Tech Procurement in the UK Justice Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2014 Registration Document Annual Financial Report Contents

2014 REGISTRATION DOCUMENT ANNUAL FINANCIAL REPORT CONTENTS 1 4 Presentation of the Company Financial Information 129 and its activities 5 4.1 Analysis on Capgemini 2014 Group consolidated 1.1 Milestones in the Group’s history and its values 6 results AFR 130 1.2 The Group’s activities 8 4.2 Consolidated accounts AFR 136 1.3 Main Group subsidiaries and simplified 4.3 Comments on the Cap Gemini S.A. Financial organization chart 13 Statements AFR 195 1.4 The market and the competitive environment 15 4.4 Cap Gemini S.A. financial statements AFR 197 1.5 2014, a year of strong growth 17 4.5 Other financial and accounting information AFR 221 1.6 The Group’s investment policy, financing policy and market risks AFR 25 1.7 Risk analysis AFR 26 5 CAP GEMINI and its shareholders 223 2 5.1 Cap Gemini S.A. Share Capital AFR 224 5.2 Cap Gemini S.A. and the stock market 229 Corporate governance 5.3 Current ownership structure 233 and Internal control 33 5.4 Share buyback program AFR 235 2.1 Organization and activities of the Board of Directors AFR 35 6 2.2 General organization of the Group AFR 54 2.3 Compensation of executive corporate officers AFR 58 2.4 Internal control and risk management Report of the Board of Directors procedures AFR 70 and draft resolutions 2.5 Statutory Auditors’ report prepared in accordance with Article L.225-235 of the French Commercial of the Combined Shareholders’ Code on the report prepared by the Chairman Meeting of May 6, 2015 237 of the Board of Directors AFR 79 6.1 Resolutions presented at the Ordinary Shareholders’ -

Carbon Footprint & Energy Transition Report

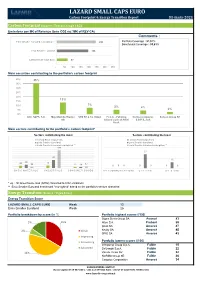

LAZARD SMALL CAPS EURO Carbon Footprint & Energy Transition Report 31-mars-2021 Carbon Footprint (Source : Trucost, scope 1&2) Emissions per M€ of Revenue (tons CO2 éq.*/M€ of REV CA) Comments : Emix Smaller Euroland reweighted ** 242 Portfolio Coverage : 97,51% Benchmark Coverage : 93,61% Emix Smaller Euroland 196 Lazard Small Caps Euro 67 - 50 100 150 200 250 300 350 Main securities contributing to the portfolio's carbon footprint 40% 35% 35% 30% 25% 20% 13% 15% 10% 7% 5% 4% 5% 2% 0% Altri, SGPS, S.A. Mayr-Melnhof Karton STO SE & Co. KGaA F.I.L.A. - Fabbrica Corticeira Amorim, Surteco Group SE AG Italiana Lapis ed Affini S.G.P.S., S.A. S.p.A. Main sectors contributing to the portfolio's carbon footprint* Sectors contributing the most Sectors contributing the least Lazard Small Caps Euro Lazard Small Caps Euro Emix Smaller Euroland Emix Smaller Euroland Emix Smaller Euroland reweighted ** Emix Smaller Euroland reweighted ** 193 27 87 12 35 28 24 13 17 12 11 00 0 0 0 0 0 BASIC MATERIALS INDUSTRIALS CONSUMER GOODS TELECOMMUNICATIONS UTILITIES OIL & GAS * eq. : All Greenhouse Gas (GHG) converted to CO2 emissions ** Emix Smaller Euroland benchmark "reweighted" based on the portfolio's sectors allocation Energy Transition (Source : Vigeo Eiris) Energy Transition Score LAZARD SMALL CAPS EURO Weak 13 Emix Smaller Euroland Weak 25 Portfolio breakdown by score (in %) Portfolio highest scores (/100) Sopra Steria Group SA Avancé 83 5% 10% Alten S.A. Probant 59 Ipsos SA Amorcé 47 2% Weak Nexity SA Amorcé 45 SPIE SA Amorcé 43 Improving Portfolio lowest scores (/100) Convincing Interpump Group S.p.A. -

