Minutes Have Been Seen by the Administration)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report

Annual Report 2006–2007 Group of Thirty 30 Group of Thirty, Washington, DC Copies of this paper are available from: Group of Thirty 1726 M Street, N.W., Suite 200 Washington, DC 20036 Tel.: (202) 331-2472, Fax (202) 785-9423 E-mail: [email protected] WWW: http://www.group30.org Annual Report 2006–2007 Published by Group of Thirty© Washington, DC 2008 Table of Contents I. Introduction ..................................................................................... 5 II. The Group of Thirty Membership ................................................... 7 III. The Work of the Group of Thirty in FY2006 and FY2007 ........... 13 Plenary Sessions .......................................................................... 13 International Banking Seminars ................................................. 13 Study Group Activities ................................................................ 14 Publications ................................................................................. 16 IV. The Finances of the Group .......................................................... 19 Annex 1. Past Membership of the Group of Thirty .......................... 31 Annex 2. Schedule of Meetings and Seminars: .............................. 33 Annex 3. International Banking Seminars ...................................... 35 Annex 4. Plenary Sessions ............................................................... 37 Annex 5. The Group of Thirty (G30) Study on Reinsurance and International Financial Markets ............................................ -

Minutes Have Been Cleared with the Chairman)

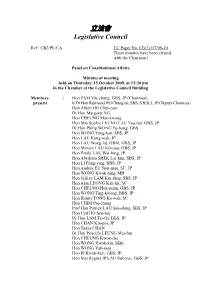

立法會 Legislative Council Ref : CB2/PL/CA LC Paper No. CB(2)117/09-10 These minutes have been cleared with the Chairman) Panel on Constitutional Affairs Minutes of meeting held on Thursday, 15 October 2009, at 12:30 pm in the Chamber of the Legislative Council Building Members : Hon TAM Yiu-chung, GBS, JP (Chairman) present Ir Dr Hon Raymond HO Chung-tai, SBS, S.B.St.J., JP (Deputy Chairman) Hon Albert HO Chun-yan Dr Hon Margaret NG Hon CHEUNG Man-kwong Hon Mrs Sophie LEUNG LAU Yau-fun, GBS, JP Dr Hon Philip WONG Yu-hong, GBS Hon WONG Yung-kan, SBS, JP Hon LAU Kong-wah, JP Hon LAU Wong-fat, GBM, GBS, JP Hon Miriam LAU Kin-yee, GBS, JP Hon Emily LAU Wai-hing, JP Hon Abraham SHEK Lai-him, SBS, JP Hon LI Fung-ying, BBS, JP Hon Audrey EU Yuet-mee, SC, JP Hon WONG Kwok-hing, MH Hon Jeffrey LAM Kin-fung, SBS, JP Hon Alan LEONG Kah-kit, SC Hon CHEUNG Hok-ming, GBS, JP Hon WONG Ting-kwong, BBS, JP Hon Ronny TONG Ka-wah, SC Hon CHIM Pui-chung Prof Hon Patrick LAU Sau-shing, SBS, JP Hon Cyd HO Sau-lan Dr Hon LAM Tai-fai, BBS, JP Hon CHAN Kin-por, JP Hon Tanya CHAN Dr Hon Priscilla LEUNG Mei-fun Hon CHEUNG Kwok-che Hon WONG Kwok-kin, BBS Hon WONG Yuk-man Hon IP Kwok-him, GBS, JP Hon Mrs Regina IP LAU Suk-yee, GBS, JP - 2 - Dr Hon PAN Pey-chyou Hon Paul TSE Wai-chun Dr Hon Samson TAM Wai-ho, JP Members : Hon Timothy FOK Tsun-ting, GBS, JP absent Hon LEE Wing-tat Hon LEUNG Kwok-hung Clerk in : Miss Flora TAI attendance Chief Council Secretary (2)3 Staff in : Mr Arthur CHEUNG attendance Senior Assistant Legal Adviser 2 Ms Amy YU Senior Council Secretary (2)3 Mrs Eleanor CHOW Senior Council Secretary (2)4 Miss Vivien POON Council Secretary (2)1 Mr Ringo LEE Senior Legislative Assistant (2)1 Mrs Fonny TSANG Legislative Assistant (2)3 Action I. -

