World Markets 5

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alternative Investment Fund in the USA

May 2016 globalfund www.globalfundmedia.commediaspecial report 2016 Guide to setting up an Alternative Investment Fund in the USA CoverlineStructuring 1 a GradingCoverline your 2 cloud HowCoverline to assess 3 tax‑efficient provider: critical a prime broker’s hedge fund criteria operational support Forward thinking is the fi rst step We’re committed to providing smart, clear and honest guidance to help you meet your goals. From hedge funds and fund of funds to private equity, we are experienced with virtually every type of product in the market. Trust that our global alternative investment experts can provide innovative solutions to help support your plans for success. Global hedge fund administration made simple Administration and accounting Middle offi ce services Custody services Registered offi ce services Investor services Tax services Legal administration Technology and compliance Treasury services For more information about our comprehensive suite of services for alternative funds, exchange-traded funds and mutual funds, call 800.300.3863 or visit usbfs.com. CONTENTS In this issue… 04 Introduction By Sunil Gopalan, Chairman & Publisher, GFM Ltd 05 Chapter 1: Legal & tax structuring 08 Structuring a tax-efficient hedge fund Interview with Ron Geffner, Sadis & Goldberg LLP 11 Grading your cloud provider: four critical criteria By Bob Guilbert, Eze Castle Integration 13 Chapter 2: Regulations & compliance 16 Compliance mindset to be set by senior management Interview with Brian Roberts, ACA Compliance Group 19 ODD considerations for -

Norway – United States

NORWAY – UNITED STATES Overview of requirements for listing shares on Oslo Børs vs NYSE Euronext / NASDAQ April 2014 Overview ∙ This presentation has been prepared with respect to listing of shares on the regulated markets operated by the Oslo Stock Exchange and NYSE Euronext and NASDAQ − In Norway: Oslo Børs and Oslo Axess − In the United States (US): New York Stock Exchange Euronext (NYSE) and NASDAQ Stock Market (NASDAQ) ∙ This presentation has been prepared by Advokatfirmaet Selmer DA for matters pertaining to Norwegian law and by Akin Gump Straus Hauer & Feld LLP for matters pertaining to US law, based on their experience for Norway and US transactions respectively, to provide an overview with respect to certain listing requirements and obligations in relation to listing on Oslo Børs / Oslo Axess vs NYSE / Nasdaq ∙ This presentation comprises only general information on certain Norwegian and US regulations related to listing, and registration of securities, and the continuing obligations of companies listed on Oslo Børs / Oslo Axess and NYSE / Nasdaq, and is not a complete nor exhaustive description of such obligations or other matters that could impact the regulations or application of such regulations. This presentation is prepared for information purposes only as of the date hereof, and shall not be considered nor construed as legal advice in any respect. No liability or responsibility are accepted as a result of this presentation 2 Main features for listing in Norway and the US 03 Listing in Norway 05 Listing in the US 10 Listing comparisons - fees and continuing obligations 16 Prospectus and registration requirements 20 American Depository Receipts, FPIs and EGCs 24 Contact persons 31 Main features for listing in Norway vs US Norway United States Time listing process Formal listing process takes minimum 8 weeks (fast Varies. -

Base Prospectus Dated 21 November 2019

BASE PROSPECTUS DATED 21 NOVEMBER 2019 Heimstaden Bostad AB (publ) (incorporated with limited liability in Sweden) €4,000,000,000 Euro Medium Term Note Programme Under this €4,000,000,000 Euro Medium Term Note Programme (the "Programme"), Heimstaden Bostad AB (publ) (the "Issuer") may from time to time issue notes (the "Notes") denominated in any currency agreed between the Issuer and the relevant Dealers (as defined below). Notes may be issued in bearer or registered form (respectively "Bearer Notes" and "Registered Notes") or in uncertificated book entry form ("VPS Notes") settled through the Norwegian Central Securities Depositary, Verdipapirsentralen ASA (the "VPS"). The maximum aggregate nominal amount of all Notes from time to time outstanding under the Programme will not exceed €4,000,000,000 (or its equivalent in other currencies calculated as described in the Programme Agreement described herein), subject to increase as described herein. The Notes may be issued on a continuing basis to one or more of the Dealers specified under "Overview of the Programme" and any additional Dealer appointed under the Programme from time to time by the Issuer (each a "Dealer" and together the "Dealers"), which appointment may be for a specific issue or on an ongoing basis. References in this Base Prospectus to the "relevant Dealer" shall, in the case of an issue of Notes being (or intended to be) subscribed by more than one Dealer, be to all Dealers agreeing to subscribe such Notes. An investment in Notes issued under the Programme involves certain risks. For a discussion of these risks see "Risk Factors". -

