Barclays PLC

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

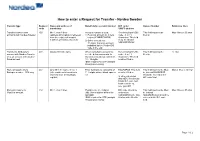

How to Enter a Request for Transfer - Nordea Sweden

How to enter a Request for Transfer - Nordea Sweden Transfer type Request Name and address of Beneficiary’s account number BIC code / Name of banker Reference lines code beneficiary SWIFT address Transfer between own 400 Min 1, max 4 lines Account number is used: Receiving bank’s BIC This field must not be Max 4 lines x 35 char accounts with Nordea Sweden (address information is retrieved 1) Personal account no = pers code - 8 or 11 filled in from the register of account reg no (YYMMDDXXXX) characters. This field numbers of Nordea, Sweden) 2) Other account nos = must be filled in 11 digits. Currency account NDEASESSXXX indicated by the 3-letter ISO code in the end Transfer to third party’s 401 Always fill in the name When using bank account no., Receiving bank’s BIC This field must not be 12 char account with Nordea Sweden see the below comments. In code - 8 or 11 filled in or to an account with another Sweden account nos consist of characters. This field Swedish bank 10 - 15 digits. must be filled in IBAN required for STP (straight through processing) Domestic payments to 402 Only fill in the name in line 1 Enter bankgiro no consisting of BGABSESS. This field This field must not be filled Max 4 lines x 35 char Bankgiro number - SEK only (other address information is 7 - 8 digits without blank spaces must be filled in. in. Instead BGABSESS retrieved from the Bankgiro etc should be entered in the register) In other currencies BIC code field than SEK: Receivning banks BIC code and bank account no. -

Nordea Group Annual Report 2018

Annual Report 2018 CEO Letter Casper von Koskull, President and Group CEO, and Torsten Hagen Jrgensen, Group COO and Deputy CEO. Page 4 4 Best and most accessible advisory, with an 21 easy daily banking experience, delivered at scale. Page 13 Wholesale Banking No.1 relationship Asset & Wealth bank in the Nordics Management with operational Personal Banking 13 excellence. Page 21 Commercial & Business Banking Our vision is to become the lead- ing Asset & Wealth Manager in the 25 Nordic market by 2020. Page 25 Best-in-class advisory and digital experience, 17 ef ciency and scale with future capabilities in a disruptive market. Page 17 Annual Report 2018 Contents 4 CEO letter 6 Leading platform 10 Nordea investment case – strategic priorities 12 Business Areas 35 Our people Board of Directors’ report 37 The Nordea share and ratings 40 Financial Review 2018 46 Business area results 49 Risk, liquidity and capital management 67 Corporate Governance Statement 2018 76 Non-Financial Statement 78 Conflict of interest policy 79 Remuneration 83 Proposed distribution of earnings Financial statements 84 Financial Statements, Nordea Group 96 Notes to Group fi nancial statements 184 Financial statements Parent company 193 Notes to Parent company fi nancial statements 255 Signing of the Annual Report 256 Auditor’s report Capital adequacy 262 Capital adequacy for the Nordea Group 274 Capital adequacy for the Nordea Parent company Organisation 286 Board of Directors 288 Group Executive Management 290 Main legal structure & Group organisation 292 Annual General Meeting & Financial calendar This Annual Report contains forward-looking statements macro economic development, (ii) change in the competitive that reflect management’s current views with respect to climate, (iii) change in the regulatory environment and other certain future events and potential fi nancial performance. -