USER GROUP »Governance, Risk, Compliance in Der IT« 14

USER GROUP »Governance, Risk, Compliance in der IT« 14. Arbeitstreffen Leipzig, 26./27. April 2018 THEMENSCHWERPUNKT „Governance, Risk & Control von IT-Sourcing und Cloud Computing: Anforde- rungen, Herausforderungen und Lösungsansätze“ FACHLICHE LEITUNG Prof. Dr. Nils Urbach Universität Bayreuth MITGLIEDER DER USER GROUP MEDIENPARTNER ORGANISATORISCHES TERMIN 26./27. April 2018 ANSPRECHPARTNER Yvonne Weißflog Seite | 2 T +49 341 98988-422 F +49 341 98988-9444 E [email protected] VERANSTALTUNGSORT Alte Essig-Manufactur Paul-Gruner-Straße 44 | 04107 Leipzig T +49 341 2 67 80 I www.michaelis-leipzig.de/de/alte-essig- manufactur/ ABENDVERANSTALTUNG Weinwirtschaft Leipzig Thomaskirchhof 13/14 | 04109 Leipzig T +49 341 49614606 I www.weinwirtschaft-leipzig.de HOTEL Eine Auswahl an Übernachtungsmöglichkeiten finden Sie unter: www.softwareforen.de/hotelempfehlungen Bitte nutzen Sie die Buchungscodes des jeweiligen Hotels, um auf die vergünstigten Konditionen der Leipziger Foren zuzugreifen. User Group »Governance, Risk, Compliance in der IT« www.softwareforen.de/it-governance RÜCKBLICK ARBEITSTREFFEN 13. Arbeitstreffen – 23./24. November 2017 Policies vs. Geschäftsziele: IT-GRC im Spannungsfeld von Effektivität und angemessener Regelungstiefe Seite | 3 12. Arbeitstreffen – 04./05. Mai 2017 Tools & Co: Automatisierung von IT-GRC - Wie bitte? Anforderungen, Möglichkeiten & Erfahrungsberichte 11. Arbeitstreffen – 10./ 11. November 2016 IT-Konsumerisierung, Cloud Computing und Schatten-IT: Neue Anforde- rungen an das GRC im Zeitalter der Digitalisierung? 10. Arbeitstreffen – 21./22. April 2016 Flexibilität vs. Kontrolle: Erfahrungen und Best Practices aus den aktuellen Anforderungen an die IT-Compliance 9. Arbeitstreffen – 26./ 27. November 2015 SIEM – Schluss mit dem Unwissen über die Gefahr? 8. Arbeitstreffen – 5./6. Mai 2015 Management und Controlling von IT-Risiken 7. -

Continued Improvement in Business Activity in Q1 2021

Press release Continued improvement in business activity in Q1 2021 . Revenue growth totalling 2.2% 1 . Clear improvement in organic revenue growth (-0.5%) with respect to the past three quarters . Buoyant market conditions confirming the outlook of a return to organic revenue growth starting in Q2 2021 Paris, 28 April 2021, 7:00 a.m. – Sopra Steria generated revenue of €1,165.2 million in the first quarter of 2021, representing growth of 2.2%. Changes in scope had a positive impact of €32.9 million. The impact of currency fluctuations was virtually neutral (-€1.4 million). At constant scope and exchange rates, revenue contracted slightly (0.5%). Sopra Steria: Consolidated revenue – Q1 2021 Organic Total €m / % Q1 2021 Q1 2020 growth growth Revenue 1,165.2 1,140.1 -0.5% 2.2% Comments on Q1 2021 business activity Market conditions were buoyant in Q1 2021. Business activity was brisk and improved with respect to previous quarters. The public sector and defence remained highly active. As an illustration, several major contracts in these two sectors were announced during the quarter: Brasidas (a unique new information system for ensuring the operational readiness of aeronautics equipment) for the French Defence Ministry, cybersecurity for the EU agencies eu-LISA and Frontex, the development of a centralised border control system for the French Interior Ministry, and the development of a national road traffic information system for Highways England. All the other vertical markets, to varying extents, saw improved trends. In this context, and with downtime lower than in Q1 2020, recruitment picked up again starting at the beginning of the year. -

