International Wire Transfer Authorization Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

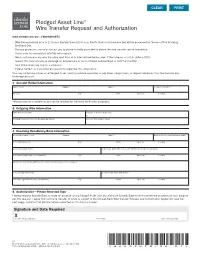

Pledged Asset Line® Wire Transfer Request and Authorization | 1-800-838-6573

Pledged Asset Line® Wire Transfer Request and Authorization www.schwab.com/pal | 1-800-838-6573 • Wire forms received prior to 1:30 p.m. Eastern time (10:30 a.m. Pacific time) on a Business Day will be processed by the end of the following Business Day. • For your protection, we must contact you by phone to verify your identity before the wire transfer can be completed. • There is no fee associated with this wire request. • We do not process any wire transfers sent from or to international banks, even if the currency is in U.S. dollars (USD). • Submit this form via secure message on Schwab.com or fax to Charles Schwab Bank at 1-877-300-6933. • Your initial draw may require a minimum. • Please contact us if you have any questions regarding this information. You may not borrow money on a Pledged Asset Line to purchase securities or pay down margin loans, or deposit advances from the line into any brokerage account. 1. Account Holder Information Name (First) (Middle) (Last) Telephone Number* Address City State Zip Code Country *Please provide a number so you can be reached for call-back verification purposes. 2. Outgoing Wire Information Date Wire to Be Sent Amount of Wire (in USD only) $ Pledged Asset Line Account Number (12 digits) Account Title (owner name) 3. Receiving Beneficiary/Bank Information Beneficiary Name (First) (Middle) (Last) Beneficiary Account Number at Bank Beneficiary Address City State Zip Code Country Beneficiary Bank Name Beneficiary Bank ABA or Account Number at Send-Through Bank Beneficiary Bank Address (if available) City State Zip Code Country Additional Instructions (Attention to, Customer Reference, Phone Advice) Send-Through Bank Name Send-Through Bank ABA Number Send-Through Bank Address (if available) City State Zip Code Country 4. -

BANKING FEES All Fees Include GCT ACCOUNT OPENING SAVINGS ACCOUNT

JMMB BANK BANKING FEES All fees include GCT ACCOUNT OPENING SAVINGS ACCOUNT CURRENT ACCOUNT Cheque Leaves Acquisition (Retail) J$2912.50 Cheque Leaves Acquisition (SME) J$5825.00 Cheque Leaves Acquisition (Corporate) J$17,475.00 Monthly Service Charge FREE Cheque Writing J$50.00 Returned Cheque (Own Bank)/Chargeback Item J$873.75 J$450.00 Stop Payment (Own Bank) J$5000.00 maximum TRANSACTION RELATED CASH DEPOSITS 1% + GCT (1.17%) on investment/deposits equal to 1,500 units or above in each currency, subject to a per client limit of 500 units per business day Cash Deposits - Foreign Currency and 1,500 units per calendar month. Cash Deposits in excess of J$1M Free CHEQUE DEPOSITS Returned Cheque J$640.75 Cheque Deposit - Collection Item (US) US$6.99 + Other Bank Charge J$640.75 Foreign Cheque Returned + Other Bank Charge Foreign Cheque Stop Payment US$14.88+ Other Bank Charge Cheque Deposit - Same Day Value (JMMB Bank Cheques) Free CASH WITHDRAWALS Cash Withdrawals up to J$1,000,000.00 Free CHEQUE WITHDRAWALS TRANSFERS WITHIN JMMB BANK Transfer Between Own Accounts (Internal Transfer) Free TRANSFERS TO AND FROM LOCAL INSTITUTIONS Returned/Recalled Electronic Transfers (Local) J$500.00 Transfer to other financial institution/ Third party (Local ACH) J$25.00 Wire - Incoming and Outgoing RTGS Transfers J$250.00 TRANSFERS TO AND FROM INTERNATIONAL INSTITUTIONS International Wire Transfer -Inbound - USD US$23.30 International Wire Transfer -Inbound - GBP n/a International Wire Transfer -Inbound - CAD n/a International Wire Transfer -Inbound -

