File~~----- Ill Aug 2 4 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

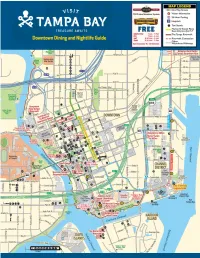

Downtown Dining Map 2019 List

To 13 51 136 137 118 138 114 17 157 123 25 23 41 154 91 10 101 98 76 45 61 83 18 149 143 2 76 86 16 26 55 105 94 14 103 56 128 109 80 48 111 8 2 77 96 104 78 74 93 28 46 99 141 53 40 1 38 7 32 97 5 153 3 146 21 39 95 134 4 66 47 106 21 90 9 59 79 102 44 72 92 58 121 120 87 70 151 127 135 69 60 82 122 124 114 115 68 100 85 120 41 125 43 117 84 88 119 71 73 140 73 12 35 64 75 20 42 34 To 27 15 29 33 24 17 156 126 19 To 52 63 158 159 37 129 152 30 81 6 147 107 155 89 To 133 11 22 139 50 132 148 131 To 130 31 36 49 62 65 110 112 AMERICAN 152 Publix Super Market on Bayshore Bakery- 87 Kahwa Café, Rivergate Tower - 17 Precinct Pizza - 813.228.6973 813.251.1173 813.225.2040 43 211 Restaurant at Hilton Tampa Downtown 96 Riverwalk Cafe at TMA - 813.421.8367 813.204.3000 BARBEQUE 66 Moxies Café - 813.221.4510 80 Tampa Pizza Co., SkyPoint - 813.463.1600 130 220 East - 813.259.1220 44 Holy Hog Barbecue - 813.223.4464 68 Nature’s Table, Park Tower - 813.223.2233 12 TamPiz - 813.252.3420 131 725 South Bistro at Westin Tampa 69 Oasis Deli - 813.223.3305 Waterside - 813.229.5000 CARIBBEAN 60 Toscanini NY Pizza and Pita - 813.500.7700 70 Ole Style Deli - 813.223-4282 97 1895 Kitchen Bar Market - 813.375.9995 34 Caribbean Cantina in Florida Aquarium - 813.273.4000 59 Pokeys - 813.223.6905 MEDITERRANEAN 132 American Social - 813.605.3333 40 Jerk Hut Downtown Café - 813.223.5375 152 Publix Deli - 813.251.1173 56 Falafel Inn Mediterranean Grill, SkyPoint - 124 Brightside Cafe - 813.241.9295 813.223.5800 84 Surf & Turf Cafe - 813.221.3354 98 Bistro at The -

Outside Counsel Firm/Attorney/Consultant Address

Outside Counsel Firm/Attorney/Consultant Address City State Zip IES Company Name Role Type of Case Akin Gump Strauss 1111 Louisana Street, 44th Floor Houston TX 77002 Ron's Electric, Inc., dba IES - North Plains Defendant Employment Agreement Dispute Allen & Gooch 1015 St. John Street Lafayette LA 70501 IES New Iberia, Inc./ Ernest P. Breaux Defendant Wrongful Termination Allen and Gooch 1015 St. John Street/PO Drawer 3768 Lafayette LA 70502 IES New Iberia, Inc./ Ernest P. Breaux Defendant Property Damage Allen Martin & Blue 121 Majorca Ave., Suite 300 Coral Gables FL 33134 Daniel Electrical Contractors, Inc. Both Employment Agreement Dispute * Baker & McKenzie 2300 Trammell Crow Center Dallas TX 75201 Bryant Electric Comm. Dispute Bracewell & Patterson, LLP 711 Louisiana Street, Suite 2900 Houston TX 77002 Galbraith Electric Co., Inc. Defendant Property Damage Brazeale Sachese & Wilson LLP PO Box 3197 Baton Rouge LA 70821 Cypress Electrical Contractors, Inc. Plaintiff Collection Bugg & Wolf P. O. Box 2917 Durham NC 27715 Bryant Electric Both Comm. Dispute Burns Day & Presnell 2626 Glenwood Ave., Suite 560 Raleigh NC 27608 Houston-Stafford Electric Holdings III, Inc. Plaintiff Collection Canterbury Stuber Elder 5005 LBJ Freeway, Suite 1000 Dallas TX 75244 Pollock Summit Electric LP Defendant NLRB Carter & Ansley 191 Peachtree Tower Atlanta GA 30303 Mark Henderson, Incorporated Defendant Personal Injury * Chamberlain Hrdlicka 191 Peachtree Street North East, 9th Fl Atlanta GA 30303 Bryant Electric Company, Inc. Both Commercial Dispute Cheifetz, Iannitelli, Marcolini, PC 1850 N. Central Avenue Phoenix AZ 85004 Hatfield Reynolds Electric Company Both Collection Chrissinger & Baumberger Three Milll Road, Suite 301 Wilmington DE 19806 Primo Electric Company Defendant Property Damage DeCaro Doran Siciliano 4601 Forbes Blvd., Suite 200 Lanham MD 20703 ARC Electric, Incorporated Defendant Personal Injury, Property Damage Bryant Electric Company, Inc. -

