Cleanweb UK: How British Companies Are Using the Web for Economic Growth & Environmental Impact

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

How Uber Won the Rideshare Wars and What Comes Next

2/18/2020 How Uber Won The Rideshare Wars and What Comes Next CUSTOMER EXPERIENCE | HOW UBER WON THE RIDESHARE WARS AND WHAT COMES NEXT How Uber Won The Rideshare Wars and What Comes Next How Uber won the first phase of the rideshare war and how cabs, competitors, and car companies are battling back. BY ELYSE DUPRE — AUGUST 29, 2016 VIEW GALLERY https://www.dmnews.com/customer-experience/article/13035536/how-uber-won-the-rideshare-wars-and-what-comes-next 1/18 2/18/2020 How Uber Won The Rideshare Wars and What Comes Next View Gallery In 2011, two University of Michigan alums Adrian Fortino and Jahan Khanna partnered with venture capitalist Sunil Paul to revolutionize how people got from point A to point B quickly without having to do much. The company was Sidecar, and the idea was simple: “We're going to replace your car with your iPhone,” Fortino explains. Sidecar did not lack competition. Around this time, the taxi industry was experimenting with new ways to make it easier for individuals to summon cars. And entrepreneurs, frustrated with wait times, imagined new ways to hire someone to drive them around. Multiple companies formed to solve this need, including one that is now considered a global powerhouse: Uber. By the time Sidecar went into beta testing in February 2012, Uber, or UberCab as it was originally known when it was founded in 2009, had raised at least $37.5 million at a $330 million post-money valuation, according to VentureBeat. Lyft followed shortly after when it went into beta in mid 2012, boasting more than $7 million in funding, according to TechCrunch's figures. -

Acquiring Zipcar: Brand Building in the Share Economy

Boston University School of Management BU Case Study 12-010 Rev. December 12, 2012 Acquiring Zipcar Brand Building in the Share Economy By Susan Fournier, Giana Eckhardt and Fleura Bardhi Scott Griffith, CEO of Zipcar, languished over his stock charts. They had something here, everyone agreed about that. Zipcar had shaken up the car rental industry with a “new model” for people who wanted steady access to cars without the hassle of owning them. Sales had been phenomenal. Since its beginning in 2000, Zipcar had experienced 100%+ growth annually, with annual revenue in the previous year of $241.6 million. Zipcar now boasted more than 750,000 members and over 8,900 cars in urban areas and college campuses throughout the United States, Canada and the U.K. and claimed nearly half of all global car-sharing members. The company had continued international expansion by purchasing the largest car sharing company in Spain. The buzz had been wonderful. Still, Zipcar’s stock price was being beaten down, falling from a high of $31.50 to a current trade at $8 and change (See Exhibit 1). The company had failed to turn an annual profit since its founding in 2000 and held but two months’ of operating cash on hand as of September 2012. Critics wondered about the sustainability of the business model in the face of increased competition. There was no doubt: the “big guys” were circling. Enterprise Rent-a-Car Co. had entered car sharing with a model of its own (See Exhibit 2). The Enterprise network, which included almost 1 million vehicles and more than 5,500 offices located within 15 miles of 90 percent of the U.S. -

Reinventing Transportation in Our Connected World September 7-11, 2014 | Cobo Center | Detroit, Michigan, USA

Preliminary Program Registration Open Reinventing Transportation in our Connected World September 7-11, 2014 | Cobo Center | Detroit, Michigan, USA Hosted by: Co-hosts: www.itsworldcongress.org | #ITSWC14 2 21st World Congress on Intelligent Transport Systems Contents Welcome ----------------------------------------------------------------------- 4 & 5 Congress Format -------------------------------------------------------------- 6 Special Features --------------------------------------------------------------- 8 The 2014 ITS World Congress Mobile App ----------- 11 Registration ---------------------------------------------------------------------- 13 Travel & Transportation Information ----------------------- 18 Accommodation Information ------------------------------------- 20 General Information ------------------------------------------------------- 21 ITS America Leadership Circle -------------------------------- 22 Session Tracks ---------------------------------------------------------------- 23 Schedule at a Glance ---------------------------------------------------- 27 Keynote Speakers ---------------------------------------------------------- 28 High Level Policy Roundtable ------------------------------------ 30 Town Hall Sessions -------------------------------------------------------- 31 Plenary Sessions ------------------------------------------------------------ 32 CTO Summit Sessions -------------------------------------------------- 34 Executive Sessions -------------------------------------------------------- 38 Special -

