Annual Bank Supervision Report 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Economists Paint a Bleak Picture of Economy As Virus Hits Harder

WITHOUT F EAR OR FAVOUR Nepal’s largest selling English daily Vol XXVIII No. 191 | 8 pages | Rs.5 O O Printed simultaneously in Kathmandu, Biratnagar, Bharatpur and Nepalgunj 35.0 C 13.0 C Thursday, September 03, 2020 | 18-05-2077 Nepalgunj Jomsom Economists paint a bleak picture of economy as virus hits harder With rising virus caseload, authorities are tightening curbs which could result in a massive economic contraction. PRITHVI MAN SHRESTHA end of the last fiscal year 2019-20, KATHMANDU, SEPT 2 down around Rs17 billion. “This suggests that there has been In normal times, the country’s com- greater recovery of existing loans than mercial banks would be busy issuing new loans,” said Bhuvan Dahal, chief loans right and left at the start of executive officer of Sanima Bank. every new fiscal year. In mid-July, The government on July 21 decided lenders would be bracing for a hectic to lift the lockdown. season. As the country saw a massive spike “That is the time importers seek in the Covid-19 caseload, local admin- loans for importing goods targeting istrators imposed prohibitory orders the Dashain and Tihar festivals,” said in various districts, shutting down Gunakar Bhatta, spokesperson for businesses and factories again. Nepal Rastra Bank. “But the report I Kathmandu, Lalitpur and Bhaktapur, have received shows that banks have the three districts in the Kathmandu been hardly issuing loans since the Valley, too were put under prohibitory fiscal year started.” orders effective August 19 midnight, When the current fiscal year started shattering hopes of an economic on July 16, the entire country was in recovery. -

D.N.Shah & Associates

D.N.Shah & Associates Membership No.200 COP No. 164 Chartered Accountants The Institute of Chartered PAN No. 301330714 Nayabaneswar, Kathmandu, Nepal. Accountants of Nepal. 01-5553879,5 I 8501 I Date: - 2075.09.29 INDEPENDENT AUDITOR'S REPORT TO THE SHAREHOLDERS OF RADHI BIDYUT COMPANY LIMITED (RBCL) We have audited the accompanying financial statements of Radhi Bidyut Company Limited, (hereinafter collectively referred to as the "the Compffiy"), which comprise the Statement of Financial Position as at 32"d Ashad,2075116th July,2018), and alio the Statement of Profit or Loss and other Comprehensive Income, the statement of Changes in Equity and the Statement of Cash Flows for the year ended and a sunmary of Significant Accounting Policies andNotes to the financial statements, MANAGEMENT'S RESPONSIBILITY FOR THE FINANCIAL STATEMMNTS Management is responsible for the preparation presentation and fair - of these financial statements iii accordance with Nepal Financial Reporting Standards (NFRS), and for such internal conrrol as management determines is necessary to enable the preparation of financial statements that are free foom material misstatement, whether due to tiaud or error. AUDITOR'S RESPONSIBILITY Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with Nepal Standards on Auditing.. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor's judgment. -

1.2 District Profile Kailali English Final 23 March

"Environmnet-friendly Development, Maximum Use of Resources and Good Governance Overall Economic, Social and Human Development; Kailali's Pridefulness" Periodic District Development Plan (Fiscal Year 2072/073 − 2076/077) First Part DISTRICT PROFILE (Translated Version) District Development Committee Kailali March 2015 Document : Periodic District Development Plan of Kailali (F/Y 2072/73 - 2076/77) Technical Assistance : USAID/ Sajhedari Bikaas Consultant : Support for Development Initiatives Consultancy Pvt. Ltd. (SDIC), Kathmandu Phone: 01-4421159, Email : [email protected] , Web: www.sdicnepal.org Date March, 2015 Periodic District Development Plan (F/Y 2072/073 - 2076/77) Part One: District Profile Abbreviation Acronyms Full Form FY Fiscal year IFO Area Forest Office SHP Sub Health Post S.L.C. School Leaving Certificate APCCS Agriculture Production Collection Centres | CBS Central Bureau of Statistics VDC Village Development Committee SCIO Small Cottage Industry Office DADO District Agriculture Development Office DVO District Veterinary Office DSDC District Sports Development Committee DM Dhangadhi Municipality PSO Primary Health Post Mun Municipality FCHV Female Community Health Volunteer M Meter MM Milimeter MT Metric Ton TM Tikapur Municipality C Centigrade Rs Rupee H Hectare HPO Health Post HCT HIV/AIDS counselling and Testing i Periodic District Development Plan (F/Y 2072/073 - 2076/77) Part One: District Profile Table of Contents Abbreviation .................................................................................................................................... -