Creating 13F-Based Strategies with Whalewisdom's Backtester

Creating 13F-based strategies with WhaleWisdom’s Backtester David Tepper may be THE best performing hedge fund manager ever. According to Forbes, over the last 23 years Tepper’s hedge fund Appaloosa Management has averaged 30% annualized net returns. Assuming the fund has charged 2% management and 20% performance fees, Tepper’s annualized returns before fees could be in the neighborhood of 40%. Tepper’s Appaloosa Management would therefore seem like a great fund to replicate using 13F filings -- SEC mandated quarterly disclosures of large funds’ positions. Tepper has demonstrated masterful stock-picking skills for many years, so it's reasonable to assume he’ll continue to build wealth for his investors going forward. If one can clone the Appaloosa’s fund using 13Fs, then an investor can piggyback on Tepper’s ideas without paying the 2 and 20 fees direct investors in his fund are subjected to. Replicating Tepper’s positions seems straightforward enough: When Appaloosa updates its holdings via 13Fs -- 45 days after the close of every quarter -- one uses WhaleWisdom to view the changes and rebalance the clone portfolio accordingly. Sounds great, let's fund an account and begin replicating Appaloosa's positions. Hold on though. A reasonable question to ask is: Would cloning Tepper’s trades using 13F holdings actually be a profitable strategy? Sure, Tepper is an investing legend with an amazing two-decade track record, but does mimicking Appaloosa’s 13Fs accurately capture the performance of his fund? One problem might be the lag of 13F filings. 13Fs are required to be disclosed 45 days after a quarter’s end. -

Msci Index Calculation Methodology

INDEX METHODOLOGY MSCI INDEX CALCULATION METHODOLOGY Index Calculation Methodology for the MSCI Equity Indexes Esquivel, Carlos July 2018 JULY 2018 MSCI INDEX CALCULATION METHODOLOGY | JULY 2018 CONTENTS Introduction ....................................................................................... 4 MSCI Equity Indexes........................................................................... 5 1 MSCI Price Index Methodology ................................................... 6 1.1 Price Index Level ....................................................................................... 6 1.2 Price Index Level (Alternative Calculation Formula – Contribution Method) ............................................................................................................ 10 1.3 Next Day Initial Security Weight ............................................................ 15 1.4 Closing Index Market Capitalization Today USD (Unadjusted Market Cap Today USD) ........................................................................................................ 16 1.5 Security Index Of Price In Local .............................................................. 17 1.6 Note on Index Calculation In Local Currency ......................................... 19 1.7 Conversion of Indexes Into Another Currency ....................................... 19 2 MSCI Daily Total Return (DTR) Index Methodology ................... 21 2.1 Calculation Methodology ....................................................................... 21 2.2 Reinvestment -

Bermuda to Oslo (And Beyond?): Still an Attractive Route to Growth by Guy Cooper, Conyers Dill & Pearman

Bermuda to Oslo (and beyond?): still an attractive route to growth By Guy Cooper, Conyers Dill & Pearman T he last five years have seen Shipping industry participants Potential investors are more incorporated – second only to several shipping and ship- choose to incorporate in likely to show interest in an Norwegian companies. The ping-related companies incor- Bermuda because investors are equity offering where there is most recent examples of porate in Bermuda and go on to comfortable with the island’s some immediate liquidity for Bermuda companies listing on list on the Oslo Stock reputation as one of the world’s their investment. Norway, the N-OTC are GoodBulk in Exchange. A key step along the premier offshore jurisdictions where shipping is in the April 2017 and 2020 Bulkers in route for a number of them has and an established international country’s DNA, is the obvious December 2017. been the use of the Norwegian finance centre. Bermuda offers place to turn to raise funds over-the-counter market as a a tax-neutral, business-friendly quickly. One option is a private Oslo listing fast-track way to access fresh environment, with a robust placement of shares to Many companies have used the capital. Avance Gas, Flex LNG, regulatory framework that investors, whilst simultaneously N-OTC as a stepping stone to a and Borr Drilling all took this full listing on the Oslo Stock route prior to an Oslo listing, Shipping industry participants choose Exchange or elsewhere. Over whilst GoodBulk and 2020 the past five years, several Bulkers listed on Norway’s to incorporate in Bermuda because Bermuda companies have OTC just last year, highlighting investors are comfortable with the island’s followed this route, including the enduring appeal of the reputation as one of the world’s premier Avance Gas in 2014, Flex LNG O c Bermuda-Oslo nexus. -

