Earnings Deck Q3 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

KEMA Enterprise Co., Ltd. No

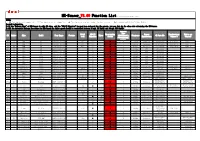

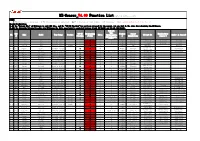

KEMA Enterprise Co., Ltd. No. 171-2, Nanbei 6th Rd., Da-an Dist., Taichung 43964, Taiwan Tel:+886-4-2688-9516 Fax:+886-4-2680-4700 www.x-kema.com BIG BRAKE KITS Application List 2019 Page 3~35 for General models. Page 36~39 Special models For all models (Picture) Comparison of normal and modified calipers. * "X": this size is not available. * Black O: this size is available. * Blue O: this model is drum-in-disc brake system. Need to add $100/set for braking rings. * Red O: calipers will be modified for this size (Picture). which also means calipers cannot be used for other models and sizes. * Blue ●: this model is disc brake system. Need to add $200/set for hydraulic parking brake device. * Red △: we do not have data for handbrake retaining. It can be made without retaining handbrake function. * "P": this model is E-parking brake. * Red P: we have production data for mechanical E-parking brake BBK. No special model fee for it. * Black P: we do not have production data (cannot take order of this model) **For all rear brakes except for E-brake, customers can choose not to retain handbrake function. For Special models * "Number": this size is available. Need to add extra cost as specified. * Red "number": calipers will be modified for this size (Picture). which also means calipers cannot be used for other models and sizes. Rotor drawing "Model" section FD-number: Front Rotor Diameter ("Z" in rotor drawing). RD-number: Rear Rotor Diameter ("Z" in rotor drawing). RD-?: Need to advise your rear rotor diameter. -

SN. Market Make Model Year Range Feature Model Code OBD

MX-Sensor_V3.09 Function List(Note:For reference only) NOTES: ● This function is supported. ○ This function is not supported. ▲ This function is a new feature in this version. Mark explaining(Red:New,Yellow:Modify) Special Declaration: 1).If the "Relearn Type" of MX-Sensor is only OBD type, and the "OBD-II Function" has not been released for the moment, you can just do the clone for relearning the MX-Sensor. 2).All the Automatic Relearn Procedure for MX-Sensor,the drive speed should be controlled between 16 mph (25 km/h) and 64 mph (100 km/h). Relearn Type Model OBD-II Programming Sensor Manufacturer Number on SN. Market Make Model Year Range Feature Tires (A=Automatic, Frequency OE Part NO. code Function Status Manufactuer Sensor # Sensor# S=Stationary, O=OBD) 103 EU BMW M5 2014/03-2016/06 F10 ○ 4 ● A 433Mhz Huf/Beru 36106798872 0532207017 RDE017 104 EU BMW M6 2014/03-2016/06 F12 ○ 4 ● A 433Mhz Huf/Beru 36106798872 0532207017 RDE017 105 EU BMW M7 2014/03-2016/06 F01 ○ 4 ● A 433Mhz Huf/Beru 36106798872 0532207017 RDE017 2906 EU BYD G5 2014/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2907 EU BYD G6 2013/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2903 EU BYD S7 2015/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2909 EU BYD Sirui 2015/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2904 EU BYD Song 2016/1-2016/12 ○ 4 ● S 433Mhz BYD 6B3609200 2908 EU BYD Surui 2015/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2905 EU BYD Tang 2015/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2939 EU Cadillac ATS-V 2016/01-2016/12 ○ 4 ● 433Mhz Schrader 20925925 60518416 20925925 2940 EU -

Deals on Wheels Great Wall’S Haval H2 Has Been Met with Strong Demand Domestic Brands Attempt Turnaround One Trend We Didn’T Forecast