August, 2019 2Nd Annual Report 2075/76

Presented By: Fund Manager Presented To: Unit Holders, Fund Supervisors & SEBON Annual Report of Sanima Mutual Fund for the FY 2075/76 as per rule number 42(1) of prevailing Mutual Fund Regulations, 2067 August, 2019 2nd Annual Report 2075/76 • Sanima Mutual Fund Mutual Fund Narayanchaur, Naxal, Kathmandu, Nepal • Registered Office: Sanima Bank Limited Fund Sponsor Narayanchaur, Naxal, Kathmandu, Nepal • Registered Office: Sanima Capital Limited Fund Narayanchaur, Naxal, Kathmandu, Nepal Manager • Registered Office: Sanima Capital Limited Depository Narayanchaur, Naxal, Kathmandu, Nepal • CA. Tirtha Raj Upadhyay • Dr. Hemanta Kumar Dabadi Fund • Mr. Khyam Narayan Dhakal Supervisors • Mr. Lalit Bahadur Basnet • Mr. Madhav Prasad Dhakal 1 2nd Annual Report 2075/76 Sr. No. Index . 1. Fund Manager Report 2. Independent Auditors Report 3. Balance Sheet 4. Income Statement 5. Statement Of Cash Flows 6. Statement Of Changes In Equity 7. Annexures 8. Significant Accounting Policies 9. Notes To Accounts Sanima Capital Limited Registered/Corporate Office: Narayanchaur, Naxal, Kathmandu, State Number 3, Nepal. Email: [email protected] Tel: +977-1-4428956/57 │Fax: +977-1-4428958 Website: www.sanima.capital 2 FUND MANAGER REPORT REPoRTFRoMsAN|MACAP|TALL|M|TEDToTHEUN|THoLDERSoFTHE SCHEME(S) OF SANIMA MUTUAL FUND Dear Unit holders, 2nd Report of It gives us great pleasure to communicate with you and present to you the Annual 31' Sanima Mutual Fund ("the Mutual Fund" or "the Fund") for the financial year ended Ashad 2076 (6th July, 2019), (.FY 2O75t7 6" / "review period") along with the audited financial statements of the Scheme(s). Mutual sanima Bank Limited ("the Fund sponsor" or "the Sponsor") had registered "Sanima various Fund" with the securities Board of Nepal (SEBON) with the objective of introducing SchemesintheNepa|esecapitalMarketthroughitssubsidiarycompanySanimacapita| ,.the Limited (..the Fund Managei' and Depository,'), and commenced its operations' ,1. -

366 14 - 20 September 2007 16 Pages Rs 30

#366 14 - 20 September 2007 16 pages Rs 30 Weekly Internet Poll # 366 Q. Who is most against elections happening? Total votes: 4,650 No accident Weekly Internet Poll # 367. To vote go to: www.nepalitimes.com Q. How should we settle the fate of monarchy? FLOOD OF TEARS: The ill-fated microbus is pulled out of the flooded Dhansar river in Rautahat the morning after five people perished. UPENDRA LAMICHHANE/KANTIPUR Accidents don’t just happen, they are a result of corruption and war he microbus carrying a microbus got stuck mid-river. artery, was knocked out by a Whenever the water receded, newly-wed couple and their As the bus headlamps flood three years ago. Makeshift passengers would make the T relatives left Dhankuta on illuminated the swollen river, the repairs allowed it to keep perilous crossing on foot to catch Saturday afternoon for the passengers got out to push. Just functioning while wheeling a bus on the other side. overnight journey to Kathmandu. then a flashflood engulfed the dealing on the contract delayed The microbus arrived at the It was important to cross the vehicle. The newlyweds, Raju and construction of a new bridge. broken bridge and seeing a bus troubled eastern tarai at night, Kimila Shrestha, and two other The work had just begun at making it safely across, took the despite the danger of highway passengers held on to the roof, the height of the Maoist war in fateful decision to cross. robberies, because of road but five others were washed away 2004 when guerrillas demanded This isn’t the first time a bus blockades and disruptions in the with logs and other debris that Rs 1.5 million from the has been washed away by daytime. -

