Potential Hotel Development in the North Coast Highway Area

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Data Standards Manual Summary of Changes

October 2019 Visa Public gfgfghfghdfghdfghdfghfghffgfghfghdfghfg This document is a supplement of the Visa Core Rules and Visa Product and Service Rules. In the event of any conflict between any content in this document, any document referenced herein, any exhibit to this document, or any communications concerning this document, and any content in the Visa Core Rules and Visa Product and Service Rules, the Visa Core Rules and Visa Product and Service Rules shall govern and control. Merchant Data Standards Manual Summary of Changes Visa Merchant Data Standards Manual – Summary of Changes for this Edition This is a global document and should be used by members in all Visa Regions. In this edition, details have been added to the descriptions of the following MCCs in order to facilitate easier merchant designation and classification: • MCC 5541 Service Stations with or without Ancillary Services has been updated to include all engine fuel types, not just automotive • MCC 5542 Automated Fuel Dispensers has been updated to include all engine fuel types, not just automotive • MCC 5812 Eating Places, Restaurants & 5814 Fast Food Restaurants have been updated to include greater detail in order to facilitate easier segmentation • MCC 5967 Direct Marketing – Inbound Telemarketing Merchants has been updated to include adult content • MCC 6540 Non-Financial Institutions – Stored Value Card Purchase/Load has been updated to clarify that it does not apply to Staged Digital Wallet Operators (SDWO) • MCC 8398 Charitable Social Service Organizations has -

Say “Hello” to the Future of Holiday Inn the Holiday Inn® Brand Is an Enduring Icon with Unmatched Recognition

Say “hello” to the future of Holiday Inn The Holiday Inn® brand is an enduring icon with unmatched recognition. That legacy shapes our present and informs our future as we continue to offer services and amenities that enable real, human connections. As we look to the future, we’ve developed a more streamlined, flexible building to meet your market needs. Questions about the new design? Experience our virtual hotel and get more information on design.holidayinn.com. Prototype Site Plan Details Acreage 2.57 acres Building Gross Building Area 73,461 sq ft Summary Number of Floors 4 stories Total Room Count 125 Gross Building Area per Key 588 sq ft Parking Spaces 127 Pool Outdoor or indoor Guest Room Public Space King 323 sq ft Lobby 2,097 sq ft Queen / Queen 323 sq ft Restaurant & Bar 1,820 sq ft Junior Suite 417 sq ft Meeting Space 1,581 sq ft Unified room bays with the fl exibility to offer King, Queen/Queen, Fitness Center & Rec. Lobby 1,337 sq ft King Comfort, King Sleeper in same size bay Open lobby with flexible space to socialize or work Multi-functional storage with integrated power and arrival moment Market 24 positioned to work with front desk or F&B concept Quality bedding and blackout shades for a great night’s sleep Flexible set of food & beverage concepts and meeting room offerings Spacious well-lit bathroom with branded shower experience to best suit your specific market needs Back of House Kitchen Catering Prep All other areas 632 sq ft 202 sq ft 3,104 sq ft ThisGet is not a anvirtual offer of atour franchise. -

Runaway Runways

RUNAWAY RUNWAYS US$1,009,008,000 Anticipated global spend on business travel by year-end 2011, UK airports have the runway capacity to be handling 540 million against US$924bn in 2010. passengers per annum (mppa) by 2050, compared with the 372m they processed in 2008, according to latest Department for Transport forecasts. All but 7m of the 168m extras passengers 5.4% per annum could be handled by regional airports – with the exception of Luton, Anticipated increase in UK spend on business travel over the next London’s gateways are full – provided additional terminal capacity is fi ve years, against 3.8% per annum in the US, 3.3% in France and made available and Plymouth and Coventry are re-opened. 2.9% in Germany. mppa mppa 11.2% per annum AIRPORT 2008 2050 Anticipated increase in China’s spend on business travel over the next fi ve years, against 10.8% per annum in India, 7.1% in Russia LONDON AIRPORTS and 7% in Brazil. Heathrow 86 86 Source: GBTA Foundation Gatwick 42 42 Stansted 35 35 Luton 10 17 London City 8 8 76,151 LONDON TOTAL 181 188 The number of car hire transactions recorded by Guild of Travel Management Companies (GTMC) members during the third quarter (to September) of 2011. This fi gure is a 16% increase on REGIONAL AIRPORTS the same quarter in 2010. Aberdeen 5 10 Source: GTMC Belfast International 10 23 Belfast City 4 4 Birmingham 18 27 ACTE/KDS STUDY 2011: IMPACT OF GLOBAL Bournemouth 26 EVENTS – HAVE YOU HAD TO RE-SCHEDULE OR Bristol 712 CANCEL A TRIP FOR THESE REASONS? Cardiff 12 12 East Midlands 25 25 Edinburgh 20 20 -

