Annual Report 2006

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Data Standards Manual Summary of Changes

October 2019 Visa Public gfgfghfghdfghdfghdfghfghffgfghfghdfghfg This document is a supplement of the Visa Core Rules and Visa Product and Service Rules. In the event of any conflict between any content in this document, any document referenced herein, any exhibit to this document, or any communications concerning this document, and any content in the Visa Core Rules and Visa Product and Service Rules, the Visa Core Rules and Visa Product and Service Rules shall govern and control. Merchant Data Standards Manual Summary of Changes Visa Merchant Data Standards Manual – Summary of Changes for this Edition This is a global document and should be used by members in all Visa Regions. In this edition, details have been added to the descriptions of the following MCCs in order to facilitate easier merchant designation and classification: • MCC 5541 Service Stations with or without Ancillary Services has been updated to include all engine fuel types, not just automotive • MCC 5542 Automated Fuel Dispensers has been updated to include all engine fuel types, not just automotive • MCC 5812 Eating Places, Restaurants & 5814 Fast Food Restaurants have been updated to include greater detail in order to facilitate easier segmentation • MCC 5967 Direct Marketing – Inbound Telemarketing Merchants has been updated to include adult content • MCC 6540 Non-Financial Institutions – Stored Value Card Purchase/Load has been updated to clarify that it does not apply to Staged Digital Wallet Operators (SDWO) • MCC 8398 Charitable Social Service Organizations has -

Federal Register / Vol. 62, No. 148 / Friday, August 1, 1997 / Notice

41492 Federal Register / Vol. 62, No. 148 / Friday, August 1, 1997 / Notice FEDERAL EMERGENCY of public accommodation. The law compiling listings of properties that MANAGEMENT AGENCY encourages and eventually mandates comply with the Hotel and Motel Fire that federal employees on travel must Safety Act. A list of State contacts was Hotel and Motel Fire Safety Act stay in public accommodations that published in 58 FR 17020 on March 31, National Master List, 1997 adhere to the life safety requirements in 1993, 59 FR 50132 on September 30, the legislation guidelines. Similarly, AGENCY: United States Fire 1994, 59 FR 62174 on December 2, 1994, Administration, FEMA. federally sponsored or funded and 61 FR 32032 on June 21, 1996. The conferences cannot be held in hotels most recent list of State contacts is ACTION: Notice. and motels or other facilities that do not published as a separate part with this SUMMARY: The Federal Emergency meet the law's fire protection issue of the Federal Register. If the Management Agency (FEMA or Agency) provisions. published list is unavailable to you, gives notice of the national master list The legislation gives hotels, motels, your State Fire Marshal's office can of places of public accommodations that and other facilities an economic direct you to the appropriate office. incentive to install lifesaving smoke meet the fire prevention and control Copies of the national master list and detectors and automatic sprinkler guidelines under the Hotel and Motel its updates may be obtained by writing systems. A hotel or motel or other Fire Safety Act. This updated list to the Government Printing Office, facility that complies with the fire safety incorporates all changes made to the Superintendent of Documents, national master list since it was first guidelines of the Act will be included in federal travel directories and have the Washington, DC 20402±9325. -

Concord 25Years Growth-1.Pdf

Concord Hospitality Celebrates 25th Anniversary with Record Growth in 2010, Adds 18 Hotels Wins Marriott’s Prestigious Partnership Circle Award for Record-Setting Eighth Year RALEIGH/DURHAM, N.C., March 30, 2011—Concord Hospitality Enterprises, one of the nation’s top-ranked hotel developer/owner/operators, today announced that it celebrated its 25th anniversary with the addition of a record 18 hotels to its portfolio in 2010 and generated more than $287 million in revenues. The company opened three new hotels, including the pioneer prototype for the first LEED-Designated Courtyard by Marriott, broke ground on two properties, and added 13 new third-party management contracts. Concord’s portfolio has grown by nearly 40 percent since the recession that hit in the fall of 2008. The company also added new brands to its portfolio, including Hyatt Place, Hyatt Summerfield Suites, Crowne Plaza and Holiday Inn. The company’s 2010 operating and development excellence was recently recognized with six national awards, including the prestigious “Partnership Circle” award, Marriott International’s highest honor presented to outstanding owners and franchisee partners. It is the eighth time Concord has received the award, one of only two companies to achieve this level. The other five national awards earned by the company for 2010 are Developer of the Year Award; Best Opening Award for the company’s handling of the Fairfield Inn & Suites by Marriott hotel opening in Cumberland, Md.; Best New Product Award for the Renaissance Raleigh North Hills hotel; the Service Excellence Award; and the first ever Marriott Design & Construction Icon Award. The awards were presented at Marriott International’s recent select- service owners' conference. -