Sixty Years of Nepal Rastra Bank

Sixty Years of Nepal Rastra Bank Nepal Rastra Bank Kathmandu, Nepal April 2018 ©Nepal Rastra Bank, 2018 Address Central Office Baluwatar, Kathmandu Nepal Telephone: 977 1 4410386 Fax: 977 1 4410159 Sixty Years of Nepal Rastra Bank Published: April 2018 ISBN: Printed by UDAYA PRINT MEDIA PVT. LTD. Baneshwor-10, Kathmandu Phone No.: 01-5172093 [email protected] All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged. An electronic copy of this book is available at www.nrb.org.np. Foreword Nepal Rastra Bank (NRB) was established as the central bank of the country on April 26, 1956. During its six-decade long journey, NRB has made a significant progress in monetary, foreign exchange, and financial sectors. This publication 'Sixty Yeears of Nepal Rastra Bank' has been commissioned to commemorate NRB's reaching its sixty-year milestone by taking a walk down the memory lane of the major course of actions taken, progression of institutional development and evolution of its major functions. During the span of six decades, besides responsibly carrying out the traditional central banking roles and responsibilities, NRB has remained a firm anchor, constantly providing the solid foundation for ensuring monetary and financial stability. Over the years, monetary management has been streamlined and strengthened while the financial sector has been expanded and consolidated. For undertaking such responsibilities, NRB has transformed its organizational structure and management process for catalyzing the opportunities and proactively mitigating the challenges. Nepal Rastra Bank has sought to devise and implement appropriate and timely policy measures to promote financial sector development, orient monetary management towards improving price, balance of payments, financial sector and exchange rate stability, as well as facilitating the overall development of the economy. -

List of Banks and Financial Institutions As of Mid Apr, 2021 (Licensed by NRB)

List of Banks and Financial Institutions As of Mid Apr, 2021 (Licensed by NRB) Class: "A" (Commercial Banks) (Rs. in Crore) Operation Paid up S.No. Name Head Office Working Area Date (A.D.) Capital 1 Nepal Bank Ltd. 1937/11/15 Dharmapath,Kathmandu 1263.68 National Level 2 Agriculture Development Bank Ltd. 1968/01/21 Ramshahpath, Kathmandu 1642.26 National Level 3 Nabil Bank Ltd. 1984/07/12 Beena Marg, Kathmandu 1348.02 National Level 4 Nepal Investment Bank Ltd. 1986/03/09 Durbarmarg, Kathmandu 1625.73 National Level 5 Standard Chartered Bank Nepal Ltd. 1987/02/28 Nayabaneshwor, Kathmandu 857.22 National Level 6 Himalayan Bank Ltd. 1993/01/18 Kamaladi, Kathmandu 1068.44 National Level 7 Nepal SBI Bank Ltd. 1993/07/07 Kesharmahal, Kathmandu 949.36 National Level 8 Nepal Bangaladesh Bank Ltd. 1994/06/06 Kamaladi, Kathmandu 900.48 National Level 9 Everest Bank Ltd. 1994/10/18 Lazimpat , Kathmandu 893.37 National Level 10 Kumari Bank Ltd. 2001/04/03 Durbarmarg, Kathmandu 1387.85 National Level 11 Laxmi Bank Ltd. 2002/04/03 Hattisar, Kathmandu 1069.57 National Level 12 Citizens Bank International Ltd. 2007/04/20 Narayanhitipath, Kathmandu 1166.20 National Level 13 Prime Commercial Bank Ltd. 2007/09/24 Kamalpokhari, Kathmandu 1608.30 National Level 14 Sunrise Bank Ltd. 2007/10/12 Gairidhara, Kathmandu 948.79 National Level 15 Century Commercial Bank Ltd. 2011/03/10 Putalisadak , Kathmandu 903.44 National Level 16 Sanima Bank Ltd. 2012/02/15 Nagpokhari, Kathmandu 968.15 National Level 17 Machhapuchhre Bank Ltd. 2012/07/09* Lazimpat , Kathmandu 905.31 National Level 18 NIC Asia Bank Ltd. -

CF-LNOB - Feb & March 2020\6

Purnima: UK Support to Post- Earthquake Recovery in Nepal Mott MacDonald Sanepa Lalitpur Nepal mottmac.com Purnima: UK Support to Post- Earthquake Recovery in Nepal Proof of Concept and Expansion Readiness Review of Challenge Fund-LNOB DFID 389785 OA4-TOR6 A D:\Kiran\MM\4. Proof of Concept Review of CF-LNOB - Feb & March 2020\6. PoC Review Final report\POC Report-FINALLY REVISED-25042020 sw.docx Mott MacDonald April 2020 Mott MacDonald Ltd, Nepal Branch, Post Box No. 3761, Kathmandu, Nepal. Registered no. 176230/074/075. Issue and Revision Record Revision Date Originator Checker Approver Description April SRI Helen SEH 2020 Wedgwood Kiran Wagle Document reference: 389785 | OA4-TOR6 | Assessment Information class: Standard This document is issued for the party which commissioned it and for specific purposes connected with the above-captioned project only. It should not be relied upon by any other party or used for any other purpose. We accept no responsibility for the consequences of this document being relied upon by any other party, or being used for any other purpose, or containing any error or omission which is due to an error or omission in data supplied to us by other parties. This document contains confidential information and proprietary intellectual property. It should not be shown to other parties without consent from us and from the party which commissioned it. This R eport has been prepar ed sol ely for use by the party w hich commissi oned it (the 'Client') in connection wi th the capti oned pr oject. It shoul d not be used for any other purpose. -