CHINA Deals on Wheels Great Wall’s Haval H2 has been met with strong demand Domestic brands attempt turnaround One trend we didn’t forecast . Two trends we forecast at the outset of 2013 – strong demand for premium cars and SUVs – have played out as expected. One we did not identify has been the implosion in market share of the domestic brands. This month we take a closer look at who has been winning and losing market share among the domestic brands and by model and the impact on discounting. Our proprietary dealer survey shows that while the domestic OEMs have selectively cut prices on some models, discounting has not escalated. Hopeful of new models reversing the trend Source: Macquarie Research, August 2014 . All four domestic brands in our survey – Great Wall, Geely, BYD and Chery – have lost share this year, with Geely and BYD suffering the biggest losses. Great Wall and Geely are both looking for better performance in 2H helped by Inside new models. We see Great Wall as the best positioned as its new models are focused on the popular SUV segment, which is likely to continue to out-pace Domestic brands attempt turnaround 2 the market. There is no evidence of any discounting on the Haval H2 across JV brands – discounts jump 9 the 14 cities in our survey, with a waiting list of up to 4 months. The Haval H6 Premium brands –intensifying continues to sell well with an average discount of just 0.1%. competition 17 Discounts expand for JV brands Model types – SUV premiums fading 21 . -

Dr. Klaus Zehender Member of the Divisional Board Mercedes-Benz Cars Responsible for Procurement & Supplier Quality

www.automotivepurchasing.com Exclusive Interview Dr. Klaus Zehender Member of the Divisional Board Mercedes-Benz Cars responsible for Procurement & Supplier Quality Bentayga January 2016 A look as the fi rst of Bentley’s super-SUV rolls o the line NEW ASTRA ˜ HUNGARY REGIONAL REPORT ˜ LIGHTWEIGHTING ‘A Global Industry in constant change, needs strong leadership’ The Automotive Leaders Summit bring together the leaders who are shaping our industry. Together they will discuss and debate; share initiatives and search for new avenues and opportunities – all in an exclusive environment. The Automotive Leaders Summit in Las Vegas will feature innovative and inspiring keynote addresses, in-depth and thought-provoking debates, focused forum discussions and private one-on-one meetings. This exclusive event, will promise attendance by top-level executives, attendees are CEOs, board members and senior executives from within the global automotive industry. Exceptional networking opportunities and access to the knowledge of what may drive, shape and affect the future design and execution of global automotive supply makes this truly a must-attend event. The Automotive Leaders Summit North America provides the opportunity for leading industry players, both domestic and international, to meet, network and debate how best to establish a practical approach to achieve common goals. The Mandarin Oriental, Las Vegas | 6-7 April 2016 www.automotiveleaderssummit.com Lunch Sponspor Event Sponspor Exclusive Gala Dinner and Awards Sponsor Following on from the success of the inaugural event in 2015 at The Plaza Hotel, New York, the team at Three6Zero are once again bringing the entire industry together in Las Vegas. This event is eagerly awaited by those who attended in 2015 as it promotes and highlights the achievements from the North American automotive supply chain sector through best performance. -

Item No. TPSK Kit No. Transmission Model Location Drawing Photo Vehicle / Model 1 TPSK001 01M/01N/01P (1989-Up) 095/096/097/098