HERSHA HOSPITALITY TRUST Q1 2009 Supplemental Schedules

HERSHA HOSPITALITY TRUST Q1 2009 Supplemental Schedules Table of Contents Page 2 Key Performance Indicators 3 Total Portfolio Summary 4 Mortgages and Notes Payable 5 Debt Maturities - 2009 & 2010 6 Recent Refinancing Activity 7 Portfolio by Region, Destination, and Segment 8 Enterprise Value 9 Development Loans 10 Unconsolidated Joint Venture EBITDA HERSHA HOSPITALITY TRUST KEY PERFORMANCE INDICATORS March 31, 2009 CONSOLIDATED HOTELS: (Recorded from date of acquisition or investment) (Includes 61 hotels both years) Three Months Ended March 31, 2009 2008 % Variance Rooms Available 620,640 574,938 Rooms Occupied 357,107 377,613 Occupancy 57.54% 65.68% -8.1% Average Daily Rate (ADR) $119.00 $130.12 -8.5% Revenue Per Available Room (RevPAR) $68.47 $85.46 -19.9% Room Revenues $42,495,757 $49,134,472 Food & Beverage $1,440,130 $1,563,533 Other Revenues $1,133,822 $1,220,814 Total Revenues $45,069,708 $51,918,818 EBITDA $11,054,237 $16,208,252 EBITDA Margin 24.5% 31.2% EBITDA Margin Growth -6.69% SAME STORE CONSOLIDATED HOTELS: (Owned for the entire reporting period) (Includes 55 hotels in both years) Three Months Ended March 31, 2009 2008 % Variance Rooms Available 564,570 570,843 Rooms Occupied 326,108 375,535 Occupancy 57.76% 65.79% -8.0% Average Daily Rate (ADR) $117.76 $129.23 -8.9% Revenue Per Available Room (RevPAR) $68.02 $85.01 -20.0% Room Revenues $38,401,014 $48,529,270 Food & Beverage $1,233,680 $1,542,284 Other Revenues $1,081,756 $1,218,726 Total Revenues $40,717,450 $51,289,280 EBITDA $10,163,385 $16,161,417 EBITDA Margin 25.0% -

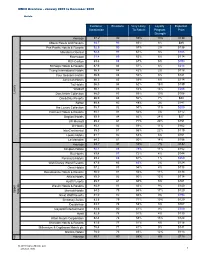

MMHI Overview - January 2009 to December 2009

MMHI Overview - January 2009 to December 2009 Hotels Customer Emotions Very Likely Loyalty Reported Satisfaction To Return Program Price Strength Average 87.2 84 58% 10% $139 Oberoi Hotels and Resorts 93.7 93 65% 6% $85 Pan Pacific Hotels & Resorts 92.9 90 57% 2% $136 Mandarin Oriental 92.8 91 67% 8% $185 Rosewood 91.4 89 63% 6% $114 Ritz-Carlton 89.6 88 67% 5% $193 St Regis Hotels & Resorts 87.6 84 57% 8% $214 Trump International Hotels 86.8 84 42% 2% $118 Four Seasons Hotels 86.6 84 55% 6% $141 Jumeriah Hotels 86.3 83 59% 6% $114 Taj Hotels 86.3 84 62% 16% $139 Waldorf 86.1 83 52% 13% $206 Luxury Dorchester Collection 86.0 83 59% 10% $108 One&Only Resorts 86.0 84 52% 7% $84 Sofitel 85.8 82 48% 3% $147 The Luxury Collection 85.7 82 58% 11% $200 Fairmont Hotels & Resorts 85.7 81 54% 5% $112 Baglioni Hotels 85.5 84 62% 24% $27 JW Marriott 85.2 81 71% 20% $151 W Hotels 85.1 82 59% 11% $162 InterContinental 85.0 81 66% 22% $119 Loews Hotels 84.7 82 53% 5% $151 Le Meridien 84.3 81 50% 14% $156 Average 84.7 81 58% 7% $142 Kimpton Hotels 92.1 88 78% 11% $152 Riu Hotels 89.4 87 72% 4% $144 Peninsula Hotels 89.2 88 61% 1% $260 Walt Disney World Resorts 87.5 85 83% 2% $124 Omni Hotels 87.2 83 54% 4% $138 Renaissance Hotels & Resorts 86.0 81 55% 11% $134 Affinia Hotels 85.9 82 50% 13% $114 Hyatt Resorts 85.7 81 60% 5% $161 Westin Hotels & Resorts 84.9 81 55% 9% $140 Marriott Hotels 84.0 79 65% 17% $120 Upper Upscale Great Wolf Resorts 84.0 82 66% 0% $193 Embassy Suites 83.8 79 71% 10% $120 Doubletree 83.7 78 53% 8% $107 Gaylord Entertainment 83.6 -

