Securities Litigation, : Civil Action No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BIO-2005-MK-ONLINE (Page 1)

THE SCIENCE. THE BUSINESS. THE WORLD OF BIOPHARMACEUTICALS. 2005 MEDIA PLANNER www.biopharminternational.com THE PRINT-BASED MARKETING Display Advertising BIOPHARM The foundation of any b-to-b marketing program, print advertising allows you to BRAND touch 29,200 BPA-qualified subscribers* with your brand or product message. BioPharm International’s Build your marketing plan around the message portfolio of products allows conveyed in your print ad and utilize other channels you to reach our highly to further reinforce your message. desirable audience through multiple marketing channels. Custom Publishing Work with us to write and design a custom white paper or article Studies show integrated published as an advertorial in the pages of BioPharm. marketing is the key to successfully delivering your Insert A unique way to deliver white papers, brochures or any other collateral message to today’s buyer. material to our readers. Reinforce your message to the most important audience Polybag in your market—ask your Talk about premium placement! Send your printed piece as a ride-along advertising sales manager and readers will get the message as soon as the issue hits their desk. to design an integrated program Direct Mail utilizing the channels that best Planning a direct mail campaign to reinforce your ad message? meet your marketing objectives. Rent our list to ensure your marketing material reaches your most important audience. Post-It Note A truly unique way to send your message to our readers, Post-It Notes serve as front cover reminders about your brand. Use Post-Its to call out your ads in the issue or run 6 or 12 Post-It Notes for a truly unique campaign. -

Breaking Eroom's

Breaking Eroom’s Law Michael S. Ringel, Jack W. Scannell, Mathias Baedeker and Ulrik Schulze https://doi.org/10.1038/d41573-020-00059-3 Supplementary Box 1 | Data and analysis Breaking Eroom’s Law The count and value of NMEs relative to R&D spend comes from BCG’s New Therapeutic Drug (NTD) Database, which is also the source of BCG’s annual publication in Nat. Rev. Drug. Discov. showing trends in count and value over time.1 FDA approvals are from FDA’s Center for Drug Evaluation and Research (CDER) and Center for Biologics Evaluation and Research (CBER),2 peak sales estimates are from EvaluatePharma®,3 and R&D spend data are from BCG Value Science, inflation-adjusted using the standard global GDP-based inflator from the Economist Intelligence Unit.4 For additional details on methodology, see Schulze, Baedeker, Chen and Greber.5 Eroom’s Law is linear on a log scale through 2010, with an average increase approximately 12% per annum, or a halving of productivity approximately every seven years. If this holds true even after 2010, we would see a continuation of the linear development of the number of drugs approved per billion US$ R&D spending when using a logarithmic scale. To demonstrate that the deviation from regression after 2010 is statistically relevant we assumed the following: 1) Eroom's law is true up to 2010. 2) Eroom's law is not true between 2010 and 2018. To confirm our assumptions, we used a log-linear regression to describe the number of new molecular entities (NMEs) approved by the US FDA per billion US$ R&D spending from 1950–2010. -

List of Section 13F Securities

List of Section 13F Securities 1st Quarter FY 2004 Copyright (c) 2004 American Bankers Association. CUSIP Numbers and descriptions are used with permission by Standard & Poors CUSIP Service Bureau, a division of The McGraw-Hill Companies, Inc. All rights reserved. No redistribution without permission from Standard & Poors CUSIP Service Bureau. Standard & Poors CUSIP Service Bureau does not guarantee the accuracy or completeness of the CUSIP Numbers and standard descriptions included herein and neither the American Bankers Association nor Standard & Poor's CUSIP Service Bureau shall be responsible for any errors, omissions or damages arising out of the use of such information. U.S. Securities and Exchange Commission OFFICIAL LIST OF SECTION 13(f) SECURITIES USER INFORMATION SHEET General This list of “Section 13(f) securities” as defined by Rule 13f-1(c) [17 CFR 240.13f-1(c)] is made available to the public pursuant to Section13 (f) (3) of the Securities Exchange Act of 1934 [15 USC 78m(f) (3)]. It is made available for use in the preparation of reports filed with the Securities and Exhange Commission pursuant to Rule 13f-1 [17 CFR 240.13f-1] under Section 13(f) of the Securities Exchange Act of 1934. An updated list is published on a quarterly basis. This list is current as of March 15, 2004, and may be relied on by institutional investment managers filing Form 13F reports for the calendar quarter ending March 31, 2004. Institutional investment managers should report holdings--number of shares and fair market value--as of the last day of the calendar quarter as required by Section 13(f)(1) and Rule 13f-1 thereunder. -