Recommended By: __ Z

Agenda Item #: 3A-2 PALM BEACH COUNTY BOARD OF COUNTY COMMISSIONERS AGENDA ITEM SUMMARY Meeting Date: January 13, 2015 [x] Consent [ ] Regular [] Ordinance [] Public Hearing Department: Administration Submitted By: Legislative Affairs Submitted For: Legislative Affairs --------------------------------------------------------------------------- I. EXECUTIVE BRIEF Motion and Title: Staff recommends motion to approve: Five (5) consulting/professional service contracts for state lobbying services on behalf of Palm Beach County and in response to RFP No. 15-008/SC for the term of twelve months from January 13, 2015 to January 12, 2016 for a total amount of $175,000 as follows: A. A contract with Ericks Consultants, Inc. in the amount of $35,000; B. A contract with Foley and Lardner, LLP in amountthe of $35,000. C. A contract with Ron L. Book, P.A. in the amount of $35,000; D. A contract with Corcoran & Associates, Inc. dba Corcoran & Johnson in the amount of $35,000; E. A contract with The Moya Group, Inc. in the amount of $35,000; Summary: In December 2014, the State Lobbyist Services Selection Committee met to review nine proposals to RFP No. 15-008/SC, State Lobbying Services. The selection committee met on two occasions to rank and recommend to the Board of County Commissioners an award of contract of to up to six firms for state lobbying services. The committee recommended the five firms listed above for approval of individual lobbying contracts of $35,000 for a total of $175,000. No SBE firms submitted and the committee recommended continuing to seek participation of such firms in county lobbying services. -

Tampa CBD Commercial Office Real Estate Update

Tampa CBD Office Market Presented by Larry Richey HOW DO WE COMPARE? Tampa CBD vs Other Southeast CBD’s CBD Class A NASHVILLE CHARLOTTE Average $33.23 $32.25 Asking DALLAS / FORT WORTH $31.90 Rates ATLANTA $31.61 JACKSONVILLE $21.39 $54.52 ORLANDO AUSTIN TAMPA $26.55 $29.87 MIAMI $50.90 Cushman & Wakefield SO, WHERE IS THERE SPACE? Tampa Bay Snapshot Total Overall Inventory No. Overall Vacancy Direct Wtd. Average 43,677,108 SF Bldgs. Inventory Rate Rental Rates (psf) Tampa CBD 26 6,032,822 13.7% $26.93 Westshore 115 12,761,174 9.0% $27.57 Total Direct Weighted Northwest 87 4,339,742 11.8% $22.28 Average Rental Rate I-75 Corridor 85 7,515,700 15.1% $21.69 Southwest 10 360,126 18.8% $18.86 $23.82 Hyde Park 10 363,994 1.3% $23.77 Ybor City 5 207,399 6.0% $0.00 Class A Total Direct St. Petersburg CBD 21 2,054,997 13.1% $27.79 Gateway/Mid-Pinellas 76 4,537,299 15.2% $21.10 Weighted Average Bayside 21 1,454,626 10.2% $21.52 Rental Rate Countryside 22 1,204,976 14.0% $19.70 $26.35 North Pinellas 19 1,262,147 7.8% $19.59 Clearwater Downtown 12 702,597 15.3% $17.97 South St. Petersburg 19 879,509 12.1% $21.15 2 Cushman & Wakefield Tampa CBD Snapshot CLASS A OFFICE PROPOSED DEVELOPMENT SunTrust Financial Center The Heights 100 North Tampa Riverwalk Tower Bank of America Plaza Water Street Tampa City Center Rivergate Tower Wells Fargo Center One Harbour Place Two Harbour Place CLASS B OFFICE Park Tower Fifth Third Center 501 East Kennedy The Times Building Cushman & Wakefield Class A Properties SunTrust Bank of 100 Tampa Financial America North City -