Arcis Access ALL Participating Hotels.Xlsx

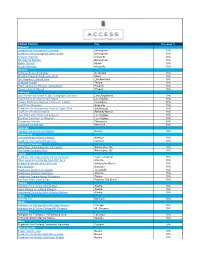

UNITED STATES City Discount % Alabama Hampton Inn Birmingham-Colonnade Birmingham 10% Residence Inn Birmingham Dtwn at UAB Birmingham 10% Huntsville Marriott Huntsville 10% Birmingham Marriott Birmingham 10% Mobile Marriott Mobile 10% Westin Huntsville Huntsville 10% Arizona Embassy Suites Scottsdale Scottsdale 10% Sheraton Mesa at Wrigleyville West Mesa 10% The Wigwam Litchfield Park Litchfield Park 10% Graduate Tempe Tempe 10% Hilton Garden Inn Phoenix Airport North Phoenix 10% Phoenix Airport Marriott Phoenix 10% California Lake Arrowhead Resort & Spa, Autograph Collection Lake Arrowhead 10% Four Points Los Angeles Int'l Airport Los Angeles 10% Crowne Plaza Los Angeles Commerce Casino Commerce 10% Hyatt Place Riverside Riverside 10% Residence Inn Sacramento Dtwn at Capitol Park Sacramento 10% Doubletree Berkeley Marina Berkeley Marina 10% Luxe City Center Hotel Los Angeles Los Angeles 10% Sheraton Gateway Los Angeles Los Angeles 10% Pleasanton Marriott Pleasanton 10% Kenwoord Inn and Spa Kenwood 30% Colorado Hampton Inn Denver Int'l Airport Denver 10% Connecticut Hartford/Windsor Marriott Airport Windsor 10% Residence Inn Hartford Downtown Hartford 10% District of Columbia Hyatt Place Washington DC/US Capitol Washington, DC 10% The Fairfax Embassy Row Washington, DC 10% Florida Residence Inn Cape Canaveral Cocoa Beach Cape Canaveral 10% Hilton Garden Inn Orlando East/UCF Area Orlando 10% Newport Beachside Hotel & Resort Sunny Isles Beach 10% Aloft Sarasota Sarasota 10% Doubletree Jacksonville Airport Jacsonville 10% Doubletree Orlando Downtown Orlando 10% Doubletree Tampa Airport-Westshore Tampa 10% Bay Point Golf Resort & Spa Panama City Beach 10% Georgia Hampton Inn & Suites Atlanta-Dtwn Atlanta 10% Hilton Garden Inn Atlanta Midtown Atlanta 10% Homewood Suites by Hilton Atlanta Midtown Atlanta 10% Idaho Knob Hill Inn Ketchum 30% Illinois Hampton Inn Chicago Dtwn Michigan Avenue Chicago 10% Hampton Inn & Suites Chicago/Mt. -

Your Wedding At

Your Wedding at DAKOTA EVENT CENTER.COM 716 LAMONT ST | ABERDEEN, SD 57401 Dear Wedding Planners, The Dakota Event Center featuring Mavericks Steak & Cocktails, the Holiday Inn Express Hotel & Suites and the Hampton Inn & Suites of Aberdeen is pleased to have the opportunity to host your special day. Lodging provided by: Catering by: Lodging Lodging Holiday Inn Express Hotel & Suites Hampton Inn Hotel & Suites www.hiexpress.com/aberdeensd www.hamptoninn.com (605) 725-4000 (605) 262-2600 For Reservations: For Reservations: 800-HOLIDAY 800-HAMPTON 3310 7th Ave SE 3216 7th Ave SE Aberdeen, SD 57401 Aberdeen, SD 57401 We are Aberdeen’s finest hotels featuring over 150 deluxe non-smoking sleeping rooms and suites between the two properties. Both hotels are connected by enclosed walkways to the event center which houses Mavericks Steak & Cocktails. All of our rooms feature comfortable pillow top king or queen beds, spacious work areas, free high-speed wireless internet, 37’’ high-definition LCD televisions, in-room coffee makers and complimentary hot breakfast. We also have rooms with whirlpool suites for those special occasions. Both hotels have fitness rooms, business centers and pool areas, with the Holiday Inn Express showcasing a 150 foot waterslide in the water park. The hotels are located on Aberdeen’s east side on Highway 12 across from the Lakewood Mall and Target, Wal-Mart and Culver’s Restaurant are all within walking distance. Storybook Land in Wylie Park, Lee Park Golf course and Rolling Hills Golf course are also just a few short minutes from the hotels. You will be able to block rooms at each of the hotels to accommodate all of your guests. -

