Office Leasing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Certified Facilities (Cooking)

List of certified facilities (Cooking) Prefectures Name of Facility Category Municipalities name Location name Kasumigaseki restaurant Tokyo Chiyoda-ku Second floor,Tokyo-club Building,3-2-6,Kasumigaseki,Chiyoda-ku Second floor,Sakura terrace,Iidabashi Grand Bloom,2-10- ALOHA TABLE iidabashi restaurant Tokyo Chiyoda-ku 2,Fujimi,Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku 1-8-1 Yurakucho, Chiyoda-ku banquet kitchen The Peninsula Tokyo hotel Tokyo Chiyoda-ku 24th floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Peter The Peninsula Tokyo hotel Tokyo Chiyoda-ku Boutique & Café First basement, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku Second floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Hei Fung Terrace The Peninsula Tokyo hotel Tokyo Chiyoda-ku First floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Lobby 1-1-1,Uchisaiwai-cho,Chiyoda-ku TORAYA Imperial Hotel Store restaurant Tokyo Chiyoda-ku (Imperial Hotel of Tokyo,Main Building,Basement floor) mihashi First basement, First Avenu Tokyo Station,1-9-1 marunouchi, restaurant Tokyo Chiyoda-ku (First Avenu Tokyo Station Store) Chiyoda-ku PALACE HOTEL TOKYO(Hot hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku Kitchen,Cold Kitchen) PALACE HOTEL TOKYO(Preparation) hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku LE PORC DE VERSAILLES restaurant Tokyo Chiyoda-ku First~3rd floor, Florence Kudan, 1-2-7, Kudankita, Chiyoda-ku Kudanshita 8th floor, Yodobashi Akiba Building, 1-1, Kanda-hanaoka-cho, Grand Breton Café -

Tokyo GB Eng.Pdf

http://www.kankyo.metro.tokyo.jp/en/index.html Introduction In the year 2000, the Tokyo Metropolitan Government (TMG) replaced the Tokyo Metropolitan Pollution Prevention Ordinance with the Tokyo Metropolitan Environmental Security Ordinance, which covers countermeasures for vehicle pollution, chemical substances and climate change. The reason for the replacement was a shift in Tokyo’s environmental problems from industrial pollution mainly attributable to factories to urban and domestic pollution due to vehicle emissions and chemical substances, which may sometimes be related to climate change problems. In 2002, we started two programmes on which Tokyo’s present climate change strategy has been based: Tokyo Green Building Program for new buildings and Tokyo Carbon Reduction Reporting Program for existing large facilities. Since 2005, we have been promoting environmentally superior developments by introducing a mechanism to evaluate and disclose facilities’ efforts made in the programmes. In Tokyo’s Big Change - The 10-Year Plan developed in 2006, we set a goal of reducing citywide greenhouse gas emissions by 25% below 2000 levels by 2020 to make Tokyo a city with the least environmental impact in the world. Then in 2007, we announced the Tokyo Climate Change Strategy, which clarified our basic attitude toward tackling climate change for the next 10 years. Following a revision of the Tokyo Metropolitan Environmental Security Ordinance in 2008, we launched the Tokyo Cap-and-Trade Program for large facilities, the world’s first urban cap- and-trade scheme that covers office buildings as well, and the Carbon Reduction Reporting Program for small and medium facilities, committed to advancing our climate change strategy ever since then. -