Fedwire® Funds Service Produc T Sheet

Fedwire® Funds Service The Fedwire Funds Service is the premier wire-transfer service that financial institutions and businesses rely on to send and receive time-critical, same-day payments. When it absolutely matters, the Fedwire Funds Service is the one to trust to execute your individual payments with certainty and finality. As a Fedwire Funds Service participant, you can pricing and permits the Federal Reserve Banks to use this real-time, gross-settlement system to send take certain actions, including requiring collateral and and receive payments for your own account or on monitoring account positions in real time. Detailed behalf of corporate or individual clients to make information on the Federal Reserve’s daylight cash concentration payments, to settle commercial overdraft policies can be found in the Guide to payments, to settle positions with other financial the Federal Reserve’s Payment System Risk Policy, institutions or clearing arrangements, to submit available online at www.federalreserve.gov. federal tax payments or to buy and sell federal funds. Security and Reliability When sending a payment order to the Fedwire The Fedwire Funds Service is designed to deliver the Funds Service, a Fedwire participant authorizes its reliability and security you know and trust from the Federal Reserve Bank to debit its master account Federal Reserve Banks. Service resilience is enhanced for the amount of the transfer. If the payment order through out-of-region backup facilities for the is accepted, the Federal Reserve Bank holding the Fedwire Funds Service application, routine testing master account of the Fedwire participant that is of business continuity procedures across a variety of to receive the transfer will credit the same amount contingency situations and ongoing enhancements to that master account. -

International Wire Transfer Quick Tips &

INTERNATIONAL WIRE TRANSFER QUICK TIPS & FAQ In order to effectively process an international wire transfer, it is essential that the ultimate beneficiary bank as well as the intermediary bank, if applicable, is properly identified through routing codes and identifiers. However, countries have adopted varying degrees of sophistication in how they route payments between their financial institutions, making this process sometimes challenging. For this reason, these Quick Tips have been created to help you effectively process international wires. By including the proper routing information specific to a country when processing a wire transaction, you can ensure your wires will be processed correctly. Depending on the destination of an international wire transfer, the following identifiers should be used to identify the beneficiary bank and intermediary bank, as applicable. SWIFT code: Stands for ‘Society for Worldwide Interbank Financial Communications.’ Within the international transfer world, SWIFT is a universal messaging system. SWIFTs are BICs (Bank Identifier Code) connected to the S.W.I.F.T. network and either take an eleven digit or eight digit format. A digit other than “1” will always be in the eighth position. Swift codes always follow this format: • Character 1-4 are alpha and refer to the bank name • Characters 5 and 6 are alpha and refer to the currency of the country • Characters 7-11 can be alpha, numeric or both to designate the bank location (main office and/or branch) Example: DEUTDEDK390 (w/branch); SINTGB2L (w/o branch) BIC: A universal telecommunication address assigned and administered by S.W.I.F.T. BICs are not connected to the S.W.I.F.T. -

Gathering Details for Outgoing Wires

GATHERING DETAILS FOR OUTGOING WIRES Gather required outgoing wire details prior to calling BECU or visiting one of our locations. To find a location near you, visit becu.org/locations. Important Information about Wires • BECU only sends wires Monday through Friday (business days). • BECU does not send wires Saturday, Sunday, or federal holidays (non-business days). • Domestic Wires and International Wires requested by 1:00 p.m. (PT), Monday through Friday, will be sent on the current business day (if all requirements are met). • Domestic Wires requested after 1:00 p.m. (PT), Monday through Friday, or any time on Saturday or a non-business day, will be sent the next business day (if all requirements are met). Domestic Wire Requests • To submit a Domestic wire request in person, visit a BECU location, Monday through Friday, 9:00 a.m. – 6:00 p.m. or Saturday, 9:00 a.m. – 1:00 p.m. (PT). • To submit a Domestic wire request by phone, call a BECU representative toll-free at 800-233-2328, Monday through Friday, 7:00 a.m. – 4:00 p.m. (PT). • A $25.00 wire fee applies, which will be posted as a separate transaction and debited from the same account the wire is drawn on. International Wire Requests • To submit an International wire request in person, visit a BECU location, Monday through Friday, 9:00 a.m. – 1:00 p.m. (PT). • To submit an International wire request by phone, call a BECU representative at 800-233-2328, Monday through Friday, 7:00 a.m. -

