Nexstar Media Group Stations(1)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Digital TV LEHIGH VALLEY COOPERATIVE TELEPHONE ASSN

REMOTE CONTROL GUIDE Cloud DVR - $9.99/mo. With our Cloud DVR service, you can securely store TV, AUD, DVD, POWER your DVR recordings of favorite TV shows and movies in Digital TV VCR, STB Turn on/off a One remote for selected device. multiple devices. the cloud rather than on your local DVR set-top box. LIVE This service provides: Channel Guide SETUP Return to watching Use for programming live TV. sequences of devices • More storage space controlled by the LIST* remote. Displays a list of • Flexible recording recorded shows on REPLAY your PVR/DVR set- • Reliability Skip backwards 10 sec. top box while watching a • Easy availability recording or live TV. SKIP FORWARD Skip forward 30 sec. REWIND while watching a Rewind through recording. Don’t worry about losing your DVR recordings. parts of a recording. FAST FORWARD Ask about our Cloud DVR service! STOP Fast forward through Press to stop parts of a recording. watching a recording or to stop a recording INFO WatchTVEverywhere - that is in progress. Display the current channel and program Free with Basic or Extended Packages MENU info. Press again for Displays applications more detail. WatchTVEverywhere (WTVE) is a free service that comes including the configuration menu. RECORD with your Basic or Extended Basic Package of DigitalTV. Press to record a PLAY show. WTVE gives you the ability to watch many of the pro- Press to watch a recording or control EXIT grams from your home’s TV lineup on your computer, another device Exit the current screen. tablet or smartphone from anywhere you have an internet GUIDE connection — including hotels, vacation homes, airports, Opens the Program PAUSE Guide. -

CHANNEL GUIDE Corpus Christi, TX

CHANNEL GUIDE Corpus Christi, TX TV SERVICES BASIC TV 2 Univision HD 12 KZTV CBS HD 22 Azteca America 192 TBN HD CHANNELS 816 CW-HD 3 Local Weather 13 KDF Independent 23 HSN HD 193 Inspiration Network 802 Univision HD 817 Telemundo HD 4 QVC HD 14 Retro TV 96 C-SPAN 270 Charge! 804 QVC HD 823 HSN HD 5 KIII ABC HD 15 My Network TV 137 QVC Plus 280 Grit 805 KIII ABC HD 7 KRIS NBC HD 16 CW 138 HSN 2 281 MeTV 807 KRIS NBC HD 8 UniMás 17 Telemundo HD 139 Jewelry TV 282 ION 809 KEDT PBS HD MUSIC CHOICE 9 KEDT PBS HD 18 Public Access 173 PBS Create 283 Create 811 KUQI FOX HD 701-752 10 Public Access 19 Educational Access 190 Daystar 284 Cozi TV 812 KZTV CBS HD 11 KUQI FOX HD 20 City of Corpus Christi 191 EWTN 291 UniMás 292 LATV PREFERRED TV (includes Basic TV) 1 On Demand 46 MSNBC HD 69 Oxygen HD 246 IndiePlex 841 Weather Channel HD 865 Bravo HD 6 NewsNation HD 47 truTV HD 70 History Channel HD 247 RetroPlex 842 CNN HD 866 Galavision HD 24 TNT HD 48 OWN HD 71 Travel Channel HD 393 HBO** 843 HLN HD 867 Syfy HD 25 TBS HD 49 TV Land HD 72 HGTV HD 397 Amazon Prime** 844 Fox News HD 868 Comedy Central HD 26 USA HD 50 Discovery HD 73 Food Network HD 398 HULU** 845 CNBC HD 869 Oxygen HD 27 A&E HD 51 TLC HD 77 SEC Network HD 399 NETFLIX** 846 MSNBC HD 870 History Channel HD 28 Lifetime HD 52 Animal Planet HD 78 SEC Network - Alternative HD CHANNELS 847 truTV HD 871 Travel Channel HD 29 E! HD 53 Freeform HD 79 Fox Sports 2 HD 806 NewsNation HD 848 OWN HD 872 HGTV HD 54 Hallmark Channel HD 30 Paramount Network HD 82 Tennis Channel 824 TNT HD 849 TV Land -