Introducing Tokyo Page 10 Panorama Views

Introducing Tokyo page 10 Panorama views: Tokyo from above 10 A Wonderful Catastrophe Ulf Meyer 34 The Informational World City Botond Bognar 42 Bunkyo-ku page 50 001 Saint Mary's Cathedral Kenzo Tange 002 Memorial Park for the Tokyo War Dead Takefumi Aida 003 Century Tower Norman Foster 004 Tokyo Dome Nikken Sekkei/Takenaka Corporation 005 Headquarters Building of the University of Tokyo Kenzo Tange 006 Technica House Takenaka Corporation 007 Tokyo Dome Hotel Kenzo Tange Chiyoda-ku page 56 008 DN Tower 21 Kevin Roche/John Dinkebo 009 Grand Prince Hotel Akasaka Kenzo Tange 010 Metro Tour/Edoken Office Building Atsushi Kitagawara 011 Athénée Français Takamasa Yoshizaka 012 National Theatre Hiroyuki Iwamoto 013 Imperial Theatre Yoshiro Taniguchi/Mitsubishi Architectural Office 014 National Showa Memorial Museum/Showa-kan Kiyonori Kikutake 015 Tokyo Marine and Fire Insurance Company Building Kunio Maekawa 016 Wacoal Building Kisho Kurokawa 017 Pacific Century Place Nikken Sekkei 018 National Museum for Modern Art Yoshiro Taniguchi 019 National Diet Library and Annex Kunio Maekawa 020 Mizuho Corporate Bank Building Togo Murano 021 AKS Building Takenaka Corporation 022 Nippon Budokan Mamoru Yamada 023 Nikken Sekkei Tokyo Building Nikken Sekkei 024 Koizumi Building Peter Eisenman/Kojiro Kitayama 025 Supreme Court Shinichi Okada 026 Iidabashi Subway Station Makoto Sei Watanabe 027 Mizuho Bank Head Office Building Yoshinobu Ashihara 028 Tokyo Sankei Building Takenaka Corporation 029 Palace Side Building Nikken Sekkei 030 Nissei Theatre and Administration Building for the Nihon Seimei-Insurance Co. Murano & Mori 031 55 Building, Hosei University Hiroshi Oe 032 Kasumigaseki Building Yamashita Sekkei 033 Mitsui Marine and Fire Insurance Building Nikken Sekkei 034 Tajima Building Michael Graves Bibliografische Informationen digitalisiert durch http://d-nb.info/1010431374 Chuo-ku page 74 035 Louis Vuitton Ginza Namiki Store Jun Aoki 036 Gucci Ginza James Carpenter 037 Daigaku Megane Building Atsushi Kitagawara 038 Yaesu Bookshop Kajima Design 039 The Japan P.E.N. -

“Hey, What's the Big Idea!? You Can't Kick Me out Just

“Hey, what’s the big idea!? You can’t kick me out just like that!” “Of course I can! There’s no place for jobless freeloaders like you here!” “Come on, this is all happening so suddenly. Can’t you give m-” “Ohhhhh, no! Don’t you dare give me that dumbass excuse, you got that!?” As the argument with his landlord reached its crux, Naokuu was flung out of his apartment, past the open door and onto the outdoors walkway on the second floor. His back hit the balcony railing running opposite the side-by-side grouping of doors, making him bounce forward an inch or two as he came to a stop. He let out a pained grunt, slumping down to the walkway floor with his head hanging down. The skies above the rental apartment building in Setagaya were gloomy. Light enough to be seen as mere overcast and not a rainstorm, but gloomy nonetheless. It did nothing to help his current situation, his landlord marching to the door’s edge. He was a man of average size, with a lanky physique bordering on anorexic, with a bloated stomach to boot. His taupe-grey hair was heavily receded, exposing his forehead and the front third of the top of his head to almost impressive effect, and his mouth was missing some teeth, one on top and two on bottom as far as the incisors were concerned. He stood in the doorway, in a white chest-stained wifebeater whose bottom hem stopped short of his belly button and grey cotton sweatpants with a black drawstring, staring down at Naokuu with hands on his hips and a cock-eyed glare. -

