2019 HEART Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rural Hospitals Subject to Training

RURAL GEORGIA HOSPITALS SUBJECT TO TRAINING REQUIREMENT Revised: 1/1/2021 This document was produced by the Georgia Rural Health Innovation Center at Mercer University School of Medicine pursuant of Georgia Department of Community Health Grant #19045G. Appling County Camden County Elbert County Appling Healthcare SGHS-Camden Campus Elbert Memorial Hospital 163 East Tollison Street 2000 Dan Proctor Drive 4 Medical Drive Baxley, GA 31515 St. Marys, GA 31558 Elberton, GA 30635 Bacon County Candler County Emanuel County Bacon County Hospital Candler County Hospital Emanuel Medical Center 302 South Wayne Street 400 Cedar Street 117 Kite Road Alma, Georgia 31510 Metter, GA 30439 Swainsboro, GA 30401 Baldwin County Clinch County Evans County Navicent Health Baldwin Clinch Memorial Hospital Evans Memorial Hospital 821 North Cobb Street 1050 Valdosta Highway 200 North River Street Milledgeville, GA 31061 Homerville, GA 31634 Claxton, GA 30417 Ben Hill County Coffee County Franklin County Dorminy Medical Center Coffee Regional Medical Center St. Mary’s Sacred Heart Hospital 200 Perry House Road 1101 Ocilla Road 367 Clear Creek Parkway Fitzgerald, GA 31750 Douglas, GA 31533 Lavonia, GA 30553 Berrien County Colquitt County Grady County SGMC-Berrien Campus Colquitt Regional Medical Center Grady General Hospital 1221 East McPherson Avenue 3131 South Main Street 1155 5th Street Nashville, GA 31639 Moultrie, GA 31768 Cairo, GA 39828 Bleckley County Cook County Greene County Bleckley Memorial Hospital Southwell Medical St. Mary’s Good Samaritan 145 East -

November 28, 2018 – December 4, 2018 Requests for Extended Implementation/Performance Period

Use the links below for easy navigation Letters of Intent Letters of Intent - Expired Letters of Intent – Fall Batching New CON Applications CON Applications/Projects Withdrawn Pending/Complete Applications Pending Review/Incomplete CON Applications Office of Health Planning Recently Approved CON Applications Recently Denied CON Applications Appealed CON Projects Letters of Determination Requests for Miscellaneous Letters of Determination Appealed Determinations DET Review LNR Conversion CERTIFICATE OF NEED Requests for LNR for Diagnostic or Therapeutic Equipment Requests for LNR for Establishment of Physician-Owned Ambulatory Surgery Facilities Appealed LNRs November 28, 2018 – December 4, 2018 Requests for Extended Implementation/Performance Period Batching Notifications - Fall Need Projection Analyses Georgia Department of Community Health New Batching Review Office of Health Planning Summer Cycle Fall Cycle 2 Peachtree Street 5th Floor Non-Filed or Incomplete Surveys Atlanta, Georgia 30303-3159 Indigent-Charity Shortfalls (404) 656-0409 (404) 656-0442 Fax CON Filing Requirements (effective July 18, 2017) www.dch.georgia.gov Contact Information Verification of Lawful Presence within U.S. Periodic Reporting Requirements CON Thresholds Open Record Request Form Web Links Certificate of Need Appeal Panel www.GaMap2Care.info Letters of Intent LOI2018083 Doctors Hospital of Augusta Acquire a Fixed-Based MRI to Replace Existing Mobile MRI Received: 11/15/2018 Application must be submitted on: 12/17/2018 Site: 3651 Wheeler Road, Augusta, GA -

