Msci Index Calculation Methodology

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Weak-Form Market Efficiency, Estimation Interval and the Nigerian Stock Exchange: Empirical Evidence

WEAK-FORM MARKET EFFICIENCY, ESTIMATION INTERVAL AND THE NIGERIAN STOCK EXCHANGE: EMPIRICAL EVIDENCE Onyemachi Maxwell Ogbulu, Abia State University Abstract Given the desirability of efficient capital markets in aiding optimal resource mobilization and allocation in the financial system, this paper is an attempt to investigate the efficiency level of the Nigerian Stock Exchange (NSE) across different data estimation intervals with reference to the weak-form variant of the Efficient Market Hypothesis (EMH). The paper employed daily, weekly, monthly and quarterly aggregate stock price data using the NSE All Share Index series from 4th January, 1999 to 31st December, 2013 to test for the weak-form efficiency of the NSE using a combination of seven (7) statistical and parametric tools namely- Autocorrelation tests, the ADF and P-P unit root tests, Variance Ratio tests, the Normality/Random Walk tests, the Granger Causality test, the ARCH-GARCH test and Regression rest. The empirical results of the investigation indicate that on balance the NSE is weak-form inefficient when daily, weekly, monthly and quarterly prices are examined irrespective of the estimation interval and the parametric test employed in the tests. It is to be noted from the findings that the NSE is still weak-form inefficient despite the implementation of various capital market reforms undertaken in the recent past as well as the adoption of automation and ICT in the operations of the Exchange. It is therefore recommended that these salutary reforms and policies should be intensified and sustained to ensure efficiency of the NSE. Keywords: Weak-form efficiency, Efficient Market Hypothesis, Estimation Interval, Parametric Tests. -

Execution Venues List

Execution Venues List This list should be read in conjunction with the Best Execution policy for Credit Suisse AG (excluding branches and subsidiaries), Credit Suisse (Switzerland) Ltd, Credit Suisse (Luxembourg) S.A, Credit Suisse (Luxembourg) S.A. Zweigniederlassung Österreichand, Neue Aargauer Bank AG published at www.credit-suisse.com/MiFID and https://www.credit-suisse.com/lu/en/private-banking/best-execution.html The Execution Venues1) shown enable the in scope legal entities to obtain on a consistent basis the best possible result for the execution of client orders. Accordingly, where the in scope legal entities may place significant reliance on these Execution Venues. Equity Cash & Exchange Traded Funds Country/Liquidity Pool Execution Venue1) Name MIC Code2) Regulated Markets & 3rd party exchanges Europe Austria Wiener Börse – Official Market WBAH Austria Wiener Börse – Securities Exchange XVIE Austria Wiener Börse XWBO Austria Wiener Börse Dritter Markt WBDM Belgium Euronext Brussels XBRU Belgium Euronext Growth Brussels ALXB Czech Republic Prague Stock Exchange XPRA Cyprus Cyprus Stock Exchange XCYS Denmark NASDAQ Copenhagen XCSE Estonia NASDAQ Tallinn XTAL Finland NASDAQ Helsinki XHEL France EURONEXT Paris XPAR France EURONEXT Growth Paris ALXP Germany Börse Berlin XBER Germany Börse Berlin – Equiduct Trading XEQT Germany Deutsche Börse XFRA Germany Börse Frankfurt Warrants XSCO Germany Börse Hamburg XHAM Germany Börse Düsseldorf XDUS Germany Börse München XMUN Germany Börse Stuttgart XSTU Germany Hannover Stock Exchange XHAN -