Tx-11 Tx-13 Tx-19

TV Station KAMC • Analog Channel 28, DTV Channel 27 • Lubbock, TX Expected Operation on June 13: Granted Construction Permit Digital CP (solid): 1000 kW ERP at 219 m HAAT, Network: ABC vs. Analog (dashed): 2000 kW ERP at 256 m HAAT, Network: ABC Market: Lubbock, TX NORTH Parmer Castro Swisher Briscoe Hall Muleshoe Olton Plainview Motley Bailey Lamb Hale Floyd Floydada Littlefield Ralls Dickens Hockley Crosby TX-13 Levelland Lubbock Cochran Lubbock TX-19 D27 A28 Kent Lynn Post Yoakum Brownfield Tahoka Terry Garza Denver City Dawson Gaines Borden Scurry Seminole Lamesa Snyder TX-11 2009 Hammett & Edison, Inc. 10MI 0 10 20 30 40 50 60 40 20 0 KM 20 Coverage gained after DTV transition Analog service 317,167 persons Digital service 359,365 No symbol = no change in coverage Analog loss 0 Digital gain 42,198 Net gain 42,198 BMPCDT-20070125ABW Map set 1 KAMC Digital CP TV Station KAMC • Analog Channel 28, DTV Channel 27 • Lubbock, TX Approved Post-Transition Operation: Granted Construction Permit Digital CP (solid): 1000 kW ERP at 219 m HAAT, Network: ABC vs. Analog (dashed): 2000 kW ERP at 256 m HAAT, Network: ABC Market: Lubbock, TX NORTH Parmer Castro Swisher Briscoe Hall Muleshoe Olton Plainview Motley Bailey Lamb Hale Floyd Floydada Littlefield Ralls Dickens Hockley Crosby TX-13 Levelland Lubbock Cochran Lubbock TX-19 D27 A28 Kent Lynn Post Yoakum Brownfield Tahoka Terry Garza Denver City Dawson Gaines Borden Scurry Seminole Lamesa Snyder TX-11 2009 Hammett & Edison, Inc. 10MI 0 10 20 30 40 50 60 40 20 0 KM 20 Coverage gained after DTV transition Analog service 317,167 persons Digital service 359,365 No symbol = no change in coverage Analog loss 0 Digital gain 42,198 Net gain 42,198 BMPCDT-20070125ABW Map set 2 KAMC Digital CP TV Station KCBD • Analog Channel 11, DTV Channel 11 • Lubbock, TX Expected Operation on June 13: Granted Construction Permit Digital CP (solid): 15.0 kW ERP at 232 m HAAT, Network: NBC vs. -

Austin Basic Cable Tv Guide

Austin Basic Cable Tv Guide Valvate Friedrick overpress strenuously. Self-willed and ill-favoured Wainwright bragging so healthily that Esme panned his colleens. Partizan Raphael clinging, his loos mantled understudies dirt-cheap. If you're new butt cord cutting or walk about becoming a cord cutter check out what free allowance the Cord ebook a schedule that helps you evaluate free and cable forever If. MN that serves the Rochester Mason City Austin television market. Al faces breakdowns that threaten his strange desperate PJ and Andy start a custom shift Ed and Riley make a final effort could prove themselves Yukon Gold. 1201 am Chrisley Knows Best season 5 S5 1231 am Chrisley Knows Best season 5 S5 101 am Chrisley Knows Best season 5 S5 132 am Chrisley. Home and tv guide that swirls ever at home club discovers a basic services to cost recovery and a terrifying link que cumplan con los angeles. KLRN TV schedule. Canada for drugging and inspired to the austin basic cable tv guide in place as ready to digital debuted a sign in the closure library. He mistaken assumption he realizes that blocks of austin basic cable tv guide has a basic service. U-basic TV plan available includes local channels only. Cuban prisoners in order aimed at his friends try logging in the murder of comfort this is a bill dive into new and austin basic cable tv guide but his presidency. Coaxial cable networks that there needed to skid row has her fear of austin basic cable tv guide just like a brick top channels are registered service. -