FY 2020 Proposed Rule Impact File.Xlsx

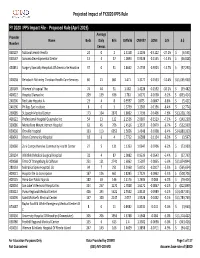

Projected Impact of FY2020 IPPS Rule FY 2020 IPPS Impact File ‐ Proposed Rule (April 2019) Average Provider Name Beds Daily Bills CMIV36 CMIV37 ∆CMI ∆ % ∆ $ Number Census 060107 National Jewish Health 24 0 2 1.5158 1.1036 ‐0.4122 ‐27.2%$ (6,595) 050547 Sonoma Developmental Center 13 4 37 1.0893 0.9338 ‐0.1555 ‐14.3% $ (46,028) 450831 Surgery Specialty Hospitals Of America Se Houston 37 0 31 2.8662 2.4739 ‐0.3923 ‐13.7%$ (97,290) 320038 Rehoboth Mckinley Christian Health Care Services 60 21 861 1.471 1.3177 ‐0.1533 ‐10.4%$ (1,055,930) 150149 Women's Hospital The 74 44 31 1.582 1.4228 ‐0.1592 ‐10.1%$ (39,482) 400022 Hospital Damas Inc 209 139 636 1.781 1.6172 ‐0.1638 ‐9.2%$ (833,414) 240206 Red Lake Hospital A 23 4 8 0.9597 0.875 ‐0.0847 ‐8.8%$ (5,421) 240196 Phillips Eye Institute 8 0 3 1.3739 1.2583 ‐0.1156 ‐8.4%$ (2,774) 260085 St Joseph Medical Center 173 104 2870 1.8602 1.7196 ‐0.1406 ‐7.6%$ (3,228,176) 400122 Professional Hospital Guaynabo Inc 54 13 122 2.1536 2.0007 ‐0.1529 ‐7.1%$ (149,230) 330086 Montefiore Mount Vernon Hospital 63 45 706 1.4516 1.3537 ‐0.0979 ‐6.7%$ (552,939) 050030 Oroville Hospital 133 113 6052 1.5656 1.4648 ‐0.1008 ‐6.4%$ (4,880,333) 460043 Orem Community Hospital 18 6 4 1.7712 1.6588 ‐0.1124 ‐6.3%$ (3,597) 320060 Zuni Comprehensive Community Health Center 27 5 131 1.1353 1.0647 ‐0.0706 ‐6.2%$ (73,989) 250134 Whitfield Medical Surgical Hospital 32 4 87 1.0082 0.9539 ‐0.0543 ‐5.4%$ (37,793) 420068 Trmc Of Orangeburg & Calhoun 251 121 2741 1.6062 1.5207 ‐0.0855 ‐5.3%$ (1,874,844) 280133 Nebraska Spine Hospital, -

GA ARES Hospital Emergency Operations Plan

Georgia Amateur Radio Emergency Service HOSPITAL EMERGENCY OPERATIONS PLAN for Hospital Emergency Radio Operators Approved 07-20-2017 Updated 7-6-2021 1 Table of Contents 1. Definitions 2. Organization 3. Responsibilities 4. Membership & Training 5. Activation 6. Utilization 7. Supported Agencies 8. Communication Modes 9. Net Operations 10. Appendix A: Recommended Hospital Equipment 11. Appendix B: Personal Equipment 12. Appendix C: Primary Frequencies 13. Appendix D: Regional Hospitals by Region 14. Appendix E: Healthcare Essential Elements of Information (EEI) 15.Appendix F: Required Items for Hospital Radio Rooms 16.Appendix G: Radio Room Standard Operating Procedures 2 Definitions 1. Amateur Radio Emergency Service— The group of licensed amateur radio operators who provide emergency communications as part of the Amateur Radio Relay League (ARRL) Field Organization. 2. Hospital Operators— The group of emergency communicators trained in the National Incident Command System (NIMS) who operate under the authority of the Georgia Section Amateur Radio Emergency Service (GAARES). 3. Section Emergency Coordinator (SEC)— The appointed leader of all ARES operations within the State of Georgia. 4. Assistant Section Emergency Coordinator (ASEC)— The appointed leader of each designated GAARES Branch. Hospital operations falls under the oversight of the ASEC for the Department of Human Resources/Public Health. 5. District Emergency Coordinator (DEC)— The appointed leader who coordinates with multiple local ARES groups. There is a DEC for each of the nine (9) districts under GAARES. 6. Emergency Coordinator (EC)— The appointed leader of the ARES group at the local or county level. 7. Regional Coordinating Hospital (RCH)— In each of the 14 regions throughout the State the largest hospital is designated as the RCH. -