OFFICIAL RECORD of PROCEEDINGS Wednesday, 29

LEGISLATIVE COUNCIL ─ 29 April 2015 9455 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 29 April 2015 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE JASPER TSANG YOK-SING, G.B.S., J.P. THE HONOURABLE ALBERT HO CHUN-YAN THE HONOURABLE LEE CHEUK-YAN THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE CHAN KAM-LAM, S.B.S., J.P. THE HONOURABLE LEUNG YIU-CHUNG DR THE HONOURABLE LAU WONG-FAT, G.B.M., G.B.S., J.P. THE HONOURABLE EMILY LAU WAI-HING, J.P. THE HONOURABLE TAM YIU-CHUNG, G.B.S., J.P. THE HONOURABLE ABRAHAM SHEK LAI-HIM, G.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, S.B.S., J.P. THE HONOURABLE FREDERICK FUNG KIN-KEE, S.B.S., J.P. THE HONOURABLE VINCENT FANG KANG, S.B.S., J.P. 9456 LEGISLATIVE COUNCIL ─ 29 April 2015 THE HONOURABLE WONG KWOK-HING, B.B.S., M.H. PROF THE HONOURABLE JOSEPH LEE KOK-LONG, S.B.S., J.P., Ph.D., R.N. THE HONOURABLE JEFFREY LAM KIN-FUNG, G.B.S., J.P. THE HONOURABLE ANDREW LEUNG KWAN-YUEN, G.B.S., J.P. THE HONOURABLE WONG TING-KWONG, S.B.S., J.P. THE HONOURABLE CYD HO SAU-LAN, J.P. THE HONOURABLE STARRY LEE WAI-KING, J.P. DR THE HONOURABLE LAM TAI-FAI, S.B.S., J.P. THE HONOURABLE CHAN HAK-KAN, J.P. THE HONOURABLE CHAN KIN-POR, B.B.S., J.P. DR THE HONOURABLE PRISCILLA LEUNG MEI-FUN, S.B.S., J.P. -

Official Record of Proceedings

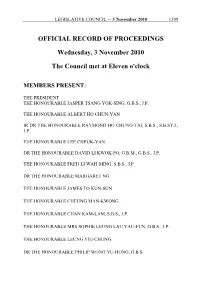

LEGISLATIVE COUNCIL ─ 3 November 2010 1399 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 3 November 2010 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE JASPER TSANG YOK-SING, G.B.S., J.P. THE HONOURABLE ALBERT HO CHUN-YAN IR DR THE HONOURABLE RAYMOND HO CHUNG-TAI, S.B.S., S.B.ST.J., J.P. THE HONOURABLE LEE CHEUK-YAN DR THE HONOURABLE DAVID LI KWOK-PO, G.B.M., G.B.S., J.P. THE HONOURABLE FRED LI WAH-MING, S.B.S., J.P. DR THE HONOURABLE MARGARET NG THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE CHEUNG MAN-KWONG THE HONOURABLE CHAN KAM-LAM, S.B.S., J.P. THE HONOURABLE MRS SOPHIE LEUNG LAU YAU-FUN, G.B.S., J.P. THE HONOURABLE LEUNG YIU-CHUNG DR THE HONOURABLE PHILIP WONG YU-HONG, G.B.S. 1400 LEGISLATIVE COUNCIL ─ 3 November 2010 THE HONOURABLE WONG YUNG-KAN, S.B.S., J.P. THE HONOURABLE LAU KONG-WAH, J.P. THE HONOURABLE LAU WONG-FAT, G.B.M., G.B.S., J.P. THE HONOURABLE MIRIAM LAU KIN-YEE, G.B.S., J.P. THE HONOURABLE EMILY LAU WAI-HING, J.P. THE HONOURABLE ANDREW CHENG KAR-FOO THE HONOURABLE TIMOTHY FOK TSUN-TING, G.B.S., J.P. THE HONOURABLE TAM YIU-CHUNG, G.B.S., J.P. THE HONOURABLE ABRAHAM SHEK LAI-HIM, S.B.S., J.P. THE HONOURABLE LI FUNG-YING, S.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, S.B.S., J.P. THE HONOURABLE FREDERICK FUNG KIN-KEE, S.B.S., J.P. -