Notice Concerning the Sale of Assets to Nippon Building Fund Inc

To whom it may concern: October 9, 2020 Company: Mitsui Fudosan Co., Ltd. Representative: Masanobu Komoda (President & Chief Executive Officer) Securities Code: 8801 (First Section, TSE) Contact: Chiharu Fujioka Managing Officer, General Manager, Corporate Communications Department (Tel.+81-3-3246-3155) Notice Concerning the Sale of Assets to Nippon Building Fund Inc. Mitsui Fudosan Co., Ltd (the "Company") hereby announces the completion of an agreement with Nippon Building Fund Inc. (hereafter “NBF”) related to the sale of assets owned by the Company. Brief details are provided as follows. 1. Overview of Assets to be Sold Date of Acquisition Price Contract Name of Assets to be Sold Transfer Acquirer (Excluding Date (Projected) consumption tax, etc.) Shinjuku Mitsui Building (*1) 170,000,000,000 yen October 9, January 8, Nippon Building 2020 2021 Fund Inc. GranTokyo South Tower (*2) 47,000,000,000 yen Total 217,000,000,000 yen *1 Property held as a tangible fixed asset by the Company. *2 The 13.33% stake held by the Company. 2. Background and Reason for the Sale ⚫ The Mitsui Fudosan Group (the “Group”) has developed many new mixed-use properties, primarily in central Tokyo, such as Tokyo Midtown Hibiya and Nihonbashi Muromachi Mitsui Tower, successfully growing its portfolio of premium assets and contributing to the creation of highly value-added neighborhoods. The Company aims to enhance its medium- to long-term corporate value through its asset and financial strategy, concentrating on appropriate balance sheet control. To maintain an optimal portfolio, the Company reviews and adjusts its portfolio regularly with a focus on asset quality, re-allocating proceeds to more efficient businesses and opportunities. -

Architekturführer Tokio

Architektu rführer Tokio Ulf Meyer DOM Apub lishers Inhalt 4 Vorwort Seite 34 Tokio - eine wunderbare Katastrophe Vif Meyer 34 Zu Besuch in der heimlichen Hauptstadt der Welt Botond Boqnar 40 Bunkyo-ku Seite 44 001 Ge denkpark für die Gefallene n Ta kefumi Aida 002 Saint Ma ry's Cat hedrali Marienkirche Kenzo Tange 003 Tokyo Do me Hotel Kenzo Tange 004 Tokyo Dome Nikken Sekkei/ Takenaka Corparation 005 Technica House Iakenaka Corporation 006 Hauptverwaltung der University of To kyo Kenzo Tange 007 Cent ury To wer Notman Foster Chiyoda-ku Seite 52 008 Metro Tour/ Edok en Office Building Atsushi Kitagawara 009 Athenee Francais Takamasa Yo shizako 010 ON Tower 21 Kevin Roche / John Dinkeloo 011 Nationaltheater Hiroyuki Iwamato 012 Kaiserliches Theater Yoshiro Taniquchi/Nitsubish! Architeetural Office 013 Akasaka Prince Hotel Kenzo Tange 014 National Showa Memorial Mu seum /Showa -kan Kiyonori Kikutake 015 Pacific Century Place Nikken Sekkei 016 Wacoa l Bu ilding Kisha Kurokawa 017 Bürohaus der Tokyo Marine and Fire Insurance Kunia Maekawa 018 National Diet Library und Annex Kunio Maekawa 019 Mizuho Corporate Bank Togo Murano 020 Nippon Budokan Mamoru Yamada 021 Mizuho Bank Head Office Building Yoshinobu Ashihara 022 Mitsui Marine and Fire Insura nce Nikken Sekkei 023 Koizumi-Sangyo-Gebäude Peter Eisenman / Kojiro Kitayama 024 Oberster Gerichtshof Shinichi Okada 025 Tajima Building Micha el Graves 026 U-Bahn-Station Iidaba shi Makoto Sei Watanab e 027 55'Building der Hosei-Universität Hiroshi Oe 028 Tokyo Sankei Building Ta kenaka Corpotation 029 Nikk en Sekkei Tokyo Bu ilding Nikken Sekkei 030 AKS Building Takenoko Corporation 031 Nationalmuseum für Moderne Kunst Yo shiro Taniguchi 032 Ni ssei-Theater und Verwaltung der Nihon-Seimei-Versicherung Murano & Mori 033 Kasumigaseki-Hochhaus Yamashita Sekkei 034 Palace Side Building Nikken Sekkei 5 InhaLt Chuo-ku Seite 72 035 Louis Vuitton Ginza Namik i Jun Aoki 036 Nihonbash i MS Building Takefum i Aida 037 Yae su-Buchhandlung Kajima 038 TheJapan P. -

