03.031 Socc04 Final 2(R)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

United States Bankruptcy Court Eastern District of Pennsylvania Authorized Mediation Panel

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF PENNSYLVANIA AUTHORIZED MEDIATION PANEL Effective – July 01, 2014 to December 31, 2014 MEDIATOR PHILADELPHIA READING Kenneth E. Aaron, Esquire Weir & Partners LLP The Widener Building X 1339 Chestnut Street, Suite 500 Philadelphia, PA 19107 Kurt Althouse, Esquire Bingaman Hess Treeview Corporate Center X Two Meridian Boulevard, Suite 100 Wyomissing, PA 19610 Derek J. Baker, Esquire Reed Smith LLP 2400 One Liberty Place X 1650 Market Street Philadelphia, PA 19103-7301 Leslie Beth Baskin, Esq. Spector, Gadon & Rosen, P.C. Seven Penn Center X 1635 Market Street, Seventh Floor Philadelphia, PA, 19103 Leslie A. Berkoff, Esquire Moritt Hock & Hamroff LLP X X 400 Garden City Plaza Garden City, New York 11530 Michael A. Bloom, Esquire Morgan Lewis & Bockius, LLP X 1701 Market Street Philadelphia, PA 19103-2921 Amelia H. Boss, Esquire 3320 Chestnut Street X Philadelphia, PA 19104 MEDIATOR PHILADELPHIA READING Eden R. Bucher, Esquire Leisawitz Heller Abramowitch Phillips, P.C. X 2755 Century Boulevard Wyomissing, PA 19610 Kenneth F. Carobus, Esquire Morris & Adelman, P.C. X 1920 Chestnut Street, Suite 300 Philadelphia, PA 19103-4620 Dexter K. Case, Esquire Case, DiGiamberardino & Lutz, P.C. X X 845 North Park Road, Suite 101 Wyomissing, PA 19610 John A. DiGiamberardino, Esquire Case, DiGiamberardino & Lutz, P.C. 845 North Park Road X Suite 101 Wyomissing, PA 19610 Anthony R. Distasio, Esquire Linton Distasio Adams 1720 Mineral Spring Road X P.O. Box 461 Reading, PA 19603-0461 David A. Eisenberg, Esquire 3140 Tilghman Street X PMB #321 Allentown, PA 18104 Joseph B. Finlay, Jr., Esquire THE VIRTUAL LAW FIRM X P.O. -

The “International” Skyscraper: Observations 2. Journal Paper

ctbuh.org/papers Title: The “International” Skyscraper: Observations Author: Georges Binder, Managing Director, Buildings & Data SA Subject: Urban Design Keywords: Density Mixed-Use Urban Design Verticality Publication Date: 2008 Original Publication: CTBUH Journal, 2008 Issue I Paper Type: 1. Book chapter/Part chapter 2. Journal paper 3. Conference proceeding 4. Unpublished conference paper 5. Magazine article 6. Unpublished © Council on Tall Buildings and Urban Habitat / Georges Binder The “International” Skyscraper: Observations While using tall buildings data, the following paper aims to show trends and shifts relating to building use and new locations accommodating high-rise buildings. After decades of the American office building being dominate, in the last twelve years we have observed a gradual but major shift from office use to residential and mixed-use for Tall Buildings, and from North America to Asia. The turn of the millennium has also seen major changes in the use of buildings in cities having the longest experience with Tall Buildings. Chicago is witnessing a series of office buildings being transformed into residential or mixed-use buildings, a phenomenon also occurring on a large scale in New York. In midtown Manhattan of New York City we note the transformation of major hotels into residential projects. The transformation of landmark projects in midtown New York City is making an impact, but it is not at all comparable to the number of new projects being built in Asia. When conceiving new projects, we should perhaps bear in mind that, in due time, these will also experience major shifts in uses and we should plan for this in advance. -

CONTACT: Cara Schneider (215) 206-2034, [email protected] REASONS the PHILADELPHIA REGION IS a MUST-VISIT THIS SPRING New