Federal Register / Vol. 62, No. 148 / Friday, August 1, 1997 / Notice

41492 Federal Register / Vol. 62, No. 148 / Friday, August 1, 1997 / Notice FEDERAL EMERGENCY of public accommodation. The law compiling listings of properties that MANAGEMENT AGENCY encourages and eventually mandates comply with the Hotel and Motel Fire that federal employees on travel must Safety Act. A list of State contacts was Hotel and Motel Fire Safety Act stay in public accommodations that published in 58 FR 17020 on March 31, National Master List, 1997 adhere to the life safety requirements in 1993, 59 FR 50132 on September 30, the legislation guidelines. Similarly, AGENCY: United States Fire 1994, 59 FR 62174 on December 2, 1994, Administration, FEMA. federally sponsored or funded and 61 FR 32032 on June 21, 1996. The conferences cannot be held in hotels most recent list of State contacts is ACTION: Notice. and motels or other facilities that do not published as a separate part with this SUMMARY: The Federal Emergency meet the law's fire protection issue of the Federal Register. If the Management Agency (FEMA or Agency) provisions. published list is unavailable to you, gives notice of the national master list The legislation gives hotels, motels, your State Fire Marshal's office can of places of public accommodations that and other facilities an economic direct you to the appropriate office. incentive to install lifesaving smoke meet the fire prevention and control Copies of the national master list and detectors and automatic sprinkler guidelines under the Hotel and Motel its updates may be obtained by writing systems. A hotel or motel or other Fire Safety Act. This updated list to the Government Printing Office, facility that complies with the fire safety incorporates all changes made to the Superintendent of Documents, national master list since it was first guidelines of the Act will be included in federal travel directories and have the Washington, DC 20402±9325. -

Holiday Inn Express® & Suites Naples Downtown 5Th Avenue Opens

FOR IMMEDIATE RELEASE Contact: Paul Sutton Holiday Inn Express & Suites Naples Downtown 5th Avenue [email protected] 1-647-567-4564 HOLIDAY INN EXPRESS® & SUITES– NAPLES DOWNTOWN 5TH AVENUE OPENS Renovated hotel located on Florida’s Paradise Coast ATLANTA (Nov. 22, 2013) — InterContinental Hotels Group (IHG) [LON:IHG, NYSE:IHG (ADRs)] today announced the opening of the 124-room Holiday Inn Express Hotel & Suites Downtown 5th Avenue. The newest Palm Holdings hotel brings quality service and familiar comfort to Naples with the completion of a $4 million re-branding and renovation to the entire interior and exterior of the former Paradise Coast Hotel and Suites. This property’s smart brand, convenient location and abundant amenities make it an ideal choice for travelers to Naples Florida, located on Florida’s Paradise Coast. "Holiday Inn Express hotels are designed to be the smart choice for value-conscious business and leisure travelers," said Heather Balsley, senior vice president, Americas Holiday Inn® Brand Family, IHG. "With more than 2,200 properties worldwide and 450 more in the pipeline, the Holiday Inn Express portfolio continues to provide our guests with an enhanced-stay experience at a great value. We are proud to welcome this hotel into the Holiday Inn brand family with the brand-new sign and everything it represents.” The hotel is within walking distance to the entertainment, shopping and business districts, trendy boutiques and art galleries and the Naples Pier. The hotel is also a convenient 30 minutes from South West Florida International Airport (RSW) in Fort Myers and 45 minutes from Everglades National Park. -