Fitch Ratings ING Groep N.V. Ratings Report 2020-10-15

Banks Universal Commercial Banks Netherlands ING Groep N.V. Ratings Foreign Currency Long-Term IDR A+ Short-Term IDR F1 Derivative Counterparty Rating A+(dcr) Viability Rating a+ Key Rating Drivers Support Rating 5 Support Rating Floor NF Robust Company Profile, Solid Capitalisation: ING Groep N.V.’s ratings are supported by its leading franchise in retail and commercial banking in the Benelux region and adequate Sovereign Risk diversification in selected countries. The bank's resilient and diversified business model Long-Term Local- and Foreign- AAA emphasises lending operations with moderate exposure to volatile businesses, and it has a Currency IDRs sound record of earnings generation. The ratings also reflect the group's sound capital ratios Country Ceiling AAA and balanced funding profile. Outlooks Pandemic Stress: ING has enough rating headroom to absorb the deterioration in financial Long-Term Foreign-Currency Negative performance due to the economic fallout from the coronavirus crisis. The Negative Outlook IDR reflects the downside risks to Fitch’s baseline scenario, as pressure on the ratings would Sovereign Long-Term Local- and Negative increase substantially if the downturn is deeper or more prolonged than we currently expect. Foreign-Currency IDRs Asset Quality: The Stage 3 loan ratio remained sound at 2% at end-June 2020 despite the economic disruption generated by the lockdowns in the countries where ING operates. Fitch Applicable Criteria expects higher inflows of impaired loans from 4Q20 as the various support measures mature, driven by SMEs and mid-corporate borrowers and more vulnerable sectors such as oil and gas, Bank Rating Criteria (February 2020) shipping and transportation. -

Nordea Fund of Funds, SICAV Société D’Investissement À Capital Variable R.C.S

Nordea Fund of Funds, SICAV Société d’Investissement à Capital Variable R.C.S. Luxembourg B 66 248 562, rue de Neudorf, L-2220 Luxembourg NOTICE TO SHAREHOLDERS On 25th January 2018 NORDEA and UBS announced an agreement on the acquisition of part of Nordea’s Luxembourg-based private banking business by UBS (hereinafter the “Transaction”). The Transaction foresees the acquisition of part of Nordea Bank S.A.’s business and its integration onto UBS’s advisory platform. Subject to the completion of the Transaction, the shareholders (the “Shareholders“) of Nordea Fund of Funds (the “Company”) are hereby informed of the following changes: 1. Change of the Investment Managers and appointment of an Investment Sub Manager: 1.1. Nordea Investment Management AB : New Investment Manager : Current Investment Manager Investment Manager with effect as of the 15th of October 2018 Nordea Bank S.A. Nordea Investment Management AB, including 562, rue de Neudorf its branches L-2220 Luxembourg Mäster Samuelsgatan 21 Stockholm, M540 10571 Sweden 1.2. UBS Europe SE, Luxembourg Branch : Investment Sub Manager : Nordea Investment Management AB has further appointed UBS Europe SE, Luxembourg Branch, 33 A Avenue J.F. Kennedy L-1855 Luxembourg as investment sub-manager with effect as of the 15th of October 2018. 2. Redemption of shares free of charges Shareholders who do not agree to the changes as described above may redeem their Shares free of any charges, with the exception of any local transaction fees that might be charged by local intermediaries on their own behalf and which are independent from the Company and the Management Company. -

Lloyds Banking Group PLC

Lloyds Banking Group PLC Primary Credit Analyst: Nigel Greenwood, London (44) 20-7176-1066; [email protected] Secondary Contact: Richard Barnes, London (44) 20-7176-7227; [email protected] Table Of Contents Major Rating Factors Outlook Rationale Related Criteria Related Research WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 5, 2020 1 THIS WAS PREPARED EXCLUSIVELY FOR USER CIARAN TRELLIS. NOT FOR REDISTRIBUTION UNLESS OTHERWISE PERMITTED. Lloyds Banking Group PLC Major Rating Factors Issuer Credit Rating BBB+/Negative/A-2 Strengths: Weaknesses: • Market-leading franchise in U.K. retail banking, and • Geographically concentrated in the U.K., which is strong positions in U.K. corporate banking and now in recession owing to the impact of COVID-19. insurance. • Our risk-adjusted capital (RAC) ratio is lower than • Cost-efficient operating model that supports strong the average for U.K. peers, which partly reflects the pre-provision profitability, business stability, and deduction of Lloyds' material investment in its competitiveness. insurance business. • Supportive funding and liquidity profiles anchored by strong deposit franchise. WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 5, 2020 2 THIS WAS PREPARED EXCLUSIVELY FOR USER CIARAN TRELLIS. NOT FOR REDISTRIBUTION UNLESS OTHERWISE PERMITTED. Lloyds Banking Group PLC Outlook The negative outlook on Lloyds Banking Group reflects potential earnings pressures arising from the economic and market impact of the COVID-19 pandemic. Downside scenario If we saw clear signs that the U.K. systemwide domestic loan loss rate was going to exceed 100 basis points in 2020, and not be offset by the prospect of a quick economic recovery, we would likely lower the anchor, our starting point for rating U.K. -