Organizing Manual National Homeless Persons' Memorial Day

22000099 OOrrggaanniizziinngg MMaannuuaall NATIONAL HOMELESS PERSONS’ MEMORIAL DAY MANUAL 2009 Organizing Manual National Homeless Persons’ Memorial Day December 21, 2009 Homeless people will die in your community this year. Plan to memorialize them on December 21, the first day of Winter, the longest night of the year. In 2008, over 120 communities participated in the 18th Annual National Homeless Persons’ Memorial Day; surpassing last years’ number of communities by more than 30. Let’s make 2009 a year of more awareness by organizing even more memorial services for the homeless throughout the nation. The National Coalition National Health Care for National Consumer for the Homeless the Homeless Council Advisory Board 2201 P St NW PO Box 60427 PO Box 60427 www.nationalhomeless.org Nashville, TN 37206 Nashville, TN 37206 Washington, DC 20037 www.nhchc.org www.nhchc.org Phone: 202.462.4822 Phone: (615) 226-2292 Phone: (615) 226-2292 Fax: 202.462.4823 Fax: (615) 226-1656 Fax: (615) 226-1656 [email protected] [email protected] [email protected] THE FIRST DAY OF WINTER. THE LONGEST NIGHT OF THE YEAR. ii NATIONAL HOMELESS PERSONS’ MEMORIAL DAY MANUAL 2009 Table of Contents 1 An Overview 2 Organizing an Event to Commemorate National Homeless Persons’ Memorial Day 4 2008 Memorial Day Event Locations 6 Sample Flyers and Agendas 10 Sample Press Releases 14 Sample State Proclamations 16 Sample City/County Resolutions 20 Highlights of 2008 Memorial Day Events 42 List of Homeless Deaths in 2008 72 “Bloggers Unite” 73 Street Sense article, March 2009 St. Louis Memorial Service, Dec. 21, 2008. -

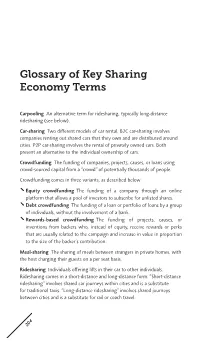

Glossary of Key Sharing Economy Terms

Glossary of Key Sharing Economy Terms Carpooling An alternative term for ridesharing, typically long-distance ridesharing (see below). Car-sharing Two different models of car rental. B2C car-sharing involves companies renting out shared cars that they own and are distributed around cities. P2P car-sharing involves the rental of privately owned cars. Both present an alternative to the individual ownership of cars. Crowdfunding The funding of companies, projects, causes, or loans using crowd-sourced capital from a “crowd” of potentially thousands of people. Crowdfunding comes in three variants, as described below. Equity crowdfunding The funding of a company through an online platform that allows a pool of investors to subscribe for unlisted shares. Debt crowdfunding The funding of a loan or portfolio of loans by a group of individuals, without the involvement of a bank. Rewards-based crowdfunding The funding of projects, causes, or inventions from backers who, instead of equity, receive rewards or perks that are usually related to the campaign and increase in value in proportion to the size of the backer’s contribution. Meal-sharing The sharing of meals between strangers in private homes, with the host charging their guests on a per seat basis. Ridesharing Individuals offering lifts in their car to other individuals. Ridesharing comes in a short-distance and long-distance form. “Short-distance ridesharing” involves shared car journeys within cities and is a substitute for traditional taxis. “Long-distance ridesharing” involves shared journeys between cities and is a substitute for rail or coach travel. 204 Glossary of Key Sharing Economy Terms 205 Sharing economy (condensed version) The value in taking underutilized assets and making them accessible online to a community, leading to a reduced need for ownership of those assets. -