Nippon Building Fund Inc

NEWS RELEASE Apr 21, 2021 R&I Affirms AA, Stable: Nippon Building Fund Inc. Rating and Investment Information, Inc. (R&I) has announced the following: ISSUER: Nippon Building Fund Inc. Issuer Rating: AA, Affirmed Rating Outlook: Stable RATIONALE: Nippon Building Fund Inc. (NBF) is a real estate investment trust that was listed in 2001. NBF specializes in investing in office buildings, and its main sponsor is Mitsui Fudosan Co., Ltd. The REIT has created a quality portfolio by investing in highly competitive large-scale buildings located mainly in central Tokyo. NBF obtained good properties of high rarity such as Shinjuku Mitsui Building and GranTokyo South Tower for a total of about 270 billion yen in the last year, achieving significant external growth. With an asset size of approximately 1,360 billion yen, NBF has established one of the most robust business bases in the J-REIT industry. It has been working on the portfolio improvement by replacing assets through, for instance, the selling of a property with an unrealized loss on advantageous terms. Shinjuku Mitsui Building is a well-known skyscraper in the Nishi-Shinjuku area and has been maintaining its competitive edge despite its old age, backed by a large amount of additional investments and good management by the sponsor, Mitsui Fudosan. The building will still be managed by the master lessee Mitsui Fudosan going forward. The average occupancy rate during the six months ended December 2020 was considerably high at 98.8%. Given that, however, several major tenants will move out in 2021, the average occupancy rate is expected to decline slightly to 97.5%. -

Major Projects Lineup November 2014

Major Projects Lineup November 2014 www.mitsuifudosan.co.jp/english Project Map (Central Tokyo) 12 25 10 17 30 24 4 31 1 3 7 6 31 2 8 29 15 9 28 21 4 11 13 20 22 19 27 18 14 32 23 26 16 地図データ ©2013 Google, ZENRIN Existing Projects New Projects 1. Nihonbashi Mitsui Tower 11. Tokyo Midtown 24. Nihonbashi Muromachi East District 2. Nihonbashi 1-Chome Mitsui Building 12. Garden Air Tower Development Projects (COREDO Nihonbashi) 13. Shiodome City Center 25. Iidabashi Grand Bloom (IIDABASHI SAKURA TERRACE) 3.Muromachi Higashi Mitsui Building 14. Celestine Shiba Mitsui Building (COREDO Muromachi1) 26. Kita-Shinagawa 5-Chome Block 1 15. Akasaka Biz Tower 4. Nihonbashi Astellas Mitsui Building Redevelopment Project 16. Gate City Ohsaki 27. Toyosu 2-, 3-Chome Block 2 Project 5. Ginza Mitsui Building 17. Shinjuku Mitsui Building 28. Hibiya Project 6. GranTokyo North Tower 18. Toyosu Center Building 29. Nihonbashi 2-Chome 7. Sumitomo Mitsui Banking Corporation Head Office Building 19. Toyosu Center Building Annex Redevelopment Project (Block C) 8. Marunouchi Mitsui Building 20. Toyosu ON Building 30. Nihonbashi Muromachi 3-Chome Urban Redevelopment Projest 9. Kasumigaseki Building 21. Kojun Building 31. OH-1 Project (Otemachi 1-Chome Block 2) 10. Jinbo-cho Mitsui Building 22. Urban Dock LaLaport TOYOSU 32. TGMM Shibaura Project 23.DiverCity Tokyo Plaza Black: Office Buildings Red: Retail Facilities 1 Existing Projects Office Buildings (Owned) Chuo-ku Nihonbashi Nihonbashi Muromachi Facility Nihonbashi Ginza Mitsui Astellas Mitsui Higashi name Mitsui -