(EC HARRIS) £23317.00 Asset Clearing Aug-16 Balanc

Service Unit Supplier Amount Account Name Period Balance Sheet ARCADIS LLP (E C HARRIS) £23,317.00 Asset Clearing Aug-16 Balance Sheet AURA GRAPHICS LTD (SSDM) £713.00 Asset Clearing Aug-16 Balance Sheet AURA GRAPHICS LTD (SSDM) £1,101.50 Asset Clearing Aug-16 Balance Sheet REDACTED - LAW ENFORECEMENT £3,475.00 Asset Clearing Aug-16 Balance Sheet REDACTED - LAW ENFORECEMENT £9,763.00 Asset Clearing Aug-16 Balance Sheet FORD MOTOR COMPANY LTD £11,760.02 Asset Clearing Aug-16 Balance Sheet HONDA UK £5,824.27 Asset Clearing Aug-16 Balance Sheet MICHELMORES LLP £2,158.00 Asset Clearing Aug-16 Balance Sheet MIDDLESBROUGH BOROUGH COUNCIL £1,500.00 Asset Clearing Aug-16 Balance Sheet PATCHSAVE SOLUTIONS LTD £997.90 Asset Clearing Aug-16 Balance Sheet PATCHSAVE SOLUTIONS LTD £737.08 Asset Clearing Aug-16 Balance Sheet PCC FOR NORTH YORKSHIRE £3,176.17 Asset Clearing Aug-16 Balance Sheet PCC FOR NORTH YORKSHIRE £2,708.60 Asset Clearing Aug-16 Balance Sheet PCC FOR NORTH YORKSHIRE £3,641.09 Asset Clearing Aug-16 Balance Sheet PEUGEOT MOTOR CO £8,770.74 Asset Clearing Aug-16 Balance Sheet PEUGEOT MOTOR CO £12,199.91 Asset Clearing Aug-16 Balance Sheet PEUGEOT MOTOR CO £12,199.91 Asset Clearing Aug-16 Balance Sheet PEUGEOT MOTOR CO £12,199.91 Asset Clearing Aug-16 Balance Sheet PEUGEOT MOTOR CO £12,199.91 Asset Clearing Aug-16 Balance Sheet PEUGEOT MOTOR CO £12,199.91 Asset Clearing Aug-16 Balance Sheet PEUGEOT MOTOR CO £12,199.91 Asset Clearing Aug-16 Balance Sheet PEUGEOT MOTOR CO £12,199.91 Asset Clearing Aug-16 Balance Sheet PEUGEOT MOTOR CO -

Internal Rules and Regulations of the Board of Directors

IRR Version 22/10/2020 SOPRA STERIA GROUP Société Anonyme with share capital of €20,547,701 326 820 065 RCS ANNECY Registered office: PAE Les Glaisins, Annecy-le-Vieux, 74940 Annecy – France Head office: 6 avenue Kleber, 75116 Paris – France INTERNAL RULES AND REGULATIONS OF THE BOARD OF DIRECTORS Introduction The Board of Directors of Sopra Steria Group operates according to the rules established by law, the Company’s Articles of Association and the recommendations contained in the AFEP- MEDEF corporate governance code to which the Company refers. Its organisational and operating methods are set out in these internal rules and regulations. The internal rules and regulations of the Board of Directors are not part of the Articles of Association of Sopra Steria Group. They are not binding on third parties. They may not be invoked by third parties or Sopra Steria Group shareholders against Sopra Steria Group or its company officers. These internal rules and regulations apply to all company officers (Directors, Executive Management), as well as any Non-Voting Directors, Works Council representatives, persons invited to meetings in connection with the items on the agenda of the Board of Directors, members of the Company’s Executive Committee, and, more generally, any person with access to the documents (preparatory or final) produced for meetings of the Board of Directors and/or its Committees. These internal rules and regulations were last amended at the Board of Directors’ meeting on 22 October 2020. Page 1 of 15 IRR Version 22/10/2020 Table of articles Article 1 – Role of the Board of Directors ............................................................................................. -