Hong Kong SAR

China Data Supplement November 2006 J People’s Republic of China J Hong Kong SAR J Macau SAR J Taiwan ISSN 0943-7533 China aktuell Data Supplement – PRC, Hong Kong SAR, Macau SAR, Taiwan 1 Contents The Main National Leadership of the PRC 2 LIU Jen-Kai The Main Provincial Leadership of the PRC 30 LIU Jen-Kai Data on Changes in PRC Main Leadership 37 LIU Jen-Kai PRC Agreements with Foreign Countries 47 LIU Jen-Kai PRC Laws and Regulations 50 LIU Jen-Kai Hong Kong SAR 54 Political, Social and Economic Data LIU Jen-Kai Macau SAR 61 Political, Social and Economic Data LIU Jen-Kai Taiwan 65 Political, Social and Economic Data LIU Jen-Kai ISSN 0943-7533 All information given here is derived from generally accessible sources. Publisher/Distributor: GIGA Institute of Asian Affairs Rothenbaumchaussee 32 20148 Hamburg Germany Phone: +49 (0 40) 42 88 74-0 Fax: +49 (040) 4107945 2 November 2006 The Main National Leadership of the PRC LIU Jen-Kai Abbreviations and Explanatory Notes CCP CC Chinese Communist Party Central Committee CCa Central Committee, alternate member CCm Central Committee, member CCSm Central Committee Secretariat, member PBa Politburo, alternate member PBm Politburo, member Cdr. Commander Chp. Chairperson CPPCC Chinese People’s Political Consultative Conference CYL Communist Youth League Dep. P.C. Deputy Political Commissar Dir. Director exec. executive f female Gen.Man. General Manager Gen.Sec. General Secretary Hon.Chp. Honorary Chairperson H.V.-Chp. Honorary Vice-Chairperson MPC Municipal People’s Congress NPC National People’s Congress PCC Political Consultative Conference PLA People’s Liberation Army Pol.Com. -

2014-2015 Report on Police Violence in the Umbrella Movement

! ! ! ! ! 2014-2015 Report on Police Violence in the Umbrella Movement A report of the State Violence Database Project in Hong Kong Compiled by The Professional Commons and Hong Kong In-Media ! ! ! Table!of!Contents! ! About!us! ! About!the!research! ! Maps!/!Glossary! ! Executive!Summary! ! 1.! Report!on!physical!injury!and!mental!trauma!...........................................................................................!13! 1.1! Physical!injury!....................................................................................................................................!13! 1.1.1! Injury!caused!by!police’s!direct!smacking,!beating!and!disperse!actions!..................................!14! 1.1.2! Excessive!use!of!force!during!the!arrest!process!.......................................................................!24! 1.1.3! Connivance!at!violence,!causing!injury!to!many!.......................................................................!28! 1.1.4! Delay!of!rescue!and!assault!on!medical!volunteers!..................................................................!33! 1.1.5! Police’s!use!of!violence!or!connivance!at!violence!against!journalists!......................................!35! 1.2! Psychological!trauma!.........................................................................................................................!39! 1.2.1! Psychological!trauma!caused!by!use!of!tear!gas!by!the!police!..................................................!39! 1.2.2! Psychological!trauma!resulting!from!violence!...........................................................................!41! -