Bankruptcy Forms

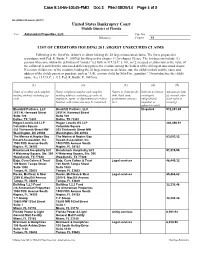

Case 9:14-bk-10145-FMD Doc 13 Filed 08/29/14 Page 41 of 92 B4 (Official Form 4) (12/07) United States Bankruptcy Court Middle District of Florida In re Antaramian Properties, LLC. Case No. Debtor(s) Chapter 11 LIST OF CREDITORS HOLDING 20 LARGEST UNSECURED CLAIMS Following is the list of the debtor's creditors holding the 20 largest unsecured claims. The list is prepared in accordance with Fed. R. Bankr. P. 1007(d) for filing in this chapter 11 [or chapter 9] case. The list does not include (1) persons who come within the definition of "insider" set forth in 11 U.S.C. § 101, or (2) secured creditors unless the value of the collateral is such that the unsecured deficiency places the creditor among the holders of the 20 largest unsecured claims. If a minor child is one of the creditors holding the 20 largest unsecured claims, state the child's initials and the name and address of the child's parent or guardian, such as "A.B., a minor child, by John Doe, guardian." Do not disclose the child's name. See 11 U.S.C. § 112; Fed. R. Bankr. P. 1007(m). (1) (2) (3) (4) (5) Name of creditor and complete Name, telephone number and complete Nature of claim (trade Indicate if claim is Amount of claim mailing address including zip mailing address, including zip code, of debt, bank loan, contingent, [if secured, also code employee, agent, or department of creditor government contract, unliquidated, state value of familiar with claim who may be contacted etc.) disputed, or security] subject to setoff Blackhill Partners, LLC Blackhill Partners, LLC Disputed 512,291.45 2651 N. -

Prime Restaurant + Retail Space in the Center of Downtown Tampa's

MODERA TAMPA North Ashley Drive + West Tyler Street | Tampa, Florida Prime Restaurant + Retail Space in the Center of Downtown Tampa’s Best Destinations MODERA TAMPA The Project Central Walkable Curated STEPS FROM THE RIVERWALK Prime 2,517 SF Retail Retail / Restaurant Spaces at Space on Busy Ashley Front Door of Drive & Additional Retail The Straz Performing Arts on W Tyler Street Center Ground Floor of High-End Modera Tampa Mixed-Use Development with 353 Residential Units 91 8,000+ 40 Walkability Apartments Within Retail-Specific Score Walking Distance Parking Spaces MODERA TAMPA Site Plan WEST FORTUNE STREET NORTH ASHLEY DRIVE (40,000 AADT) (40,000 DRIVE ASHLEY NORTH RETAIL A-2 2,517 SF RETAIL B-1 RETAIL B-2 2,084 SF 3,222 SF RETAIL A-1 3,742 SF AT LEASE Steps From . Straz Performing Arts Center . Tampa Riverwalk . Curtis Hixon Park WEST TYLER STREET (5,000 AADT) . Armature Works . The Heights District . Tampa Convention Center . Tampa Museum of Art 1 MILE 3 MILE 5 MILE . Glazer Children’s Museum . Tampa Theatre POPULATION 21,818 119,091 250,005 . Amalie Arena AVG HH INCOME $67,104 $82,770 $86,126 . University of Tampa 12,919 SF GROUND SURROUNDING 3,088 10,249 18,298 BUSINESS FLOOR RETAIL with frontage on Tyler St. DAYTIME 43,429 115,107 215,287 POPULATION and/or Ashley Ave MODERA TAMPA Site Plan EMERGENCY ACCESS PEDESTRIAN CIRCULATION TRAFFIC CIRCULATION WALKWAY FOR PEDESTRIANS MODERA TAMPA Aerial View MODERA TAMPA Tampa-Hillsborough County Public Library Newly Improved Tampa Riverwalk Featuring a 12-foot-wide sloping walking trail, AER TOWER along the Hillsborough 33 story, River seawall Multi-unit Cass Street MODERA TAMPA VIEW OF RETAIL A2 AT THE CORNER OF THE PLAZA FACING ASHLEY DRIVE Renderings VIEW OF RETAIL B ALONG TYLER STREET RETAIL ELEVATION ALONG ASHLEY DRIVE MODERA TAMPA Parking Plan Proposed Retail Parking: 1st and 2nd Level Garage Parking - 40 Parking Spaces - MODERA TAMPA Surrounding Parking STREET PARKING 315 spaces 279 SPACES WITHIN 5 MIN WALK $ PAY STATIONS PARKING GARAGE 5 min. -