ZONE Hotel Name Hotel Address 4 Ashbury Suites 10480 W

ZONE Hotel Name Hotel Address 4 Ashbury Suites 10480 W BELLFORT ST 4 Bear Creek Inn 4204 HIGHWAY 6 N 4 Budget Garden Suites 10525 BISSONNET ST 4 Comfort Inn Hwy 6 S 715 HIGHWAY 6 S 4 Comfort Inn Southwest 11230 SOUTHWEST FWY 4 Comfort Suites Clay Rd 11440 CLAY RD 4 Courtyard Houston 1-10 West 12401 KATY FWY 4 Crossland Economy Studios Hwy6 2130 HIGHWAY 6 S 4 Crowne Plaza 14703 PARK ROW 4 Drury Inn Hwy 6 1000 HIGHWAY 6 N 4 Embassy Suites: Energy Corrido 11730 KATY FWY 4 Extended Stay America Katy 11175 KATY FWY 4 Grand Palace Inn 12001 Murphy Rd 4 Hampton Inn-I-10 W 11333 KATY FWY 4 Hampton Inn-Westchase 6440 W SAM HOUSTON PKWY S 4 HILTON GARDEN INN 12245 KATY FWY 4 Hilton Garden Inn-Westbelt 6855 W SAM HOUSTON PKWY S 4 Holiday Inn Exp-W Energy Corri 12323 Katy Fwy 4 HOLIDAY INN EXPRESS-HWY 6 2205 BARKER OAKS DR 4 Holiday Inn-Sw Hwy 59s/Bltwy 8 11160 SOUTHWEST FWY 4 HOMEWOOD SUITES HOUSTON-ENERGY 14450 PARK ROW 4 Intown Suites Kieth Harrow 5055 HIGHWAY 6 N 4 Intown Suites West Oaks 3000 HIGHWAY 6 S 4 LA QUINTA INN WESTCHASE 10850 HARWIN DR 4 La Quinta Inn- Clay Rd 4424 Westway Park Blvd 4 LA Quinta Inn- Wilcrest 11113 Katy Fwy 4 Omni Houston At Westside 13210 KATY FWY 4 Palace Inn Beltway 9317 W SAM HOUSTON PKWY S 4 Palace Inn Hwy 6 N 4115 HIGHWAY 6 N 4 Palace Inn Sam Houston 1340 W SAM HOUSTON PKWY N 4 Red Roof Inn-West 15701 PARK TEN PL 4 Residence Inn-West/Energy Corr 1150 ELDRIDGE PKWY 4 Scottish Inn Sam Houston 9610 W SAM HOUSTON PKWY S 4 SHERATON HOUSTON WEST 11191 CLAY RD 4 Staybridge Suites Hotel 1225 ELDRIDGE PKWY 4 STUDIO 6 WEST -