CONTACT: Cara Schneider (215) 206-2034, [email protected] REASONS THE PHILADELPHIA REGION IS A MUST-VISIT THIS SPRING New Museum Opens On Independence Mall & Philadelphia Museum of Art Opens New Galleries As Part Of Major Renovation PHILADELPHIA, March 1, 2021 – As spring nears and COVID-19 restrictions continue to lift, the Philadelphia region is eager to welcome visitors to safely explore new, renovated and just-reopened museums; inspired exhibits; beloved annual events; and brand new hotels. Those looking to dip their toes back into travel after a long hiatus can explore the brand-new Faith and Liberty Discovery Center, making its debut on Independence Mall in May; check out the Philadelphia Museum of Art’s new galleries, part of a Frank Gehry-designed interior expansion and renovation; and take a special twilight tour of the haunting Eastern State Penitentiary, also hosting its first-ever beer garden in the baseball diamond. When it’s time to rest their tired feet after days spent touring the town, visitors can do so at the city’s first W Hotel or at the Guild House Hotel, a boutique property in a National Historic Landmark building, both opening in spring. Another great option for spending a night or two is the ever-popular Visit Philly Overnight Hotel Package, which includes hotel parking and buy-one-get-one-free tickets for 19 attractions, many of which are hosting special exhibits this spring (see below). It’s available at 40 hotels and bookable at visitphilly.com/overnight. Here’s a look at why Philadelphia is a must-visit this spring: Museum Openings & Renovations: • Independence Seaport Museum – The first day of spring brings with it the reopening of the Delaware River Waterfront museum focused on national maritime history. -

2008 Annual Report

2008 ANNUAL REPORT Mission Statement Hill International’s mission is to be the very best professional services firm in the world helping our clients minimize the risks inherent in the construction process. Corporate Summary For more than three decades, public- and private-sector clients worldwide have selected Hill International (NYSE:HIL) as construction consultants on their most complex projects. Each of our clients has unique needs and goals, yet they choose Hill because they need experts who can prevent problems, minimize risks and eliminate surprises – they need a firm they can trust who will deliver results. Meeting our clients’ diverse needs in managing construction risk and exceeding their highest expectations is our goal at Hill. We accomplish this objective by providing a broad range of project management and construction claims services that support our clients during every phase of a project, from planning and design, through procurement and construction, to start-up and operation. With 2,376 employees in 80 offices in 30 countries around the world, Hill has the experience and the expertise to help our clients deliver their projects on time, within budget and with the highest quality possible. Worldwide Offices Americas Europe Middle East Baltimore, MD Ankara, Turkey Abu Dhabi, UAE Bellevue, WA Athens, Greece Ajman, UAE Bensalem, PA Barcelona, Spain Baghdad, Iraq Boston, MA Belgrade, Serbia Doha, Qatar Cancun, Mexico Birmingham, UK Dubai, UAE Chicago, IL Bristol, UK Jeddah, Saudi Arabia Dallas, TX Bucharest, Romania Manama, -

Philadelphia in Philadelphia, Your STEM Students Can Explore a City Filled with Robotics, Fossils, Butterflies, VR Experiences, Flight Simulators, and So Much More

TOP STEM DESTINATIONS: Philadelphia In Philadelphia, your STEM students can explore a city filled with robotics, fossils, butterflies, VR experiences, flight simulators, and so much more. If your students are ready to become detectives and examining skeletal remains, explore the “heart” of the Franklin Institute, or take lessons have been developed to meet Educational Standards, including Pennsylvania State Standards and the Next Generation Science Standards, Educational Destinations can make your Philadelphia history trip rewarding and memorable. EDUCATIONAL STEM OPPORTUNITIES: • Meet Pennsylvania Academic Standards • Discovery Camps • Interactive School Tours • Museum Sleepovers • Be a Forensic Anthropologist • Philadelphia Science Festival (Spring) • Scavenger Hunts • Live Science Shows • Animal Encounters • Tech Studios • Amazing Adaptations • Robotics Workshops • Escape Rooms • Movie-Making Workshops • Virtual Reality Experiences • Drone Workshops • Flight Simulators • Game Design Workshops • Planetarium Exhibits • Lego Robotics • Survivial Experiences • Engineering for Kids STEM ATTRACTIONS: • University of Pennsylvania • Garden State Discovery Museum • Penn Museum • Greener Partners’ Longview Farm • The Franklin Institute • Independence Seaport Museum • Mütter Museum at The College of Physicians of Philadelphia • John Heinz National Wildlife Refuge at Tinicum • Pennsylvania Hospital Physic Garden • John James Audubon Center at Mill Grove • Philadelphia Insectarium and Butterfly Pavilion • Linvilla Orchards • Academy of Natural Sciences -

