Global Telecommunications Primer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Statement of Investment Holdings Dec. 31, 2016

1 DEUTSCHE TELEKOM AG STATEMENT OF INVESTMENT HOLDINGS IN ACCORDANCE WITH § 285 HGB AS OF DECEMBER 31, 2016 1. Subsidiaries Shareholders’ equity Indirectly Directly Total thousands of Net income/net loss Reporting No. Name and registered office Via % % nominal value Currency reporting currency thousands of € currency Note 1. 3.T-Venture Beteiligungsgesellschaft mbH (3. TVB), Bonn 1.93. 100.00 25,000 EUR 6,382 764 EUR e) 2. Antel Germany GmbH, Karben 1.105. 100.00 25,000 EUR (119) (48) EUR i) 3. Arbeitgeberverband comunity, Arbeitgeberverband für EUR - - EUR Telekommunikation und IT e.V., Bonn 4. Assessment Point (Proprietary) Limited, Johannesburg 1.125. 100.00 100 ZAR (3,192) (6) ZAR e) 5. Atrada GmbH, Nuremberg 100.00 150,000 EUR 3,220 (2,210) EUR e) 6. Atrada Trading Network Limited, Manchester 1.5. 100.00 1 GBP 0 0 GBP e) 7. BENOCS GmbH, Bonn 1.327. 100.00 25,000 EUR 94 (765) EUR e) 8. Benocs, Inc., Wilmington, DE 1.7. 100.00 100 USD - - USD 9. CA INTERNET d.o.o., Zagreb 1.129. 100.00 20,000 HRK 228 11 HRK e) 10. CBS GmbH, Cologne 1.19. 100.00 838,710 EUR 18,055 0 EUR a) e) 11. CE Colo Czech, s.r.o., Prague 1.232. 100.00 711,991,857 CZK 854,466 88,237 CZK e) 12. COMBIS - IT Usluge d.o.o., Belgrade 1.14. 100.00 49,136 RSD (112,300) (9,378) EUR e) 13. COMBIS d.o.o. Sarajevo, Sarajevo 1.14. 100.00 2,000 BAM 5,297 969 BAM e) 14. -

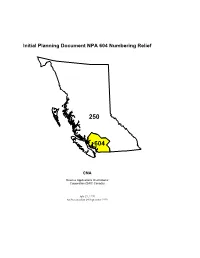

Initial Planning Document NPA 604 Numbering Relief

Initial Planning Document NPA 604 Numbering Relief 250 604 CNA Science Applications International Corporation (SAIC Canada) July 27, 1999 As Presented on 24 September 1999 INITIAL PLANNING DOCUMENT NPA 604 NUMBERING RELIEF JULY 27, 1999 TABLE OF CONTENTS 1. EXECUTIVE SUMMARY ......................................................................................................................... 1 2. INTRODUCTION ..................................................................................................................................... 1 3. CENTRAL OFFICE CODE EXHAUST .................................................................................................... 2 4. CODE RELIEF METHODS...................................................................................................................... 3 4.1. Geographic Split.............................................................................................................................. 3 4.1.1. Definition ...................................................................................................................................... 3 4.1.2. General Attributes ........................................................................................................................ 4 4.2. Distributed Overlay .......................................................................................................................... 4 4.2.1. Definition ..................................................................................................................................... -

BT Group PLC: Wholesale-Only Overhang

Equity Research Telecommunications | European Telecom Services BT Group PLC 3 May 2018 Stock Rating EQUAL WEIGHT Wholesale-Only overhang from Overweight Industry View POSITIVE In a separate report published today, The Rise of Wholesale Only, we analyse the Unchanged impact Open Fiber is having in Italy and the extent to which it can be replicated Price Target GBp 280 elsewhere. Italy appears an ideal market for fostering alternative infrastructure lowered -20% from GBp 350 build (and increased retail competition). We note actual competitor builds to date in the UK have been few and far between, even if the narrative has been consistently Price (01-May-2018) GBp 245 noisy. However, we do see BT as potentially vulnerable, especially given the Potential Upside/Downside +14.3% increased focus of numerous infrastructure funds and regulatory direction. Tickers BT/A LN / BT.L Resolution of this overhang for BT looks unlikely, in our view. Reflecting this, we lower our medium-term forecasts, cut our PT to 280p and move BT to Equal Weight. Market Cap (GBP mn) 24591 Shares Outstanding (mn) 9921.90 Wholesale-only is not new – Why worry now? We have become accustomed to a Free Float (%) 84.31 spate of alternative FTTH build announcements in recent months from numerous 52 Wk Avg Daily Volume (mn) 22.4 players. In reality, FTTH build has been limited. However, having met recently with 52 Wk Avg Daily Value (GBP mn) 60.93 Open Fiber in Italy, we see an opportunity to make double-digit IRRs for alternative Dividend Yield (%) 6.3 build in markets like Italy/the UK/Germany. -

