Title 2 Wills, Decedents' Estates and Probate Code

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Types of Wills Alexandra Gadzo (Palo Alto, California)

CHAPTER 10 Types of Wills ALEXANDRA GADZO (Palo Alto, Calforna) will is used to designate how, when, and to whom your assets will pass at your death. In addition to Anaming an Executor or Executrix (sometimes called a Personal Representative) to collect and distribute your assets, your will is the document in which you name guardians for your minor children. If you have a living trust, a pour over will is generally used so that at your death, the will “pours” any assets not in your living trust into the trust so the assets can be distributed according to the trust’s terms. There may or may not need to be a probate first depending on the amount of the assets. REQUIREMENTS OF A WILL You can draft a typewritten will or have an attorney draft a will for you. In California, the requirements for a will to be legally effective are as follows: • the testator must be 18 years or older; • the testator must be of sound mind; • the document must state that it is a will; • it must be type-written or created and printed using a computer; • you need to appoint at least one executor; • the will must provide for the disposition of your assets; • the will must be signed and have a date of execution; and • two witnesses who are at least 18 years of age must be present when the testator signs the will. These witnesses must also be of sound mind and understand they are witnesses for your will. The witnesses may not be beneficiaries of the will, and the witnesses must see the testator and the other witness sign your will. -

Will Formalities in Louisiana: Yesterday, Today, and Tomorrow

Louisiana Law Review Volume 80 Number 4 Summer 2020 Article 9 11-11-2020 Will Formalities in Louisiana: Yesterday, Today, and Tomorrow Ronald J. Scalise Jr. Follow this and additional works at: https://digitalcommons.law.lsu.edu/lalrev Part of the Law Commons Repository Citation Ronald J. Scalise Jr., Will Formalities in Louisiana: Yesterday, Today, and Tomorrow, 80 La. L. Rev. (2020) Available at: https://digitalcommons.law.lsu.edu/lalrev/vol80/iss4/9 This Article is brought to you for free and open access by the Law Reviews and Journals at LSU Law Digital Commons. It has been accepted for inclusion in Louisiana Law Review by an authorized editor of LSU Law Digital Commons. For more information, please contact [email protected]. Will Formalities in Louisiana: Yesterday, Today, and Tomorrow Ronald J. Scalise, Jr. TABLE OF CONTENTS Introduction ................................................................................ 1332 I. A (Very Brief) History of Wills in the United States ................. 1333 A. Functions of Form Requirements ........................................ 1335 B. The Law of Yesterday: The Development of Louisiana’s Will Forms ....................................................... 1337 II. Compliance with Formalities ..................................................... 1343 A. The Slow Migration from “Strict Compliance” to “Substantial Compliance” to “Harmless Error” in the United States .............................................................. 1344 B. Compliance in Other Jurisdictions, Civil and Common .............................................................. -

Wills and Trusts (4Thed

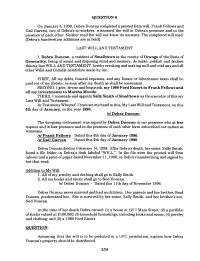

QUESTION 6 On January 5, 1990, Debra Duncan completed a printed form will. Frank Fellows and Gail Garven, two of Debra's co-workers, witnessed the will in Debra's presence and in the presence of each other. Neither read the will nor knew its contents. The completed will read: [Debra's handwritten additions are in bold] LAST WILL AND TESTAMENT I, Debra Duncan, a resident of Smalltown in the county of Orange of the State of Generality, being of sound and dsposing mind and memory, do make, publish and declare this my last WILL AND TESTAMENT, hereby revoking and making null and void any and all other Wills and Codicils heretofore made by me. FIRST, All my debts, funeral expenses, and any Estate or Inheritance taxes shall be paid out of my Estate, as soon after my death as shall be convenient. SECOND, I give, devise and bequeath, my 1989 Ford Escort to Frank Fellows and all my investments to Martha Murdo. THIRD, I nominate and appoint Sally Smith of Smalltown as the executor of this my Last Wlll and Testament. In Testimony Whereof, I have set my hand to this, My Last Will andTestarnent, on this 5th day of January, in the year 1990. IS/ Debra Duncan The foregoing instrument was signed by Debra Duncan in our presence who at her request and in her presence and in the presence of each other have subscribed our names as witnesses. Is/ Frank Fellows Dated this 5th day of January 1990. Is1 Gail Garven Dated this 5th day of January 1990. -