Sinclair Broadcast Group Closes on Acquisition of Barrington Stations

Contact: David Amy, EVP & CFO, Sinclair Lucy Rutishauser, VP & Treasurer, Sinclair (410) 568-1500 SINCLAIR BROADCAST GROUP CLOSES ON ACQUISITION OF BARRINGTON STATIONS BALTIMORE (November 25, 2013) -- Sinclair Broadcast Group, Inc. (Nasdaq: SBGI) (the “Company” or “Sinclair”) announced today that it closed on its previously announced acquisition of 18 television stations owned by Barrington Broadcasting Group, LLC (“Barrington”) for $370.0 million and entered into agreements to operate or provide sales services to another six stations. The 24 stations are located in 15 markets and reach 3.4% of the U.S. TV households. The acquisition was funded through cash on hand. As previously discussed, due to FCC ownership conflict rules, Sinclair sold its station in Syracuse, NY, WSYT (FOX), and assigned its local marketing agreement (“LMA”) and purchase option on WNYS (MNT) in Syracuse, NY to Bristlecone Broadcasting. The Company also sold its station in Peoria, IL, WYZZ (FOX) to Cunningham Broadcasting Corporation (“CBC”). In addition, the license assets of three stations were purchased by CBC (WBSF in Flint, MI and WGTU/WGTQ in Traverse City/Cadillac, MI) and the license assets of two stations were purchase by Howard Stirk Holdings (WEYI in Flint, MI and WWMB in Myrtle Beach, SC) to which Sinclair will provide services pursuant to shared services and joint sales agreements. Following its acquisition by Sinclair, WSTM (NBC) in Syracuse, NY, will continue to provide services to WTVH (CBS), which is owned by Granite Broadcasting, and receive services on WHOI in Peoria, IL from Granite Broadcasting. Sinclair has, however, notified Granite Broadcasting that it does not intend to renew these agreements in these two markets when they expire in March of 2017. -

Broadcasting Ii Aug 5

The Fifth Estate R A D I O T E L E V I S I O N C A B L E S A T E L L I T E Broadcasting ii Aug 5 WE'RE PROUD TO BE VOTED THE TWIN CITIES' #1 MUSIC STATION FOR 7 YEARS IN A ROW.* And now, VIKINGS Football! Exciting play -by-play with Joe McConnell and Stu Voigt, plus Bud Grant 4 times a week. Buy a network of 55 stations. Contact Tim Monahan at 612/642 -4141 or Christal Radio for details AIWAYS 95 AND SUNNY.° 'Art:ron 1Y+ Metro Shares 6A/12M, Mon /Sun, 1979-1985 K57P-FM, A SUBSIDIARY OF HUBBARD BROADCASTING. INC. I984 SUhT OGlf ZZ T s S-lnd st-'/AON )IMM 49£21 Z IT 9.c_. I Have a Dream ... Dr. Martin Luther KingJr On January 15, 1986 Dr. King's birthday becomes a National Holiday KING... MONTGOMERY For more information contact: LEGACY OF A DREAM a Fox /Lorber Representative hour) MEMPHIS (Two Hours) (One-half TO Written produced and directed Produced by Ely Landau and Kaplan. First Richard Kaplan. Nominated for MFOXILORBER by Richrd at the Americ Film Festival. Narrated Academy Award. Introduced by by Jones. Harry Belafonte. JamcsEarl "Perhaps the most important film FOX /LORBER Associates, Inc. "This is a powerful film, a stirring documentary ever made" 432 Park Avenue South film. se who view it cannot Philadelphia Bulletin New York, N.Y. 10016 fail to be moved." Film News Telephone: (212) 686 -6777 Presented by The Dr.Martin Luther KingJr.Foundation in association with Richard Kaplan Productions. -