Horizon Book of Authorities

PATENTED MEDICINE PRICES REVIEW BOARD IN THE MATTER OF THE PATENT ACT R.S.C. 1985, C. P-4, AS AMENDED AND IN THE MATTER OF HORIZON PHARMA PLC (THE “RESPONDENT”) AND THE MEDICINE CYSTEAMINE BITARTRATE SOLD BY THE RESPONDENT UNDER THE TRADE NAME PROCYSBI® BOOK OF AUTHORITIES OF THE RESPONDENT (MOTION TO BIFURCATE, STRIKE EVIDENCE AND FOR THE INSPECTION AND PRODUCTION OF DOCUMENTS) Torys LLP 79 Wellington St. W., Suite 3000 Toronto ON M5K 1N2 Fax: 416.865.7380 Sheila R. Block Tel: 416.865.7319 [email protected] Andrew M. Shaughnessy Tel: 416.865.8171 [email protected] Rachael Saab Tel: 416.865.7676 [email protected] Stacey Reisman Tel: 416.865.7537 [email protected] Counsel to Respondent, Horizon Pharma PLC INDEX 1. Board Decision – Alexion Pharmaceuticals Inc. and the Medicine “Soliris” (September 20, 2017) 2. Alexion Pharmaceuticals Inc. v. Canada (Attorney General), 2019 FC 734 3. Celgene Corp. v. Canada (Attorney General), 2011 SCC 1 4. Board Decision – Alexion Pharmaceuticals Inc. and the Medicine “Soliris” (March 29, 2016) 5. Mayne Pharma (Canada) Inc. v. Aventis Pharma Inc., 2005 FCA 50 6. P.S. Partsource Inc. v. Canadian Tire Corp., 2001 FCA 8 7. Harrop (Litigation Guardian of) v. Harrop, 2010 ONCA 390 8. Merck & Co v. Canada (Minister of Health), 2003 FC 1511 9. Vancouver Airport Authority v. Commissioner of Competition, 2018 FCA 24 10. Merck & Co, Inc. v. Canada (Minister of Health), 2003 FC 1242 11. H-D Michigan Inc. v. Berrada, 2007 FC 995 12. Roger T. Hughes, Arthur Renaud & Trent Horne, Canadian Federal Courts Practice 2019 (Toronto: LexisNexis Canada Inc., 2019) 13. -

Speech Karl-Gerhard Eick

Not to be released until: February 27, 2009, 10:00 a.m. / Start statement René Obermann – Check against delivery – Statement delivered at the press conference on Deutsche Telekom’s FY results 2008 February 27, 2009 in Bonn Dr. Karl-Gerhard Eick Member of the Board of Management Finance Deputy CEO Deutsche Telekom AG Thank you, René! I am very pleased with our full-year financial results. We achieved a turn- around in adjusted EBITDA, free cash flow, and adjusted net income. Ad- justed EBITDA grew by 0.7 percent to almost EUR 19.5 billion, driven by Mobile and an improved trend in domestic Broadband/Fixed Network, which came in slightly better than the original guidance range. Free cash flow im- proved to EUR 7 billion, supported by working capital, lower restructuring payments, and lower net interest payments, more than offsetting higher in- come tax payments and higher cash capex. Adjusted net income improved by 14 percent to EUR 3.4 billion due, in particular, to lower D&A. Net debt increased only modestly by EUR 0.9 billion to EUR 38.2 billion, despite EUR 4.4 billion spent on acquisitions (net of divestments), namely SunCom and OTE, and despite cash capex of EUR 8.7 billion. This is a reflection of our very strong cash flow generation. - 2 - Let me remind you that we were faced with a significant currency headwind last year. Assuming constant exchange rates revenues would have been EUR 1.3 billion higher. Similarly, adjusted EBITDA would have been EUR 0.3 billion higher. Adjusted for these currency effects and changes in the scope of consolidation, organic revenues were flat last year, while or- ganic adjusted EBITDA grew by 0.8 percent. -