Case M.8934 - DANSKE BANK / DNB / NORDEA BANK / SEB/ SVENSKA HANDELSBANKEN / SWEDBANK / KYC Utility

EUROPEAN COMMISSION DG Competition Case M.8934 - DANSKE BANK / DNB / NORDEA BANK / SEB/ SVENSKA HANDELSBANKEN / SWEDBANK / KYC Utility Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 13/06/2019 In electronic form on the EUR-Lex website under document number 32019M8934 EUROPEAN COMMISSION Brussels, 13.06.2019 C(2019) 4501 final PUBLIC VERSION To the notifying parties Subject: Case M.8934 - DANSKE BANK / DNB / NORDEA BANK / SEB/ SVENSKA HANDELSBANKEN / SWEDBANK / KYC Utility Commission decision pursuant to Article 6(1)(b) of Council Regulation (EC) No 139/20041 and Article 57 of the Agreement on the European Economic Area2 Dear Sir or Madam, 1. On 17 May 2019, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Danske Bank A/S (“Danske Bank”, Denmark), DNB Bank ASA (“DNB”, Norway), Nordea Bank Abp (“Nordea”, Sweden), Skandinaviska Enskilda Banken AB (“SEB”, Sweden), Svenska Handelsbanken AB (“Svenska Handelsbanken”, Sweden), Swedbank AB (“Swedbank”, Sweden) aquire within the meaning of Articles 3(1)(b) and 3(4) of the Merger Regulation joint control over a newly created joint venture (“KYC Utility”) by way of purchase of shares.3 2. The business activities of the undertakings concerned are: Danske Bank, DNB, Nordea, SEB, Svenska Handelsbanken, and Swedbank are banking groups based in the Nordics; KYC Utility will be active in the Nordic region offering Know Your Customer (“KYC”) services consisting in gathering, validating, and providing to customers, such as banks and financial institutions, the information required under the applicable anti-money laundering and counter-terrorist financing regulations, with the view of facilitating compliance with these regulations. -

Nordea Share

Debt Investor Presentation Q2 2016 Disclaimer This presentation contains forward-looking statements that reflect management’s current views with respect to certain future events and potential financial performance. Although Nordea believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of various factors. Important factors that may cause such a difference for Nordea include, but are not limited to: (i) the macroeconomic development, (ii) change in the competitive climate, (iii) change in the regulatory environment and other government actions and (iv) change in interest rate and foreign exchange rate levels. This presentation does not imply that Nordea has undertaken to revise these forward- looking statements, beyond what is required by applicable law or applicable stock exchange regulations if and when circumstances arise that will lead to changes compared to the date when these statements were provided. 2 • Nordea in brief 3 • Nordea is the largest financial services group in the Nordics 11 million customers Nordic distribution power and platform - Approx. 10 million personal customers - 590 000 corporate customers, incl. Nordic Top 500 Distribution power - Approx. 600 branch office locations - Leading market position in all four Nordic countries Financial strength - EUR 10.1bn in full year income (2015) - EUR -