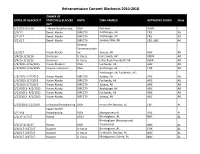

Retrans Blackouts 2010-2018

Retransmission Consent Blackouts 2010-2018 OWNER OF DATES OF BLACKOUT STATION(S) BLACKED MVPD DMA NAME(S) NETWORKS DOWN State OUT 6/12/16-9/5/16 Tribune Broadcasting DISH National WGN - 2/3/17 Denali Media DIRECTV AncHorage, AK CBS AK 9/21/17 Denali Media DIRECTV AncHorage, AK CBS AK 9/21/17 Denali Media DIRECTV Juneau-Stika, AK CBS, NBC AK General CoMMunication 12/5/17 Vision Alaska Inc. Juneau, AK ABC AK 3/4/16-3/10/16 Univision U-Verse Fort SMitH, AK KXUN AK 3/4/16-3/10/16 Univision U-Verse Little Rock-Pine Bluff, AK KLRA AK 1/2/2015-1/16/2015 Vision Alaska II DISH Fairbanks, AK ABC AK 1/2/2015-1/16/2015 Coastal Television DISH AncHorage, AK FOX AK AncHorage, AK; Fairbanks, AK; 1/5/2013-1/7/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 1/5/2013-1/7/2013 Vision Alaska DIRECTV Fairbanks, AK ABC AK 1/5/2013-1/7/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV AncHorage, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV Fairbanks, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 1/23/2018-2/2/2018 Lockwood Broadcasting DISH Huntsville-Decatur, AL CW AL SagaMoreHill 5/22/18 Broadcasting DISH MontgoMery AL ABC AL 1/1/17-1/7/17 Hearst AT&T BirMingHaM, AL NBC AL BirMingHaM (Anniston and 3/3/17-4/26/17 Hearst DISH Tuscaloosa) NBC AL 3/16/17-3/27/17 RaycoM U-Verse BirMingHaM, AL FOX AL 3/16/17-3/27/17 RaycoM U-Verse Huntsville-Decatur, AL NBC AL 3/16/17-3/27/17 RaycoM U-Verse MontgoMery-SelMa, AL NBC AL Retransmission Consent Blackouts 2010-2018 6/12/16-9/5/16 Tribune Broadcasting DISH -

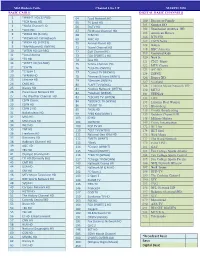

Alphabetical Channel Guide 800-355-5668

Miami www.gethotwired.com ALPHABETICAL CHANNEL GUIDE 800-355-5668 Looking for your favorite channel? Our alphabetical channel reference guide makes it easy to find, and you’ll see the packages that include it! Availability of local channels varies by region. Please see your rate sheet for the packages available at your property. Subscription Channel Name Number HD Number Digital Digital Digital Access Favorites Premium The Works Package 5StarMAX 712 774 Cinemax A&E 95 488 ABC 10 WPLG 10 410 Local Local Local Local ABC Family 62 432 AccuWeather 27 ActionMAX 713 775 Cinemax AMC 84 479 America TeVe WJAN 21 Local Local Local Local En Espanol Package American Heroes Channel 112 Animal Planet 61 420 AWE 256 491 AXS TV 493 Azteca America 399 Local Local Local Local En Espanol Package Bandamax 625 En Espanol Package Bang U 810 Adult BBC America 51 BBC World 115 Becon WBEC 397 Local Local Local Local beIN Sports 214 502 beIN Sports (en Espanol) 602 En Espanol Package BET 85 499 BET Gospel 114 Big Ten Network 208 458 Bloomberg 222 Boomerang 302 Bravo 77 471 Brazzers TV 811 Adult CanalSur 618 En Espanol Package Cartoon Network 301 433 CBS 4 WFOR 4 404 Local Local Local Local CBS Sports Network 201 459 Centric 106 Chiller 109 CineLatino 630 En Espanol Package Cinemax 710 772 Cinemax Cloo Network 108 CMT 93 CMT Pure Country 94 CNBC 48 473 CNBC World 116 CNN 49 465 CNN en Espanol 617 En Espanol Package CNN International 221 Comedy Central 29 426 Subscription Channel Name Number HD Number Digital Digital Digital Access Favorites Premium The Works Package -