Road Warrior Secrets Revealed

Welcome To a Presentation of Road Warrior Secrets Revealed Presented by: Laurie Rusin Owner/President LXR Travel an affiliate of Travel Experts a Virtuoso Agency To truly understand where we are today, we must first remember where we’ve been. The next 3 slides take us from past to present… Flying, as it was from 1958 to 1974. It all changed in 1975 with Deregulation My, how times have changed…the TRAVAIL is back in Travel http://cdbaby.com/cd/barandgrill Bar and Grill Singers Homeland Security Then….and even now The Game: ROAD WARRIORS Times keep changing… The Objective - To Travel with your Corporate Initiative as your Top Priority The Rules - To be an educated traveler and good planner to meet the corporate objective as well as your own (comfort and convenience). AIRFARE WAR GAMES No X’s & O’s but...Q,V,Y,K, etc. PRIORITIZE Date & Time? -OR- Purpose? PRE-FEE or NOT TO PRE-FEE EMDA’s are coming – it may be a Good News/Bad News dilemma SEE THE SAVINGS http://itasoftware.com/ DETERMINING LOWEST LOGICAL TRIP COST http://i.slimg.com/sc/sl/graphic/u/ul/ultimate-guide-to-airline-fees.pdf THE “FAVORITE SEAT” The Rules FF Rank, Equipment, FAA, Timing, Up Sell The Loopholes Timing, In Person Requests, Knowing the Rules/Airlines The Possibilities The FF game, Buy the Up-sell, Patience www.Seatguru.com for good seat info on all carriers and equipment GLOBAL PLANNING REGISTER YOUR TRIP WITH THE EMBASSY https://travelregistration.state.gov/ibrs/ui/ CALL YOUR BANK TELL THEM YOU WILL BE OUT OF THE COUNTRY SO YOUR CREDIT CARD/ATM CARD WON’T TRIGGER A FRAUD ALERT. -

Hospitality Design Experience

Hospitality Design Experience Full Service Hilton Garden Inn & Fairfield Inn and Suites Homewood Suites Tulsa, Oklahoma Embassy Suites Alexandria, Virginia Nampa, Idaho Cleveland, Ohio Grand Junction, Colorado Holiday Inn Express Scottsdale, Arizona Hotel Indigo Broken Arrow, Oklahoma Casa Grande, Arizona Tulsa, Oklahoma Downtown Tulsa, Oklahoma Gadsden, Alaska Marriott Southern Hills Fort Pierce, Florida Tulsa, Oklahoma Home2Suites East Peoria, Illinois Highlands Ranch, Colorado Marriott Nampa, Idaho St. Robert, Missouri Wichita, Kansas Hyatt Place Hilton | Santa Fe, NM Garden City, New York Crowne Plaza TownePlace Suites Key West, Florida La Quinta Round Rock, Texas Arlington, Texas Idaho Falls, Idaho Marriott Pere Marquette San Antonio, Texas Lakewood, Washinton Peoria, Illinois (Airport and Convention Center) Prototype and Design TownePlace/ Residence Inn Guidelines for Fairfield Inn and Suites Austin, Texas Schaumburg, Illinois International Five-Star Hotel Big Sky, Montana Multiple Locations, Asia Garden City (Long Island), New York Tannery Hotel Omaha, Nebraska Oklahoma City, OK Select Service Springwoods Village, Texas Comfort Inn SpringHill Suites Hampton Inn and Suites Tulsa, Oklahoma St. Robert, Missouri Grand Junction, Colorado Ocean City, Maryland Courtyard by Marriott Baltimore, Maryland Tulsa, Oklahoma New Construction Henrietta, New York Hilton Garden Inn Springwoods Village, Texas Courtyard by Marriott Tulsa, Oklahoma Galveston, Texas Parsippany, New York Element Hotel Lakewood, Washington Bozeman, Montana Springfield, -