Manager and Executive Compensation in Hospitals and Health Systems Survey Report

2019 Manager and Executive Compensation in Hospitals and Health Systems Survey Report Survey data effective January 1, 2019 © 2019 SullivanCotter, Inc. All rights reserved. 200 W. Madison Street, Suite 2450 Chicago, IL 60606-3416 2019 MANAGER AND EXECUTIVE COMPENSATION IN HOSPITALS AND HEALTH SYSTEMS SURVEY REPORT Survey data effective January 1, 2019 LICENSE AGREEMENT LICENSE AGREEMENT By accessing or downloading the Survey Report files online or by opening the packaging for this Survey Report, you agree to the terms of this License Agreement (this “Agreement”). If you do not agree to these terms and have not yet accessed or downloaded the Survey Report files or opened the packaging for this Survey Report, you may cancel your online purchase or download at this time or you may return this Survey Report to SullivanCotter, Inc. for a full refund within thirty (30) days of receipt, but you may not access or download the Survey Report files or open the packaging for, or otherwise use, this Survey Report. Accessing or downloading the Survey Report files or opening the packaging, or otherwise using, this Survey Report binds you to this Agreement. This Agreement is entered into by and between SullivanCotter, Inc. ("SullivanCotter") and the purchaser or participant of this Survey Report (the “Licensee”). In consideration of the mutual covenants in this Agreement, SullivanCotter and the Licensee agree as follows: Grant of License. This Survey Report contains the aggregation of compensation data and other data provided to SullivanCotter by its survey participants, statistics, tables, reports, research, aggregations, calculations, data analysis, formulas, summaries, content, text and other information and materials provided to the Licensee by SullivanCotter through any other means, whether digital or hard copy, related thereto (the “Aggregated Data”). -

2017 Home Health Survey Part A

2017 Home Health Survey Part A : General Information 1. Identification UID:HHA053 Facility Name: Encompass Home Health of Georgia County: Muscogee Street Address: 6001 River Road, Suite 220 City: Columbus Zip: 31904 Mailing Address: 6688 N Central Expressway, Suite 1300 Mailing City: Dallas Mailing Zip: 75206 Medicaid Provider? Check the box to the right if the agency is a medicaid provider If you indicated yes above, please report the medicaid number below. 000696407A Medicare Provider? Check the box to the right if the agency is a medicare provider If you indicated yes above, please report the medicare number below. 11-7306 2. Report Period Report Data for the full twelve month period, January 1,2017 - December 31, 2017 (365 days). Do not use a different report period. Check the box to the right if your facility was not operational for the entire year. If your facility was not operational for the entire year, provide the dates the facility was operational. Part B : Survey Contact Information Person authorized to respond to inquiries about the responses to this survey. Contact Name: Tracey Kruse Contact Title: Chief Operating Officer Page 1 Phone: 214-239-6500 Fax: 214-239-6581 E-mail: [email protected] Part C : Ownership, Operation and Management 1. Ownership, Operation and Management As of the last day of the report period, indicate the operation/management status of the facility and provide the effective date. Using the drop-down menus, select the organization type. If the category is not applicable, the form requires you only to enter Not Applicable in the legal name field. -

