Table of Contents and Section 1 – General Service Boxcars

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Improved Freight Modeling of Containerized Cargo Shipments Between Ocean Port, Handling Facility, and Final Market for Regional Policy and Planning

Final Technical Report TNW2008-08 Research Project Agreement No. 61-5907 Improved Freight Modeling of Containerized Cargo Shipments between Ocean Port, Handling Facility, and Final Market for Regional Policy and Planning Kaori Fugisawa Anne Goodchild Research Associate Assistant Professor University of Washington University of Washington Eric Jessup Assistant Professor Washington State University A report prepared for Transportation Northwest (TransNow) University of Washington 135 More Hall, Box 352700 Seattle, Washington 98195-2700 July 2008 TECHNICAL REPORT STANDARD TITLE PAGE 1. REPORT NO. 2. GOVERNMENT ACCESSION NO. 3. RECIPIENT’S CATALOG NO. TNW2008-08 4. TITLE AND SUBTITLE 5.REPORT DATE Improved Freight Modeling of Containerized Cargo Shipments between Ocean Port, July 2008 Handling Facility, and Final Market for Regional Policy and Planning 6. PERFORMING ORGANIZATION CODE 7. AUTHOR(S) 8. PERFORMING ORGANIZATION REPORT NO. Anne Goodchild, Eric Jessup, Kaori Fugisawa TNW2008-08 9. PERFORMING ORGANIZATION NAME AND ADDRESS 10. WORK UNIT NO. Transportation Northwest Regional Center X (TransNow) Box 352700, 129 More Hall University of Washington 11. CONTRACT OR GRANT NO. Seattle, WA 98195-2700 DTRS99-G-0010 12. SPONSORING AGENCY NAME AND ADDRESS 13. TYPE OF REPORT AND PERIOD COVERED United States Department of Transportation Office of the Secretary of Transportation Final Research Report 400 Seventh St. S.W. 14. SPONSORING AGENCY CODE Washington, D.C. 20590 15. SUPPLEMENTARY NOTES This study was conducted in cooperation with the University of Washington and the US Department of Transportation. ABSTRACT The proposed research will address an emerging need by local, state and regional transportation planners and policymakers to better understand the transportation characteristics, functions and dynamics of ocean port-to-handling facility and handling facility-to-final market freight movements. -

Section 10 Locomotive and Rolling Stock Data

General Instruction Pages Locomotive and Rolling Stock Data SECTION 10 LOCOMOTIVE AND ROLLING STOCK DATA General Instruction Pages Locomotive and Rolling Stock Data SECTION 10 Contents 3801 Limited Eveleigh - Locomotives................................................................................................................3 3801 Limited Eveleigh - Passenger Rolling Stock...............................................................................................3 3801 Limited Eveleigh - Freight Rolling Stock ...................................................................................................3 Australian Traction Corporation - Locomotives ................................................................................................3 Australian Traction Corporation - Freight Rolling Stock....................................................................................3 Australian Railway Historical Society A.C.T. Division – Locomotives................................................................3 Australian Railway Historical Society A.C.T. Division – Rail Motors ..................................................................4 Australian Railway Historical Society A.C.T. Division – Passenger Rolling Stock...............................................4 Australian Railway Historical Society A.C.T. Division – Freight Rolling Stock....................................................4 Australian Rail Track Corporation Ltd - Special Purpose Rolling Stock..............................................................4 -

The Last Car Is Changing

"In the gaudy lexicon of railroad jargon, it has more names than any other property in the economy of the high iron, even more than there are for engines and engine drivers. It is a caboose, the last crummy, way car, van, cage, doghouse, drone house, bouncer, • bedhouse, buggy, chariot, shelter house, glory wagon, go-car, hack, hut, monkey wagon, pavilion, palace, parlor, brainbox, zoo, oar1s diner, kitchen, perambulator, cabin car and shanty. There are probably others in a variety only bounded by the limitations of human imagining and the vocabulary of profane and ohanging uninhibited men." -A Treasury of Railroad Folklore Early version of the caboose. 14 UNION PACIFIC INFO a natural part of every railroad. lookout nest on top lives on in the memories of old-timers who can THEN ... Still, there was a time when the still hear it hustling along far behind No one knows for sure when the conductor parked himself wherever the huffing and puffing steam loco "caboose" came into existence. he could ride in the early days. motives of yesteryear. The word dates to the time when it Maybe it was in a boxcar, or lying described either a ship's galley or prone on a flatcar or in the engine ... NOW... the galley's iron cookstoves. One or wherever he could hang on for Today the caboose is still a familiar dictionary says it was derived from awhile. sight on most railroads, although the Dutch work "kabuis" that de But the conductor, being are some no longer use it on every freight veloped from the Middle Low sourceful soul who played an essen train. -