The Scottsdale/Paradise Valley Tourism Study Part I: Lodging Statistics

The Scottsdale/Paradise Valley Tourism Study Part I: Lodging Statistics February 2007 City of Scottsdale Economic Vitality Department February 2007 Lodging Report Part I: Lodging Statistics February 2007 Scottsdale City Council Mary Manross Mayor Betty Drake Robert Littlefield Wayne Ecton Ron McCullagh W.J. “Jim” Lane Tony Nelssen Janet M. Dolan City Manager An annual publication of: The City of Scottsdale Economic Vitality Department 7447 E. Indian School Road, Suite 200 Scottsdale, AZ 85251 (480) 312-7989 (480) 312-2672 http://www.ci.scottsdale.az.us/economics/default.asp [email protected] February 2007 Lodging Report 2 Table of Contents Study Overview 5 Study Introduction & Limitations 6 Executive Summary 7 The Scottsdale/Paradise Valley Market Area 8 Trends in Tax Collection 12 Trends in Room Inventory 15 Average Room Rates and Occupancy 20 Room Revenues Vs. Total Hotel Revenues 22 Market Area Golf, Spas and Destination Events 24 February 2007 Lodging Report 3 Index Map 1 (Market Area Map) 9 Table 1 (List of Market Area Hotels) 10 Table 2 (Monthly Bed Tax Receipts) 13 Table 3 (Monthly Sales Tax Receipts) 14 Table 4 (Market Area Hotel Inventory) 15 Table 5 (Scottsdale Room Inventory by Category) 15 Table 6 (Property Inventory) 17 Chart 1 (Hotel Occupancy and Average Rate) 20 Table 7 (Hotel Occupancy and Average Rate) 21 Table 8 (Room Revenue as a Percent of Hotel Revenue) 23 Table 9 (Hotel Revenue Streams) 23 Table 10 (Market Area Golf Courses) 25 Map 2 (Market Area Golf Courses) 27 Table 11 (Market Area Destination Spas) 28 Table 12 (Selected Scottsdale Events) 29 February 2007 Lodging Report 4 STUDY OVERVIEW Part I: Lodging Statistics Part II: Visitor Statistics Part I of The Scottsdale/Paradise Valley Part II of the Tourism Study deals with Tourism Study analyzes trends relating trends relating to tourists themselves. -

Zone Airport Hotel Name Hotel Address City Zip Code

Zone Airport Hotel Name Hotel Address City Zip Code 1 IAD Springhills Suites Centerville 5920 TRINITY PKWY CENTREVILLE 20120 1 IAD Courtyard Marriott Dulles 3935 CENTERVIEW DR CHANTILLY 20151 1 IAD Courtyard Marriott Dulles 3935 CENTERVIEW DR CHANTILLY 20151 EXTENDED STAY AMERICA 1 IAD CHANTILL 14420 CHANTILLY CROSSING LN CHANTILLY 20151 EXTENDED STAY AMERICA 1 IAD CHANTILL 14420 CHANTILLY CROSSING LN CHANTILLY 20151 1 IAD Hampton Inn Chantilly 4050 Westfax Dr Chantilly 20151 1 IAD Hampton Inn Chantilly 4050 Westfax Dr Chantilly 20151 4504 BROOKFIELD CORPORATE 1 IAD HOMESTEAD STUDIO SUITE DR CHANTILLY 20151 1 IAD Hyatt Place Dulles South Chant 4994 WESTONE PLZ CHANTILLY 20151 1 IAD Hyatt Place Dulles South Chant 4994 WESTONE PLZ CHANTILLY 20151 1 IAD MARRIOTT TOWNSLEY SUITES 14036 THUNDERBOLT PL CHANTILLY 20151 1 IAD MARRIOTT WESTFIELD CONF CTR 14750 CONFERENCE CENTER DR CHANTILLY 20151 1 IAD MARRIOTT WESTFIELD CONF CTR 14750 CONFERENCE CENTER DR CHANTILLY 20151 1 IAD Hampton Inn Sterling 46331 McClellan Way Sterling 20165 1 IAD Towneplace Suites by Marriott 21123 Whitfield Pl Sterling 20165 1 IAD Towneplace Suites by Marriott 21123 Whitfield Pl Sterling 20165 1 IAD AMERISUITES DULLES 21481 RIDGETOP CIR DULLES 20166 1 IAD AMERISUITES DULLES 21481 RIDGETOP CIR DULLES 20166 1 IAD Courtyard Marriott - Dulles 45500 Majestic Dr Sterling 20166 1 IAD Courtyard Marriott - Dulles 45500 Majestic Dr Sterling 20166 1 IAD Fairfield Inn Marriot Dulles 23000 Indian Creek Dr Sterling 20166 1 IAD Fairfield Inn Marriot Dulles 23000 Indian Creek Dr Sterling -