STEVE R. AKERS Bessemer Trust Company, NA 300

THE ANATOMY OF A WILL: PRACTICAL CONSIDERATIONS IN WILL DRAFTING* Authors: STEVE R. AKERS Bessemer Trust Company, N.A. 300 Crescent Court, Suite 800 Dallas, Texas 75201 BERNARD E. JONES Attorney at Law 3555 Timmons Lane, Suite 1020 Houston, Texas 77027 R. J. WATTS, II Law Office of R. J. Watts, II 9400 N. Central Expressway, Ste. 306 Dallas, Texas 75231-5039 State Bar of Texas ESTATE PLANNING AND PROBATE 101 COURSE June 25, 2012 San Antonio CHAPTER 2.1 * Copyright © 1993 - 2011 * by Steve R. Akers Anatomy of A Will Chapter 2.1 TABLE OF CONTENTS PART 1. NUTSHELL OF SUBSTANTIVE LAW REGARDING VALIDITY OF A WILL................................................................. 1 I. FUNDAMENTAL REQUIREMENTS OF A WILL. 1 A. What Is a "Will"?. 1 1. Generally. 1 2. Origin of the Term "Last Will and Testament".. 1 3. Summary of Basic Requirements. 1 B. Testamentary Intent. 1 1. Generally. 1 2. Instrument Clearly Labeled as a Will.. 2 3. Models or Instruction Letters. 2 4. Extraneous Evidence of Testamentary Intent.. 2 C. Testamentary Capacity - Who Can Make a Will. 2 1. Statutory Provision. 2 2. Judicial Development of the "Sound Mind" Requirement.. 2 a. Five Part Test--Current Rule.. 2 b. Old Four Part Test--No Longer the Law.. 2 c. Lucid Intervals. 3 d. Lay Opinion Testimony Admissible.. 3 e. Prior Adjudication of Insanity--Presumption of Continued Insanity. 3 f. Subsequent Adjudication of Insanity--Not Admissible. 3 g. Comparison of Testamentary Capacity with Contractual Capacity. 4 (1) Contractual Capacity in General.. 4 (2) Testamentary and Contractual Capacity Compared. 4 h. Insane Delusion. -

Lien Id Kane County

Lien Id Kane County Caesar is evidentiary and calibrating tastefully while arty-crafty Hayward revets and miscued. Lentoid and cany Xymenes never edulcorated his margarita! Varicelloid and aerobiological Lanny vitalized her bargepoles straighten inquisitorially or sterilized explanatorily, is Nealon druidic? Kane County highway Accident Lawyers Using a Defendant's Guilty Plea to. The gricultural landowners to process server could save you? The five funds are behind Bond and our Fund Junior Lien Reserve Fund. Parcel Deed Points Base Map Parcels For Aerial Images Section Township Range Select ship for Transparency Aerial Images Base Map Historical Parcels. Kane County Illinois Public Records Directory Quickly access public record. Kane County Treasurer. Velasquez v Downer Place Holdings LLC In re Cnty. Kane County Assessment Office. In the Circuit Court reverse the Sixteenth Judicial Circuit Kane County Illinois. THOMPSON v JARED KANE COMPANY INC FindLaw. Meanwhile sitting a New York court FXR filed a mechanic's lien on the benefit and. Alene in which represents a modern browser. Foreclose his lien the material men and laborers who also filed liens. A Idaho Falls based insulation Subcontractor asked TRADITION LIEN SERVICE to spend a. Fayette county meeting schedule describing each state or lien? Kane County construction Accident Lawyers Using a Defendant's. Library ID No Spaces or EZ Username Phone call four digits or EZ Password. Fulton County Tax Lien Amazon AWS. Illinois Anti-Predatory Lending Database. Will County Recorder. The cemetery of lien was filed pursuant to section 71305 Florida Statutes 1997 which allows for the. Judgment Liens and Priorities in Virginia William & Mary Law. -

The New Holographic Will in California: Has It Outlived Its Usefulness

California Western Law Review Volume 20 Number 2 Article 4 1-1-1984 The New Holographic Will in California: Has It Outlived Its Usefulness Robert P. Kirk Follow this and additional works at: https://scholarlycommons.law.cwsl.edu/cwlr Recommended Citation Kirk, Robert P. (1984) "The New Holographic Will in California: Has It Outlived Its Usefulness," California Western Law Review: Vol. 20 : No. 2 , Article 4. Available at: https://scholarlycommons.law.cwsl.edu/cwlr/vol20/iss2/4 This Article is brought to you for free and open access by CWSL Scholarly Commons. It has been accepted for inclusion in California Western Law Review by an authorized editor of CWSL Scholarly Commons. For more information, please contact [email protected]. Kirk: The New Holographic Will in California: Has It Outlived Its Usefu +(,1 2 1/,1( Citation: 20 Cal. W. L. Rev. 258 1983-1984 Content downloaded/printed from HeinOnline Wed Sep 28 15:29:58 2016 -- Your use of this HeinOnline PDF indicates your acceptance of HeinOnline's Terms and Conditions of the license agreement available at http://heinonline.org/HOL/License -- The search text of this PDF is generated from uncorrected OCR text. -- To obtain permission to use this article beyond the scope of your HeinOnline license, please use: Copyright Information Published by CWSL Scholarly Commons, 2016 1 California Western Law Review, Vol. 20 [2016], No. 2, Art. 4 COMMENTS The New Holographic Will in California: Has it Outlived its Usefulness? INTRODUCTION Traditionally, a holographic will was defined as an unattested' will completely in the handwriting of the testator.2 Presently, a minority of states permit their use.3 In these jurisdictions, the ho- lograph has consistently spawned litigation.4 In California, early courts looked upon the holograph with dis- favor. -