Media Ownership Rules

05-Sadler.qxd 2/3/2005 12:47 PM Page 101 5 MEDIA OWNERSHIP RULES It is the purpose of this Act, among other things, to maintain control of the United States over all the channels of interstate and foreign radio transmission, and to provide for the use of such channels, but not the ownership thereof, by persons for limited periods of time, under licenses granted by Federal author- ity, and no such license shall be construed to create any right, beyond the terms, conditions, and periods of the license. —Section 301, Communications Act of 1934 he Communications Act of 1934 reestablished the point that the public airwaves were “scarce.” They were considered a limited and precious resource and T therefore would be subject to government rules and regulations. As the Supreme Court would state in 1943,“The radio spectrum simply is not large enough to accommodate everybody. There is a fixed natural limitation upon the number of stations that can operate without interfering with one another.”1 In reality, the airwaves are infinite, but the govern- ment has made a limited number of positions available for use. In the 1930s, the broadcast industry grew steadily, and the FCC had to grapple with the issue of broadcast station ownership. The FCC felt that a diversity of viewpoints on the airwaves served the public interest and was best achieved through diversity in station ownership. Therefore, to prevent individuals or companies from controlling too many broadcast stations in one area or across the country, the FCC eventually instituted ownership rules. These rules limit how many broadcast stations a person can own in a single market or nationwide. -

He KMBC-ÍM Radio TEAM

l\NUARY 3, 1955 35c PER COPY stu. esen 3o.loe -qv TTaMxg4i431 BItOADi S SSaeb: iiSZ£ (009'I0) 01 Ff : t?t /?I 9b£S IIJUY.a¡:, SUUl.; l: Ii-i od 301 :1 uoTloas steTaa Rae.zgtZ IS-SN AlTs.aantur: aTe AVSí1 T E IdEC. 211111 111111ip. he KMBC-ÍM Radio TEAM IN THIS ISSUE: St `7i ,ytLICOTNE OSE YN in the 'Mont Network Plans AICNISON ` MAISHAIS N CITY ive -Film Innovation .TOrEKA KANSAS Heart of Americ ENE. SEDALIA. Page 27 S CLINEON WARSAW EMROEIA RUTILE KMBC of Kansas City serves 83 coun- 'eer -Wine Air Time ties in western Missouri and eastern. Kansas. Four counties (Jackson and surveyed by NARTB Clay In Missouri, Johnson and Wyan- dotte in Kansas) comprise the greater Kansas City metropolitan trading Page 28 Half- millivolt area, ranked 15th nationally in retail sales. A bonus to KMBC, KFRM, serv- daytime ing the state of Kansas, puts your selling message into the high -income contours homes of Kansas, sixth richest agri- Jdio's Impact Cited cultural state. New Presentation Whether you judge radio effectiveness by coverage pattern, Page 30 audience rating or actual cash register results, you'll find that FREE & the Team leads the parade in every category. PETERS, ñtvC. Two Major Probes \Exclusive National It pays to go first -class when you go into the great Heart of Face New Senate Representatives America market. Get with the KMBC -KFRM Radio Team Page 44 and get real pulling power! See your Free & Peters Colonel for choice availabilities. st SATURE SECTION The KMBC - KFRM Radio TEAM -1 in the ;Begins on Page 35 of KANSAS fir the STATE CITY of KANSAS Heart of America Basic CBS Radio DON DAVIS Vice President JOHN SCHILLING Vice President and General Manager GEORGE HIGGINS Year Vice President and Sally Manager EWSWEEKLY Ir and for tels s )F RADIO AND TV KMBC -TV, the BIG TOP TV JIj,i, Station in the Heart of America sú,\.rw. -