The Portrayal of Female Officials in Hong Kong Newspapers

Constructing perfect women: the portrayal of female officials in Hong Kong newspapers Francis L.F. Lee CITY UNIVERSITY OF HONG KONG, HONG KONG On 28 February 2000, the Hong Kong government announced its newest round of reshuffling and promotion of top-level officials. The next day, Apple Daily, one of the most popular Chinese newspapers in Hong Kong, headlined their full front-page coverage: ‘Eight Beauties Obtain Power in Newest Top Official Reshuffling: One-third Females in Leadership, Rarely Seen Internationally’.1 On 17 April, the Daily cited a report by regional magazine Asiaweek which claimed that ‘Hong Kong’s number of female top officials [is the] highest in the world’. The article states that: ‘Though Hong Kong does not have policies privileging women, opportunities for women are not worse than those for men.’ Using the prominence of female officials as evidence for gender equality is common in public discourse in Hong Kong. To give another instance, Sophie Leung, Chair of the government’s Commission for Women’s Affairs, said in an interview that women in Hong Kong have space for development, and she was quoted: ‘You see, Hong Kong female officials are so powerful!’ (Ming Pao, 5 February 2001). This article attempts to examine news discourses about female officials in Hong Kong. Undoubtedly, the discourses are complicated and not completely coherent. Just from the examples mentioned, one could see that the media embrace the relatively high ratio of female officials as a sign of social progress. But one may also question the validity of treating the ratio of female officials as representative of the situation of gender (in)equality in the society. -

Cambodia's Experience

38538 Public Disclosure Authorized EAST ASIAN Public Disclosure Authorized VISIONS PERSPECTIVES ON ECONOMIC DEVELOPMENT AUN PORN MONIROTH • ROBERTO F. DE OCAMPO • TOYOO GYOHTEN • YUJIRO HAYAMI JOMO K. S. • CAO SY KIEM • TOMMY KOH • HARUHIKO KURODA • LONG YONGTU KISHOREPublic Disclosure Authorized MAHBUBANI • FELIPE MEDALLA • MARI PANGESTU • MINXIN PEI • ANDREW SHENG WU JINGLIAN • JOSEPH YAM • ZHENG BIJIAN EDITED BY INDERMIT GILL, YUKON HUANG, AND HOMI KHARAS Public Disclosure Authorized EAST ASIAN VISIONS EAST AS I AN VI S I ONS PE RSP ECTIVE S ON E C ONO MIC DEVELOP ME N T EDITORS INDERMIT GILL • YUKON HUANG • HOMI KHARAS AUTHORS AUN PORN MONIROTH • ROBERTO F. DE OCAMPO TOYOO GYOHTEN • YUJIRO HAYAMI • JOMO K. S. CAO SY KIEM • TOMMY KOH • HARUHIKO KURODA LONG YONGTU • KISHORE MAHBUBANI FELIPE MEDALLA • MARI PANGESTU • MINXIN PEI ANDREW SHENG • WU JINGLIAN • JOSEPH YAM ZHENG BIJIAN A copublication of the World Bank and the Institute of Policy Studies (Singapore) ©2007 The International Bank for Reconstruction and Development / The World Bank and The Institute of Policy Studies The International Bank for Reconstruction The Institute of Policy Studies and Development / The World Bank 29 Heng Mui Keng Terrace #06-06 1818 H Street NW Singapore 119620 Washington DC 20433 Tel: +65-6215-1010 Telephone: 202-473-1000 Fax: 6215-1014 Internet: www.worldbank.org Internet: www.ips.org.sg E-mail: [email protected] E-mail: [email protected] All rights reserved 1 2 3 4 5 10 09 08 07 This volume is a product of the staff of the International Bank for Reconstruction and Development / The World Bank. -

