2014 Registration Document Annual Financial Report Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Microsoft Partner of the Year Award Winners and Finalists

2021 Microsoft Partner of the Year Award Winners and Finalists The Microsoft Partner of the Year Awards acknowledge outstanding achievements and innovations from across our global partner ecosystem. This impressive group of partners and their solutions demonstrates amazing agility and creativity in building new technologies across the intelligent cloud to edge, all with the goal of exceeding customer expectations by bringing technology to life in meaningful ways. This year’s group of winners and finalists is an inspiring reflection of the impact our partner ecosystem enables through the innovative technologies they continue to build for our mutual customers. Across categories including Azure, Modern Work & Security, and Social Impact, our partners are dedicated to helping customers solve challenges and truly work to support our mission to empower every person and every organization on the planet to achieve more. Congratulations to this year’s winners and finalists, which have shown exceptional expertise, dedication to our customers, and care for our world through a year of change. Table of contents Partner of the Year Awards: Category Winners • Azure • Business Applications • Modern Work & Security • Industry • Social Impact • Business Excellence Category Finalists Country/Region Winners 2021 Microsoft Partner of the Year Award Winners – Category Azure 2021 Microsoft Partner of the Year Award Winners – Category 2021 Microsoft Partner of the Year Award Winners – Category Azure AI Icertis United States www.icertis.com Icertis’ strategic bet with Microsoft on Azure AI is delivering strong customer success and leadership positioning in the contract lifecycle management market. Hundreds of customers have been empowered through over 10 million contracts valued at more than $1 trillion, and in 40+ languages across 90+ countries. -

2018 Performance Related Share Grant

October 3, 2018 Grant of performance shares to Corporate executive officers The Board of Directors of Capgemini SE, upon recommendation of the Compensation Committee, has decided during its meeting on October 3, 2018, to grant a total of 1 384 530 performance shares of the company Capgemini SE to employees and corporate officers of the Company and its French and foreign subsidiaries. Out of this total, reduced versus last year due to the share price evolution, 61 000 performance shares have been granted to Mr. Paul Hermelin, Chairman and CEO, and to Messrs. Thierry Delaporte and Aiman Ezzat, Chief Operating Officers, as follows: Board of Directors decision on As a reminder 03.10.2018 2018 % of the total 2017 % of the (total number of authorized (total number of shares total shares granted) amount * granted) authorized amount Mr. P. Hermelin 28 000 35,000 2.07% Chairman and CEO Mr. T. Delaporte 16 500 3,62% n/a n/a Chief Operating Officer Mr. A. Ezzat 16 500 n/a n/a Chief Operating Officer * Ceiling of 10% of the maximum allocation authorized by the Shareholders' Meeting of May 23, 2018 (23rd resolution) for the total allocation to Corporate executive officers For each of the Corporate executive officers, the final vesting of the shares, after a three-years acquisition period, is subject to the completion of the following performance conditions: • A market performance condition (35%) based on the comparative performance of the Capgemini SE share against the average performance of a basket of eight comparable companies in the same business -

F I N a N C I a L R E P O R T 2 0

FINANCIAL REPORT 2009 REFERENCE DOCUMENT CONTENTS BOARD OF DIRECTORS Serge KAMPF, Chairman Daniel BERNARD Yann DELABRIÈRE Jean-René FOURTOU 02 Financial highlights Paul HERMELIN, Chief Executive Officer 03 The Capgemini Group Michel JALAbert 23 Corporate responsibility and sustainability Phil LASKAWY 44 Report of the Chairman Bernard LIAUTAUD of the Board of Directors Thierry de MONTBRIAL 58 Management report Ruud van OMMEREN presented by the Board of Directors Terry OZAN to the Shareholders' Meeting of May 27, 2010 Pierre PRINGUET 75 Capgemini Consolidated Financial Statements Bruno ROGER 148 Cap Gemini S.A. Financial Statements 174 Text of the draft resolutions NON-VOTING DIRECTORS presented by the Board of Directors "CENSEURS" to the ordinary and extraordinary Shareholders' Meeting of May 27, 2010 Pierre HESSLER Geoff UNWIN 182 Specific information 200 Cross-reference tables STATUTORY AUDITORS PRICEWATERHOUSECOOPERS AUDIT represented by Serge VILLEPELET KPMG S.A. represented by Jean-Luc DECORNOY The English language version of this report is a free translation from the original, which was prepared in French. All possible care has been taken to ensure that the translation is an accurate presentation of the original. However, in all matters of interpretation, views or opinions expressed in the original language version of the document in French take precedence over the translation. 2009 annual report Capgemini 1 FINANCIAL HIGHLIGHTS CONSOLIDATED FINANCIAL STATEMENTS in millions of euros 2005 2006 2007 2008 2009 REVENUES 6,954 7,700 8,703 -