Transportation Network Companies

Transportation Network Companies Testimony of Ginger Goodin, P.E. Senior Research Engineer and Director, Transportation Policy Research Center and Maarit Moran Associate Transportation Researcher Texas A&M Transportation Institute to the Texas Senate Committee on Business and Commerce March 14, 2017 Introduction Chairman Hancock and Members, I am Ginger Goodin, Director of the Texas A&M Transportation Institute Policy Research Center, and I am joined today by Maarit Moran, TTI Associate Transportation Researcher and Principal Investigator of the research to be discussed at this hearing. In your briefing material is a map summarizing the nationwide legislation enacted to authorize and regulate transportation network companies through March 1, 2017. Background Since 2010, a number of private companies have entered the transportation services market by offering new travel options that use digital technology to provide an on-demand and highly automated private ride service. The most well-known of the transportation network companies, or TNCs, as these companies are frequently classified, may be Uber and Lyft, although there are many companies operating in this arena. TNCs have expanded rapidly in cities worldwide. However, they do not fit neatly into current regulatory schemes and have caused some disruption in the transportation marketplace. We take no position regarding any desirability or lack thereof of regulating TNCs at any level of government. Our purpose is to help policy makers navigate the inherent policy considerations. To that end, we examined laws and lawmaking efforts in other states as well as regulatory efforts in a number of Texas cities, and we compiled the state-level information into an easily accessed interactive online map. -

Summer/Fall 2008

The Journal of Values-Based Leadership Volume 1 Article 7 Issue 2 Summer/Fall 2008 July 2008 Summer/Fall 2008 Follow this and additional works at: http://scholar.valpo.edu/jvbl Part of the Business Commons Recommended Citation (2008) "Summer/Fall 2008," The Journal of Values-Based Leadership: Vol. 1 : Iss. 2 , Article 7. Available at: http://scholar.valpo.edu/jvbl/vol1/iss2/7 This Full Issue is brought to you for free and open access by the College of Business at ValpoScholar. It has been accepted for inclusion in The ourJ nal of Values-Based Leadership by an authorized administrator of ValpoScholar. For more information, please contact a ValpoScholar staff member at [email protected]. JOURNAL OF VALUESBASED LEADERSHIP* Summer/Fall 2008 Volume 1, Issue 2 Editor-in-Chief: Elizabeth Gingerich Assistant Professor, Business Law Valparaiso University College of Business Administration (219) 464-5035 [email protected] *The JVBL name and logo are proprietary trademarks. All rights reserved. JVBL Mission Statement The mission of the JVBL is to promote ethical and moral leadership and behavior by serving as a forum for ideas and the sharing of “best practices.” It will serve as a resource for business and institutional leaders, educators, and students concerned about values-based leadership. JVBL defines values-based leadership to include topics involving ethics in leadership, moral considerations in business decision-making, stewardship of our natural environment, and spirituality as a source of motivation. The Journal strives to publish articles that are intellectually rigorous yet of practical use to leaders and teachers. In this way, the JVBL shall serve as a high quality, international journal focused on converging the practical, theoretical and applicable ideas and experiences of scholars and practitioners. -

REGULATING the SHARING ECONOMY Vanessa Katz†

REGULATING THE SHARING ECONOMY Vanessa Katz† Internet commerce has enabled peer-to-peer (“P2P”) transactions on a larger scale than ever before.1 While the law slowly adapts to address P2P sales of goods, a wave of online marketplaces has emerged for P2P exchanges of services: short-term rentals of residential housing or office space,2 rentals of peer-owned assets,3 transportation network companies (“TNCs”) for short trips in personal vehicles or small planes,4 auction houses for temporary licenses,5 contracting services for daily chores and © 2015 Vanessa Katz. † J.D. Candidate, 2016, University of California, Berkeley, School of Law. 1. See, e.g., David Gamage & Devin J. Heckman, A Better Way Forward for State Taxation of E-Commerce, 92 B.U. L. REV. 483, 484 (2012). 2. Some short-term rental platforms allow users to rent individual bedrooms or entire residences. E.g., AIRBNB, https://www.airbnb.com/; HOMEAWAY, http://www.homeaway.com/; ROOMORAMA, https://www.roomorama.com/. Others allow users to book a workspace, including individual desks and full conference rooms. E.g., PEERSPACE, http://www.peerspace.com/; ZIPCUBE, https://www.zipcube.com/ (all URLs last visited Feb. 26, 2015). 3. E.g., GETAROUND, https://www.getaround.com/ (cars); BOATBOUND, https://boatbound.co/ (boat rentals); CAMERALENDS, https://www.cameralends.com/ (cameras); BESCRAPPY, https://bescrappy.com/ (tools); LITERATOO, http://en.literatoo.com/ (books); STYLELEND, http://stylelend.com/ (high-fashion clothes) (all URLs last visited Feb. 26, 2015). 4. TNCs generally allow riders to contact black cars or other personal vehicles for short trips. LYFT, https://www.lyft.com/; SIDECAR, http://www.side.cr/. -