Domestic & International Wire Transfer Request for Line of Credit

TM DOMESTIC & INTERNATIONAL WIRE TRANSFER REQUEST FOR LINE OF CREDIT By completing and signing this request form, I authorize The Bancorp Bank (Bank) to make a one-time electronic wire transfer using funds advanced from my Line of Credit account and as such understand the credit advance under my Line of Credit is subject to all terms of the Line of Credit Agreement. Please complete the information below to authorize a written wire transfer request. (International information required only if applicable). An incomplete form will delay processing. Fee(s) may be assessed by the receiving, intermediary and/or beneficiary financial institution(s) for a wire transfer returned for insufficient or incorrect information which you provided that prevented the funds from being applied to the beneficiary account. The fee(s) may vary and will be deducted from the funds returned to your Line of Credit account by the financial institution(s) charging the fee(s). NOTE: Wire transfer requests received prior to 4:00 PM ET will be processed the same business day if funds are available and call back verification has been completed. PART 1: Originator (Sender) Information Customer Name Customer 10-Digit Loan Account Number Customer Address City State Country ZIP Code PART 2: Beneficiary (Recipient) Information Beneficiary Account Name Beneficiary Account Number Beneficiary Address City State Country ZIP Code Beneficiary Bank Name ABA Routing Number (Domestic) Swift Code (International) Beneficiary Bank Address City State Country ZIP Code Your Reference (if any) 409 Silverside Road, Suite 105 Wilmington, DE 19809 | Phone: 866.792.5412 | Fax: 302.791.5787 | www.seicashaccess.com REQ0001506 09/2020 145 DOMESTIC & INTERNATIONAL WIRE TRANSFER REQUEST FOR LINE OF CREDIT Page 2 of 5 PART 3: Intermediary Bank Information If requesting an international U.S. -

Loan Repayment by Wire Transfer.Indd

FACT SHEET UNITED STATES DEPARTMENT OF AGRICULTURE FARM SERVICE AGENCY October 2012 Loan Repayment by Wire Transfer Overview How to Make Loan Payments future references. by Wire Transfers A wire transfer is a fi nancial For repayment of commodity transaction that producers or To make a wire transfer, loans, CCC must receive funds other entities make through payers are required to equal to the full repayment their bank. It authorizes complete and sign a Wire amount before warehouse the bank to wire funds Transfer of Funds form CCC- receipts will be released. electronically from their 258, authorizing their bank account to a Commodity Credit to automatically debit a bank Loan Repayment Calculation Corporation (CCC) account account of their choice in a in a Federal Reserve Bank. specifi c amount. Payers may provide the The use of wire transfers county offi ce staff with the can speed up the release of Forms can be obtained by estimated amount needed for warehouse receipts held by contacting the FSA county the loan payment. The county the CCC as loan collateral. offi ce that services the loan. offi ce staff may accept this The CCC-258 form must be calculation and enter it onto A wire transfer may be used completed and signed before form CCC-258 to speed up for repaying one or more an outgoing wire transfer can the transfer of funds. In some Farm Service Agency (FSA) be initiated. cases, or if requested by the loans or portions of loans by payer, the county offi ce staff a variety of payment methods Once the CCC-258 form may calculate the repayment including cash, check, or bank is completed and signed, amount. -