TPSK Kit No. Item Transmission location Drawing Photo Vehicle / Model No. Model 1 C3 Retainer 57020 2 B2 Piston 57021 3 C2 Reverse Piston 57022 AUDI: A3, A4, A6, AVANT, CABRIOLET, COUPE TPSK001 FORD: GAlAXY 01M/01N/01P MERCEDES BENZ: V-CLASS 4 (1989-up) C3 Piston 57023 SEAT: ALHAMBRA, TOLEDO 095/096/097/098 VOLKSWAGEN: BEETLE, BORA, CABRIO, (1995-up) CARAVELLE, EUROVAN, GOLF, GTI, JETTA, C1 Forward Clutch JETTA WAGON, PASSAT, POLO, SHARAN, 5 57024 VENTO Piston B1 (Low/Reverse) 6 57025 Piston C1 Forward Clutch 7 57026 Retainer 8 B2-4 Piston 56964 9 Input Clutch Retainer 56965 10 Forward Clutch Piston 56966 TPSK002 TOYOTA: PASEO, VIOS, RUSH U540E Forward Clutch 11 56967 Retainer Low/ Reverse Clutch 12 56968 Piston 13 Input Clutch Piston 56969 BUICK: EXCELLE 14 C Brake Piston 56970 CHEVROLET: EPICA, OPTRA, ORLANDO TPSK003 DAEWOO: CIELO, LACETTI, LANOS, ZF4HP16 LEGANZA, MAGNUS, REZZO, TACOMA, 15 D Brake Piston 56970 VIVANT SUZUKI: FORENZA, RENO, VERONA TPSK Kit No. Item Transmission location Drawing Photo Vehicle / Model No. Model C2 Direct Clutch 16 56978 Piston C3 Reverse Clutch AUDI: A2,TT BMW: MINI CLUBMAN, MINI COOPER 17 TPSK004 56979 Retainer SAAB: 9'3 09G/09K/09M/ SEAT: ALTEA, LEON, TOLEDO TF-60SN/ C1 Forward Clutch SKODA: SUPERB TF-62SN 18 56980 VOLKSWAGEN: BEETLE, GOLF, JETTA, Retiner PASSAT, TIGUAN, TOURAN, TRANSPORTER C2 Direct Clutch 19 56981 Retainer 20 Servo Piston 56817 Low/Reverse Brake 21 56818 Piston Direct Clutch Apply 22 56731 Piston MAZDA: 2,3,3i, 3S, 3SP23, 323, 5, 6, 6i, 8, TPSK005 Forward Clutch Apply ATENZA, AXELA, WAGON, BIANTE, CX7, 23 56732 FN4A-EL Piston DEMIO, FAMILIA, MPV(VAN), PREMACY, PROTEGE, TRIBUTE, VERISA 24 Reverse Clutch Piston 56811 Forward Clutch 25 56816 Retainer 26 Direct Clutch Retainer 56815 27 Reverse Clutch Piston 57943 28 Servo Piston 56817 MAZDA: 2,3,3i, 3S, 3SP23, 323, 5, 6, 6i, 8, TPSK005A ATENZA, AXELA, WAGON, BIANTE, CX7, FN4A-EL DEMIO, FAMILIA, MPV(VAN), PREMACY, Low/Reverse Brake PROTEGE, TRIBUTE, VERISA 29 56818 Piston Direct Clutch Apply 30 56731 Piston TPSK Kit No. -

Single Vehicle Universal Credits Unlimited Year/Model Universal

Single Unlimited Vehicle Year/Model Model Type Year Universal Universal Credits Credits AUDI A3 2.0L TFSI (8P, 8V) (MED9.1, MED17.5) (*****) 04-- 4 N/A 15 AUDI A4 2.0L TFSI (B8) (MED17.1.1) (*****) 07--18 6 N/A AUDI A4 3.0L TFSI (B8) (SIMOS 8.4) (*****) 08--11 6 N/A AUDI A4 3.0L TFSI (B8/B8.5) (SIMOS 8.5) (*****) 12--18 6 N/A AUDI A5 3.0L TFSI (B8) (SIMOS 8.4) (*****) 08--10 6 N/A AUDI A5 3.0L TFSI (B8/B8.5) (SIMOS 8.5) (*****) 11--18 6 N/A AUDI A6 2.0L TFSI (C7) (MED17.1.1) (*****) 12--18 6 N/A AUDI A6 3.0L TFSI (C7) SIMOS 8.5) (*****) 14--18 6 N/A AUDI A6/A6L 3.0L TFSI (C7) (SIMOS 8.5) (*****) 11--18 6 N/A AUDI A7 3.0L TFSI (4G) (SIMOS 8.5) (*****) 10--11 6 N/A AUDI A7 3.0L TFSI (4G) (SIMOS 8.5) (*****) 14--17 6 N/A AUDI A8/A8L 3.0L TFSI (D4) (SIMOS 8.5) (*****) 10--11 6 N/A AUDI A8/A8L 3.0L TFSI (D4) (SIMOS 8.5) (*****) 13--14 6 N/A AUDI A8/A8L 4.0L TFSI (D4) (MED17.1.1) (*****) 13--18 6 N/A AUDI Q5 3.0L TFSI (8RB) (SIMOS 8.5) (*****) 12--13 6 N/A AUDI Q5 3.0L TFSI (8RB) (SIMOS 8.5) (*****) 15--17 6 N/A AUDI RS4 4.2L FSI (B8.5) (MED17.1.1) (*****) 12--17 6 N/A AUDI RS5 4.2L FSI (B8/B8.5) (MED17.1.1) (*****) 10--17 6 N/A AUDI RS6 4.0L TFSI (C7) (MED17.1.1) (*****) 13--18 6 N/A AUDI RS7 4.0L TFSI (4G) (MED17.1.1) (*****) 13--18 6 N/A AUDI RSQ3 2.5L TFSI (MED17.1.1) (*****) 13--16 6 N/A AUDI S3 2.0L TFSI (8P, 8V) (MED9.1) (*****) 06--19 4 N/A AUDI S4 3.0L TFSI (B8) (SIMOS 8.4) (*****) 09--10 6 N/A AUDI S4 3.0L TFSI (B8.5) (SIMOS 8.5) (*****) 11--16 6 N/A AUDI S5 3.0L TFSI (B8) (SIMOS 8.4) (*****) 09--10 6 N/A AUDI S5 3.0L TFSI (B8/B8.5) -