Carbon Footprint & Energy Transition Report

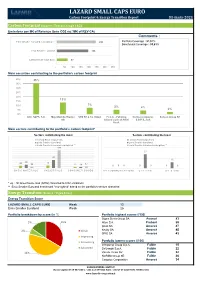

LAZARD SMALL CAPS EURO Carbon Footprint & Energy Transition Report 31-mars-2021 Carbon Footprint (Source : Trucost, scope 1&2) Emissions per M€ of Revenue (tons CO2 éq.*/M€ of REV CA) Comments : Emix Smaller Euroland reweighted ** 242 Portfolio Coverage : 97,51% Benchmark Coverage : 93,61% Emix Smaller Euroland 196 Lazard Small Caps Euro 67 - 50 100 150 200 250 300 350 Main securities contributing to the portfolio's carbon footprint 40% 35% 35% 30% 25% 20% 13% 15% 10% 7% 5% 4% 5% 2% 0% Altri, SGPS, S.A. Mayr-Melnhof Karton STO SE & Co. KGaA F.I.L.A. - Fabbrica Corticeira Amorim, Surteco Group SE AG Italiana Lapis ed Affini S.G.P.S., S.A. S.p.A. Main sectors contributing to the portfolio's carbon footprint* Sectors contributing the most Sectors contributing the least Lazard Small Caps Euro Lazard Small Caps Euro Emix Smaller Euroland Emix Smaller Euroland Emix Smaller Euroland reweighted ** Emix Smaller Euroland reweighted ** 193 27 87 12 35 28 24 13 17 12 11 00 0 0 0 0 0 BASIC MATERIALS INDUSTRIALS CONSUMER GOODS TELECOMMUNICATIONS UTILITIES OIL & GAS * eq. : All Greenhouse Gas (GHG) converted to CO2 emissions ** Emix Smaller Euroland benchmark "reweighted" based on the portfolio's sectors allocation Energy Transition (Source : Vigeo Eiris) Energy Transition Score LAZARD SMALL CAPS EURO Weak 13 Emix Smaller Euroland Weak 25 Portfolio breakdown by score (in %) Portfolio highest scores (/100) Sopra Steria Group SA Avancé 83 5% 10% Alten S.A. Probant 59 Ipsos SA Amorcé 47 2% Weak Nexity SA Amorcé 45 SPIE SA Amorcé 43 Improving Portfolio lowest scores (/100) Convincing Interpump Group S.p.A. -

Tech Procurement in the UK Justice Sector

Tech Procurement in the UK Justice Sector December 2020 Trusted Insight on Government Contracts and Spend Trusted by suppliers, the public sector, and the media — Corporate Government Media 550+ Press citations since Jan 2019 “Serious-minded business data provider Tussell” Matthew Vincent 22nd September 2018 2 | Trends and Opportunities in the Justice Sector We transform open data into useful data – so you don’t have to — Open data Third party data Useful data Use cases CONTRACT DATA Public Sector Aggregate Get better value from TED (EU) suppliers Companies House Contracts Finder (UK), Sell2Wales, PCS Match Digital Marketplace Suppliers Normalise Win government Circa 70 local portals contracts Cleanse SPEND DATA Moody’s Analytics 6800+ Central Gov’t, Press Local Gov’t & NHS Machine Scrutinise public bodies learn spending 3 | Trends and Opportunities in the Justice Sector Total data coverage: Justice — Spend Contracts Q1 2016 – Q2 2020 Q1 2015 – Q3 2020 864,000 invoices 7,000 contracts £28bn spend value £17bn contract value 43 buyers 100 buyers 31,000 suppliers 2,600 suppliers 4 | Trends and Opportunities in the Justice Sector Questions Tussell will answer — 1. How big is the market? 2. What’s the breakdown by sub-sector? 3. Can new entrants break through? 4. Has demand recovered from Covid? 5. How can I position my firm for future rebids? 5 | Procurement in the UK EdTech market Technology spend in the justice sector in the five years from 2016-2020 was £3bn in total, an average of £597m per annum Spend data £728M £710M Average: £597M £578M -