ESG at Nordea Environmental Social Governance 2

ESG at Nordea Environmental Social Governance 2 Sustainable Finance at Nordea – Enabling the transition towards a sustainable future Nordea is the largest financial services group in the Nordic region and one of the biggest banks in Europe. We are a full-service universal bank with a total operat- ing income of EUR 9.5 billion and total assets of EUR 581.6 billion in 2017. “Together with We want to make a real difference - for our customers and for the communities in partners and which we operate - by sharing our broad expertise based on 200 years in the customers Nordea banking business. Sustainable Finance at Nordea is about integrating sustainabil- ity into all our business activities and products within our core areas investment, enables the transition financing and customer advice. Together with partners and customers Nordea to a sustainable enables the transition to a sustainable future. future.” We are constantly facing global challenges and in relation to our business it means that we work integrated with environmental, social and governance (ESG) issues in all relevant our fields. We also engage our clients, partners and other stakeholders by providing information about relevant sustainability issues. By acting on behalf of our clients we can contribute to economic growth and pros- perity, through capital allocation and interaction with companies. This is not only a business opportunity, but a part of our fiduciary responsibility. ESG stands for environmental, social and governance. ESG at Nordea – Environmental Social Governance 3 2,000 More than 2,000 empirical studies show that integration of ESG factors provides equal or better returns1. -

Sustainable Finance at Nordea, Went Below the Surface to Look at the Effects of Climate Change

SustainableESG financeat Nordea at Nordea Together with partnersSub heading and customers Nordea enables the transition towards a sustainable future. Your money is a powerful tool for driving change Your banking relationship can span everything from savings and lending, to the advice you receive from your bank. Sustainable finance means including sustainability as a natural part of these solutions and services. As a leading European bank, working with sustainable finance not only provides a business opportunity for Nordea – it is also our duty in relation to customers and society. ESG and how we define sustainability ESG stands for Environmental, Social and Governance. Good ESG practices are also often called ‘sustainability’. In a business context, sustainability is about the company’s business model, i.e. how its products and services contribute to sustainable development. It is also about a company’s risk management, i.e. how it manages its own operations to minimise adverse impact. Examples: Environmental: How does a company treat our environment? Social: How does a company treat its employees, society and the community? Governance: What are a company’s business ethics (i.e. bribery and corruption)? Why sustainable finance? We are living in a time of global challenges with many aspects of our lives changing, such as our climate. We need to react and adapt to “Together with the limitations of our planet. Just as you partners and might choose organic fair-trade bananas in customers Nordea the store, you need to think in the same enables the transition way about your financial products, like the towards a sustain- funds in which you save. -

Nordea Fund of Funds, SICAV Société D’Investissement À Capital Variable R.C.S

Nordea Fund of Funds, SICAV Société d’Investissement à Capital Variable R.C.S. Luxembourg B 66 248 562, rue de Neudorf, L-2220 Luxembourg NOTICE TO SHAREHOLDERS On 25th January 2018 NORDEA and UBS announced an agreement on the acquisition of part of Nordea’s Luxembourg-based private banking business by UBS (hereinafter the “Transaction”). The Transaction foresees the acquisition of part of Nordea Bank S.A.’s business and its integration onto UBS’s advisory platform. Subject to the completion of the Transaction, the shareholders (the “Shareholders“) of Nordea Fund of Funds (the “Company”) are hereby informed of the following changes: 1. Change of the Investment Managers and appointment of an Investment Sub Manager: 1.1. Nordea Investment Management AB : New Investment Manager : Current Investment Manager Investment Manager with effect as of the 15th of October 2018 Nordea Bank S.A. Nordea Investment Management AB, including 562, rue de Neudorf its branches L-2220 Luxembourg Mäster Samuelsgatan 21 Stockholm, M540 10571 Sweden 1.2. UBS Europe SE, Luxembourg Branch : Investment Sub Manager : Nordea Investment Management AB has further appointed UBS Europe SE, Luxembourg Branch, 33 A Avenue J.F. Kennedy L-1855 Luxembourg as investment sub-manager with effect as of the 15th of October 2018. 2. Redemption of shares free of charges Shareholders who do not agree to the changes as described above may redeem their Shares free of any charges, with the exception of any local transaction fees that might be charged by local intermediaries on their own behalf and which are independent from the Company and the Management Company. -