Annual Report 2010 for the Fiscal Year Ended March 31, 2010

Annual Report 2010 For the fiscal year ended March 31, 2010 Creating Value through Environmental Leadership “ As a group of individuals working together as one, we pursue creative progress and development founded on both rational, scientific principles and a humanitarian outlook, through which we strive to continually advance our business operations and contribute to society.” Profile The Kajima Group is one of Japan’s largest general contractors. Established in 1840 and headquartered in Tokyo, the Kajima Group has more than 15,000 employees serving customers in over 20 countries. For the fiscal year ended March 31, 2010, consolidated revenues totaled ¥1,637 billion (U.S.$17.6 billion). Customer satisfaction is a priority. In our core building construction, civil engineering and real estate development operations, we use our comprehensive capabilities in every area and phase of our business activities to provide total solutions. Our broad technical expertise underpins our comprehensive capabilities. We consistently develop innovative technologies that help us add value to our products and earn customer satisfaction. Committed to global corporate citizenship, we emphasize ethical operations, compliance and corporate social responsibility in continually working to earn the trust and respect of all stakeholders. Forward-Looking Statements This Annual Report includes forward-looking statements that represent Kajima’s assumptions and expectations in light of information available as of May 13, 2010. These statements reflect industry trends, customer’s situations and other factors, and involve risks and uncertainties that may cause actual performance results to differ from those discussed in the forward-looking statements in accordance with changes in the domestic and overseas business environment. -

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered And/Or Non-Authorized Entities)

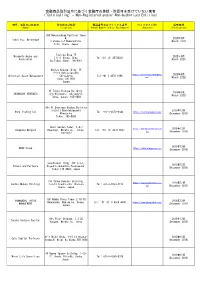

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered and/or Non-Authorized Entities) 商号、名称又は氏名等 所在地又は住所 電話番号又はファックス番号 ウェブサイトURL 掲載時期 (Name) (Location) (Phone Number and/or Fax Number) (Website) (Publication) 28F Nakanoshima Festival Tower W. 2020年3月 Tokai Fuji Brokerage 3 Chome-2-4 Nakanoshima. (March 2020) Kita. Osaka. Japan Toshida Bldg 7F Miyamoto Asuka and 2020年3月 1-6-11 Ginza, Chuo- Tel:+81 (3) 45720321 Associates (March 2021) ku,Tokyo,Japan. 104-0061 Hibiya Kokusai Bldg, 7F 2-2-3 Uchisaiwaicho https://universalassetmgmt.c 2020年3月 Universal Asset Management Chiyoda-ku Tel:+81 3 4578 1998 om/ (March 2022) Tokyo 100-0011 Japan 9F Tokyu Yotsuya Building, 2020年3月 SHINBASHI VENTURES 6-6 Kojimachi, Chiyoda-ku (March 2023) Tokyo, Japan, 102-0083 9th Fl Onarimon Odakyu Building 3-23-11 Nishishinbashi 2019年12月 Rock Trading Inc Tel: +81-3-4579-0344 https://rocktradinginc.com/ Minato-ku (December 2019) Tokyo, 105-0003 Izumi Garden Tower, 1-6-1 https://thompsonmergers.co 2019年12月 Thompson Mergers Roppongi, Minato-ku, Tokyo, Tel: +81 (3) 4578 0657 m/ (December 2019) 106-6012 2019年12月 SBAV Group https://www.sbavgroup.com (December 2019) Sunshine60 Bldg. 42F 3-1-1, 2019年12月 Hikaro and Partners Higashi-ikebukuro Toshima-ku, (December 2019) Tokyo 170-6042, Japan 31F Osaka Kokusai Building, https://www.smhpartners.co 2019年12月 Sendai Mubuki Holdings 2-3-13 Azuchi-cho, Chuo-ku, Tel: +81-6-4560-4410 m/ (December 2019) Osaka, Japan. 16F Namba Parks Tower 2-10-70 YAMANASHI KYOTO 2019年12月 Nanbanaka, Naniwa-ku, Osaka, Tel: +81 (0) 6-4560-4440 https://www.ykmglobal.com/ MANAGEMENT (December 2019) Japan 8th Floor Shidome, 1.2.20 2019年12月 Tenshi Venture Capital Kaigan, Minatu-ku, Tokyo (December 2019) 6flr Nishi Bldg. -