Promotion and Development Collaborations Between Established Players

Promotion and Development Collaborations Between Established Players Randall B. Sunberg Pharma and Biotech In-Licensing, Co-Development and Co-Promotion Agreements October 21-22, 2002 1 www.morganlewis.com MorganMorgan Lewis:Lewis: LifeLife SciencesSciences FocusFocus • Founded in 1873, today 1,100 lawyers in 13 offices worldwide • 175 Life Sciences professionals, including 90 with advanced degrees ranging from biochemistry to molecular genetics to immunology • Interdisciplinary coordination of transactions, IP, litigation, FDA and antitrust expertise to meet our clients’ strategic objectives • Recently ranked as the 5th leading transactional law firm in the nation by The American Lawyer "Corporate Scorecard” • Named by many Fortune 250 companies as one of their primary law firms • Recognized by corporate counsel for exceptional client service in a survey of Fortune 1000 companies • Featured prominently in the annual National Law Journal survey of “Who Defends Corporate America” 2 MorganMorgan Lewis:Lewis: RecentRecent LifeLife SciencesSciences DealsDeals • Aventis - Genta collaboration for co-development and commercialization of Genasense™ • Enzon - Elan acquisition of Abelcet® product rights and manufacturing assets • Quintiles - Eli Lilly co-promotion and marketing collaboration for Cymbalta™ • Adolor - GlaxoSmithKline development and commercialization collaboration for Alvimopan™ • Arena Pharmaceuticals - Merck drug discovery collaboration • Cephalon - Anesta stock-for-stock public company acquisition • Aventis - Millennium alliance -

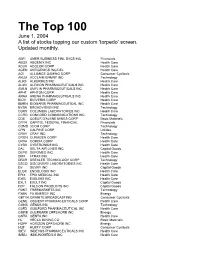

The Bottom 99

The Top 100 June 1, 2004 A list of stocks topping our custom 'torpedo’ screen. Updated monthly. ABFI AMER BUSINESS FINL SVCS INC Financials ABGX ABGENIX INC Health Care ADLR ADOLOR CORP Health Care AGEN ANTIGENICS INC/DEL Health Care AGI ALLIANCE GAMING CORP Consumer Cyclicals AKLM ACCLAIM ENMNT INC Technology ALKS ALKERMES INC Health Care ALXN ALEXION PHARMACEUTICALS INC Health Care AMLN AMYLIN PHARMACEUTICALS INC Health Care APHT APHTON CORP Health Care ARNA ARENA PHARMACEUTICALS INC Health Care BIOV BIOVERIS CORP Health Care BMRN BIOMARIN PHARMACEUTICAL INC Health Care BVSN BROADVISION INC Technology CBRX COLUMBIA LABORATORIES INC Health Care CCRD CONCORD COMMUNICATIONS INC Technology CDE COEUR D'ALENE MINES CORP Basic Materials CFFN CAPITOL FEDERAL FINANCIAL Financials COMS 3COM CORP Technology CPN CALPINE CORP Utilities CRAY CRAY INC Technology CRGN CURAGEN CORP Health Care CRXA CORIXA CORP Health Care CYBX CYBERONICS INC Health Care DAL DELTA AIR LINES INC Capital Goods DEPO DEPOMED INC Health Care DMX I-TRAX INC Health Care DRXR DREXLER TECHNOLOGY CORP Technology DSCO DISCOVERY LABORATORIES INC Health Care DV DEVRY INC Capital Goods ELGX ENDOLOGIX INC Health Care EPIX EPIX MEDICAL INC Health Care EXEL EXELIXIS INC Health Care EXLT EXULT INC Capital Goods FCP FALCON PRODUCTS INC Capital Goods FMKT FREEMARKETS INC Technology FXEN FX ENERGY INC Energy GBTVK GRANITE BROADCASTING Consumer Cyclicals GENE OSCIENT PHARMACEUTICALS CORP Health Care GGNS GENUS INC Technology GLFD GUILFORD PHARMACEUTICAL INC Health Care GMRK GULFMARK OFFSHORE -