Final Report Amending ITS on Main Indices and Recognised Exchanges

Final Report Amendment to Commission Implementing Regulation (EU) 2016/1646 11 December 2019 | ESMA70-156-1535 Table of Contents 1 Executive Summary ....................................................................................................... 4 2 Introduction .................................................................................................................... 5 3 Main indices ................................................................................................................... 6 3.1 General approach ................................................................................................... 6 3.2 Analysis ................................................................................................................... 7 3.3 Conclusions............................................................................................................. 8 4 Recognised exchanges .................................................................................................. 9 4.1 General approach ................................................................................................... 9 4.2 Conclusions............................................................................................................. 9 4.2.1 Treatment of third-country exchanges .............................................................. 9 4.2.2 Impact of Brexit ...............................................................................................10 5 Annexes ........................................................................................................................12 -

How Miami Is Becoming a Haven for Rich Investors

December 11, 2017 UMV: 76,182 As thousands of visitors flocked to Miami to look at priceless works of art last week, the Miami Downtown Development Authority pitched hedge funds managers and investors to move to South Florida’s financial center. Since 2013, the DDA has been courting hedge fund managers and big time investors living in New York and Connecticut to move down to Miami’s burgeoning investment hub. Since then, the DDA has helped recruit 50 money managers and service providers to move to South Florida, according to the agency. And next year, the pitch could get much easier, according to some experts. Provisions in the tax bills passed by both the U.S. House of Representatives and U.S. Senate proposed federal deductions for state and local taxes (SALT). While Congress is working to pass the final bill, removing these deductions would mean that states with high state incomes taxes such as New York and New Jersey might not be able to qualify for these tax write-offs. Page 2 Alan Lips, a CPA and partner at the Miami-based accounting firm Gerson Preston, said that by removing these federal deductions, he expects more high-net worth investment managers will move to South Florida, where there is no state income tax. “This absolutely helps,” Lips said. “The proposed state income tax deductions make South Florida that much more attractive to Northeast and foreign investors.” With these investors potentially comes more high-skilled jobs and more money flowing into South Florida’s local economy. In addition, some observers say there could be a ripple effect, where these investments spawn a growth in financial services in South Florida. -

Sustainability-Related Indices Should Be Attuned to the Cohort Driving Growth in Sustainable Investing – Millennials

Sustainability-Related Indices Should Be Attuned to the Cohort Driving Growth in Sustainable Investing – Millennials The Harvard community has made this article openly available. Please share how this access benefits you. Your story matters Citation Curtis, Daryl. 2019. Sustainability-Related Indices Should Be Attuned to the Cohort Driving Growth in Sustainable Investing – Millennials. Master's thesis, Harvard Extension School. Citable link https://nrs.harvard.edu/URN-3:HUL.INSTREPOS:37365395 Terms of Use This article was downloaded from Harvard University’s DASH repository, and is made available under the terms and conditions applicable to Other Posted Material, as set forth at http:// nrs.harvard.edu/urn-3:HUL.InstRepos:dash.current.terms-of- use#LAA Sustainability-related Indices Should be Attuned to the Cohort Driving Growth in Sustainable Investing – Millennials Daryl D. Curtis A Thesis in the Field of Sustainability and Environmental Management for the Degree of Master of Liberal Arts in Extension Studies Harvard University April 2019 1 Copyright 2019 Daryl D. Curtis 2 Abstract This research explored to what extent sustainability-related indices are attuned to millennial investor’s interests. Current and projected growth in millennials’ wealth, increases in sustainably-invested assets, millennials’ interests in sustainable investing, ESG integration in the investment profession, and the United Nations’ implementation of sustainability initiatives are amongst several factors which indicate there’s a demand for sustainability-related indexed products for retail and institutional millennial investors. The basis for this research is product issuers can only develop and bring to market sustainability-related index-based products (e.g., Exchanged Traded Funds (ETFs), mutual funds, tracker funds, and derivatives) for the millennial cohort if index providers construct indices based on millennial investors’ interests. -