Everest Group PEAK Matrix™ for Devops Service Providers 2019

® Everest Group PEAK Matrix™ for DevOps Service Providers 2019 Focus on Capgemini September 2019 ® ™ Copyright © 2019 Everest Global, Inc. This document has been licensed for exclusive use and distribution by Capgemini EGR-2019-32-E-3316 Introduction and scope Everest Group recently released its report titled “DevOps Services PEAK Matrix™ Assessment and Market Trends 2019 – Siloed DevOps is No DevOps! ” This report analyzes the changing dynamics of the DevOps services landscape and assesses service providers across several key dimensions. As a part of this report, Everest Group updated its classification of 20 service providers on the Everest Group PEAK Matrix™ for DevOps services into Leaders, Major Contenders, and Aspirants. The PEAK Matrix is a framework that provides an objective, data-driven, and comparative assessment of DevOps service providers based on their absolute market success and delivery capability. Based on the analysis, Capgemini emerged as a Leader. This document focuses on Capgemini’s DevOps services experience and capabilities and includes: ⚫ Capgemini’s position on the DevOps PEAK Matrix ⚫ Detailed DevOps services profile of Capgemini Buyers can use the PEAK Matrix to identify and evaluate different service providers. It helps them understand the service providers’ relative strengths and gaps. However, it is also important to note that while the PEAK Matrix is a useful starting point, the results from the assessment may not be directly prescriptive for each buyer. Buyers will have to consider their unique situation and requirements, and match them against service provider capability for an ideal fit. Source: Everest Group (2019) unless cited otherwise ® Copyright © 2019, Everest Global, Inc. -

IDC Marketscape Names Accenture a Digital Strategy Leader | Accenture

IDC MarketScape IDC MarketScape: Worldwide Digital Strategy Consulting Services 2021 Vendor Assessment Douglas Hayward IDC MARKETSCAPE FIGURE FIGURE 1 IDC MarketScape Worldwide Digital Strategy Consulting Services Vendor Assessment Source: IDC, 2021 June 2021, IDC #US46766521 Please see the Appendix for detailed methodology, market definition, and scoring criteria. IDC OPINION This study represents the vendor assessment model called IDC MarketScape. This research is a quantitative and qualitative assessment of the characteristics that explain a vendor's current and future success in the digital strategy consulting services marketplace. This study assesses the capabilities and business strategies of 13 prominent digital strategy consulting services vendors. This evaluation is based on a comprehensive framework and a set of parameters expected to be most conducive to success in providing digital strategy consultancy. A significant component of this evaluation is the inclusion of digital strategy consulting buyers' perception of both the key characteristics and the capabilities of these providers. This client input was provided primarily from the vendors' clients, supplemented with a worldwide survey. Key findings include: . Consultancies are getting the basics right. Reference clients that IDC spoke with were impressed by the quality of the people from the leading digital strategy consultancies. On average, reference clients gave consultancies highest scores for people quality, action orientation, and client-specific insight. This indicates that digital strategy consultancies are getting the basics right — they are recruiting smart and empathetic people and are training and developing them well, they are getting to know their clients inside out, and they are producing very useful advice as a result. Clients want to be challenged more than ever by their digital strategy consultants. -