Concord 25Years Growth-1.Pdf

Concord Hospitality Celebrates 25th Anniversary with Record Growth in 2010, Adds 18 Hotels Wins Marriott’s Prestigious Partnership Circle Award for Record-Setting Eighth Year RALEIGH/DURHAM, N.C., March 30, 2011—Concord Hospitality Enterprises, one of the nation’s top-ranked hotel developer/owner/operators, today announced that it celebrated its 25th anniversary with the addition of a record 18 hotels to its portfolio in 2010 and generated more than $287 million in revenues. The company opened three new hotels, including the pioneer prototype for the first LEED-Designated Courtyard by Marriott, broke ground on two properties, and added 13 new third-party management contracts. Concord’s portfolio has grown by nearly 40 percent since the recession that hit in the fall of 2008. The company also added new brands to its portfolio, including Hyatt Place, Hyatt Summerfield Suites, Crowne Plaza and Holiday Inn. The company’s 2010 operating and development excellence was recently recognized with six national awards, including the prestigious “Partnership Circle” award, Marriott International’s highest honor presented to outstanding owners and franchisee partners. It is the eighth time Concord has received the award, one of only two companies to achieve this level. The other five national awards earned by the company for 2010 are Developer of the Year Award; Best Opening Award for the company’s handling of the Fairfield Inn & Suites by Marriott hotel opening in Cumberland, Md.; Best New Product Award for the Renaissance Raleigh North Hills hotel; the Service Excellence Award; and the first ever Marriott Design & Construction Icon Award. The awards were presented at Marriott International’s recent select- service owners' conference. -

Ackerman and Greenstone Secure Financing, Sign 20‐Year Franchise Agreement with IHG for Crowne Plaza® Riverside Village Hotel in North Augusta, South Carolina

FOR IMMEDIATE RELEASE For more information, contact: Harvey Rudy 678.589.7619 hrudy@greenstone‐properties.com Ackerman and Greenstone Secure Financing, Sign 20‐Year Franchise Agreement with IHG for Crowne Plaza® Riverside Village Hotel in North Augusta, South Carolina North Augusta, S.C., January 25, 2018 – Ackerman & Co. and Greenstone Properties today announces that they have broken ground and secured financing for the development of the new‐build Crowne Plaza® Riverside Village hotel – a five‐story, 180‐key hotel located within the Riverside Village mixed‐use project in North Augusta, S.C., along the Savannah River. The partner companies have signed a 20‐year franchise agreement with InterContinental Hotels Group® (IHG®), one of the world’s leading hotel companies. Slated to open by the end of 2018, the hotel project – adjacent to the new Augusta GreenJackets’ SRP Park – will feature modern rooms and suites, the Wood Fired Grill restaurant, an outdoor pool and event space, a fitness center, a rooftop bar, and more than 7,000 square feet of conference center and meeting space with a ballroom and several meeting rooms. A 417‐space parking deck will provide hotel, ballpark and residential parking. “This is an important milestone in the development of Riverside Village, a project that will provide outstanding amenities for visitors and the local community as well as a catalyst for further economic development,” said Robert Pettit, Mayor of North Augusta. The 30‐acre, $200‐million Riverside Village live‐work‐play development combines apartment, single‐ and multi‐family living, a vibrant town center featuring high‐quality office space, premier national and local retailers, and diverse dining options, in addition to the new GreenJackets’ ballpark. -

Intercontinental Hotels Group PLC 2021 First Quarter Trading Update

7 May 2021 InterContinental Hotels Group PLC 2021 First Quarter Trading Update Highlights • Improvement in demand within the first quarter, led by the Americas and Greater China. • Group RevPAR down 50.6% vs 2019 (down 33.7% vs 2020); continued industry outperformance in key markets. • RevPAR reflects a 23%pts reduction in occupancy, with rate sustained at ~80% of 2019 levels. • Occupancy of 40.0%, improving through the quarter; 223 hotels (4% of estate) closed at 31 March. • Net system size growth broadly flat YTD; global estate 884k rooms (5,959 hotels). • Opened 7.3k rooms (56 hotels); 5.8k added to Essentials and Suites brands, 1.5k in Premium, Luxury & Lifestyle. • Removed 9.5k rooms (61 hotels); 6.3k (31 hotels) for Holiday Inn and Crowne Plaza in Americas and EMEAA. • Signed 14.5k rooms (92 hotels), ahead of Q1 last year; total pipeline increased to 274k rooms (1,820 hotels). • Repaid £600m UK Government CCFF at maturity; total available liquidity at 31 March of $2.1bn. Keith Barr, Chief Executive Officer, IHG Hotels & Resorts, said: “Trading continued to improve during the first quarter of 2021, with IHG maintaining its outperformance of the industry in key markets and seeing strong performance in openings and signings as we expand our brands around the world. There was a notable pick-up in demand in March, particularly in the US and China, which continued into April. While the risk of volatility remains for the balance of the year, there is clear evidence from forward bookings data of further improvement as we look to the months ahead. -