Pierre Cremieux October 2020 CV (English)

PIERRE-YVES CREMIEUX, PH.D. President Office: 617 425 8135 111 Huntington Avenue Fax: 617 425 8001 14th Floor [email protected] Boston, MA 02199 Pierre-Yves Cremieux, President of Analysis Group, has a broad range of expertise in health economics, antitrust, statistics, and labor economics. He has consulted to numerous clients in the United States and Canada and testified in bench and jury trials, arbitrations, and administrative proceedings. Dr. Cremieux has served as an expert and supported other experts in both litigation and non-litigation matters on antitrust issues; general commercial claims; contractual disputes; and a number of labor- related matters in a variety of industries, including high tech, pharmaceuticals, biotech, financial products, consumer products, and commodities. He has assessed the evaluation of damages on a class-wide basis in some of the largest class action matters in recent years. His scientific research in antitrust economics, class certification, health economics, and statistics has been published in numerous peer-reviewed journals, including the George Mason Law Review, the American Bar Association Economics Committee Newsletter, The Review of Economics and Statistics, the Journal of Health Economics, Industrial and Labor Relations Review, the Journal of Clinical Oncology, and The American Journal of Managed Care. Dr. Cremieux’s research has been cited in leading media outlets including The Wall Street Journal and Forbes. Dr. Cremieux has frequently presented at leading legal, health care, and economics seminars on topics such as antitrust, class certification, health economics, and statistics, in both the United States and Canada. He has also been invited to teach courses on economics, statistics, health care, and antitrust at various schools including McGill University, Boston University, Harvard Medical School, and the Yale School of Management. -

The Regental Laureates Distinguished Presidential

REPORT TO CONTRIBUTORS Explore the highlights of this year’s report and learn more about how your generosity is making an impact on Washington and the world. CONTRIBUTOR LISTS (click to view) • The Regental Laureates • Henry Suzzallo Society • The Distinguished Presidential Laureates • The President’s Club • The Presidential Laureates • The President’s Club Young Leaders • The Laureates • The Benefactors THE REGENTAL LAUREATES INDIVIDUALS & ORGANIZATIONS / Lifetime giving totaling $100 million and above With their unparalleled philanthropic vision, our Regental Laureates propel the University of Washington forward — raising its profile, broadening its reach and advancing its mission around the world. Acknowledgement of the Regental Laureates can also be found on our donor wall in Suzzallo Library. Paul G. Allen & The Paul G. Allen Family Foundation Bill & Melinda Gates Bill & Melinda Gates Foundation Microsoft DISTINGUISHED PRESIDENTIAL LAUREATES INDIVIDUALS & ORGANIZATIONS / Lifetime giving totaling $50 million to $99,999,999 Through groundbreaking contributions, our Distinguished Presidential Laureates profoundly alter the landscape of the University of Washington and the people it serves. Distinguished Presidential Laureates are listed in alphabetical order. Donors who have asked to be anonymous are not included in the listing. Acknowledgement of the Distinguished Presidential Laureates can also be found on our donor wall in Suzzallo Library. American Heart Association The Ballmer Group Boeing The Foster Foundation Jack MacDonald* Robert Wood Johnson Foundation Washington Research Foundation * = Deceased Bold Type Indicates donor reached giving level in fiscal year 2016–2017 1 THE PRESIDENTIAL LAUREATES INDIVIDUALS & ORGANIZATIONS / Lifetime giving totaling $10 million to $49,999,999 By matching dreams with support, Presidential Laureates further enrich the University of Washington’s top-ranked programs and elevate emerging disciplines to new heights. -