IDC Fintech Rankings Top 100

IDC FinTech Rankings Top 100 Ranking Company Ranking Company Ranking Company 1 FIS 42 Sopra Banking Software 82 Nucleus Software IDC Financial Insights 2 Tata Consultancy Services Limited 43 Sinosoft Company Limited 83 Diasoft 3 NTT DATA 44 IPC 84 Novantas, Inc. FinTech Rankings 4 Fiserv 45 Experian 85 Kasasa Top 25 Enterprise 5 Cognizant Technology Solutions 46 Pegasystems Inc. 86 Celero 6 SS&C Technologies 47 GFT Technologies SE 87 Capital Asset Planning, Inc. 7 Infosys Limited 48 Ping An Technology 88 Doxim Ranking Company 8 NCR Corporation 49 Yunnan Nantian Electronics Information Corp.,LTD. 89 TAS Group E1 IBM 9 Diebold Nixdorf 50 Murex 90 BPC Banking Technologies E2 Microsoft 10 Global Payments 51 Pactera Jinxin 91 MX E3 Dell 11 NRI (Nomura Research Institute, Ltd. ) 52 CRIF S.p.A. 92 ARGO Data Resource Corporation E4 Deloitte 12 Finastra 53 Refinitiv 93 Sinqia E5 Accenture 13 Jack Henry & Associates, Inc. 54 Yusys Technologies Co., Ltd. 94 xQuant Company, Ltd. E6 Cisco Systems, Inc. 14 Ingenico 55 BearingPoint 95 DCI (Data Center Inc) E7 Intel 15 CoreLogic 56 Bottomline Technologies 96 Baker Hill E8 DXC Technology 16 TransUnion 57 Q2 Holdings, Inc. (Q2) 97 ARCA E9 Oracle 17 Broadridge Financial Solutions, Inc 58 Fundbox 98 Zhejiang Bangsun Technology CO.,Ltd. E10 Capgemini 18 Moody’s Analytics, Inc. 59 EVERTEC, Inc. 99 Featurespace E11 Hitachi, Ltd. 19 Equifax 60 Computer Services, Inc. (CSI) 100 VSoft E12 Fujitsu 20 ACI Worldwide 61 Simplex Inc. E13 Hewlett Packard Enterprise 21 SAS 62 Intellect Design Arena Ltd E14 SAP SE 22 Virtu Financial 63 Linedata Services E15 Wipro Limited 23 Worldline 64 Silverlake Axis Limited E16 Atos 24 Black Knight 65 NeoXam E17 Amazon (AWS) 25 GLORY 66 OneConnect E18 HCL Technologies 26 Genpact 67 nCino E19 CGI 27 FICO 68 Calypso Technology, Inc. -

Mergers & Acquisitions Leverage

Mergers & Acquisitions Mergers & Acquisitions Leverage Transforming insights into M&A solutions Vol. 5 Issue 1 2016 Risk. Reinsurance. Human Resources. Editorial Contents It has been an interesting first year. EMEA specifically showed a 5 year low half of 2016. The global economy at USD 428.4 billion – 14% lower than H1 continues to struggle and the IMF 2015ii. Whether we consider H1 deal values, predicts 2016 global GDP growth quarter-by-quarter performance or cross- at 3.16% i. Major economies in border activity, 2016 is showing a drop from Europe, Asia Pacific, Japan & 2015. However, not all regions have shown a the Middle East continue to be decline. China in particular continues to spend 02 sluggish, while there are some on transactions, and this trend appears set to COVER FEATURE bright spots in the US, Germany continue throughout the near future. Germany and India. The impact of Brexit is also appears to have made a comeback from the yet to be fully predicted or 2015 dip, with increased figures both as a buyer Driving Change in assimilated into the European and indeed the and a seller. global economy. Headwinds on the global Times of Organizational economy will continue to impact the overall With this backdrop of global uncertainty with Transformation investment climate, trade and cross-border pockets of opportunity for cross-border and deals. But for individual countries, the inner in-country deals, this issue brings to you articles The Mantra Unlocked market dynamics will continue to drive industry that will help throw light on various elements. consolidations and some organic growth ‘Driving Change in Times of Organizational outside of home country, etc. -