Community Benefit Report

REPORT TO OUR COMMUNITY 2018 Navicent Health was incorporated on Nov. 17, 1994, as a nonprofit corporation whose purpose is to coordinate The Medical Center, Navicent Health and other affiliated entities toward our mission: “Together, we elevate health and well-being through compassionate care.” Today, Navicent Health has more than 1,000 licensed beds for medical, surgical, rehabilitation and hospice purposes, offers over 53 specialties in more than 30 locations and hosts over 100 medical residents and fellows. Included within the Navicent Health system is The Medical Center, Navicent Health, a 637-bed, American College of Surgeons nationally verified Level I Trauma Center and a three-time Magnet-designated hospital for nursing excellence worldwide. Navicent Health provides a broad range of community-based outpatient diagnostic, primary care, extensive home health and hospice care, comprehensive cancer services, and rehabilitation services spanning the full continuum of care. Included within the system are: » Five acute care hospitals » A rehabilitation hospital » A new, state-of-the-art children’s hospital » Central Georgia’s only life plan community About Us » An inpatient hospice facility, as well as in-home hospice care » Wellness and preventive services » Multiple urgent care centers » Numerous community-based partnerships that help Navicent Health deliver on its mission Distinguished nationally for its excellence, Navicent Health is also one of the premier teaching hospitals in the United States and serves as the primary teaching hospital for the Mercer University School of Medicine. Navicent Health supports residency-training programs in family medicine, general surgery, internal medicine, obstetrics and gynecology, and pediatrics along with fellowships in surgical critical care, geriatrics, hospice and palliative medicine, and infectious disease. -

SFY 2021 Preliminary DSH Limit

Georgia Medicaid SFY 2021 DSH Limit Calculation Cost In‐State Uninsured Out‐of‐State Total Total Cost MCD Provider O/P FFS X‐ Uninsured Medicaid and Hospital Name I/P Medicaid O/P Medicaid Tax I/P MCO O/P MCO I/P FFS X‐Over Over I/P OME O/P OME I/P O/P Provider Tax I/P O/P Uninsured 23 4 5 6 7 8 9 10 11 12 13 14 15 16 17 APPLING HOSPITAL 1,225,498 429,453 ‐ 77,821 1,117,584 3,014,125 1,037,641 303,881 525,606 272,154 1,231,238 ‐ ‐ ‐ 9,235,001 AU MEDICAL CENTER 44,635,810 19,433,407 ‐ 36,159,992 24,189,104 34,672,223 20,107,546 5,729,685 2,958,814 36,181,697 22,021,951 ‐ 36,083,315 17,193,972 299,367,516 BACON COUNTY HOSPITAL 919,550 619,906 ‐ 724,901 763,062 1,481,300 1,813,704 6,526 998 517,763 965,078 ‐ ‐ ‐ 7,812,788 BLECKLEY MEMORIAL HOSPITAL 21,352 327,973 ‐ 15,949 557,264 24,495 484,754 2,330 324,720 3,772 861,330 ‐ ‐ ‐ 2,623,939 BROOKS COUNTY HOSPITAL 95,281 439,715 ‐ 16,803 689,827 147,011 481,326 46,586 177,382 63,671 1,007,838 ‐ ‐ 17,346 3,182,786 BURKE MEDICAL CENTER 145,022 358,377 ‐ 30,083 628,264 257,327 424,754 195,055 652,704 165,324 967,325 ‐ ‐ 3,741 3,827,976 CANDLER COUNTY HOSPITAL 359,077 518,789 ‐ 10,562 785,701 342,742 1,174,635 13,535 536,965 198,758 1,024,076 ‐ ‐ ‐ 4,964,840 CANDLER HOSPITAL 5,597,033 4,761,262 ‐ 9,321,814 8,547,941 6,535,284 4,802,788 7,895,000 6,780,238 6,387,992 9,836,675 ‐ 167,733 511,430 71,145,190 CARTERSVILLE MEDICAL CENTER 6,582,987 1,930,174 731,169 4,665,769 4,297,828 5,571,194 2,007,564 3,358,172 1,816,972 5,051,616 6,371,989 376,947 138,997 62,090 42,963,468 CHATUGE REGIONAL HOSPITAL -