The Dark Side of Social Media Alarm Bells, Analysis and the Way Out

The Dark Side of Social Media Alarm bells, analysis and the way out Sander Duivestein & Jaap Bloem Vision | Inspiration | Navigation | Trends [email protected] II Contents 1 The Dark Side of Social Media: r.lassche01 > flickr.com Image: a reality becoming more topical by the day 1 Contents PART I ALARM BELLS 7 2 2012, a bumper year for social media 7 3 Two kinds of Social Media Deficits 9 4 Addiction in the Attention Deficit Economy 10 PART II ANALYSIS 12 5 Ten jet-black consequences for Homo Digitalis Mobilis 12 6 Social media a danger to cyber security 20 7 The macro-economic Social Media Deficit 21 8 How did it get this far? 22 PART III THE WAY OUT 25 9 Dumbing-down anxiety 25 10 Basic prescription: social is the new capital 27 11 The Age of Context is coming 28 12 SlowTech should really be the norm 30 13 The Slow Web movement 31 14 Responsible for our own behavior 33 References 35 Justification iv Thanks iv This work is licensed under the Creative Commons Attribution Non Commercial Share Alike 3.0 Unported (cc by-nc-sa 3.0) license. To view a copy of this license, visit http://creativecommons.org/licenses/ by-nc-sa/3.0/legalcode or send a letter to Creative Commons, 543 Howard Street, 5th floor, San Francisco, California, 94105, usa. The authors, editors and publisher have taken care in the preparation of this book, but make no expressed or implied warranty of any kind and assume no responsibility for errors or omissions. -

Projet De Note En Réponse) Which Was Filed with the French Autorité Des Marchés Financiers on 23 September 2019 and Which Remains Subject to Its Review

This document is an unofficial English-language translation of the draft response document (projet de note en réponse) which was filed with the French Autorité des marchés financiers on 23 September 2019 and which remains subject to its review. In the event of any differences between this unofficial English- language translation and the official French draft response document, the official French draft response document shall prevail. The draft offer and this draft response document remain subject to the French Financial Market's Authority review. DRAFT DOCUMENT PREPARED BY IN RESPONSE TO THE PUBLIC TENDER OFFER FOR THE SHARES OF THE COMPANY ALTRAN TECHNOLOGIES LAUNCHED BY This draft response document (projet de note en réponse) was filed with the French Financial Markets Authority (the "AMF") on 23 September 2019, in accordance with the provisions of Article 231-26 of the AMF's general regulation. It was prepared in accordance with Article 231-19 of the AMF's general regulation. The draft offer and this draft response document remain subject to the review of the AMF. Important notice Pursuant to Articles 231-19 and 261-1 et seq. of the AMF's general regulation, the report of Finexsi, acting in its capacity as independent expert, is included in this draft response document. This draft response document (the "Draft Response Document") is available on the websites of ALTRAN (www.altran.com) and the AMF (www.amf-france.org) and may be obtained free of charge from Altran Technologies' registered office at 96, avenue Charles de Gaulle, 92200 Neuilly-sur-Seine – FRANCE. In accordance with the provisions of Article 231-28 of the AMF's general regulation, information relating to Altran Technologies, in particular legal, financial and accounting information, will be filed with the AMF and made available to the public in the same manner no later than the day before the opening of the tender offer. -