The Cultural Politics of Tobacco Control in Hong Kong

Lingnan University Digital Commons @ Lingnan University Theses & Dissertations Department of Cultural Studies 2009 Beyond public health : the cultural politics of tobacco control in Hong Kong Wai Yin CHAN Follow this and additional works at: https://commons.ln.edu.hk/cs_etd Part of the Critical and Cultural Studies Commons, Health Policy Commons, and the Social Control, Law, Crime, and Deviance Commons Recommended Citation Chan, W. Y. (2009).Beyond public health : the cultural politics of tobacco control in Hong Kong (Doctor's thesis, Lingnan University, Hong Kong). Retrieved from http://dx.doi.org/10.14793/cs_etd.4 This Thesis is brought to you for free and open access by the Department of Cultural Studies at Digital Commons @ Lingnan University. It has been accepted for inclusion in Theses & Dissertations by an authorized administrator of Digital Commons @ Lingnan University. Terms of Use The copyright of this thesis is owned by its author. Any reproduction, adaptation, distribution or dissemination of this thesis without express authorization is strictly prohibited. All rights reserved. BEYOND PUBLIC HEALTH: THE CULTURAL POLITICS OF TOBACCO CONTROL IN HONG KONG CHAN WAI YIN PHD LINGNAN UNIVERSITY 2009 BEYOND PUBLIC HEALTH: THE CULTURAL POLITICS OF TOBACCO CONTROL IN HONG KONG by CHAN Wai Yin A thesis submitted in partial fulfillment of the requirements for the Degree of Doctor of Philosophy in Cultural Studies Lingnan University 2009 ABSTRACT Beyond Public Health: The Cultural Politics of Tobacco Control in Hong Kong by CHAN Wai Yin Doctor of Philosophy This work provides cultural and political explanations on how and why cigarette smoking has increasingly become an object of intolerance and control in Hong Kong. -

Permanent Secretary, Chief Executive's Office Session No

Index Page Replies to supplementary questions raised by Finance Committee Members in examining the Estimates of Expenditure 2014-15 Controlling Officer : Permanent Secretary, Chief Executive's Office Session No. : 10 File Name : CEO-2S-e1.docx Reply Serial Question No. Serial No. Name of Member Head Programme S-CEO01 S0089 CHAN Ka-lok, Kenneth 21 (2) Executive Council S-CEO02 SV020 FAN Kwok-wai, Gary 21 (1) Chief Executive's Office S-CEO03 S0096 HO Sau-lan, Cyd 21 (1) Chief Executive's Office (2) Executive Council Examination of Estimates of Expenditure 2014-15 Reply Serial No. S-CEO01 CONTROLLING OFFICER’S REPLY (Question Serial No. S0089) Head: (21) Chief Executive’s Office Subhead (No. & title): (-) Not Specified Programme: (2) Executive Council Controlling Officer: Permanent Secretary, Chief Executive’s Office (Ms Alice LAU) Director of Bureau: Director of the Chief Executive’s Office This question originates from: Question: Would the Administration inform this Committee of the attendance rates of Non-official Members at the meetings of the Executive Council in each of the past 3 years using the following table? Name Total no. of No. of meetings No. of meetings No. of withdrawals meetings held attended not attended from discussions Asked by: Hon CHAN Ka-lok, Kenneth Reply: The Executive Council (ExCo) Secretariat keeps minutes of every ExCo meeting, which record, among other things, Members’ attendance and withdrawals from discussions. Since Non-official Members may need to withdraw from the discussion of individual items due to conflict of interest, and the conflict of interest involved may vary from one discussion item to another, the attendance rates of Members alone cannot accurately reflect their participation. -