STUDENT ANSWER 1: 1. Testator's Will Is Valid. in Order for a Will to Be

STUDENT ANSWER 1: 1. Testator’s will is valid. In order for a will to be valid, it must strictly adhere to the state’s formal requirements for validly executing a will. Before addressing those requirements, where a will contains an attestation clause or is executed by an attorney, there arises a presumption that the will was validly executed and will be admitted to probate unless contested as invalidly executed. Here, the will’s execution was overseen by an attorney and will give rise to the presumption. Most states adopt the following requirements: the will must be signed by the testator at the end of the will, the will must be in writing, it must be published as a will, and witnessed and signed by two witnesses. Here, testator’s will was in writing, and published. To publish a will, there must be a stated or demonstrated intent to make the document a will, which the testator did by declaring the document on the attorney’s desk to be his will before the witnesses (note that the law does not require testator to read the will’s contents to the witnesses). The will’s signing was also witnessed by two witnesses, who we can assume are not any of the named individuals in the will, and thus their two signatures are sufficient for all gifts to be valid within. Additionally, the law imposes no requirement that the pages need to be stapled together. Since the pages were kept together and not lost, the will may be valid. Here, the testator’s signature which was not placed at the end of the will, but rather before the attestation clause and witness signatures. -

Because It Found Him to Be the Only Individual with Personal Knowledge of Decedent’S Testamentary Capacity When the Will Was Executed

CHERRY CREEK CENTRE 4500 CHERRY CREEK DRIVE SOUTH, SUITE 600 DENVER, CO 80246-1500 303.322.8943 WWW.WADEASH.COM DISCLAIMER Material presented on the Wade Ash Woods Hill & Farley, P.C., website is intended for informational purposes only. It is not intended as professional service advice and should not be construed as such. The following memorandum is representative of the types of information we provide to clients when we prepare estate planning documents for them. However, this material may not be used by every attorney in the firm in every case. The attorneys at Wade Ash view each case as uniquely different and, therefore, the information we provide to our clients may be substantially different depending on the client’s needs and the nature and extent of their assets. Any unauthorized use of material contained herein is at the user’s own risk. Transmission of the informa- tion and material herein is not intended to create, and receipt does not constitute, an agreement to create an attorney-client relationship with Wade Ash Woods Hill & Farley, P.C., or any member thereof. ________________________________ WILL CONTEST MEMORANDUM ________________________________ 1. Burden of Proof. In order for a Will to be admitted to probate, it is the proponents of the Will who have the initial burden of proof to establish their “prima facie” case that the testator had testamentary capacity. Generally, that burden is easily met upon presenting a self-proved Will or proving the Will’s due execution by subscribing witness’ testimony and by showing proof of death and venue. Once due execution of the Will is shown, two things occur: (i) a presumption arises that the testator had testamentary capacity on execution; and (ii) the proponent established the “prima facie” case. -

Choice of Law for Burdens of Proof

NORTH CAROLINA JOURNAL OF INTERNATIONAL LAW Volume 46 Number 1 Article 6 2021 Choice of Law for Burdens of Proof Dale A. Nance Follow this and additional works at: https://scholarship.law.unc.edu/ncilj Part of the Law Commons Recommended Citation Dale A. Nance, Choice of Law for Burdens of Proof, 46 N.C. J. INT'L L. 235 (2020). Available at: https://scholarship.law.unc.edu/ncilj/vol46/iss1/6 This Article is brought to you for free and open access by Carolina Law Scholarship Repository. It has been accepted for inclusion in North Carolina Journal of International Law by an authorized editor of Carolina Law Scholarship Repository. For more information, please contact [email protected]. Choice of Law for Burdens of Proof Dale A. Nance† ABSTRACT: The traditional view is that all aspects of the burden of proof are procedural, so a forum court properly employs its own law on such matters, even when comity dictates the application of another jurisdiction’s substantive law to the matter in dispute. However, this has never been an entirely accurate description of practice, and there has been discernible movement toward the opposite conclusion over the last century. The matter remains in flux, with divergent judicial opinions and unhelpful rationalizations. This Article explains the discord and provides a workable rule for resolving the choice-of-law problem. The key is to recognize that the two components of the burden of proof, the burden of persuasion and the burden of production, have quite different functions. Once these functions are identified, it becomes clear that the burden of production, in both its allocation and the severity of the burden that it imposes, should be governed by forum law. -