Cig Number 202005040015 – Florida Connect System

EXECUTIVE OFFICE OF THE GOVERNOR OFFICE OF THE CHIEF INSPECTOR GENERAL REVIEW OF THE DEPARTMENT OF ECONOMIC OPPORTUNITY FLORIDA CONNECT SYSTEM CIG NUMBER: 202005040015 March 4, 2021 CIG NUMBER 202005040015 – FLORIDA CONNECT SYSTEM Agency Executive Directors and Other Key Individuals Agency for Workforce Innovation (AWI) and Department of Economic Opportunity (DEO)1 Executive Directors and other key individuals relevant to the CONNECT project are listed below. AWI / DEO Executive Directors Monesia Brown, January 2, 2007 to February 1, 2009 Cynthia Lorenzo, February 2, 2009 to September 30, 2011 Doug Darling, October 1, 2011 to January 31, 2012 Cynthia Lorenzo, Interim, February 2, 2012 to April 15, 2012 Hunting Deutsch, April 16, 2012 to December 16, 2012 Darrick McGhee, Interim, December 17, 2012 to January 7, 2013 Jesse Panuccio, January 8, 2013 to January 8, 2016 Theresa “Cissy” Proctor, January 9, 2016 to January 8, 2018 Ken Lawson, January 9, 2018 to August 31, 2020 Dane Eagle, September 14, 2020 to Present Deloitte Consulting, LLP John Hugill, Principal David Minkkinen, Project Director, March 2011 to May 2012 Kevin McCarter, Project Director, May 2012 to May 2015 Ernst & Young, LLP Mike Shaklik, Principal The North Highland Company Andy Loveland, Project Manager, 2009 to 2011 Wayne Messina, Project Manager, 2011 to 2015 KPMG, LLP Dianna Suggs, Project Manager, 2010 to 2011 Linda Fuchs, Project Manager, 2011 to 2012 Nancy Snow, Communication Coordinator, 2012 -2014 1 Effective October 1, 2011, AWI was dissolved as part of a larger government reorganization legislated by Senate Bill 2156. As a result of the 2011 reorganization, Department of Economic Opportunity became the contracting agency responsible for the implementation of the UC Modernization project. -

The Capgemini Time

1967 2015 The Capgemini Time 1967 1975 The Start of an Entrepreneurial Adventure 1 October 1967. Serge Kampf creates Sogeti, an IT services company, in Grenoble, France. A year later he opens offices in Switzerland to meet the needs of a client. Sogeti rapidly expands, first in the provinces and then in Paris, in 1969. The spirit of conquest is already established! 1970: the Group diversifies, first intoconsulting and then outsourcing, 20 years ahead of its competitors. 1974: With the acquisition of Cap and Gemini Computer Systems, Sogeti becomes a truly European company and enters the era of large IT systems. 1975: the Cap Gemini Sogeti Group is born. Two years later, the leading European IT services company, with nearly 2,000 employees, enters the United States, the country posting the Group’s best growth today. 1976 1989 Growth and Expansion At the forefront of innovation, the Group plays a major role in creating the French electronic directory, the largest IT system distributed across the world. The Group relies on large and small shareholders to assist its development. Among the most significant, CGIP, which enters the capital in 1982, remains a loyal supporter for more than 20 years. The information contained in the document is proprietary and confidential. It is for Capgemini internal use only. ©2015 Capgemini. All rights reserved. 12 June 1985: the Group is floated on the Paris Stock Exchange. The share price increases by 25% in 5 days and 5 months later Serge Kampf establishes the Group’s headquarters at the prestigious Place de l’Etoile in Paris. -

ISG Providerlens™ Quadrant Report

Salesforce Ecosystem Partners Germany 2020 A research report comparing provider Quadrant Report strengths, challenges and competetive differentiators. March 2020 Customized report courtesy of: ISG Provider Lens™ Quadrant Report | March 2020 Section Name About this Report Information Services Group, Inc. is solely responsible for the content of this report. ISG Provider Lens™ delivers leading-edge and actionable research studies, reports and consulting services focused on technology and service providers’ strengths and Unless otherwise cited, all content, including illustrations, research, conclusions, weaknesses and how they are positioned relative to their peers in the market. These assertions and positions contained in this report were developed by and are the sole reports provide influential insights accessed by our large pool of advisors who are property of Information Services Group, Inc. actively advising outsourcing deals as well as large numbers of ISG enterprise clients who are potential outsourcers. The research and analysis presented in this report includes research from the ISG Provider Lens™ program, ongoing ISG Research programs, interviews with ISG advisors, For more information about our studies, please email [email protected], briefings with services providers and analysis of publicly available market information call +49 (0) 561-50697537, or visit ISG Provider Lens™ under ISG Provider Lens™. from multiple sources. The data collected for this report represents information that ISG believes to be current as of February 2020 for providers who actively participated as well as for providers who did not. ISG recognizes that many mergers and acquisitions have taken place since that time, but those changes are not reflected in this report.