The Following Hotels Are Excluded from Use of This Cobone

The following hotels are excluded from use of this Cobone AC Hotels by Marriott, Aloft, Adagio, All Seasons, Andaz by Hyatt, ARIA, art'otel, Ascend Collection, Autograph Collection by Marriot, Ayre Hotels, Bally's, Bellagio, Bill's Gamblin' Hall, Caesars, Caesars Atlantic City, Caesars Palace, Cambria Suites, Candlewood Suites, Carlson, Circus Circus, Clarion, Comfort Inn, Comfort Suites, Conrad Hotels & Resorts, Country Inn & Suites, Courtyard by Marriott, Crowne Plaza, Don Carlos Leisure Resort & Spa, Doubletree, Eaton Smart Honk Kong, EconoLodge, Element by Westin, Elite Hotels, Embassy Suites, Excalibur, Expo Hotel Barcelona, Expo Hotel Valencia, Fairfield Inn & Suites by Marriott, Fairmont, Flamingo Las Vegas, Four points by Sheraton, Four Seasons, Gran Melia, Grand Hyatt, Hampton, Harrah's, Harveys Resort & Casino, Hilton Garden Inn, Hilton Hotels & Resorts, Holiday Inn, Holiday Inn Express, Homewood Suites, Horseshoe, Hotel Cleopatra Palace, Hotel Princesa Sofía, Hotel Sir Anthony, Hotel Torre Catalunya, Hyatt Hotels & Resorts, Hyatt Place, Hyatt Regency, Hyatt Summerfield Suites, Hyatt Vacation Club, Ibis, Indigo, InterContinental, Joie De Vivre, Kimpton, Langham Hotels, Le Meridien, Luxor, Luxury Collection by Starwood, Mainstay Suites, Mandalay Bay, Marriott, Marriott Conference Centers, Marriott Vacation Club, Me by Melia, Melia, Mercure, MGallery, MGM Grand, Mirage, Moevenpick, New York New York, Noble House, Novotel, Orbis, Paradisus, Paris Las Vegas, Park Hyatt, Park Inn, Park Plaza, Planet Hollywood, Pullman, Quality, Radisson, Radisson Blu, Radisson Edwardian, Regent, Residence Inn by Marriott, Rio All-Suite Hotel & Casino, Ritz-Carlton, Rodeway Inn, Scandic, Shangri-la hotels, Sheraton, Showboat Atlantic City, Sleep Inn, Sofitel, Sol Hotels, SpringHill Suites by Marriott, St. Regis, Staybridge Suites, Suburban Extended Stay, The Signature at MGM Grand, THEhotel at Mandalay Bay, TownePlace Suites by Marriott, Tryp Hotels, Vdara, Vincci Hotels, W Hotels, Waldorf Astoria, Westin. -

Supplemental Schedules 2008-Q2

HERSHA HOSPITALITY TRUST KEY PERFORMANCE INDICATORS June 30, 2008 CONSOLIDATED HOTELS: (Recorded from date of acquisition or investment) (Includes 59 hotels in 2008 and 56 hotels in 2007) (Includes 59 hotels in 2008 and 56 hotels in 2007) Three Months Ended Six Months Ended June 30, June 30, 2008 2007 % Variance 2008 2007 % Variance Rooms Available 583,570 554,571 1,158,373 1,095,001 Rooms Occupied 458,837 443,580 836,440 794,277 Occupancy 78.63% 79.99% -1.7% 72.21% 72.54% -0.5% Average Daily Rate (ADR) $139.56 $131.54 6.1% $135.30 $126.43 7.0% Revenue Per Available Room (RevPAR) $109.73 $105.21 4.3% $97.70 $91.71 6.5% Room Revenues $64,037,467 $58,346,956 $113,171,938 $100,422,315 Food & Beverage $1,956,698 $1,891,762 $3,520,321 $3,480,182 Other Revenues $1,383,191 $1,330,591 $2,604,009 $2,469,095 Total Revenues $67,377,356 $61,569,309 $119,296,268 $106,371,592 Discontinued Assets $0 $1,908,705 $0 $3,496,059 EBITDA $27,585,963 $25,121,581 $43,706,278 $39,025,831 EBITDA Margin 40.9% 40.8% 36.6% 36.7% EBITDA Margin Growth 0.14% -0.05% SAME STORE CONSOLIDATED HOTELS: (Owned for the entire reporting period) (Includes 53 hotels in both years) (Includes 49 hotels in both years) Three Months Ended Six Months Ended June 30, June 30, 2008 2007 % Variance 2008 2007 % Variance Rooms Available 552,482 552,471 1,045,975 1,039,875 Rooms Occupied 437,281 442,092 756,674 755,596 Occupancy 79.15% 80.02% -1.1% 72.34% 72.66% -0.4% Average Daily Rate (ADR) $137.92 $131.18 5.1% $132.57 $125.37 5.7% Revenue Per Available Room (RevPAR) $109.16 $104.97 4.0%