Richest Hedge Funds the World's

THE WORLD’S DR. BROWNSTEIN’S WINNING FORMULA RICHEST PAGE 40 CANYON’S SECRET EMPIRE HEDGE PAGE 56 CASHING IN ON CHAOS FUNDS PAGE 68 February 2011 BLOOMBERG MARKETS 39 100 THE WORLD’S RICHEST HEDGE FUNDS COVER STORIES FOR 20 YEARS, DON BROWNSTEIN TAUGHT philosophy at the University of Kansas. He special- ized in metaphysics, which examines the character of reality itself. ¶ In a photo from his teaching days, he looks like a young Karl Marx, with a bushy black beard and unruly hair. That photo is now a relic standing behind the curved bird’s-eye-maple desk in Brownstein’s corner office in Stamford, Connecticut. Brownstein abandoned academia in 1989 to try to make some money. ¶ The career change paid off. Brownstein is the founder of Structured Portfolio Man- agement LLC, a company managing $2 billion in five partnerships. His flagship fund, the abstrusely named Structured Servicing Holdings LP, returned 50 percent in the first 10 months of 2010, putting him at the top of BLOOMBERG MARKETS’ list of the 100 best-performing hedge CONTINUED ON PAGE 43 DR. BROWNSTEIN’S By ANTHONY EFFINGER and KATHERINE BURTON WINNING PHOTOGRAPH BY BEN BAKER/REDUX FORMULA THE STRUCTURED PORTFOLIO MANAGEMENT FOUNDER MINE S ONCE-SHUNNED MORTGAGE BONDS FOR PROFITS. HIS FLAGSHIP FUND’S 50 PERCENT GAIN PUTS HIM AT THE TOP OF OUR ROSTER OF THE BEST-PERFORMING LARGE HEDGE FUNDS. 40 BLOOMBERG MARKETS February 2011 NO. BEST-PERFORMING 1 LARGE FUNDS Don Brownstein, left, and William Mok Structured Portfolio Management FUND: Structured Servicing Holdings 50% 2010 135% 2009 TOTAL RETURN In BLOOMBERG MARKETS’ first-ever THE 100 TOP- ranking of the top 100 large PERFORMING hedge funds, bets on mortgages, gold, emerging markets and global LARGE HEDGE FUNDS economic trends stand out. -

The List of Approved Stock Exchanges

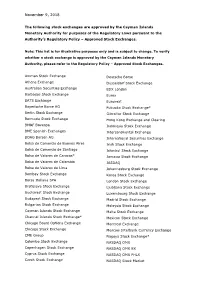

November 9, 2018 The following stock exchanges are approved by the Cayman Islands Monetary Authority for purposes of the Regulatory Laws pursuant to the Authority’s Regulatory Policy – Approved Stock Exchanges. Note: This list is for illustrative purposes only and is subject to change. To verify whether a stock exchange is approved by the Cayman Islands Monetary Authority, please refer to the Regulatory Policy – Approved Stock Exchanges. Amman Stock Exchange Deutsche Borse Athens Exchange Dusseldorf Stock Exchange Australian Securities Exchange EDX London Barbados Stock Exchange Eurex BATS Exchange Euronext Bayerische Borse AG Fukuoka Stock Exchange* Berlin Stock Exchange Gibraltar Stock Exchange Bermuda Stock Exchange Hong Kong Exchange and Clearing BM&F Bovespa Indonesia Stock Exchange BME Spanish Exchanges Intercontinental Exchange BOAG Borsen AG International Securities Exchange Bolsa de Comercio de Buenos Aires Irish Stock Exchange Bolsa de Comercio de Santiago Istanbul Stock Exchange Bolsa de Valores de Caracas* Jamaica Stock Exchange Bolsa de Valores de Colombia JASDAQ Bolsa de Valores de Lima Johannesburg Stock Exchange Bombay Stock Exchange Korea Stock Exchange Borsa Italiana SPA London Stock Exchange Bratislava Stock Exchange Ljubljana Stock Exchange Bucharest Stock Exchange Luxembourg Stock Exchange Budapest Stock Exchange Madrid Stock Exchange Bulgarian Stock Exchange Malaysia Stock Exchange Cayman Islands Stock Exchange Malta Stock Exchange Channel Islands Stock Exchange* Mexican Stock Exchange Chicago Board Options Exchange -

Hedge Funds and Stock Price Formation

Research Financial Analysts Journal | A Publication of CFA Institute Hedge Funds and Stock Price Formation Charles Cao, Yong Chen, William N. Goetzmann, and Bing Liang Charles Cao is Smeal Chair Professor of Finance at Smeal College of Business, Pennsylvania State University, University Park, Pennsylvania. Yong Chen is associate professor of finance at Mays Business School, Texas A&M University, College Station, Texas. William N. Goetzmann is Edwin J. Beinecke Professor of Finance and Management Studies and director of the International Center for Finance at Yale School of Management, New Haven, Connecticut. Bing Liang is Charles P. McQuaid Endowed Professor of finance at Isenberg School of Management, University of Massachusetts Amherst, Amherst, Massachusetts. Using comprehensive quarterly Hedge funds have become the Galápagos Islands of finance. data on hedge fund stock hold- ings, we study the role of hedge —Andrew W. Lo, Adaptive Markets, 2017 funds in the process of stock price formation. We find that hedge n November 2016, Goldman Sachs launched a brand-new exchange- funds tend to hold undervalued traded fund (ETF), GVIP, to track the performance of its hedge fund stocks and that both hedge fund Iindex, the VIP. The VIP is based on fundamentally driven hedge fund ownership and trading by hedge managers’ “very important positions,” which are those that appear funds are positively related to most frequently among their top 10 long equity holdings. The VIP the degree of stock mispricing. A has outperformed the S&P 500 Index by an average of more than 2% portfolio of undervalued stocks annually since the index inception in 2001.