Sr. No. Boid Name Bankacnum Bankname Reject Reason 1 1301070000007664 ACHYUT PRASAD PYAKHUEL 01200501206866 Everest Bank Ltd.-Pulchowk Branch Account Doesnot Exists

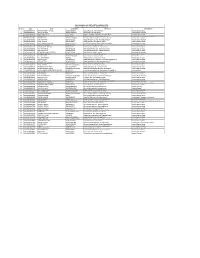

SWABHALAMBAN LAGHUBITTA BITTYA SANSTHA LIMITED. Dividend Rejected List as of 25 Jun, 2020 ( F.y. 2073/074) Sr. No. BoId Name BankAcNum BankName Reject Reason 1 1301070000007664 ACHYUT PRASAD PYAKHUEL 01200501206866 Everest Bank Ltd.-Pulchowk Branch Account Doesnot Exists. 2 1301090000029794 AMA RAJ KHADKA 001011170005795 Sanima Bank Ltd.-Head Office Account Name Mismatch. 3 1301070000059578 AMRITA MAHASETH 11276738401 Standard Chartered Bank Nepal Ltd.-Head Office Account Doesnot Exists. 4 1301090000001316 ANJU BATAJU 00515073723 Siddhartha Bank Ltd.-Pokhara/Bagar Branch Invalid Status. Transaction not allowed. 5 1301180000103455 BHAGIRATH RAI 0230230001644SR Century Commercial Bank Ltd.-Samakhusi Branch Account Doesnot Exists. 6 1301150000003731 BIJAYA ADHIKARI 3907010002151 Global IME Bank Ltd.-IME - Anamnagar Branch Account Name Mismatch. 7 1301120000119697 BIKASH DONGOL 060701006812 Global IME Bank Ltd.-Kuleshwor Branch Account Doesnot Exists. 8 1301060000050367 BIMAL KUMAR DHUNGANA 050000020166524 Bank of Kathmandu Ltd.-Head Office, Kamalpokhari Account Doesnot Exists. 9 1301310000182198 BISHNU PD NEUPANE 006000002073D Sanima Bank Ltd.-Pokhara Branch Account Name Mismatch. 10 1301090000011210 BISHOW NATH SHRESTHA 01700281-PB Prime Commercial Bank Ltd.-Panauti Branch Account Doesnot Exists. 11 1301150000003949 CHET NATH RIMAL 0010007091013 NIDC Capital Markets Ltd.- Head Office Branch Account Doesnot Exists. 12 1301150000003949 CHET NATH RIMAL 0010007091013 NIDC Capital Markets Ltd.- Head Office Branch Account Doesnot Exists. 13 1301040000010678 DEEPAK MAN SINGH SHRESTHA 3510017505809 Nabil Bank Ltd.-Chabahil Branch Account Name Mismatch. 14 1301060000674375 DIGAMBER SHRESTHA 99901600033577000001 Union Finance Ltd.- Head Office Branch Account Doesnot Exists. 15 1301120000014991 DILSOVA SAKYA 0550008894214001 Sunrise Bank Ltd.-Newroad Branch Account Freezed. 16 1301340000002951 DIPENDRA KOIRALA 0154015 NIC Asia Bank Ltd.- Tripureswor Branch Account Doesnot Exists. -

Sr. No. Boid Name Bankacnum Bankname Reject Reason 1 1301270000010334 AASHISH RATNA SHAKYA 00701700042846000001 United Finance Ltd.- New Road Branch Account Freezed