441573 Master S Thesis

Master’s Thesis M.Sc. Economics and Business Administration International Business What Drives Incumbent Firms to Acquire Sharing Economy Platforms? A Multiple Case Study Authors: Thibaut Evers Submission date: 15th of May 2018 Student Number: 107121 Total Characters: 244,211 Ida Mari Gundersen Supervisor: Ioanna Constantinou Student Number: 102528 Department of Digitalization Abstract Platforms from the sharing economy have turned traditional patterns of ownership upside down. The trend has fundamentally challenged market mechanisms and disrupted industries. Incumbent firms relying on traditional business models, seem to no longer ignore these threats. Apart from simple competition through differentiation, also partnerships and acquisitions are increasingly becoming relevant for the incumbent firms. This thesis aims to answer: “What drives incumbent firms to acquire sharing economy platforms?” In particular: “What are the incumbent firms’ strategic aims and integration strategies?” Lastly, this thesis provides insights of how these acquisitions affect the environment of the sharing economy. The Håkanson model (1995), as well as the business model by Johnson et al. (2008) lay the foundation of the analysis to answer the research questions. Herein, six cases that include an incumbent firm as acquirer and a sharing economy platform as acquisition target are studied in-depth. The aggregation and pattern matching analysis revealed three categories of incumbent firms. Based on their positioning in the value chain these categories include: The Manufacturer, The Distributor and The Maverick. These three categories of incumbents are distinguishable in their strategic aim and integration of distinctive product and service offerings from the sharing economy. The Manufacturer is motivated to move downstream in its value chain by capitalizing on customers that are access over ownership oriented. -

If It Doesn't Exist Or It Needs Improvement, Invent and Innovate

engineeringVanderbilt SPRINGFALL 20102009 From Startups to Success VUSE engineers thrive as entrepreneurs in businesses large and small I n s I g h t ◦ I n n ovat I o n ◦ I m pac t s m honors and awards Vanderbilt Volume 51, Number 1, spring 2010 Editor Nancy Wise Designer engineering Chris Collins Assistant Art Director Michael Smeltzer Art Director Donna Pritchett 2 from the dean Contributors Joanne L. Beckham (BA’62), Brenda Ellis, 6 cover story Mardy Fones, Becky Green, David Kosson, Laura Miller, Sandy Smith, Fiona Soltes, From Startups to Success: VUSE Susan Starcher, Mary Ellen Crowley Ternes Engineers Thrive as Entrepreneurs (BE’84), Jennifer Zehnder in Businesses Large and Small Photography Neil Brake, Tom Cherrey, Kerry Dahlen, Daniel Dubois, Steve Green, Peyton Hoge, 12 on campus Jenny Mandeville, John Russell, Zach Student Developer Draws Sales Goodyear Photography Web Edition Design and Development with iPhone Apps Lacy Tite 14 next Administration Pushing to Improve Dean Xenofon Koutsoukos, associate pro- Kenneth F. Galloway fessor of computer science and com- Senior Associate Dean Julie Adams, assistant professor puter engineering, participated in the 18 in the field K. Arthur Overholser of computer science and computer National Academy of Engineering’s Associate Dean for Development and W. Wesley Eckenfelder, Distin- Quest for Knowledge Spurs engineering, has been awarded a first Frontiers of Engineering Educa- Alumni Relations guished Professor of Environmental Nanotechnology Entrepreneur David M. Bass Department of Defense program tion symposium. He was chosen from and Water Resources Engineering, Karen Buechler grant to support her work in the area a highly competitive pool of appli- Associate Dean for Research and emeritus, has published WWE (W. -