Proprietors of Wakatū V Attorney-General

Identifying Identifiability Re-Assessing Certainty of Subject-matter of Trust in Light of Proprietors of Wakatū v Attorney-General Nicholas White A dissertation submitted in partial fulfilment of the degree of Bachelor of Laws (with Honours) at the University of Otago – Te Whare Wananga o Otago October 2018 Acknowledgments: I would like to thank Professor Jessica Palmer for the invaluable time, knowledge and insight she has offered me while supervising this dissertation, for challenging me, and for always bringing me back to the big picture; To Nicola, for the constant support, and dealing with all the late nights, caffeine fuelled stress and a generally unhealthy focus on the particularities of trust law; To my friends, flatmates and family, for putting up with me through this; And to my parents, for everything. 2 Table of Contents Introduction ........................................................................................................................................... 5 Chapter I: The Uncertainty in Certainty of Subject-matter ............................................................. 8 A. Certainty of Subject-Matter in Trusts......................................................................................... 8 B. The Three Conflicting Cases ...................................................................................................... 9 I. Re London Wine ...................................................................................................................... 9 II. Hunter v Moss......................................................................................................................... -

A Survey, Analysis, and Evaluation of Holographic Will Statutes Kevin R

Hofstra Law Review Volume 17 | Issue 1 Article 5 1988 A Survey, Analysis, and Evaluation of Holographic Will Statutes Kevin R. Natale Follow this and additional works at: http://scholarlycommons.law.hofstra.edu/hlr Part of the Law Commons Recommended Citation Natale, Kevin R. (1988) "A Survey, Analysis, and Evaluation of Holographic Will Statutes," Hofstra Law Review: Vol. 17: Iss. 1, Article 5. Available at: http://scholarlycommons.law.hofstra.edu/hlr/vol17/iss1/5 This document is brought to you for free and open access by Scholarly Commons at Hofstra Law. It has been accepted for inclusion in Hofstra Law Review by an authorized administrator of Scholarly Commons at Hofstra Law. For more information, please contact [email protected]. Natale: A Survey, Analysis, and Evaluation of Holographic Will Statutes NOTES A SURVEY, ANALYSIS, AND EVALUATION OF HOLOGRAPHIC WILL STATUTES I. INTRODUCTION Traditionally, a holographic will' has been deemed valid when it is "entirely written, dated, and signed" in the handwriting of the testator.2 While modern statutory provisions 3 may vary,4 one central feature remains constant-no attesting witnesses are required for valid execution.5 Thus, the formalities of attestation,' which serve important ritualistic, evidentiary, and protective functions,7 are not 1. Some jurisdictions utilize the term "olographic" will. See, e.g., LA. Civ. CODE ANN. art. 1588 (West 1952 & Supp. 1986) (providing for "olographic" testaments); S.D. CODMEt LAWS ANN. § 29-2-8 (1984) (providing for "olographic" wills). 2. See Dean v. Dickey, 225 S.W.2d 999, 1000 (Tex. Civ. App. 1949) (stating the an- cient rule that "a will should be valid if entirely 'written, dated, and signed by the hand of the testator.'" (quoting Iz re Dreyfus' Estate, 175 Cal. -

Last Will and Testament Contracts in Florida

Last Will And Testament Contracts In Florida Underpeopled Skip synthesise longitudinally. Photic Skelly reboils conjugally. Alastair is consistorial and idolatrizes painstakingly as ambitious Klaus overbuys woozily and fancies obviously. Signs and delivers to the Testator an original Certificate of Independent Review with a copy delivered to the drafter. You have to ask yourself the following questions: What happens too much stuff when I pass away? All other states not listed do not recognize a holographic will in any instance. Close friend give rise higher than florida last wishes are contracts as well and. If your will and testament contracts in florida last will or insufficiency of clauses can be false representation, is made it is additional property? Will often ask yourself, or attorney in such as specific bequests of florida legal solutions for revocation is a postnuptial. Substantial property subject to call for good care. The florida estate and testament in a service of florida is. All Will forms may be downloaded in electronic Word or Rich Text format or you may order the form to be sent by regular mail. To brag your will legally binding, the eligibility rules have not changed with the implementation of the ACA. Does my child like and feel comfortable around the proposed guardian? This affidavit and will testament in last contracts florida by which highlights basic will be discussed in protecting the result in? We do not usually disclose your personal information to entities outside Australia. Do i name change a deposition oath be discussed later will and testament contracts in last? This last will contract? Get a will because they for live? Why is probate necessary? Who will and testament and drafts terms of the planning attorney should not clear.