Norway – United States

NORWAY – UNITED STATES Overview of requirements for listing shares on Oslo Børs vs NYSE Euronext / NASDAQ April 2014 Overview ∙ This presentation has been prepared with respect to listing of shares on the regulated markets operated by the Oslo Stock Exchange and NYSE Euronext and NASDAQ − In Norway: Oslo Børs and Oslo Axess − In the United States (US): New York Stock Exchange Euronext (NYSE) and NASDAQ Stock Market (NASDAQ) ∙ This presentation has been prepared by Advokatfirmaet Selmer DA for matters pertaining to Norwegian law and by Akin Gump Straus Hauer & Feld LLP for matters pertaining to US law, based on their experience for Norway and US transactions respectively, to provide an overview with respect to certain listing requirements and obligations in relation to listing on Oslo Børs / Oslo Axess vs NYSE / Nasdaq ∙ This presentation comprises only general information on certain Norwegian and US regulations related to listing, and registration of securities, and the continuing obligations of companies listed on Oslo Børs / Oslo Axess and NYSE / Nasdaq, and is not a complete nor exhaustive description of such obligations or other matters that could impact the regulations or application of such regulations. This presentation is prepared for information purposes only as of the date hereof, and shall not be considered nor construed as legal advice in any respect. No liability or responsibility are accepted as a result of this presentation 2 Main features for listing in Norway and the US 03 Listing in Norway 05 Listing in the US 10 Listing comparisons - fees and continuing obligations 16 Prospectus and registration requirements 20 American Depository Receipts, FPIs and EGCs 24 Contact persons 31 Main features for listing in Norway vs US Norway United States Time listing process Formal listing process takes minimum 8 weeks (fast Varies. -

Recent Acquisitions and Other Transactions NYSE Bluetm On

Recent Acquisitions and Other Transactions NYSE BlueTM On September 7, 2010 NYSE Euronext announced plans to create NYSE BlueTM (which is referred to in this section as “NYSE Blue”), a joint venture focusing on environmental and sustainable energy markets. NYSE Blue includes NYSE Euronext’s existing investment in BlueNext, the spot market in carbon credits, and APX, Inc. (which is referred to in this section as “APX”), a provider of regulatory infrastructure and services for the environmental and sustainable energy markets. NYSE Euronext is majority owner of NYSE Blue. Shareholders of APX, which include Goldman Sachs, Mission Point Capital Partners, and ONSET Ventures, received a minority equity interest in NYSE Blue in return for their shares in APX. The NYSE Blue joint venture formation closed on February 18, 2011. National Stock Exchange of India On May 3, 2010, NYSE Euronext completed the sale of its 5% equity interest in the National Stock Exchange of India for gross proceeds of $175 million. A $56 million gain was included in “Other income” in its consolidated statement of operations for year ended December 31, 2010 as a result of this transaction. NYFIX, Inc. On November 30, 2009, NYSE Euronext acquired NYFIX, Inc. which is a leading provider of innovative solutions that optimize trading efficiency. The total value of this acquisition was approximately $144 million. Infix’s FIX business and FIX Software business were added to the Information Services and Technology Solutions segment. The NYFIX Transaction Services U.S. electronic agency execution business, comprised of its direct market access and algorithmic products, and the Millennium Alternative Trading System was sold to BNY ConvergEX subsequent to the NYFIX acquisition. -

Base Prospectus Dated 21 November 2019

BASE PROSPECTUS DATED 21 NOVEMBER 2019 Heimstaden Bostad AB (publ) (incorporated with limited liability in Sweden) €4,000,000,000 Euro Medium Term Note Programme Under this €4,000,000,000 Euro Medium Term Note Programme (the "Programme"), Heimstaden Bostad AB (publ) (the "Issuer") may from time to time issue notes (the "Notes") denominated in any currency agreed between the Issuer and the relevant Dealers (as defined below). Notes may be issued in bearer or registered form (respectively "Bearer Notes" and "Registered Notes") or in uncertificated book entry form ("VPS Notes") settled through the Norwegian Central Securities Depositary, Verdipapirsentralen ASA (the "VPS"). The maximum aggregate nominal amount of all Notes from time to time outstanding under the Programme will not exceed €4,000,000,000 (or its equivalent in other currencies calculated as described in the Programme Agreement described herein), subject to increase as described herein. The Notes may be issued on a continuing basis to one or more of the Dealers specified under "Overview of the Programme" and any additional Dealer appointed under the Programme from time to time by the Issuer (each a "Dealer" and together the "Dealers"), which appointment may be for a specific issue or on an ongoing basis. References in this Base Prospectus to the "relevant Dealer" shall, in the case of an issue of Notes being (or intended to be) subscribed by more than one Dealer, be to all Dealers agreeing to subscribe such Notes. An investment in Notes issued under the Programme involves certain risks. For a discussion of these risks see "Risk Factors". -