Everest Group PEAK Matrix™ Assessment Preview Rules of The

Everest Group PEAK Matrix™ Pre-release Everest Group is happy to share a pre-release version of the For more information on the “Workplace Services PEAK Matrix™ – Europe-focused – PEAK Matrix, you can review our Assessment and Profile Compendium 2015”. We plan to release the final report the week of 14 September. overview document Read more We are offering this pre-release file to facilitate your preparation for its public release; please note that the PEAK Matrix report For Marketing information, please has not been published. As such, we ask that you note these review our citation and logo use policies for its use. policy. Read more Release of this information is embargoed until the report is published on the Everest Group website If you have any questions concerning how you can use this This information is for internal use only; please do not share it with anyone outside of your organization for any reason PEAK Matrix pre-release, please until published on the Everest Group website do not hesitate to contact No action or response is required from you; this pre-release is for your information only Andrea M. Riffle Vice President Everest Group’s PEAK Matrix research methodology includes an RFI as well as measures to clarify and confirm Marketing data. This pre-release is offered for your information only – and is not meant to serve as a fact check nor to open discussions regarding positioning on the PEAK Matrix Proprietary & Confidential. © 2015, Everest Global, Inc. 1 Everest Group PEAK Matrix™ Pre-release Workplace Services PEAK -

2016 Corporate Responsibility Report

CORPORATE RESPONSIBILITY Sopra Steria Corporate Responsibility Report 2016 - Extract from Registration Document Delivering Transformation. Together. ABOUT SOPRA STERIA GROUP Corporate Responsibility Our fi rst responsibility is to secure our business development and our long-term Corporate future while considering our local and global impact. As an international group operating in many countries, we play a major role in responsibility helping to create a more sustainable world. Marketplace Workplace Environment Community engagement Responsible dialogue with A team at the heart of the Innovating in support Supporting local all stakeholders Group’s Enterprise Project. of the environment for the communities: education, A confi rmed principle of benefi t of our clients access to employment, equal opportunities digital inclusion and the right to water One of Europe’s leading recruiters Score Gold level 8,498 A- in Leadership NEW EMPLOYEES IN 2016 Among the top 3 technology Score 88% firms 31% WOMEN IN THE GROUP 193,170 Happy Trainees Sopra Steria shares accreditation bought by employees in France for the No. 1 recruiter of via "We Share 2016" 4th consecutive year young graduates in the digital fi eld in France 69% (-) 6.6 % (-) 19% 98% Share of energy from Overall reduction in Reduction including Of Waste Electrical renewable sources in greenhouse gas emissions renewable energy & Electronic Equipment electricity consumption of relative to 2014 (WEEE) gets a second offi ces and on-site data centres life Target: 15% reduction by 2020 relative to 2014 C ertifi cations For more information, see Chapter 3 Registration Document 2016 - Sopra Steria 11 3 CORPORATE RESPONSIBILITY Sopra Steria: committed to a more sustainable world 82 1. -

India Rankings 2017 ID Institute Name Discipline

Institute Name MAHARAJA AGRASEN INSTITUTE OF TECHNOLOGY India Rankings 2017 ID IR17-ENGG-2-12853 Discipline ENGNEERING Parameter Placement No of Minimum Maximum Average Median 3A.GPHE S.No. Academic Year Name of the Company students salary salary salary salary recruited Offered offered offered offered ION TRADING 5 2.5 10.5 4.95118 4.875 PAY U 5 ZS ASSOCIATES 21 UNISYS 7 LIBSYS 1 SAMSUNG 3 CUBASTION 1 JOSH TECHNOLOGY 1 ACCENTURE 447 INFOSYS 259 MUSIGMA 35 VINSOL 5 NEWGEN 3 NAGARRO 3 OPERA SOLUTIONS 3 ERNEST &YOUNG 6 RANE GROUP 3 1 2015-16 TIMES INTERNET 2 SOPRA STERIA 1 GLOBAL LOGIC 3 ELGI 1 HCL TECHNOLOGIES 7 COMPRO TECH. 1 TRIGENT SOFTWARE 4 INDUS TOWER 1 CONSULT ADD 2 ANGLO-EASTERNSHIP 1 SAMSUNG 2 SAMSUNG 2 INDIAN ARMY 7 INDIAN AIR FORCE 4 INDIAN NAVY 6 Amazon 4 SAPIENT 5 HACKER RANK 1 1.8 15.36 4.6598 3.64 IGNITE WORLD 1 MICROSOFT 3 INFOSYS 288 ACCENTURE 268 NEWGEN 3 CVENT 3 VINSOL 2 CSC 10 MUSIGMA 7 LIBSYS 1 OPTIMUS 1 MPHASIS 3 NAGARRO 3 STERIA 1 EATON 1 COMPRO TECH. 3 ANGLO EASTERNSHIP 14 E&Y 6 TAVANT 4 SVAM INTERNATIONAL 5 2 2014-15 OSS CUBE 1 ARICENT 7 HCL TECH. 10 PRACTO TECH. 3 HETTICH 2 TIMES INTERNET 2 COPPER MOBILE 7 APPS DISCOVER 2 SANMAR GROUP 1 ZS ASSOCIATES 13 INDIAN ARMY 11 INDIAN NAVY 6 INDIAN AIR FORCE 4 W&H 1 HIKE 1 ABP HOLDING 1 MIND TREE 2 ION TRADING 4 ERICSSON 7 ASPIRING MINDS 1 CMS 1 MICROSOFT 1 1.5 10.02 3.9914 3.5 GULF BIO ANALYTICS, DUBAI 1 3 2013-14 ROYAL BANK OF SCOTLAND 1 ADOBE 1 CAPITAL IQ 1 JOSH TECHNOLOGY 1 ZS ASSOCIATES 16 SAMSUNG 5 Aakash Educational Services Pvt Ltd. -

