1 APPROVED Management Board of AB Nasdaq Vilnius January 20

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Final Report Amending ITS on Main Indices and Recognised Exchanges

Final Report Amendment to Commission Implementing Regulation (EU) 2016/1646 11 December 2019 | ESMA70-156-1535 Table of Contents 1 Executive Summary ....................................................................................................... 4 2 Introduction .................................................................................................................... 5 3 Main indices ................................................................................................................... 6 3.1 General approach ................................................................................................... 6 3.2 Analysis ................................................................................................................... 7 3.3 Conclusions............................................................................................................. 8 4 Recognised exchanges .................................................................................................. 9 4.1 General approach ................................................................................................... 9 4.2 Conclusions............................................................................................................. 9 4.2.1 Treatment of third-country exchanges .............................................................. 9 4.2.2 Impact of Brexit ...............................................................................................10 5 Annexes ........................................................................................................................12 -

Join Us in Celebrating International Women’S Day March 8, 2021 RING the BELL for GENDER EQUALITY

Join us in Celebrating International Women’s Day March 8, 2021 RING THE BELL FOR GENDER EQUALITY A Call To Action For Businesses Everywhere To Take Concrete Actions To Advance Women’s Empowerment And Gender Equality Celebrate International Women’s Day Ring the Bell for Gender Equality 7th Annual “Ring the Bell for Objectives: Gender Equality” Ceremony • Raise awareness of the importance of private sector action To celebrate International Women’s Day (8 March), to advance gender equality, and showcase existing examples Exchanges around the world will be invited to be to empower women in the workplace, marketplace and part of a global event on gender equality by hosting community a bell ringing ceremony – or a virtual event– to • Convene business leaders, investors, government, civil help raise awareness for women’s economic society and other key partners at the country- and regional empowerment. level to highlight the business case for gender equality • Encourage business to take action to advance the Sustainable Development Goals (SDGs) and promote uptake of the Women’s Empowerment Principles (WEPs) • Highlight how exchanges can help advance the SDGs by promoting gender equality VIRTUAL OPTION: Please note that given the current COVID-19 crisis, if in person ceremonies are not possible, partners are welcome to host a virtual event on the online platform we will use to organize a virtual global Ring the Bell for Gender Equality event this year. Be Part of a Global Effort In March 2020, 77 exchanges rang their bells for gender equality — -

World Markets 5

MARKET5 final 2019_Layout 1 2/15/19 5:19 PM Page 25 Lisette WORLD Van Doorn Ruchir “Sentiment is more negative on cities fac- Sharma's ing geopolitical risks” Markets Top 10 Economic Financial Markets Insights Trends To Watch p.02 Out For in 2019 Distributed Freely Monthly Edition ⎥ Volume II ⎥ Issue 05 ⎥ January 2019 P. 07 John Bogle East & SE Europe Equities The life and legacy of Vanguard’s Monthly performance reports and Analysts give their 2019 outlook on FUNDS founder p.06 statistics from the region p.02 world markets p.03 SEE STOCK EXCHANGES FORECAST GREAT TRADERS David Alan Tepper A specialist in distressed debt investing David A.Tepper was born on 11 Sep- Bond Funds. He also worked in the treasury tember 1957 in Pittsburgh, Pennsylva- department of Republic Steel. In 1985 Tepper nia, USA. He is the founder and was recruited by Goldman Sachs as a Credit D president of the wildly successful hedge Analyst. His primary focus was bankruptcies “The point is, fund Appaloosa Management which is based and special situations at the firm. Within six in Miami Beach, Florida and now manages months he became its head trader, remaining markets adapt, $15 billion. Tepper earned a Bachelor of Arts at Goldman till December 1992. He founded people adapt. with honors in economics from the University Appaloosa Management in early 1993. A 2010 Don’t listen to of Pittsburgh in 1978 and an M.B.A. from profile in New York Magazine described him Carnegie Mellon University in 1982. During as the object of “a certain amount of hero wor- all the crap college, he began small scale investing in var- ship inside the industry.” Forbes listed him as out there.” ious markets. -