599-2291, [email protected] Arturo Varela (267) 765-0387, [email protected] Tweet Us: @Visitphillypr

CONTACTS: Deirdre Hopkins (215) 599-2291, [email protected] Arturo Varela (267) 765-0387, [email protected] Tweet Us: @visitphillyPR Tweet It: The Fourth of July in @visitphilly means six days of free parties, bands, fireworks, museum access, outdoor movies and a grand finale concert with @IAMJHUD and @Meghan_Trainor: https://vstphl.ly/2WUxW3r PHILADELPHIA THROWS AN EPIC FOURTH OF JULY PARTY IN 2019 Six-Day Wawa Welcome America Festival Features Free Fireworks, Concerts, Movies, Museum Access & More PHILADELPHIA, May 20, 2019 – Renowned for its preeminent Independence Day—full of free events that last nearly a whole week—Philadelphia, the birthplace of the United States, hosts Wawa Welcome America, June 29-July 4. Over the course of six days (and nights), resident and visitors are treated to three fireworks shows (plus two more for Phillies fans at Citizens Bank Park), a proud U.S. military showing and thoughtful community activations, in addition to museum access, patriotic street festivals and moving ceremonies. What’s more, the festival’s grand finale includes fireworks and an outdoor concert by Jennifer Hudson alongside the Philly POPS Big Band, and Meghan Trainor in front of the iconic Philadelphia Museum of Art. The best way to enjoy America’s best July Fourth festival is to spend the night in Philadelphia. And the best way to stay over in Philly is to book the Visit Philly Overnight Hotel Package, whose highest- value-ever summer edition comes with hotel parking, a Garces Group restaurant card, rides on Penn’s Landing’s Ferris wheel, Franklin Square’s carousel and the PHLASH loop, and more. -

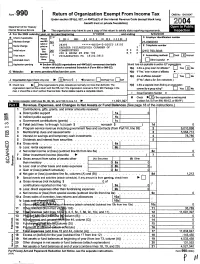

Return of Organization Exempt from Income

Form' 99'0 Return of Organization Exempt From Income Tax OMB No 1545-0047 -Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung 2j 004 benefit trust or private foundation) [L Department of the Treasury 0 • ' • " • Internal Revenue Service Jill, The organization may have to use a copy of this return to satisfy state reporting requirements. IW-Nis eilrel l. A For the 2004 calendar ear or tax year beginning 7/1/2004 and ending 6/30/2005 C N D Employer Identification number B Check if applicable. Please Illt���l�nnl�'��nlrlll Il�ll�l111111 �llln�l�l�t��rl�� Add ress change use IRS Gr! 23-0969030 label or 28395 *****"AUTO**5-DIGIT 19102 Name change print or IN E Telephone number GREATER PHILADELPHIA CEiAMBER OF I initial return type COMMERCETERS P 4 R Fj See 20( B 9 S 215 790-3646 specific 200 S BROAD ST STE 700 C F Accounti ng method : ❑Cash EX Accrual FIFinal return Instruc- PHILADELPHIA PA 19102 - 3813 dons. ► fl Amended return Phi l 31 I]Other (specify) El Application pending • Section 501 (c)(3) organizations and 4947( a)(1) nonexempt charitable H and I are not applicable to section 527 organizations. trusts must attach a completed Schedule A (Form 990 or 990-EZ). H(a) Is this a group return for affiliates? El Yes FX No H(b) If "Yes," enter number of affiliates ► _ H(c) Are all affiliates included? 0 Yes No J Organization type (check only one) ► U501(c) (6 ) -4 (insert no) U4947(aX1) or U527 (If "No," attach a list See instructions ) K Check here ►[:]d the organization's gross receipts are normally not more than $25,000. -

Pennsylvania's Largest Employers (At Least 1,000 Employees)