Oberweis Micro-Cap Fund Schedule of Investments (Unaudited) March 31, 2020

Date: 05/28/2020 03:55 PM Toppan Merrill Project: 20-19498-25 Form Type: NPORT-EX Client: 20-19498-25_Oberweis - OBERWEIS FUNDS_NPORT-EX File: tm2019498d25_nportex.htm Type: NPORT- EX Pg: 1 of 9 Oberweis Micro-Cap Fund Schedule of Investments (unaudited) March 31, 2020 Shares Value Equities 91.6% Alternative Energy 1.5% Ameresco, Inc.* 40,608 $ 691,554 Back Office Support, Human Resources & Consulting 2.7% CRA International, Inc. 18,800 628,108 Huron Consulting Group, Inc.* 14,000 635,040 1,263,148 Banks - Diversified 1.8% Enterprise Financial Services Corp. 19,700 549,827 First Foundation, Inc. 26,300 268,786 818,613 Banks - Savings, Thrifts & Mortgage 1.3% Meta Financial Group, Inc. 27,300 592,956 Biotechnology 8.8% Baudax Bio, Inc.* 79,660 197,557 Castle Biosciences, Inc.* 43,700 1,302,697 Coherus Biosciences, Inc.* 32,800 532,016 Collegium Pharmaceutical, Inc*. 46,000 751,180 Pfenex, Inc.* 45,200 398,664 Recro Pharma, Inc.* 104,100 850,497 4,032,611 Building Materials 1.0% Griffon Corp. 36,800 465,520 Commercial Services - Rental & Leasing 1.5% McGrath RentCorp. 12,900 675,702 Commercial Vehicles & Parts 1.6% Spartan Motors, Inc.* 57,700 744,907 Communications Technology 4.6% Bandwidth, Inc.* 13,249 891,525 Comtech Telecommunications Corp. 13,700 182,073 Digi International, Inc.* 60,400 576,216 Harmonic, Inc.* 80,600 464,256 2,114,070 Computer Services Software & Systems 20.6% Bottomline Technologies (DE), Inc.* 22,400 820,960 ChannelAdvisor Corp.* 80,000 580,800 Digital Turbine, Inc.* 162,000 698,220 EverQuote, Inc.* 22,300 585,375 Limelight Networks, Inc.* 207,300 1,181,610 Model N, Inc.* 39,200 870,632 OneSpan, Inc.* 70,700 1,283,205 Perficient, Inc.* 22,500 609,525 Telaria, Inc.* 166,800 1,000,800 The Rubicon Project, Inc.* 146,200 811,410 Upland Software, Inc.* 21,900 587,358 Zix Corp.* 100,600 433,586 9,463,481 Computer Technology 0.8% Impinj, Inc.* 21,000 350,910 Diversified Manufacturing Operations 3.1% Federal Signal Corp.