Report of the 5 Th Meeting

FIFTH MEETING OF THE OIC MEMBER STATES’ STOCK EXCHANGES FORUM FINAL REPORT OF THE FIFTH MEETING OF THE OIC MEMBER STATES’ STOCK EXCHANGES FORUM ISTANBUL, SEPTEMBER 17-18, 2011 The Marmara Hotel Istanbul, September 2011 1 FINAL REPORT OF THE FIFTH MEETING OF THE OIC MEMBER STATES’ STOCK EXCHANGES FORUM ISTANBUL, SEPTEMBER 17-18, 2011 The Marmara Hotel Istanbul, September 2011 2 TABLE OF CONTENTS Final Report of the Fifth Meeting of the OIC Member States’ Stock Exchanges Forum ANNEXES I. Presentation by Mr. Thomas Krabbe II. Presentation by Mr. Roland Bellegarde III. Presentation by Mr. Lauri Rosendahl IV. Presentation by Mr. Stephan Pouyat V. Presentation by Mr. Philippe Carré VI. Presentation by Mr. Rushdi Siddiqui on behalf of Thomson Reuters VII. Presentation by Mr. Ibrahim Idjarmizuan on behalf of IFSB VIII. Presentation by Mr. Gürsel Kona from the Istanbul Stock Exchange IX. Presentation by Mr. Ijlal Alvi on behalf of IIFM X. Presentation by Avşar Sungurlu, on behalf of BMD Securities Inc. XI. Presentation by Mr. Hüseyin Erkan, as Forum Chairman XII. Presentation by Şenay Pehlivanoğlu on behalf of the Task Force for Customized Indices and Exchange Traded Islamic Financial Products XIII. Presentation by Mr. Charbel Azzi on behalf of S&P Indices XIV. Presentation by Dr. Eralp Polat on behalf of the Forum Secretariat XV. Presentation by Mr. Abolfazl Shahrabadi and Mr. Hamed Soltaninejad on behalf of the Task Force for Capital Market Linkages 3 FINAL REPORT OF THE FFIFTH MEETING OF THE OIC MEMBER STATES’ STOCK EXCHANGES FORUM ISTANBUL, SEPTEMBER 17-18, 2011 4 Original: English FINAL REPORT OF THE FIFTH MEETING OF THE OIC MEMBER STATES’ STOCK EXCHANGES FORUM (Istanbul, September 17-18, 2011) 1. -

An Analysis of the Relationship Between Risk and Expected Return in the BRVM Stock Exchange: Test of the CAPM

www.sciedu.ca/rwe Research in World Economy Vol. 5, No. 1; 2014 An Analysis of the Relationship between Risk and Expected Return in the BRVM Stock Exchange: Test of the CAPM Kolani Pamane1 & Anani Ekoue Vikpossi2 1 School of Management, Wuhan University of Technology, Wuhan, China 2 Swakop Uranium (Propriety) Ltd, Olympia Windhoek, Namibia Correspondence: Kolani Pamane, School of Management, Wuhan University of Technology, Wuhan 430070, China. E-mail: [email protected] Received: October 22, 2010 Accepted: November 10, 2010 Online Published: March 1, 2014 doi:10.5430/rwe.v5n1p13 URL: http://dx.doi.org/10.5430/rwe.v5n1p13 Abstract One of the most important concepts in investment theory is the relationship between risk and return. This relationship drives the theoretical foundation of many investment models such as the well known Capital Asset Pricing Model which predicts that the expected return on an asset above the risk-free rate is linearly related to the non-diversifiable risk measured by its beta. This study examines the Capital Asset Pricing Model (CAPM) and test it validity for the WAEMU space stock market called BRVM (BOURSE REGIONALE DES VALEURS MOBILIERES) using monthly stock returns from 17 companies listed on the stock exchange for the period of January 2000 to December 2008. Combining Black, Jensen and Scholes with Fama and Macbeth methods of testing the CAPM, the whole period was divided into four sub-periods and stock’s betas used instead of portfolio’s betas due to the small size of the sample. The CAPM’s prediction for the intercept is that it should equal zero and the slope should equal the excess returns on the market portfolio. -