Tallest Buildings Constructed in 1970-1980

This PDF was downloaded from The Skyscraper Center on 2018/01/11 UTC For the most up to date version, please visit http://skyscrapercenter.com Building List All Regions, All Companies, 200m+, 1970-1980 Completed Architecturally Topped Structurally Topped Under On Never Proposed Vision Demolished Out Out Construction Hold Completed # Building Name City Height (m) Height (ft) Floors Completed Material Use 1 Willis Tower Chicago 442.1 1,451 108 1974 steel office 2 Aon Center Chicago 346.3 1,136 83 1973 steel office 3 First Canadian Place Toronto 298.1 978 72 1975 steel office 4 601 Lexington New York City 278.9 915 63 1977 steel office 5 Water Tower Place Chicago 261.9 859 74 1976 concrete residential / hotel / retail 6 Aon Center Los Angeles 261.5 858 62 1974 steel office 7 Transamerica Pyramid Center San Francisco 260 853 48 1972 composite office 8 U.S. Steel Tower Pittsburgh 256.3 841 64 1970 steel office 9 IDS Center Minneapolis 241.4 792 55 1973 composite office 10 200 Clarendon Boston 240.8 790 62 1976 steel office 11 Sunshine 60 Tower Tokyo 240 787 60 1978 composite office 12 Commerce Court West Toronto 239 784 57 1973 composite office 13 Enterprise Plaza Houston 230.4 756 55 1980 composite office 14 One Penn Plaza New York City 228.6 750 57 1972 steel office 15 1251 Avenue of the Americas New York City 228.6 750 54 1972 steel office 16 MLC Centre Sydney 228 748 60 1977 concrete office 17 One Astor Plaza New York City 227.1 745 54 1972 composite office 18 One Liberty Plaza New York City 226.5 743 54 1972 steel office 19 Parque Central -

Annual Report 2016

MITSUI FUDOSAN ANNUAL REPORT 2016 Year ended March 31, 2016 WorldReginfo - fef7ed36-deb9-45a8-97f2-9c8e8c236f06 CONTENTS ABOUT THE MITSUI FUDOSAN GROUP ABOUT 02 ABOUT THE MITSUI FUDOSAN GROUP 02 Statement/Vision/Mission 04 Mitsui Fudosan Group Business Domains 06 The Source of Value Creation 08 Our Value Creation 10 Feature 1 Creating Neighborhoods that Boost Urban Value 12 Feature 2 Raising the Value of Areas and Creating New Industries 14 Performance Highlights TOP MESSAGE TOP 16 TOP MESSAGE BUSINESS SUMMARY 22 BUSINESS SUMMARY 22 Leasing 26 Property Sales Detailed Information on the Website 30 Management 32 Mitsui Home Shareholder and Investor Information 33 Other 34 Overseas Business Contains materials related to financial results, audio and video versions of results briefings and information for shareholders and investors. CSR (CORPORATE SOCIAL RESPONSIBILITY) (CORPORATE http://www.mitsuifudosan.co.jp/english/corporate/ir/ 36 MITSUI FUDOSAN GROUP’S APPROACH TO CSR 36 The Mitsui Fudosan Group’s CSR Efforts 38 Initiatives for the Environment 40 Initiatives for Social Contribution 41 Initiatives for Employees CORPORATE GOVERNANCE CORPORATE 42 CORPORATE GOVERNANCE 42 Corporate Governance Initiatives for Society and the Environment Editorial Policy (Detailed CSR information) 46 Management Team The Mitsui Fudosan Group formulated the medium-term business plan “Innovation 2017 Stage II” and is implementing growth strategies to advance further Introduces initiatives for society and the environment based toward its goal of sustaining growth into the 2020s. For stakeholders to gain a correct understanding of the strategic growth measures presented as our priority on the Mitsui Fudosan Group’s Group Vision. issues, in addition to financial information such as financial results, review of operations and management strategies, it is also important to gain a systematic View the Report for detailed commentary on understanding of non-financial information relating to aspects such as society, the environment, human resources and governance.