LGTW ECO Contributions

Date Contributor Name Address City State Zip Occupation Amount 6/24/2010 F. ANNETTE SCOTT REVOCABLE TRUST ACCOUNT 1400 GULF SHORE BLVD STE 148 NAPLES, FL 34102 SELF EMPLOYED $ 2,000,000.00 6/28/2010 GOTTSEGER PETER M. 136 BEDFORD ROAD POUND RIDGE, NY 10576 INVESTOR $ 2,500.00 6/28/2010 DANIELS L.B. 100 EVERGLADES AVENUE PALM BEACH, FL 33480 INVESTOR $ 25,000.00 6/28/2010 SCHMEELK RICHARD J. 160 VIA DEL LAGO PALM BEACH, FL 33480 FINANCIAL ADVISOR $ 2,500.00 6/28/2010 PALM BEACH HEALTH ASSOCIATES INC. 1590 SOUTH CONGRESS AVENUE WEST PALM BEACH, FL 33406 HEALTH CARE $ 10,000.00 6/28/2010 SALAZAR BARBARA C. 5790 SW 97TH STREET PINECREST, FL 33156 CONSULTANT $ 20,000.00 6/28/2010 ATLANTIS PHYSICIAN GROUP 4960 SW 72ND AVENUE STE 406 MIAMI, FL 33155 HEALTH CARE $ 10,000.00 6/28/2010 PRIMARY CARE SPECIALISTS OF THE PALM BEACHES 6701 SOUTH DIXIE HIGHWAY WEST PALM BEACH, FL 32405 HEALTH CARE $ 10,000.00 6/28/2010 JV-CAM LLC 3191 CORAL WAY STE 303 MIAMI, FL 33155 SOFTWARE DEVELOPER $ 1,500.00 6/28/2010 PHYSICIAN CONSORTIUM SERVICES LLC 3191 CORAL WAY STE 303 MIAMI, FL 33145 HEALTH CARE $ 2,000.00 6/28/2010 MCCI GROUP HOLDINGS LLC 4960 SW 72ND AVENUE STE 406 MIAMI, FL 33155 SOFTWARE DEVELOPER $ 10,000.00 6/28/2010 TEAL BRUCE 112 HIDDEN POINT HENDERSONVILLE, TN 37075 HEALTH CARE EXECUTIV $ 300.00 7/2/2010 F. ANNETTE SCOTT REVOCABLE TRUST ACCOUNT 1400 GULF SHORE BLVD STE 148 NAPLES, FL 34102 SELF EMPLOYED $ 3,000,000.00 7/16/2010 F. -

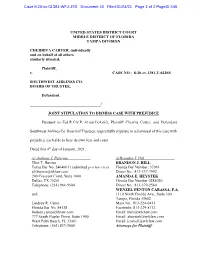

Joint Stipulation to Dismiss Case with Prejudice

Case 8:20-cv-01381-WFJ-JSS Document 46 Filed 01/04/21 Page 1 of 2 PageID 449 UNITED STATES DISTRICT COURT MIDDLE DISTRICT OF FLORIDA TAMPA DIVISION CHERRITA CARTER, individually and on behalf of all others similarly situated, Plaintiff, v. CASE NO.: 8:20-cv-1381-T-02JSS SOUTHWEST AIRLINES CO. BOARD OF TRUSTEE, Defendant. ____________________________________/ JOINT STIPULATION TO DISMISS CASE WITH PREJUDICE Pursuant to Fed.R.Civ.P. 41(a)(1)(A)(ii), Plaintiff Cherrita Carter, and Defendant Southwest Airlines Co. Board of Trustees, respectfully stipulate to a dismissal of this case with prejudice, each side to bear its own fees and costs. Dated this 4th day of January, 2021. /s/ Anthony J. Palermo /s/Brandon J. Hill Eliot T. Burriss BRANDON J. HILL Texas Bar No. 24040611 (admitted pro hac vice) Florida Bar Number: 37061 [email protected] Direct No.: 813-337-7992 200 Crescent Court, Suite 1600 AMANDA E. HEYSTEK Dallas, TX 75201 Florida Bar Number 0285020 Telephone: (214) 964-9500 Direct No.: 813-379-2560 WENZEL FENTON CABASSA, P.A. and 1110 North Florida Ave., Suite 300 Tampa, Florida 33602 Lindsey R. Camp Main No.: 813-224-0431 Florida Bar No. 84138 Facsimile: 813-229-8712 [email protected] Email: [email protected] 777 South Flagler Drive, Suite 1900 Email: [email protected] West Palm Beach, FL 33401 Email: [email protected] Telephone: (561) 833-2000 Attorneys for Plaintiff Case 8:20-cv-01381-WFJ-JSS Document 46 Filed 01/04/21 Page 2 of 2 PageID 450 and Anthony J. Palermo Florida Bar No. -