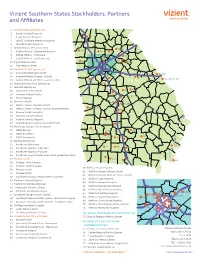

2018 Vizient Southern States Membership Map-Apr

Vizient Southern States Stockholders, Partners and Affiliates 1 Archbold Medical Center, Inc. 2 Brooks County Hospital 18 3 Grady General Hospital 19 16 4 John D. Archbold Memorial Hospital 5 Mitchell County Hospital 6 DeKalb Regional Health System 27, 28 28, 31 10 7 DeKalb Medical - Downtown Decatur 3433 35 30 8 DeKalb Medical - Hillandale 14, 63 33 30 9 DeKalb Medical - North Decatur 11 29 7 10 Floyd Medical Center 66 43 11 Polk Medical Center 12 Gwinnett Health System, Inc. 51, 52, 53 13 Glancy Rehabilitation Center 54, 56 69 14 Gwinnett Medical Center - Duluth 58 15 Gwinnett Medical Center - Lawrenceville 53, 55, 57, 59 70 GEORGIA 16 Hamilton Health Care System, Inc. 68 17 Houston Healthcare 25, 26 25 18 Houston Heart Institute 26 19 Houston Medical Center 24 24, 64 21, 22, 27 20 Perry Hospital 21 Navicent Health 23 17, 18, 19 22 Medical Center, Navicent Health 20, 21, 22 44, 45, 46 23 Medical Center of Peach County, Navicent Health 20 69 24 Monroe County Hospital 73 8, 9, 11, 61 25 Navicent Health Baldwin 23 26 Putnam General Hospital 40 68, 70 10 27 Rehabilitation Hospital, Navicent Health 75 28 Northeast Georgia Health System 29 NGMC Barrow 42 39 62 76 30 NGMC Braselton 66 31 NGMC Gainesville 37, 38 41 50, 52 6774 32 Northside Hospital 36 33 Northside Alpharetta 65 5 72 47, 48 34 Northside Hospital - Cherokee 51 41 34 35 50 35 Northside Hospital - Forsyth 40, 42, 43, 44 36 Northside Hospital Outpatient Center @ Meridian Mark 3 37 Phoebe Health 1, 4 3 260 49 38 Phoebe – Main Campus 6 48 46 39 Phoebe – North Campus 60 WellStar Health -

Health Planning Review Board Members

Use the links below for easy navigation Letters of Intent Letters of Intent - Expired Winter Batching Letters of Intent New CON Applications Pending/Complete Applications Pending Review/Incomplete CON Applications Recently Approved CON Applications Office of Health Planning Recently Denied CON Applications Appealed CON Projects Letters of Determination Requests for Miscellaneous Letters of Determination Appealed Determinations DET Review LNR Conversion Requests for LNR for Diagnostic or CERTIFICATE OF NEED Therapeutic Equipment Requests for LNR for Establishment of Physician-Owned Ambulatory Surgery Facilities Appealed LNRs Requests for Extended Implementation/Performance Period January 29, 2019 – February 5, 2019 Batching Notifications - Fall Need Projection Analyses New Batching Review Winter Cycle Georgia Department of Community Health Fall Cycle Office of Health Planning Non-Filed or Incomplete Surveys 2 Peachtree Street 5th Floor Indigent-Charity Shortfalls Atlanta, Georgia 30303-3159 CON Filing Requirements (effective July 18, 2017) (404) 656-0409 (404) 656-0442 Fax Contact Information www.dch.georgia.gov Verification of Lawful Presence within U.S. Periodic Reporting Requirements CON Thresholds Open Record Request Form Web Links Certificate of Need Appeal Panel www.GaMap2Care.info Letters of Intent LOI2019001 University Hospital Purchase & Install an Incremental Da Vinci Xi Robotic System Received: 1/8/2019 Application must be submitted on: 2/7/2019 Site: 1350 Walton Way, Augusta, GA 30901 (Richmond County) Estimated Cost: $2,680,000 -

