mail Wragge Lawrence BT JLL UK Standard Life ScottishPower Graham & Co LLP Deutsche Telekom AG L&Q Housing Group The Royal Bank of Severn Trent Intel Corporation Land Securities Scotland Group SGN ST Microelectronics Lend Lease UBS Terna Workday Foundation Quintain Estates & UniCredit Thames Water Development PLC Zurich United Utilities Sanctuary Housing Group Shaftesbury The Crown Estate Willmott Dixo .