Has Announced the Appointment of Christian Burks As Chief Scientific

PEOPLE Affinium Pharmaceuticals (Toronto, Ontario, joined the company as senior vice president, Canada) has announced the appointment of research and preclinical development. Dr. Christian Burks as chief scientific officer. Dr. Miletich was most recently senior vice presi- Burks was most recently vice president and dent for worldwide preclinical development chief informatics officer at Exelixis. at Merck Research Laboratories. OXiGENE (Watertown, MA) has appointed Gilead Sciences (Foster City, CA) has named Frederick Driscoll as CEO, replacing Bjorn John F. Milligan senior vice president and Nordenvall. Dr. Nordenvall will remain on CFO. Dr. Milligan joined Gilead in 1990 and the board of directors as vice chairman and served most recently as vice president, cor- serve as a strategic consultant to the compa- porate development. Sharon Surrey- ny. Prior to joining OXiGENE as president Barbari, who joined Gilead in 1998 and has and CFO in October 2000, Mr. Driscoll served as vice president and CFO since served as senior vice president of finance and February 2000, has announced her resigna- operations at Collagenesis. tion from the company. CuraGen (New Haven, CT) has announced Orchid BioSciences (Princeton, NJ) has the elections of David R. Ebsworth and John appointed Kenneth D. Noonan to its board H. Forsgren to its board of directors. Dr. of directors to replace Anne VanLent, who Ebsworth was formerly president and gener- resigned in 2001. Dr. Noonan is a partner at al manager of the pharmaceutical business LEK Consulting and leads the firm’s life sci- group for Bayer AG, and Mr. Forsgren is vice ences practice in the UK and Europe. -

The Bottom 99

The Top 100 December 1, 2003 A list of stocks topping our custom 'torpedo’ screen. Updated monthly. ABFI AMER BUSINESS FINL SVCS INC Financials Thrifts & Mortgage Finance ABGX ABGENIX INC Health Care Biotechnology AGEN ANTIGENICS INC/DEL Health Care Pharmaceuticals AGIX ATHEROGENICS INC Health Care Pharmaceuticals ALKS ALKERMES INC Health Care Biotechnology ALXN ALEXION PHARMACEUTICALS INC Health Care Biotechnology AMLN AMYLIN PHARMACEUTICALS INC Health Care Biotechnology AMR AMR CORP/DE Industrials Airlines APHT APHTON CORP Health Care Biotechnology ARRY ARRAY BIOPHARMA INC Health Care Biotechnology ATW ATWOOD OCEANICS Energy Oil & Gas Drilling AVII AVI BIOPHARMA INC Health Care Biotechnology BEAV BE AEROSPACE INC Industrials Aerospace & Defense BFD BOSTONFED BANCORP INC Financials Thrifts & Mortgage Finance BPUR BIOPURE CORP Health Care Biotechnology BVSN BROADVISION INC Information Technology Internet Software & Services CBST CUBIST PHARMACEUTICALS INC Health Care Biotechnology CHPC CHIPPAC INC Information Technology Semiconductors CLHB CLEAN HARBORS INC Industrials Environmental Services CPTS CONCEPTUS INC Health Care Health Care Equipment CRGN CURAGEN CORP Health Care Biotechnology CRXA CORIXA CORP Health Care Biotechnology CTIC CELL THERAPEUTICS INC Health Care Biotechnology CVC CABLEVISION SYS CORP -CL A Consumer Discretionary Broadcasting & Cable TV CVTX CV THERAPEUTICS INC Health Care Biotechnology CYMI CYMER INC Information Technology Semiconductor Equipment DMI DEPOMED INC Health Care Pharmaceuticals DNDN DENDREON CORP Health -

Table of Contents

Table of contents Executive Summary Chapter 1 – Introduction Chapter 2 – Trends in drug delivery dealmaking 2.1. Introduction 2.2. Drug delivery partnering over the years 2.3. Bigpharma drug delivery dealmaking activity 2.4. Big biotech drug delivery dealmaking activity 2.5. Most active drug delivery dealmakers 2.6 Drug delivery partnering by deal type 2.7. Drug delivery partnering by disease type 2.8. Partnering by drug delivery technology type 2.9. Average deal terms for drug delivery partnering 2.9.1 Drug delivery headline values 2.9.2 Drug delivery upfront payments 2.9.3 Drug delivery milestone payments 2.9.4 Drug delivery royalty rates 2.10. The anatomy of drug delivery partnering 2.11. Drug delivery or specialty pharma? 2.11.1. Is specialty pharma the only way for drug delivery? 2.11.2. Best practice for optimizing drug delivery program development 2.11.3. The anatomy of a drug delivery deal 2.11.3.a. Case study 1: Alpharma – Durect 2.11.3.b. Case study 2: Bayer – MDRNA 2.11.3.c. Case study 3: Endo Pharmaceuticals – BioDelivery Sciences Chapter 3 – Leading drug delivery deals 3.1. Introduction 3.2. Top drug delivery deals by value Chapter 4 – Bigpharma drug delivery deals 4.1. Introduction 4.2. How to use bigpharma drug delivery partnering deals 4.3. Big pharma drug delivery partnering company profiles Abbott Actavis Inc (formerly Watson Pharmaceuticals) Actavis (merged with Watson Pharmaceuticals Oct 2012) Actelion Allergan Amgen Astellas AstraZeneca Baxter International Bayer Biogen Idec Boehringer Ingelheim Bristol-Myers Squibb Celgene CSL Daiichi Sankyo Dainippon Sumitomo Eisai Eli Lilly Endo Pharmaceuticals Forest Laboratories Galderma Gilead Sciences GlaxoSmithKline Grifols Hospira Johnson & Johnson Kyowa Hakko Kirin Lundbeck Menarini Merck & Co Merck KGaA Mylan Novartis Novo Nordisk Otsuka Pfizer Purdue Roche Sanofi Shionogi Shire Takeda Teva UCB Valeant Warner Chilcott Chapter 5 – Bigbiotech drug delivery deals 5.1. -