City of Toronto Customized Global Template

STAFF REPORT June 18, 2001 To: Economic Development Committee From: Joe Halstead, Commissioner Economic Development, Culture and Tourism Subject: South Etobicoke Employer Cluster Capacity Study Etobicoke-Lakeshore - Ward 6 Purpose: The purpose of this report is to provide an overview on the findings and recommendations contained in the South Etobicoke Employer Cluster Capacity Study. Financial Implications and Impact Statement: There are no financial implications resulting from the adoption of this report. Recommendations: It is recommended that: (1) the findings and recommendations of the South Etobicoke Employer Cluster Capacity Study be endorsed by the Economic Development and Parks Committee and Council; (2) this report be forwarded to the Planning and Transportation Committee and Etobicoke Community Council for their information and consideration when reviewing land use options for the New Toronto Secondary Plan; (3) the Commissioner of Economic Development, Culture and Tourism be requested to monitor and report on implementation of the South Etobicoke Employer Cluster Capacity Action Plan; and (4) the appropriate City officials be authorized and directed to take necessary action to give effect thereto. - 2 - Background: South Etobicoke is located in the southwest quadrant of the City and includes the area south of the Queen Elizabeth Highway to Lake Ontario and west of the Humber River to the Etobicoke Creek, as shown on Attachment No. 1. In 1999, South Etobicoke was identified as an “Employment Revitalization Program Area” and private and public resources (including funds from Human Resources Development Canada) were successfully leveraged to revitalize the area. This initiative has facilitated a collaborative community based process designed to encourage reinvestment in the community. -

Communications Network Builders Corporate Profile

Communications Network Builders Corporate Profile Corporate Profile OUR HISTORY Founded in 1967, TELECON quickly established itself with itsits expertise in burying communication cablecabless and a technical service provider to industry leaders such as BBellellellell Canada. FFFromFrom the startstart,,,, TELECON stood out for ititss commitment to quality workmanshipworkmanship and on time deldeliveries.iveries. In the early 1970’s, TELECON widened its array of servicesservices by adding underground infrastructure construction and utility pole installation servicesservices.. Consequently it obtainobtainedededed thethethe contract to renew the entire aerial network of the Abitibi region installtallinginginging over 600 km of specialized cable. This later led to itsitsits diversification into television cacableble distribution and mandates to deploy communicationcommunication networks across the Province of Quebec. The 90’s wewerere markmarkeded by major technological and core business changeschanges in the teletelecommunicationcommunication industries. ThTheseese opportunities led us into specialized sectors suchsuch as wireless technology, optical networknetworkssss deployment, and switched networks supporting voice data and vivivideovi deo servicesservices.. TELECON is a unique partner, one that mastersmasters alalll the necessary elements for the construction of leading edge telecommunication and electrical netwonetworkrkrkssss.... TELECON services are available from coast to coast, using only qualified and certicertifiedfied personnel -

Dl-Studiemoodys-Data.Pdf

CORPORATES CREDIT OPINION Deutsche Telekom AG 21 June 2021 Update following outlook change to stable Update Summary Deutsche Telekom AG's (Deutsche Telekom) Baa1 rating primarily reflects the company's large size and scale; its geographical diversification in Germany, the US, and Central and Eastern Europe; its strong market positions across its geographical footprint, despite the potential for increased competition; its high capital spending requirements, given the low fibre coverage in RATINGS Germany; and the marginal impact of the coronavirus pandemic on the company's operating Deutsche Telekom AG performance. Domicile Bonn, Germany Long Term Rating Baa1 Deutsche Telekom’s rating also factors in management’s financial policy that includes a Type Senior Unsecured - Fgn leverage comfort zone of net debt/EBITDA (as reported by the company) between 2.25x and Curr 2.75x (equivalent to Moody’s-adjusted net leverage of around 3.0x); its continued commitment Outlook Stable towards the net leverage corridor and deleveraging after the consolidation of T-Mobile USA, Please see the ratings section at the end of this report Inc. (T-Mobile USA, Ba2 stable); the strong evolution of the company's US subsidiary, the for more information. The ratings and outlook shown group's key growth engine; and its excellent liquidity management, with a minimum two-year reflect information as of the publication date. pre-funding policy. Given Deutsche Telekom's status as a government-related issuer (GRI), the Baa1 rating benefits Contacts from a one-notch uplift stemming from our expectation of support from the Government of Carlos Winzer +34.91.768.8238 Germany (Aaa stable). -

Deutsche Telekom Services Europe Czech Republic Company Presentation OVERVIEW

Deutsche telekom services Europe Czech republic Company presentation OVERVIEW 01 Deutsche Telekom Group 02 Deutsche Telekom Services Europe 03 Deutsche Telekom Services Europe Czech Republic: overview 04 Deutsche Telekom Services Europe Czech Republic: our Teams 2 DEUTSCHE TELEKOM PROFILE German telecommunication company Headquarters in Bonn By revenue the largest telecommunications provider in Europe – 73 bn. € (2016) Formed in 1996 - the former state-owned monopoly Deutsche Bundespost was privatized Active in 36 countries worldwide More than 218.000 employees DEUTSCHE TELEKOM figures Customers & Markets Facts & Figures Customers Markets Telekom in figures, 2018 Employees & responsibility Employeesworldwide: 215,675 178.4 mnmobile customers Presentin > 50 countries Revenue € 75.7 bn 5,713 trainees and cooperative 27.9 mnfixed-network lines/ Germany, Europe and the USA: Adjusted EBITDA € 23.3 bn degree students in Germany 20.2 mnbroadband lines with own infrastructure Free Cash-Flow € 6.2 bn Pioneer of social issues Approx. 8.2 m TV customers T-Systems: global presence& (climate protection, data privacy, alliances via partners diversity, etc.) Source: DT 2018 annual report 4 Company presentation OVERVIEW 01 Deutsche Telekom Group 02 Deutsche Telekom Services Europe 03 Deutsche Telekom Services Europe Czech Republic: overview 04 Deutsche Telekom Services Europe Czech Republic: our Teams 5 Where does dtse stand in the deutsche telekom group? operating model Future target operating Headquarters give an explicit Group model -