List of Best Execution Venues Last Update 28.05.2021

List of Best Execution Venues Last update 28.05.2021 Cash Equities, Depository Receipts, Bonds, Exchange Traded Funds and Exchange Traded Securitised Derivatives Country Name MIC LGT preferred broker network SIX Swiss Exchange Switzerland SIX Swiss Exchange XSWX LGT as exchange participant Switzerland SIX Swiss Exchange – Structured Products XQMH LGT as exchange participant Europe Austria Wiener Börse* XWBO Belgium Euronext Brussels* XBRU Belgium Euronext Brussels – Derivatives XBRD Cyprus CSE Cyprus SE XCYS Denmark NASDAQ Copenhagen* XCSE Finland NASDAQ Helsinki* XHEL France Euronext Paris* XPAR France NYSE Euronext MONEP XMON Germany Berlin Stock Exchange XBER Germany Düsseldorf Stock Exchange XDUS Germany Eurex Frankfurt XEUR Citigroup Global Markets Ltd CS Securities Sociedad de Valores SA Germany Frankfurt Stock Exchange* XFRA Deutsche Bank AG Germany Frankfurt Stock Exchange – Certificates XSCO Kepler Cheuvreux SA Germany Hamburg Stock Exchange XHAM Morgan Stanley Europe SE Raiffeisen Bank International AG Germany Hannover Stock Exchange XHAN Wolfgang Steubing AG Germany München Stock Exchange XMUN Germany Stuttgart Stock Exchange XSTU Germany XETRA* XETR Greece ASE Athens XATH Ireland Euronext Dublin ESM* XDUB 5 Ireland Euronext Dublin MSM* XMSM Italy Borsa Italiana* XMIL Page 1 of Italy EuroTLX ETLX Italy Italian Derivatives Market (IDEM) XDMI 9999 Luxembourg BdL Luxembourg XLUX Netherlands Euronext Amsterdam* XAMS 28052021 C en 8665 * Smart Order Routing applicable GL Country Name MIC LGT preferred broker network Europe Netherlands -

NASDAQ NORDIC and BALTIC MARKET Nasdaq Membership Application

APPLICATION FOR NASDAQ NORDIC AND BALTIC MARKET Nasdaq Membership Application We are applying for membership to the following exchanges and markets: NASDAQ COPENHAGEN EQUITIES FIXED INCOME FIRST NORTH NASDAQ HELSINKI EQUITIES FIXED INCOME FIRST NORTH NASDAQ ICELAND EQUITIES FIXED INCOME FIRST NORTH NASDAQ RIGA EQUITIES FIXED INCOME FIRST NORTH NASDAQ STOCKHOLM EQUITIES FIXED INCOME FIRST NORTH NASDAQ TALLINN EQUITIES FIXED INCOME FIRST NORTH NASDAQ VILNIUS EQUITIES FIXED INCOME FIRST NORTH EXCHANGE CLEARING NASDAQ DERIVATIVES MARKETS MEMBER MEMBER TYPE OF DERIVATIVES MEMBERSHIP Non Clearing Member (NCM) Direct Clearing Member (DCM) General Clearing Member (GCM) DERIVATIVES MEMBERS MARKET ACCESS EUR Equity SEK Equity & NOK Equity & DKK Equity & Index Derivatives Index Derivatives Index Derivatives Derivatives (Finnish) DERIVATIVES SEK Index NOK Index DKK Index MARKET ACCESS EUR Index Derivatives ONLY Derivatives ONLY Derivatives ONLY (VINX30, OMXV10) Equity & Index SEK World Index EUR World Index USD World Index (Requires separate (Requires separate (Requires separate Basket Basket Request Form) Basket Request Form) Request Form) DERIVATIVES SEK Equity & NOK Equity & EUR Equity DKK Equity & Index MARKET ACCESS Index Derivatives Index Derivatives Derivatives Derivatives (OTC Only) Flexible Instruments (OTC Only) (OTC Only) (Finnish) (OTC Only) SEK Fixed NOK Fixed DKK Fixed Income Income Futures & Income Futures & Futures DERIVATIVES Forwards Forwards MARKET ACCESS SEK Fixed Income NOK Fixed Income Fixed Income Options (OTC Only) Options (OTC Only) SEK Repo (OTC Only) DKK Repo (OTC Only) DERIVATIVES MARKET ACCESS SEK NOK DKK Generic Rates Instruments 2 DOCUMENTS SIGNING Nasdaq uses electronic signature application (DocuSign) which allows to sign documents digitally (for example Membership agreement). Based on Company’s signature policy, please select one of the below documents signing options: A. -