United States Bankruptcy Court Middle District of Florida Fort Myers Division

UNITED STATES BANKRUPTCY COURT MIDDLE DISTRICT OF FLORIDA FORT MYERS DIVISION In re: Chapter 11 VICTOR G. MELLOR, Case No. 9:10-bk-20398-DHA COLONIAL CONSTRUCTION Case No. 9:10-bk-28157-DHA COMPANY, INC., COLONIAL READY MIX, LLC, Case No. 9:10-bk-28160-DHA CCC TRUCKING, LLC, Case No. 9:10-bk-28161-DHA Debtors. (Jointly Administered under / Case No. 9:10-bk-20398-DHA) Emergency Hearing Requested for December 16, 2010 at 10:30 a.m. EMERGENCY MOTION OF COLONIAL CONSTRUCTION COMPANY, INC., COLONIAL READY MIX, LLC, AND CCC TRUCKING, LLC FOR ENTRY OF AN ORDER (A) AUTHORIZING THE SALE OF SUBSTANTIALLY ALL OF THE ASSETS OWNED BY DEBTORS COLONIAL CONSTRUCTION COMPANY, INC., COLONIAL READY MIX, LLC, AND CCC TRUCKING, LLC, FREE AND CLEAR OF LIENS, CLAIMS AND ENCUMBRANCES PURSUANT TO 11 U.S.C. § 363; (B) ESTABLISHING BID PROCEDURES AND SALE PROCESS; (C) APPROVING ASSET PURCHASE AGREEMENT; (D) APPROVING FORM AND MANNER OF NOTICES; (E) SCHEDULING AUCTION AND FINAL SALE APPROVAL HEARING; (F) AUTHORIZING THE REJECTION OF CERTAIN EXECUTORY CONTRACTS AT THE SALE HEARING AND AUTHORIZING THE ASSUMPTION AND ASSIGNMENT OF OTHERS; AND (G) GRANTING RELATED RELIEF Colonial Construction Company, Inc. (“Colonial”), Colonial Ready Mix, LLC (“Ready Mix”), and CCC Trucking, LLC (“CCC Trucking”, collectively with Colonial and Ready Mix, the “Debtors” or “Corporate Debtors”), by and through their undersigned counsel, and pursuant to 11 U.S.C. §§ 105, 363 and 365, Fed. R. Bank. P. 2002, 6004, 6006, and 9014 and Local Rules 2002-1, 6004-1, and 9014-1, move the Court for entry of an order: A. -

Tampa Bay Office Market Report First Quarter 2019

Tampa Bay Office Market Report First Quarter 2019 Continued Strong Economic and Leasing Fundamentals Expected in 2019 Although 2018 ended with stock market volatility, economic uncertainty and a government shutdown, the outlook for 2019 looks bright and the underlying economic fundamentals that drove growth through most of 2018 remain in place and are expected to drive continued growth this year. Florida added more than 207,000 private sector jobs in 2018 (54,000 of which were in the office-using professional and business services sector) growing by 2.7%, well above the U.S. private sector job growth rate of 2.1%. As of February 2019, 22 out of 24 metro areas in the state had year-over-year job gains, with the Tampa Bay MSA growing by over 5,000 jobs. Additionally, Governor DeSantis recently announced that Tampa Bay ranked first in the Class A rents have state in December 2018 with regard to job demand, specifically for high-wage STEM (science, technology, set a record high in engineer and mathematics) jobs. Westshore at Leasing activity has been brisk so far this year with five deals greater than 20,000 sf closing during the first quarter, and additional speculative development is on the horizon. Overall asking rental rates have grown $33.54 per sf by 5.1% in the trailing 12-month period ending with the first quarter of 2019, with class A rates growing by 4.8%. With respect to overall submarket size, the most noteworthy rent growth occurred in the Tampa CBD with further room to (up 7.1%), followed by the I-75 Corridor (up 6.3%) and Westshore (up 5.7%). -