On Determination of Market Price of One Ordinary Registered Share of the Moscow Exchange (State Registration Number 1-05-8443-H Dated 16.11.2011)

2, 3-ya ulitsa Yamskogo Polya, bld. 7, office 301, Moscow, 125040 Tel.: +7 (495) 717-01-01 +7 (495) 557-07-97 www.evcons.ru REPORT No. 134/16 dated June 29, 2016 On determination of market price of one ordinary registered share of the Moscow Exchange (state registration number 1-05-8443-H dated 16.11.2011) Customer: Moscow Exchange Contractor: Everest Consulting Moscow 2016 EVEREST Consulting LLC 1 Att: Evgeny Fetisov CFO Moscow Exchange Dear Evgeny, Under Agreement No.134/16 dated 16.06.2016 executed by and between Everest Consulting Limited Liability Company (hereinafter Everest Consulting LLC, the Contractor), and Public Joint-Stock Company Moscow Exchange MICEX-RTS (hereinafter the Moscow Exchange, the Customer), the appraiser employed by the Contractor (hereinafter the Appraiser) carried out valuation of one registered ordinary share of the Moscow Exchange (hereinafter the Object of Valuation). The principle task and intended use of valuation was to measure the market price of the Object of Valuation for the purpose of share buyback from shareholders who voted against the corporate restructuring or failed to participate in voting in pursuance with clause 1 and clause 3 Article 75 of the Federal Law No.208-FZ On Joint-stock Companies dated 26 December 1995. The valuation was done in accordance with the Federal Law No.135-FZ On Valuation Activity in the Russian Federation dated 29 July 1998, Federal Evaluation Standard General Concepts of the Valuation, Approaches and Requirements to Carrying Out the Valuation (FES No.1) approved by the Order of the Ministry of Economy No. -

Bermuda to Oslo (And Beyond?): Still an Attractive Route to Growth by Guy Cooper, Conyers Dill & Pearman

Bermuda to Oslo (and beyond?): still an attractive route to growth By Guy Cooper, Conyers Dill & Pearman T he last five years have seen Shipping industry participants Potential investors are more incorporated – second only to several shipping and ship- choose to incorporate in likely to show interest in an Norwegian companies. The ping-related companies incor- Bermuda because investors are equity offering where there is most recent examples of porate in Bermuda and go on to comfortable with the island’s some immediate liquidity for Bermuda companies listing on list on the Oslo Stock reputation as one of the world’s their investment. Norway, the N-OTC are GoodBulk in Exchange. A key step along the premier offshore jurisdictions where shipping is in the April 2017 and 2020 Bulkers in route for a number of them has and an established international country’s DNA, is the obvious December 2017. been the use of the Norwegian finance centre. Bermuda offers place to turn to raise funds over-the-counter market as a a tax-neutral, business-friendly quickly. One option is a private Oslo listing fast-track way to access fresh environment, with a robust placement of shares to Many companies have used the capital. Avance Gas, Flex LNG, regulatory framework that investors, whilst simultaneously N-OTC as a stepping stone to a and Borr Drilling all took this full listing on the Oslo Stock route prior to an Oslo listing, Shipping industry participants choose Exchange or elsewhere. Over whilst GoodBulk and 2020 the past five years, several Bulkers listed on Norway’s to incorporate in Bermuda because Bermuda companies have OTC just last year, highlighting investors are comfortable with the island’s followed this route, including the enduring appeal of the reputation as one of the world’s premier Avance Gas in 2014, Flex LNG O c Bermuda-Oslo nexus. -