Lonsdor Menus

Vehicle IMMO Brand Menu Application Add key,Delete key,Read key TRUMPCHI\GS5\Immobilizer count, TRUMPCHI\GS5\Smart key Program smart key, Add key,Delete key,Read key TRUMPCHI\GA5\Immobilizer count, TRUMPCHI\GA5\Smart key Program smart key, Add key,Delete key,Read key TRUMPCHI\GA3\Immobilizer count, Add key,Delete key,Read key TRUMPCHI\GA8\Immobilizer count, TRUMPCHI Add key,Delete key,Read key TRUMPCHI\GS4\Immobilizer count, Add key,Delete key,Read key TRUMPCHI\GA6\Immobilizer count, TRUMPCHI\Extended electric Add key,Delete key,Read key vehicles\Immobilizer count, TRUMPCHI\GA3\Smart key Program smart key, TRUMPCHI\GA6\Smart key Program smart key, TRUMPCHI\GA8\Smart key Program smart key, TRUMPCHI\GS4\Smart key Program smart key, TRUMPCHI\GS8\Smart key Program smart key, Add key,Delete key,Read key TRUMPCHI\GS8\Immobilizer count, Add key,Delete key,Read key TRUMPCHI\GA4\Immobilizer count, TRUMPCHI\GA4\Smart key Program smart key, Add key,Delete key,Read key TRUMPCHI\GS3\Immobilizer count, TRUMPCHI\GS3\Smart key Program smart key, TRUMPCHI\GS7\Smart key Program smart key, TRUMPCHI\GE3\Smart key Program smart key, TRUMPCHI\GM8\Smart key Program smart key, TRUMPCHI\New energy Add key,Delete key,Read key vehicles\Immobilizer count, TRUMPCHI\GA3S(PHEV)\Smart key Program smart key, TRUMPCHI\GS4(PHEV)\Smart key Program smart key, Add key,Lost all key,Read CEM VOLVO\S60\Smart key[insert start] security data,Key recognition & unlocking, VOLVO Add key,Lost all key,Read CEM VOLVO\S80\2009-\Smart key[insert security data,Key recognition & start] -

GPR Full Catalog

ACURA Engine Cyl Set Number Line Application Model Bore CC Years Chrome Plain No 2.3CL F23A1 86.00 2254 98-99 C5005+ 6 2.5TL G25A4 85.00 2456 96-98 C5007+ 5 3.0CL J30A1 86.00 3000 97-99 C5006+ 7 CIVIC I-VTECH (DOHC) K20A3 87.00 1998 02-06 S5249+ 9 ILX K24Z7 87.00 2354 13-15 S5356+ 11 Integra D16A1 75.00 1590 86-89 C1676+ 1 Integra B17A1 81.00 1678 91-93 C1780+ 2 Integra B18A1 81.00 1834 90-01 C1780+ 3 Integra B18B1 81.00 1834 94-01 C1780+ 3 Legend C25A1 84.00 2493 86-87 C1677+ 4 Legend C27A1 87.00 2675 87-97 C1678+ 8 Legend C32A1 90.00 3206 91-05 C1783+ 12 Legend, CL, TC C32A6 90.00 3206 91-98 C5008+ 14 NSX, NSX-T C30A1 90.00 2977 96-05 C5008+ 13 NSX, NSX-T C32B1 93.00 3179 97-05 C1957+ 16 RL C35A1 C35A1 90.00 3474 96-04 C5009+ 15 RSX I-VTECH (DOHC) K20A3 87.00 1998 02-06 S5249+ 9 TSX K24A2 87.00 2354 04-08 S5355+ 10 TSX K24Z3 87.00 2354 12-15 S5356+ 11 Vigor G25A1 85.00 2456 92-94 C5007+ 5 Line Bore Diameter Ring Size No Application CC Set No Cyl Inch MM Comp Oil 1 Integra (1.6L) 1590 C 1 6 7 6 + 4 2.953 75.00 4 - 1.20 4 - 2.80 4 - 1.50 2 Integra (1.7L) 1678 C 1 7 8 0 + 4 3.189 81.00 4 - 1.00 4 - 2.80 4 - 1.20 3 Integra (1.8L) 1834 C 1 7 8 0 + 4 3.189 81.00 4 - 1.00 4 - 2.80 4 - 1.20 4 Legend (2.5L) 2493 C 1 6 7 7 + 6 3.307 84.00 6 - 1.20 6 - 4.00 6 - 1.20 5 Vigor (2.5L) 2456 C 5 0 0 7 + 5 3.346 85.00 5 - 1.20 5 - 2.80 2 . -