Meeting Guide for Enhanced Care PPO (ECP) Non-Medicare UAW

Meeting guide Enhanced Care PPO (ECP) for non-Medicare UAW Trust members All states New for 2019 We want to help you get 1 great plan. familiar with your new Blue Cross Blue Shield of Michigan health care plan, Enhanced 3 ways to learn about it. Care PPO (ECP). Join us in person, by teleconference or for a webinar to get key information about your new and improved health care plan, and learn why you’ll have convenience and care like never before. Registration is required. Reserve your spot for an in-person meeting, teleconference or webinar at bcbsm.com/uawtrust or call 1-877-395-7758 Monday through Friday from 8:30 a.m. to 8 p.m. Eastern time. 2018 meeting schedule In-person meetings Join us in a city near you. Each meeting is about an hour and a half long and will start promptly at 10 a.m. and 2 p.m. local time. Alabama Florida Florence Sarasota Wednesday, September 26 Monday, November 19 Marriott Shoals Hotel & Spa Holiday Inn Sarasota – Airport 10 Hightower Place, Florence, AL 35630 8009 15th St. E., Sarasota, FL 34243 Huntsville Tampa Tuesday, September 25 Tuesday, November 20 Huntsville Marriott Space & Rocket Center Four Points Sheraton Suites Tampa Airport 5 Tranquility Base, Huntsville, AL 35805 4400 W. Cypress St., Tampa, FL 33607 Delaware Georgia Wilmington Peachtree Corners Tuesday, September 18 Thursday, September 27 DoubleTree Hotel Wilmington Atlanta Marriott Peachtree Corners 4727 Concord Pike, Wilmington, DE 19803 475 Technology Parkway NW Peachtree Corners, GA 30092 Indiana Flint Indianapolis Tuesday, October 2 Monday, October 15 Tuesday, October 23 Tuesday, October 16 Holiday Inn Gateway Centre Wyndham Indianapolis West 5353 Gateway Centre, Flint, MI 48507 2544 Executive Drive, Indianapolis, IN 46241 Grand Rapids Kokomo Thursday, October 11 Wednesday, October 17 DoubleTree Grand Rapids Hotel Rozzi’s Catering Continental Ballroom 4747 28th St. -

AWARD BRAND HOTEL NAME Torchbearer Candlewood Suites TERRE HAUTE Torchbearer Candlewood Suites CLEARWATER Torchbearer Candlewood

2019 IHG® HOTEL AWARD WINNERS AWARD BRAND HOTEL NAME TorchBearer Candlewood Suites TERRE HAUTE Torchbearer Candlewood Suites CLEARWATER TorchBearer Candlewood Suites COLUMBIA HWY 63 & I-70 TorchBearer Candlewood Suites CUT OFF - GALLIANO TorchBearer Candlewood Suites KEARNEY TorchBearer Candlewood Suites LOVELAND TorchBearer Candlewood Suites PENSACOLA - UNIVERSITY AREA TorchBearer Candlewood Suites LONGMONT TorchBearer Candlewood Suites OMAHA - MILLARD AREA TorchBearer Candlewood Suites WACO TorchBearer Candlewood Suites CHICAGO/LIBERTYVILLE TorchBearer Candlewood Suites CHICAGO-WAUKEGAN TorchBearer Candlewood Suites COLUMBUS AIRPORT TorchBearer Crowne Plaza SEATTLE-DOWNTOWN TorchBearer EVEN NEW YORK - TIMES SQUARE SOUTH TorchBearer Holiday Inn LA PIEDAD TorchBearer Holiday Inn MEXICO CITY-PLAZA UNIVERSIDAD TorchBearer Holiday Inn LONGVIEW - NORTH TorchBearer Holiday Inn DENVER TECH CENTER-CENTENNIAL TorchBearer Holiday Inn SELMA-SWANCOURT TorchBearer Holiday Inn ST. GEORGE CONV CTR TorchBearer Holiday Inn EAU CLAIRE SOUTH I-94 TorchBearer Holiday Inn INDIANAPOLIS AIRPORT TorchBearer Holiday Inn MONTERREY NORTE TorchBearer Holiday Inn MAZATLAN TorchBearer Holiday Inn OWENSBORO RIVERFRONT TorchBearer Holiday Inn CHILPANCINGO TorchBearer Holiday Inn Club Vacations SUNSET COVE RESORT TorchBearer Holiday Inn Express AUGUSTA NORTH - GA TorchBearer Holiday Inn Express SHARON-HERMITAGE TorchBearer Holiday Inn Express OAXACA-CENTRO HISTORICO TorchBearer Holiday Inn Express COLUMBUS TorchBearer Holiday Inn Express COON RAPIDS-BLAINE AREA TorchBearer