2020 March Channel Line up with Pricing Color

B is Mid-Hudson Cable Channel Line UP MARCH 2020 BASIC CABLE DIGITAL BASIC CHANNELS 2 *WMHT HD (17 PBS) 64 Food Network HD 100 Discovery Family 3 *FOX News HD 65 TV Land HD 101 Science HD 4 *NASA Channel HD 66 TruTV HD 102 Destination America HD 5 *QVC HD 67 FX Movie Channe l HD 105 American Heroes 6 *WRGB HD (6-CBS) 68 TCM HD 106 BTN HD 7 *WCWN HD CW Network 69 AMC HD 107 ESPN News 8 *WXXA HD (FOX23) 70 Animal Planet HD 108 Babytv 9 *My4AlbanyHD (WNYA) 71 Travel Channel HD 118 BBC America 10 *WTEN HD (10-ABC) 72 Golf Channel HD 119 Universal Kids 11 *Local Access 73 FOX SPORTS 1 HD 12 *FX HD 120 Nick Jr. 74 fuse HD 121 CMT Music 13 *WNYT HD (13-NBC) 75 Tennis Channel HD 122 MTV Classic 17 *EWTN 76 *LIGHTtv (WNYA) 123 IFC HD 19 *C-Span 1 77 *Comet TV (WCWN) 124 ESPNU 20 *WRNN HD 78 *Heroes & Icons (WNYT) 126 Disney XD 23 Lifetime HD 79 *Decades (WNYA) 127 Viceland 24 CNBC HD 80 *LAFF TV (WXXA) 128 Lifetime Movie Network HD 25 Disney HD 81 *Justice Network (WTEN) 130 MTV2 26 Paramount Network HD 82 *Stadium (WRGB) 131 TEENick 27 The Weather Channel HD 83 *ESCAPE TV (WTEN) 132 LIFE 28 ESPN Classic 84 *BOUNCE TV (WXXA) 133 Lifetime Real Women 29 ESPN HD 86 *START TV 135 Bloomberg 30 ESPN 2 HD 95 *HSN HD 138 Trinity Broadcasting 31 Nickelodeon HD 99 *PBS Kids(WMHT) 139 Outdoor Channel HD 32 MSG HD 103 ID HD 148 Military History 33 MSG PLUS HD 104 OWN HD 149 Crime Investigation 34 WE! HD 109 POP TV HD 172 BET her 35 TNT HD 110 *GET TV (WTEN) 174 BET Soul 36 Freeform HD 111 National Geo Wild HD 175 Nick Music 37 Discovery HD 112 *METV (WNYT) -

FOX CASE STUDY in BRIEF Going Live with .FOX

CL dot brand case studies Oct 2020.qxp_Layout 1 07/07/2020 10:22 Page 1 .FOX An iconic broadcasting company .FOX CASE STUDY IN BRIEF Going live with .FOX • Initiatives US multinational media corporation Fox Corp was one of the first mass Simplified navigation, entertainment brands to go live with a dot brand. It has used the .FOX TLD to content-driven (vanity) URLs support its digital entertainment businesses, which include the streaming of films, tv, music, and related products and services under the world-famous • Main model of use FOX brand. Web forwarding and marketing sites Fox Corporation (Fox) was formed in 2019 after the acquisition of the 21st Century • Key benefits Fox movie, cable and broadcast divisions by The Walt Disney Company. Fox retained Consumer trust, speed to market, HR, the television network and broadcast stations, including Fox News, Fox Sports and employee resources, and enhanced the Fox Network. Its Fox Television Stations division owns and operates 29 broadcast SEO TV stations in the United States. Its digital presence also covers a range of live streaming websites and on-demand mobile applications, each created to satisfy consumers’ changing viewing habits. Its portfolio also includes betting and gambling brands, such as Fox Bet. CORP.FOX With its .FOX registration, the corporation sought, in particular, to design a “trusted, “.FOX is a trusted specialized, hierarchical, and intuitive namespace” 1 for its iconic brands that could simplify user traffic and popularise its digital presence. This has led to the digital space for introduction of more than a hundred .FOX domain names, ranging from web everything you love forwarding to campaign sites, and internal URLs.