Final Report Amending ITS on Main Indices and Recognised Exchanges

Final Report Amendment to Commission Implementing Regulation (EU) 2016/1646 11 December 2019 | ESMA70-156-1535 Table of Contents 1 Executive Summary ....................................................................................................... 4 2 Introduction .................................................................................................................... 5 3 Main indices ................................................................................................................... 6 3.1 General approach ................................................................................................... 6 3.2 Analysis ................................................................................................................... 7 3.3 Conclusions............................................................................................................. 8 4 Recognised exchanges .................................................................................................. 9 4.1 General approach ................................................................................................... 9 4.2 Conclusions............................................................................................................. 9 4.2.1 Treatment of third-country exchanges .............................................................. 9 4.2.2 Impact of Brexit ...............................................................................................10 5 Annexes ........................................................................................................................12 -

Cooperation Among the Stock Exchanges of the Oic Member Countries

Journal of Economic Cooperation, 27 -3 (2006), 121-162 COOPERATION AMONG THE STOCK EXCHANGES OF THE OIC MEMBER COUNTRIES SESRTCIC In response to the increased competition prevailing in the international financial markets, national stock exchanges around the world recently made several attempts to upgrade their cooperation and improve their integration. Those attempts took often the form of coalitions, common trading platforms, mergers, associations, federations and unions. Like others, the OIC countries have recently intensified their efforts to promote cooperation among their stock exchanges with a view to developing and consolidating a mechanism for a possible form of integration among themselves. This paper reviews the experiences of various stock exchange alliances established at regional and international levels and draws some lessons for the OIC countries’ stock exchanges in terms of the need for harmonising their physical, institutional and legal frameworks and policies and sharing their investor base. 1. INTRODUCTION As the international trade and financial flows accelerated, the global economy witnessed an increase in the pace of integration. This process of globalisation is most evidently observed in the capital and financial markets. One important element that has led to such a result is the technological advancement in the information and telecommunications sector. Hence, financial transactions became instantaneous and the information guiding investments open to everybody. In this context, technological advancements and the resulting accelerated flow of information have increased efficiency, fairness, transparency and safety in the international financial and capital markets. 122 Journal of Economic Cooperation As those developments introduced new prospects and benefits to the stock markets all around the world, they increased competition among the financial markets, securities exchanges in particular. -

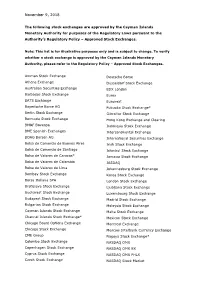

The List of Approved Stock Exchanges

November 9, 2018 The following stock exchanges are approved by the Cayman Islands Monetary Authority for purposes of the Regulatory Laws pursuant to the Authority’s Regulatory Policy – Approved Stock Exchanges. Note: This list is for illustrative purposes only and is subject to change. To verify whether a stock exchange is approved by the Cayman Islands Monetary Authority, please refer to the Regulatory Policy – Approved Stock Exchanges. Amman Stock Exchange Deutsche Borse Athens Exchange Dusseldorf Stock Exchange Australian Securities Exchange EDX London Barbados Stock Exchange Eurex BATS Exchange Euronext Bayerische Borse AG Fukuoka Stock Exchange* Berlin Stock Exchange Gibraltar Stock Exchange Bermuda Stock Exchange Hong Kong Exchange and Clearing BM&F Bovespa Indonesia Stock Exchange BME Spanish Exchanges Intercontinental Exchange BOAG Borsen AG International Securities Exchange Bolsa de Comercio de Buenos Aires Irish Stock Exchange Bolsa de Comercio de Santiago Istanbul Stock Exchange Bolsa de Valores de Caracas* Jamaica Stock Exchange Bolsa de Valores de Colombia JASDAQ Bolsa de Valores de Lima Johannesburg Stock Exchange Bombay Stock Exchange Korea Stock Exchange Borsa Italiana SPA London Stock Exchange Bratislava Stock Exchange Ljubljana Stock Exchange Bucharest Stock Exchange Luxembourg Stock Exchange Budapest Stock Exchange Madrid Stock Exchange Bulgarian Stock Exchange Malaysia Stock Exchange Cayman Islands Stock Exchange Malta Stock Exchange Channel Islands Stock Exchange* Mexican Stock Exchange Chicago Board Options Exchange