INVL Umbrella Fund Rules

INVL ASSET MANAGEMENT Open-ended Harmonized investment fund INVL Umbrella Fund RULES Main information about the collective investment undertaking: Name INVL Umbrella Fund (in Lithuanian: “INVL sudėtinis fondas”), (hereinafter – the Fund) Legal form Harmonized Investment Fund with no rights of legal entity Type Open-ended Umbrella Investment Fund Fund currency Euro (EUR) Registered office Gynėjų str. 14, LT-01109 Vilnius Telephone +370 700 55 959 Fax +370 5 279 0602 E-mail [email protected] Website www.invl.com Fund inception date 29 October, 2010 Duration Open-ended Management Company INVL Asset Management, UAB (hereinafter – the Management Company) Registered Office Gynėjų str. 14, 01109 Vilnius Telephone +370 700 55959 Fax +370 5 2790602 Depository AB SEB bank Registered office Gedimino Ave. 12, 01103 Vilnius Telephone +370 5 268 2800 Fax +370 5 268 2333 Approved by Management Company: By minutes of the Board meeting No. 02-28/13 as of 22nd October, 2010; Rules become effective on 29 October, 2010. Changed: By minutes of the Board meeting No. 8 of 15 October 2012 of Finasta Asset Management UAB; Rules become effective on 1 January, 2013. Changed: By minutes of the Board meeting No. 8 of 27 February 2013 of Finasta Asset Management UAB; Rules become effective on 6 March, 2013. Changed: By minutes of the Board meeting No. 8 of 24 April 2014 of Finasta Asset Management UAB; Rules become effective on 14th of May, 2014. Changed: By minutes of the Board meeting No. 30 of 23 July 2014 of Finasta Asset Management UAB; Rules become effective on 24th of July, 2014. -

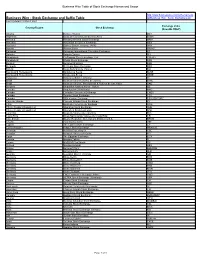

Stock Exchange and Suffix Table Ml/Business Wire Stock Exchanges.Pdf Last Updated 12 March 2021

Business Wire Table of Stock Exchange Names and Usage http://www.businesswire.com/schema/news Business Wire - Stock Exchange and Suffix Table ml/Business_Wire_Stock_Exchanges.pdf Last Updated 12 March 2021 Exchange Value Country/Region Stock Exchange (NewsML ONLY) Albania Bursa e Tiranës BET Argentina Bolsa de Comercio de Buenos Aires BCBA Armenia Nasdaq Armenia Stock Exchange ARM Australia Australian Securities Exchange ASX Australia Sydney Stock Exchange (APX) APX Austria Wiener Börse WBAG Bahamas Bahamas International Securities Exchange BS Bahrain Bahrain Bourse BH Bangladesh Chittagong Stock Exchange, Ltd. CSEBD Bangladesh Dhaka Stock Exchange DSE Belgium Euronext Brussels BSE Bermuda Bermuda Stock Exchange BSX Bolivia Bolsa Boliviana de Valores BO Bosnia and Herzegovina Banjalucka Berza BLSE Bosnia and Herzegovina Sarajevska Berza SASE Botswana Botswana Stock Exchange BT Brazil Bolsa de Valores do Rio de Janeiro BVRJ Brazil Bolsa de Valores, Mercadorias & Futuros de Sao Paulo SAO Bulgaria Balgarska fondova borsa - Sofiya BB Canada Aequitas NEO Exchange NEO Canada Canadian Securities Exchange CNSX Canada Toronto Stock Exchange TSX Canada TSX Venture Exchange TSX VENTURE Cayman Islands Cayman Islands Stock Exchange KY Chile Bolsa de Comercio de Santiago SGO China, People's Republic of Shanghai Stock Exchange SHH China, People's Republic of Shenzhen Stock Exchange SHZ Colombia Bolsa de Valores de Colombia BVC Costa Rica Bolsa Nacional de Valores de Costa Rica CR Cote d'Ivoire Bourse Regionale Des Valeurs Mobilieres S.A. BRVM Croatia -