SN. Mark Et Make Model Year Range Feature OBD-II Function

MX-Sensor_V4.00 Function List(Note:For reference only) NOTES: ● This function is supported. ○ This function is not supported. ▲ This function is a new feature in this version. Mark explaining(Red:New,Yellow:Modify) Special Declaration: 1).If the "Relearn Type" of MX-Sensor is only OBD type, and the "OBD-II Function" has not been released for the moment, you can just do the clone for relearning the MX-Sensor. 2).All the Automatic Relearn Procedure for MX-Sensor,the drive speed must be controled between 16 mph (25 km/h) and 64 mph (100 km/h). Relearn Type Mark OBD-II Programming Frequenc Sensor Manufacturer SN. Make Model Year Range Feature Tires (A=Automatic, OE Part NO. Number on Sensor# et Function Status y Manufactuer Sensor # S=Stationary, O=OBD) C1024 EU Cadillac SRX 2007/01-2009/12 ○ ● 4 S 433Mhz Schrader 20922901 90518390 20922901 C1025 EU Cadillac SRX 2010/01-2016/12 ○ ● 4 S 433Mhz Schrader 25789964 90518185 25789964 B0270 EU Geely EC7 2014/01-2014/12 433Mhz ○ ● 4 433Mhz TTE 06703309 6703309 9811764480/ B0532 EU Peugeot Expert 2014/06-2016/06 ● ● 4 433Mhz Schrader 9808859080 9808859080 B0535 EU Peugeot Partner 2014/06-2016/06 ○ ● 4 Copy only 433Mhz Schrader 9811536380 9811536380 A0227 EU Subaru C-Concept 2014/06-2016/06 ● ● 4 O 433Mhz Schrader 28103FJ000 A0228 EU Subaru Forester 2014/01-2016/06 ● ● 4 O 433Mhz Schrader 28103FJ000 A0229 EU Subaru Impreza 2014/01-2016/06 ● ● 4 O 433Mhz Schrader 28103FJ000 A0230 EU Subaru Justy 2014/01-2015/12 ● ● 4 O 433Mhz Schrader 28103FJ000 A0231 EU Subaru Legacy 2014/10-2016/06 ● ● 4 O 433Mhz -

Welltec Catalogue List

PAGE NO. WVA APPLY Fiat Ducato Bus 03.94-04.02 Fiat Ducato Box 0 3 .94-04.02 Fiat Ducato Platform 1 2 .98-04.02 Peugeot Boxer Box 03.96-09.98 Peugeot Boxer Bus 03.94-04.02 Peugeot Boxer Platform 03.94-04.02 Citroen Jumper Bus 02.94-04.02 Citroen Jumper Box 03.94-04.02 1 SR0001.01 21797;21798 Citroen Jumper P l a t f o r m 03.94-04.02 Iveco Daily III Box 05.99- 2 SR0002.01 29121 Iveco Daily III Platform 05.99- Citroen Berlingo MPV 07.96- Box Citroen Berlingo 07.96- Citroen Xsara Break 10.97-08.05 Citroen Xsara Coupe 02.98-04.05 Peugeot 306 Break 06.94-04.02 Peugeot 306 Convertible 03.94-04.02 Peugeot 306 Hatchback 04.93-08.01 Peugeot Partner Box 04.96- 3 SR0003.01 23124;23125 Peugeot Partner Combispace 05.96- Citroen Berlingo MPV 07.96- Box Citroen Berlingo 07.96- Citroen Xsara Break 10.97-08.05 Citroen Xsara Coupe 02.98-04.05 Peugeot 306 Break 06.94-04.02 Peugeot 306 Convertible 03.94-04.02 Peugeot 306 Hatchback 04.93-08.01 Peugeot Partner Box 04.96- 4 SR0003.02 23124 Peugeot Partner Combispace 05.96- Citroen Berlingo MPV 07.96- Box Citroen Berlingo 07.96- Citroen Xsara Break 10.97-08.05 Citroen Xsara Coupe 02.98-04.05 Peugeot 306 Break 06.94-04.02 Peugeot 306 Convertible 03.94-04.02 Peugeot 306 Hatchback 04.93-08.01 Peugeot Partner Box 04.96- 5 SR0003.03 23125 Peugeot Partner Combispace 05.96- Peugeot 505 Saloon 08.83-09.95 Peugeot 505 Estate 04.82-12.93 6 SR0004.01 20631 Alpine A310 Coupe 01.76-12.84 Peugeot 106I Hatchback 09.91-04.96 Peugeot 106II Hatchback 05.96- Peugeot 405I Estate 10.88-08.92 Peugeot 405II Estate 08.92-10.96 Renault -