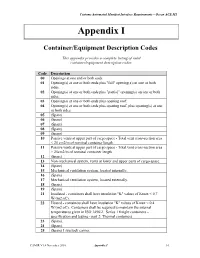

Appendix I – Container/Equipment Description Codes

Customs Automated Manifest Interface Requirements – Ocean ACE M1 Appendix I Container/Equipment Description Codes This appendix provides a complete listing of valid container/equipment description codes. Code Description 00 Openings at one end or both ends. 01 Opening(s) at one or both ends plus "full" opening(s) on one or both sides. 02 Opening(s) at one or both ends plus "partial" opening(s) on one or both sides. 03 Opening(s) at one or both ends plus opening roof. 04 Opening(s) at one or both ends plus opening roof, plus opening(s) at one or both sides. 05 (Spare) 06 (Spare) 07 (Spare) 08 (Spare) 09 (Spare) 10 Passive vents at upper part of cargo space - Total vent cross-section area < 25 cm2/m of nominal container length. 11 Passive vents at upper part of cargo space - Total vent cross-section area > 25cm2/m of nominal container length. 12 (Spare) 13 Non-mechanical system, vents at lower and upper parts of cargo space. 14 (Spare) 15 Mechanical ventilation system, located internally. 16 (Spare) 17 Mechanical ventilation system, located externally. 18 (Spare) 19 (Spare) 21 Insulated - containers shall have insulation "K" values of Kmax < 0.7 W/(m2.oC). 22 Heated - containers shall have insulation "K" values of Kmax < 0.4 W/(m2.oC). Containers shall be required to maintain the internal temperatures given in ISO 1496/2. Series 1 freight containers – specification and testing - part 2: Thermal containers. 23 (Spare). 24 (Spare). 25 (Spare) Livestock carrier. CAMIR V1.4 November 2010 Appendix I I-1 Customs Automated Manifest Interface Requirements – Ocean ACE M1 Code Description 26 (Spare) Automobile carrier. -

Tax Year 2022 Railcar Annual Report Form 82059.Xlsx

AZ CVP TAX ID #: 59 - __ __ __CONFIDENTIAL PROPERTY TAX FORM PRIVATE CAR COMPANIES TAX YEAR 2022 DUE: APRIL 1, 2021 STATE OF ARIZONA, DEPARTMENT OF REVENUE Local Jurisdictions District Centrally Valued Property Unit 1600 West Monroe Division Code 13 Phoenix, Arizona 85007 Attn: Debra Artzer email: [email protected] Phone: (602) 716-6836 Fax: (602) 542-4425 Year Ending December 31, 2020 OFFICIAL MAILING ADDRESS (Please indicate corrections of name and/or address.) If you are not responsible for reporting private railcars held by you which operate in Arizona, please indicate the responsible party below and return as soon as possible. Name Email Address City, State, Zip Code DO NOT DETACH ANY PAGES. Return all pages of the completed property tax form. REFUSAL OR FAILURE TO FILE: FAILURE TO FILE a completed report ON OR BEFORE APRIL 1, 2021 or on the extended due date if an extension is granted, shall result in a PENALTY in the amount of the lesser of one-half of one percent of the value estimated by the Department or one hundred dollars per day for each day the company fails to file the report. The number of days late will be calculated from the original due date, April 1, 2021. (A.R.S. § 42-14402) Checklist of the required documents to accompany this return when filing: This entire 82059 Railcar Form (All 13 tabs if conducting business in Arizona) Information page - (Page 2) PDF or scanned copy of signed Verificaiton Page All other pages if answering "Yes" to Question 8 on Page 2 Total Mileage Report of all private rail cars conducting -