香港特别行政区排名名单 the Precedence List of the Hong Kong Special Administrative Region

二零二一年九月 September 2021 香港特别行政区排名名单 THE PRECEDENCE LIST OF THE HONG KONG SPECIAL ADMINISTRATIVE REGION 1. 行政长官 林郑月娥女士,大紫荆勋贤,GBS The Chief Executive The Hon Mrs Carrie LAM CHENG Yuet-ngor, GBM, GBS 2. 终审法院首席法官 张举能首席法官,大紫荆勋贤 The Chief Justice of the Court of Final The Hon Andrew CHEUNG Kui-nung, Appeal GBM 3. 香港特别行政区前任行政长官(见注一) Former Chief Executives of the HKSAR (See Note 1) 董建华先生,大紫荆勋贤 The Hon TUNG Chee Hwa, GBM 曾荫权先生,大紫荆勋贤 The Hon Donald TSANG, GBM 梁振英先生,大紫荆勋贤,GBS, JP The Hon C Y LEUNG, GBM, GBS, JP 4. 政务司司长 李家超先生,SBS, PDSM, JP The Chief Secretary for Administration The Hon John LEE Ka-chiu, SBS, PDSM, JP 5. 财政司司长 陈茂波先生,大紫荆勋贤,GBS, MH, JP The Financial Secretary The Hon Paul CHAN Mo-po, GBM, GBS, MH, JP 6. 律政司司长 郑若骅女士,大紫荆勋贤,GBS, SC, JP The Secretary for Justice The Hon Teresa CHENG Yeuk-wah, GBM, GBS, SC, JP 7. 立法会主席 梁君彦议员,大紫荆勋贤,GBS, JP The President of the Legislative Council The Hon Andrew LEUNG Kwan-yuen, GBM, GBS, JP - 2 - 行政会议非官守议员召集人 陈智思议员,大紫荆勋贤,GBS, JP The Convenor of the Non-official The Hon Bernard Charnwut CHAN, Members of the Executive Council GBM, GBS, JP 其他行政会议成员 Other Members of the Executive Council 史美伦议员,大紫荆勋贤,GBS, JP The Hon Mrs Laura CHA SHIH May-lung, GBM, GBS, JP 李国章议员,大紫荆勋贤,GBS, JP Prof the Hon Arthur LI Kwok-cheung, GBM, GBS, JP 周松岗议员,大紫荆勋贤,GBS, JP The Hon CHOW Chung-kong, GBM, GBS, JP 罗范椒芬议员,大紫荆勋贤,GBS, JP The Hon Mrs Fanny LAW FAN Chiu-fun, GBM, GBS, JP 黄锦星议员,GBS, JP 环境局局长 The Hon WONG Kam-sing, GBS, JP Secretary for the Environment # 林健锋议员,GBS, JP The Hon Jeffrey LAM Kin-fung, GBS, JP 叶国谦议员,大紫荆勋贤,GBS, JP The Hon -

Legco to Debate Motion on the Report of the Duty Visit to the Guangdong- Hong Kong-Macao Greater Bay Area

LegCo to debate motion on the Report of the duty visit to the Guangdong- Hong Kong-Macao Greater Bay Area The following is issued on behalf of the Legislative Council Secretariat: The Legislative Council (LegCo) will hold a meeting on Wednesday (December 12) at 11am in the Chamber of the LegCo Complex. During the meeting, Members will debate a motion on the Report of the joint-Panel delegation of the Panel on Economic Development, Panel on Financial Affairs, Panel on Commerce and Industry, and Panel on Information Technology and Broadcasting on its duty visit to the Guangdong-Hong Kong-Macao Greater Bay Area. The motion, moved by Mr Jeffrey Lam, states: "That this Council notes the Report of the joint-Panel delegation of the Panel on Economic Development, Panel on Financial Affairs, Panel on Commerce and Industry, and Panel on Information Technology and Broadcasting on its duty visit to the Guangdong-Hong Kong-Macao Greater Bay Area from April 20 to 22, 2018." Ms Starry Lee will move a motion under Rule 49E(2) of the Rules of Procedure. The motion states: "That this Council takes note of Report No. 7/18-19 of the House Committee laid on the Table of the Council on December 12, 2018 in relation to the Peak Tramway (Safety) (Amendment) Regulation 2018, the Peak Tramway Ordinance (Amendment of Section 3(3)) Notice 2018 and the Financial Institutions (Resolution) (Loss-absorbing Capacity Requirements—Banking Sector) Rules." Meanwhile, Dr Pierre Chan will move a motion on requesting the Government to set up crisis support centres for sexual violence victims and abused children in public hospitals.