Pennsylvania's Largest Employers (At Least 1,000 Employees) 1st Quarter, 2018 Combined Government Ownerships Center for Workforce Information & Analysis (877) 4WF-DATA • www.workstats.dli.pa.gov • [email protected] September 2018 Rank Employer Rank Employer 1 Federal Government 51 ACME Markets Inc 2 State Government 52 Aerotek Inc 3 Wal-Mart Associates Inc 53 Geisinger Medical Center 4 Trustees of the University of PA 54 Reading Hospital 5 City of Philadelphia 55 Dolgencorp LLC 6 Pennsylvania State University 56 Carnegie Mellon University 7 Giant Food Stores LLC 57 Abington Memorial Hospital 8 School District of Philadelphia 58 FedEx Ground Package System Inc 9 UPMC Presbyterian Shadyside 59 Highmark Inc 10 United Parcel Service Inc 60 Kohl's Department Stores Inc 11 PNC Bank NA 61 Rite Aid of Pennsylvania Inc 12 University of Pittsburgh 62 Marmaxx Operating Corporation 13 Lowe's Home Centers LLC 63 The Hershey Company 14 Weis Markets Inc 64 Wells Fargo NA 15 The Children's Hospital of Philadelphia 65 Temple University Hospital Inc 16 Comcast Cablevision Corp (PA) 66 York Hospital 17 Home Depot USA Inc 67 SmithKline Beecham Corporation 18 PA State System of Higher Education 68 Starbucks Corporation 19 Giant Eagle Inc 69 Boscov's Department Store LLC 20 Amazon.com DEDC LLC 70 School District of Pittsburgh 21 The Vanguard Group Inc 71 UPMC Pinnacle Hospitals 22 Target Corporation 72 Geisinger Clinic 23 Merck Sharp & Dohme Corporation 73 Dick's Sporting Goods Inc 24 Western Penn Allegheny Health 74 Hershey Entertainment & Resorts Co 25 -

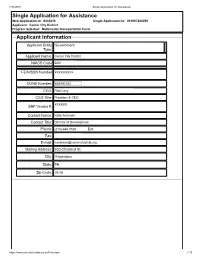

Penn Center Plaza Transportation Gateway Application ID 8333219 Exhibit 1: Project Description

MULTIMODAL TRANSPORTATION FUND APPLICATION Center City District: Penn Center Plaza Transportation Gateway Application ID 8333219 Exhibit 1: Project Description The Center City District (CCD), a private-sector sponsored business improvement district, authorized under the Commonwealth’s Municipality Authorities Act, seeks to improve the open area and entrances to public transit between the two original Penn Center buildings, bounded by Market Street and JFK Boulevard and 15th and 16th Streets. In 2014, the CCD completed the transformation of Dilworth Park into a first class gateway to transit and a welcoming, sustainably designed civic commons in the heart of Philadelphia. In 2018, the City of Philadelphia completed the renovations of LOVE Park, between 15th and 16th Street, JFK Boulevard and Arch Street. The adjacent Penn Center open space should be a vibrant pedestrian link between the office district and City Hall, a prominent gateway to transit and an attractive setting for businesses seeking to capitalize on direct connections to the regional rail and subway system. However, it is neither well designed nor well managed. While it is perceived and used as public space, its divided ownership between the two adjacent Penn Center buildings and SEPTA has long hampered efforts for a coordinated improvement plan. The property lines runs east/west through the middle of the plaza with Two Penn Center owning the northern half, 1515 Market owning the southern half and neither party willing to make improvements without their neighbor making similar improvements. Since it opened in the early 1960s, Penn Center plaza has never lived up to its full potential. The site was created during urban renewal with the demolition of the above ground, Broad Street Station and the elevated train tracks that ran west to 30th Street. -