Technologies, Inc. Phase I Environmental Site Assessment

TECHNOLOGIES, INC. PHASE I ENVIRONMENTAL SITE ASSESSMENT For: CEP CAPTRUST LLC Property (BB& T ESA #102928) 102 West Whiting Street Tampa, Hillsborough County, Florida Prepared for: Branch Banking & Trust 5130 Parkway Plaza Boulevard Charlotte, North Carolina 28217 Prepared by: A2L Technologies. Inc. 10220 Harney Road NE Thonotosassa, Florida 33592 (813) 248-8558 www.A2LTechnologies.com September 29, 2010 Project 100268 10220 Harney Road N E, Thonotosassa, FL 33592 PH (813) 248.8558 FAX (813) 248-8656 www.A2LTechnologies.com TECHNOLOGIES. INC. September 29, 2010 Project # 100268 Ms. Cindi M. Lewis Branch Banking & Trust 5130 Parkway Plaza Boulevard Charlotte, North Carolina 28217 RE: CEP CAPTRUST LLC Property BB& T ESA #: 102928 102 West Whiting Street Tampa, Hillsborough County, Florida Dear Ms. Lewis: Pursuant to your request and agreement, A2L Technologies, Inc. is pleased to present you with this Phase I Environmental Site Assessment for the above referenced property. We would like to take this opportunity to thank you for selecting A2L Technologies, Inc. to assist you with this project. This report is for the sole and exclusive use of Branch Banking & Trust. As always, should you have any further questions please feel free to contact us at your convenience. Respectfully submitted, Kent R. Ward, ASP i REPA, LEP Vice President Director of Environmental Services TABLE OF CONTENTS SECTION PAGE 1.0 Executive Summary .................................................. I 2.0 Introduction. 1 2.1 Purpose 2.2 Detailed Scope of Services 2.3 Significant Assumptions 2.4 Limitations and Exceptions 2.5 Special Terms and Conditions 2.6 User Reliance 3.0 Site Description . 2 3.1 Location and Legal Description 3.2 Site and Vicinity Characteristics 3.3 Current Use of the Property 3.4 Description of Structures, Roads, Other Improvements on Site 3.5 Site Utilities 3.6 Current Uses of the Adjoining Properties 4.0 User Provided Information ............................................ -

Guide Book 2010

TAMPA’S DOWNTOWN GUIDE BOOK 2010 JULY - DECEMBER 2010 Dining | Arts & Entertainment | 1 Services | Shopping | On The Move PB Welcome to Tampa’s WDowntown... Welcome to Tampa’s Downtown! Tampa’s downtown is one of the city’s most intriguing communities offering a diverse array of activities, restaurants, retailers, service providers, and cultural & entertainment venues. TAMPA’S DOWNTOWN GUIDE BOOK 2010 is your companion as you make your list of places to go and things to do. From fast paced sporting events to trendy art galleries, downtown has it. From upscale restaurants to quaint bistros, downtown has it. From high end trend setting fashions to a Tampa keepsake, downtown has it. It’s all in downtown Tampa! TAMPA’S DOWNTOWN GUIDE BOOK 2010 is designed to take the guesswork out of what’s available. Deciding where to go and what to do is up to you. 2 PB Dining Name the category of cuisine and you will find a restaurant in downtown Tampa to match your desire. Downtown is home to the most creative chefs, delectable delights and a selection of settings to make dining a true pleasure. Early morning to late evening, a downtown restaurant is open to serve you whatever you wish. B Breakfast L Lunch D Dinner T Takeout de Delivery Wi Fi WiFi Available 3 3 PB Dining 725 S. Bistro Bua Thai Restaurant American Thai 725 Harbour Island Blvd. Tampa Theatre (813) 229-5000 713 North Franklin Street B L D T Wi Fi (813) 223-3158 www.buathaitampa.com Algusto Fine L D T Mexican Cuisine Mexican Café De Soto 912 W.