SWABHALAMBAN LAGHUBITTA BITTYA SANSTHA LIMITED. Dividend Rejected List as of 25 Jun, 2020 ( F.y. 2075/076) Sr. No. BoId Name BankAcNum BankName Reject Reason 1 1301270000010334 AASHISH RATNA SHAKYA 00701700042846000001 United Finance Ltd.- New Road Branch Account Freezed. 2 1301070000059578 AMRITA MAHASETH 11276738401 Standard Chartered Bank Nepal Ltd.-Head Office Account Doesnot Exists. 3 1301220000137402 ANJU POUDEL 024102006280901 Janata Bank Nepal Ltd.-Jyatha Branch Account Doesnot Exists. 4 1301130000033912 APSARA RAI 0550006545C5 Century Commercial Bank Limited.-Manbhawan Branch 2 Account Closed. 5 1301360000000129 ARADHANA KHANAL 003108037803301 Janata Bank Nepal Ltd.-New Road Branch Account Doesnot Exists. 6 1301300000034367 ARBIND KUMAR KUSHWAHA 4100267808524001NPR NIC Asia Bank Ltd.-Satdobato Branch Account Doesnot Exists. 7 1301270000018770 ASMITA DEVI AGRAWAL 041107024358901 Janata Bank Nepal Ltd.-Hetauda Branch Account Doesnot Exists. 8 1301250000001703 BANDANA RIMAL 028000000250L Sanima Bank Ltd.- Ekanta Kuna Branch Account Name Mismatch. 9 1301480000006843 BASHU DEV DHUNGANA 0550005795C5 Century Commercial Bank Ltd.-Kumaripati Branch Account Closed. 10 1301180000103455 BHAGIRATH RAI 0230230001644SR Century Commercial Bank Ltd.-Samakhusi Branch Account Doesnot Exists. 11 1301280000005743 BHAGYAREKHA SAVING AND CREDIT 01715003043 Siddhartha Bank Ltd.-Tinkune/Gatthaghar/Sankhamul Branch Account Name Mismatch. 12 1301020000012400 BHESH RAJ PAUDEL 072106037408101 Janata Bank Nepal Limited.-Putalisadak Branch Account Doesnot -

Annual Report 2018-19.Pdf

Financial Highlights Deposits (NPR. In Billion) Loans and Advances (NPR. In Billion) 92.28 83.44 79.18 69.24 58.23 46.42 51.84 40.90 34.05 28.59 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 As at Mid July As at Mid July Investments (NPR. In Billion) Total Assets (NPR. In Billion) 16.96 109.06 91.82 13.17 70.00 10.73 9.16 55.96 7.74 40.30 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 As at Mid July As at Mid July Shareholders Fund (NPR. In Billion) Net Interest Income (NPR. In Million) 11.99 10.79 4,208.70 9.06 3,015.52 5.35 2,242.12 3.43 1,722.30 1,139.39 2015 2016 2017 2018 2019 2014/15 2015/16 2016/17 2017/18 2018/19 As at Mid July Fiscal Year Operating Profit (NPR. In Million) Net Profit (NPR. In Million) 2,285.10 3,224.90 2,415.20 1,697.50 1,998.10 1,304.10 1,478.50 996.05 925.70 624.14 2014/15 2015/16 2016/17 2017/18 2018/19 2014/15 2015/16 2016/17 2017/18 2018/19 Fiscal Year Fiscal Year Financial Highlights Non Performing Loans (%) CAR (%) 15.57 11.08 12.36 12.41 13.19 0.073 0.019 0.010 0.030 0.080 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 As at Mid July As at Mid July ROE (%) DPS (%) No. -

Payment Systems Oversight Report 2075/76 (2018/2019)

Payment Systems Oversight Report 2075/76 (2018/2019) Nepal Rastra Bank Payment Systems Department Baluwatar, Kathmandu Nepal Message from Executive Director Dear Valued Readers, Nepal Rastra Bank (NRB) has been entrusted with the responsibility of establishing and promoting the system of payment, clearing and settlement and to regulate these activities in order to develop secure, healthy and efficient system of payment in the country. Payment Systems has been considered to be an important element of the financial stability and is evolving as a core central banking function around the world. It is believed that a well- developed payment system ultimately contributes in strengthening the domestic financial system. Payment System modernization effort in Nepal was started with the formulation of Nepal Payment System Development Strategy in 2014. Since then NRB has initiated number of reforms in the payment systems. Currently, Payment Systems Department of NRB is performing catalytic, operator, and overseer role in the payment systems. Payment System Act, 2075 provides a strong legal basis for the development of national payment system. Increasing number of card users, IPS users, digital banking users, e- Commerce users shows that Nepalese payment system is developing rapidly. As an overseer of the National Payment System, NRB is committed to ensure safety and efficiency of the payment system. Payment Systems Department of NRB oversees all licensed Payment Service Providers and Payment System Operators as per the approved annual work plan based on the Principles of Financial Market Infrastructures (PFMIs). As stated in the Payment and Settlement Bylaws 2015, Payment Systems Department has prepared and published Payment System Oversight Report.