The State of Competition in Canada's Telecommunications Industry

RESEARCH PAPERS MAY 2015 THE STATE OF COMPETITION IN CANADA’S TELECOMMUNICATIONS INDUSTRY – 2015 By Martin Masse and Paul Beaudry The Montreal Economic Institute is an independent, non-partisan, not-for-profi t research and educational organization. Through its publications, media appearances and conferences, the MEI stimu- lates debate on public policies in Quebec and across Canada by pro- posing wealth-creating reforms based on market mechanisms. It does 910 Peel Street, Suite 600 not accept any government funding. Montreal (Quebec) H3C 2H8 Canada The opinions expressed in this study do not necessarily represent those of the Montreal Economic Institute or of the members of its Phone: 514-273-0969 board of directors. The publication of this study in no way implies Fax: 514-273-2581 that the Montreal Economic Institute or the members of its board of Website: www.iedm.org directors are in favour of or oppose the passage of any bill. Reproduction is authorized for non-commercial educational purposes provided the source is mentioned. ©2015 Montreal Economic Institute ISBN 978-2-922687-59-0 Legal deposit: 2nd quarter 2015 Bibliothèque et Archives nationales du Québec Library and Archives Canada Printed in Canada Martin Masse Paul Beaudry The State of Competition in Canada’s Telecommunications Industry – 2015 Montreal Economic Institute • May 2015 TABLE OF CONTENTS HIGHLIGHTS .......................................................................................5 INTRODUCTION .................................................................................7 -

Download Section

N0 1 N0 2 OTE GROUP FINANCIAL PERFORMANCE: OTE’S IMPROVED PERFORMANCE CONTINUES WITH SOLID CASH FLOW AND REDUCED DEBT IN 2013 Revenues (€ mn) Pro forma EBITDA* (€ mn) 4,330.3 1,515.9 4,054.1 1,456.3 35.9% 35.0% N0 4 N0 3 2012 2013 2012 2013 Pro forma EBITDA* (€ mn) Pro forma EBITDA margin % * Excluding the impact of Voluntary Retirement Programs and Restructuring Plans Earnings per Share (€) Adjusted Free Cash Flow* (€ mn) (from continuing operations) 1,205.3 € 0.90 1,171.4 € 0.59 734.1 723.6 2012 2013 (447.8) (471.2) 2012 2013 Adjusted Net Operating Cash Flow* Adjusted. Free Cash Flow* Adjusted Capex* * Cash Flow excluding discontinued operations, Voluntary Exit Programs, 14 Restructuring and/or Spectrum payments N0 5 Operating Expenses breakdown* (€ mn) 7.2% Group 2,843.7 - Group 2,640.1 914.5 -10.2% 821.5 Personel cost Personel cost 510.5 -8.3% 468.2 Interconnection Interconnection & Roaming Cost & Roaming Cost -8.6% 990.8 905.3 N0 6 Other OpEx Other OpEx (Direct & Indirect) (Direct & Indirect) -2.9% 173.7 168.7 Commission Costs Commission Costs +8.7% 254.2 276.4 Device Cost Device Cost 2012 2013 * Excluding D&A, impact of Voluntary Retirement Programs and Restructuring Plans Total Capex as % of Revenues (continuing operations) 14.9% 11.7% 3.3% E 1.4% C AN L 10.3% 11.6% G A T A 2012 2013 2. 2013 2. 2013 Spectrum Payments as % of Revenues Adjusted Capex*as % of Revenues 15 * Excluding Spectrum payments N0 7 N0 8 Underlying Net Debt (€ mn) Underlying Net Debt/Pro forma EBITDA* 2,879.3 1.7χ 1,495.6 1.0χ N0 9 2012 2013 2012 2013 * Excluding -

PRIMUS TELECOMMUNICATIONS GROUP, INCORPORATED (Exact Name of Registrant As Specified in Its Charter)

Table of Contents SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File No. 0-29092 PRIMUS TELECOMMUNICATIONS GROUP, INCORPORATED (Exact name of registrant as specified in its charter) Delaware 54-1708481 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 7901 Jones Branch Drive, Suite 900, McLean, VA 22102 (Address of principal executive offices) (Zip Code) (703) 902-2800 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered None N/A Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $.01 per share Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.