Public Version

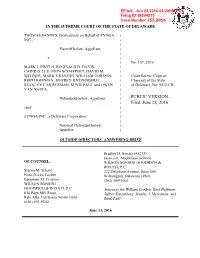

EFiled: Jun 28 2016 03:20PM EDT Filing ID 59204210 Case Number 157,2016 IN THE SUPREME COURT OF THE STATE OF DELAWARE THOMAS SANDYS, Derivatively on Behalf of ZYNGA ) INC., ) ) Plaintiff below, Appellant, ) ) v. ) ) No. 157, 2016 MARK J. PINCUS, REGINALD D. DAVIS, ) CADIR B. LEE, JOHN SCHAPPERT, DAVID M. ) WEHNER, MARK VRANESH, WILLIAM GORDON, ) Court Below: Court of REID HOFFMAN, JEFFREY KATZENBERG, ) Chancery of the State STANLEY J. MERESMAN, SUNIL PAUL and OWEN ) of Delaware, No. 9512-CB VAN NATTA, ) ) Defendants below, Appellees. ) ) -and- ) ) ZYNGA INC., a Delaware Corporation, ) ) Nominal Defendant below, ) Appellee. ) OUTSIDE DIRECTORS’ ANSWERING BRIEF Bradley D. Sorrels (#5233) Jessica A. Montellese (#5645) OF COUNSEL: WILSON SONSINI GOODRICH & ROSATI, P.C. Steven M. Schatz 222 Delaware Avenue, Suite 800 Nina (Nicki) Locker Wilmington, Delaware 19801 Benjamin M. Crosson (302) 304-7600 WILSON SONSINI GOODRICH & ROSATI, P.C. Attorneys for William Gordon, Reid Hoffman, 650 Page Mill Road Jeffrey Katzenberg, Stanley J. Meresman, and Palo Alto, California 94304-1050 Sunil Paul (650) 493-9300 June 13, 2016 THIS DOCUMENT IS CONFIDENTIAL AND FILED UNDER SEAL. REVIEW AND ACCESS TO THIS DOCUMENT IS PROHIBITED EXCEPT BY PRIOR COURT ORDER. TABLE OF CONTENTS Page NATURE OF PROCEEDINGS ...................................................................................... 1 SUMMARY OF ARGUMENT ...................................................................................... 3 STATEMENT OF FACTS AS TO THE OUTSIDE DIRECTORS ............................. -

Sandys V. Pincus

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE THOMAS SANDYS, Derivatively on Behalf of ) ZYNGA INC., ) ) Plaintiff, ) ) v. ) C.A. No. 9512-CB ) MARK J. PINCUS, REGINALD D. DAVIS, ) CADIR B. LEE, JOHN SCHAPPERT, DAVID M. ) WEHNER, MARK VRANESH, WILLIAM ) GORDON, REID HOFFMAN, JEFFREY ) KATZENBERG, STANLEY J. MERESMAN, ) SUNIL PAUL and OWEN VAN NATTA, ) ) Defendants, ) ) and ) ) ZYNGA INC., a Delaware Corporation, ) ) Nominal Defendant. ) MEMORANDUM OPINION Date Submitted: November 17, 2015 Date Decided: February 29, 2016 Norman M. Monhait and P. Bradford deLeeuw, ROSENTHAL, MONHAIT & GODDESS, P.A., Wilmington, Delaware; Jeffrey S. Abraham and Philip T. Taylor, ABRAHAM, FRUCHTER & TWERSKY, LLP, New York, New York; Attorneys for Plaintiff. Elena C. Norman, Nicholas J. Rohrer and Paul J. Loughman, YOUNG CONAWAY STARGATT & TAYLOR, LLP, Wilmington, Delaware; Jordan Eth, Anna Erickson White and Kevin A. Calia, MORRISON & FOERSTER LLP, San Francisco, California; Attorneys for Defendants Mark J. Pincus, Reginald D. Davis, Cadir B. Lee, John Schappert, David M. Wehner, Mark Vranesh, Owen Van Natta, and Nominal Defendant Zynga Inc. Bradley D. Sorrels and Jessica A. Montellese, WILSON SONSINI GOODRICH & ROSATI, P.C., Wilmington, Delaware; Steven M. Schatz, Nina Locker and Benjamin M. Crosson, WILSON SONSINI GOODRICH & ROSATI, P.C., Palo Alto, California; Attorneys for Defendants William Gordon, Reid Hoffman, Jeffrey Katzenberg, Stanley J. Meresman and Sunil Paul. BOUCHARD, C. A stockholder of Zynga Inc. brings this derivative suit to recover damages the company allegedly suffered because the Zynga board approved exceptions to lockup agreements and other trading restrictions that allowed certain directors and officers to sell some of their Zynga shares in an April 2012 secondary offering.