Northern Trust Emea Order Execution Policy

NORTHERN TRUST EMEA ORDER EXECUTION POLICY For Professional Clients of the following Northern Trust entities: • Northern Trust Global Services SE, and its branches • Northern Trust Securities LLP, and its branches • The Northern Trust Company, London branch Publication date: 1 January 2021 Contents INTRODUCTION .................................................................................................................................................................... 3 A. Purpose of this policy .................................................................................................................................................................................... 3 B. What is Best Execution? ............................................................................................................................................................................... 3 POLICY SCOPE ..................................................................................................................................................................... 4 A. Northern Trust entities subject to this Policy ................................................................................................................................................. 4 B. Types of Clients ............................................................................................................................................................................................. 4 C. Activities ....................................................................................................................................................................................................... -

FIX for Genium INET for NASDAQ Nordic 2.0

FIX for Genium INET for NASDAQ Nordic 2.0 Revision 2.08 2017-10-31 Confidentiality/Disclaimer This specification is being forwarded to you strictly for informational purposes and solely for the purpose of developing or operating systems for your use that interact with systems of NASDAQ and its affiliates (collectively, NASDAQ ). This specification is proprietary to NASDAQ. NASDAQ reserves the right to withdraw, modify, or replace this specification at any time, without prior notice. No obligation is made by NASDAQ regarding the level, scope or timing of NASDAQ’s implementation of the functions or features discussed in this specification. The specification is provided “AS IS,” “WITH ALL FAULTS”. NASDAQ makes no warranties to this specification or its accuracy, and disclaims all warranties, whether express, implied, or statutory related to the specification or its accuracy. This document is not intended to represent an offer of any terms by NASDAQ. Whilst all reasonable care has been taken to ensure that the details contained herein are true and not misleading at the time of publication, no liability whatsoever is assumed by NASDAQ for any incompleteness or inaccuracies. By using this specification you agree that you will not, without prior written permission from NASDAQ, copy or reproduce the information in this specification except for the purposes noted above. You further agree that you will not, without prior written permission from NASDAQ, store the information contained in this specification in a retrieval system, or transmit it in any form or by any means, whether electronic, mechanical, or otherwise except for the purposes noted above. -

The Problem with European Stock Markets

THE PROBLEM WITH EUROPEAN STOCK MARKETS Analysis of the fragmented stock exchange landscape in Europe, how it is holding back growth in capital markets – and what we can do about it March 2021 by William Wright & Eivind Friis Hamre SUMMARY It is not new news that Europe has a complex patchwork of equity markets, stock exchanges and post-trade infrastructure, but this short paper paints this problem in particularly stark terms. The genesis of this paper came from two simple thought experiments: first, can we draw a diagram of the structure of European equity markets on one page? And second, what would the US stock market look like if every state has its own stock exchange? If you read nothing else in this report, please look at the map of the US market on page three and the diagram of European equity markets on page six. Here is a quick summary of this paper: > The elephant in the room The complex patchwork of European equity markets is a huge obstacle to building bigger and better capital markets at a time when the European economy needs them more than ever. We can tinker at the edges with the detail of regulation, but so as long as Europe has 22 different stock exchange groups operating 35 different exchange for listings, 41 exchanges for trading, and nearly 40 different CCPs and CSDs, not much will change. > Punching below its weight The European equity market is less than half the size of the US but has three times as many exchange groups; more than 10 times as many exchanges for listings; more than twice as many exchanges for trading; and roughly 20 times as many post-trade infrastructure providers. -