Proceedings of the Sawtooth Software Technology Acceptance Model to Account for Social Conference

ASME 2016 International Design Engineering Technical Conferences and Computers and Information in Engineering Conference IDETC2016 August 21-24, 2016, Charlotte, North Carolina DETC2016-60015 FORECASTING TECHNOLOGICAL IMPACTS ON CUSTOMERS’ CO-CONSIDERATION BEHAVIORS: A DATA-DRIVEN NETWORK ANALYSIS APPROACH Mingxian Wang Zhenghui Sha Yun Huang Integrated Design Integrated Design Science of Networks in Automation Laboratory Automation Laboratory Communities Northwestern University Northwestern University Northwestern University Evanston, IL, USA Evanston, IL, USA Evanston, IL, USA Noshir Contractor Yan Fu Wei Chen* Science of Networks in Ford Analytics Integrated Design Communities Global Data Insight & Analytics Automation Laboratory Northwestern University Ford Motor Company Northwestern University Evanston, IL, USA Dearborn, MI, USA Evanston, IL, USA ABSTRACT 1. INTRODUCTION Forecasting customers’ responses and market competitions Advances in technology consistently stimulate the creation is essential before launching major technological changes in of new or improved products. Such a force that drives product product design. In this research, we present a data-driven innovation and moves industry forward is known as technology network analysis approach to understand the interactions among push. As Coombs et al. [2] argue, unlike market pull that often technologies, products, and customers. Such an approach causes products to develop in an evolutionary way, technology provides a quantitative assessment of the impact of technological push tends to cause revolutionary transformation. In automotive changes on customers’ co-consideration behaviors. The multiple industry, for example, the improved electronics and software regression quadratic assignment procedure (MRQAP) is technology have enabled new telematics features for vehicles, employed to quantitatively predict product co-consideration such as automatic parallel parking, lane-keeping assistance, relations as a function of various effect networks created by adaptive cruise control and blind spot detection. -

The Concept of Vehicle Design for Chinese Marketing

The Concept of Vehicle Design for Chinese Marketing A thesis Submitted in fulfillment of the requirements of the degree of Master of Industrial Design By Qianyuan Zhao Under the Supervision of Prof. Bill Green Dr. Eddi Pianca Faculty of Art and Design University of Canberra, Australia January 2016 Abstract With the rapid development of China’s economy and the rise of Chinese living standards, Chinese demand for private car ownership is increasing significantly. China is already the world’s largest automobile market and is coveted by many giant automotive enterprises. However it is extremely difficult to cater to China’s automobile market demands because of particular Chinese conditions such as the unique culture, the diverse requirements of a geographically dispersed population, fastidious consumers and crowded traffic. The problem is that there is very limited literature in this area to guide car designers when designing a car for the Chinese market. This research examines the special demands of private cars for Chinese consumers, identifies particular elements of vehicle design that are important for successful Chinese marketing, and incorporates them into a new computer-generated 3D model. I Table of contents Acknowledgements P. xv Abstract P. 1 1. Introduction and Overview 1.1Chinese Consumers P. 1 1.2 Aging society P. 2 1.3 Chinese marketing P. 2 1.4 Research Problem P. 3 1.5 Research Question P. 3 1.6 Aim of Research P. 3 1.7 Research Strategy and Methods P. 5 1.7.1 Literature Review P. 5 1.7.2 Data Collection and Questionnaire P. 6 1.7.3 Data Evaluation P.