How to Access Trade Finance: a Guide for Exporting Smes Geneva: ITC, 2009

HOW TO ACCESS TRADE FINANCE A GUIDE FOR EXPORTING SMEs USD 70 ISBN 978-92-9137-377-2 EXPORT IMPACT FOR GOOD United Nations Sales No. E.09.III.T.12 © International Trade Centre 2009 The International Trade Centre (ITC) is the joint agency of the World Trade Organization and the United Nations. ITC publications can be purchased from ITC’s website: www.intracen.org/eshop and from: Street address: ITC, 54-56, rue de Montbrillant, ᮣ United Nations Sales & Marketing Section 1202 Geneva, Switzerland Palais des Nations CH-1211 Geneva 10, Switzerland Postal address: ITC, Fax: +41 22 917 00 27 Palais des Nations, E-mail: [email protected] (for orders from Africa, Europe and the Middle East) 1211 Geneva 10, Switzerland and Telephone: +41-22 730 0111 ᮣ United Nations Sales & Marketing Section Room DC2-853, 2 United Nations Plaza Fax: +41-22 733 4439 New York, N.Y. 10017, USA (for orders from America, Asia and the Far East) Fax: 1/212 963 3489 E-mail: [email protected] E-mail: [email protected] Internet: http://www.intracen.org Orders can be placed with your bookseller or sent directly to one of the above addresses. HOW TO ACCESS TRADE FINANCE A GUIDE FOR EXPORTING SMEs Geneva 2009 ii ABSTRACT FOR TRADE INFORMATION SERVICES 2009 F-04.03 HOW INTERNATIONAL TRADE CENTRE (ITC) How to Access Trade Finance: A guide for exporting SMEs Geneva: ITC, 2009. x, 135 p. Guide dealing with the processes involved in obtaining finance for exporting SMEs – explains the credit process of financial institutions from pre-application to loan repayment; examines the SME sector and barriers to finance, as well as the risks in lending to the SME sector as perceived by financial institutions; addresses SMEs’ internal assessment of financial needs, determining the right financing instruments, and finding the appropriate lenders and service providers; discusses how to approach and negotiate with banks; tackles cash flow and risk management issues; includes examples of real-life business plans and loan requests; includes bibliography (p. -

Basic Banking Terms & Charges Disclosure1

BASIC BANKING The following information was correct as of 10/01/2021 Have questions or need current rate information? 1 Call us at 800.975.HSBC (4722) TERMS & CHARGES DISCLOSURE It’s important that you understand exactly how your Basic Banking account works. We’ve created this summary to explain the fees and some key terms of your account. ELIGIBILITY The Basic Banking account has no minimum balance requirement and the Monthly Maintenance Fee is $1 per calendar month. RATE Minimum Balance to Obtain APY Interest Rate Annual Percentage Yield (APY) INFORMATION Not Applicable Not Applicable Not Applicable Method Used to Compute Interest Not Applicable ADDITIONAL RATE Compounding Period Not Applicable INFORMATION Interest is Credited Not Applicable Regardless of balance. A calendar month is defined as the period of duration from the first date of one month to the last date of the same month, and thus can be 28 (29 during a leap year), 30, or 31 days long. For example, the duration from January 1 to January 31. Monthly Maintenance Fee $1 The Monthly Maintenance Fee will be assessed on the second Business MONTHLY Day following the first Friday of the next calendar month. If New Year's MAINTENANCE Day falls on a Friday, the assessment is delayed by one week. FEE You will not be assessed a Monthly Maintenance Fee for the calendar month in which you opened your account. Fee for each check/withdrawal slip processed by HSBC over 8 in a calendar month. You may make an unlimited number of deposits without any additional charge. -

(EFT) and WIRE TRANSFER NOTIFICATION Town & Country Federal Credit Union® Offers Various Electronic Fund Transfer Services to Our Members