An Updated Look at Regenerative Medicine

December 28, 2017 Industry Research Department, Mizuho Bank Mizuho Industry Focus Vol. 203 An Updated Look at Regenerative Medicine Tim Wang, CFA, 2016 〈Summary〉 ○ Following our initial report on regenerative medicine in October 2013, cell and gene therapy field has made major strides. In this updated report, we take another snapshot of the industry and examine the recent past, current status and what the future may hold. ○ Pharmaceutical innovation is a slow process. It often takes many years for a project to go from an idea to a drug. Sometimes enough technical advances accumulate to a threshold level to enable the development of a breakthrough medicine. To complete the loop, clear clinical data is needed to validate the underlying technology advances. We believe in regenerative medicine, gene therapy and the related field of oligonucleotide therapy have cleared important technical hurdles and proved their mettle in the clinic. ○ The incorporation of new AAV-vectors in gene therapy has ushered in a golden era of gene therapy. From neurodegenerative CNS disease, hemophilia, hemoglobinopathy, to genetic-caused eye diseases, gene therapy has generated groundbreaking data, even promising of a cure. Although commercial success has so far been lacking, we believe it is a matter of time before we see the first blockbuster gene therapy product. Given the complex logistics and higher cost, regenerative medicine need to show transformative effect on disease rather than incremental benefit. Gene therapy is a prime example of how a one-time therapy can have huge and lasting impact on patients’ lives. ○ In the cell therapy area, with the exception of CAR-T therapy, the clinical trial experience over the last four years has been mostly disappointing. -

Beigene Corporate Brochure

The BeiGene Story A global biopharmaceutical innovator focused on improving 3,400+ 10 offices Trials in 35 treatment outcomes and patient access employees on 4 continents countries and regions (as of January 29, 2020) BeiGene is a fully-integrated biopharmaceutical Our broad product portfolio and pipeline include: company co-founded in 2010 by John Oyler, an • 3 wholly owned late-stage oncology candidates, American entrepreneur, and Dr. Xiaodong Wang, including one approved in the U.S. and one one of the youngest ever U.S. Academy of Science approved in China members and Director of China’s National Institute • 27 Phase 3 or potentially registration-enabling of Biological Sciences (NIBS) in Beijing. The two set trials ongoing, 60+ studies in total out to build a unique company that was globally • 32 clinical or commercial stage assets including focused from its inception. seven internally developed and 25 in-licensed BeiGene (NASDAQ: BGNE; HKEX 06160) focuses on BeiGene has built a strong innovative pipeline of developing novel cancer therapies where there is clinical drug candidates through internal discovery global unmet need. and collaborations. Transformative Collaboration with Amgen This global strategic oncology collaboration expands • Companies jointly developing 20 Amgen access to important oncology medicines for patients oncology pipeline assets globally, with BeiGene in China and around the globe with: leading development in China • BeiGene commercializing three Amgen oncology • Amgen investing $2.8B for a 20.5% products in China — XGEVA® (denosumab), stake in BeiGene KYPROLIS™ (carfilzomib), and BLINCYTO® (blinatumomab) BEIGENE’S COMMERCIAL PRODUCT PORTFOLIO ® • China NMPA approvals in R/R multiple myeloma and multiple myeloma BRUKINSA™ • U.S.