Nordea-Merger-Prospectus.Pdf

IMPORTANT NOTICE (FOR ELECTRONIC DELIVERY) NOT FOR DISTRIBUTION BY ANY MEDIUM TO ANY PERSON IN AUSTRALIA, CANADA, CHINA, HONG KONG OR ANY OTHER JURISDICTION IN WHICH DISTRIBUTION WOULD NOT BE PERMISSIBLE. IMPORTANT: You must read the following before continuing. The following applies to the merger prospectus (the “Prospectus”) following this notice, and you are therefore advised to read this notice carefully before reading, accessing or making any other use of the Prospectus. In accessing the Prospectus, you agree to be bound by the following terms and conditions, including any modifications thereto, each time you receive any information from us as a result of such access. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION, REGULATORY APPROVAL, EXEMPTION FROM REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION (TOGETHER, THE “RESTRICTED JURISDICTIONS”). NORDEA FINLAND REQUIRES PERSONS INTO WHOSE POSSESSION THE PROSPECTUS COMES TO INFORM THEMSELVES OF AND OBSERVE ALL SUCH RESTRICTIONS. NONE OF NORDEA FINLAND AND NORDEA SWEDEN (AS DEFINED IN THE PROSPECTUS) ACCEPT ANY LEGAL RESPONSIBILITY FOR ANY VIOLATION BY ANY PERSON, WHETHER OR NOT A SHAREHOLDER OF NORDEA SWEDEN, OF ANY SUCH RESTRICTIONS. THE PROSPECTUS MAY NOT BE FORWARDED OR DISTRIBUTED TO ANY OTHER PERSON AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER. ANY FORWARDING, DISTRIBUTION OR REPRODUCTION OF THE PROSPECTUS IN WHOLE OR IN PART IS UNAUTHORISED. FAILURE TO COMPLY WITH THIS DIRECTIVE MAY RESULT IN A VIOLATION OF APPLICABLE LAWS. Confirmation of your representation: In order to be eligible to view the Prospectus or to make any investment decision with respect to the securities, investors must be located outside of a Restricted Jurisdiction. -

Nordea Cuts Payment Costs, Boosts Customer Satisfaction

CASE STUDY Nordea Cuts Payment Costs, Boosts Customer Satisfaction The solution delivers a win-win “situation for customers and employees, offering greater visibility of payments and more efficient processes for the back office.” Sarah Charlesworth Head of Payments, Nordea At a Glance Products About Nordea • Fusion Payment Manager As the largest financial services group in Northern Europe, Nordea has total assets of EUR 636.3 billion and operates 800 branches in eight countries. It is a leader in corporate, institutional, retail and private banking, serving 10 million private consumers and 0.5 million corporate customers. Nordea was formed in 2001 via the merger of four major banking groups: Merita, Nordbanken, Unibank and Christiania Bank. Working with two Finastra The Challenge “consultants meant changes to the With customers relying on Nordea to process huge numbers of payments every day— solution could be done quickly. often in numerous currencies—the London Branch needed to automate and standardize Fusion Payment Manager seems its approach or risk leaving customers waiting and with little visibility into transactions. to be very flexible in the way it can The Solution be set up to resolve issues. ” Nordea dramatically enhanced the efficiency and transparency of payments processing by deploying Fusion Payment Manager as a hub between its systems. The solution offers Peter Roberts a single point of control for the company and a unified view for customers. Operations Manager, Nordea’s London Branch The Result Straight-through processing increased to 97%, accelerating transactions and boosting customer satisfaction. By eliminating manual work, employees save time that can be re- directed to higher-value tasks; the London Branch cut staff costs by 20%.