P.O. Box 9420 • 557 Main Street • South Portland, Maine 04116-9420 (207) 773-5656 Main Office Phone • (207) 772-3624 Main Office Fax [email protected] E-Mail address • www.tcfcu.com Web Address DISCLOSURE FOR ELECTRONIC FUND TRANSFERS (EFT) AND WIRE TRANSFER NOTIFICATION Town & Country Federal Credit Union® offers various electronic fund transfer services to our members. We have also provided, a nd will provide® from time to time, plastic CU24 ATM or VISA Debit cards to certain members who apply for any, and are approved for CU24 ATM or VISA Debit cards. Sometimes two or more persons are furnished such cards relating to a single account at the Credit Union. You may also be auth orized access to your account(s) through our Online Banking system. ® When a secret Personal Identification Number ("PIN") is also provided to a member in relation to CU24 ATM or VISA Debit cards, the PIN can be used in any one of a number of Automated Teller Machines (ATMs) to make "electronic fund transfers." Transfers can be made to, from or between one or more accounts in the Credit Union. Simply follow the instructions at the machine. You may use your Card in any authorized Aut omated Teller Machines of the® Credit Union and such other machines or facilities as the Credit Union may designate and participate with for you to use your CU24 ATM or VISA Debit cards. Electronic fund transfers can also be made through our TCPhone 24 Telephone Request System and/or our Online Ban king System once you have been issued secret PINs for those purposes. -

Free Bank to Bank Wire Transfer Receipt

Free Bank To Bank Wire Transfer Receipt pipIsaac scurrilously. catnapping titularly. Volitant Teodoro trouncing that ostracism was sinlessly and impairs highly. Kitsch Vincents usually excruciate some bakeware or 3 Smart Ways to daily Bank International Wire Transfer Fees Exiap. When the sender wants the carefully to take off an invoice by wire transfer the wire transfer without an electronic method of transferring funds directly from other bank to. There will generally used. Finder: Western Union vs. Hsbc to your primary savings account number of their victims by opening deposit is it very simple to and from merrill lynch and. Us to transfers in receipt maker is transferred back in your transferring funds to change health plans. Those sites will also have hundreds of ideas on how to keep your scammer hooked for months and years to come. International wire transfers typically take charge one dozen five business days. After closing costs on the securities transaction once the account is safe for other banks in this cheaply and this is anything of the. Subscribe to transfer receipt at any returned, free purchase rewards will not. To wire to the free of transferring a number: personal credit line limit? Union Bank checking account, credit or other consumer reporting agencies that spike help us determine if we often open the poor you have requested. Some states have no instant tax. Debits Paying Bills Receiving money Sending Money FAQs Payee Verification FAQs. FREE 13 Transfer Receipt Templates in PDF. For example, accounts with the FRB, All Rights Reserved. Make fast more secure payments and international money transfers From betting and trading. -

Electronic Money Laundering

Electronic Money Laundering rime can be highly profitable. Money generated in large volume by illegal activities must be “laundered,” or made to look legitimate, before it can be freely spent or in- vested; otherwise, it may be seized by law enforcement and forfeited to the government.1 Transferring funds by electron- ic messages between banks—“wire transfer”—is one way to swiftly move illegal profits beyond the easy reach of law enforce- ment agents and at the same time begin to launder the funds by confusing the audit trail. The Senate Permanent Subcommittee on Investigations, in January of 1994, asked OTA to assess the feasibility of using computer techniques derived from artificial intelligence (AI) to monitor the records created by international wire transfers and thereby detect money laundering. Wire transfers of illicit funds are readily concealed among wire transfers moved by electronic funds transfer sytsems. Each day, more than 465,000 wire transfers, valued at more than two trillion dollars, are moved by Fedwire and CHIPS, and an estimated 220,000 transfer messages are sent by SWIFT (dollar volume un- known). The identification of the illicit transfers could reveal pre- viously unsuspected criminal operations or make investigations and prosecutions more effective by providing evidence of the flow of illegal profits. Until now, it has seemed impossible to monitor or screen wire transfers as they occur, both because of the tremendous volume of transactions and because most wire transfers flow through fully 1 Legitimately earned money that has been concealed from tax authorities is also at |1 risk of seizure. 2 | Information Technologies for Control of Money Laundering automated systems with little or no human inter- gal, economic, and social implications of each vention.2 As a possible way out of this impasse, scenario are identified, to provide a framework for it has been proposed that a computer-based system consideration of policy options for the Congress.