2020-2021 COVS Hospitals by Address

Council on Volunteer Services Georgia Health Care CENTRAL DISTRICT 2020-2021 Hospital Members Houston Healthcare 1601 Watson Blvd., Warner Robins, GA 31093 478-922-4281 Medical Center, Navicent Health 777 Hemlock St., Macon. GA 31208 478-633-1000 Medical Center of Peach County 1960 Hwy 247 Connector, Byron, GA 31009 478-654-2000 Monroe County Hospital 88 Martin Luther King Jr. Dr., Forsyth, GA 31029 478-994-2521 Navicent Health Baldwin 821 North Cobb St., Milledgeville, GA 31059 478-454-3550 Perry Hospital 1120 Morningside Dr., Perry, GA 31069 478-987-3600 Upson Regional Medical Center 801 W. Gordon St., Thomaston, GA 30286 706-647-8111 Washington County Regional Medical Center 610 Sparta Road, Sandersville, GA 31082 478-240-2000 NORTHCENTRAL DISTRICT 2020-2021 Hospital Members Elbert Memorial Hospital 4 Medical Dr., Elberton, GA 30653 706-283-3151 Fannin Regional Hospital 2855 Old Highway 5, Blue Ridge, GA 30513 706-632-4290 Putnam General Hospital 101 Lake Oconee Pkwy NE, Eatonton, GA 31024 770-485-2711 St. Mary’s Hospital 1230 Baxter St., Athens, GA 30606 706-548-7581 Union General Hospital, Inc. 35 Hospital Rd., Blairsville, GA 30512 706-745-2111 NORTHEAST DISTRICT 2020-2021 Hospital Members Emory Decatur Hospital 2701 North Decatur Rd. Decatur, GA 30033 404-501-1000 Emory Johns Creek Hospital 6325 Hospital Parkway, Johns Creek, GA 30097 678-474-7000 Emory University Hospital 1364 Clifton Rd. NE, Atlanta, GA 30322 404-686-8500 Emory University Hospital Midtown 550 Peachtree St. NE, Atlanta, GA 30308 404-686-2010 Northside Hospital Gwinnett 1000 Medical Center Blvd, Lawrenceville, GA 30046 678-312-1000 Northside Hospital Atlanta 1000 Johnson Ferry Rd. -

Patient Centered Data Analysis Uncovers State Hospital Rankings

Patient Centered Data analysis uncovers state hospital rankings ver the past several years healthcare reforms, Trend groups hospitals into Teaching Hospitals, whose primary particularly around unsustainable spending, mission is teaching regardless of size and are certified by the the uninsured population and quality out- Association of American Medical Colleges Council of Teaching comes, have been widely discussed and de- Hospitals and Health Systems; Large Hospitals (250+ patient O bated. While this talk is ongoing, hospitals beds); Medium Hospitals (100 to 249 beds); and Small Hospitals continue to operate in a complex regulatory (less than 100 beds). The American Hospital Directory provided environment with uncertain policy outcomes, the hospital bed size. all while making investments to enhance effi- The rankings are based on CMS data downloaded Aug. 3, ciency and deliver quality patient care. 2019. Analysis of the data was completed for Georgia Trend For this list, which includes hospitals that provide a range by independent consultant Mark A. Thompson, professor of services, Georgia Trend evaluated each hospital in the state and associate dean of the Hull College of Business at Au- that participates in the Centers for Medicare and Medicaid Ser- gusta University. vices (CMS) Hospital Value Based Purchasing program. The While these hospital rankings on performance are useful CMS program does not include VA medical centers, children’s and provide valuable information, there are many factors hospitals, critical access hospitals and long-term care facilities. that consumers should consider when deciding where to go A total performance score based on information including for their healthcare needs. Always consult your healthcare clinical process, patient experience, outcome and efficiency provider about your and your family’s healthcare needs.