Caboose Progress the Freighthouse So It Could Accept Visitors

Issue Number 57 San Luis Obispo, California Fall 2016 www.slorrm.com Museum open every Saturday 10:00 to 4:00; other times for groups by arrangement. Contact [email protected]. Recognition for Major Supporters A new board mounted in the exhibit hall identifies Last in the Train – But First On the List those who made major contributions to upgrading Caboose Progress the Freighthouse so it could accept visitors. Volunteers have given high priority to restoring form- er Southern Pacific bay window caboose #1886 –seats, flooring, painting, hardware, and fixtures—aiming for public tours by the Railroad Festival in October. Work has progressed with the support of several Museum and community members. Brad LaRose, Dennis Lynch, Dan Manion, and Bob Wilson in particular have spent many hours returning the heavily used and somewhat abused interior to near original condition. Cabooses accommodated freight conductors and brakemen, who worked with waybills and switch lists, monitored brake-line air pressure, kept an eye on the whole train, and protected the rear of the train. The body of a bay window caboose was narrower than a typical car, with the bay’s slanted end windows allowing a clear view of the train on even gradual curves. SP used bay window cabooses from the late 1940s through the end of the Tank Car Arrives at the Museum “caboose era” in the 1980s. Three photos by Glen Matteson Several years of searching, negotiating, and planning paid off July 29 when this former Southern Pacific tank car arrived at the Museum. Thanks to Curator Brad LaRose’s diligence, it was donated by Union Pacific Railroad. -

History and Regulation of Trailer-On-Flatcar Movement

History and Regulation of Trailer-on-Flatcar Movement JOSEPHINE AYRE, Economist, Economics and Requirements Division, Office of Research and Development, U. S. Bureau of Public Roads "Piggyback," the popular name for trailer-on-flatcar (TOFC) movement, has been one of the greatest technological innova tions in land transportation of recent years, although the idea is not of recent origin. Piggyback development represents an attempt on the part of the railroads to bolster their declining revenues and to reclaim traffic lost over the last few years to the trucking industry. It represents an example of coordination of transport facilities, routes and rates. Each unfavorable ICC decisionhas arrested the development of piggyback for a temporary period thereafter. The Container Case in 1931 killed the incentive for use of containers because the Commission set an unprofitable rate for shippers. The rules laid down in Ex Parte 129 (19 39) were favorable to the development of piggyback service, but it was not until the New York, New Haven and Hartford decision in 1954 that certain principles were established which encouraged piggyback develop ment. Piggyback carloading surged forward thereafter in spite of subsequent ICC investigations. •TRAILER-ON-FLATCAR or "piggyback" as it is commonly called refers to the move ment of loaded or empty highway trailers on railroad flatcars. The term also embraces the tr ansportation of §teel container s on flatcars. Steel containers are a lso utilized on ships ("fishyback") and on planes ("birdyback"); however, only trailer -on-flatcar (TOFC) or piggyback will be discussed in this paper, although the general principles of economy and efficiency are the same. -

D-RAIL Project Aims to Identify the Root Causes of Derailment with Particular Reference to Rail Freight Vehicles

Theme [SST.2011.4.1-3] Development of the Future Rail System to Reduce the Occurrences and Impact of Derailment Development of the Future Rail Freight System to Reduce the Occurrences and Impact of Derailment D-RAIL Grant Agreement No.: 285162 FP7 – THEME [SST.2011.4.1-3] Project Start Date: 01/10/2011 Duration: 36 Months D2.2 Future Rolling Stock breakdown to 2050 Due date of deliverable: 31/08/2012 Actual submission date: 25/03/2013 Work Package Number: WP2 Dissemination Level: PU Status: Final F Name Organisation Leader of this deliverable: Dr Dewan Islam UNEW Prepared by: Dewan Islam UNEW Ross Jackson UNEW Phil Mortimer UNEW … Verified by: Cristian Ulianov UNEW Anders Ekberg Chalmers Dissemination Level PU Public PU PP Restricted to other programme participants (including the Commission Services) RE Restricted to a group specified by the consortium (including the Commission Services) CO Confidential, only for members of the consortium (including the Commission Services) Final (PU) 1 (59) D-RAIL D2.2 Future rolling stock breakdown to 2050 Document History Version Date Authors / Contributors Description of additions / modifications V1 19/09/2012 Ross Jackson, Dewan 1st draft Islam, Phil Mortimer V2 20/12/2012 Ross Jackson, Dewan 2nd Draft Islam, Phil Mortimer V3 19/03/2013 Ross Jackson, Dewan 3rd Draft Islam, V4 21/3/2013 Pat Scott 4th Draft F 25/3/2013 Dr Dewan MZ Islam Final Final (PU) 2 (59) D-RAIL D2.2 Future rolling stock breakdown to 2050 Contents Executive Summary .......................................................................................................... 6 1 Introduction ............................................................................................................... 8 1.1 Objective ........................................................................................................................ 8 1.2 Structure of the report ................................................................................................... -