Arts, Culture, and Economic Prosperity in Greater Philadelphia

arts culture & economic prosperity in Greater Philadelphia Peggy Amsterdam, President Greater Philadelphia Cultural Alliance One of the most frequent requests to the Greater Philadelphia Cultural Alliance is for the economic impact of the region’s cultural sector. It is with great pleasure, then, that we present Arts, Culture, and Economic Prosperity in Greater Philadelphia, the latest data available regarding the economic activity of our region’s nonprofit arts and cultural organizations and their audiences. This report is the result of collaboration among many partners, including Americans for the Arts, the Pennsylvania Cultural Data Project (PACDP), Metropolitan Philadelphia Indicators Project, and Drexel University’s Arts Administration Graduate Program. We thank the cultural organizations whose participation in the PACDP made this report possible, in particular those who allowed us to survey their audience members. We are also grateful to The Pew Charitable Trusts and the William Penn Foundation for their support of the Cultural Alliance, and to Tom Scannepieco and 1706 Rittenhouse Associates for supporting the design, printing, and distribution of this report. We express sincere gratitude to our external reviewers, board of directors, and staff, who guided the work through its inception and development. Much growth has occurred in our sector over the last decade. Through the information, analysis, and tools contained within this report, we trust that Arts, Culture, and Economic Prosperity in Greater Philadelphia will help us all in the quest to continue building an ever-stronger, more vibrant region. Tom Scannapieco, Partner Joe Zuritsky, Partner 1706 Rittenhouse Square Associates Over the past decade, Greater Philadelphia has experienced remarkable growth. -

Annual Report 2018

2018 Annual Report 4 A Message from the Chair 5 A Message from the Director & President 6 Remembering Keith L. Sachs 10 Collecting 16 Exhibiting & Conserving 22 Learning & Interpreting 26 Connecting & Collaborating 30 Building 34 Supporting 38 Volunteering & Staffing 42 Report of the Chief Financial Officer Front cover: The Philadelphia Assembled exhibition joined art and civic engagement. Initiated by artist Jeanne van Heeswijk and shaped by hundreds of collaborators, it told a story of radical community building and active resistance; this spread, clockwise from top left: 6 Keith L. Sachs (photograph by Elizabeth Leitzell); Blocks, Strips, Strings, and Half Squares, 2005, by Mary Lee Bendolph (Purchased with the Phoebe W. Haas fund for Costume and Textiles, and gift of the Souls Grown Deep Foundation from the William S. Arnett Collection, 2017-229-23); Delphi Art Club students at Traction Company; Rubens Peale’s From Nature in the Garden (1856) was among the works displayed at the 2018 Philadelphia Antiques and Art Show; the North Vaulted Walkway will open in spring 2019 (architectural rendering by Gehry Partners, LLP and KXL); back cover: Schleissheim (detail), 1881, by J. Frank Currier (Purchased with funds contributed by Dr. Salvatore 10 22 M. Valenti, 2017-151-1) 30 34 A Message from the Chair A Message from the As I observe the progress of our Core Project, I am keenly aware of the enormity of the undertaking and its importance to the Museum’s future. Director & President It will be transformative. It will not only expand our exhibition space, but also enhance our opportunities for community outreach. -

Prnpolicy Review & News

Policy Review & News Important information about Highmark Blue Shield August 2007 www.highmarkblueshield.comPRN In This Issue Blue Shield adds adultBasic and CHIP language to PremierBlue Shield preferred provider regulations............................................1 MA Blue Shield’s documentation requirements outlined ....................5 Look for this Blue Shield reimbursement changes approved ..........................10 symbol for all Medicare Advantage Blue Shield changes coverage guidelines for erythropoiesis- related stimulating agents ......................................................................11 information News Blue Shield adds adultBasic and CHIP language to PremierBlue Shield preferred provider regulations Highmark Blue Shield has revised its PremierBlueSM Shield preferred provider regulations to comply with the adultBasic/CHIP language. The revision consists of adding a new appendix, Appendix D, to the existing regulations. This revision will become effective on Nov. 11, 2007. Blue Shield will send a copy of Appendix D to all of its PremierBlue Shield preferred providers. The revision applies to this regulation: • Highmark Blue Shield PremierBlue Shield Regulations for Preferred Providers (form PB7) Highmark is a registered mark of Highmark Inc. Blue Shield and the Shield symbol are registered service marks of the Blue Cross and Blue Shield Association, an association of independent Blue Cross and Blue Shield Plans. PRN Here is the adultBasic/CHIP language that has been included in Appendix D: APPENDIX D ADULTBASIC