Stock Exchange Guidance on Human Rights Disclosure

SSE Policy Brief: Gender Diversity on CorporatePolicy Boards - G20 ExchangesBrief Stock exchange guidance on human rights disclosure An analysis of human rights references in stock exchange ESG disclosure guidance Overview This report provides an analysis of human rights Key Findings references in ESG disclosure guidance documents produced by stock exchanges. Most of the stock exchanges (48 out of 56) mentioned human rights in their Most stock exchanges (48 out of 56) mention ESG disclosure guidance. When looking at references to human rights in their ESG disclosure guidance. direct, or specific, human rights instruments (corporate human rights policies, processes, and practices, etc.) less 16 out of 56 stock exchanges refer explicitly to the than half of the stock exchanges mention these. The UN Guiding Principles on Business and Human Guiding Principles on Business and Human Rights is Rights. referenced less than a quarter of the time (16 out of 55). The findings indicate that stock exchange guidance to Many ESG disclosure guidance documents issuers on human rights disclosure is becoming a market mention indirect terms related to human rights in practice, and that some areas of disclosure regarding more bullet points without additional explanatory text. detailed issues are more infrequently mentioned. SSE Policy Brief: Stock exchange guidance on human rights disclosure 1. Introduction The United Nations’ Guiding Principles on Business and Human Rights recognize business enterprises as having a responsibility to respect human rights throughout their operations and business relationships. Stock exchanges are in a key position to influence improved corporate sustainability practices, including those relating to human rights. By providing guidance on human rights expectations for issuers that are aligned with the Guiding Principles, stock exchanges can help to ensure the mainstreaming of corporate human rights disclosure. -

List of Third-Country Markets Considered As Equivalent to a UK Regulated Market Under UK EMIR

Last updated: 17/12/2020 List of third-country markets considered as equivalent to a UK regulated market under UK EMIR The third country markets listed below have been considered to be equivalent to a UK regulated market in accordance with article 2a of UK EMIR. Please see the FCA register for the list of UK regulated markets. Country of Name of the third-country market MIC Code (if Status establishment applicable) Effective Date Australia ASX 01/01/2021 Australia ASX24 01/01/2021 Australia Chi-X 01/01/2021 Austria Wiener Börse AG WBAH 01/01/2021 Belgium Euronext Brussels Derivatives XBRD 01/01/2021 Belgium Euronext Brussels XBRU 01/01/2021 Bulgaria BULGARIAN STOCK EXCHANGE MAIN ZBUL 01/01/2021 MARKET Bulgaria BULGARIAN STOCK EXCHANGE IBUL 01/01/2021 INTERNATIONAL Bulgaria BULGARIAN STOCK EXCHANGE BaSE ABUL 01/01/2021 1 Canada Aequitas Neo Exchange Inc. 01/01/2021 Canada Alpha Exchange Inc. 01/01/2021 Canada Bourse de Montreal Inc. 01/01/2021 Canada Canadian Securities Exchange 01/01/2021 Canada ICE NGX Canada Inc. 01/01/2021 Canada TSX Inc. 01/01/2021 Canada TSX Venture Inc. 01/01/2021 Canada NASDAQ CXC Limited 01/01/2021 Croatia Zagrebačka burza d.d. XZAG 01/01/2021 Cyprus CYPRUS STOCK EXCHANGE XCYS 01/01/2021 Czech Republic Burza cenných papírů Praha, a.s. XPRA 01/01/2021 Czech Republic RM-SYSTÉM, česká burza cenných papírů, XRMZ 01/01/2021 a.s. Denmark NASDAQ COPENHAGEN A/S XCSE 01/01/2021 Denmark Nasdaq Copenhagen A/S - Nordic@MID DCSE 01/01/2021 2 Denmark Nasdaq Copenhagen - Auction on MCSE 01/01/2021 Demand Estonia NASDAQ Tallinn