Register Your Facility

BNSF Railway Transload Facility Questionnaire Complete one questionnaire for each transload facility and return to: [email protected] Name of Company ________________________________________________________________ Facility Address __________________________ City _______________ ST___ Zip _________ Company Contacts: Primary: Name _________________________________ Title ____________________________ Address (if different than facility)_____________________________________________________________________________________________ City _________________________________________________ ST _____ Zip _____________________ Phone ___________________________ Mobile Phone _____________________________________ Email Address_____________________________________________________________________________________ Alternate: Name _________________________________ Title ____________________________ Address (if different than facility)_____________________________________________________________________________________________ City _________________________________________________ ST _____ Zip _____________________ Phone ___________________________ Mobile Phone _____________________________________ Email Address_____________________________________________________________________________________ Web Address_________________________________________________________________________________________________________________________ Facility Information: Choose all that apply: ____ Bulk (plastics, chemicals, minerals or ag products moved in hoppers or tank cars) -

Rail and Auto Traffic History Manufacturing Plants Automobile

Contents Introduction Modeling the automobile industry ........................................ 4 Chapter 1 Rail and auto traffic history The two industries have been intertwined since the early 20th century......... 6 Chapter 2 Manufacturing plants Large factories became lucrative customers.............................. 15 Chapter 3 Automobile boxcars Finished autos traveled in boxcars through the 1950s ...................... 24 Chapter 4 Auto carrier containers and trailers “Haulaway” trucks took finished auto traffic as roads improved .............. 36 Chapter 5 Open auto racks These cars brought long-haul auto traffic back to railroads.................. 41 Chapter 6 Enclosed auto racks Damage protection was the name of the game ........................... 52 Chapter 7 Distribution and reload centers How the delivery scene changed over the years .......................... 64 Chapter 8 Auto parts cars These cars carried thousands of auto parts .............................. 72 Chapter 9 Operations The ways autos were moved is as interesting as the equipment used ......... 84 Bibliography................................................... 96 INTRODUCTION Modeling the automobile industry Railroads have long played a major role in the automobile industry, from the era of primitive converted wagons to today’s high-performance cars. The industry offers many great modeling opportunities, from assembly plants, parts- production facilities, and transloading centers to distinctive rolling stock such as auto racks and high-cube parts boxcars. The following chapters will provide you have the space and inclination to an overview of the auto industry in capture one of these huge complexes. An North America, tracing the growth auto plant can be a layout unto itself— of major manufacturers, seeing how some had their own in-plant railroads— assembly plants operate, and following with multiple switching locomotives and the progression to a true international dozens of places to spot cars. -

Western Uniformity Scenario Analysis

The U.S. Department of Transportation’s Western Uniformity Scenario Analysis A Regional Truck Size and Weight Scenario Requested by the Western Governors’ Association April 2004 i Table of Contents List of Acronyms........................................................................................................... ix Executive Summary Introduction .............................................................................................................. ES-1 Scenario Impacts ...................................................................................................... ES-1 Conclusions .............................................................................................................. ES-9 I Introduction Introduction ..................................................................................................................I-1 Study Purpose...............................................................................................................I-1 Impact Areas.................................................................................................................I-1 Updates and Improvements..........................................................................................I-2 Outreach .......................................................................................................................I-2 Organization of Analysis..............................................................................................I-2 II Scenario Description Introduction ............................................................................................................... -

Railcar Market Update September 18Th, 2019 Forward-Looking Statements

RAILCAR MARKET UPDATE SEPTEMBER 18TH, 2019 FORWARD-LOOKING STATEMENTS Statements in this Presentation not based on historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and, accordingly, involve known and unknown risks and uncertainties that are difficult to predict and could cause our actual results, performance, or achievements to differ materially from those discussed. These include statements as to our future expectations, beliefs, plans, strategies, objectives, events, conditions, financial performance, prospects, or future events. In some cases, forward-looking statements can be identified by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” ”outlook,” “continue,” “likely,” “will,” “would”, and similar words and phrases. Forward-looking statements are necessarily based on estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Accordingly, you should not place undue reliance on forward-looking statements, which speak only as of the date they are made, and are not guarantees of future performance. We do not undertake any obligation to publicly update or revise these forward-looking statements. The following factors, in addition to those discussed in our other filings with the SEC, including our Form 10-K for the year ended December 31, 2018 and subsequent reports on Form 10-Q, could cause actual results to differ materially from our current expectations expressed in forward-looking statements: . exposure to damages, fines, criminal and civil penalties, and reputational harm arising . reduced opportunities to generate asset remarketing income from a negative outcome in litigation, including claims arising from an accident involving .